Endoscope Reprocessing Market Report

Published Date: 31 January 2026 | Report Code: endoscope-reprocessing

Endoscope Reprocessing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Endoscope Reprocessing market, covering key trends, market size, and growth forecasts for the period from 2023 to 2033. Insights include regional dynamics, industry challenges, and the performance of different product segments.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

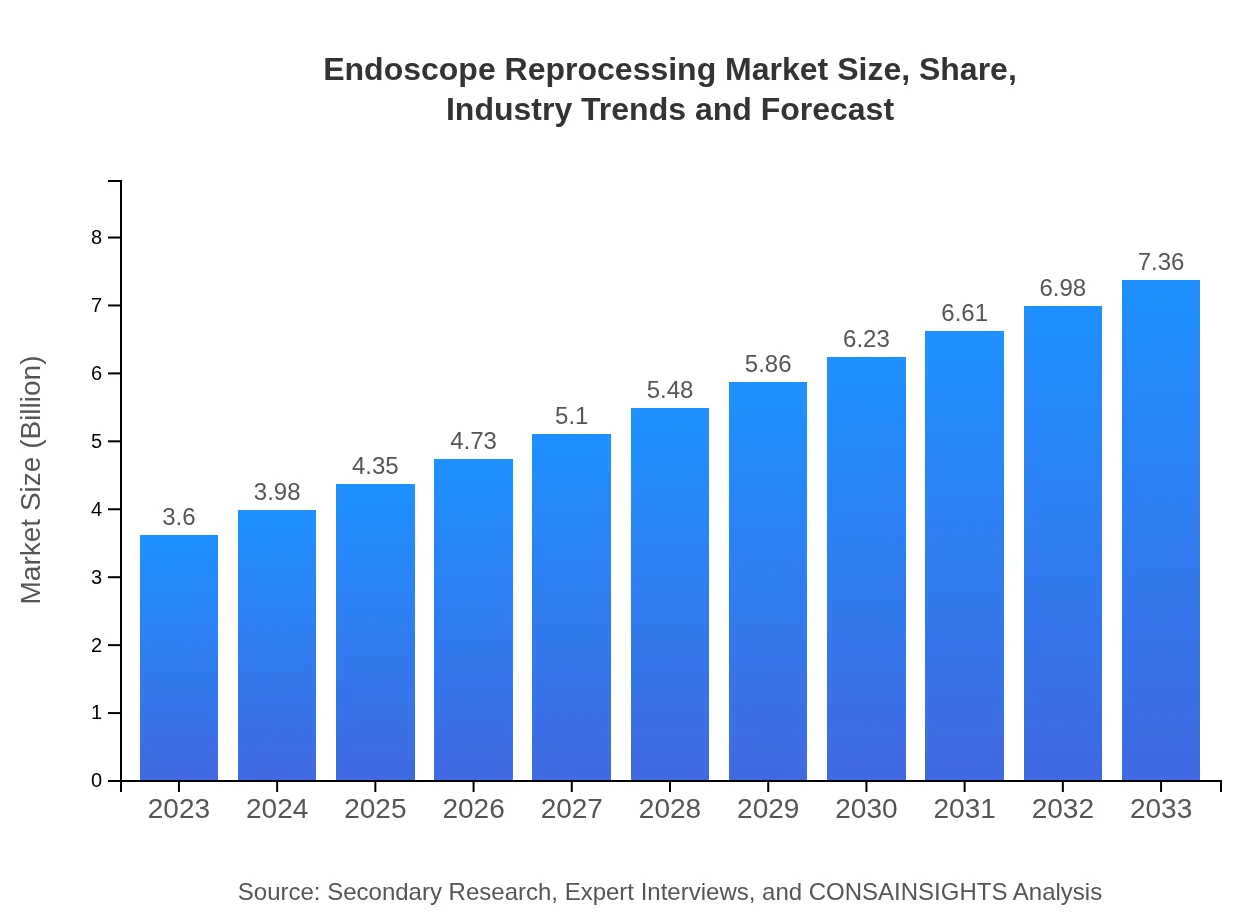

| 2023 Market Size | $3.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.36 Billion |

| Top Companies | Olympus Corporation, Ethicon (Johnson & Johnson), Medivators Inc. (Cantel Medical Corp.), Stryker Corporation, CLEANING SYSTEMS |

| Last Modified Date | 31 January 2026 |

Endoscope Reprocessing Market Overview

Customize Endoscope Reprocessing Market Report market research report

- ✔ Get in-depth analysis of Endoscope Reprocessing market size, growth, and forecasts.

- ✔ Understand Endoscope Reprocessing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Endoscope Reprocessing

What is the Market Size & CAGR of Endoscope Reprocessing market in 2023?

Endoscope Reprocessing Industry Analysis

Endoscope Reprocessing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Endoscope Reprocessing Market Analysis Report by Region

Europe Endoscope Reprocessing Market Report:

Europe also presents a strong market, starting at 1.00 billion USD in 2023 and growing to 2.04 billion USD by 2033. The European market benefits from established healthcare systems and rigorous adherence to sterilization standards.Asia Pacific Endoscope Reprocessing Market Report:

The Asia Pacific region held a market size of approximately 0.73 billion USD in 2023, growing to an estimated 1.48 billion USD by 2033. The increasing prevalence of chronic diseases and enhanced spending on healthcare drive this growth. Additionally, rising awareness regarding the importance of infection control proliferates, resulting in a rising number of endoscopic procedures.North America Endoscope Reprocessing Market Report:

North America holds the largest market share, with a market size of 1.20 billion USD in 2023, expected to reach 2.46 billion USD by 2033. High spending on healthcare, stringent regulations for patient safety, and advanced reprocessing technologies significantly foster growth in this region.South America Endoscope Reprocessing Market Report:

In South America, the market is expected to grow from 0.34 billion USD in 2023 to 0.70 billion USD in 2033. The growth is attributed to the improving healthcare infrastructure and increased adoption of endoscopic treatments, despite economic challenges in the region.Middle East & Africa Endoscope Reprocessing Market Report:

The Middle East and Africa market is projected to grow from 0.33 billion USD in 2023 to 0.68 billion USD in 2033. Increased focus on healthcare quality and patient safety in this region drives the demand for thorough endoscope reprocessing.Tell us your focus area and get a customized research report.

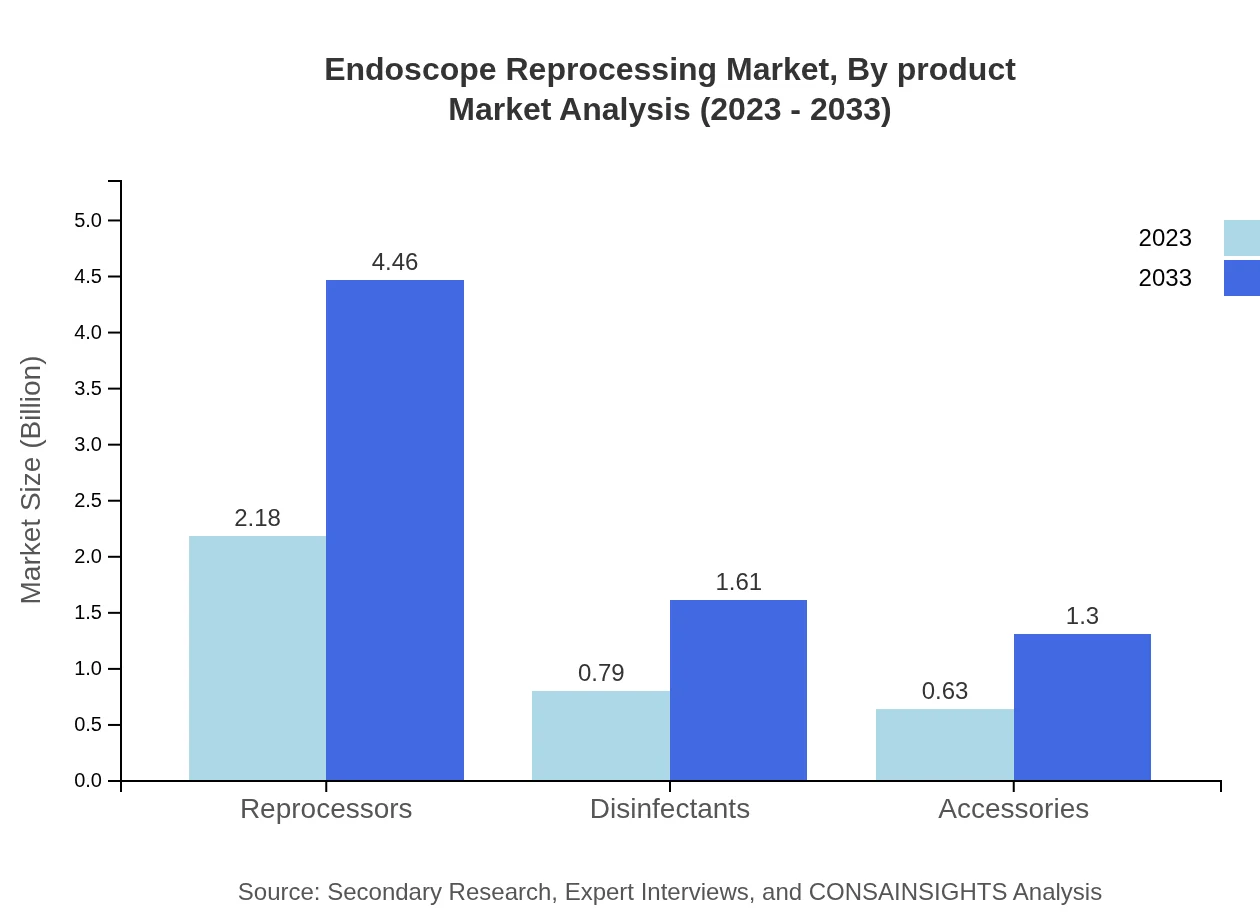

Endoscope Reprocessing Market Analysis By Product

The product analysis reveals that reprocessors account for a significant share of the market with a growth from 2.18 billion USD in 2023 to 4.46 billion USD in 2033. Disinfectants and accessories also play crucial roles, reflecting the importance of combined strategies in reprocessing.

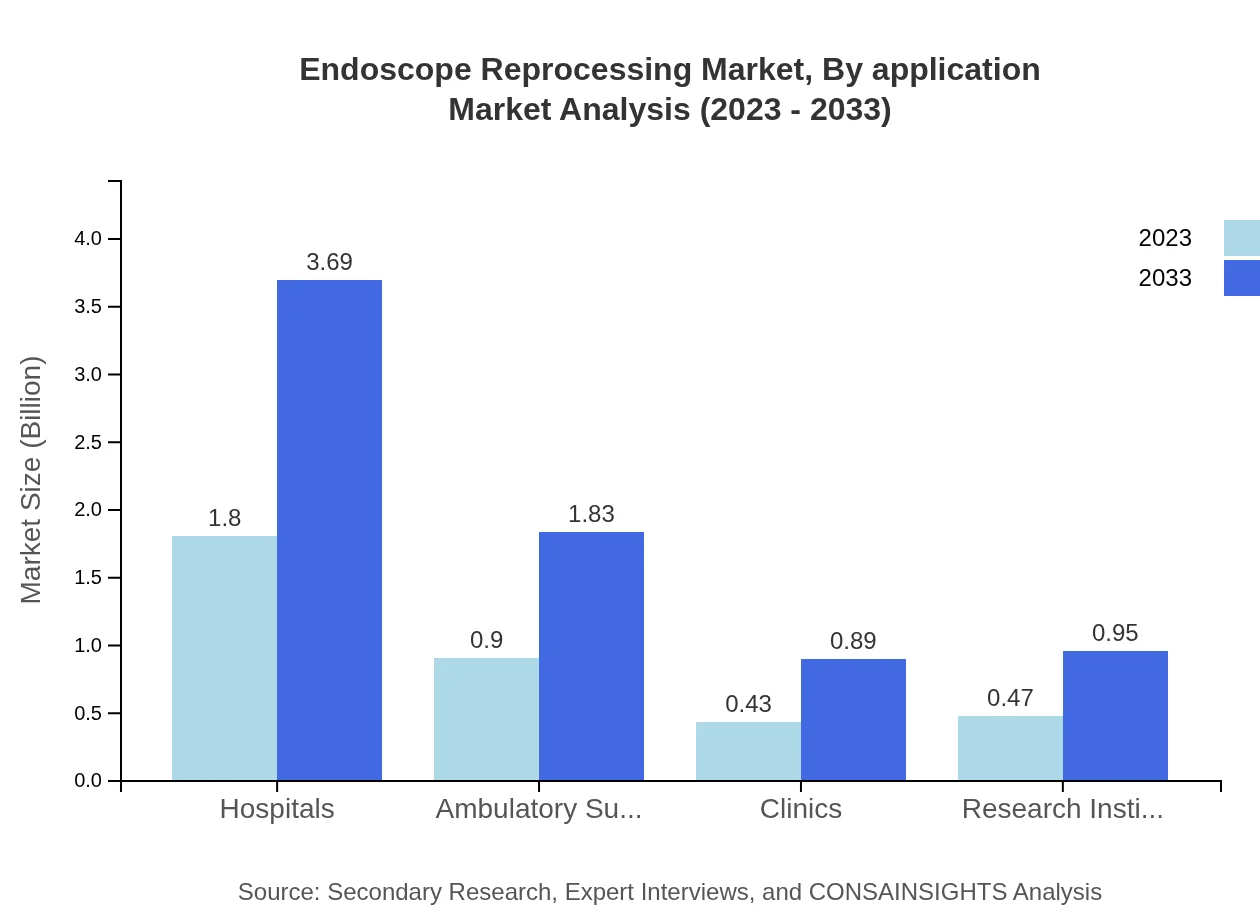

Endoscope Reprocessing Market Analysis By Application

The application segment highlights the significance of gastrointestinal and respiratory procedures. With increasing demand for these procedures, the relevant market shares are expected to grow accordingly, driving investment in reprocessing technologies.

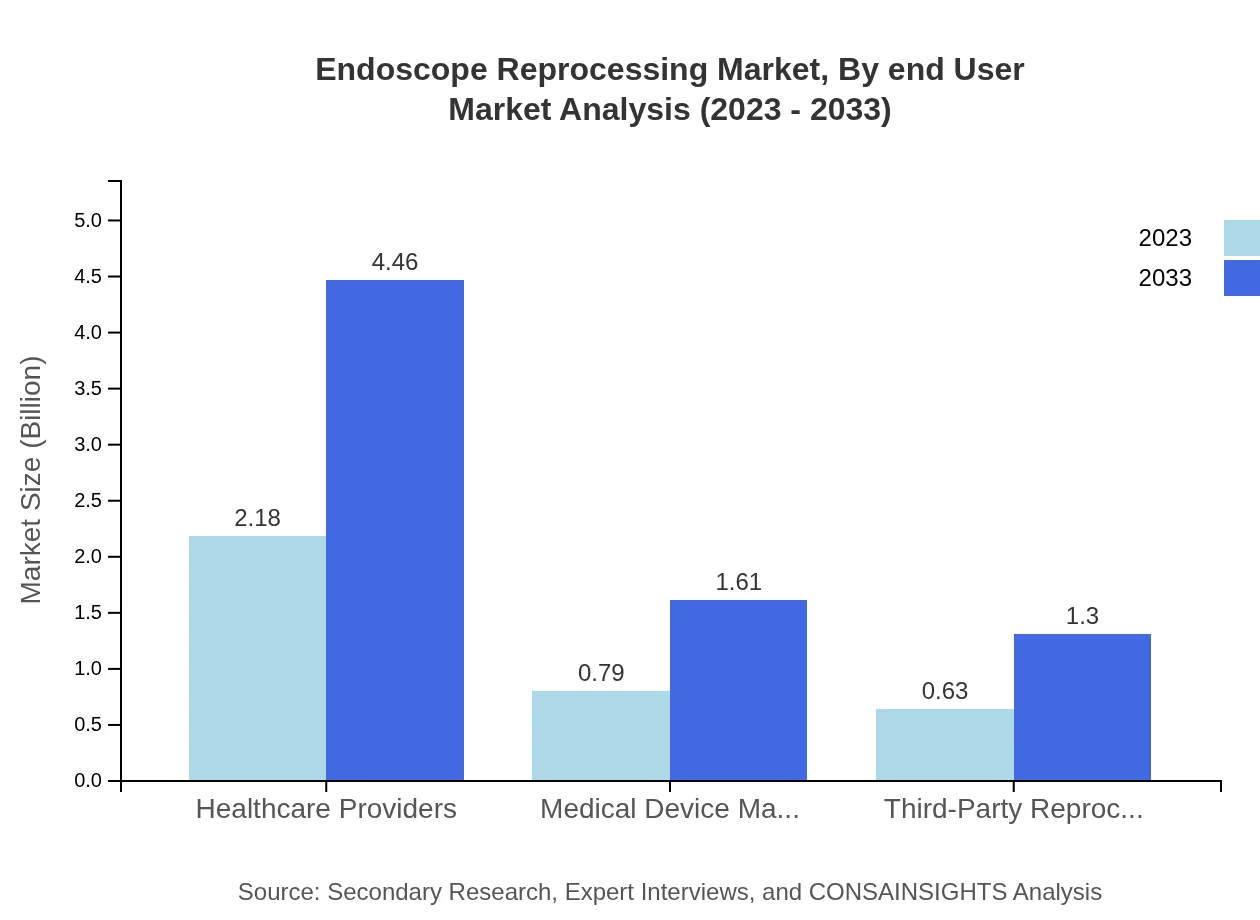

Endoscope Reprocessing Market Analysis By End User

Hospitals dominate the end-user segment due to the high volume of procedures performed. The market for hospitals is anticipated to expand from 2.18 billion USD in 2023 to 4.46 billion USD by 2033, driven by the rising number of endoscopic procedures.

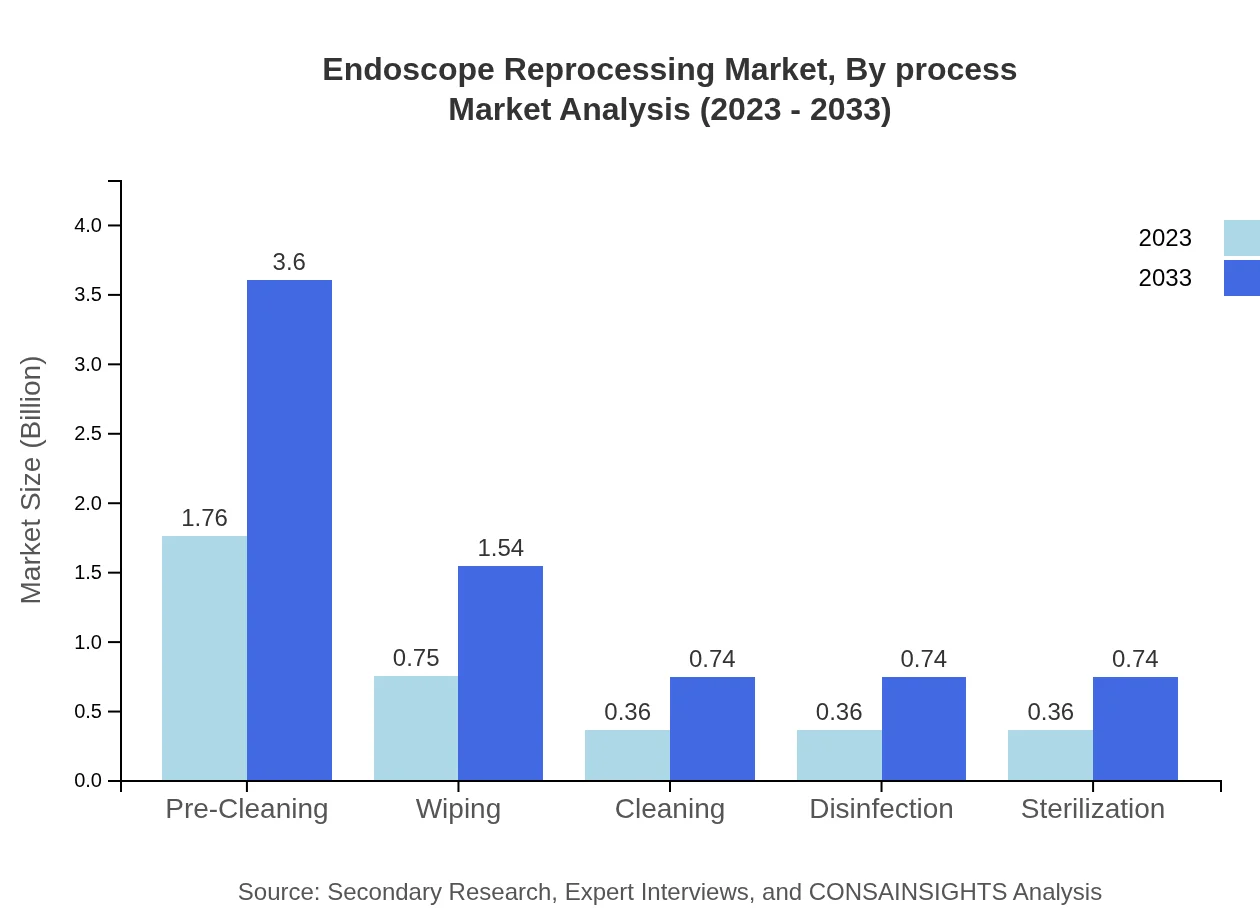

Endoscope Reprocessing Market Analysis By Process

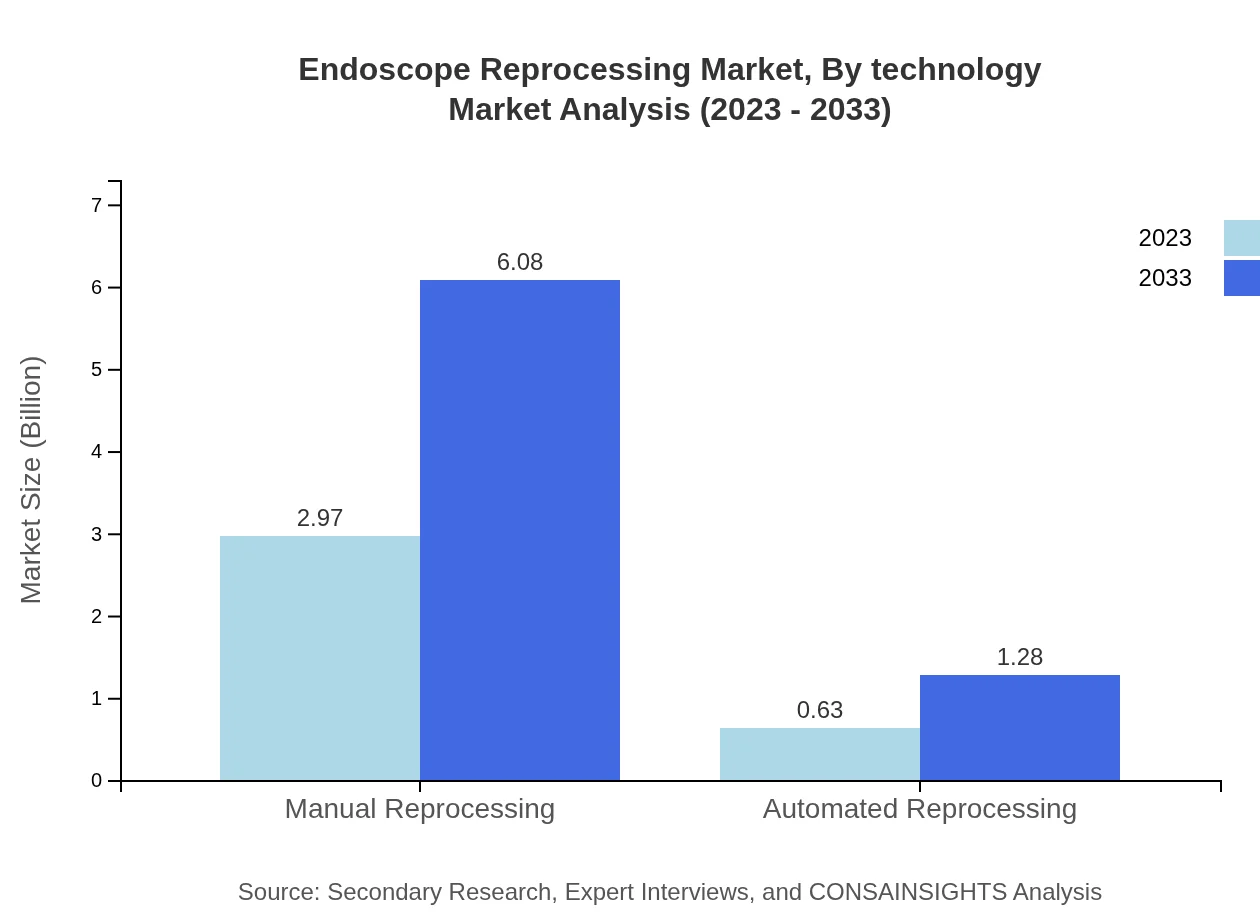

Manual reprocessing currently holds a substantial market share of 82.62%, with growth expected towards automated solutions as technology advancements are embraced for efficiency and reliability.

Endoscope Reprocessing Market Analysis By Technology

Technology advancements are facilitating the adoption of automated reprocessing systems, reducing human error and enhancing effectiveness. This shift is critical for meeting stringent regulations while improving patient safety.

Endoscope Reprocessing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Endoscope Reprocessing Industry

Olympus Corporation:

A global leader in the medical systems industry, Olympus produces high-quality endoscopic products and reprocessing systems, focusing significantly on R&D to enhance patient safety.Ethicon (Johnson & Johnson):

Ethicon is a key player in surgical and wound management products, offering a range of reprocessing systems and dedicated support to hospitals and surgical centers.Medivators Inc. (Cantel Medical Corp.):

Specializing in infection prevention, Medivators provides advanced endoscope reprocessing solutions focusing on quality systems and regulatory compliance.Stryker Corporation:

Known for innovative medical technologies, Stryker provides solutions for reprocessing and sterilization to maximize safety in surgical environments.CLEANING SYSTEMS:

CLEANING SYSTEMS specializes in sterilization and cleaning products tailored for the healthcare sector, promoting effective reprocessing protocols in hospitals.We're grateful to work with incredible clients.

FAQs

What is the market size of endoscope Reprocessing?

The endoscope reprocessing market is valued at $3.6 billion in 2023 and is projected to experience a compound annual growth rate (CAGR) of 7.2%, reaching significant growth by 2033.

What are the key market players or companies in the endoscope Reprocessing industry?

Key players in the endoscope reprocessing market include Olympus Corporation, Medivators Inc., and Steris Corporation, among others. These companies are recognized for their innovations and contributions to the endoscope reprocessing sector.

What are the primary factors driving the growth in the endoscope Reprocessing industry?

Growth in the endoscope reprocessing industry is driven by rising surgical procedures, an increasing number of endoscopic examinations, and advancements in sterilization technology, ensuring high levels of infection control.

Which region is the fastest Growing in the endoscope Reprocessing?

The fastest-growing region for the endoscope reprocessing market is expected to be North America, with a market size growing from $1.20 billion in 2023 to $2.46 billion by 2033, reflecting significant investment and healthcare demand.

Does ConsaInsights provide customized market report data for the endoscope Reprocessing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the endoscope-reprocessing industry, allowing clients to gain insights based on unique parameters and market dynamics.

What deliverables can I expect from this endoscope Reprocessing market research project?

Expected deliverables from the endoscope reprocessing market research project include comprehensive market analysis, trend forecasting, competitive landscape, and detailed segment insights over a specified period.

What are the market trends of endoscope Reprocessing?

Current market trends in endoscope reprocessing include the increasing adoption of automated systems, enhanced awareness of infection prevention, and rising investments in healthcare infrastructure to improve patient safety.