Engineering Services Market Report

Published Date: 31 January 2026 | Report Code: engineering-services

Engineering Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Engineering Services market, including insights on market trends, segmentation, regional dynamics, and future forecasts from 2023 to 2033.

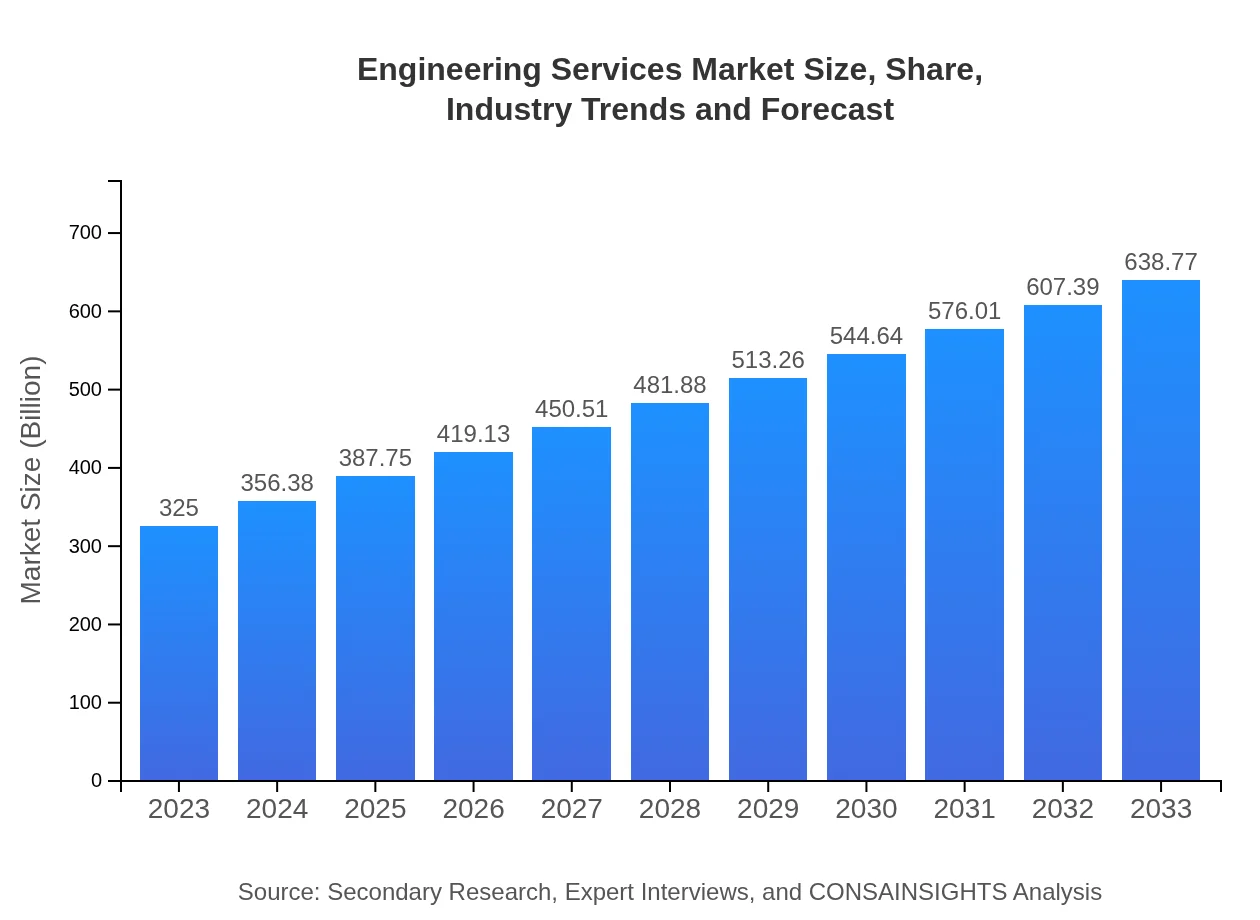

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $325.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $638.77 Billion |

| Top Companies | AECOM, Jacobs Engineering, WSP Global, SNC-Lavalin, Buro Happold |

| Last Modified Date | 31 January 2026 |

Engineering Services Market Overview

Customize Engineering Services Market Report market research report

- ✔ Get in-depth analysis of Engineering Services market size, growth, and forecasts.

- ✔ Understand Engineering Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Engineering Services

What is the Market Size & CAGR of Engineering Services market in 2023?

Engineering Services Industry Analysis

Engineering Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Engineering Services Market Analysis Report by Region

Europe Engineering Services Market Report:

Europe's Engineering Services market is anticipated to grow from $80.80 billion in 2023 to $158.80 billion by 2033. The European Union's commitment to sustainable development and green technology positions it well for growth, driven by regulations requiring energy-efficient and sustainable engineering practices.Asia Pacific Engineering Services Market Report:

In the Asia Pacific region, the Engineering Services market was valued at approximately $63.57 billion in 2023 and is expected to reach $124.94 billion by 2033. Rapid industrialization, urbanization, and infrastructure development are significant drivers, alongside an increase in R&D activities, particularly in countries like China and India.North America Engineering Services Market Report:

North America leads with a market size of approximately $125.52 billion in 2023, escalating to about $246.69 billion by 2033. The region benefits from a strong focus on technology innovation in engineering services, alongside substantial investments from both public and private sectors to develop next-generation transportation and infrastructure systems.South America Engineering Services Market Report:

South America’s Engineering Services market was valued at about $16.06 billion in 2023, projected to double to $31.56 billion by 2033. This growth is propelled by investments in energy projects, particularly renewable energy, and infrastructure upgrades to enhance connectivity across countries.Middle East & Africa Engineering Services Market Report:

The Middle East and Africa region saw a market size of $39.06 billion in 2023, projected to grow to $76.78 billion by 2033. Infrastructure development and a push for modernization in sectors such as oil and gas are crucial growth factors, alongside increased investments in megaprojects.Tell us your focus area and get a customized research report.

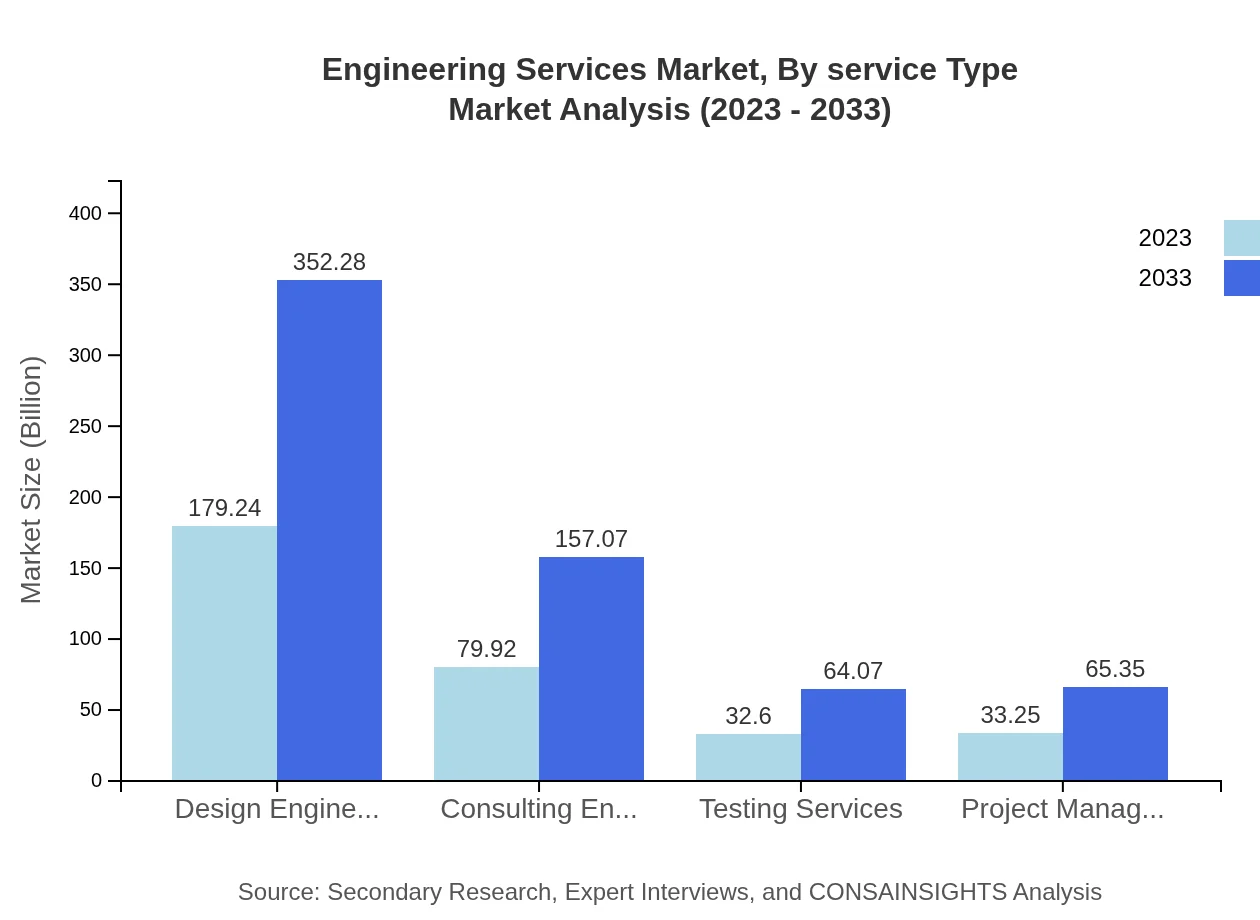

Engineering Services Market Analysis By Service Type

The services segment includes key offerings like Design Engineering Services, Consulting Engineering Services, Project Management Services, and Testing Services. Design Engineering Services alone are projected to grow from $179.24 billion in 2023 to $352.28 billion by 2033, reflecting their critical role in project development.

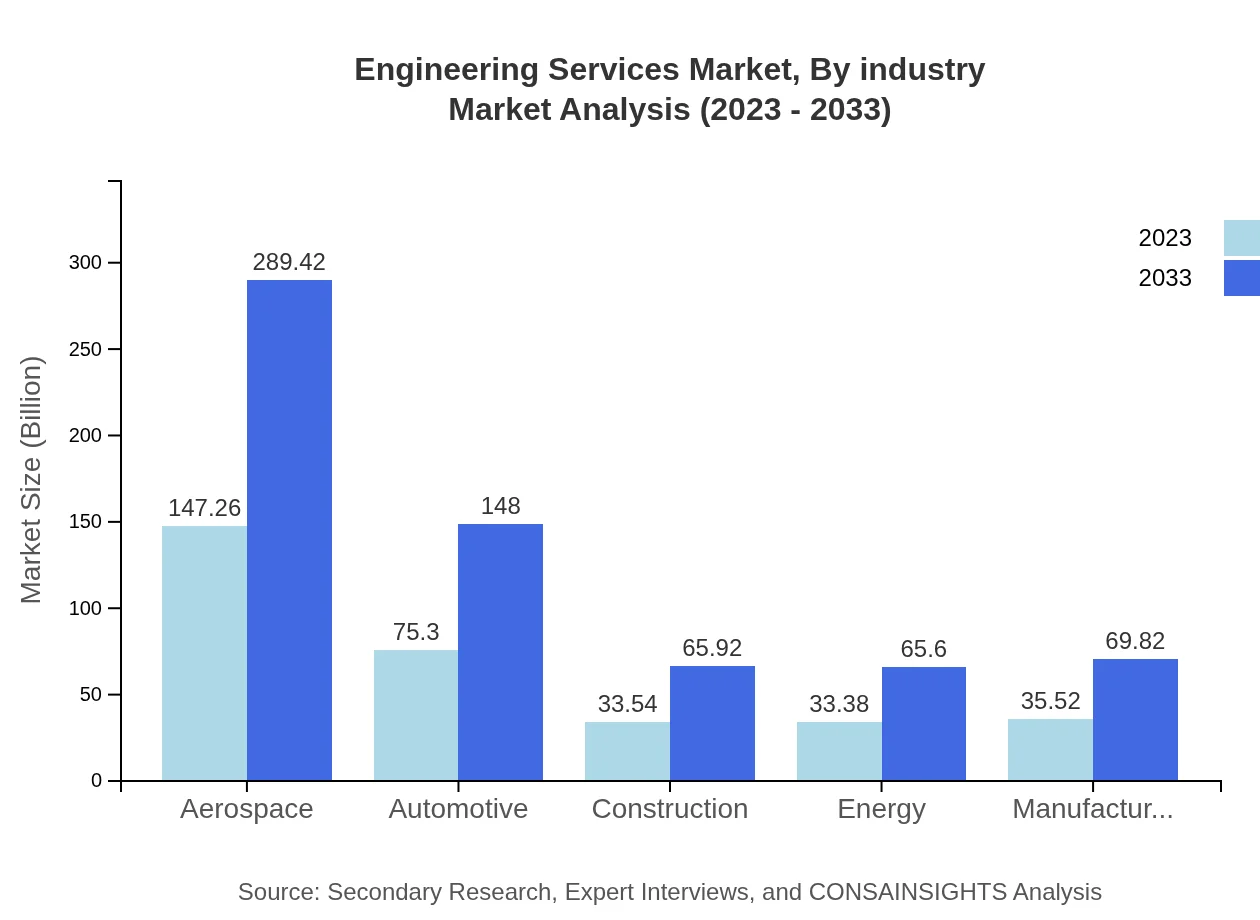

Engineering Services Market Analysis By Industry

The sectors served by Engineering Services include Aerospace, Automotive, Construction, and Energy. The Aerospace sector is expected to see significant growth from $147.26 billion in 2023 to $289.42 billion by 2033, driven by advancements in aviation technology and increasing demand for air transportation.

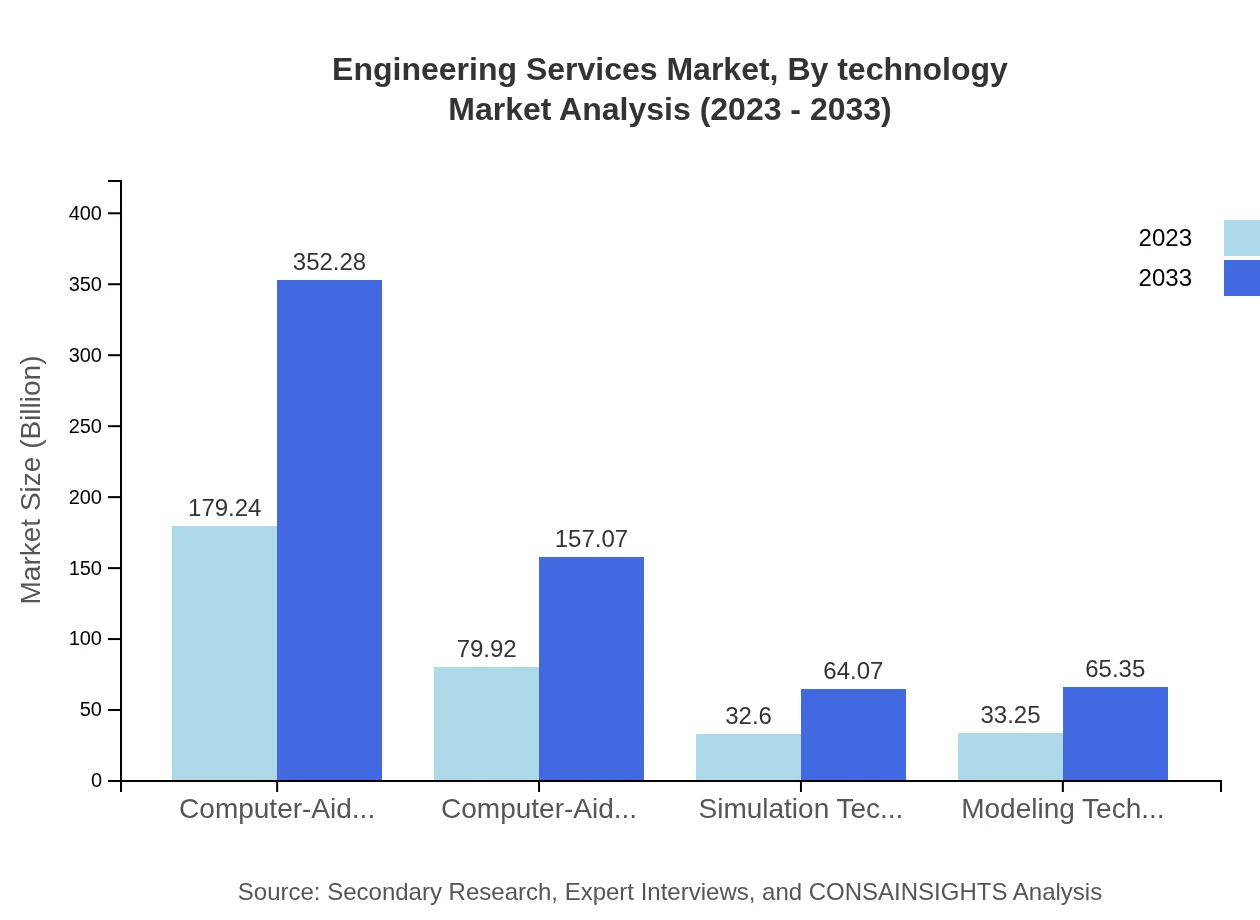

Engineering Services Market Analysis By Technology

Technological advancements play a significant role in enhancing service offerings. CAD and CAM technologies are crucial, with CAD projected to grow from $179.24 billion in 2023 to $352.28 billion by 2033, reflecting the importance of precision in engineering design.

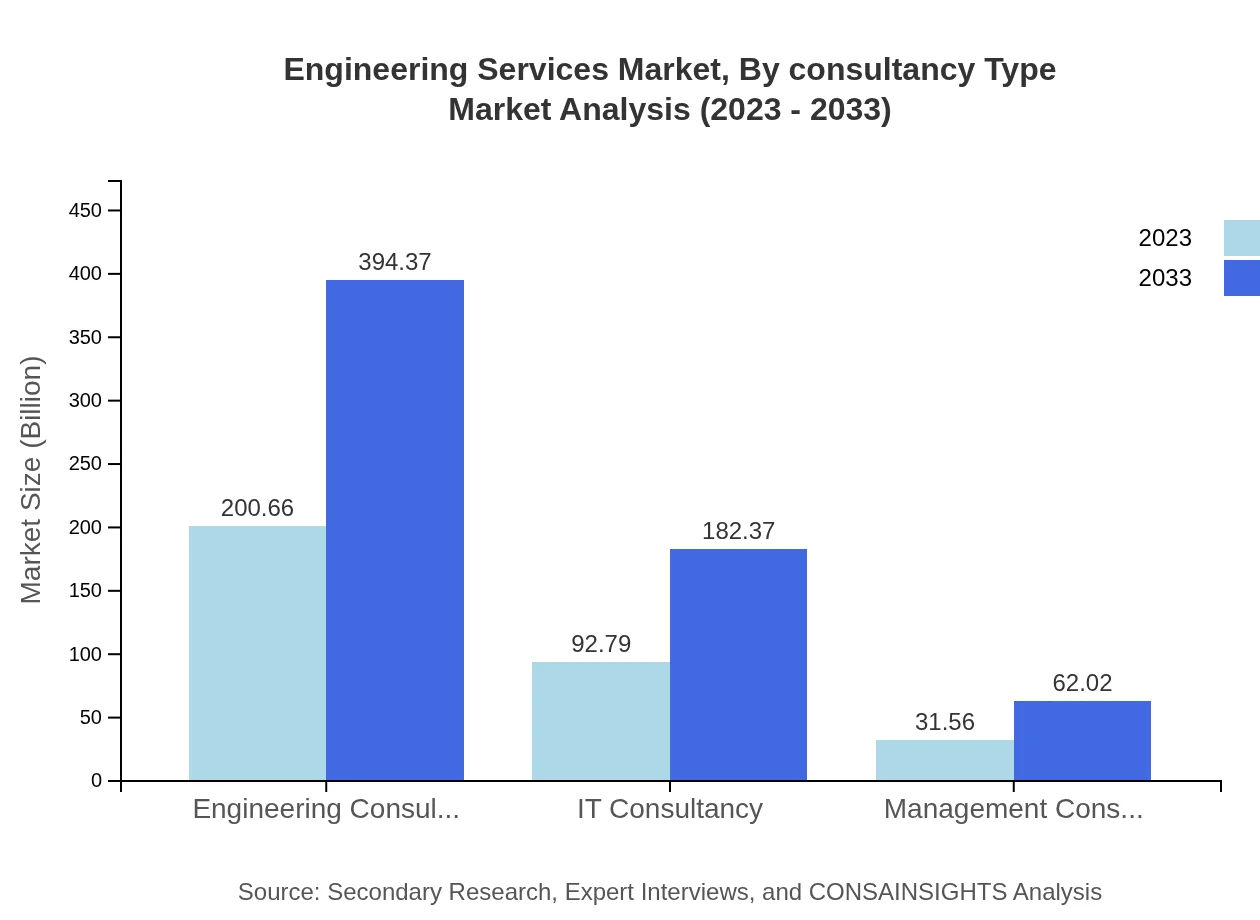

Engineering Services Market Analysis By Consultancy Type

Consulting types such as Engineering Consultancy and IT Consultancy form a substantial part of the market. Engineering Consultancy is estimated to grow from $200.66 billion in 2023 to $394.37 billion by 2033, highlighting its essential role in guiding project execution and strategic planning.

Engineering Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Engineering Services Industry

AECOM:

AECOM is a leading engineering and construction management firm known for its comprehensive range of services, from infrastructure development to environmental consulting.Jacobs Engineering:

Jacobs is a global provider of professional services in engineering, design, and construction, recognized for its innovative solutions in various infrastructure projects.WSP Global:

WSP Global offers a variety of engineering services, specializing in engineering consultancy, project management, and design services across multiple sectors.SNC-Lavalin:

SNC-Lavalin is known for its expertise in engineering and project management, particularly in construction and infrastructure advisory.Buro Happold:

Buro Happold is an international consultancy recognized for its engineering expertise in building services, sustainable design, and structural engineering.We're grateful to work with incredible clients.

FAQs

What is the market size of engineering Services?

The engineering services market is currently valued at approximately $325 billion and is expected to grow at a CAGR of 6.8% over the next decade, projecting a robust demand for engineering solutions across various industries.

What are the key market players or companies in the engineering Services industry?

Key players in the engineering services industry include leading firms like AECOM, Jacobs Engineering, WSP Global, and Bechtel. These companies dominate through innovative solutions and comprehensive engineering and consulting services.

What are the primary factors driving the growth in the engineering services industry?

The growth of the engineering services market is driven by increased investment in infrastructure, advancements in technology, demand for sustainable practices, and globalization of projects requiring complex engineering solutions.

Which region is the fastest Growing in the engineering Services market?

The Asia Pacific region is the fastest-growing area in the engineering services market, expected to increase from $63.57 billion in 2023 to $124.94 billion by 2033, reflecting strong economic development and infrastructural investments.

Does ConsaInsights provide customized market report data for the engineering Services industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the engineering services industry, providing comprehensive insights tailored to client requirements for informed decision-making.

What deliverables can I expect from this engineering Services market research project?

Clients can expect detailed reports including market analysis, segment performance, competitive landscape insights, and regional breakdowns, along with actionable recommendations for strategic planning.

What are the market trends of engineering Services?

Emerging trends include digital transformation in engineering practices, increased remote working methodologies, and a focus on sustainability, shaping how engineering services are delivered and consumed.