Endpoint Detection And Response Market Report

Published Date: 31 January 2026 | Report Code: endpoint-detection-and-response

Endpoint Detection And Response Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Endpoint Detection and Response (EDR) market from 2023 to 2033, providing insights into market size, growth trends, segmentation, and regional analysis.

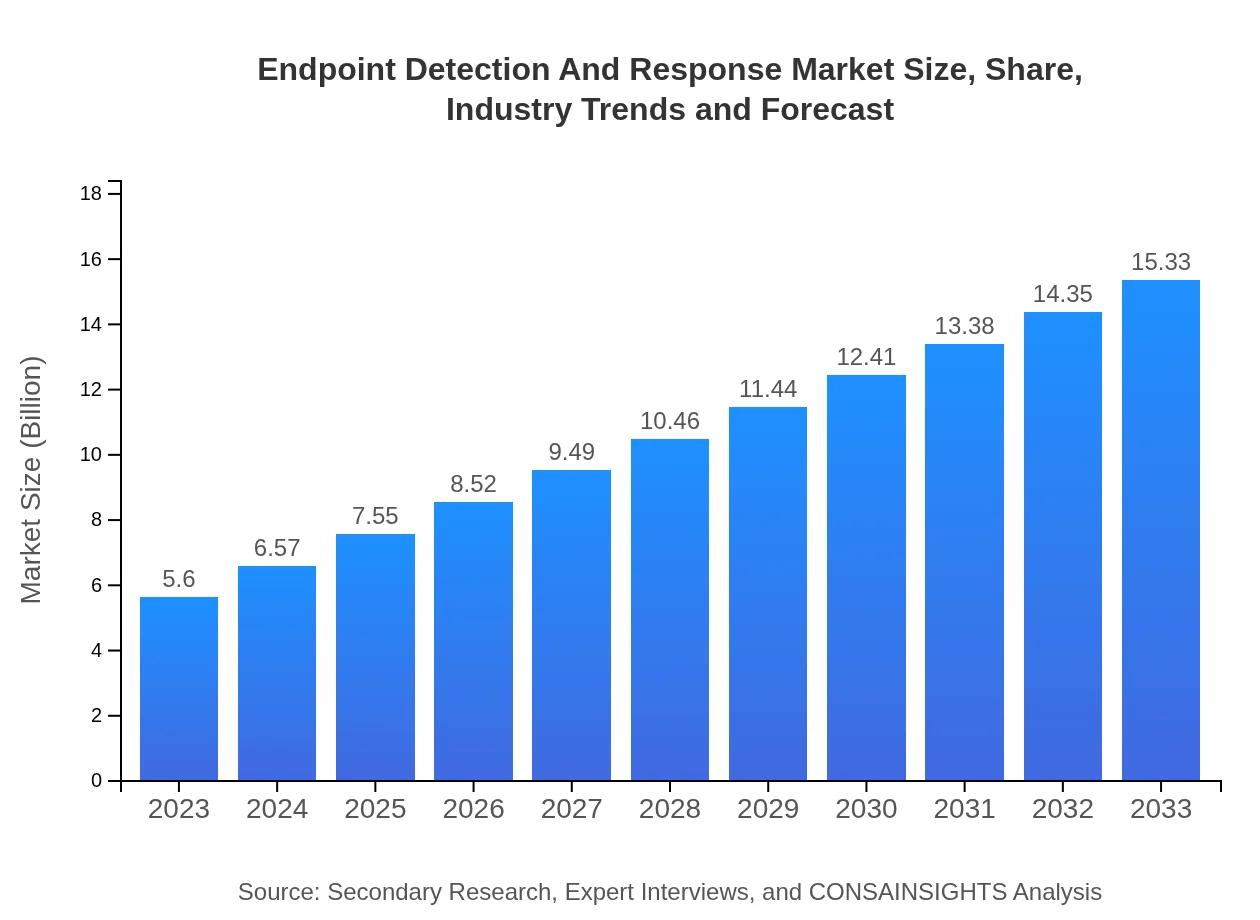

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | CrowdStrike, SentinelOne, Palo Alto Networks, McAfee, Sophos |

| Last Modified Date | 31 January 2026 |

Endpoint Detection And Response Market Overview

Customize Endpoint Detection And Response Market Report market research report

- ✔ Get in-depth analysis of Endpoint Detection And Response market size, growth, and forecasts.

- ✔ Understand Endpoint Detection And Response's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Endpoint Detection And Response

What is the Market Size & CAGR of Endpoint Detection And Response market in 2023?

Endpoint Detection And Response Industry Analysis

Endpoint Detection And Response Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Endpoint Detection And Response Market Analysis Report by Region

Europe Endpoint Detection And Response Market Report:

Europe's EDR market is forecasted to grow from $1.66 billion in 2023 to $4.54 billion by 2033, driven by stringent regulations and compliance requirements that compel businesses to enhance their cybersecurity measures.Asia Pacific Endpoint Detection And Response Market Report:

The Asia Pacific region is expected to grow from $1.06 billion in 2023 to $2.91 billion in 2033, driven by increased digital transformation initiatives and a focus on securing endpoint devices amidst a rising frequency of cyberattacks.North America Endpoint Detection And Response Market Report:

The North American market is projected to experience significant growth from $2.05 billion in 2023 to $5.61 billion in 2033, owing to the strong presence of technology giants and the high adoption rate of innovative cybersecurity solutions.South America Endpoint Detection And Response Market Report:

In South America, the EDR market is anticipated to expand from $0.33 billion in 2023 to $0.89 billion by 2033. This growth is supported by heightened awareness of cybersecurity threats and investments in security technologies across various sectors.Middle East & Africa Endpoint Detection And Response Market Report:

The Middle East and Africa region will see the EDR market increase from $0.51 billion in 2023 to $1.39 billion in 2033 as governments and organizations prioritize cybersecurity investment in response to surging cyber threats.Tell us your focus area and get a customized research report.

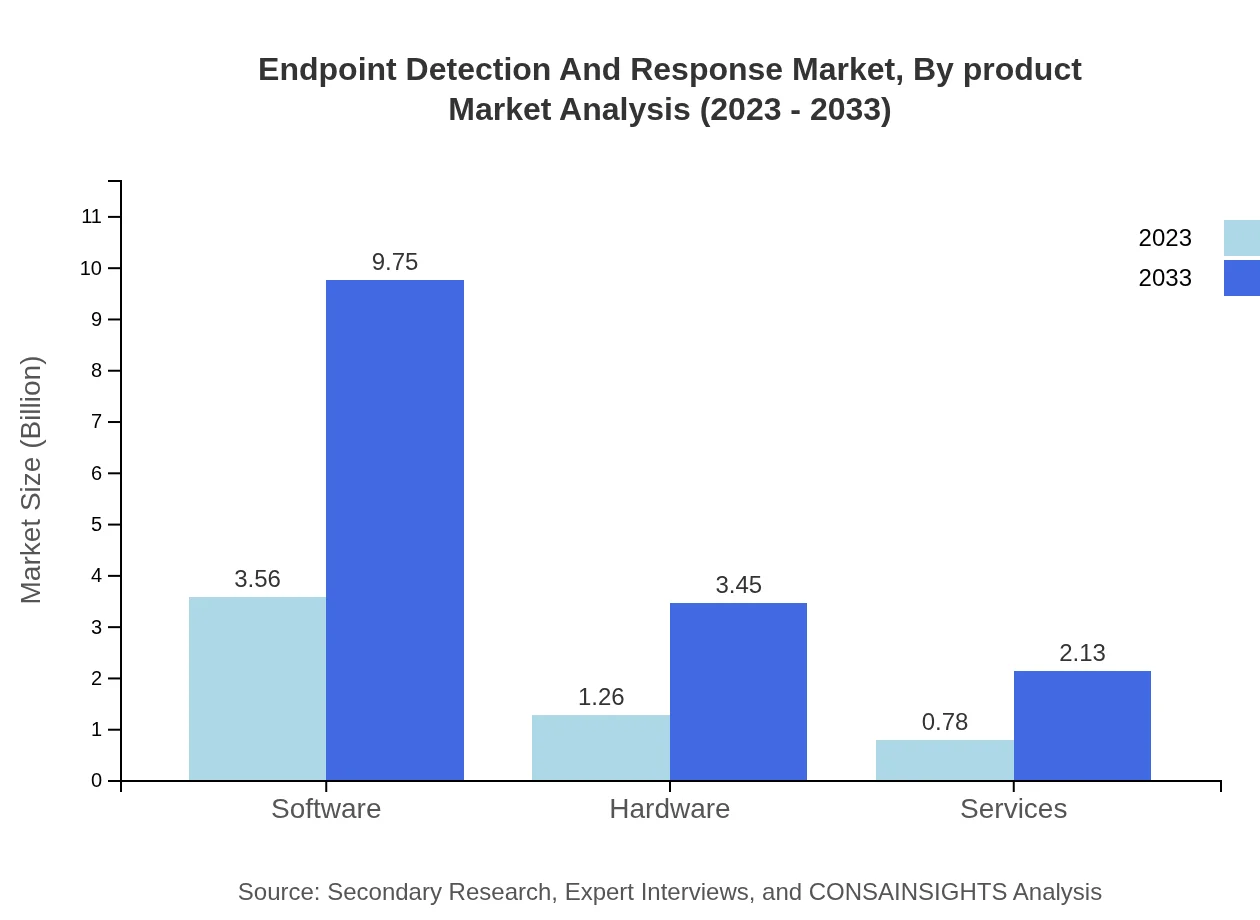

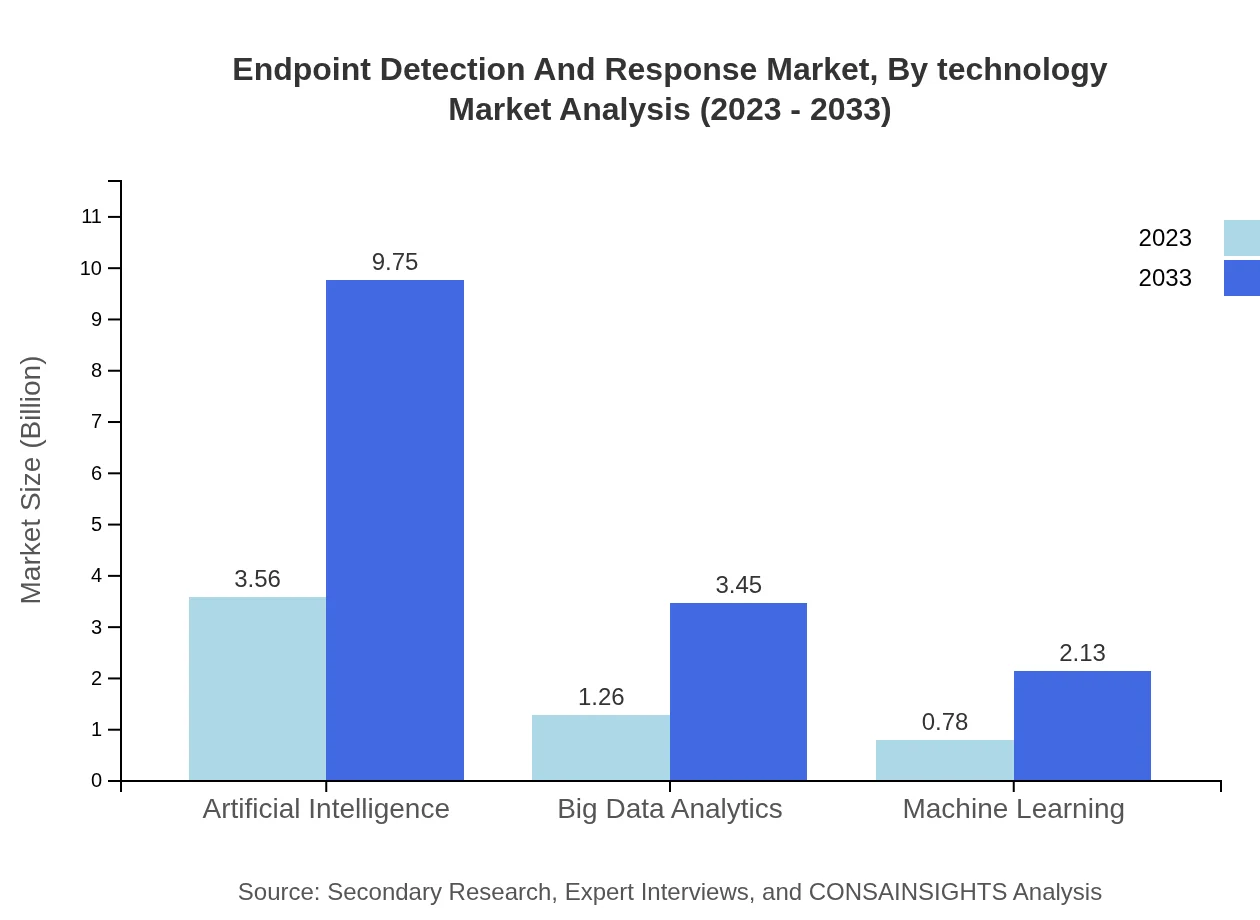

Endpoint Detection And Response Market Analysis By Product

The product segment of the EDR market primarily includes software solutions, hardware devices, and services. Software dominates this segment, growing from $3.56 billion in 2023 to $9.75 billion in 2033. Hardware products are projected to grow from $1.26 billion to $3.45 billion during the same period. Services, covering consulting and managed services, will expand from $0.78 billion to $2.13 billion.

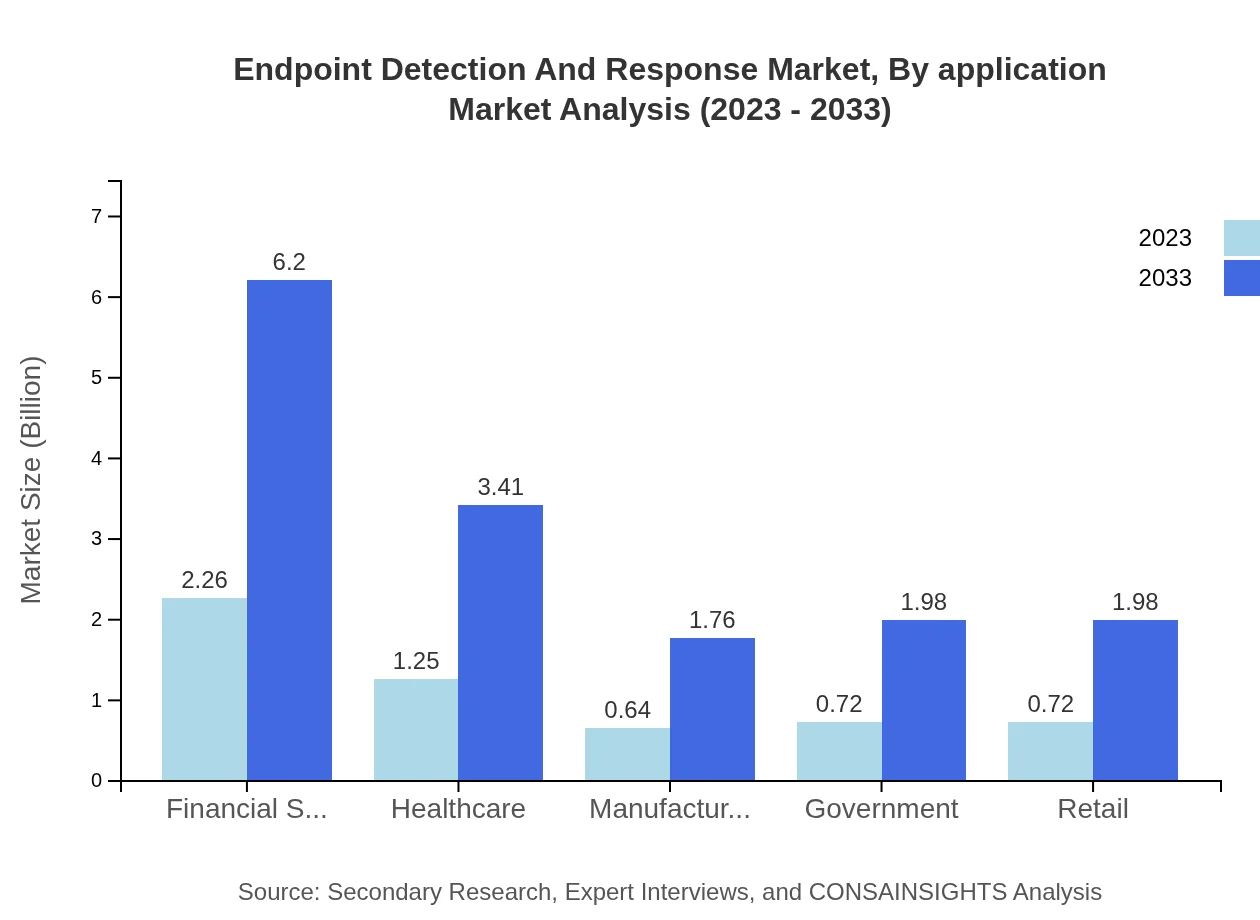

Endpoint Detection And Response Market Analysis By Application

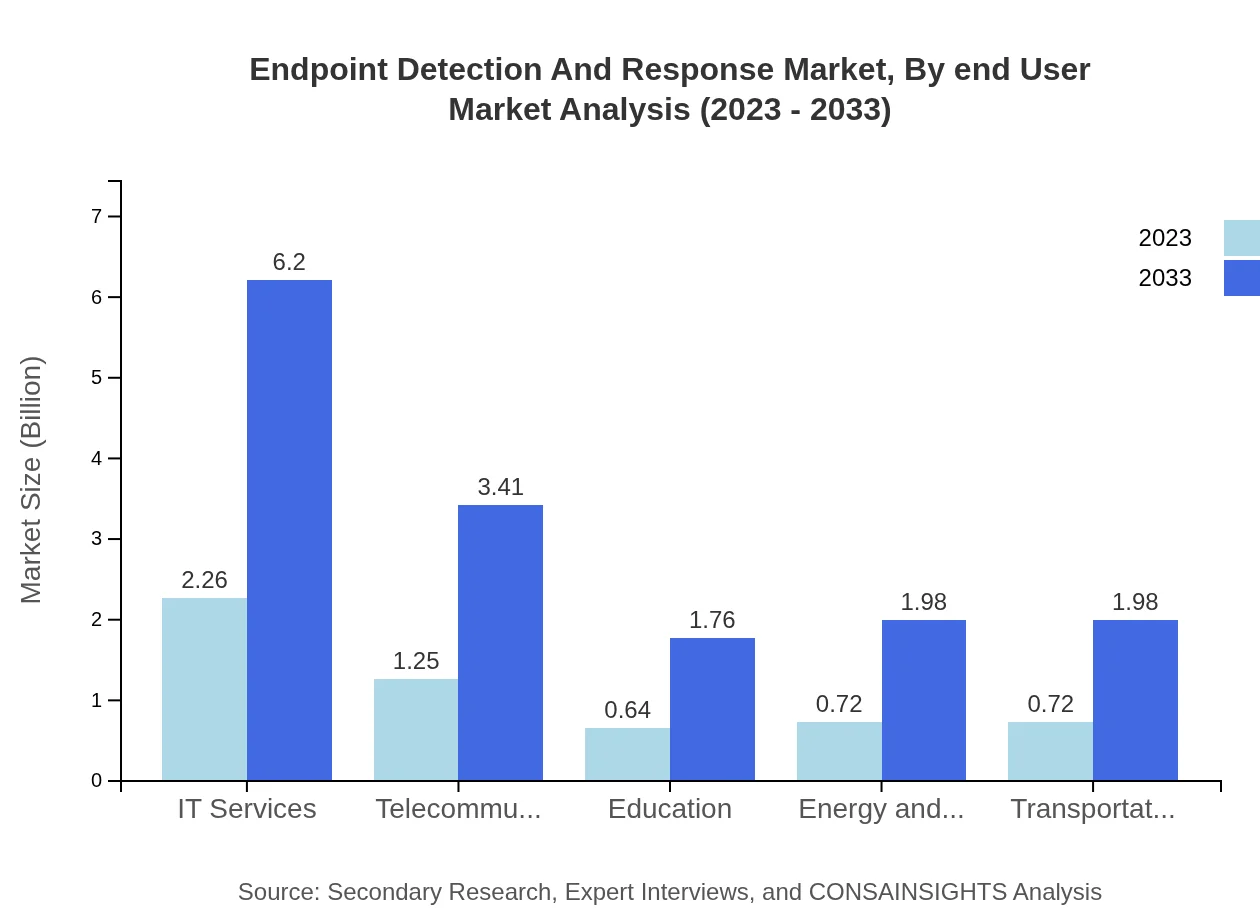

Applications for EDR are widespread across various industries such as IT services, finance, healthcare, and education. Notably, the IT services segment is expected to increase from $2.26 billion in 2023 to $6.20 billion by 2033, underscoring its importance in supporting organizational security strategies.

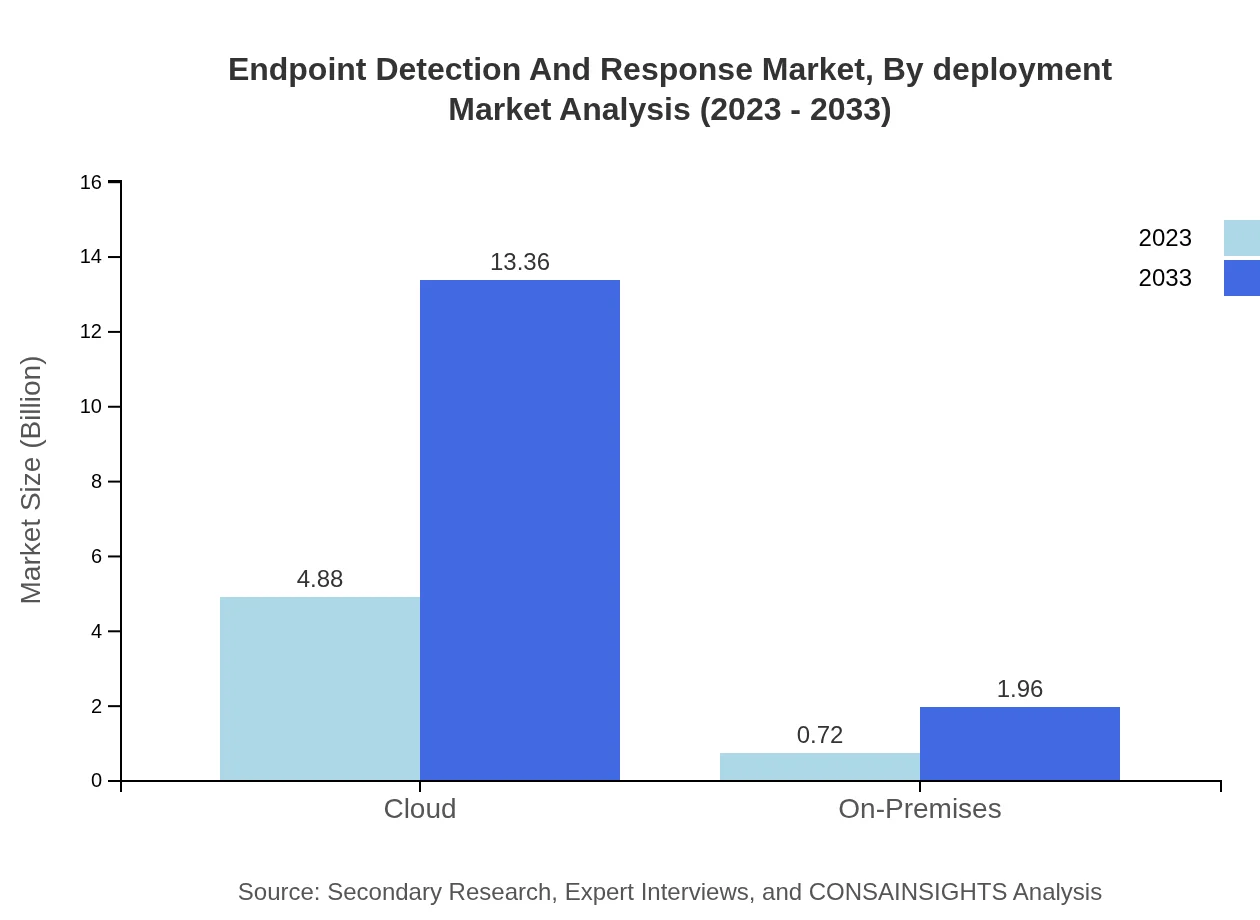

Endpoint Detection And Response Market Analysis By Deployment

The EDR market is bifurcated into cloud-based and on-premises deployment modes. Cloud-based solutions hold the dominant market share, accounting for 87.18% of the market share in 2023 and continuing to expand significantly through 2033, while on-premises solutions are expected to maintain a smaller but consistent presence in the market.

Endpoint Detection And Response Market Analysis By End User

The end-user market for EDR includes financial services, healthcare, education, and government. The financial services sector will showcase robust growth, from $2.26 billion in 2023 to $6.20 billion in 2033, amidst regulatory pressures and high-stakes risks involved in data security.

Endpoint Detection And Response Market Analysis By Technology

Technologies driving the EDR market include artificial intelligence, machine learning, and big data analytics. AI and machine learning are expected to see substantial growth due to their capabilities in threat detection and predictive analytics, growing from $3.56 billion in 2023 to $9.75 billion by 2033.

Endpoint Detection And Response Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Endpoint Detection And Response Industry

CrowdStrike:

A leader in cybersecurity services, CrowdStrike offers a cloud-native endpoint protection platform that uses AI for detecting threats and responding to attacks.SentinelOne:

SentinelOne provides autonomous endpoint protection with advanced AI capabilities, focusing on prevention, detection, and response in real-time.Palo Alto Networks:

Palo Alto Networks integrates EDR capabilities into its comprehensive cybersecurity approach, focusing on enterprise security solutions to combat cyber threats.McAfee:

As a well-established player in cybersecurity, McAfee offers effective EDR solutions that focus on threat detection and automated response mechanisms.Sophos:

Sophos provides AI-driven endpoint protection solutions designed to simplify management while delivering robust security against evolving threats.We're grateful to work with incredible clients.

FAQs

What is the market size of Endpoint Detection and Response?

The market size of Endpoint Detection and Response is estimated at $5.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 10.2% through 2033. This significant growth highlights the increasing demand for advanced cybersecurity solutions in various sectors.

What are the key market players or companies in the Endpoint Detection and Response industry?

Key players in the Endpoint Detection and Response market include reputable cybersecurity firms such as CrowdStrike, Carbon Black, Cybereason, and McAfee. Their competitive strategies and innovative offerings continuously shape the market landscape while addressing evolving security challenges.

What are the primary factors driving the growth in the Endpoint Detection and Response industry?

The growth in the Endpoint Detection and Response industry is primarily driven by an increase in cyber threats, the rise of remote work, and the need for proactive security measures. Regulatory compliance and advancements in AI further accelerate innovation and strengthen market demand.

Which region is the fastest Growing in the Endpoint Detection and Response market?

The fastest-growing region in the Endpoint Detection and Response market is Europe, projected to grow from $1.66 billion in 2023 to $4.54 billion in 2033. North America follows closely, expanding from $2.05 billion to $5.61 billion during the same period.

Does ConsaInsights provide customized market report data for the Endpoint Detection and Response industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the Endpoint Detection and Response industry. This flexibility ensures that stakeholders receive relevant insights to support informed strategic decisions.

What deliverables can I expect from this Endpoint Detection and Response market research project?

Deliverables from the Endpoint Detection and Response market research project typically include detailed reports, regional analysis, competitive landscapes, segmentation insights, and actionable recommendations to guide strategic planning and market entry.

What are the market trends of Endpoint Detection and Response?

Current market trends in Endpoint Detection and Response include increasing integration of artificial intelligence for threat detection, a shift towards cloud-based solutions, and a growing focus on user behavior analytics to enhance endpoint security measures.