Emulsifier Market Report

Published Date: 31 January 2026 | Report Code: emulsifier

Emulsifier Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Emulsifier market, highlighting key trends, market sizes, and growth forecasts from 2023 to 2033, along with insights into regional markets and key players.

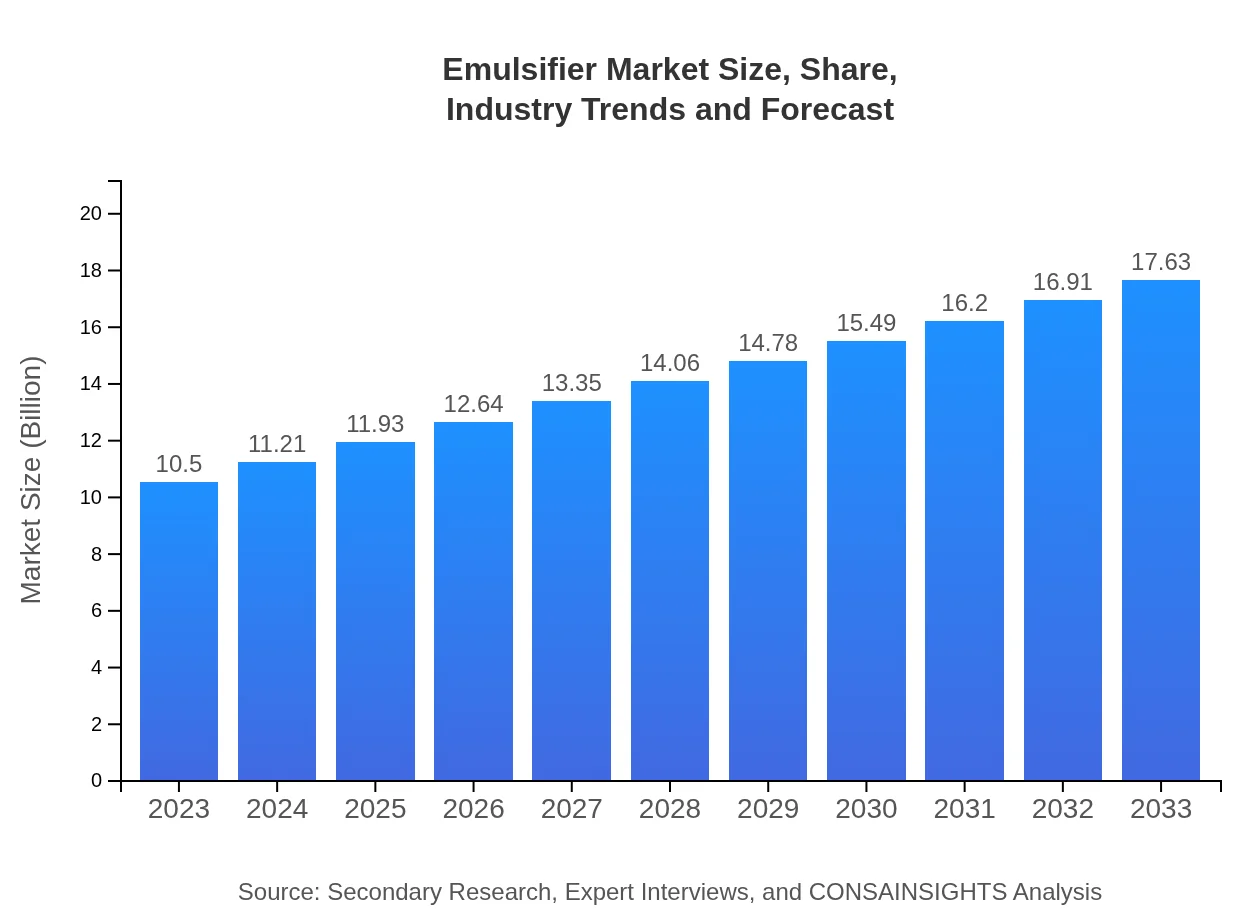

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | BASF SE, Croda International plc, AkzoNobel, Dupont de Nemours, Inc. |

| Last Modified Date | 31 January 2026 |

Emulsifier Market Overview

Customize Emulsifier Market Report market research report

- ✔ Get in-depth analysis of Emulsifier market size, growth, and forecasts.

- ✔ Understand Emulsifier's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Emulsifier

What is the Market Size & CAGR of Emulsifier market in 2023?

Emulsifier Industry Analysis

Emulsifier Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Emulsifier Market Analysis Report by Region

Europe Emulsifier Market Report:

Europe's emulsifier market is valued at $2.69 billion in 2023, with expectations to grow to $4.52 billion by 2033. The region emphasizes stringent regulatory standards, which foster innovation in natural emulsifiers as manufacturers respond to sustainability demands.Asia Pacific Emulsifier Market Report:

The Asia Pacific region marked a market value of approximately $2.28 billion in 2023, projected to reach $3.83 billion by 2033. Increased demand for processed and packaged food, coupled with growth in the cosmetic industry, are driving factors for this market's expansion.North America Emulsifier Market Report:

North America recorded a market value of $3.94 billion in 2023 and is forecasted to reach $6.62 billion by 2033. The region is witnessing growth due to rising health awareness and demand for clean label products across food and personal care industries.South America Emulsifier Market Report:

The South American market for emulsifiers stood at $0.89 billion in 2023, expected to grow to $1.50 billion by 2033. The growth is spurred by increasing consumer demand for natural food additives and the rise of organic products in the region.Middle East & Africa Emulsifier Market Report:

The Middle East and Africa market was valued at $0.69 billion in 2023 and is projected to reach $1.16 billion by 2033. This growth is attributed to increasing food industry developments and rising consumer interest in personal care products.Tell us your focus area and get a customized research report.

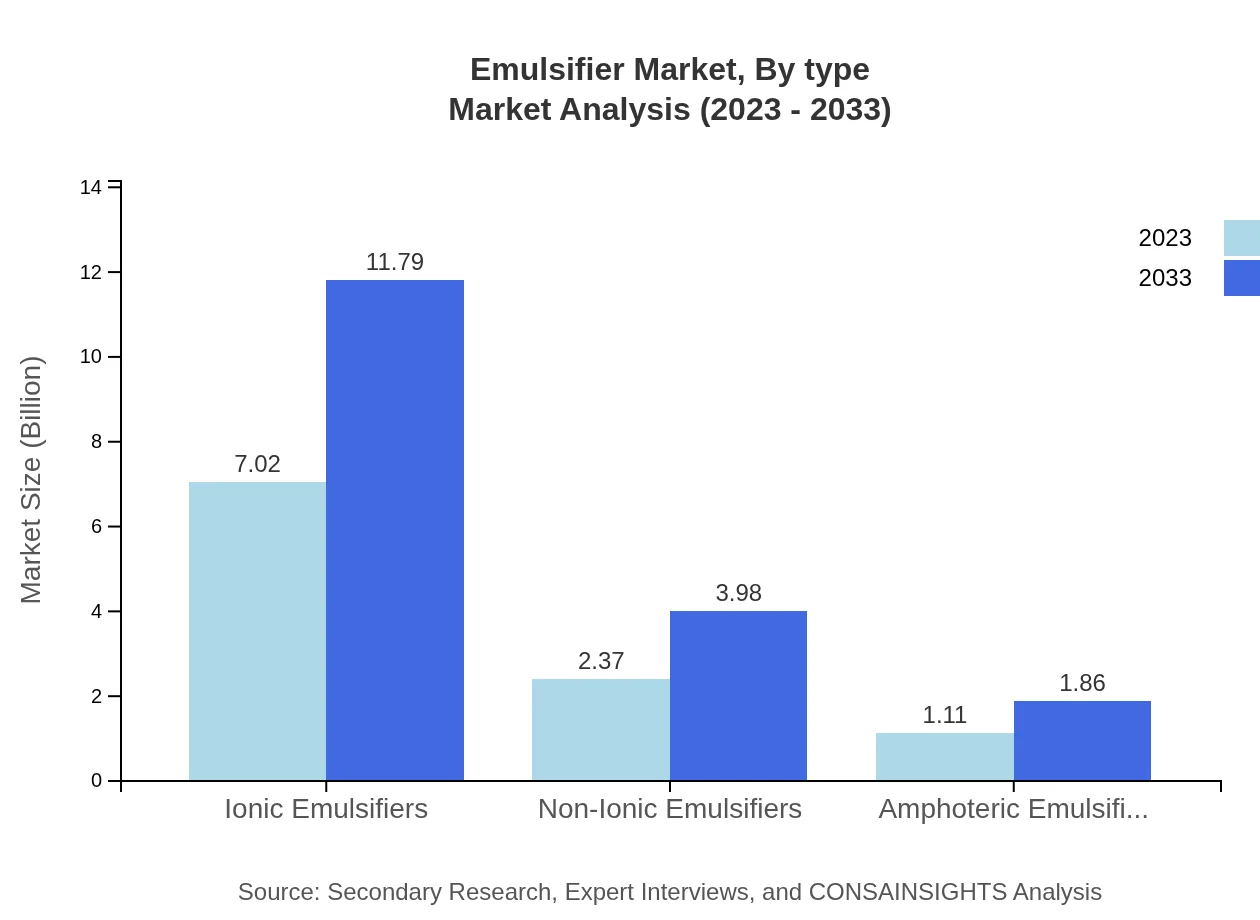

Emulsifier Market Analysis By Type

The Emulsifier market, by type, showcases different performance metrics among categories. In 2023, ionic emulsifiers hold a significant market share with a size of $7.02 billion (66.89% of the market), projected to grow to $11.79 billion (66.89%) by 2033, supported by their versatility and effectiveness in both food and cosmetic formulations. Non-ionic emulsifiers, primarily valued for their stability in varying conditions, show a size moving from $2.37 billion (22.57%) in 2023 to $3.98 billion (22.57%) in 2033. Natural emulsifiers are also gaining traction, expanding from $8.53 billion (81.24%) to $14.32 billion (81.24%), reflecting a strong consumer shift toward clean label products. Conversely, synthetic emulsifiers, although still significant, are expected to grow from $1.97 billion (18.76%) to $3.31 billion (18.76%), indicating a competitive response to natural alternatives.

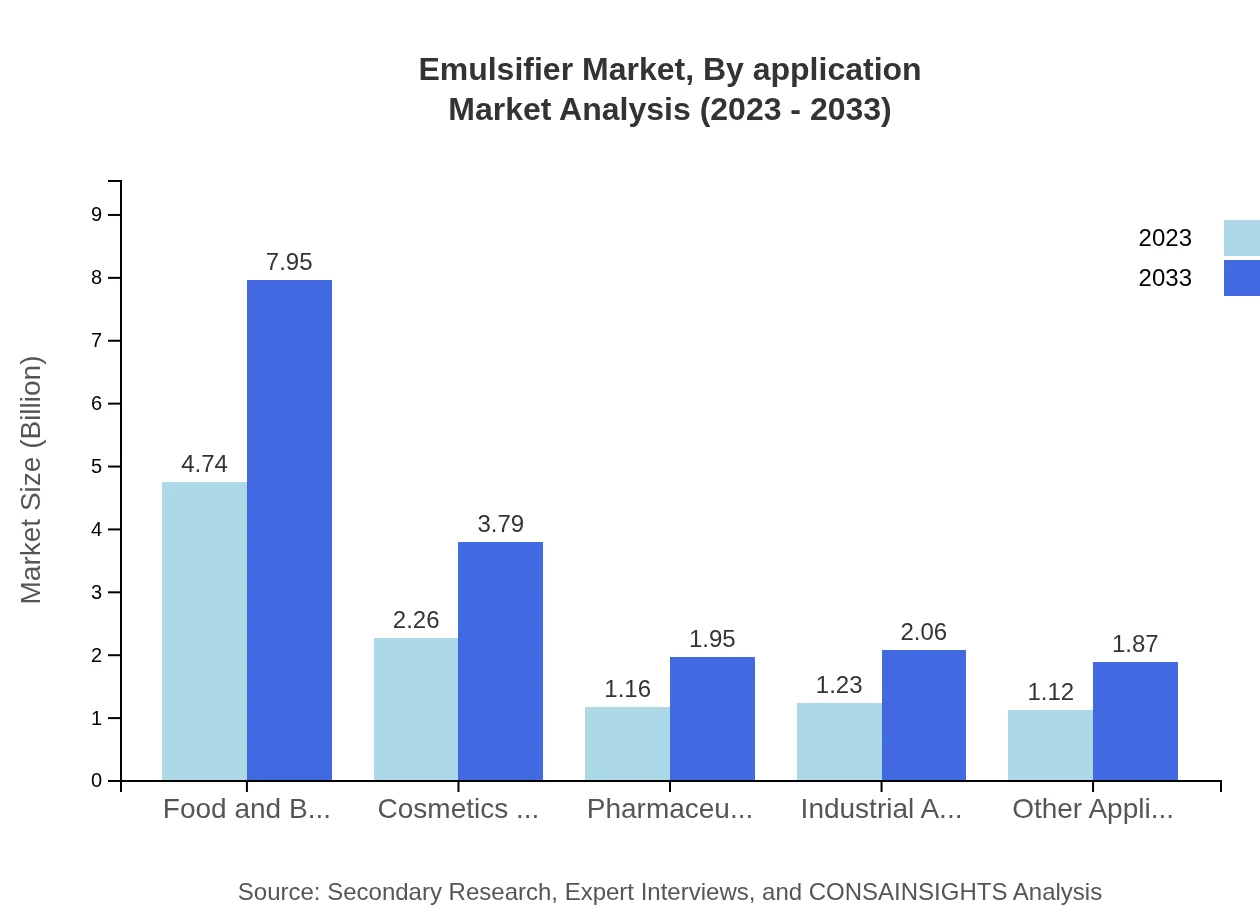

Emulsifier Market Analysis By Application

The Emulsifier market, by application, highlights distinct demands across sectors. The food and beverages segment dominates with a market value of $4.74 billion (45.12%) in 2023, projected to rise to $7.95 billion (45.12%) by 2033, demonstrating the crucial role of emulsifiers in food stability and texture. The cosmetics and personal care market is also prominent, moving from $2.26 billion (21.5%) to $3.79 billion (21.5%) due to increased demand for quality skincare products. Pharmaceuticals represent a budding sector, increasing from $1.16 billion (11.07%) to $1.95 billion (11.07%), driven by innovative drug formulations. Industrial applications and miscellaneous uses constitute about $1.23 billion (11.68%) and $1.12 billion (10.63%) respectively, indicating growth in diverse industrial sectors.

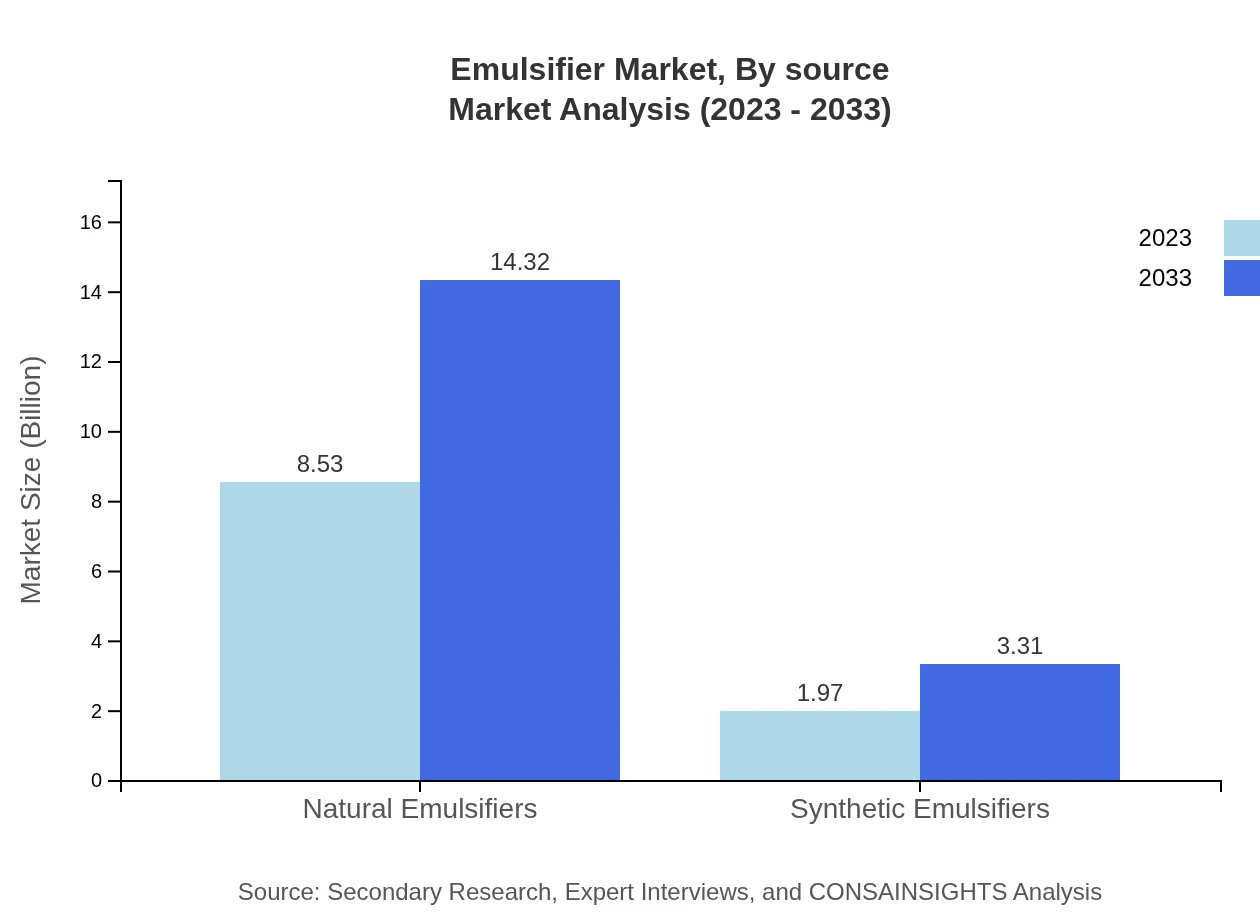

Emulsifier Market Analysis By Source

The market segments based on sources are integral to understanding raw material trends for production. Natural sources, including plant-based ingredients, are becoming increasingly favored, reflecting a shift towards organic products. The segment's performance is strengthened by consumer preference for health-conscious options. Synthetic sources, while still relevant, are facing challenges due to regulatory pressures and consumer scrutiny concerning safety and sustainability.

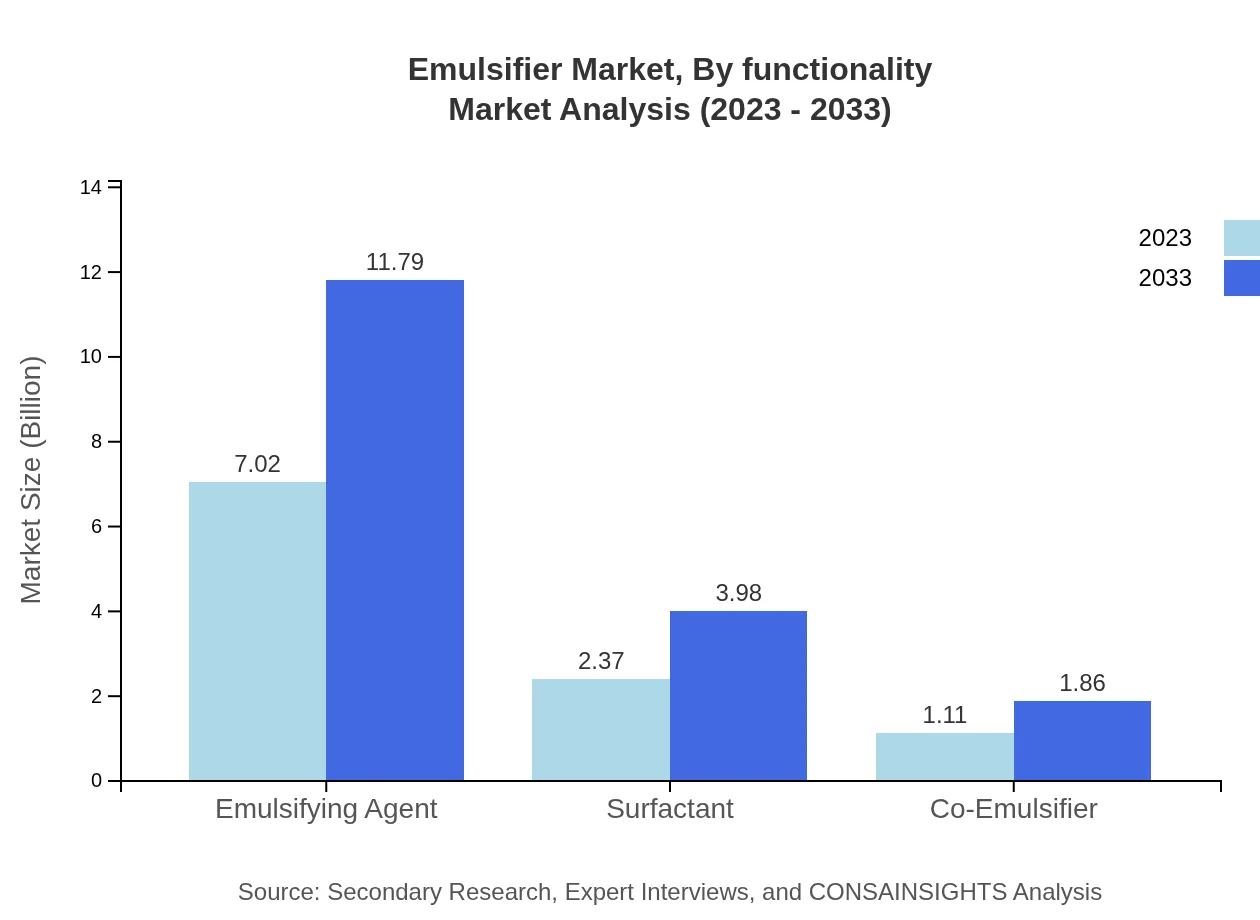

Emulsifier Market Analysis By Functionality

Segmented by functionality, the market includes emulsifying agents, surfactants, and co-emulsifiers. Emulsifying agents remain paramount, holding a large market share due to their critical role in stabilizing product mixtures. Surfactants are also significant, providing additional functionalities such as wetting and spreading, while co-emulsifiers support the primary emulsifiers to enhance stability.

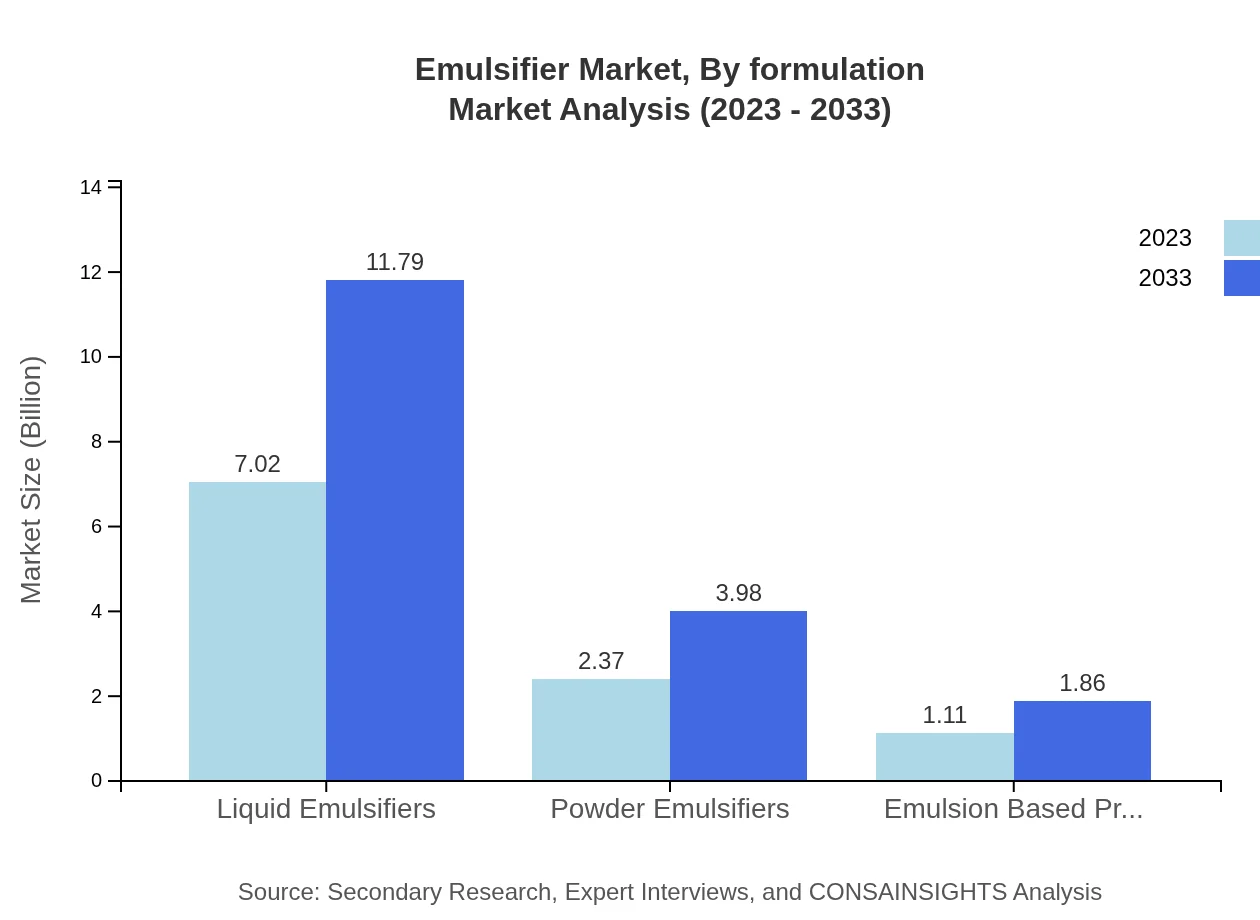

Emulsifier Market Analysis By Formulation

The formulation segment categorizes emulsifiers into liquid and powder forms. Liquid emulsifiers, with a market size of $7.02 billion (66.89%) in 2023, reached $11.79 billion (66.89%) by 2033, reflecting their versatility in various industries. Powder emulsifiers, while smaller at $2.37 billion (22.57%) now, are expected to grow to $3.98 billion (22.57%), highlighting a niche market for dry formulations.

Emulsifier Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Emulsifier Industry

BASF SE:

A leading global chemical company that produces various emulsifiers, focusing on sustainable solutions for food and personal care industries.Croda International plc:

Specializes in emulsifiers for cosmetics and pharmaceuticals, known for their innovative ingredient formulations.AkzoNobel:

A major player in specialty chemicals, including emulsifiers, with a robust portfolio supporting diverse industrial applications.Dupont de Nemours, Inc.:

Offers a wide range of emulsifiers with a strong emphasis on innovation and sustainability, primarily in food applications.We're grateful to work with incredible clients.

FAQs

What is the market size of emulsifier?

The emulsifier market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 5.2%, indicating substantial growth potential through the next decade.

What are the key market players or companies in this emulsifier industry?

Key players in the emulsifier market include companies like BASF SE, Dow Chemical Company, and Kerry Group, among others, which dominate the market through innovation and a diverse product portfolio.

What are the primary factors driving the growth in the emulsifier industry?

The growth of the emulsifier industry is driven by increasing consumer demand for processed foods, innovations in the personal care sector, and rising applications in pharmaceuticals and industrial manufacturing.

Which region is the fastest Growing in the emulsifier market?

The Asia Pacific region is poised to be the fastest-growing market, with expected growth from $2.28 billion in 2023 to $3.83 billion by 2033, fueled by urbanization and rising disposable incomes.

Does ConsaInsights provide customized market report data for the emulsifier industry?

Yes, ConsaInsights offers customized market report data for the emulsifier industry, tailoring insights and analytics to meet the specific needs of clients and their market focus.

What deliverables can I expect from this emulsifier market research project?

From the emulsifier market research project, you can expect detailed market reports, segment analysis, regional data, competitive landscape summaries, and tailored insights for strategic decision-making.

What are the market trends of emulsifier?

Current trends in the emulsifier market include a shift towards natural emulsifiers, increased demand for clean label products, and innovations focusing on sustainable and biodegradable ingredients.