Engineering Services Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: engineering-services-outsourcing

Engineering Services Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Engineering Services Outsourcing market, highlighting trends, growth potential, and detailed regional analysis. It covers the forecast period from 2023 to 2033, offering strategic data for stakeholders.

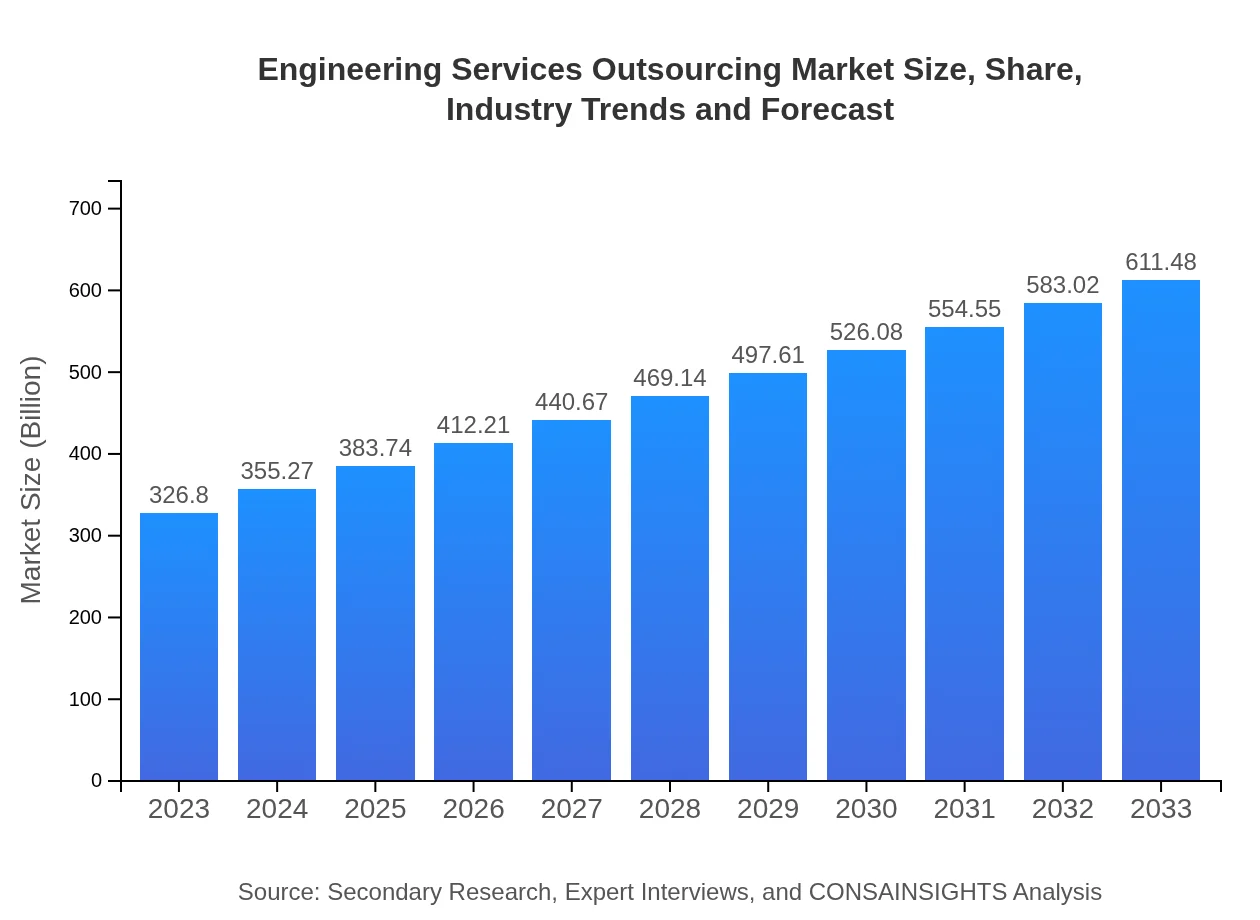

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $326.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $611.48 Billion |

| Top Companies | Tata Consultancy Services (TCS), Wipro, Infosys, Accenture |

| Last Modified Date | 31 January 2026 |

Engineering Services Outsourcing Market Overview

Customize Engineering Services Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Engineering Services Outsourcing market size, growth, and forecasts.

- ✔ Understand Engineering Services Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Engineering Services Outsourcing

What is the Market Size & CAGR of Engineering Services Outsourcing market in 2023?

Engineering Services Outsourcing Industry Analysis

Engineering Services Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Engineering Services Outsourcing Market Analysis Report by Region

Europe Engineering Services Outsourcing Market Report:

With a current market size of $101.96 billion in 2023, Europe is forecasted to reach $190.78 billion in 2033. The region benefits from an established engineering sector that combines traditional expertise with modern technological advances, catering to demands in energy transition and sustainable solutions.Asia Pacific Engineering Services Outsourcing Market Report:

In 2023, the Asia Pacific region holds a market value of $63.56 billion, projected to reach $118.93 billion by 2033. India and China emerge as major players, benefiting from a large pool of engineers and competitive labor costs, facilitating a rapid increase in outsourcing activities. Growing investments in technology and engineering services also boost this growth trajectory.North America Engineering Services Outsourcing Market Report:

North America, valued at $112.13 billion in 2023 and expected to expand to $209.80 billion by 2033, remains a dominant market for ESO. The strong presence of advanced technology firms, robust aerospace and automotive industries, alongside growing startups in the engineering domain bolster the growth trends. The region's demand for innovation and highly specialized engineering services contributes significantly to market expansion.South America Engineering Services Outsourcing Market Report:

The South American market for Engineering Services Outsourcing stood at $12.12 billion in 2023, with expectations to grow to $22.69 billion by 2033. Countries such as Brazil and Argentina are leading in this sector by capitalizing on skill development in engineering and improving infrastructural capabilities, attracting foreign investments in outsourcing.Middle East & Africa Engineering Services Outsourcing Market Report:

The Engineering Services Outsourcing market in the Middle East and Africa is estimated at $37.03 billion in 2023, with growth projected to reach $69.28 billion by 2033. Rapid urbanization and investment in infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries, are key factors driving market development.Tell us your focus area and get a customized research report.

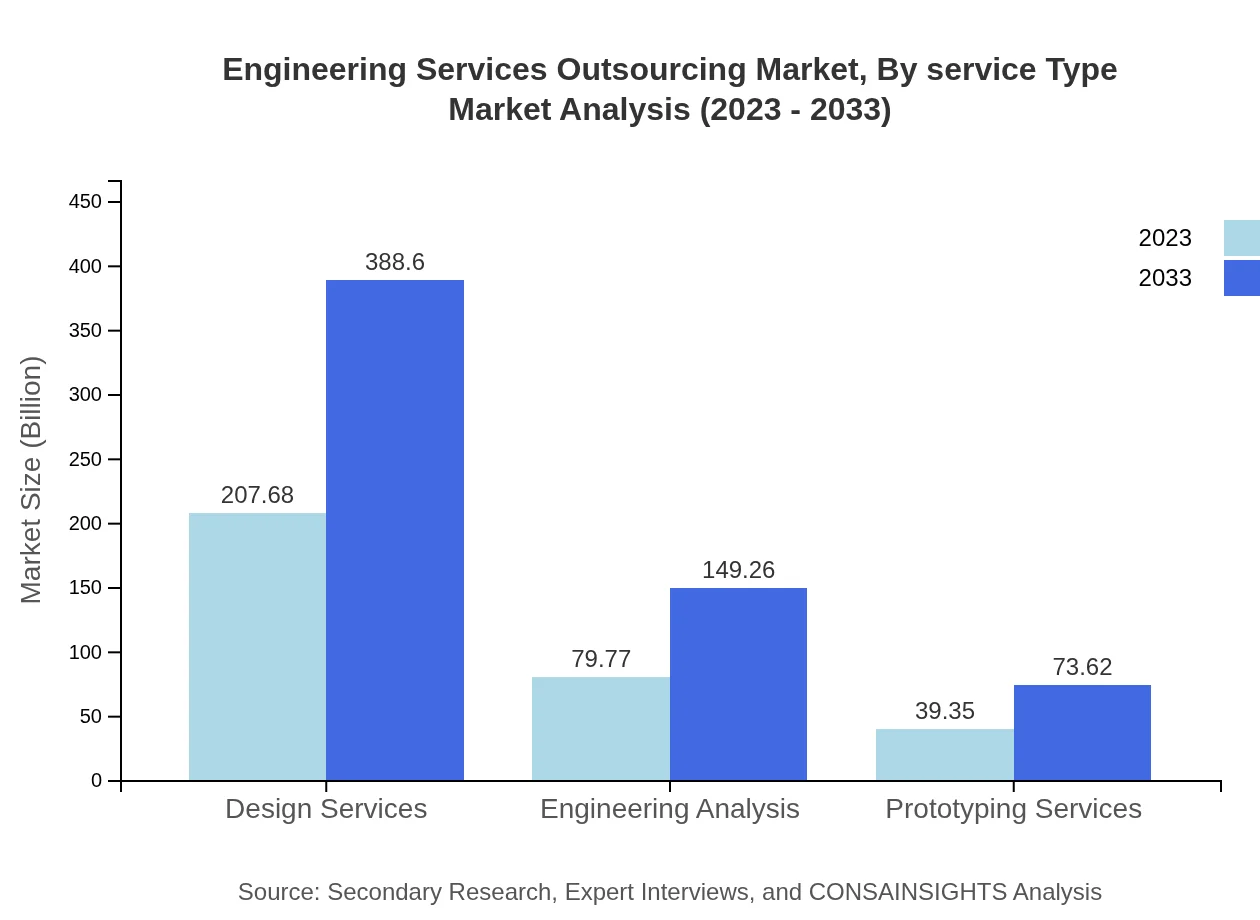

Engineering Services Outsourcing Market Analysis By Service Type

The Engineering Services Outsourcing market segmentation by service type reveals substantial growth across various categories: Design Services ($207.68 billion in 2023 to $388.60 billion in 2033), Engineering Analysis ($79.77 billion to $149.26 billion), and Prototyping Services ($39.35 billion to $73.62 billion). Other relevant segments include Quality Assurance and Supply Chain Management, reflecting the breadth of services encompassed within ESO.

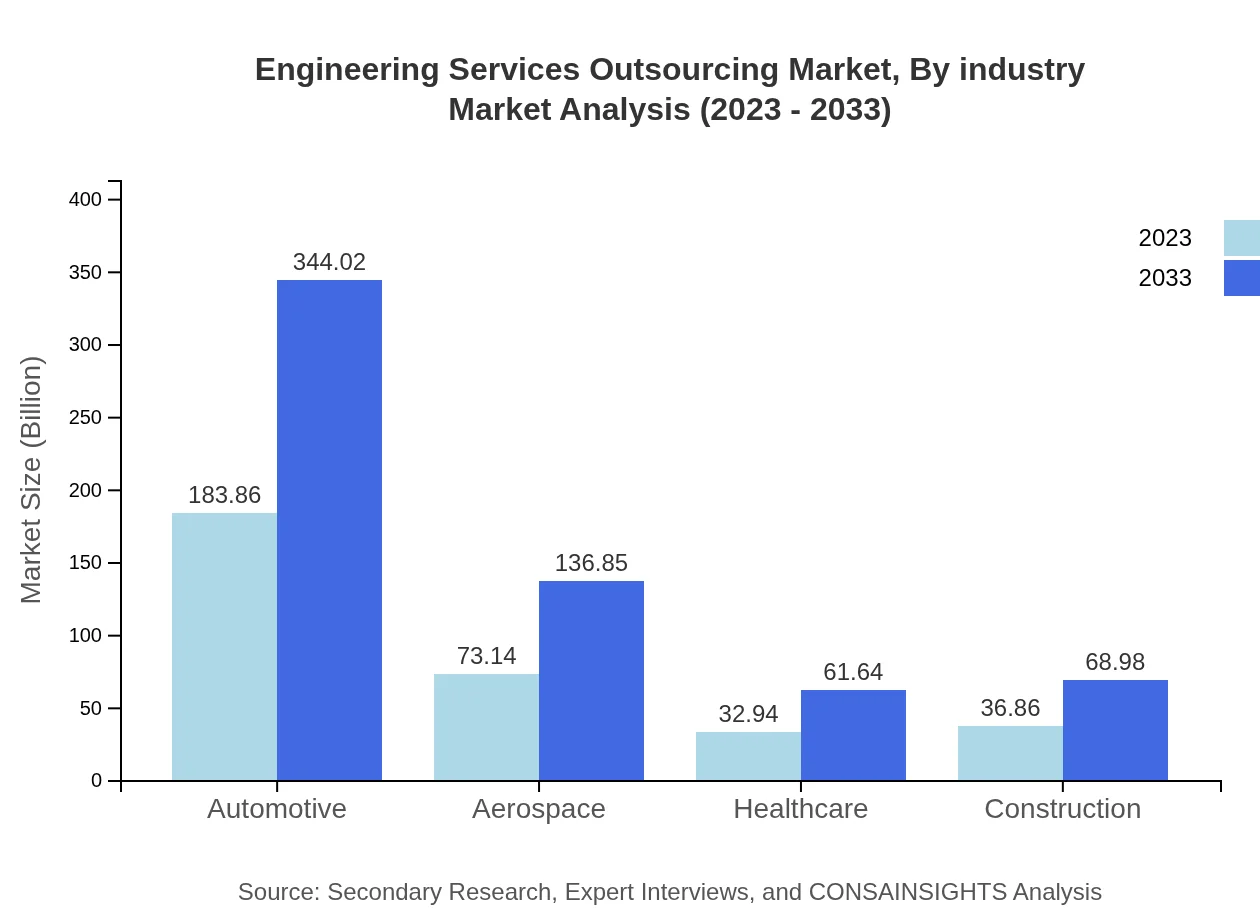

Engineering Services Outsourcing Market Analysis By Industry

Analyzing market segments by industry reveals that the Automotive segment dominates ESO services with market values projected to grow from $183.86 billion in 2023 to $344.02 billion in 2033. The Aerospace sector holds significant parts of the market ($73.14 billion to $136.85 billion), while Healthcare and Construction also show resolute growth driven by modernization efforts and stringent regulations.

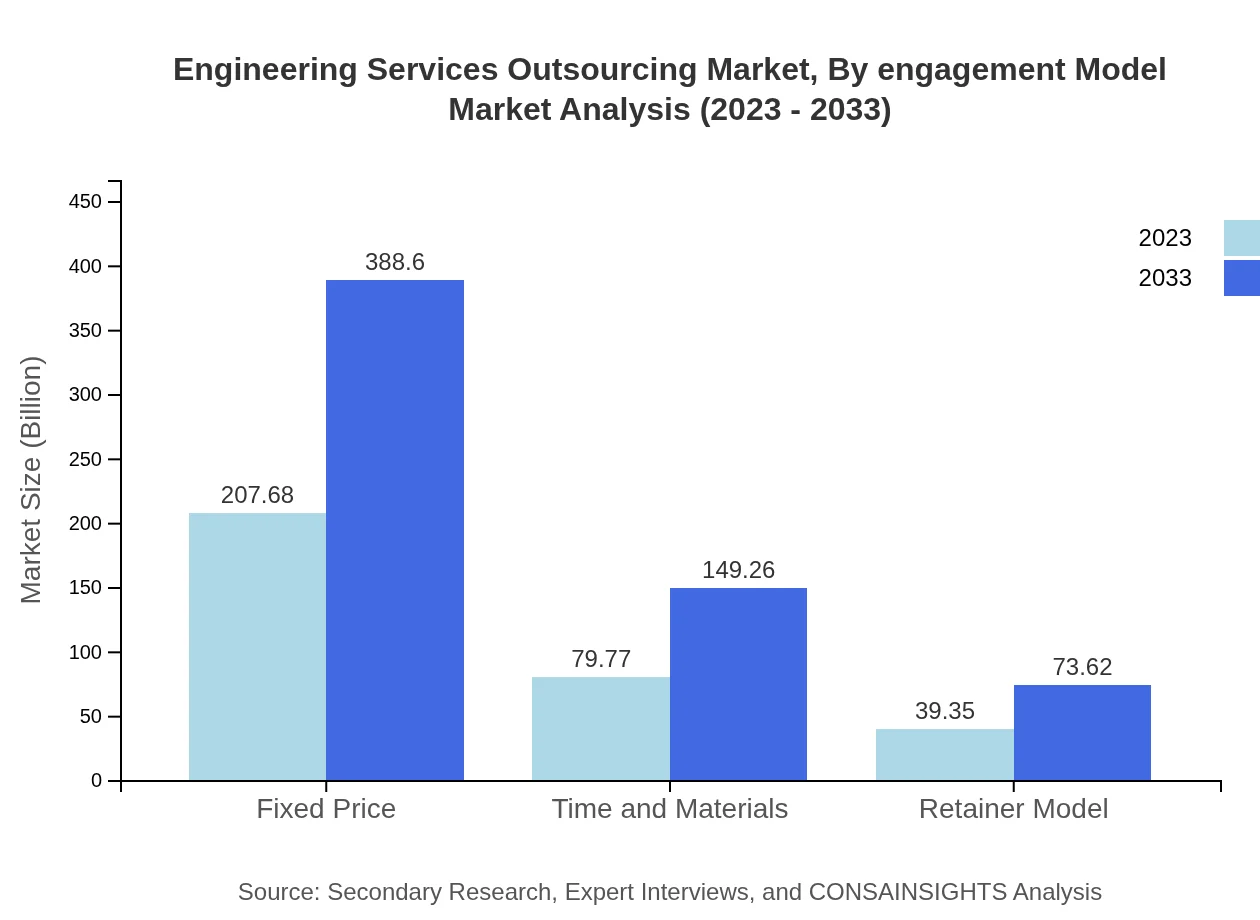

Engineering Services Outsourcing Market Analysis By Engagement Model

Engagement models within the ESO market present three key approaches: Fixed Price Model, Time and Materials, and the Retainer Model. The Fixed Price model is anticipated to see continuous growth from $207.68 billion to $388.60 billion, reflecting client preference for clarity in project cost. The Time and Materials market is also significant, growing from $79.77 billion to $149.26 billion, emphasizing flexibility and adaptability in project requirements.

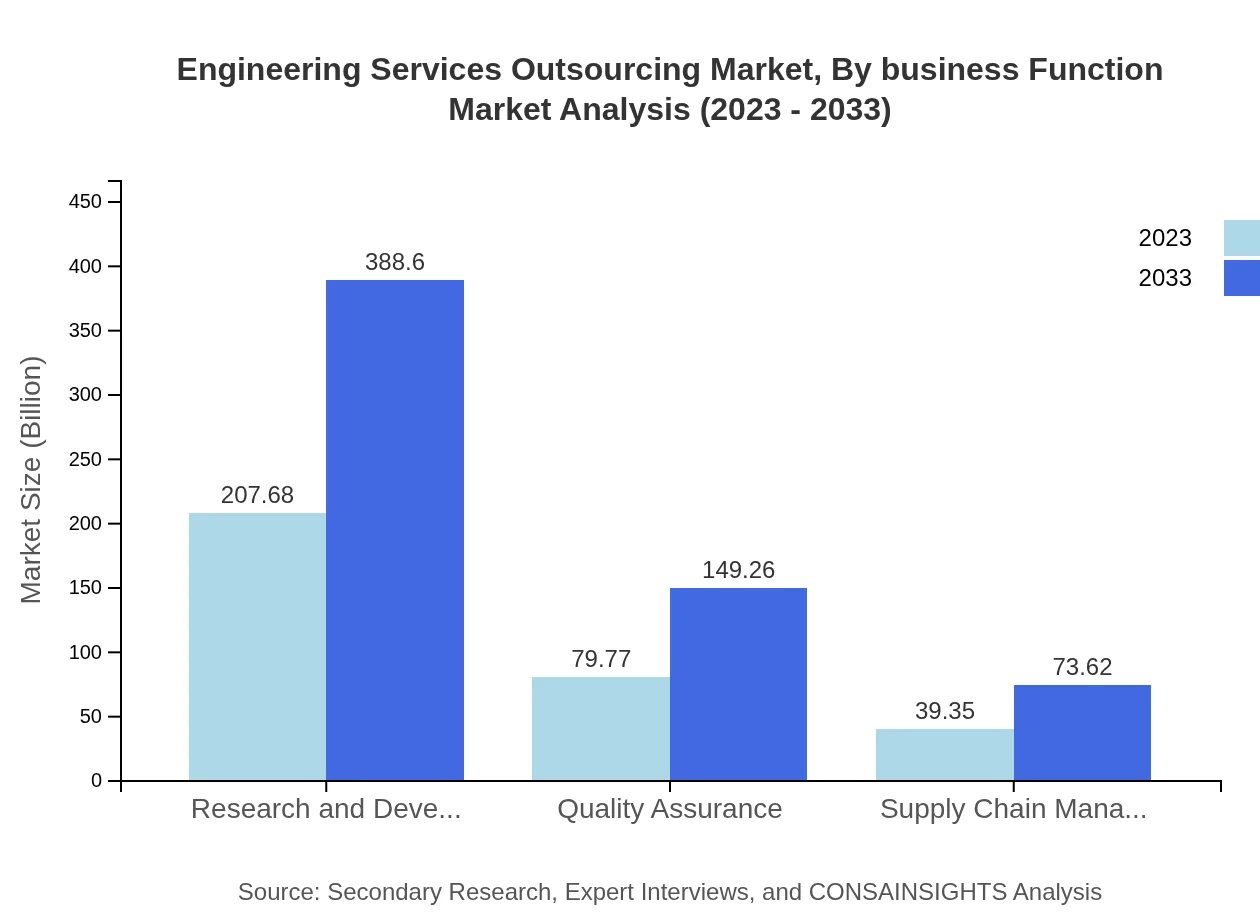

Engineering Services Outsourcing Market Analysis By Business Function

Within business functions, sectors such as Research and Development ($207.68 billion to $388.60 billion), Quality Assurance ($79.77 billion to $149.26 billion) and Supply Chain Management ($39.35 billion to $73.62 billion) are the focal points, showcasing the integration of engineering services with core business strategies aimed at achieving competitive advantages.

Engineering Services Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Engineering Services Outsourcing Industry

Tata Consultancy Services (TCS):

TCS offers a diverse range of engineering services across various industries, leveraging its extensive global delivery model and engineering expertise to innovate client solutions.Wipro:

Wipro is recognized for its engineering services in IT and product development, focusing on sustainability and smart product engineering to meet client needs.Infosys:

Infosys provides end-to-end engineering services, helping organizations optimize their engineering activities through digital transformation and process modernization.Accenture:

Accenture leverages its strategic consulting background to offer high-value engineering services, focusing on optimization and innovative technological solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of engineering Services Outsourcing?

The global engineering services outsourcing market is valued at approximately $326.8 billion in 2023, with a projected CAGR of 6.3% over the next decade. This growth trajectory indicates significant expansion across multiple sectors and regions, driven by technological advancements.

What are the key market players or companies in the engineering Services Outsourcing industry?

Key players in the engineering services outsourcing sector include global firms like Tata Consultancy Services, Wipro, Accenture, and Infosys, which dominate with innovative solutions and extensive service offerings across various engineering applications and sectors.

What are the primary factors driving the growth in the engineering Services Outsourcing industry?

The growth in engineering services outsourcing is primarily driven by increasing demand for cost-effective engineering solutions, advancements in technology, globalization of engineering services, and the rising need for specialized engineering capabilities in various industries.

Which region is the fastest Growing in the engineering Services Outsourcing?

The North America region is the fastest-growing in engineering services outsourcing, with a market size forecast to grow from $112.13 billion in 2023 to $209.80 billion by 2033, reflecting strong demand for high-quality engineering solutions.

Does ConsaInsights provide customized market report data for the engineering Services Outsourcing industry?

Yes, ConsaInsights offers tailored market report data for the engineering services outsourcing industry, enabling clients to access specific insights and analyses that cater to their unique business needs and strategic objectives.

What deliverables can I expect from this engineering Services Outsourcing market research project?

Deliverables from the engineering services outsourcing market research project include comprehensive reports featuring market size, segmentation analysis, trends, competitive landscape insights, and regional performance data, tailored for strategic decision-making.

What are the market trends of engineering Services Outsourcing?

Current trends in the engineering services outsourcing market include increased adoption of AI and machine learning, a shift towards digital transformation, growing demand for sustainable engineering solutions, and the rise of collaborative platform technologies in engineering workflows.