Embedded Systems Market Report

Published Date: 31 January 2026 | Report Code: embedded-systems

Embedded Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Embedded Systems market, covering market size, segmentation, key industry players, and future forecasts from 2023 to 2033. It aims to deliver valuable insights into current trends and challenges impacting the industry.

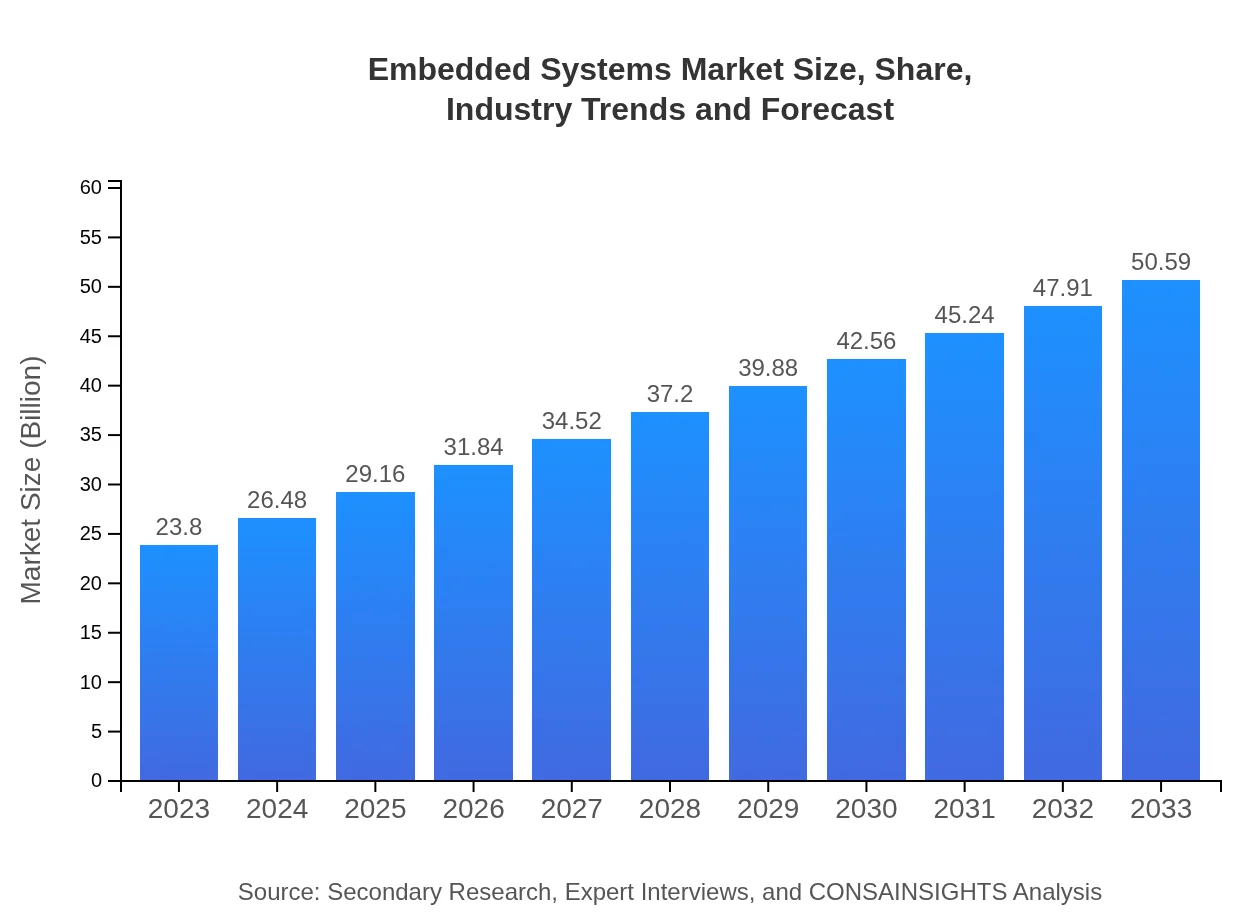

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.80 Billion |

| CAGR (2023-2033) | 7.6% |

| 2033 Market Size | $50.59 Billion |

| Top Companies | Intel Corporation, Texas Instruments, NXP Semiconductors, Renesas Electronics |

| Last Modified Date | 31 January 2026 |

Embedded Systems Market Overview

Customize Embedded Systems Market Report market research report

- ✔ Get in-depth analysis of Embedded Systems market size, growth, and forecasts.

- ✔ Understand Embedded Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Systems

What is the Market Size & CAGR of Embedded Systems market in 2023?

Embedded Systems Industry Analysis

Embedded Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Systems Market Analysis Report by Region

Europe Embedded Systems Market Report:

In the European market, the embedded systems sector is expected to grow from $5.75 billion in 2023 to $12.23 billion by 2033. The region is marked by technological innovation, stringent safety regulations, and increasing demand for automation in manufacturing processes. Strong automotive and aerospace industries in Germany and France contribute significantly to market growth.Asia Pacific Embedded Systems Market Report:

The Asia-Pacific region is anticipated to be one of the largest markets for embedded systems, with a market size projected to grow from $4.77 billion in 2023 to $10.14 billion by 2033. Rapid industrialization, increased adoption of smart devices, and substantial investments in IoT technologies drive this growth. Countries like China, India, and Japan are at the forefront, emphasizing advanced manufacturing techniques and digital transformation initiatives.North America Embedded Systems Market Report:

North America is projected to see significant growth in the embedded systems market, with sizes estimated at $9.14 billion in 2023, increasing to $19.43 billion by 2033. The region benefits from advanced technological infrastructure and dominance in automotive electronics, healthcare technology, and AI advancements. High investments from key industry players and a focus on R&D further enhance market prospects.South America Embedded Systems Market Report:

In South America, the embedded systems market is projected to expand from $1.40 billion in 2023 to $2.99 billion by 2033. Increasing demand for consumer electronics, combined with technology advancements in the automotive sector, are key contributing factors. Additionally, the region's ongoing development in telecommunications and smart infrastructure is likely to boost investments in embedded system technologies.Middle East & Africa Embedded Systems Market Report:

The Middle East and Africa region will likely experience growth from $2.73 billion in 2023 to $5.81 billion by 2033. An increase in demand for smart devices and automation solutions in various sectors, especially within manufacturing and healthcare, drives this expansion. Additionally, ongoing digital transformation initiatives are paving the way for more sophisticated embedded systems applications.Tell us your focus area and get a customized research report.

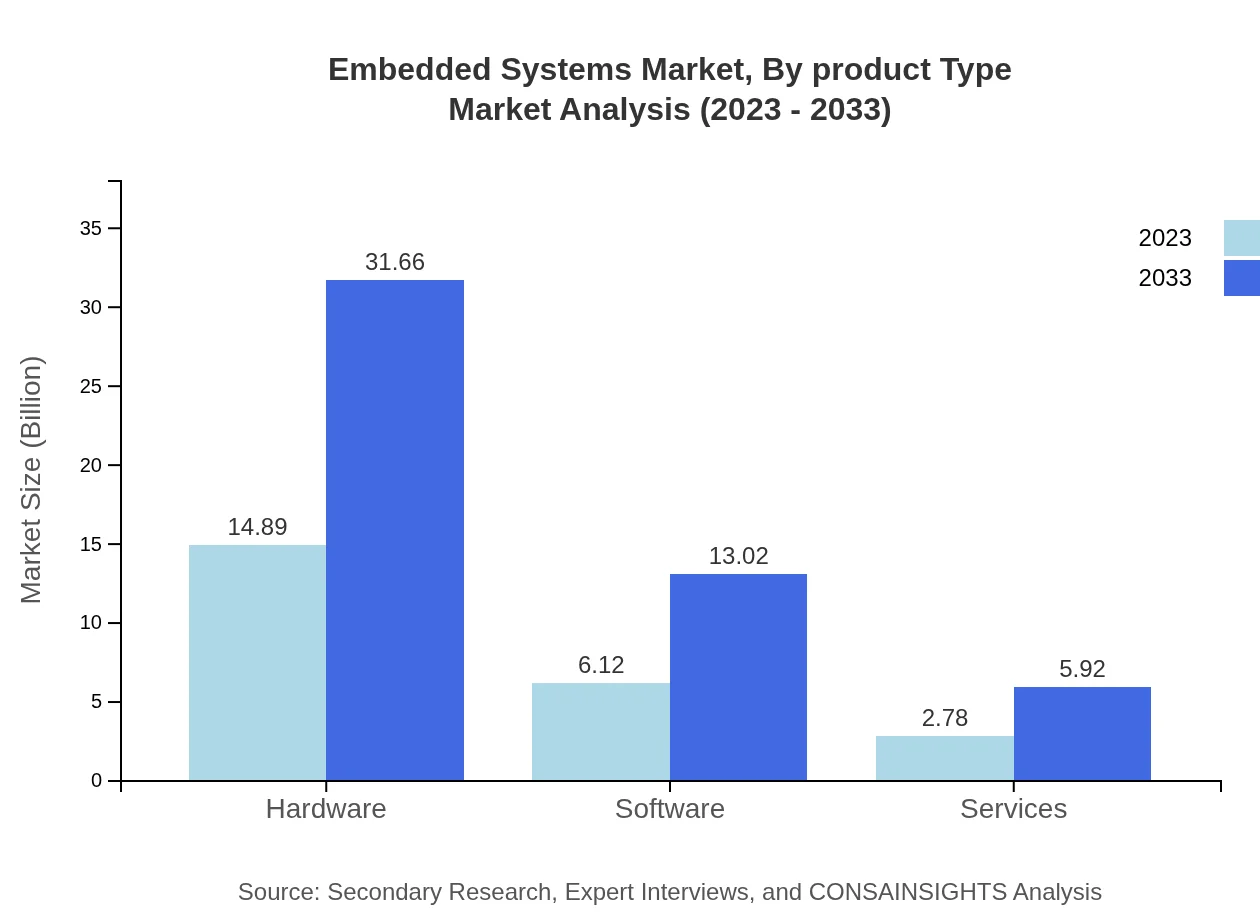

Embedded Systems Market Analysis By Product Type

The embedded systems market by product type is primarily divided into hardware and software segments. In 2023, hardware is estimated to hold a significant market share, expected to reach $14.89 billion and grow to $31.66 billion by 2033, representing a share of 62.57%. Software solutions, while slightly smaller, also show promising growth from $6.12 billion in 2023 to $13.02 billion in 2033, capturing 25.73% of the market. This reflects the critical role both categories play in the functionality and performance of embedded systems.

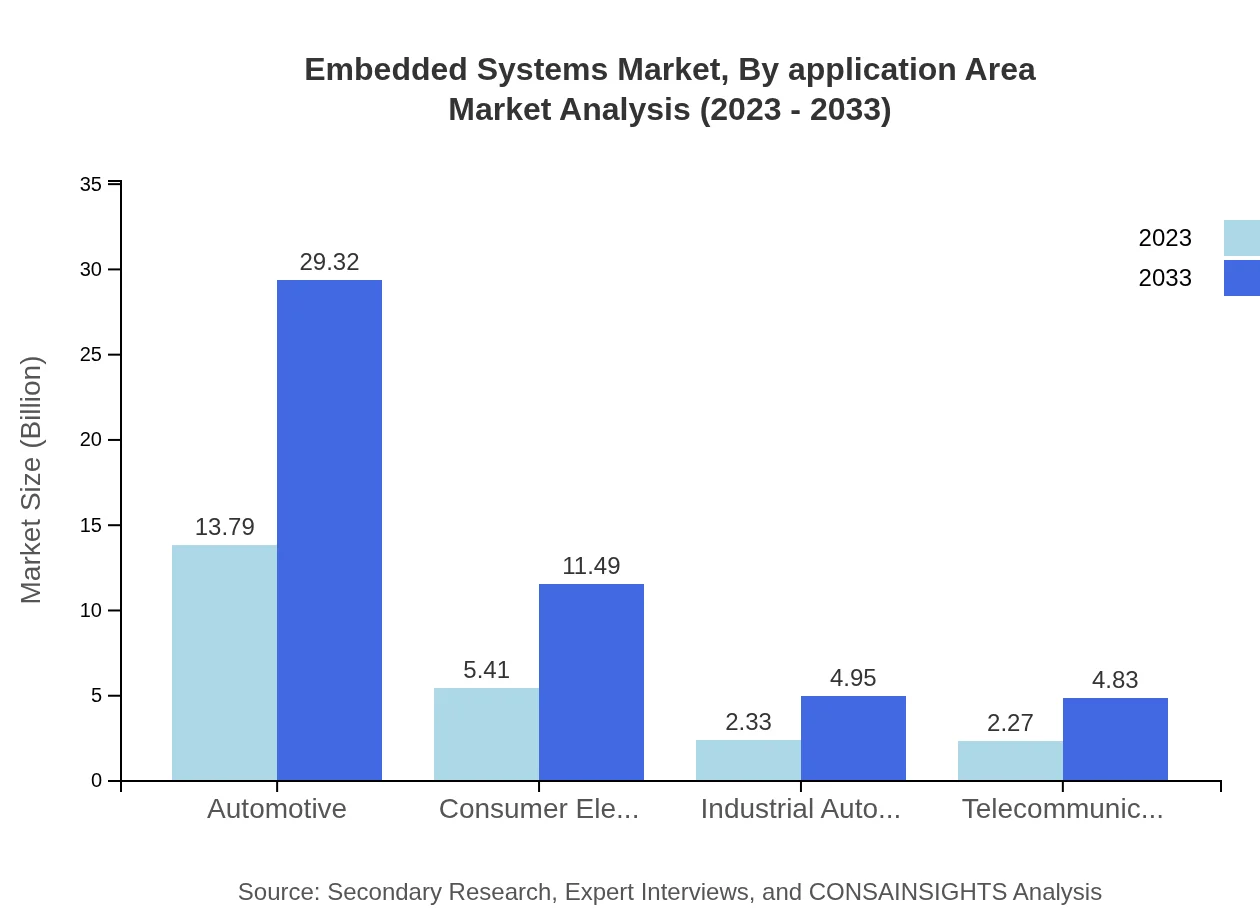

Embedded Systems Market Analysis By Application Area

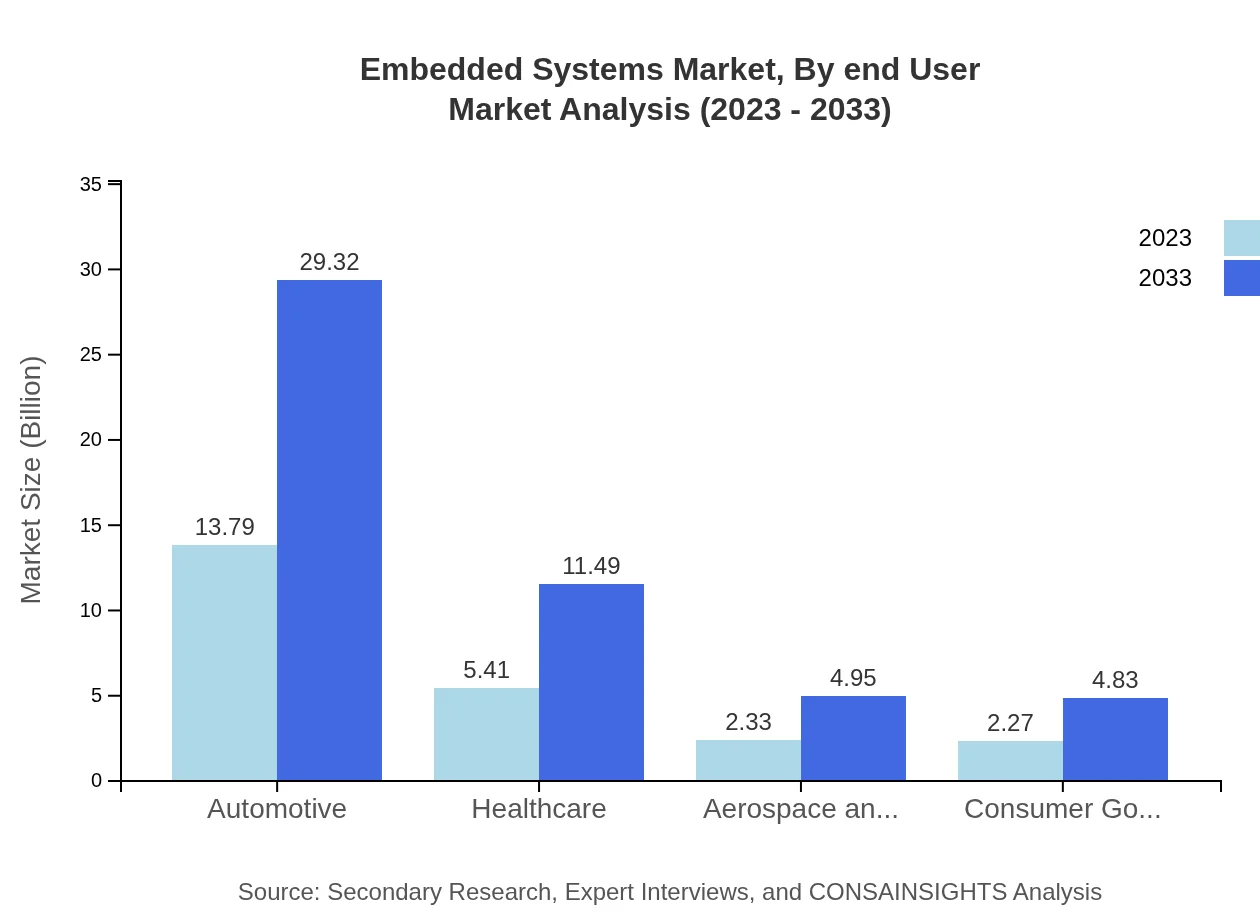

Analyzing embedded systems by application area, the market is significantly impacted by sectors such as automotive, healthcare, consumer electronics, and industrial automation. The automotive sector leads with a market size of $13.79 billion in 2023, projected to grow to $29.32 billion by 2033, holding a 57.95% market share. Healthcare systems are also crucial, with growth expected from $5.41 billion to $11.49 billion, maintaining a market share of 22.72%. Consumer electronics and industrial automation markets contribute significantly as well, highlighting diversified applications' importance within the embedded systems landscape.

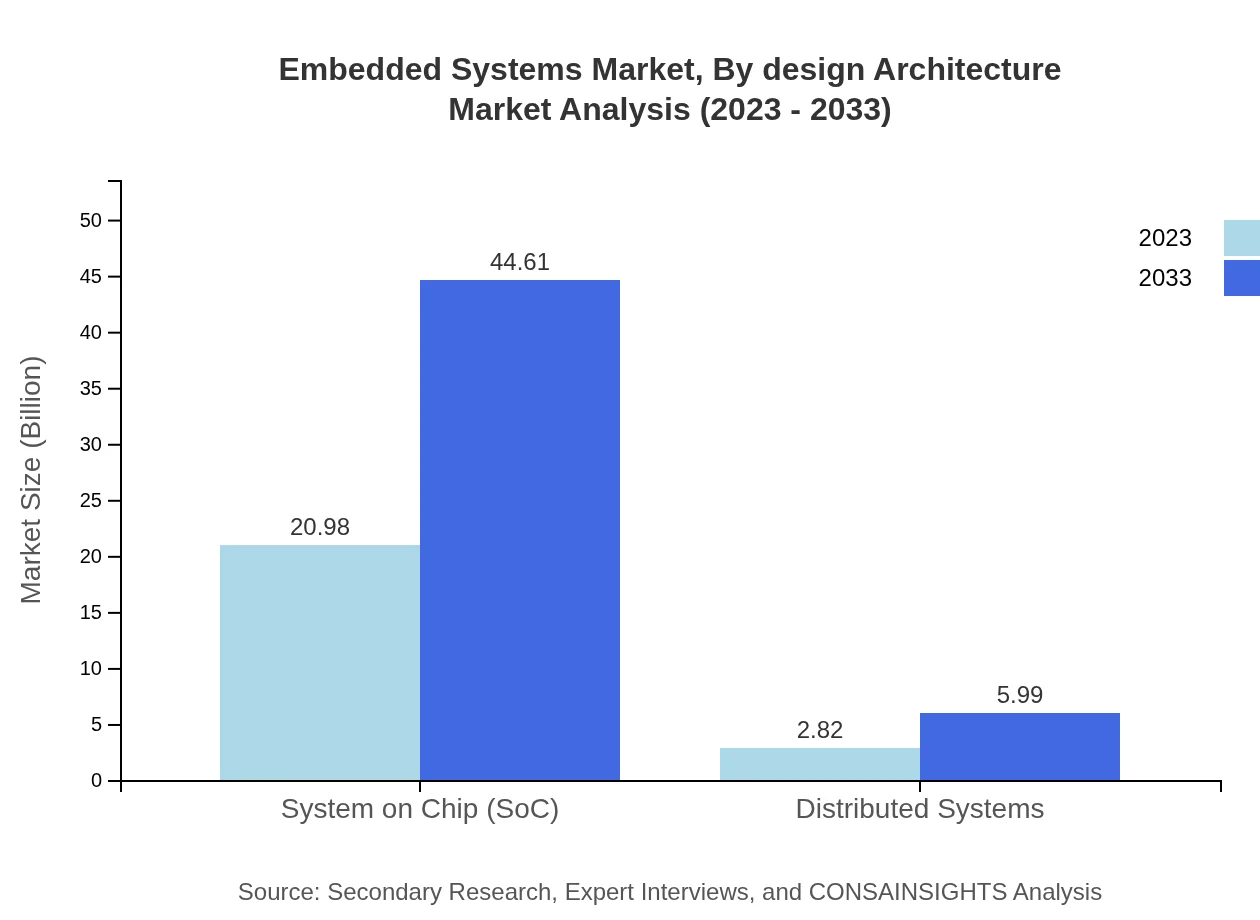

Embedded Systems Market Analysis By Design Architecture

The design architecture segment of embedded systems includes System on Chip (SoC) and distributed systems, with the SoC segment dominating the market. In 2023, the SoC market is valued at $20.98 billion, expected to climb to $44.61 billion by 2033, commanding an 88.17% overall share of the segments. The need for integrated solutions promoting efficiency and reduced power consumption drives these figures, as organizations seek to minimize costs while maximizing performance.

Embedded Systems Market Analysis By End User

The end-user segment of the embedded systems market highlights industries that significantly utilize these technologies. The automotive sector stands out with a market size of $13.79 billion in 2023, growing to $29.32 billion by 2033. This is followed by consumer electronics with $5.41 billion in 2023, growing to $11.49 billion. The healthcare sector also plays a vital role, reflecting the broad applications across diverse industries where embedded systems enhance functionality and performance, with forecasts suggesting robust growth trajectories.

Embedded Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Systems Industry

Intel Corporation:

Intel is a multinational corporation and technology company, known for its microprocessors and embedded systems solutions that power various electronics. It plays a critical role in the development of hardware platforms, including System on Chips (SoCs) for diverse applications.Texas Instruments:

Texas Instruments is a leading manufacturer of embedded processing and analog technologies. The company provides solutions for a variety of applications including automotive, industrial, and personal electronics, making significant contributions to the embedded systems market.NXP Semiconductors:

NXP Semiconductors specializes in embedded processing solutions and is a significant player in the automotive and industrial automation sectors. Their microcontrollers and processors facilitate advanced functionalities and innovation in smart technologies.Renesas Electronics:

Renesas Electronics is a global leader in microcontrollers and embedded systems, focusing on automotive applications, industrial automation, and IoT. The company emphasizes innovation and solutions that enhance operational efficiencies.We're grateful to work with incredible clients.

FAQs

What is the market size of embedded Systems?

The embedded systems market is valued at approximately $23.8 billion in 2023, with a projected CAGR of 7.6%, indicating robust growth opportunities through 2033.

What are the key market players or companies in this embedded Systems industry?

Key players in the embedded systems market include major technology firms, component suppliers, and software developers, contributing significantly to the innovation and supply chain within the industry.

What are the primary factors driving the growth in the embedded systems industry?

The growth of the embedded systems industry is driven by advancements in IoT technology, increasing demand for automation in various sectors, and the rise of smart devices across consumer, automotive, and industrial applications.

Which region is the fastest Growing in the embedded systems market?

The fastest-growing regions include North America and Europe, with North America projected to reach a market size of $19.43 billion by 2033, up from $9.14 billion in 2023.

Does ConsaInsights provide customized market report data for the embedded systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the embedded systems industry, facilitating in-depth analysis based on client requirements.

What deliverables can I expect from this embedded systems market research project?

Expect comprehensive reports including market trends, segment analysis, competitive landscape, growth forecasts, and actionable insights specific to the embedded systems sector.

What are the market trends of embedded systems?

Emerging trends in embedded systems include increased integration of AI capabilities, growing emphasis on cybersecurity, and the expansion of applications in automotive, healthcare, and consumer electronics.