Embolotherapy Market Report

Published Date: 31 January 2026 | Report Code: embolotherapy

Embolotherapy Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Embolotherapy market, covering key insights, trends, and forecasts from 2023 to 2033. It presents data on market size, growth rates, segmentation, and regional analysis, helping stakeholders understand the dynamics of this evolving industry.

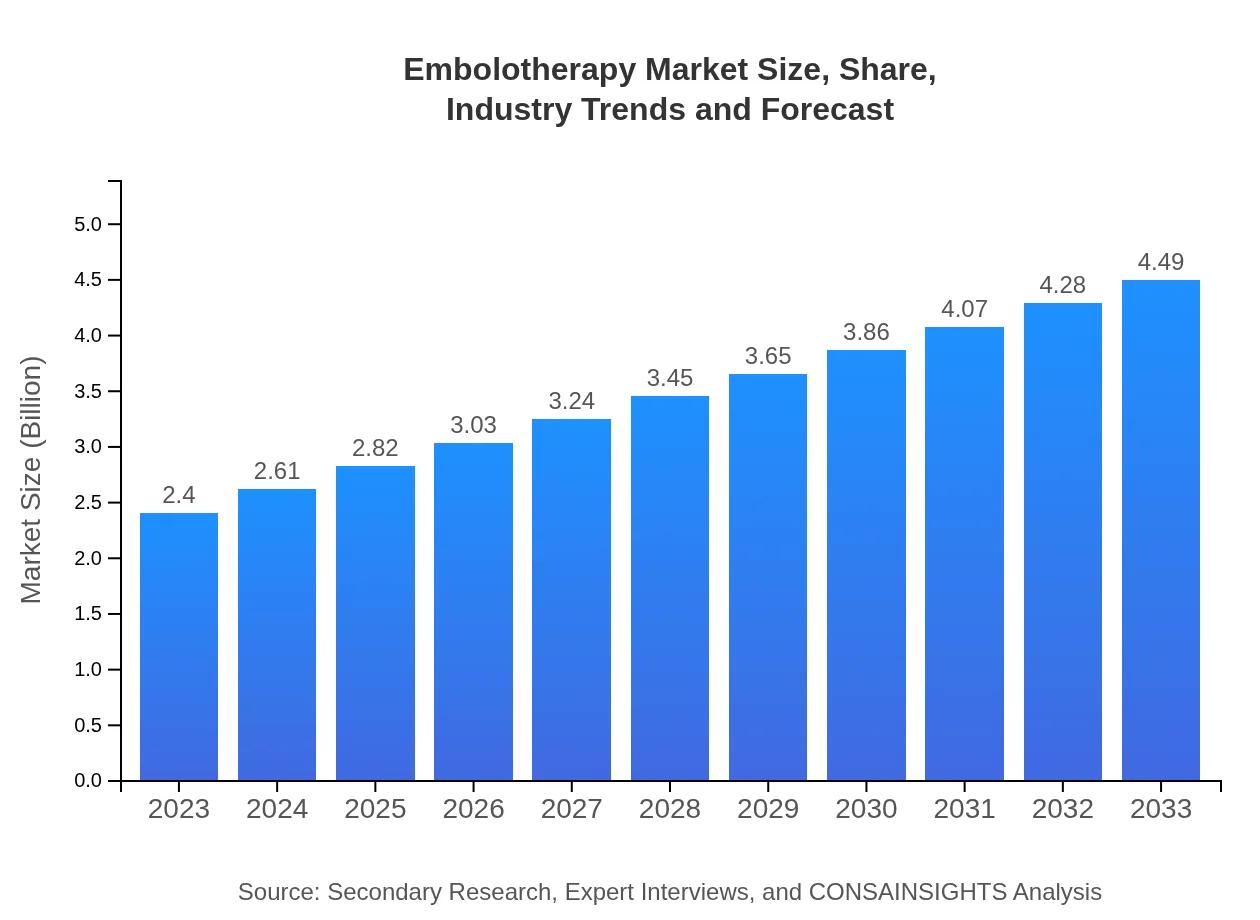

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.40 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $4.49 Billion |

| Top Companies | Medtronic , Boston Scientific, Terumo Corporation, Cook Medical |

| Last Modified Date | 31 January 2026 |

Embolotherapy Market Overview

Customize Embolotherapy Market Report market research report

- ✔ Get in-depth analysis of Embolotherapy market size, growth, and forecasts.

- ✔ Understand Embolotherapy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embolotherapy

What is the Market Size & CAGR of Embolotherapy market in 2023?

Embolotherapy Industry Analysis

Embolotherapy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embolotherapy Market Analysis Report by Region

Europe Embolotherapy Market Report:

In Europe, the Embolotherapy market was valued at approximately $0.75 billion in 2023 and is expected to reach $1.41 billion by 2033. Strong healthcare systems and a rise in outpatient procedures are crucial factors driving this market in countries like Germany, France, and the UK.Asia Pacific Embolotherapy Market Report:

In the Asia Pacific region, the Embolotherapy market was valued at approximately $0.41 billion in 2023 and is expected to grow to $0.76 billion by 2033. The increase is driven by rising healthcare expenditure and the growing prevalence of diseases requiring embolization. Countries like Japan, China, and India are significant contributors to this growth due to improved healthcare facilities and government initiatives in health.North America Embolotherapy Market Report:

North America is the largest region for Embolotherapy, with a market size of approximately $0.89 billion in 2023, likely to expand to $1.66 billion by 2033. The high prevalence of cancer and vascular disorders, coupled with advanced healthcare technologies and significant investments in research, support this market's growth.South America Embolotherapy Market Report:

The South American market for Embolotherapy is smaller, with an estimated value of $0.16 billion in 2023, projected to reach $0.29 billion by 2033. Growth is largely supported by increasing chronic diseases and awareness of treatment options. Challenges such as economic fluctuations and healthcare infrastructure may affect growth rates.Middle East & Africa Embolotherapy Market Report:

The Middle East and Africa region's market for Embolotherapy is valued at $0.20 billion in 2023 and projected to grow to $0.37 billion by 2033. The increasing incidence of vascular diseases and improving healthcare infrastructure in the region bolster this growth, despite challenges including limited access to advanced medical technologies.Tell us your focus area and get a customized research report.

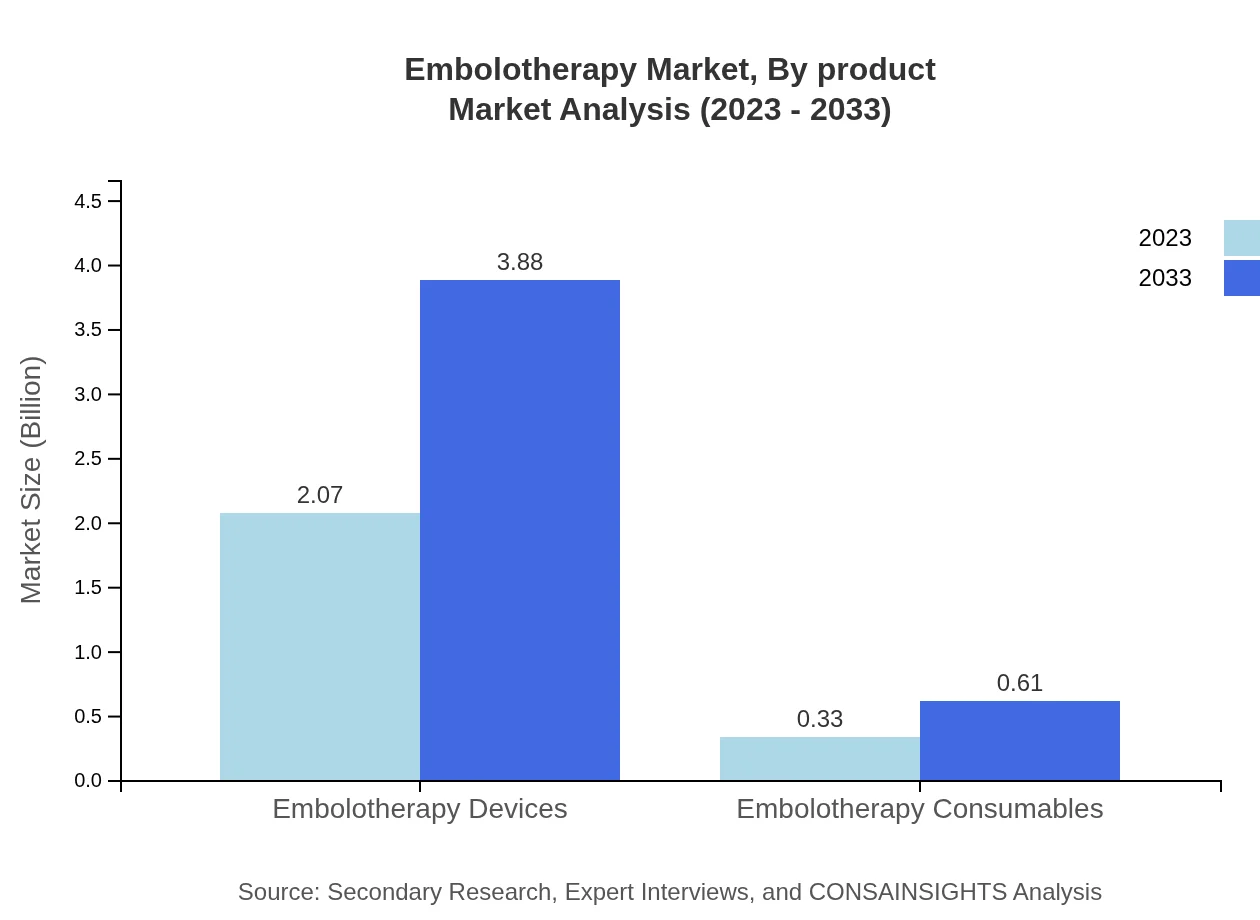

Embolotherapy Market Analysis By Product

The Embolotherapy market by product can be divided into embolization devices, embolic agents, and other accessories. In 2023, the embolization devices market is valued at approximately $2.07 billion and is expected to grow to $3.88 billion by 2033, holding a market share of 86.31% throughout this period. The embolic agents segment is projected to enhance its market size from $0.33 billion in 2023 to $0.61 billion in 2033, indicating a significant interest in new embolic materials and agent formulations.

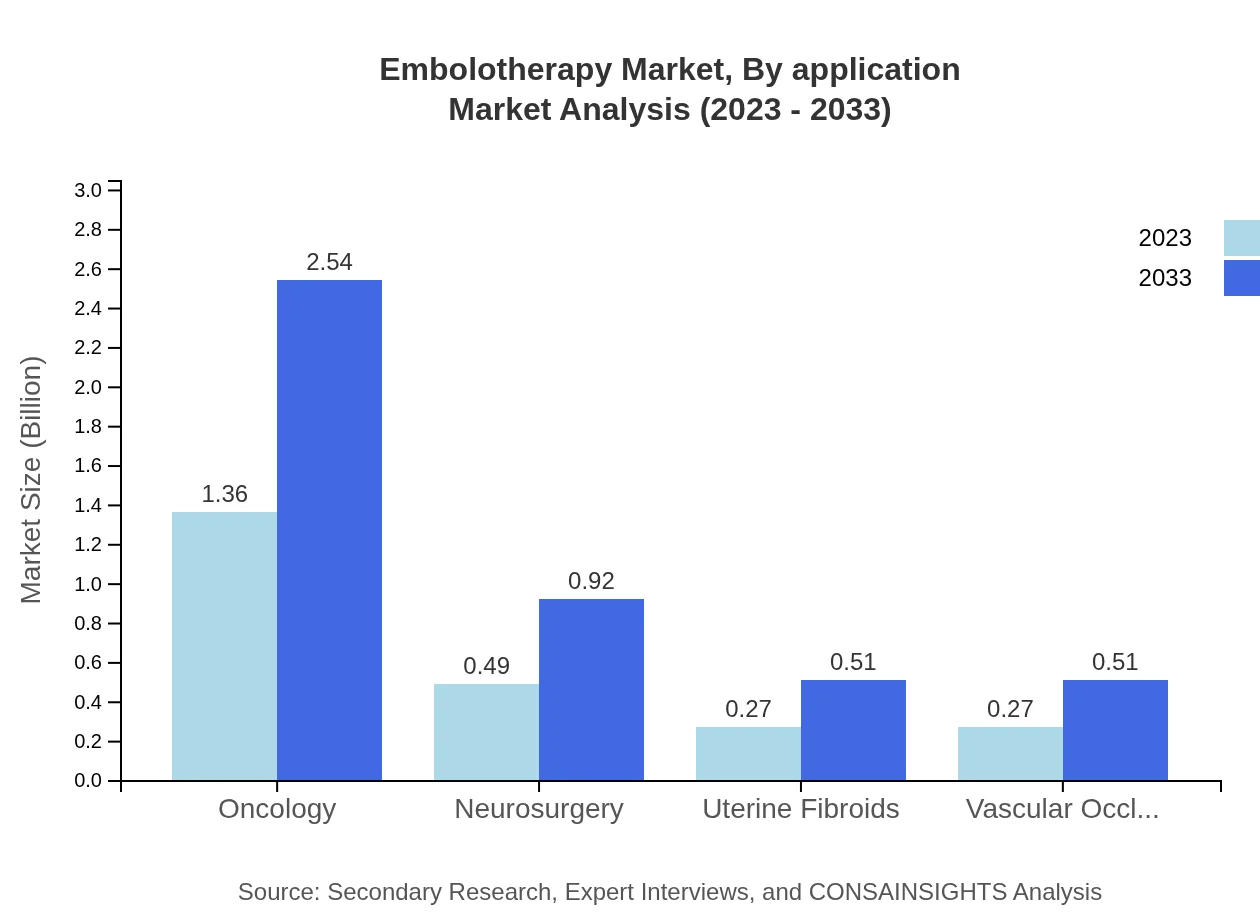

Embolotherapy Market Analysis By Application

The applications of embolotherapy are vast, including oncology, neurosurgery, treatment for uterine fibroids, and vascular occlusions. The oncology segment leads with a market size of $1.36 billion in 2023, expected to grow to $2.54 billion by 2033, holding 56.58% share in the application segment. Other applications such as vascular occlusions and uterine fibroid treatments are expected to grow steadily, recognizing the importance of targeted therapies in modern medicine.

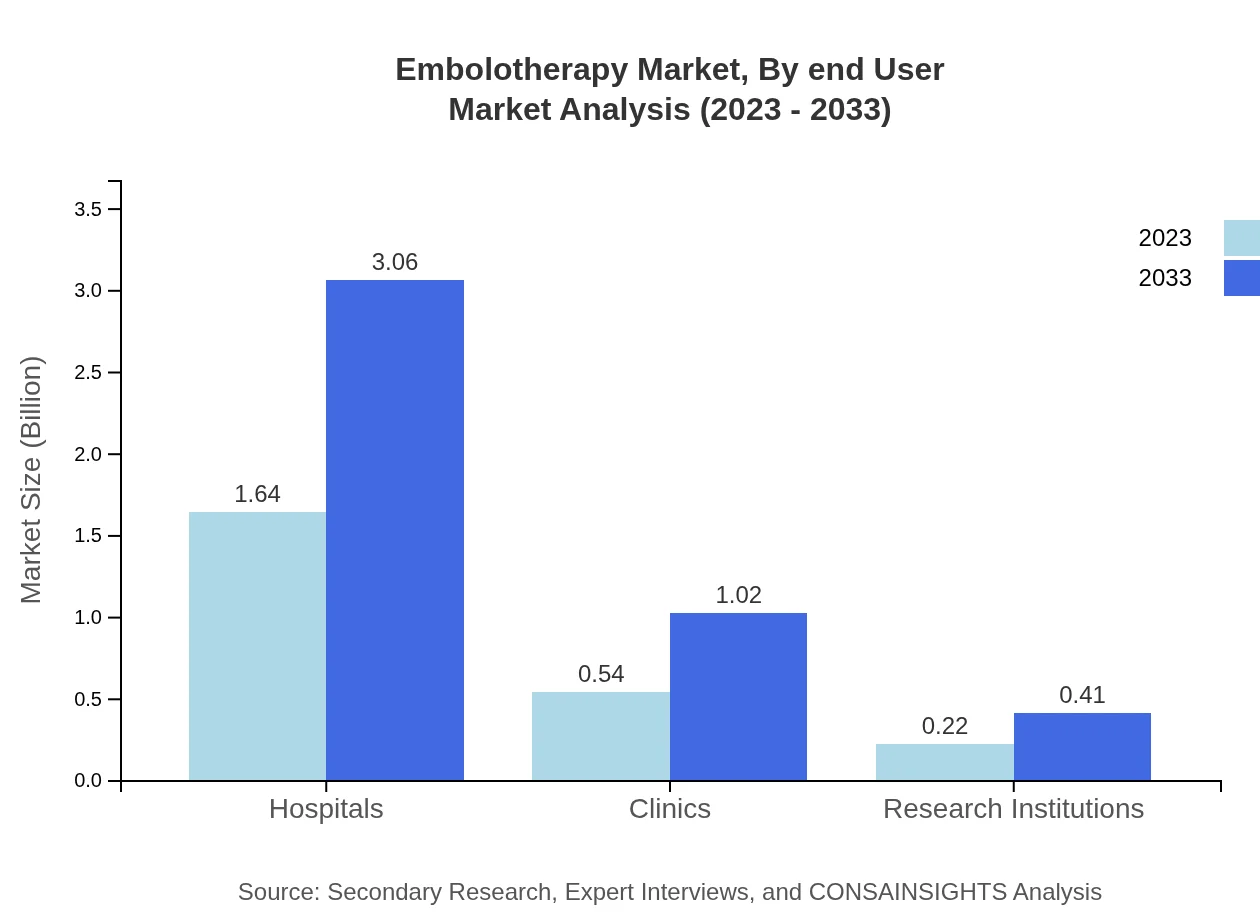

Embolotherapy Market Analysis By End User

The primary end-users of embolotherapy services include hospitals, clinics, and ambulatory surgical centers. Hospitals dominate the market, accounting for $1.64 billion in 2023 and expected to grow to $3.06 billion by 2033, holding a notable share of 68.18%. Clinics are also emerging as significant players, with a growing market size from $0.54 billion in 2023 to $1.02 billion by 2033.

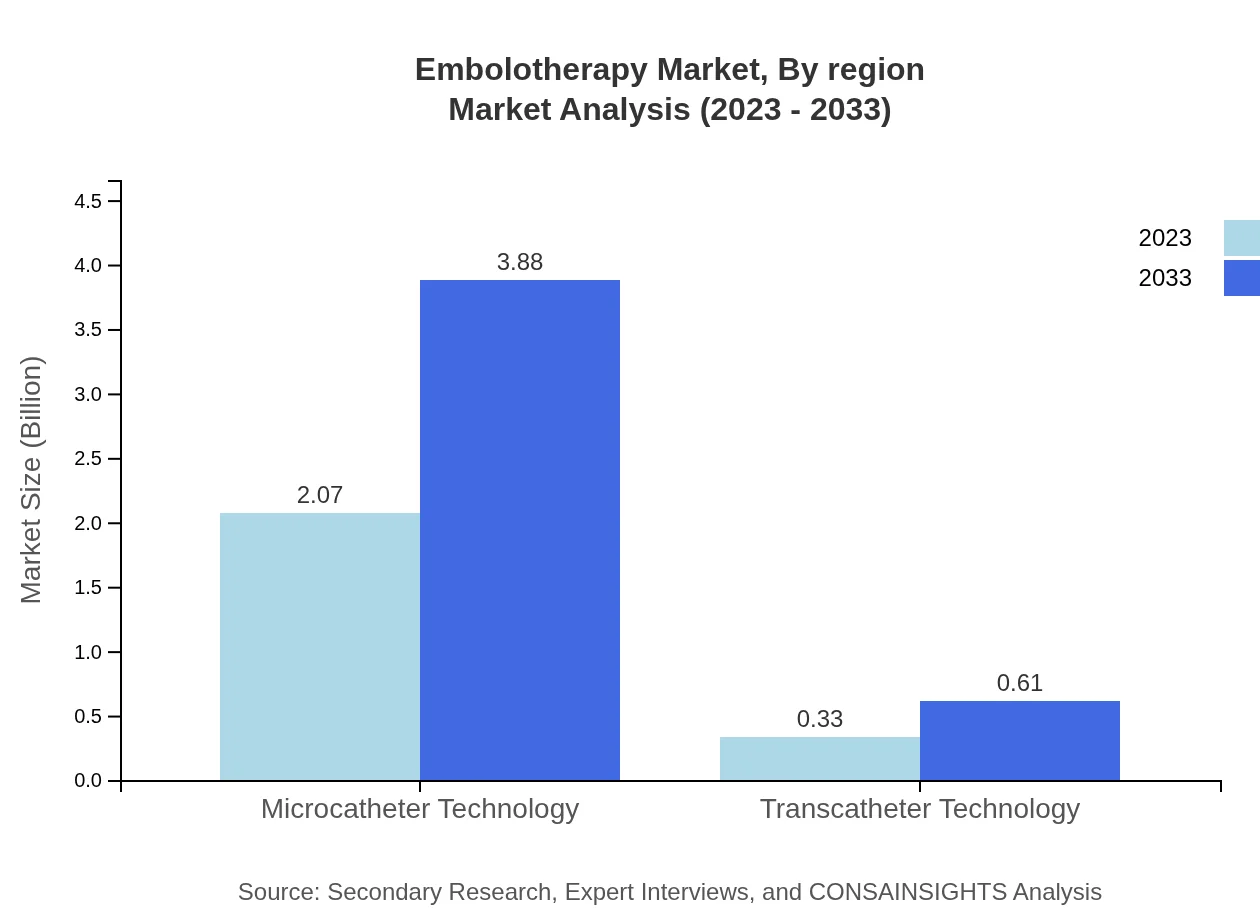

Embolotherapy Market Analysis By Region

Embolotherapy technologies include microcatheter and transcatheter technologies. Microcatheter technology is the leading segment, with a market size of $2.07 billion in 2023, projected to reach $3.88 billion by 2033. The transcatheter technology segment is comparatively smaller, growing from $0.33 billion in 2023 to $0.61 billion by 2033, reflecting ongoing innovations in device designs and applications.

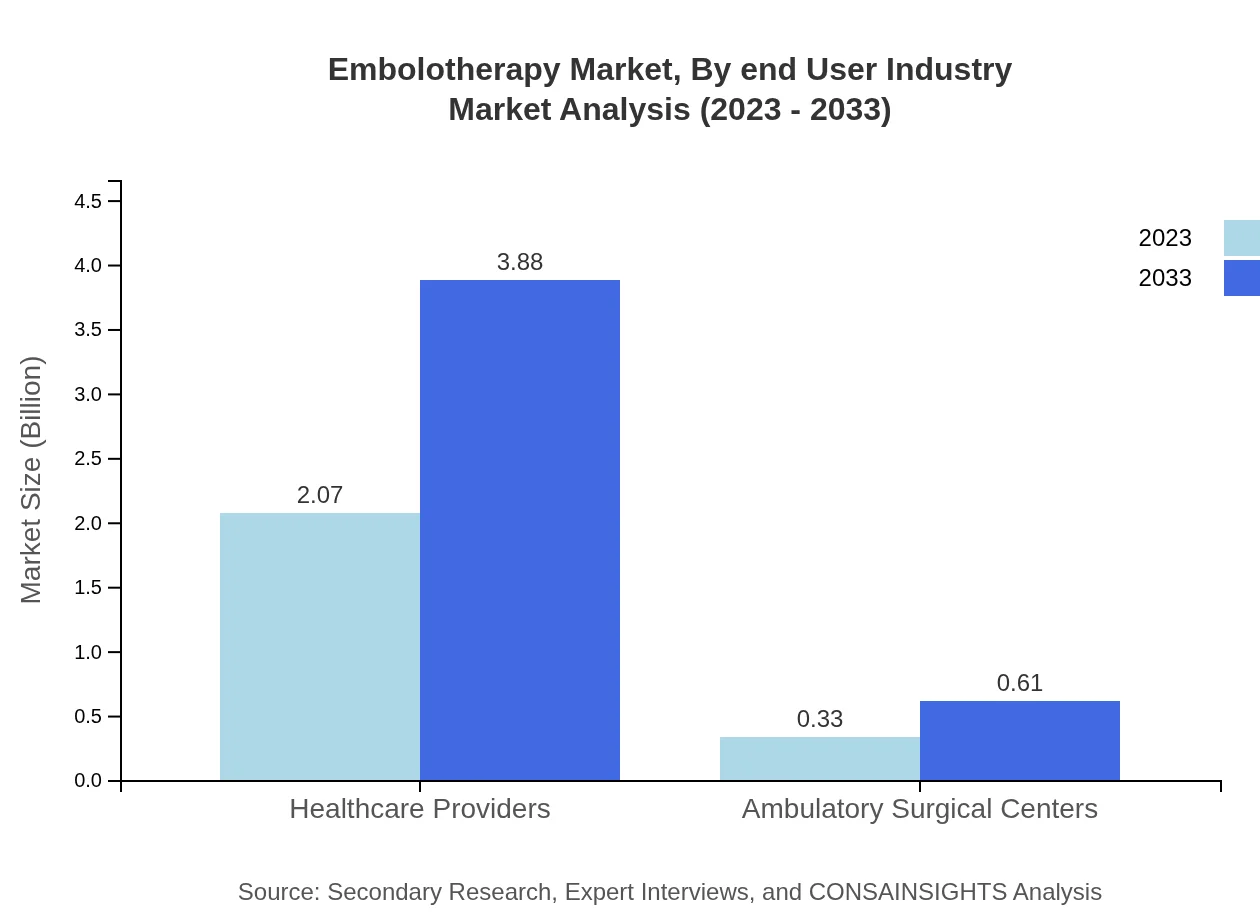

Embolotherapy Market Analysis By End User Industry

The end-user industries for embolotherapy are predominantly healthcare providers, including hospitals, clinics, and research institutions. The healthcare providers segment maintains a market size of $2.07 billion in 2023, anticipated to rise to $3.88 billion by 2033. The research institutions segment, while smaller, is expected to show consistent growth due to increased research activities into embolotherapy techniques and efficacy.

Embolotherapy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embolotherapy Industry

Medtronic :

Medtronic is a global leader in healthcare technology, offering innovative embolization devices and solutions that enhance procedural effectiveness and patient care.Boston Scientific:

Boston Scientific provides a wide range of embolization products, including advanced embolic agents and devices designed to improve clinical outcomes in minimally invasive procedures.Terumo Corporation:

Terumo Corporation is renowned for its high-quality interventional products, including microcatheter systems utilized in embolotherapy procedures.Cook Medical:

Cook Medical specializes in developing embolization devices and embolic materials focused on improving safety and effectiveness in various surgical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of embolotherapy?

The embolotherapy market is estimated to reach $2.4 billion by 2033, growing at a CAGR of 6.3%. The market reflects an uptick in demand for minimally invasive procedures enabling better patient outcomes.

What are the key market players or companies in this embolotherapy industry?

Key players include Medtronic, Boston Scientific, Terumo Corporation, and Stryker Corporation. These companies are driving innovation and expanding product offerings, which significantly influence the embolotherapy market dynamics.

What are the primary factors driving the growth in the embolotherapy industry?

Growth factors include the increasing prevalence of vascular diseases, advancements in embolotherapy technologies, and rising demand for minimally invasive surgical procedures, which enhance patient recovery times and outcomes.

Which region is the fastest Growing in the embolotherapy market?

The Asia Pacific region exhibits the fastest growth, projected to increase from $0.41 billion in 2023 to $0.76 billion by 2033. This growth is driven by improving healthcare infrastructure and rising healthcare spending.

Does ConsaInsights provide customized market report data for the embolotherapy industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the embolotherapy industry, including detailed analysis of trends, regional data, and competitive landscape assessments.

What deliverables can I expect from this embolotherapy market research project?

Deliverables typically include comprehensive market analysis reports, SWOT analysis, market forecasts, competitive landscape overviews, and insights into key market trends driving the embolotherapy industry.

What are the market trends of embolotherapy?

Market trends indicate a shift towards innovative technologies in embolotherapy, focusing on microcatheter systems, and a growing preference for outpatient procedures, thus ensuring expanded access and quicker patient recovery.