Empty Capsules Market Report

Published Date: 31 January 2026 | Report Code: empty-capsules

Empty Capsules Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Empty Capsules market, covering market dynamics, segmentation, regional insights, and future forecasts between 2023 and 2033. It aims to equip stakeholders with valuable data and insights for strategic decision-making.

| Metric | Value |

|---|---|

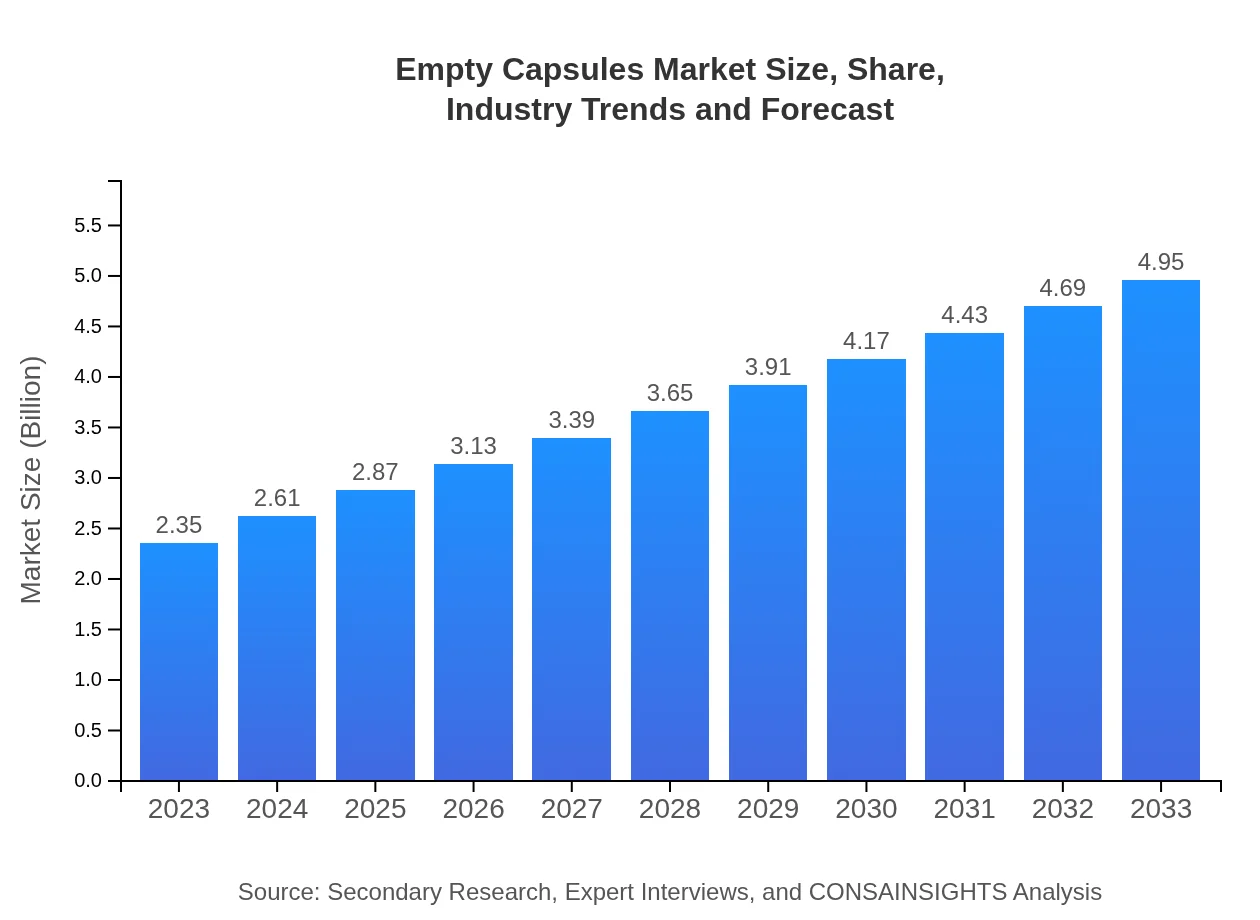

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.35 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $4.95 Billion |

| Top Companies | Capsugel (Lonza), Qualicaps, ACG Capsules, Suheung Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Empty Capsules Market Overview

Customize Empty Capsules Market Report market research report

- ✔ Get in-depth analysis of Empty Capsules market size, growth, and forecasts.

- ✔ Understand Empty Capsules's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Empty Capsules

What is the Market Size & CAGR of Empty Capsules market in 2023?

Empty Capsules Industry Analysis

Empty Capsules Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Empty Capsules Market Analysis Report by Region

Europe Empty Capsules Market Report:

The European market for Empty Capsules is worth $0.73 billion in 2023, with an anticipated growth to $1.53 billion by 2033. Strong regulatory frameworks and an emphasis on quality drive the demand for high-standard capsules in both pharmaceutical and nutraceutical sectors.Asia Pacific Empty Capsules Market Report:

The Asia Pacific region is poised for substantial growth, with a market value of $0.41 billion in 2023, projected to reach $0.87 billion by 2033. The expansion is driven by the increasing investment in pharmaceutical manufacturing and a growing consumer base for dietary supplements.North America Empty Capsules Market Report:

North America holds a significant portion of the market, valued at $0.88 billion in 2023 and predicted to grow to $1.84 billion by 2033. The region benefits from a robust pharmaceutical industry and high consumer awareness regarding health supplements.South America Empty Capsules Market Report:

In South America, the Empty Capsules market is valued at $0.16 billion in 2023 and is expected to grow to $0.33 billion by 2033. Factors such as rising health consciousness and advancements in capsule technology are key growth drivers in this region.Middle East & Africa Empty Capsules Market Report:

The Middle East and Africa market is valued at $0.18 billion in 2023 and is expected to reach $0.37 billion by 2033. Growth in this region is driven by an increasing focus on health and wellness and a rise in investments in healthcare and pharmaceutical sectors.Tell us your focus area and get a customized research report.

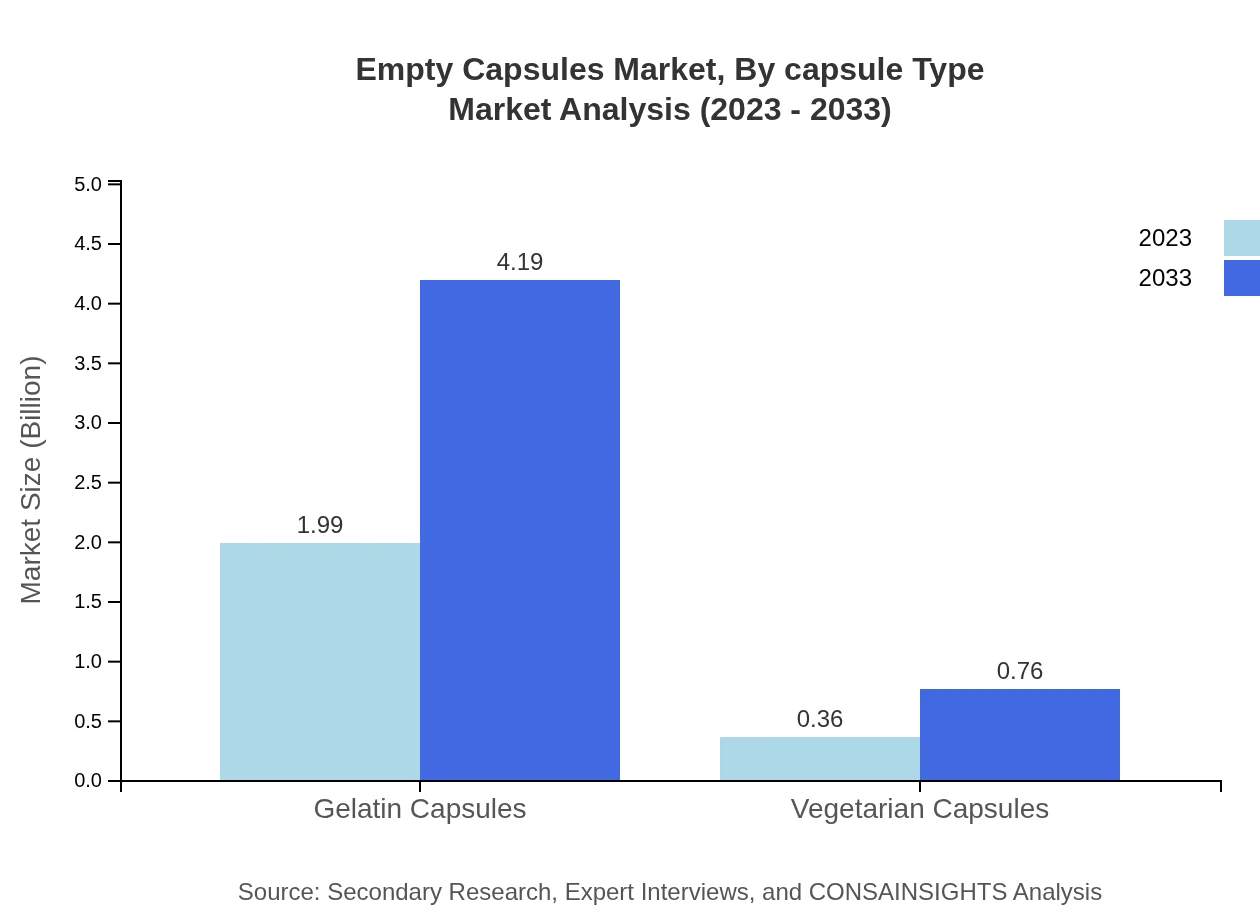

Empty Capsules Market Analysis By Capsule Type

In 2023, the market for gelatin capsules stands at $1.99 billion, maintaining an 84.69% share, while vegetarian capsules account for $0.36 billion, making up 15.31% of the market. Over the next decade, both segments are likely to witness growth, with the gelatin market projected to rise to $4.19 billion by 2033, while the vegetarian segment increases to $0.76 billion.

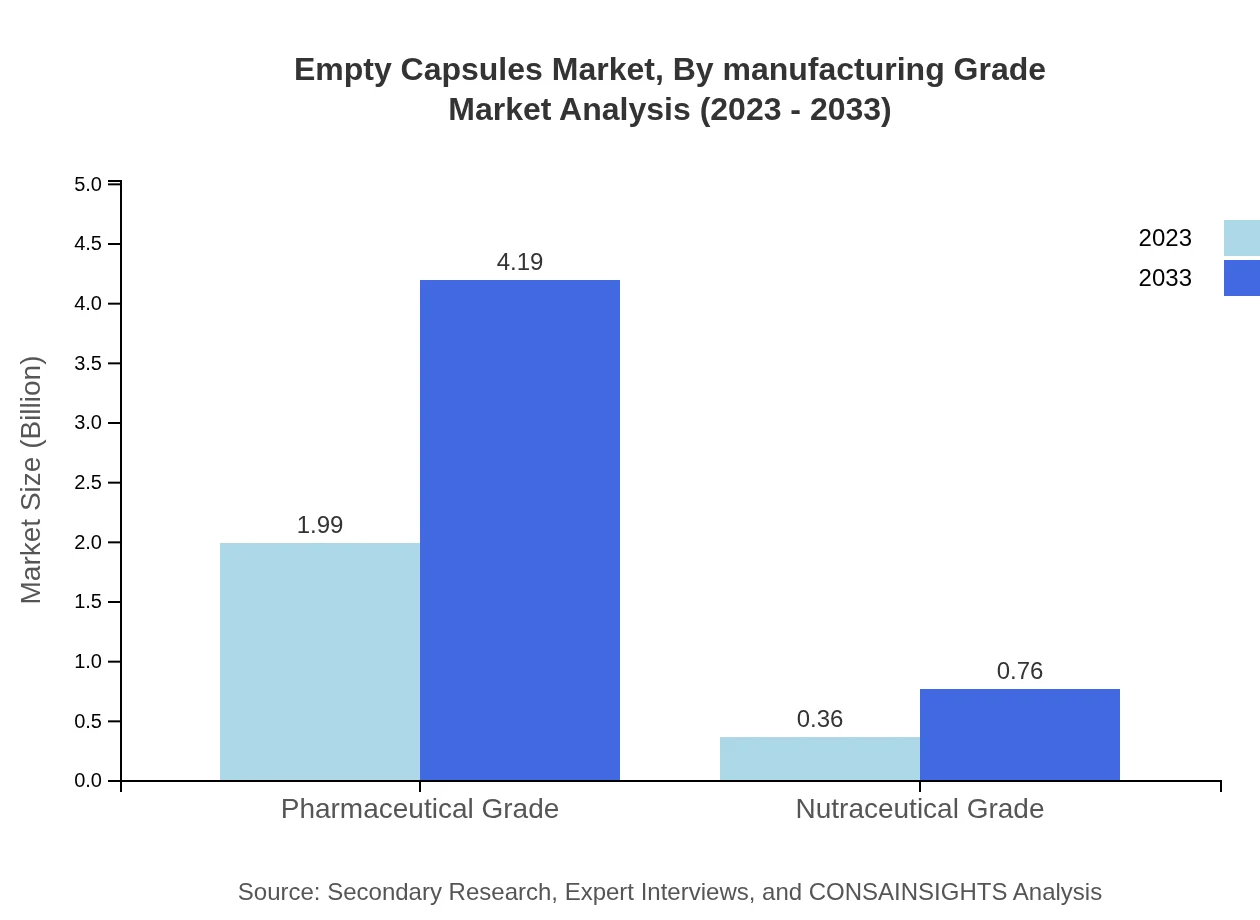

Empty Capsules Market Analysis By Manufacturing Grade

Pharmaceutical grade capsules dominate the market with a size of $1.99 billion in 2023 (84.69% share) and are forecasted to reach $4.19 billion by 2033. Nutraceutical grade capsules are projected to grow from $0.36 billion (15.31% share) to $0.76 billion in the same period.

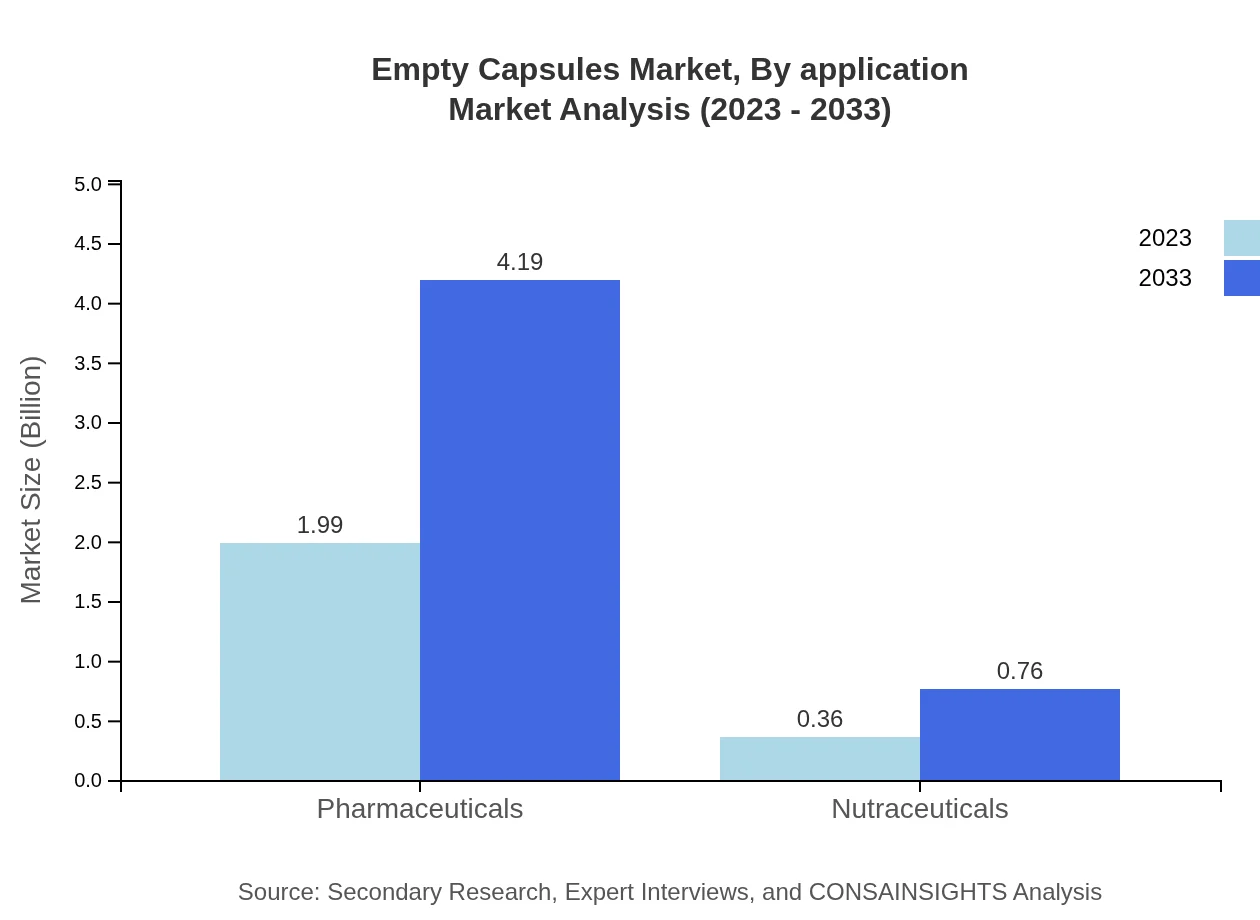

Empty Capsules Market Analysis By Application

The pharmaceutical application dominates with a projected market size of $1.99 billion in 2023, expected to expand to $4.19 billion by 2033. The nutraceutical application is also significant, with market values growing from $0.36 billion to $0.76 billion, reflecting the rising awareness surrounding health supplements.

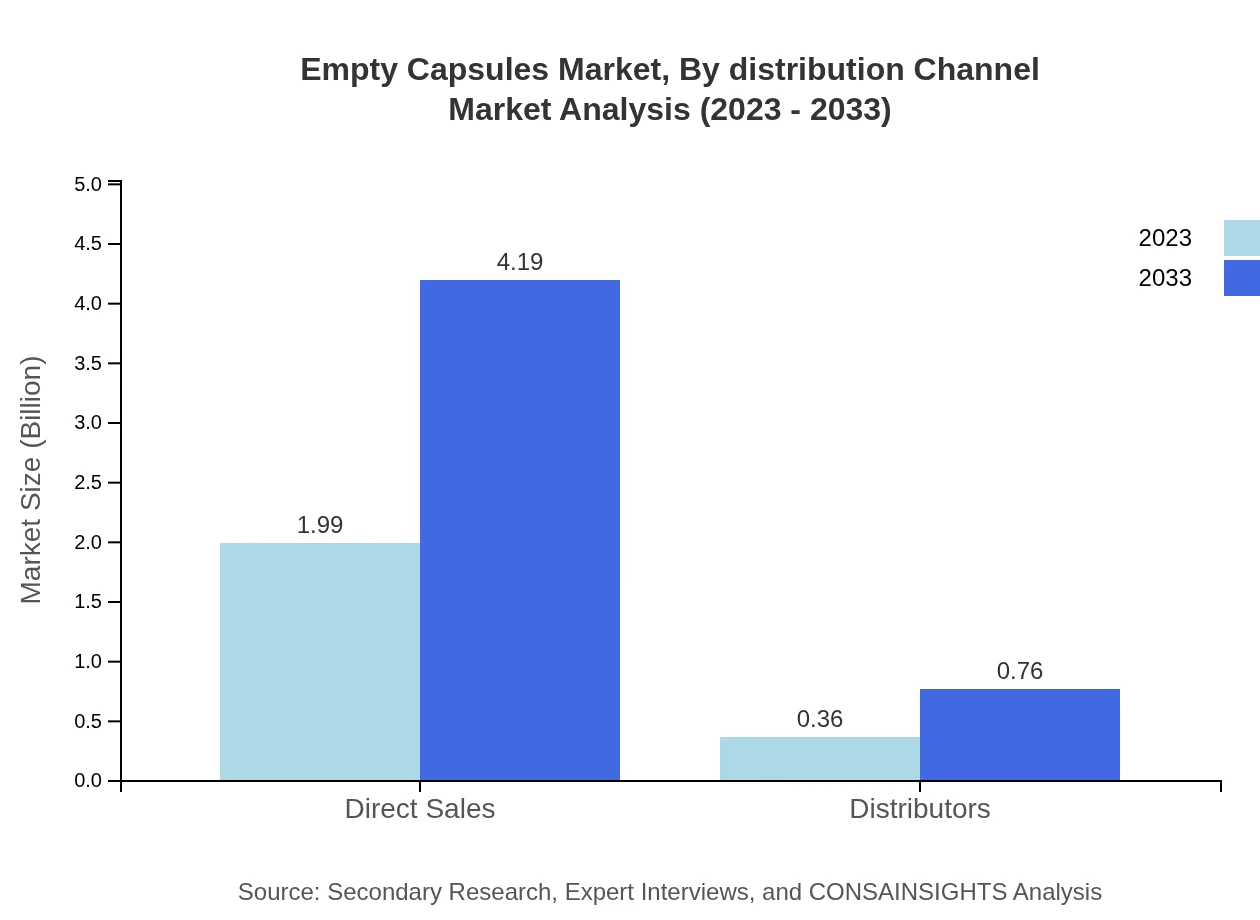

Empty Capsules Market Analysis By Distribution Channel

The distribution channel analysis shows direct sales accounting for $1.99 billion (84.69% share) in 2023, set to grow to $4.19 billion by 2033, while distributors are expected to rise from $0.36 billion (15.31% share) to $0.76 billion over the same period.

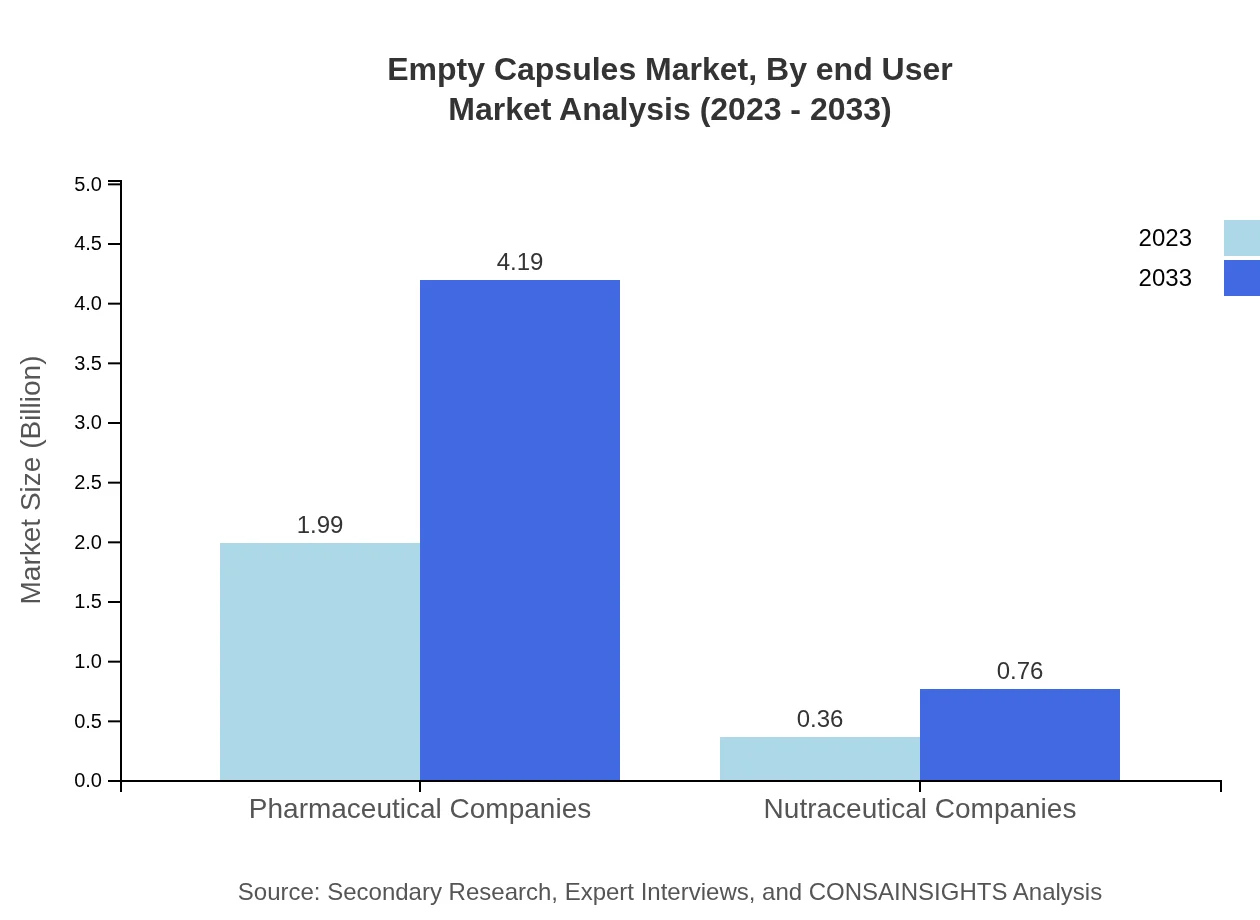

Empty Capsules Market Analysis By End User

Pharmaceutical companies are the major end-users of Empty Capsules, valued at $1.99 billion in 2023, projected to grow to $4.19 billion by 2033. Nutraceutical companies follow with a market size of $0.36 billion, expected to expand to $0.76 billion, highlighting the strong health and wellness trend.

Empty Capsules Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Empty Capsules Industry

Capsugel (Lonza):

As a leading manufacturer of gelatin and vegetarian capsules, Capsugel offers a wide range of custom capsule solutions, driving innovation across pharmaceutical and dietary supplement markets.Qualicaps:

Qualicaps specializes in manufacturing and providing empty capsules, known for their commitment to quality and service across the global pharmaceutical industry.ACG Capsules:

ACG Capsules manufactures high-quality empty capsules and is noted for its extensive range catering to both pharmaceutical and nutraceutical markets.Suheung Co., Ltd.:

Suheung Co., Ltd. is renowned for its advancements in capsule technologies and commitment to producing a variety of high-performance capsules.We're grateful to work with incredible clients.

FAQs

What is the market size of empty capsules?

The global empty capsules market is estimated at $2.35 billion in 2023, with a compound annual growth rate (CAGR) of 7.5% expected until 2033. The market is witnessing robust growth attributed to increasing demands in pharmaceuticals and nutraceuticals.

What are the key market players or companies in the empty capsules industry?

Key players in the empty capsules market include major pharmaceutical and nutraceutical companies that develop and distribute gelatin and vegetarian capsules. The industry is characterized by several well-established firms known for their innovation and product quality.

What are the primary factors driving the growth in the empty capsules industry?

The growth of the empty capsules market is driven by factors such as the rising demand for capsule-based drug delivery systems, the increasing prevalence of chronic diseases, and the growing popularity of nutraceuticals, which require effective encapsulation methods.

Which region is the fastest Growing in the empty capsules?

The fastest-growing region in the empty capsules market is Europe, with projected growth from $0.73 billion in 2023 to $1.53 billion by 2033, reflecting a strong demand for pharmaceutical applications across the region.

Does ConsaInsights provide customized market report data for the empty capsules industry?

Yes, ConsaInsights offers customized market report data for the empty capsules industry, addressing specific client needs and focusing on unique market aspects such as regional trends, competitive landscape, and segment performance.

What deliverables can I expect from this empty capsules market research project?

From an empty capsules market research project, you can expect comprehensive reports featuring market size data, growth projections, competitive analysis, segment breakdown, regional insights, and overarching market trends tailored for strategic decision-making.

What are the market trends of empty capsules?

Current market trends in empty capsules include the growing preference for vegetarian capsules, advancements in capsule production technology, and an expanding range of applications in the nutraceutical sector, which collectively influence market dynamics.