Engine Oil Market Report

Published Date: 02 February 2026 | Report Code: engine-oil

Engine Oil Market Size, Share, Industry Trends and Forecast to 2033

This report provides a thorough analysis of the Engine Oil market from 2023 to 2033, focusing on market size, segmentation, technological advancements, and regional insights. It aims to deliver substantive data-driven forecasts and trends that will be influential in strategic decision-making.

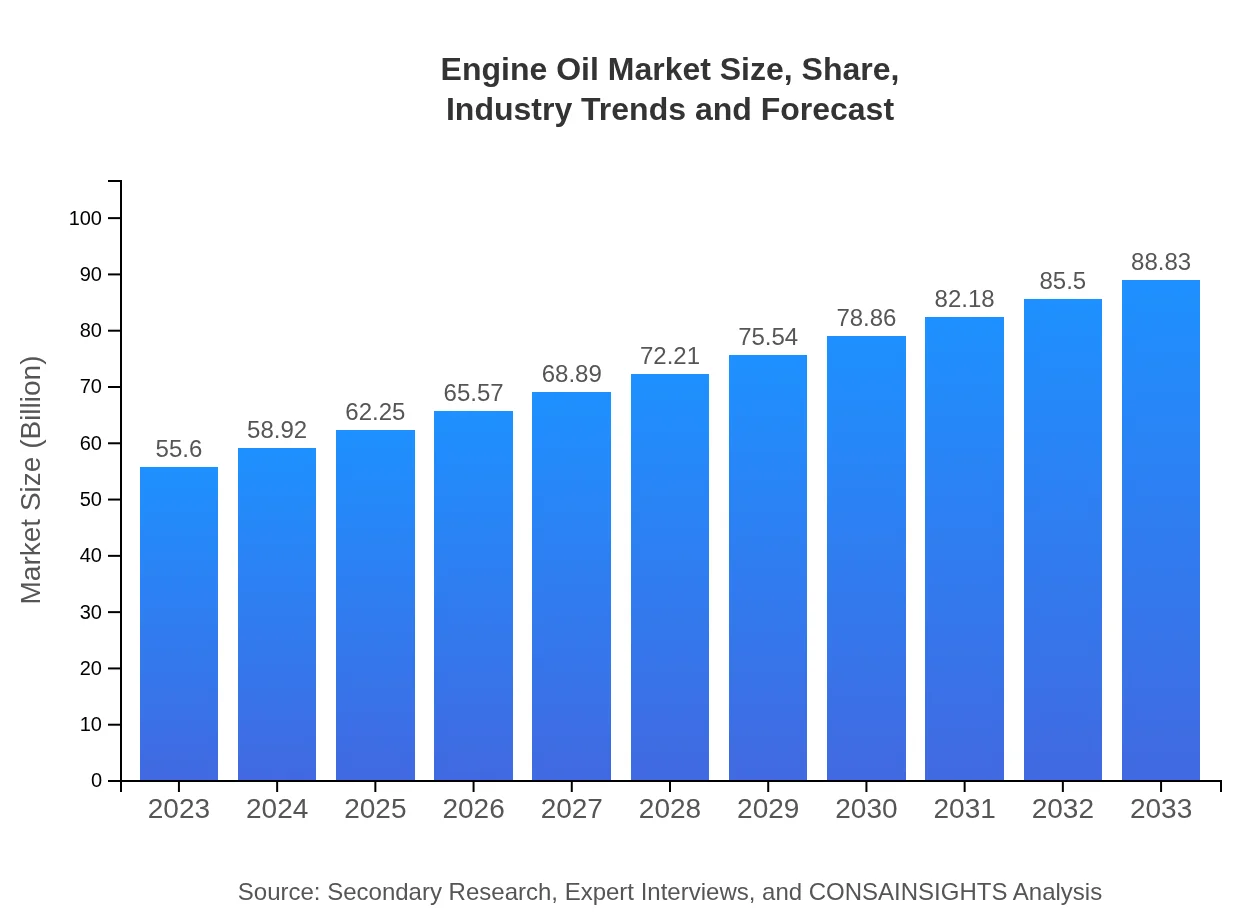

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $55.60 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $88.83 Billion |

| Top Companies | Shell, Mobil 1, Castrol, Valvoline, Liqui Moly |

| Last Modified Date | 02 February 2026 |

Engine Oil Market Overview

Customize Engine Oil Market Report market research report

- ✔ Get in-depth analysis of Engine Oil market size, growth, and forecasts.

- ✔ Understand Engine Oil's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Engine Oil

What is the Market Size & CAGR of Engine Oil market in 2023?

Engine Oil Industry Analysis

Engine Oil Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Engine Oil Market Analysis Report by Region

Europe Engine Oil Market Report:

Europe's Engine Oil market size was valued at $14.08 billion in 2023 and is projected to grow to $22.49 billion by 2033. The growth is spurred by stringent environmental regulations and rising demand for energy-efficient vehicles, leading to the adoption of better-performing synthetic oils.Asia Pacific Engine Oil Market Report:

In the Asia Pacific region, the Engine Oil market is anticipated to expand from $11.19 billion in 2023 to $17.87 billion by 2033. Factors such as rapid urbanization, increased automotive production, and the expansion of the logistics sector drive the market. Key countries like China and India are major contributors owing to their large vehicle populations.North America Engine Oil Market Report:

North America accounts for a substantial market share, with an estimated size of $19.45 billion in 2023 projected to surge to $31.07 billion by 2033. The region's mature automotive market coupled with trends toward high-performance engine oils significantly influence these figures, driven by consumer preferences for leading brands.South America Engine Oil Market Report:

The South American Engine Oil market, valued at $5.49 billion in 2023, is expected to reach $8.78 billion by 2033. Economic growth in countries like Brazil and Argentina, alongside rising consumer income levels, will likely promote vehicle sales and, consequently, engine oil consumption, despite economic challenges.Middle East & Africa Engine Oil Market Report:

In the Middle East and Africa, the market is expected to grow from $5.39 billion in 2023 to $8.62 billion by 2033. Economic development, infrastructural investments, and growth in the automotive sector in countries like the UAE and South Africa are driving this increase.Tell us your focus area and get a customized research report.

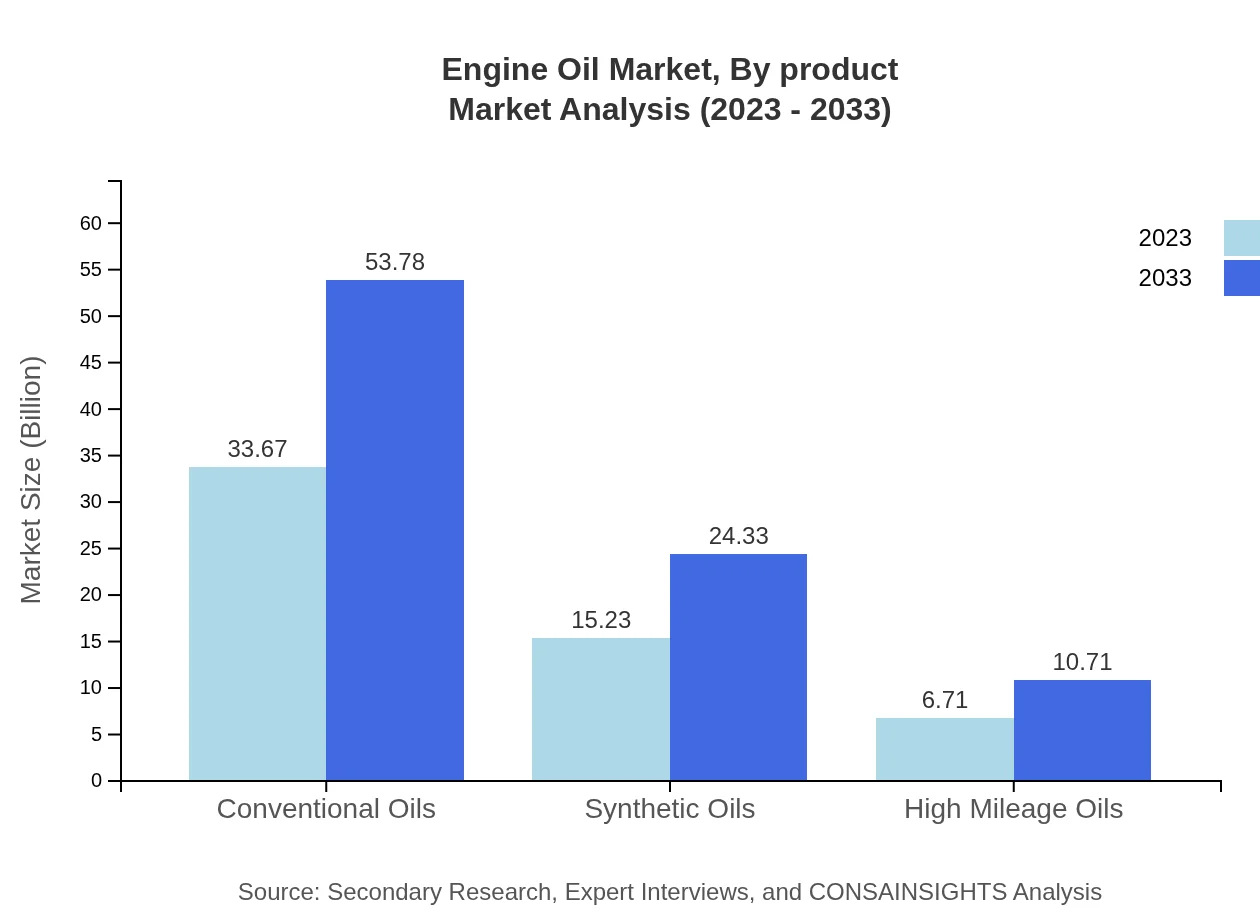

Engine Oil Market Analysis By Product

The Engine Oil market is segmented by product into Conventional Oils, Synthetic Oils, and High Mileage Oils. In 2023, Conventional Oils lead the market with a size of $33.67 billion, expected to grow to $53.78 billion by 2033. Synthetic Oils and High Mileage Oils also show considerable growth, with sizes of $15.23 billion and $6.71 billion in 2023, respectively. The increase in preference for synthetic oils highlights a shift towards healthier engine performance.

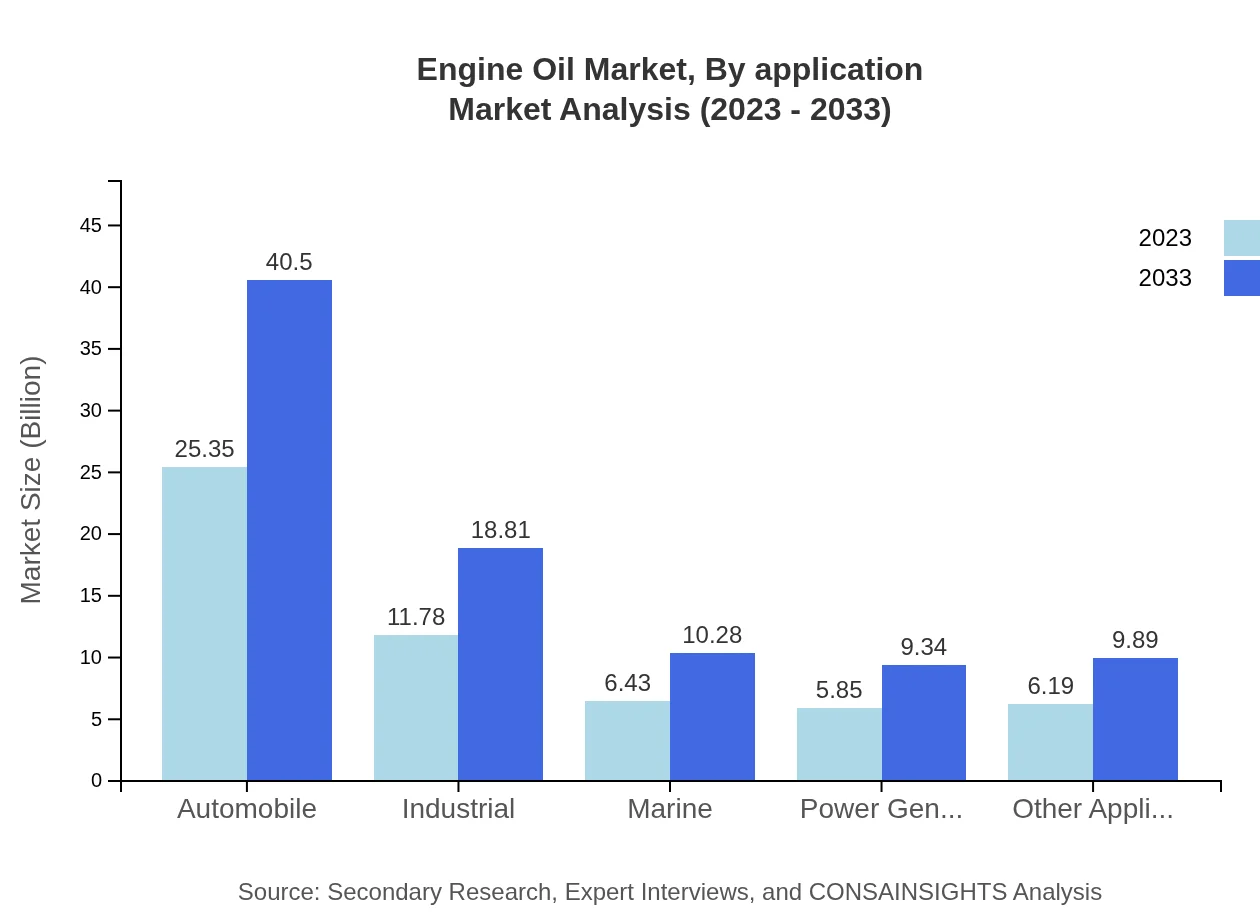

Engine Oil Market Analysis By Application

The market is segmented by application into Automobile, Industrial, Marine, and Others. The Automobile segment dominates the market, valued at $25.35 billion in 2023 and expected to reach $40.50 billion by 2033. Industrial applications follow closely, showing significant growth due to expanding manufacturing activities globally.

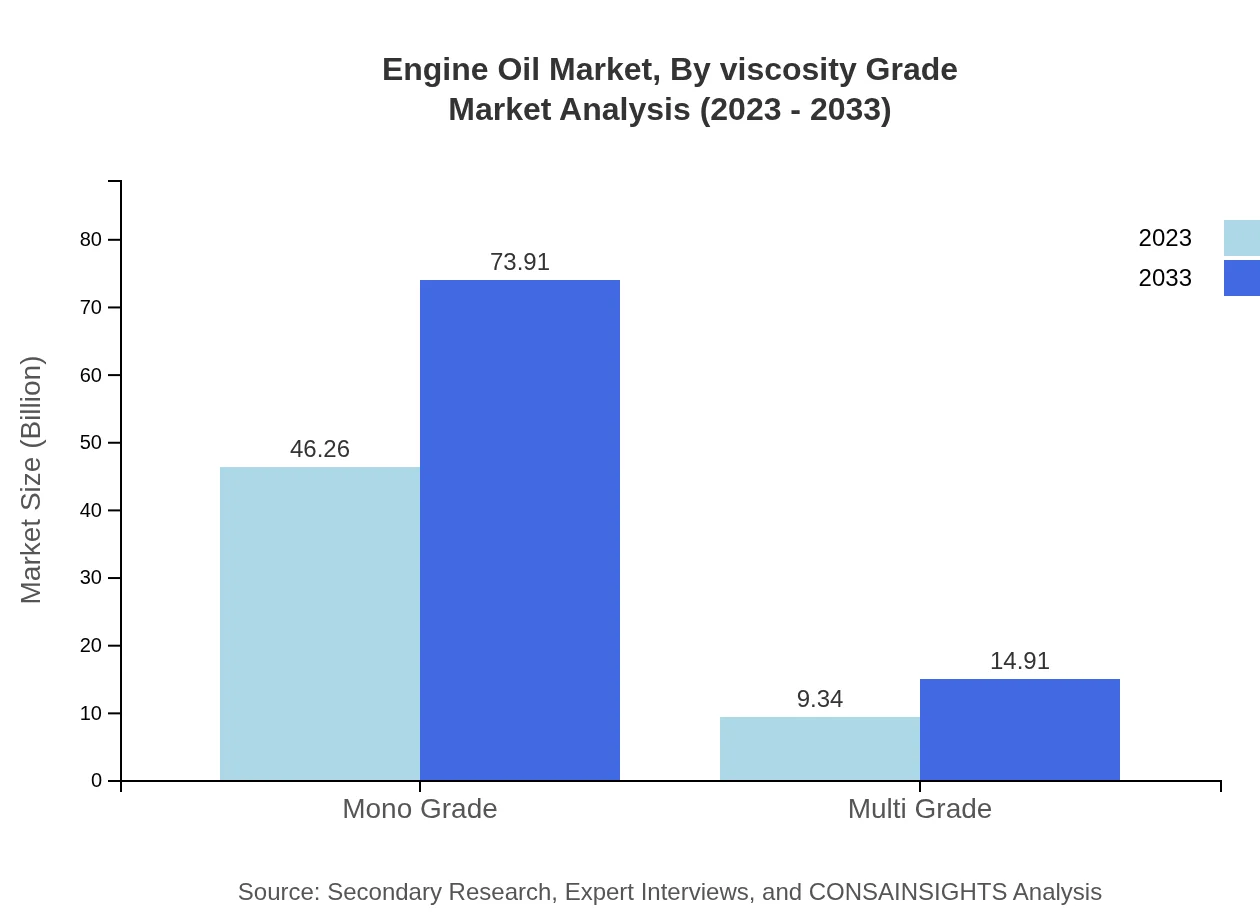

Engine Oil Market Analysis By Viscosity Grade

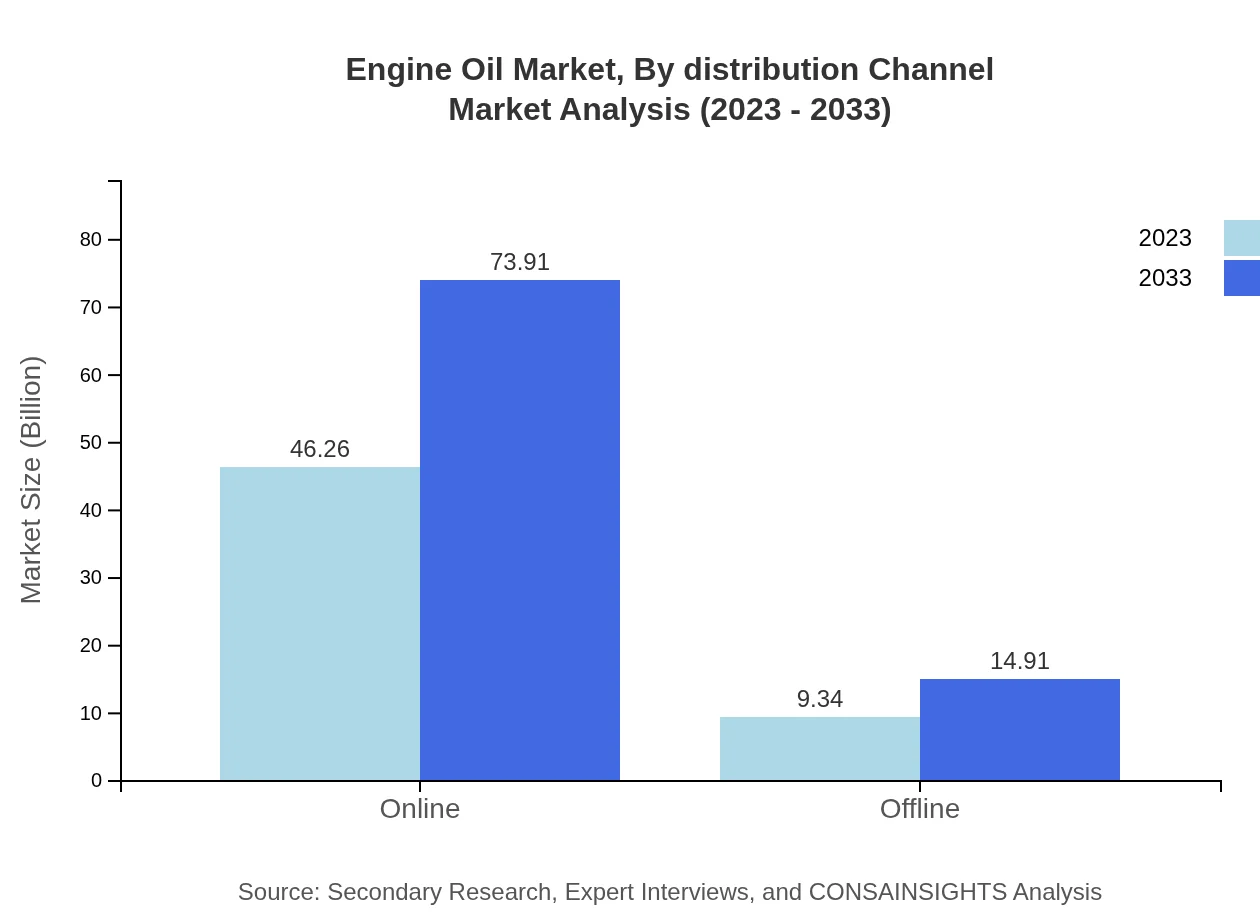

The segment is classified into Mono Grade and Multi Grade oils. Mono Grade oils hold a significant market share of $46.26 billion in 2023, expected to grow to $73.91 billion by 2033. Multi Grade oils, which offer versatility, are also projected to grow from $9.34 billion to $14.91 billion during the same period.

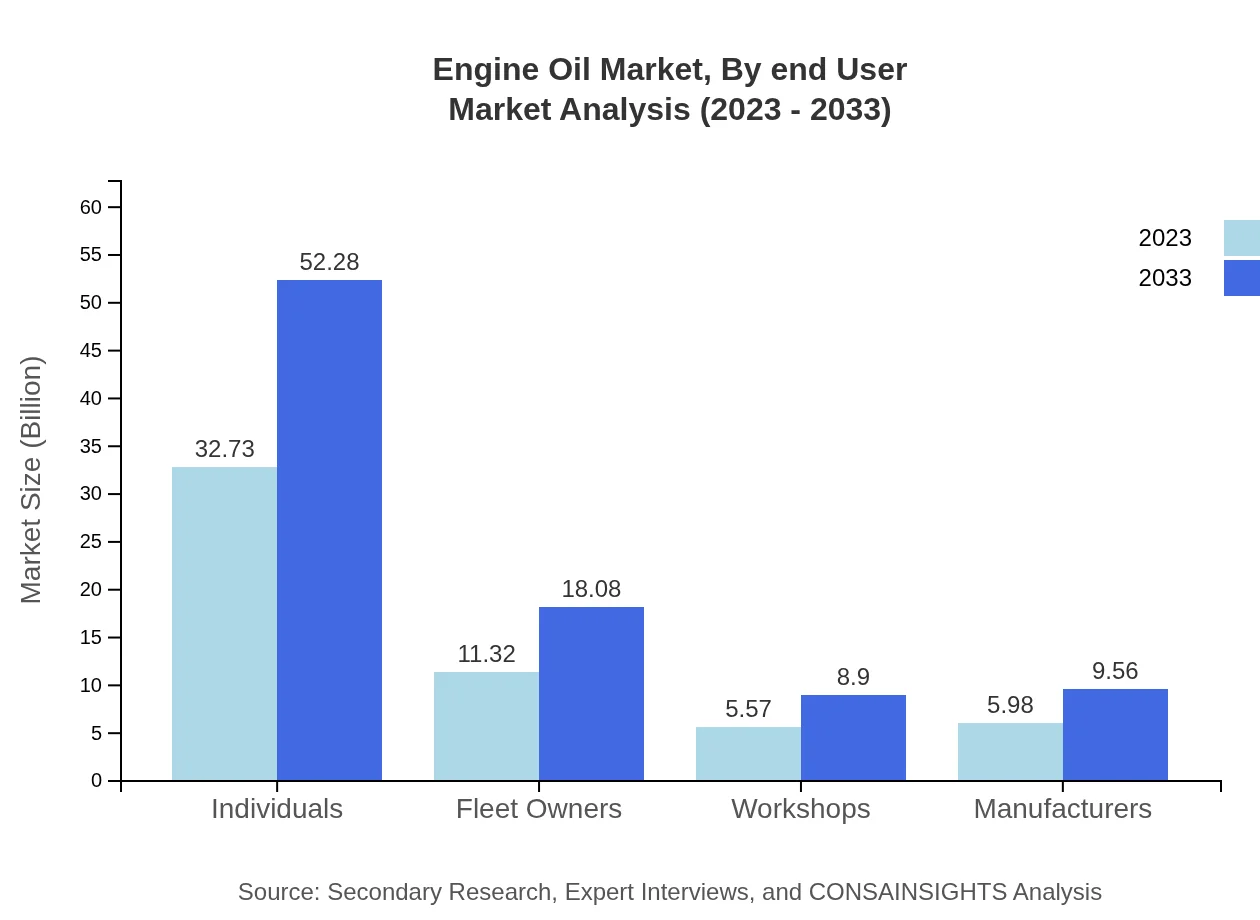

Engine Oil Market Analysis By End User

The Engine Oil market is segmented by end-user into Individuals, Fleet Owners, Workshops, and Manufacturers. The Individual segment leads with a market size of $32.73 billion in 2023 and forecasts growth to $52.28 billion by 2033, reflecting the growing consumer base and increased vehicle ownership.

Engine Oil Market Analysis By Distribution Channel

The distribution channels for engine oils include Online and Offline. The Online channel holds a significant market share, valued at $46.26 billion in 2023, which is anticipated to grow to $73.91 billion by 2033, showcasing the shift to e-commerce for oils, while Offline channels continue to play a critical role.

Engine Oil Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Engine Oil Industry

Shell:

A world-leading oil and gas company known for its extensive portfolio of high-quality engine oils, Shell maintains a significant position in both consumer and industrial markets with innovative lubricant technologies.Mobil 1:

A renowned brand under ExxonMobil, Mobil 1 offers advanced full synthetic engine oils designed for enhanced engine protection and performance, widely recognized in the automotive sector.Castrol:

Castrol is a part of BP and specializes in producing premium lubricants with a strong focus on performance and sustainability, catering to automotive and industrial clients alike.Valvoline:

With a wide-ranging portfolio, Valvoline provides engine oils and enhanced lubricants noted for their quality and innovation, serving both DIY consumers and service providers.Liqui Moly:

As a German manufacturer, Liqui Moly is recognized for developing high-quality lubricants and additives, emphasizing performance and reliability in the global Engine Oil market.We're grateful to work with incredible clients.

FAQs

What is the market size of engine Oil?

The global engine oil market is projected to reach a size of approximately $55.6 billion by 2033, growing at a CAGR of 4.7%. This sustained growth reflects the increasing demand for higher-performance lubricants across various automotive segments.

What are the key market players or companies in this engine Oil industry?

Key players in the engine oil industry include global brands such as ExxonMobil, Shell, Chevron, BP, and TotalEnergies. These companies are pivotal in driving innovation and maintaining competitive pricing.

What are the primary factors driving the growth in the engine Oil industry?

The growth in the engine oil market is primarily driven by the rising automotive production, increasing vehicle ownership, and technological advancements in oil formulations that enhance performance and durability.

Which region is the fastest Growing in the engine Oil market?

The fastest-growing region in the engine oil market is North America, projected to expand from $19.45 billion in 2023 to $31.07 billion by 2033, reflecting a significant market push attributed to increased vehicle maintenance and ownership.

Does ConsaInsights provide customized market report data for the engine Oil industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the engine oil industry, delivering insights suited to particular market segments and geographic areas.

What deliverables can I expect from this engine Oil market research project?

Deliverables from the engine oil market research project include detailed market analysis reports, segmentation data, trend forecasts, competitive landscape analysis, and strategic recommendations for market entry.

What are the market trends of engine Oil?

Market trends in the engine oil sector include a growing preference for synthetic oils, the rise of eco-friendly formulations, and an increasing shift toward online retail platforms for purchasing lubricants.