Embedded Multimedia Card Emmc Market Report

Published Date: 31 January 2026 | Report Code: embedded-multimedia-card-emmc

Embedded Multimedia Card Emmc Market Size, Share, Industry Trends and Forecast to 2033

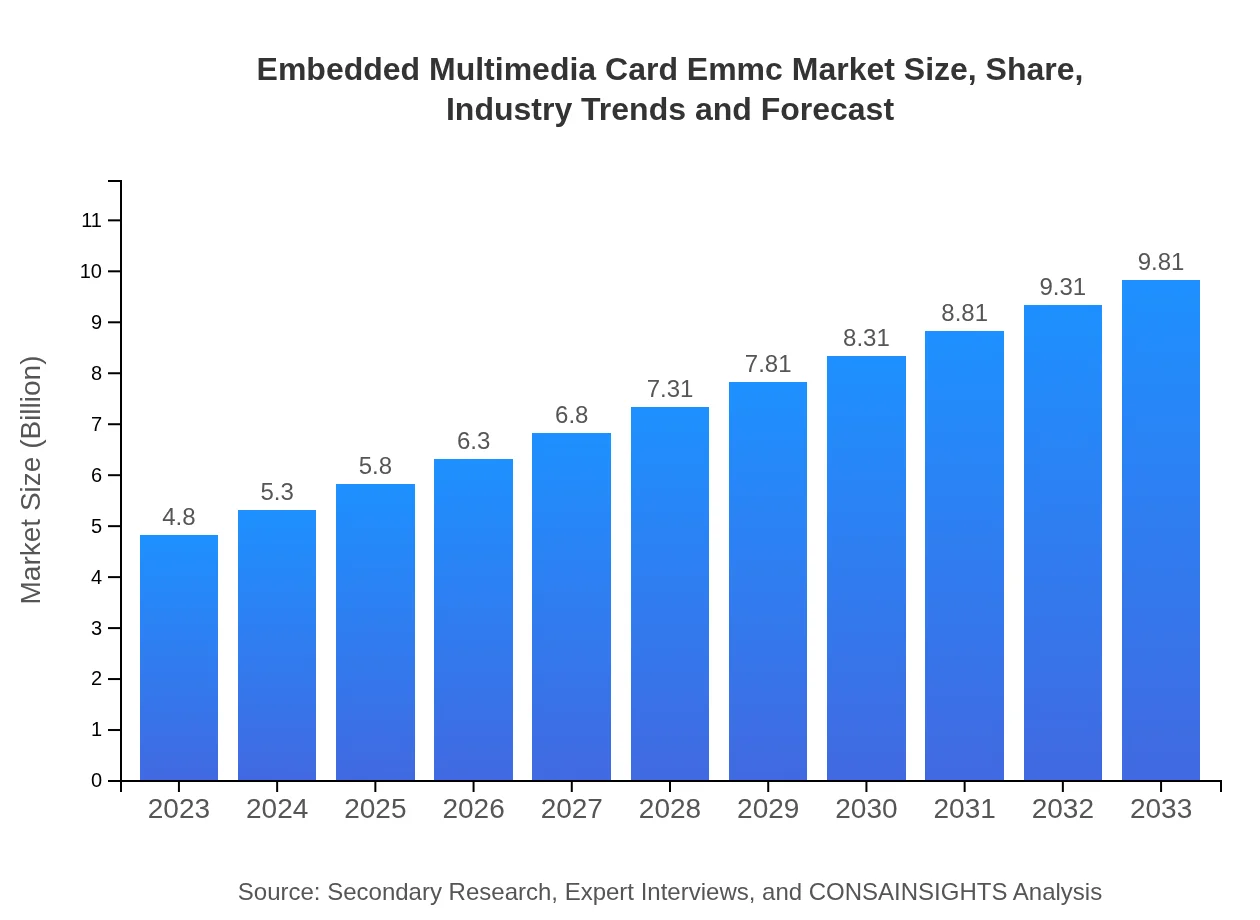

This report provides an in-depth analysis of the Embedded Multimedia Card (eMMC) market, highlighting key trends, market size, forecasts, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $9.81 Billion |

| Top Companies | Samsung Electronics, SanDisk (Western Digital), Micron Technology, Kingston Technology |

| Last Modified Date | 31 January 2026 |

Embedded Multimedia Card Emmc Market Overview

Customize Embedded Multimedia Card Emmc Market Report market research report

- ✔ Get in-depth analysis of Embedded Multimedia Card Emmc market size, growth, and forecasts.

- ✔ Understand Embedded Multimedia Card Emmc's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Multimedia Card Emmc

What is the Market Size & CAGR of Embedded Multimedia Card Emmc market in 2023?

Embedded Multimedia Card Emmc Industry Analysis

Embedded Multimedia Card Emmc Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Multimedia Card Emmc Market Analysis Report by Region

Europe Embedded Multimedia Card Emmc Market Report:

Europe's eMMC market is projected to transition from $1.70 billion in 2023 to $3.47 billion by 2033. Increasing adoption of IoT devices and consumer electronics featuring advanced memory solutions are major growth drivers.Asia Pacific Embedded Multimedia Card Emmc Market Report:

The Asia Pacific region leads in eMMC market share due to the high volume of smartphone manufacturing, with a market size of $0.82 billion in 2023 expected to grow to $1.69 billion by 2033. Countries like China and India contribute significantly to this growth through technological advancements and increased consumer electronics consumption.North America Embedded Multimedia Card Emmc Market Report:

North America holds a noteworthy market size of $1.57 billion in 2023, anticipated to grow to $3.21 billion by 2033. The region is characterized by high demand in automotive applications, particularly with the advent of smart vehicles embedding advanced computing technologies.South America Embedded Multimedia Card Emmc Market Report:

South America's eMMC market, while smaller, is set for growth from $0.19 billion in 2023 to $0.39 billion in 2033. Factors include rising smartphone penetration and increased digitalization pushing demand for enhanced memory solutions.Middle East & Africa Embedded Multimedia Card Emmc Market Report:

The Middle East and Africa region, witnessing gradual growth, will increase from $0.52 billion in 2023 to $1.06 billion by 2033, primarily fueled by advancements in telecommunication infrastructures and the rising trend of smart devices.Tell us your focus area and get a customized research report.

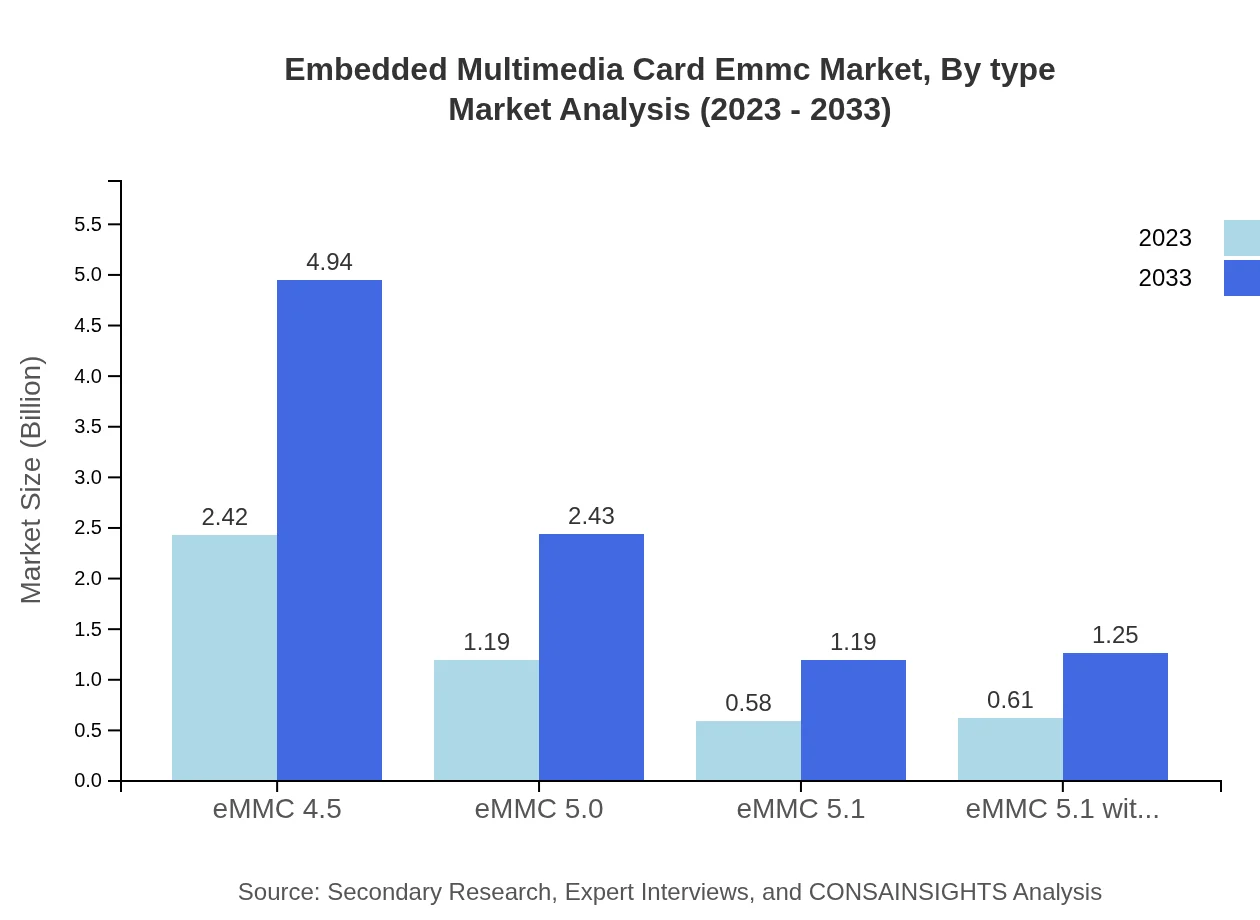

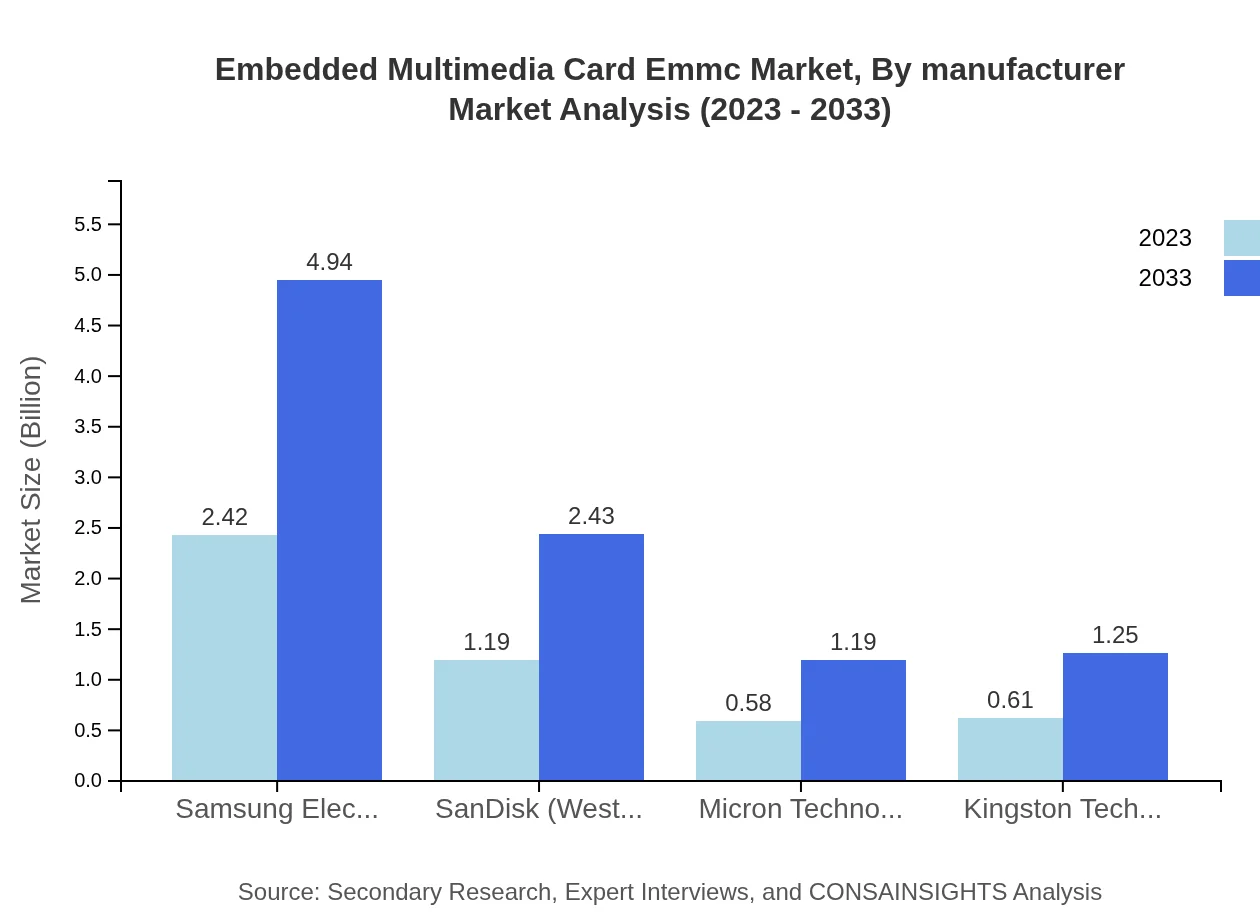

Embedded Multimedia Card Emmc Market Analysis By Type

The market segments based on eMMC type show significant trends. eMMC 4.5 dominates the market with a size of $2.42 billion in 2023, expected to reach $4.94 billion by 2033. eMMC 5.0 follows with $1.19 billion in 2023 and is projected to grow to $2.43 billion by 2033. eMMC 5.1 is also expanding, and advancements such as HS400 technology significantly improve performance metrics with respected shares.

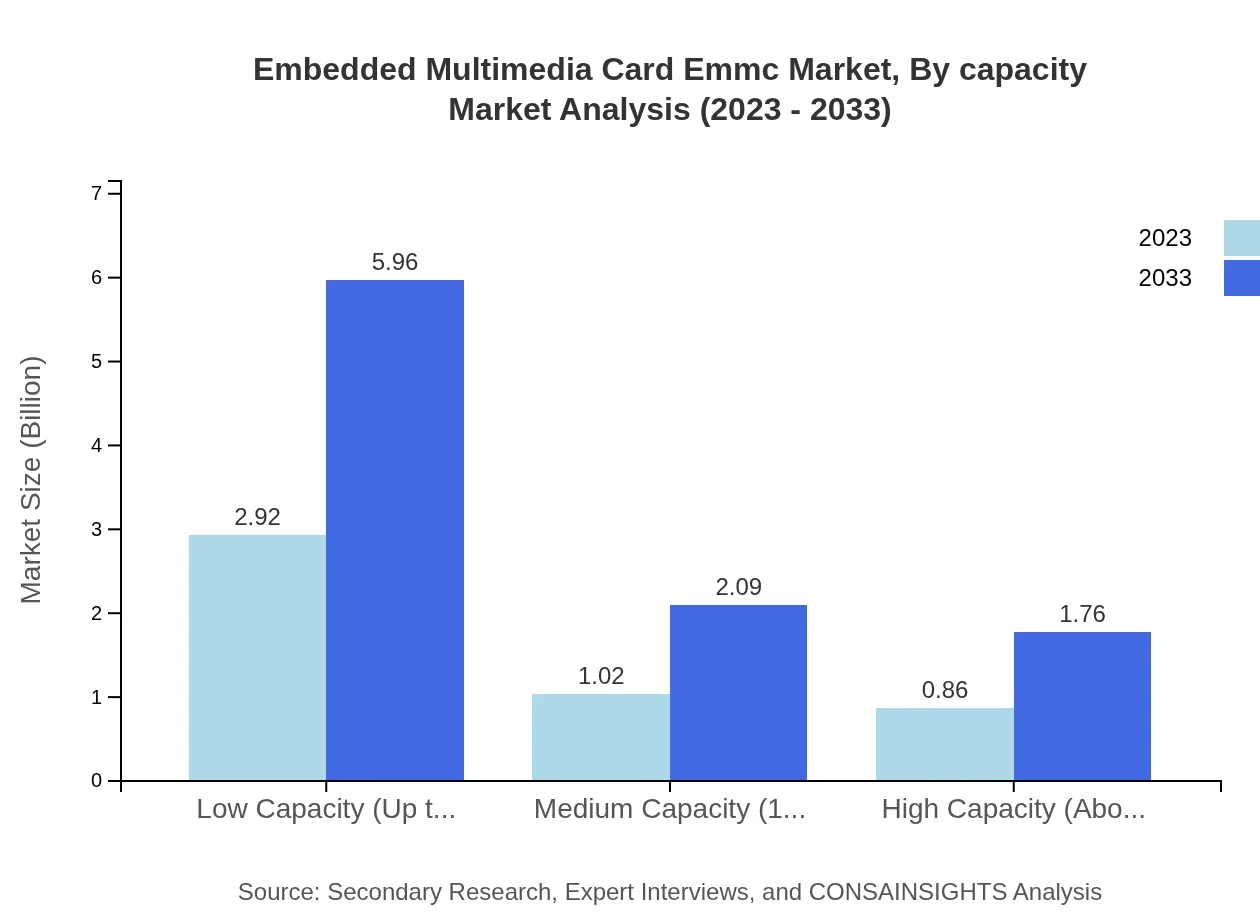

Embedded Multimedia Card Emmc Market Analysis By Capacity

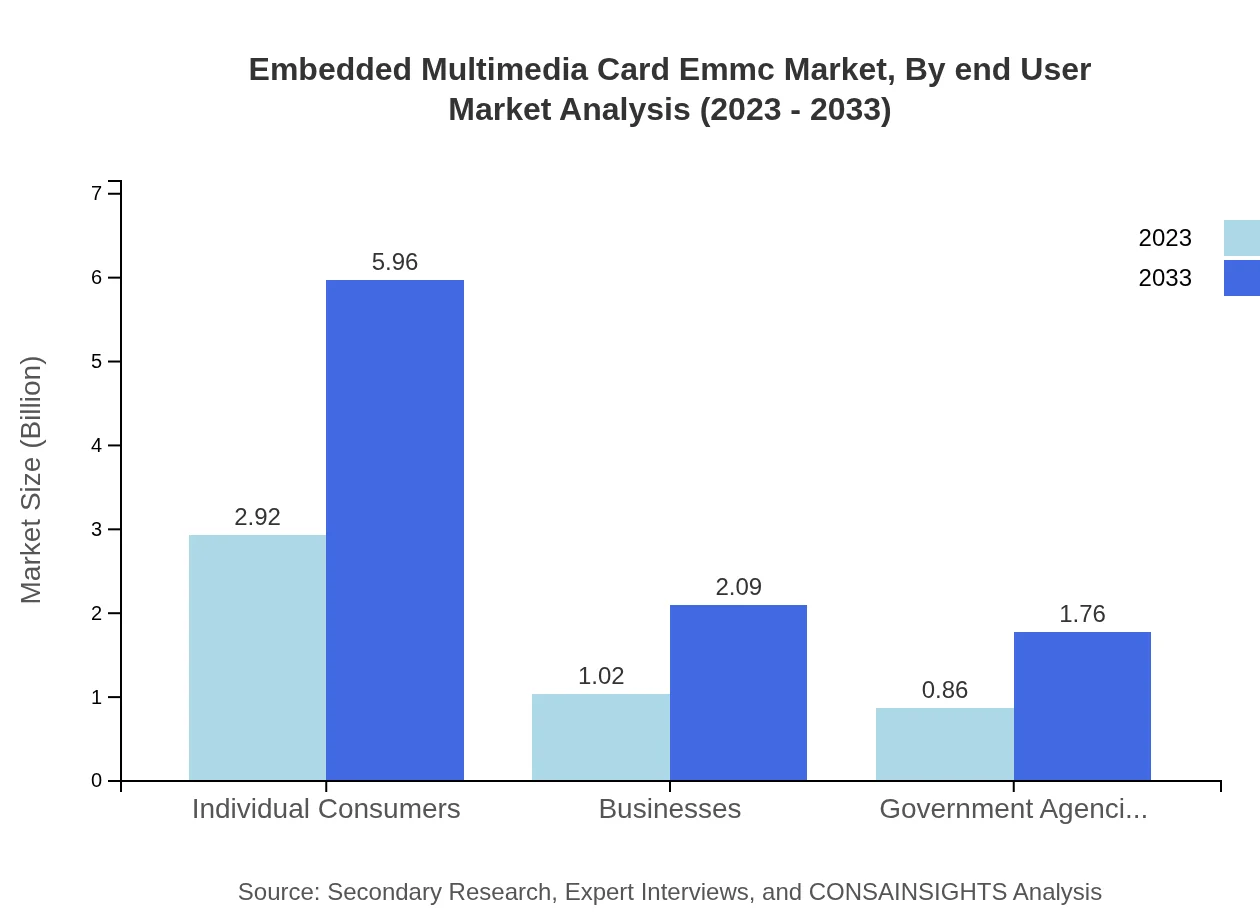

Capacity segments reveal distinct growth trajectories. Low capacity (up to 16 GB) holds a substantive share, valued at $2.92 billion in 2023 and expected to grow to $5.96 billion by 2033, reflecting its continued preference in entry-level devices. Medium capacity (16 GB to 64 GB) shows steady demand reaching $2.09 billion by 2033, while high capacity (above 64 GB) is also growing, facilitated by expanding applications in high-end gadgets.

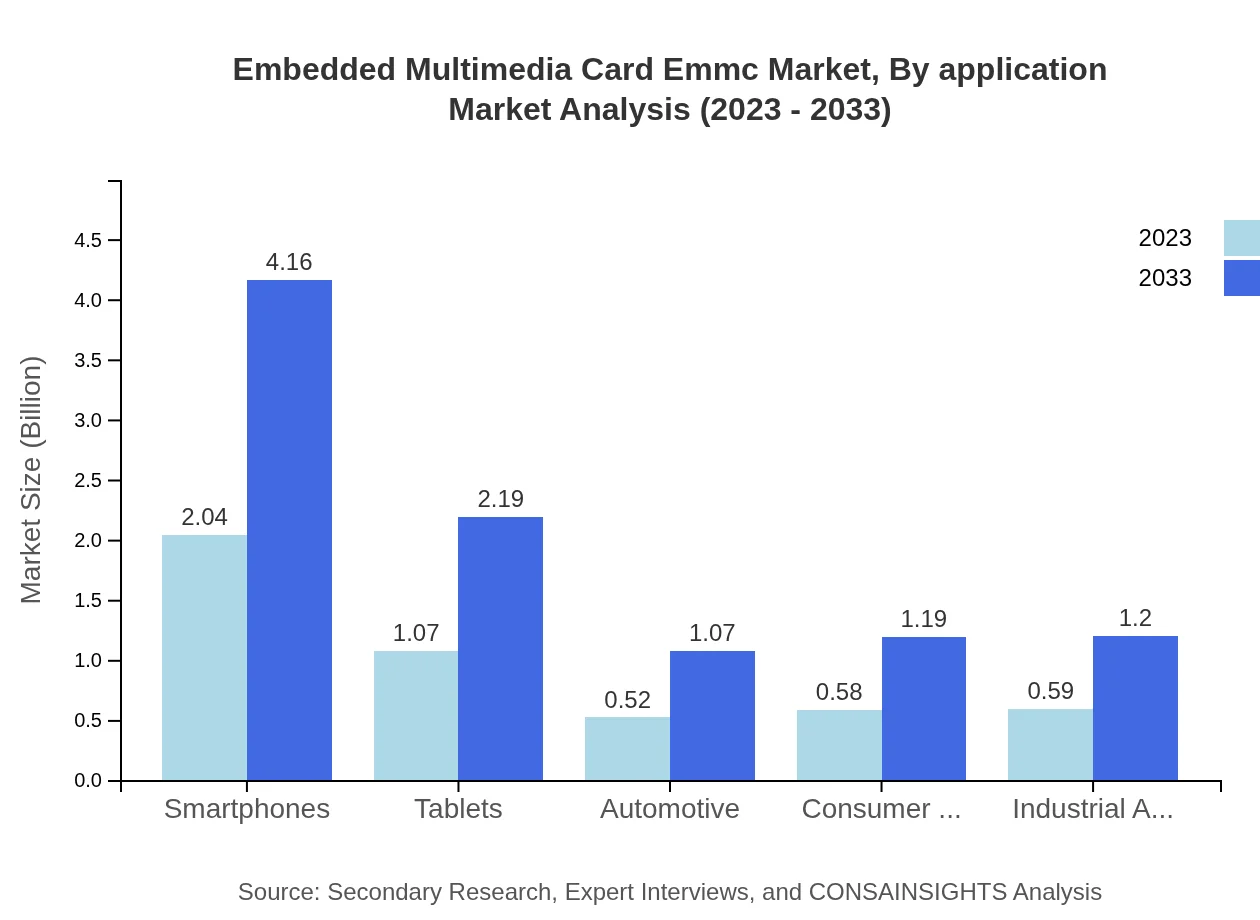

Embedded Multimedia Card Emmc Market Analysis By Application

Analysis by application showcases smartphones as a primary target, contributing $2.04 billion in 2023 and projected to rise to $4.16 billion by 2033. Tablets follow with a significant share, expected to grow from $1.07 billion to $2.19 billion. EMMCs will also increasingly play a role in automotive applications showing a steady rise, strengthening their integration in connected vehicles.

Embedded Multimedia Card Emmc Market Analysis By Manufacturer

Top manufacturers, including Samsung Electronics, SanDisk, Micron Technology, and Kingston Technology, dominate the eMMC landscape. Samsung leads with substantial market influence, primarily due to its innovative product designs and manufacturing capabilities that cater to a variety of applications across consumer electronics.

Embedded Multimedia Card Emmc Market Analysis By End User

End-user analysis indicates individual consumers as the largest user group of eMMC products, valued at $2.92 billion in 2023, showing steady growth. Business adoption is also increasing driven by corporate technology enhancements, with government agencies leveraging eMMCs for various digital applications, further driving the market.

Embedded Multimedia Card Emmc Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Multimedia Card Emmc Industry

Samsung Electronics:

Samsung leads the eMMC market with innovative product designs and a vast portfolio of storage solutions that cater to diverse applications including consumer electronics and automotive sectors.SanDisk (Western Digital):

SanDisk, now part of Western Digital, is recognized for its storage solutions and has a significant share in the eMMC market, particularly in consumer devices like smartphones and tablets.Micron Technology:

Micron focuses on high-performance memory solutions and plays a vital role in advancing eMMC technologies that support the demands of various applications.Kingston Technology:

Kingston is well-known for providing quality storage products and increasingly gaining market share through value-added solutions and robust customer support.We're grateful to work with incredible clients.

FAQs

What is the market size of Embedded Multimedia Card (eMMC)?

The Embedded Multimedia Card (eMMC) market is currently valued at $4.8 billion in 2023, with a projected growth rate of 7.2% CAGR through 2033. This indicates a significant opportunity for expansion in the coming years.

What are the key market players or companies in the eMMC industry?

Key players in the eMMC market include Samsung Electronics, holding a 50.35% market share; SanDisk (Western Digital), with a 24.74% share; and Micron Technology, Kingston Technology, contributing 12.13% and 12.78%, respectively.

What are the primary factors driving the growth in the eMMC industry?

Growth in the eMMC industry is primarily driven by increasing demand for mobile devices, rapid advancements in technology, the proliferation of IoT applications, and enhanced storage requirements across various electronic applications.

Which region is the fastest Growing in the eMMC market?

The fastest-growing region in the eMMC market is Europe, projected to grow from $1.70 billion in 2023 to $3.47 billion by 2033, representing a significant increase in demand and production capabilities in the region.

Does ConsaInsights provide customized market report data for the eMMC industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the eMMC industry, allowing clients to receive pertinent insights that cater to their unique business strategies and market conditions.

What deliverables can I expect from this eMMC market research project?

From the eMMC market research project, clients can expect comprehensive reports, market trend analyses, regional insights, competitive landscape evaluations, and forecasts, aiding in strategic decision-making.

What are the market trends of eMMC?

Current trends in the eMMC market include increased adoption of higher capacity models, advancements in technology standards, growing automotive applications, and a shift towards integrated solutions for smartphones, tablets, and other consumer electronics.