Emission Control Catalyst Market Report

Published Date: 02 February 2026 | Report Code: emission-control-catalyst

Emission Control Catalyst Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Emission Control Catalyst market, covering key insights, market data, and forecasts from 2023 to 2033. It aims to provide stakeholders with valuable information on market dynamics, trends, and regional performance.

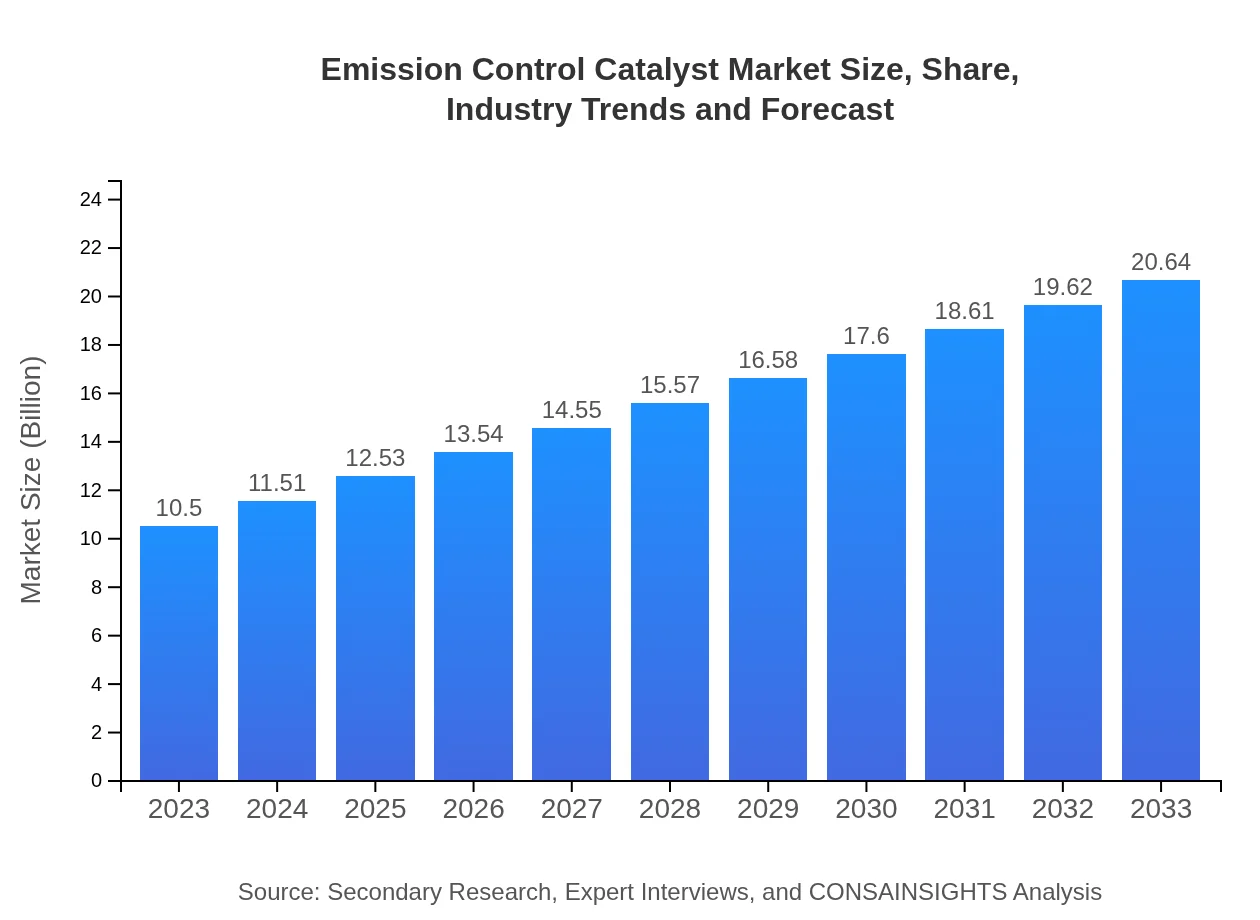

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | BASF SE, Johnson Matthey PLC, Umicore SA, Clariant AG, Cataler Corporation |

| Last Modified Date | 02 February 2026 |

Emission Control Catalyst Market Overview

Customize Emission Control Catalyst Market Report market research report

- ✔ Get in-depth analysis of Emission Control Catalyst market size, growth, and forecasts.

- ✔ Understand Emission Control Catalyst's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Emission Control Catalyst

What is the Market Size & CAGR of Emission Control Catalyst market in 2023?

Emission Control Catalyst Industry Analysis

Emission Control Catalyst Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Emission Control Catalyst Market Analysis Report by Region

Europe Emission Control Catalyst Market Report:

The European market for Emission Control Catalysts was valued at USD 3.28 billion in 2023, projected to reach USD 6.45 billion by 2033. Europe is at the forefront of stringent emissions legislation, which positively influences the adoption of advanced catalysts in both the automotive and industrial sectors.Asia Pacific Emission Control Catalyst Market Report:

Asia Pacific is expected to be a major contributor to the Emission Control Catalyst market, with a size of USD 2.17 billion in 2023, projected to grow to USD 4.26 billion by 2033. This growth is fueled by rising automotive production and stringent emission regulations in countries like China and India, making it a key market for both manufacturers and consumers seeking cleaner technology.North America Emission Control Catalyst Market Report:

North America is a significant market with a size of USD 3.39 billion in 2023, expected to increase to USD 6.66 billion by 2033. The growth in this region is driven by strict environmental regulations and a high level of awareness regarding air quality, leading to increased adoption of advanced catalytic technologies in vehicles.South America Emission Control Catalyst Market Report:

In South America, the market size for Emission Control Catalysts is anticipated to grow from USD 0.34 billion in 2023 to USD 0.67 billion by 2033, supported by increasing automotive manufacturing and regional initiatives for environmental sustainability. Regulatory frameworks are gradually becoming more stringent, driving the need for advanced emission control solutions.Middle East & Africa Emission Control Catalyst Market Report:

The Middle East and Africa market is estimated to grow from USD 1.32 billion in 2023 to USD 2.59 billion by 2033, reflecting a gradual shift towards adopting emission control technologies amid growing concerns about air pollution and sustainability across the region.Tell us your focus area and get a customized research report.

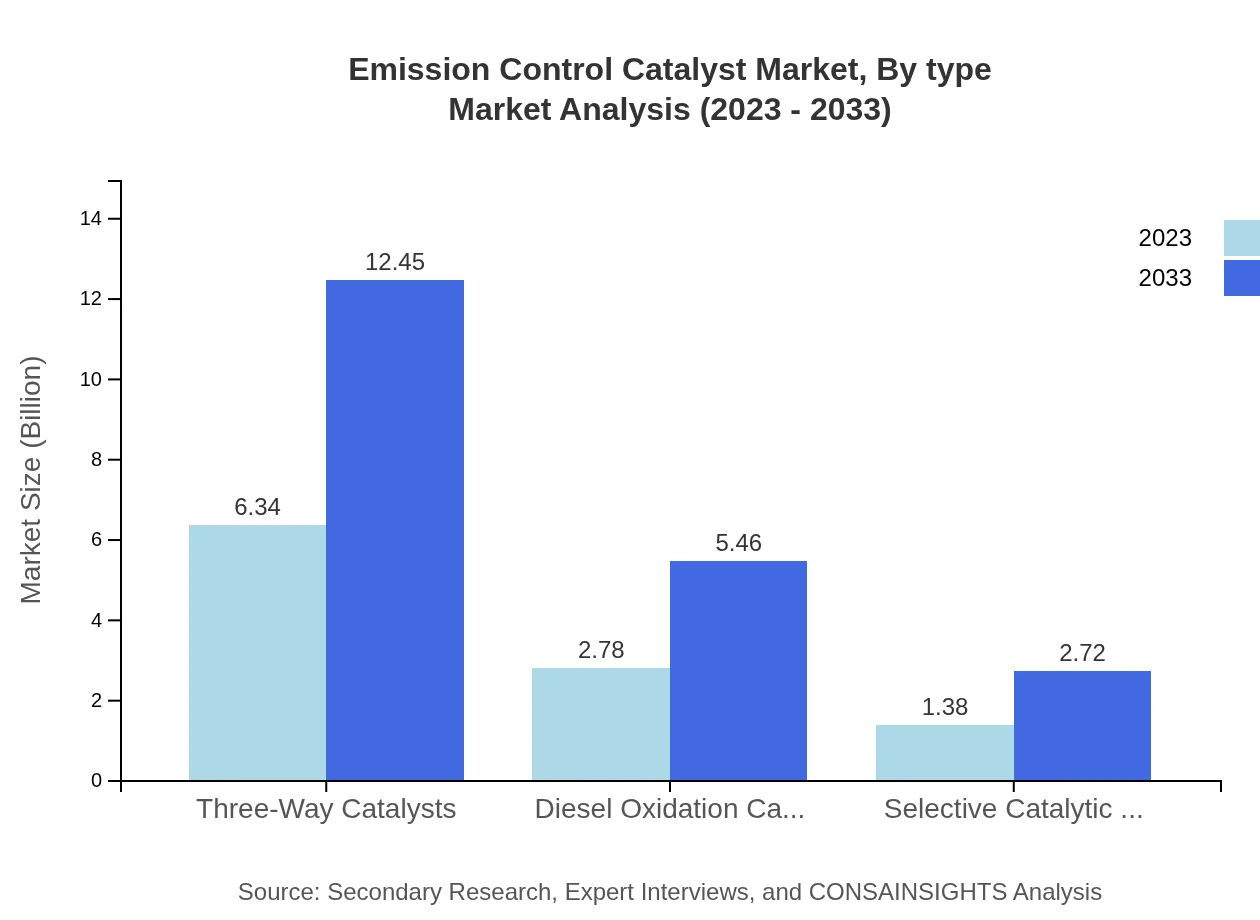

Emission Control Catalyst Market Analysis By Type

The Emission Control Catalyst market segmented by type includes Three-Way Catalysts, Diesel Oxidation Catalysts (DOC), Selective Catalytic Reduction (SCR), and Platinum, Palladium, and Rhodium-based Catalysts. In 2023, Three-Way Catalysts dominate the market, valued at USD 6.34 billion with a market share of 60.34%. This segment is projected to see significant growth, reaching USD 12.45 billion by 2033, driven by the need for advanced composite catalysts in modern vehicles. Meanwhile, Diesel Oxidation Catalysts are projected to grow from USD 2.78 billion to USD 5.46 billion over the same period, holding a share of 26.47%.

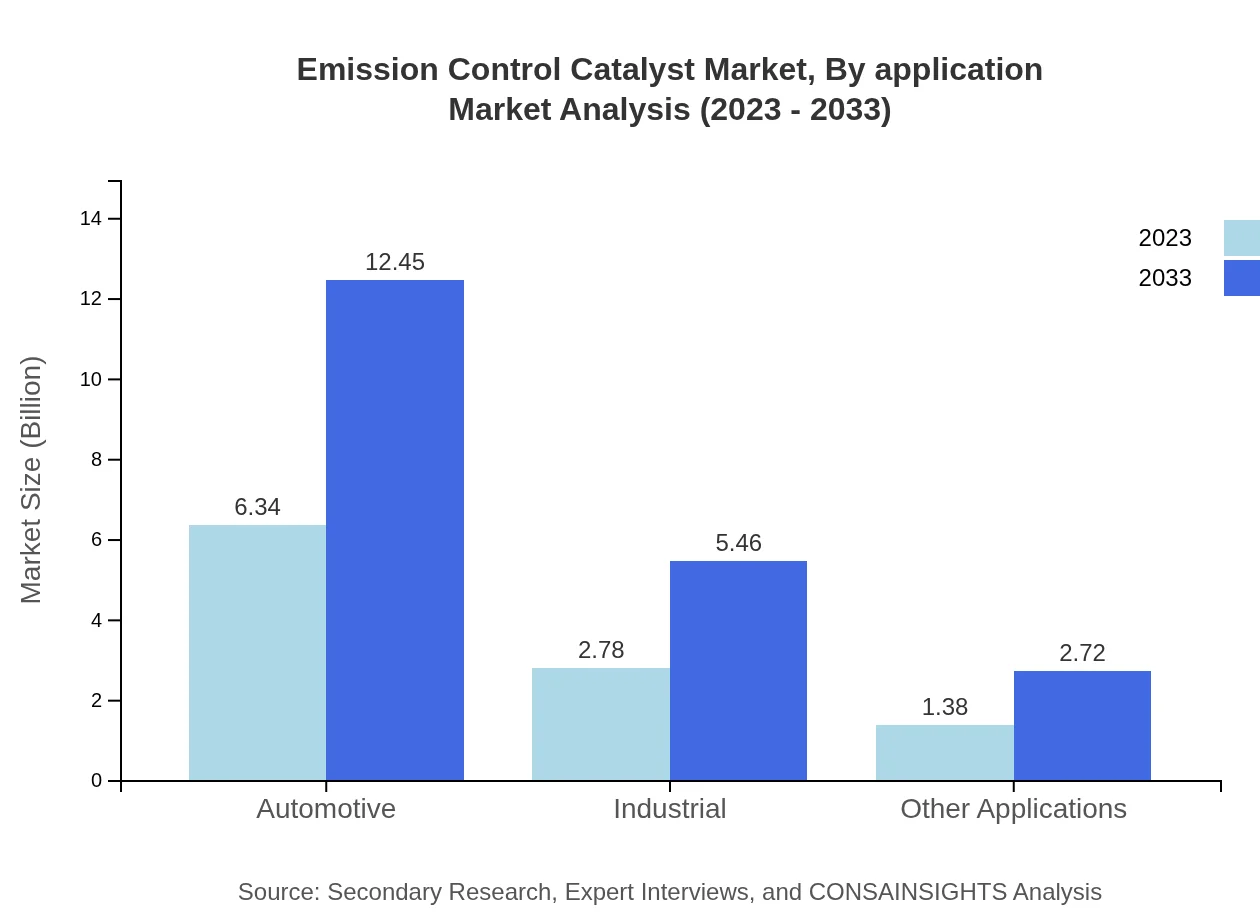

Emission Control Catalyst Market Analysis By Application

By application, the Emission Control Catalyst market is divided into Automotive, Industrial, and Other applications. The automotive sector is hugely significant, projected to account for roughly 60.34% of the total market share in 2023, with a market size of USD 6.34 billion, growing to USD 12.45 billion by 2033. The industrial applications, primarily driven by regulatory demands, are expected to rise from USD 2.78 billion to USD 5.46 billion, holding a 26.47% share.

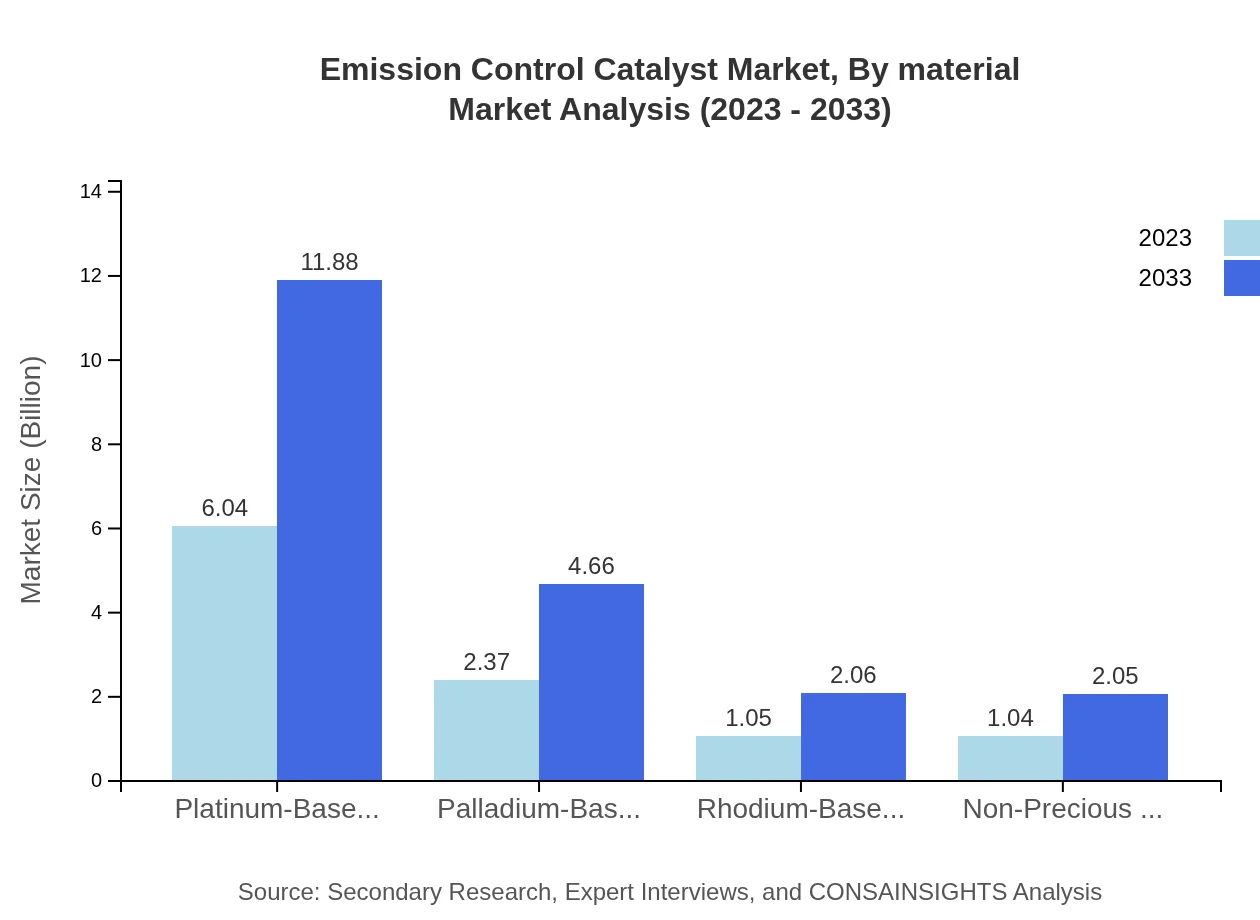

Emission Control Catalyst Market Analysis By Material

The materials used in the Emission Control Catalyst include Platinum, Palladium, and Rhodium, which are pivotal for the effectiveness of emission reduction technologies. Platinum-based catalysts currently represent a market value of USD 6.04 billion and are expected to grow to USD 11.88 billion by 2033, capturing 57.55% of the market share. Meanwhile, non-precious metal catalysts are emerging due to cost-effectiveness and are anticipated to see significant growth from USD 1.04 billion to USD 2.05 billion.

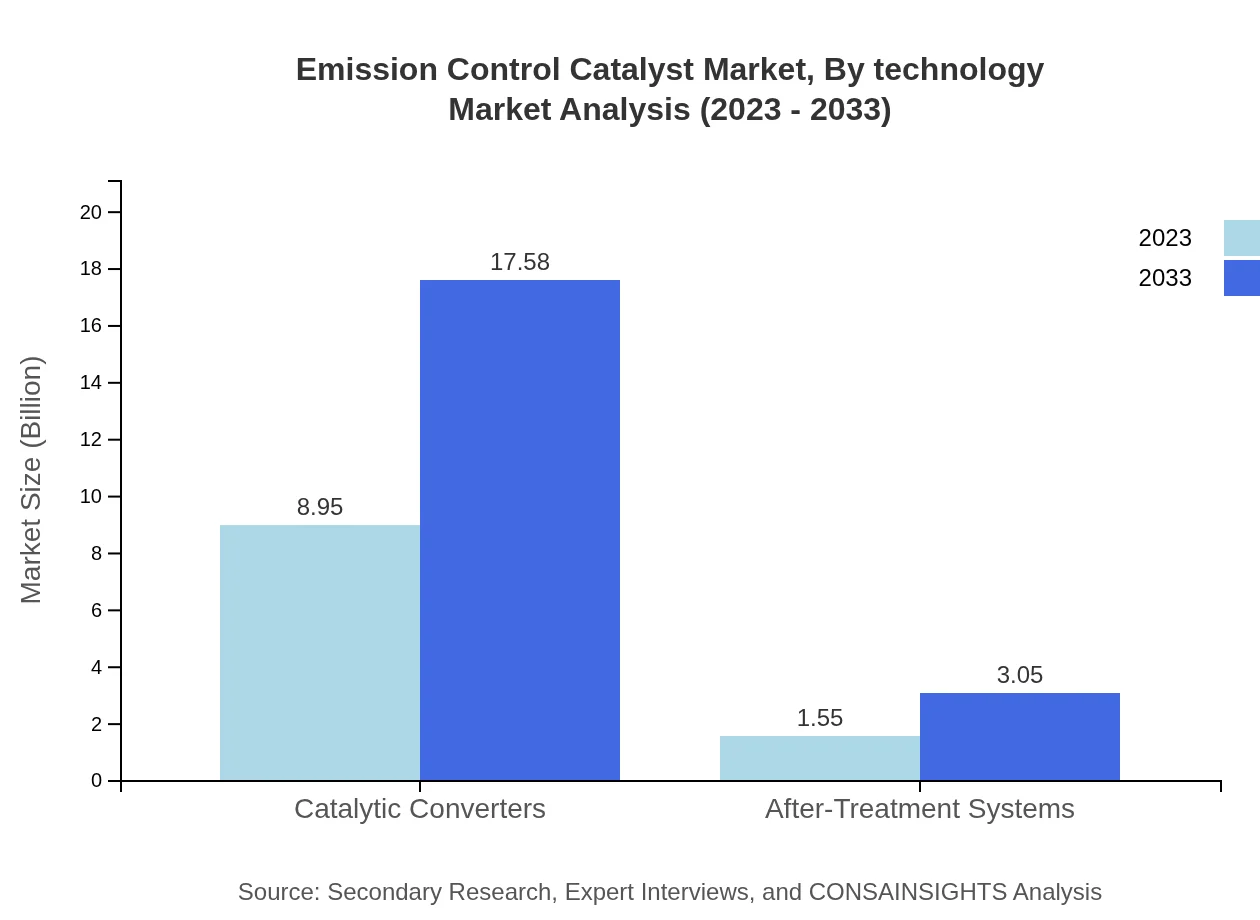

Emission Control Catalyst Market Analysis By Technology

Technological advancement in catalyst design is crucial in the Emission Control Catalyst market. Innovations include the development of more efficient formulations and better performance under varying temperatures and conditions. The rise of non-precious metal catalysts and alternative formulations is becoming prominent as manufacturers aim for sustainability and cost-reduction while meeting emissions targets.

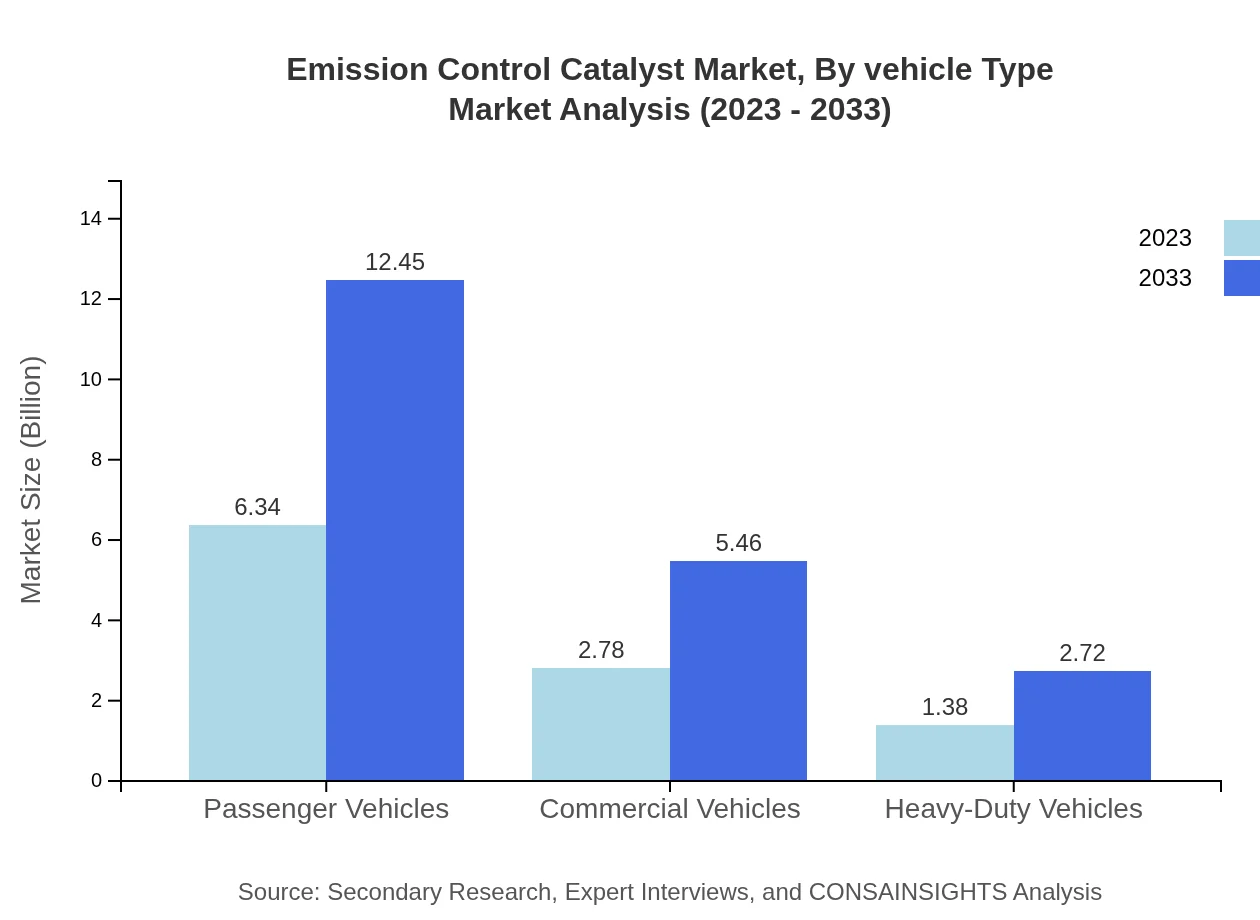

Emission Control Catalyst Market Analysis By Vehicle Type

In the vehicle type category, the market is segmented into Passenger Vehicles, Commercial Vehicles, and Heavy-Duty Vehicles. Passenger vehicles dominate the segment, valued at USD 6.34 billion in 2023 and projected to reach USD 12.45 billion by 2033. Commercial vehicles and heavy-duty trucks will also experience growth, with market sizes of USD 2.78 billion and USD 1.38 billion expected to grow to USD 5.46 billion and USD 2.72 billion respectively.

Emission Control Catalyst Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Emission Control Catalyst Industry

BASF SE:

A leading supplier of chemical products, BASF is a key player in the emission control catalyst industry, providing innovative solutions and technologies for automotive and industrial applications.Johnson Matthey PLC:

Specializing in sustainable technologies, Johnson Matthey is recognized for its advanced catalyst technologies that contribute to reducing harmful emissions from vehicles and industrial processes.Umicore SA:

Umicore is a global materials technology and recycling group, known for its commitment to sustainable development and its effective emission control catalyst solutions.Clariant AG:

Clariant operates in diverse sectors and has developed effective catalysts aimed at achieving optimal emissions reductions and improved environmental compliance.Cataler Corporation:

A significant player in the Asian market, Cataler manufactures a wide range of emission control catalysts focusing on advanced technologies and innovative solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of emission Control Catalyst?

The global emission control catalyst market is valued at approximately $10.5 billion in 2023, with an anticipated CAGR of 6.8% over the next decade, aiming for significant growth by 2033.

What are the key market players or companies in this emission Control Catalyst industry?

Key players in the emission control catalyst market include companies like BASF, Johnson Matthey, and Umicore, which dominate with innovative technologies and extensive product portfolios, fueling competitive dynamics.

What are the primary factors driving the growth in the emission control catalyst industry?

Growth drivers in the emission control catalyst industry include stringent environmental regulations, the increase in vehicle production, technological advancements in catalyst manufacturing, and rising awareness of sustainable practices.

Which region is the fastest Growing in the emission control catalyst?

Asia Pacific is the fastest-growing region for emission control catalysts, projected to expand from a market size of $2.17 billion in 2023 to $4.26 billion by 2033, reflecting rapid industrialization and vehicle growth.

Does ConsaInsights provide customized market report data for the emission control catalyst industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the emission control catalyst industry, providing detailed insights and analyses relevant to clients' strategic decision-making.

What deliverables can I expect from this emission control catalyst market research project?

From the emission control catalyst market research project, expect comprehensive reports, data analysis, graphical representations of trends, competitor analysis, and tailored insights to inform your strategic initiatives.

What are the market trends of emission control catalyst?

Current trends in the emission control catalyst market include increasing use of three-way catalysts, advancements in non-precious metal catalysts, growing demand for diesel oxidation catalysts, and the rise in electric vehicle adoption.