Endoscopy Devices Market Report

Published Date: 31 January 2026 | Report Code: endoscopy-devices

Endoscopy Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Endoscopy Devices market, offering insights into market size, growth trends, segmentation, and regional performance from 2023 to 2033, aimed at helping stakeholders make informed decisions.

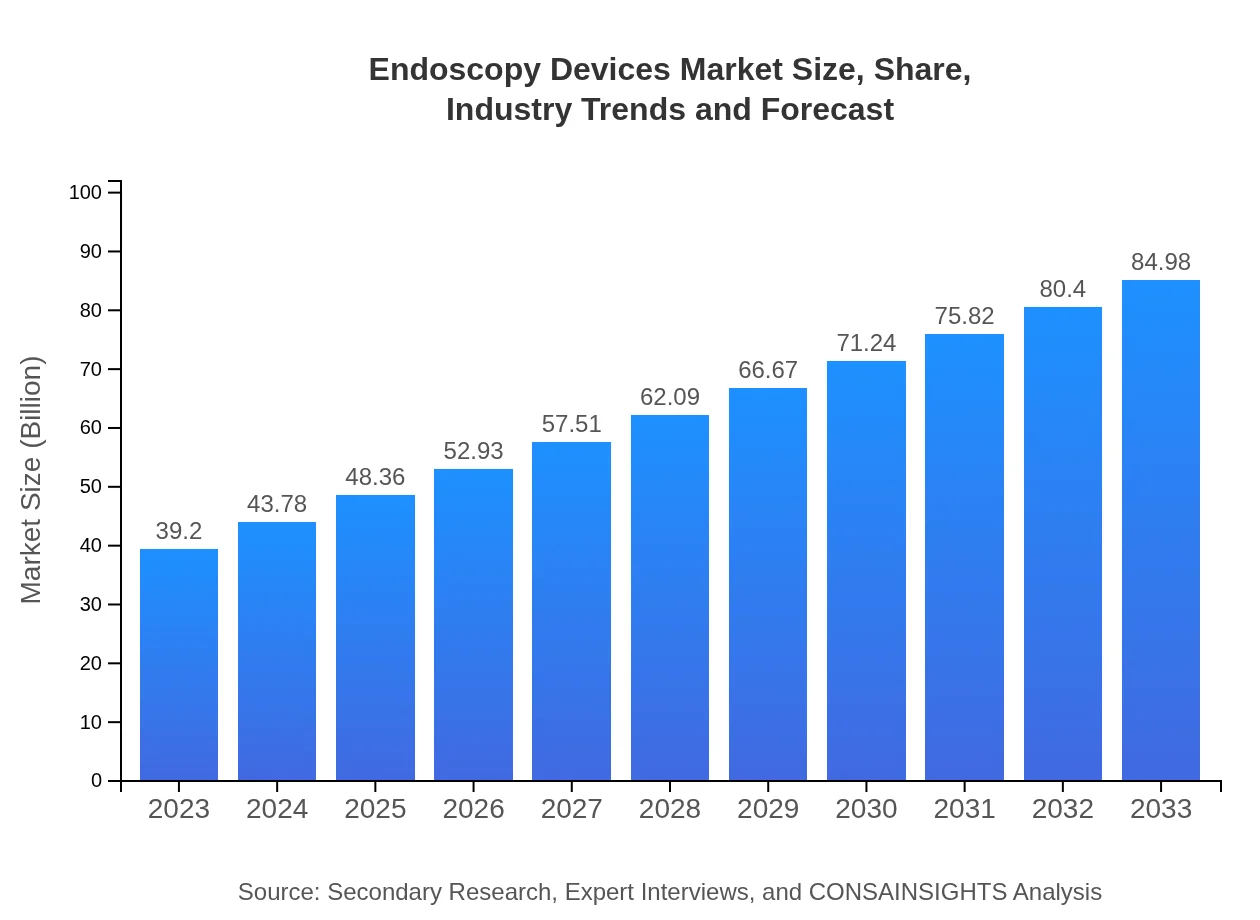

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $39.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $84.98 Billion |

| Top Companies | Olympus Corporation, Fujifilm Holdings Corporation, Karl Storz GmbH, Medtronic plc, Boston Scientific Corporation |

| Last Modified Date | 31 January 2026 |

Endoscopy Devices Market Overview

Customize Endoscopy Devices Market Report market research report

- ✔ Get in-depth analysis of Endoscopy Devices market size, growth, and forecasts.

- ✔ Understand Endoscopy Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Endoscopy Devices

What is the Market Size & CAGR of Endoscopy Devices market in 2023?

Endoscopy Devices Industry Analysis

Endoscopy Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Endoscopy Devices Market Analysis Report by Region

Europe Endoscopy Devices Market Report:

In Europe, the market is expected to evolve from $10.20 billion in 2023 to $22.11 billion by 2033. The rising elderly population, coupled with increasing awareness of minimally invasive surgeries, is expected to drive the demand for advanced endoscopy solutions throughout the region.Asia Pacific Endoscopy Devices Market Report:

In the Asia Pacific region, the Endoscopy Devices market is projected to grow from $7.96 billion in 2023 to $17.25 billion by 2033. This growth can be attributed to rising healthcare expenditures, increasing disposable incomes, and enhanced healthcare infrastructure. The demand for advanced endoscopic procedures is anticipated to increase due to a surge in chronic diseases.North America Endoscopy Devices Market Report:

North America remains a significant contributor to the Endoscopy Devices market, estimated to grow from $14.52 billion in 2023 to $31.48 billion by 2033. This region benefits from advanced healthcare facilities, a high prevalence of gastrointestinal diseases, and robust research and development activities driving innovations in endoscopic devices.South America Endoscopy Devices Market Report:

South America shows a steady growth trajectory for the Endoscopy Devices market, expected to rise from $1.11 billion in 2023 to $2.40 billion by 2033. Factors such as increased healthcare access, investment in healthcare technology, and a growing focus on preventative care are influencing market growth positively.Middle East & Africa Endoscopy Devices Market Report:

The Middle East and Africa market is anticipated to witness growth from $5.41 billion in 2023 to $11.73 billion by 2033. Growing investments in healthcare infrastructure, technological advancements, and increased focus on healthcare services are the key drivers propelling the market in this region.Tell us your focus area and get a customized research report.

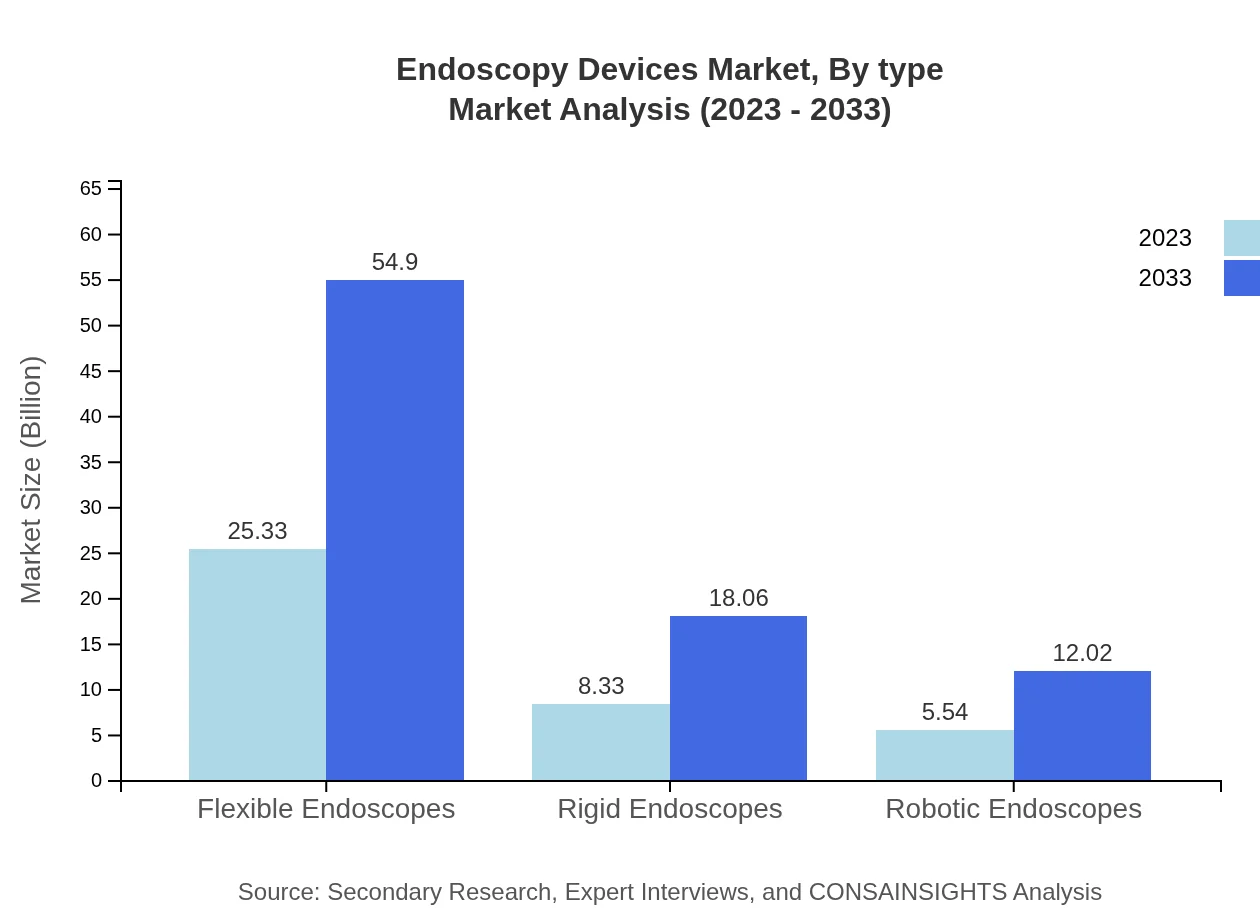

Endoscopy Devices Market Analysis By Type

In 2023, Flexible Endoscopes dominate the market with a size of $25.33 billion (64.61% market share) and are projected to grow to $54.90 billion by 2033. Rigid Endoscopes have a market size of $8.33 billion, expected to expand to $18.06 billion. Robotic Endoscopes are notable for their niche application, starting at $5.54 billion and forecasting a growth to $12.02 billion.

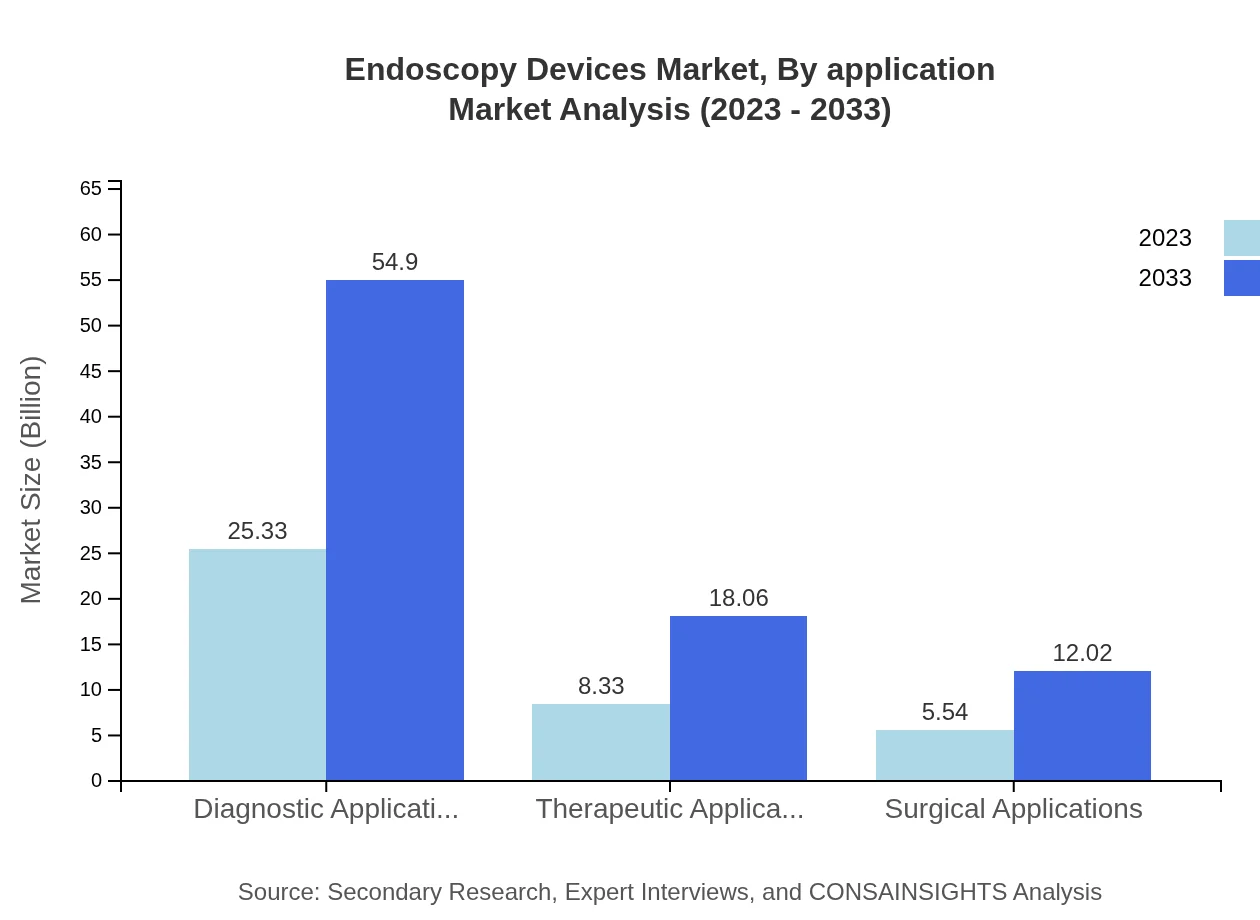

Endoscopy Devices Market Analysis By Application

Diagnostic Applications account for a significant share, with a market size of $25.33 billion in 2023, growing to $54.90 billion by 2033. Therapeutic Applications and Surgical Applications hold market sizes of $8.33 billion and $5.54 billion respectively, with both set to witness healthy growth trends, reflecting growing healthcare needs and improving technologies.

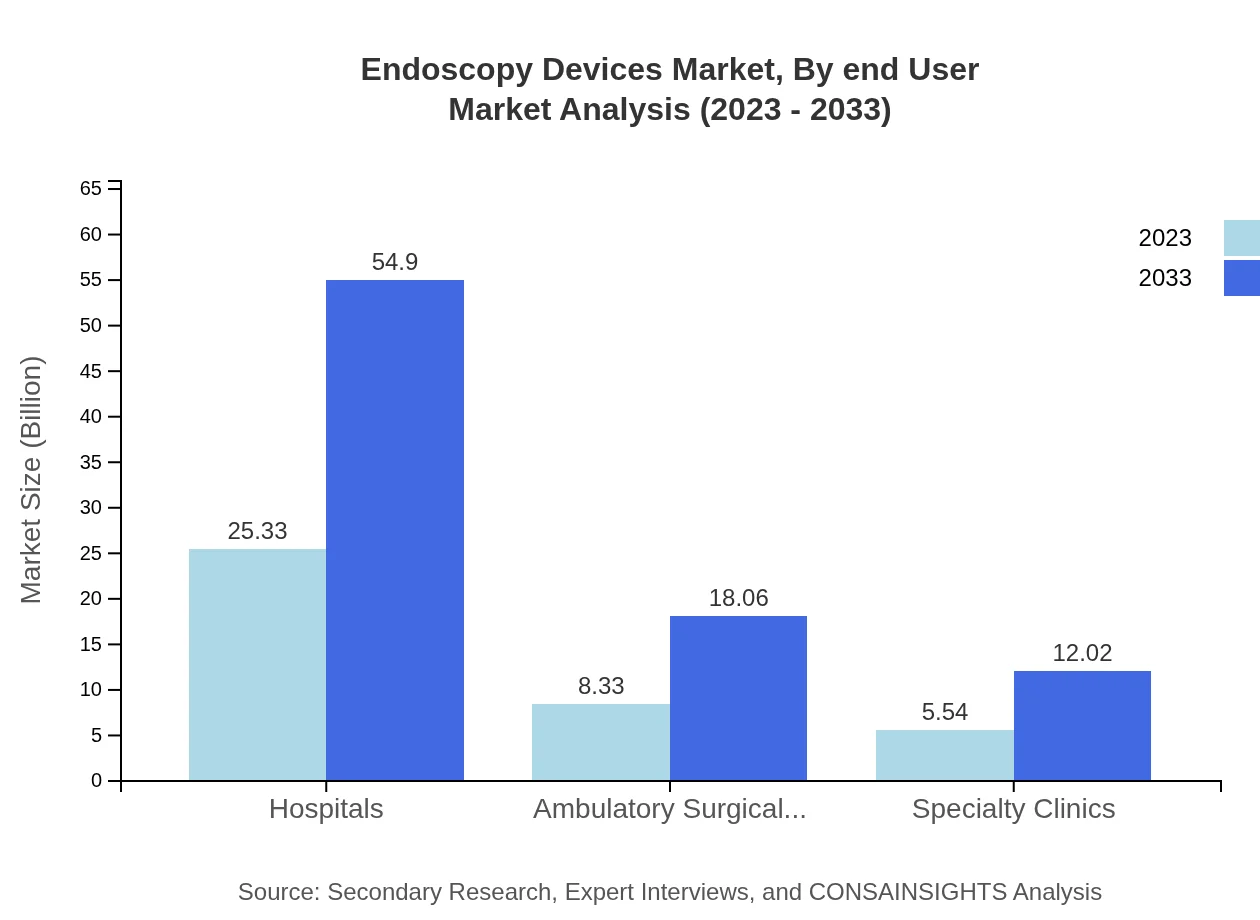

Endoscopy Devices Market Analysis By End User

Hospitals are the largest end-user segment, with a market size of $25.33 billion (64.61% market share), expected to grow to $54.90 billion. Ambulatory Surgical Centers and Specialty Clinics also form significant portions of the market, with $8.33 billion and $5.54 billion respectively in 2023, highlighting the demand for outpatient services.

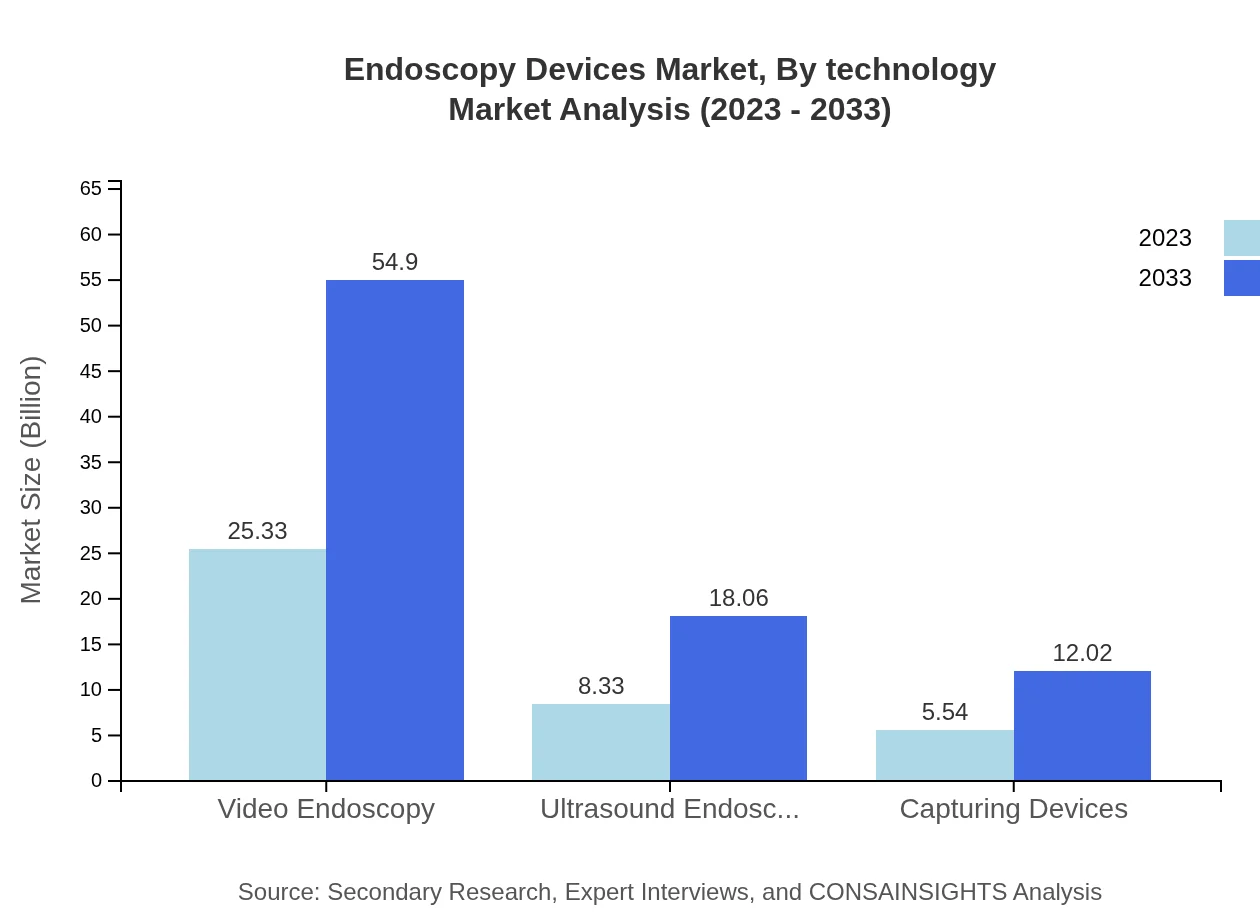

Endoscopy Devices Market Analysis By Technology

Video Endoscopy is a leading technology in the market, starting at $25.33 billion and forecasted to reach $54.90 billion by 2033. Ultrasound Endoscopy and Capturing Devices are expected to see notable growth, with each starting from $8.33 billion and $5.54 billion respectively, catering to specific healthcare needs.

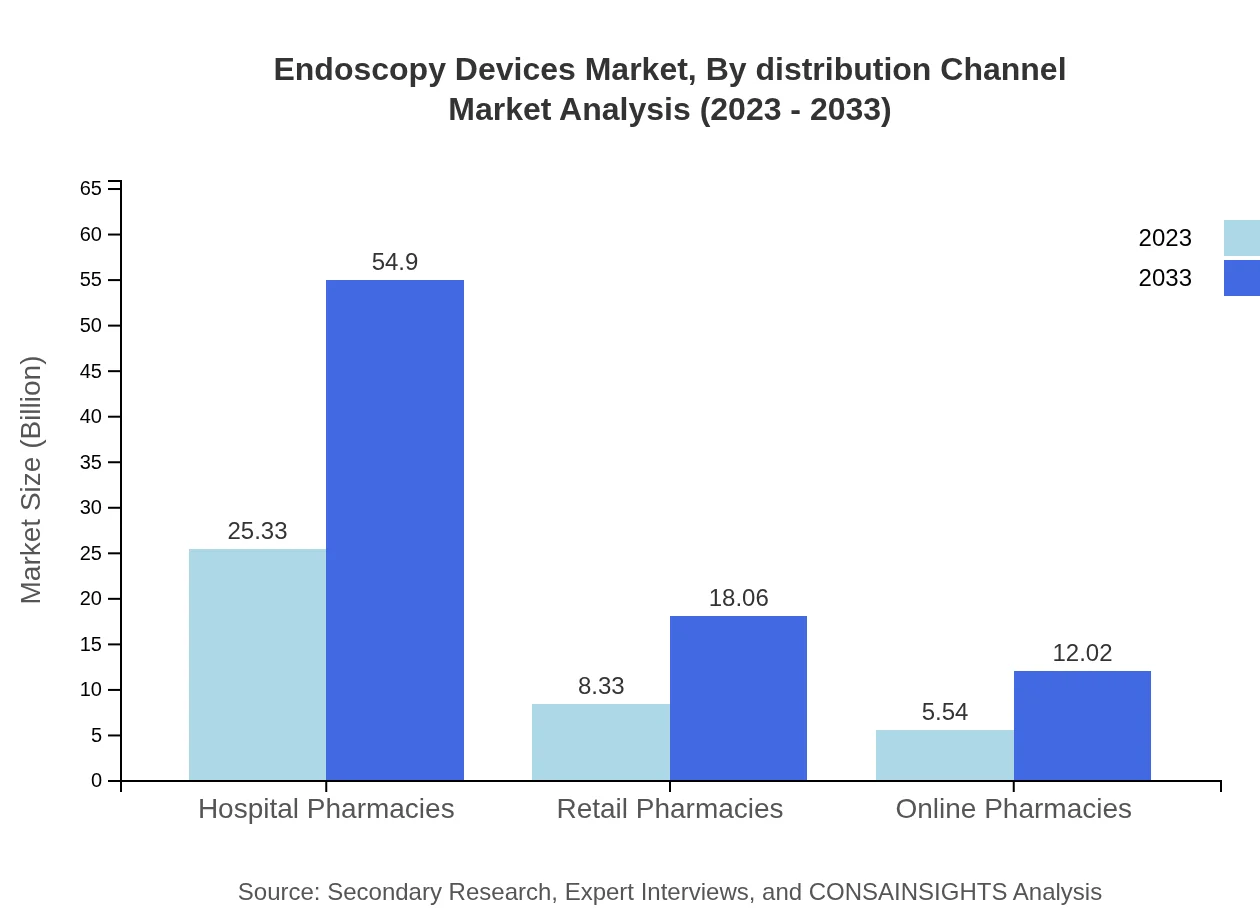

Endoscopy Devices Market Analysis By Distribution Channel

Hospital Pharmacies dominate the distribution channel for Endoscopy Devices, with a market size of $25.33 billion, expected to grow. Retail and Online Pharmacies are crucial as well, reflecting shifts in patient purchasing behaviors and the growing emphasis on accessibility.

Endoscopy Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Endoscopy Devices Industry

Olympus Corporation:

A leading manufacturer of endoscopic equipment, Olympus has contributed significantly to the endoscopy market with advanced imaging systems and flexible endoscopes.Fujifilm Holdings Corporation:

Known for their innovative healthcare solutions, Fujifilm specializes in video endoscopy and imaging systems, focusing on high-definition and user-friendly technologies.Karl Storz GmbH:

Karl Storz is recognized for its pioneering work in the field of endoscopic equipment, with robust offerings in both rigid and flexible endoscopes for various medical applications.Medtronic plc:

Medtronic's advancements in robotic-assisted surgery have revolutionized the endoscopy field, providing solutions that improve patient outcomes and surgical accuracy.Boston Scientific Corporation:

This company specializes in providing innovative endoscopy devices focused on therapeutic applications, enhancing minimally invasive procedures.We're grateful to work with incredible clients.

FAQs

What is the market size of endoscopy Devices?

The global market size of endoscopy devices is projected to reach approximately $39.2 billion by 2033, with a robust CAGR of 7.8% during the forecast period. This growth reflects the increasing demand for minimally invasive surgical procedures.

What are the key market players or companies in the endoscopy Devices industry?

Key players in the endoscopy devices market include large medical device companies which produce diverse endoscopic equipment, ranging from flexible and rigid endoscopes to robotic-assisted systems. Notable companies specialize in innovative technologies enhancing diagnosis and treatment.

What are the primary factors driving the growth in the endoscopy Devices industry?

Key drivers for growth in the endoscopy devices sector include rising prevalence of gastrointestinal diseases, advancements in endoscopic technologies, and increasing preference for minimally invasive surgeries. These factors collectively enhance patient outcomes and drive market demand.

Which region is the fastest Growing in the endoscopy Devices market?

The Asia Pacific region is identified as the fastest-growing market for endoscopy devices, projected to grow from $7.96 billion in 2023 to $17.25 billion by 2033, capturing a significant share due to advancements in healthcare infrastructure and growing medical needs.

Does ConsaInsights provide customized market report data for the endoscopy Devices industry?

Yes, ConsaInsights offers customized market report data for the endoscopy-devices industry. Tailored reports can be developed to suit specific business needs, focusing on unique market segments, regions, or technological advancements.

What deliverables can I expect from this endoscopy Devices market research project?

Deliverables from the endoscopy-devices market research project typically include comprehensive market analysis, forecasts, competitive landscape insights, regional assessments, and detailed segment breakdowns, providing a clear view of current and future market trends.

What are the market trends of endoscopy Devices?

Key trends in the endoscopy devices market include the shift towards digital solutions with video endoscopy, innovative robotic-assisted procedures, and increasing adoption of single-use endoscopes. These trends reflect advances in technology and changing healthcare practices.