Endoscopic Vessel Harvesting Market Report

Published Date: 31 January 2026 | Report Code: endoscopic-vessel-harvesting

Endoscopic Vessel Harvesting Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Endoscopic Vessel Harvesting market, covering market trends, size, segmentation, regional analysis, technological advancements, and forecasts from 2023 to 2033.

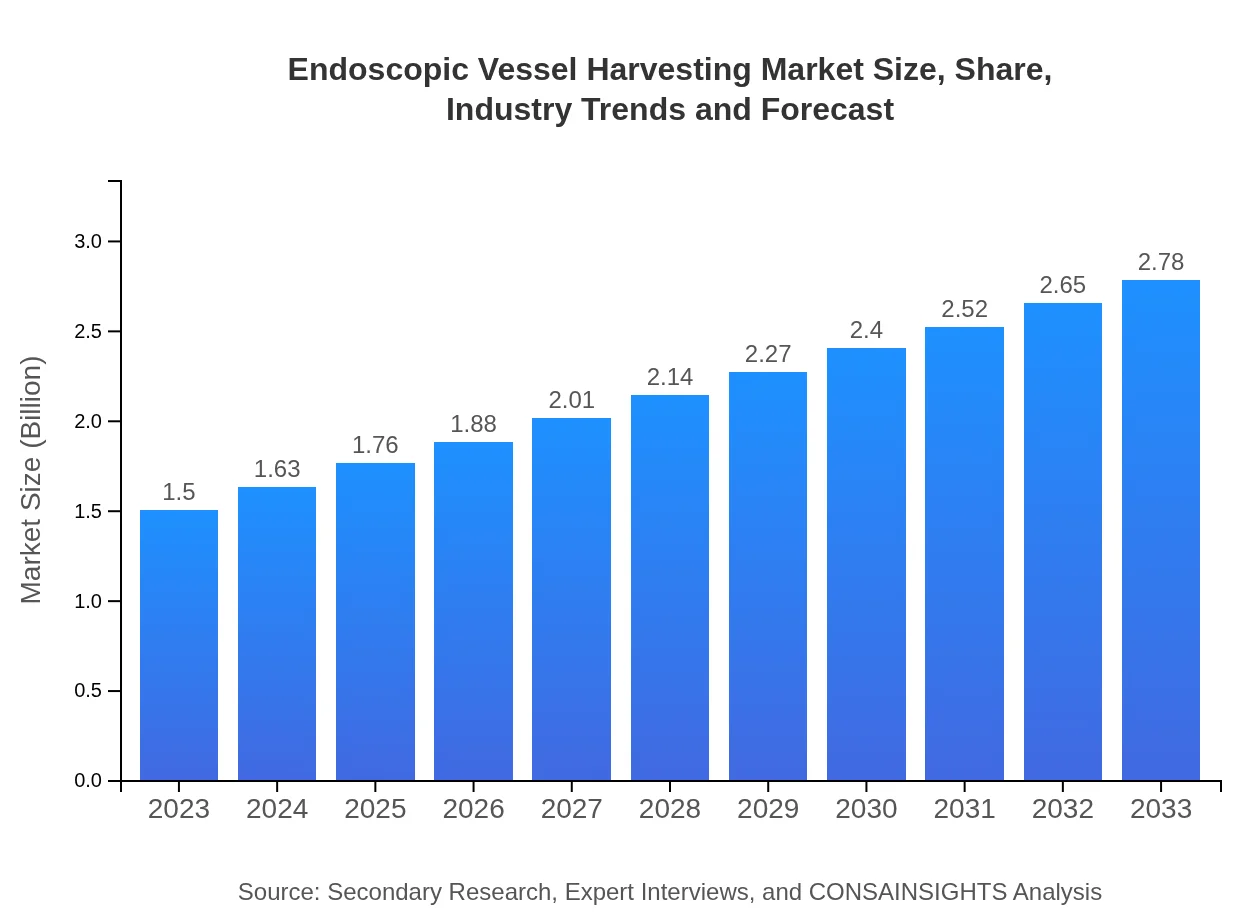

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Medtronic , Boston Scientific, Stryker Corporation, Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Endoscopic Vessel Harvesting Market Overview

Customize Endoscopic Vessel Harvesting Market Report market research report

- ✔ Get in-depth analysis of Endoscopic Vessel Harvesting market size, growth, and forecasts.

- ✔ Understand Endoscopic Vessel Harvesting's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Endoscopic Vessel Harvesting

What is the Market Size & CAGR of Endoscopic Vessel Harvesting market in 2023?

Endoscopic Vessel Harvesting Industry Analysis

Endoscopic Vessel Harvesting Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Endoscopic Vessel Harvesting Market Analysis Report by Region

Europe Endoscopic Vessel Harvesting Market Report:

The European Endoscopic Vessel Harvesting market is poised for growth, estimated to rise from $0.47 billion in 2023 to approximately $0.87 billion by 2033. Factors driving this growth include advanced healthcare systems, a high prevalence of cardiovascular diseases, and significant investments in surgical technologies. Countries like Germany and France are leading in the adoption of minimally invasive surgical techniques.Asia Pacific Endoscopic Vessel Harvesting Market Report:

The Asia-Pacific Endoscopic Vessel Harvesting market is projected to grow significantly, reaching approximately $0.44 billion by 2033, up from $0.24 billion in 2023. This region benefits from increasing healthcare expenditures, the rising prevalence of cardiovascular diseases, and an expanding elderly population. Countries such as China and India are witnessing substantial investments in health infrastructure, further bolstering market growth.North America Endoscopic Vessel Harvesting Market Report:

The North America region leads the global Endoscopic Vessel Harvesting market, with an estimated value of $0.57 billion in 2023, projected to reach approximately $1.05 billion by 2033. A robust healthcare infrastructure, rising rates of cardiovascular surgeries, and innovative surgical practices contribute to this growth. Additionally, increasing awareness about minimally invasive procedures is prompting hospitals and surgical centers to adopt endoscopic techniques.South America Endoscopic Vessel Harvesting Market Report:

In South America, the market is expected to expand from $0.05 billion in 2023 to $0.10 billion by 2033. The growth can be attributed to the increasing incidence of heart diseases and the adoption of advanced surgical techniques. Initiatives to improve healthcare access in developing countries also play a crucial role in promoting market growth.Middle East & Africa Endoscopic Vessel Harvesting Market Report:

The Middle East and Africa market is expected to grow from $0.17 billion in 2023 to $0.32 billion by 2033. The increasing occurrence of heart diseases, coupled with improving healthcare infrastructure, is fostering market growth in this region. Countries within the Gulf Cooperation Council (GCC) are particularly focusing on enhancing healthcare services, further boosting the adoption of endoscopic techniques.Tell us your focus area and get a customized research report.

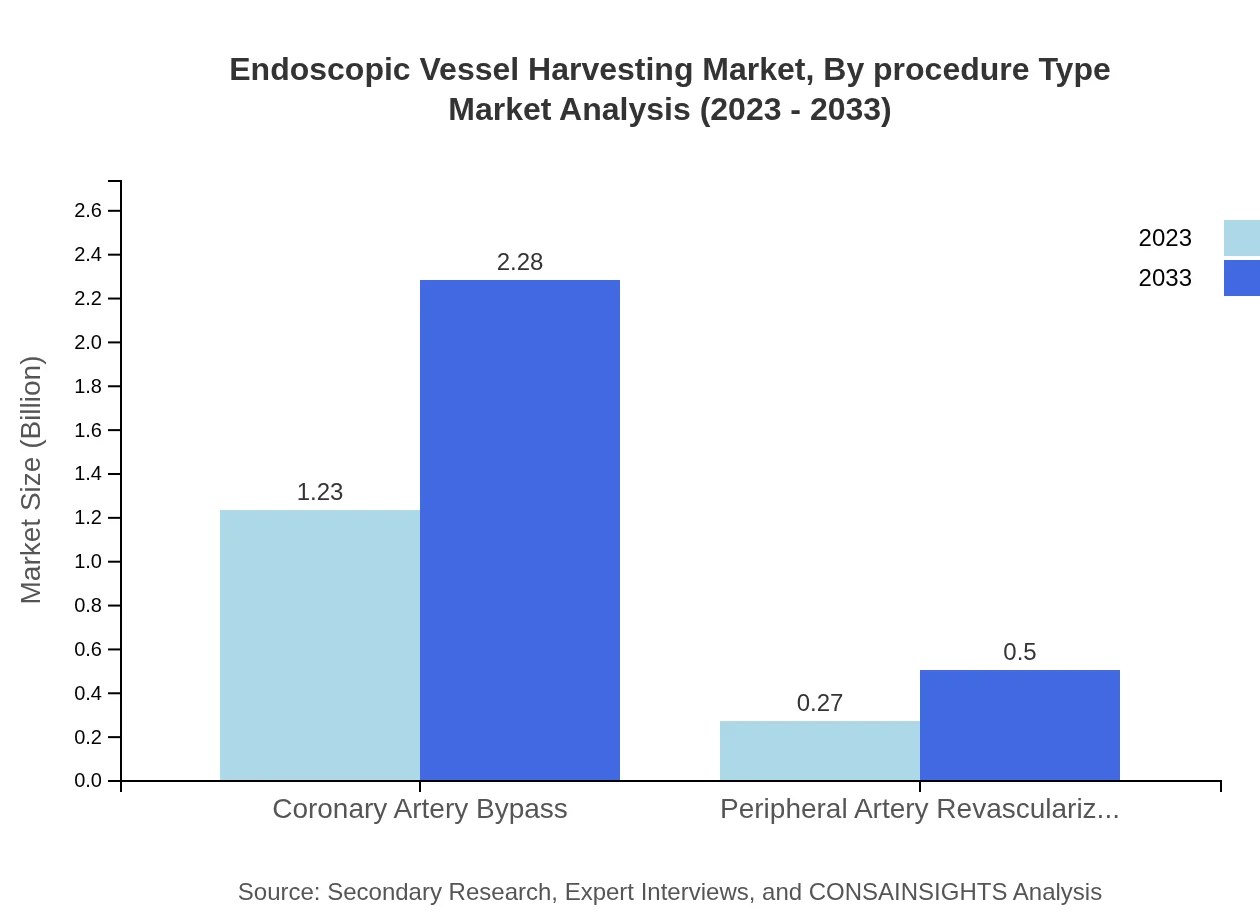

Endoscopic Vessel Harvesting Market Analysis By Procedure Type

The Endoscopic Vessel Harvesting market by procedure type shows significant dominance of the Coronary Artery Bypass procedure, which held a 82.02% market share in 2023 and is projected to maintain this share through 2033. A substantial market size of $1.23 billion in 2023, growing to $2.28 billion by 2033, indicates the continued reliance on this procedure due to its effectiveness in treating coronary artery diseases. Conversely, Peripheral Artery Revascularization has a smaller market share at 17.98%, but is also expected to see growth as awareness and applications expand.

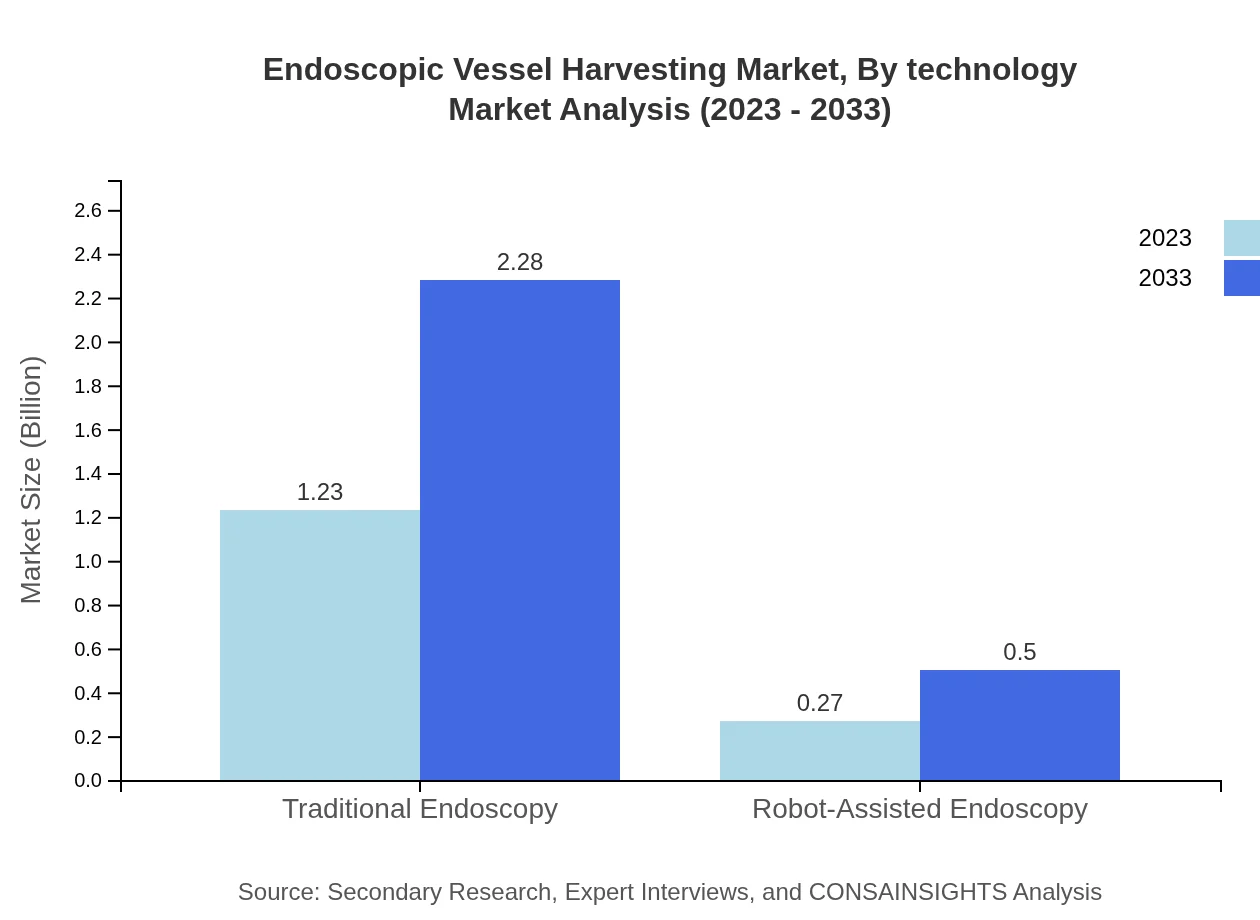

Endoscopic Vessel Harvesting Market Analysis By Technology

In terms of technology, the market primarily consists of traditional endoscopy and robotic-assisted endoscopy. Traditional endoscopy is dominant, capturing an 82.02% market share in 2023, with a market size of $1.23 billion projected to grow to $2.28 billion by 2033. The adoption of robotic-assisted techniques, comprising 17.98% of the market, is gradually increasing as technologies improve and costs become more accessible.

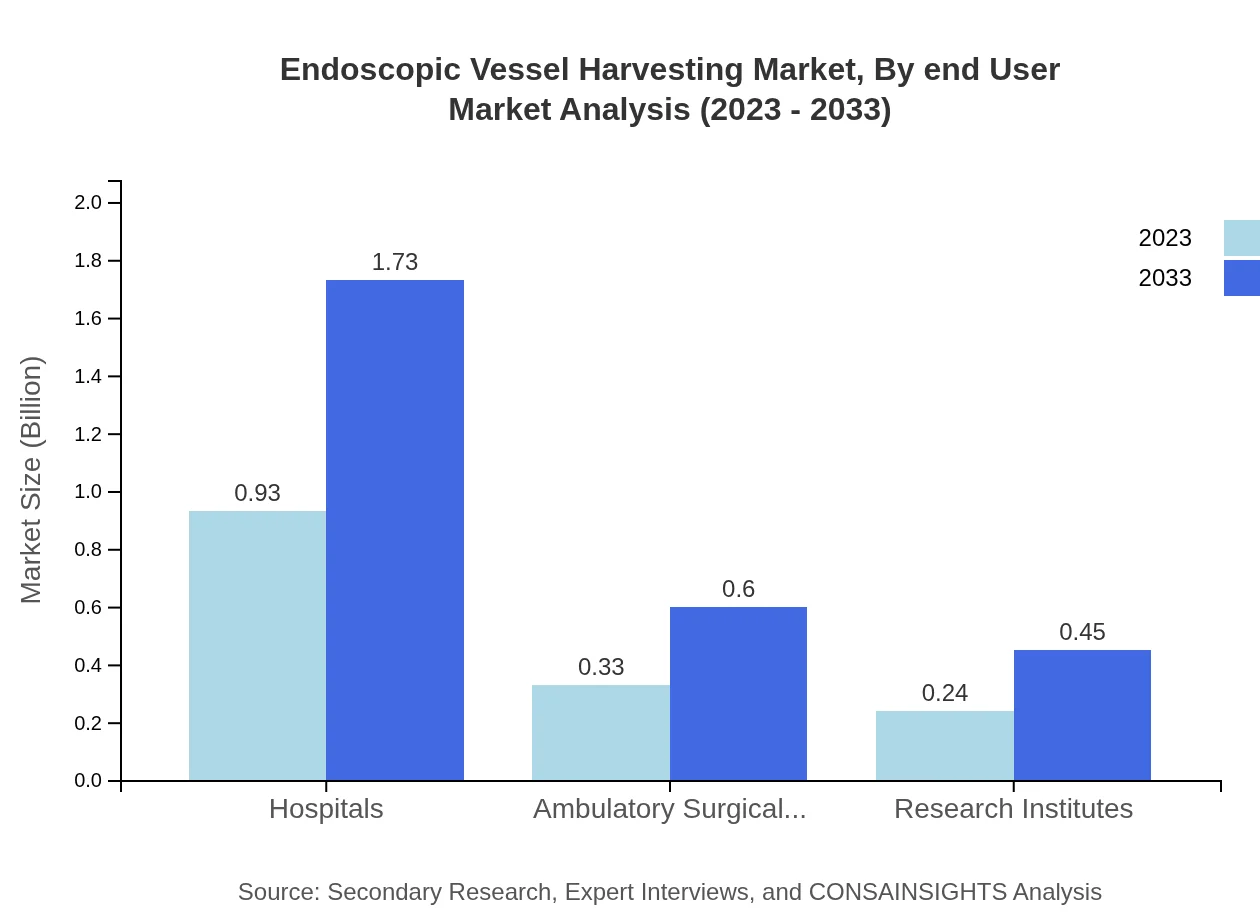

Endoscopic Vessel Harvesting Market Analysis By End User

The Endoscopic Vessel Harvesting market by end-user shows hospitals as the primary segment, with a market size of $0.93 billion in 2023, projected to $1.73 billion by 2033, holding 62.09% market share. Ambulatory surgical centers contribute significantly at 21.76%, with growth anticipated as outpatient surgeries rise. Research institutes also play a crucial role, maintaining a market share of 16.15%.

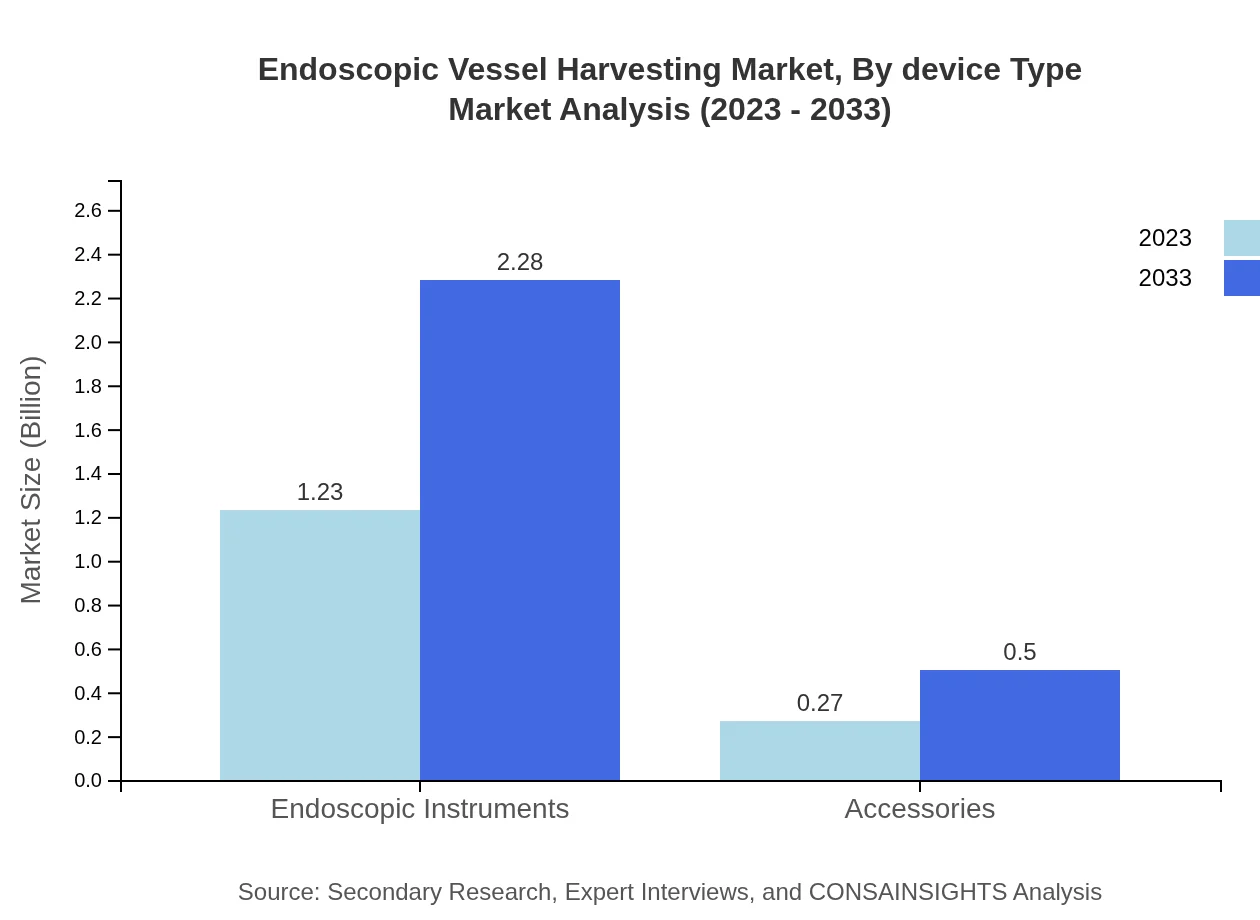

Endoscopic Vessel Harvesting Market Analysis By Device Type

The device type segmentation highlights Endoscopic Instruments as the largest category, with a market size of $1.23 billion in 2023, expected to grow to $2.28 billion by 2033, retaining an 82.02% market share. Accessories capture an increasing market share, forecasted to grow from $0.27 billion to $0.50 billion, indicating heightened demand for supportive tools and technologies in endoscopic procedures.

Endoscopic Vessel Harvesting Market Analysis By Region

Global Endoscopic Vessel Harvesting Market, By Region Market Analysis (2023 - 2033)

The Endoscopic Vessel Harvesting market analyzed by region indicates North America as the leading market due to advanced healthcare facilities and high procedure volumes. Europe follows closely, driven by technological advancements. The Asia-Pacific region showcases the fastest growth rate, influenced by rising healthcare investments and an increasing aging population. South America and the Middle East and Africa are emerging regions, with notable growth potential.

Endoscopic Vessel Harvesting Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Endoscopic Vessel Harvesting Industry

Medtronic :

Medtronic is a global leader in medical technology, offering innovative products and solutions for vascular surgery, including advanced endoscopic harvesting equipment.Boston Scientific:

Boston Scientific specializes in minimally invasive medical solutions, particularly known for its cutting-edge technologies in endoscopic vessel harvesting.Stryker Corporation:

Stryker is recognized for its instrumentation and medical devices in endoscopic surgery, contributing significantly to advancements in the vessel harvesting market.Johnson & Johnson:

Johnson & Johnson provides a range of surgical products, including those that enhance endoscopic procedures, strengthening their market presence.We're grateful to work with incredible clients.

FAQs

What is the market size of endoscopic vessel harvesting?

The endoscopic vessel harvesting market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.2% leading to growth in upcoming years. This growth is indicative of increasing adoption and demand for minimally invasive surgical techniques.

What are the key market players or companies in the endoscopic vessel harvesting industry?

Key players in the endoscopic vessel harvesting market include major medical equipment manufacturers and specialized endoscopic device providers. Their innovation and technological advancements significantly impact the industry's landscape, enhancing service delivery and surgical outcomes.

What are the primary factors driving the growth in the endoscopic vessel harvesting industry?

Driving factors for the endoscopic vessel harvesting market include advancements in technology, an increasing prevalence of cardiovascular diseases, and the rising preference for minimally invasive surgical procedures that reduce recovery time and improve patient outcomes.

Which region is the fastest Growing in the endoscopic vessel harvesting?

North America is the fastest-growing region for endoscopic vessel harvesting, with market size anticipated to increase from $0.57 billion in 2023 to $1.05 billion by 2033. This growth is driven by advancements in healthcare technologies and increased healthcare expenditure.

Does ConsaInsights provide customized market report data for the endoscopic vessel harvesting industry?

Yes, ConsaInsights offers tailored market report data for the endoscopic vessel harvesting industry. Clients can request specific insights and analysis designed to meet their unique business needs and market dynamics.

What deliverables can I expect from this endoscopic vessel harvesting market research project?

Clients can expect comprehensive market analysis reports, segment data breakdowns, growth forecasts, competitive landscape assessments, and insights into emerging trends and technologies within the endoscopic vessel harvesting market.

What are the market trends of endoscopic vessel harvesting?

Current trends in the endoscopic vessel harvesting market include the integration of robotic-assisted technologies, increasing utilization of minimally invasive techniques, and a focus on patient safety and recovery, shaping the future of surgical procedures.