Enteral Feeding Formulas Market Report

Published Date: 31 January 2026 | Report Code: enteral-feeding-formulas

Enteral Feeding Formulas Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enteral Feeding Formulas market, highlighting market trends, segmentation, regional insights, and forecasts for 2023 to 2033.

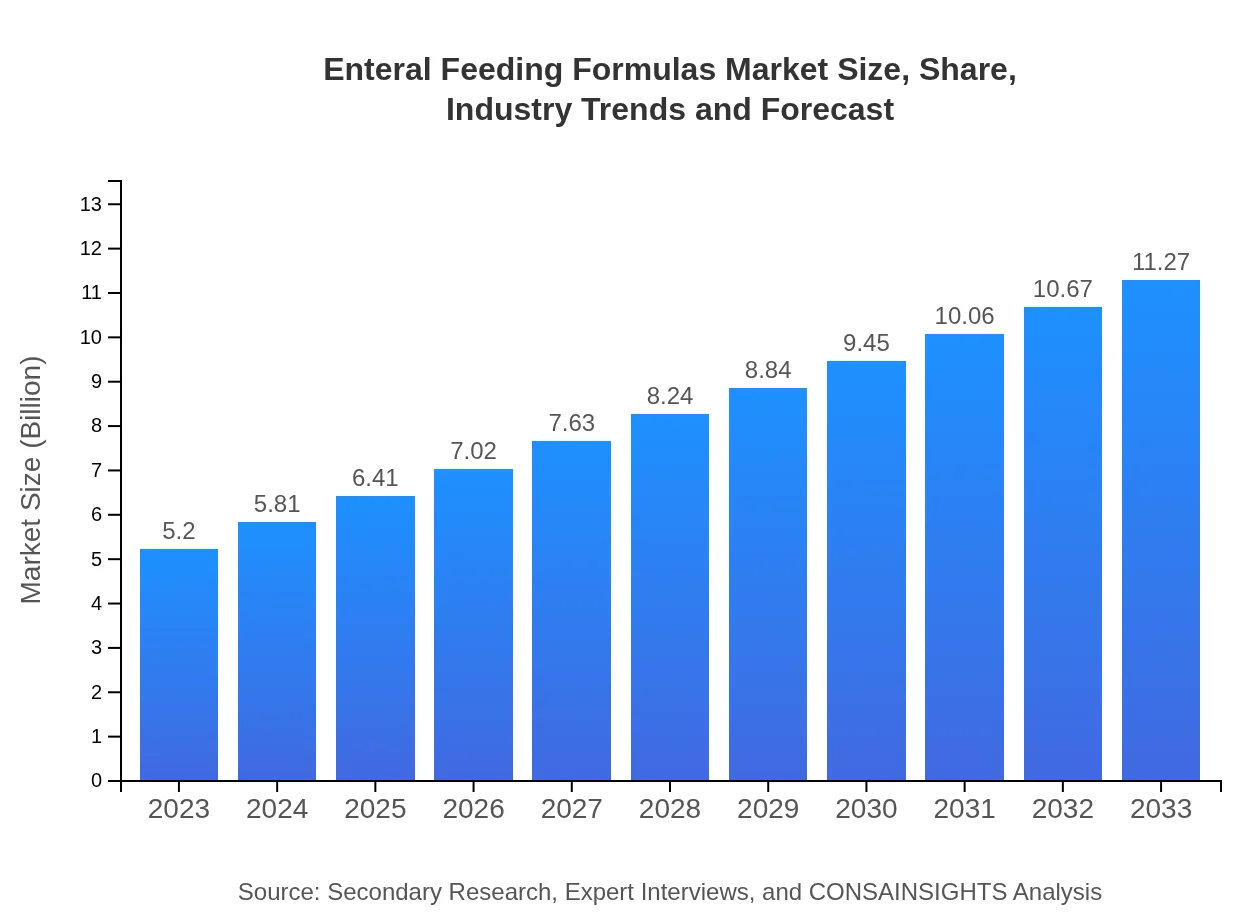

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Abbott Laboratories, Danone S.A., Nestlé Health Science, Fresenius Kabi AG |

| Last Modified Date | 31 January 2026 |

Enteral Feeding Formulas Market Overview

Customize Enteral Feeding Formulas Market Report market research report

- ✔ Get in-depth analysis of Enteral Feeding Formulas market size, growth, and forecasts.

- ✔ Understand Enteral Feeding Formulas's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enteral Feeding Formulas

What is the Market Size & CAGR of Enteral Feeding Formulas market in 2023 and 2033?

Enteral Feeding Formulas Industry Analysis

Enteral Feeding Formulas Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enteral Feeding Formulas Market Analysis Report by Region

Europe Enteral Feeding Formulas Market Report:

In Europe, the market was valued at $1.59 billion in 2023, with expectations to double to $3.44 billion by 2033. This region benefits from a mature healthcare market with rapid adoption of technological advancements and a growing emphasis on personalized nutritional care.Asia Pacific Enteral Feeding Formulas Market Report:

In 2023, the Enteral Feeding Formulas market in the Asia Pacific was valued at $1.01 billion and is expected to grow to $2.19 billion by 2033. This region is witnessing an increasing awareness of health and nutrition, coupled with the rising elderly population requiring nutritional support, driving market longevity and development.North America Enteral Feeding Formulas Market Report:

North America held a market size of $1.75 billion in 2023 and is set to reach $3.80 billion by 2033. The growth trajectory is attributed to advanced healthcare systems, high prevalence of chronic diseases, and increased research activities focusing on nutritional formulations.South America Enteral Feeding Formulas Market Report:

The South American market for Enteral Feeding Formulas was $0.32 billion in 2023 and is projected to reach $0.70 billion by 2033. Growth is anticipated due to a rise in healthcare funding, leading to better healthcare access and improved health conditions that require enteral nutrition.Middle East & Africa Enteral Feeding Formulas Market Report:

The Middle East and Africa market for Enteral Feeding Formulas was valued at $0.53 billion in 2023 and is projected to grow to $1.14 billion by 2033. Factors such as increasing government investments in healthcare infrastructure and rising rates of chronic diseases are fueling growth in this region.Tell us your focus area and get a customized research report.

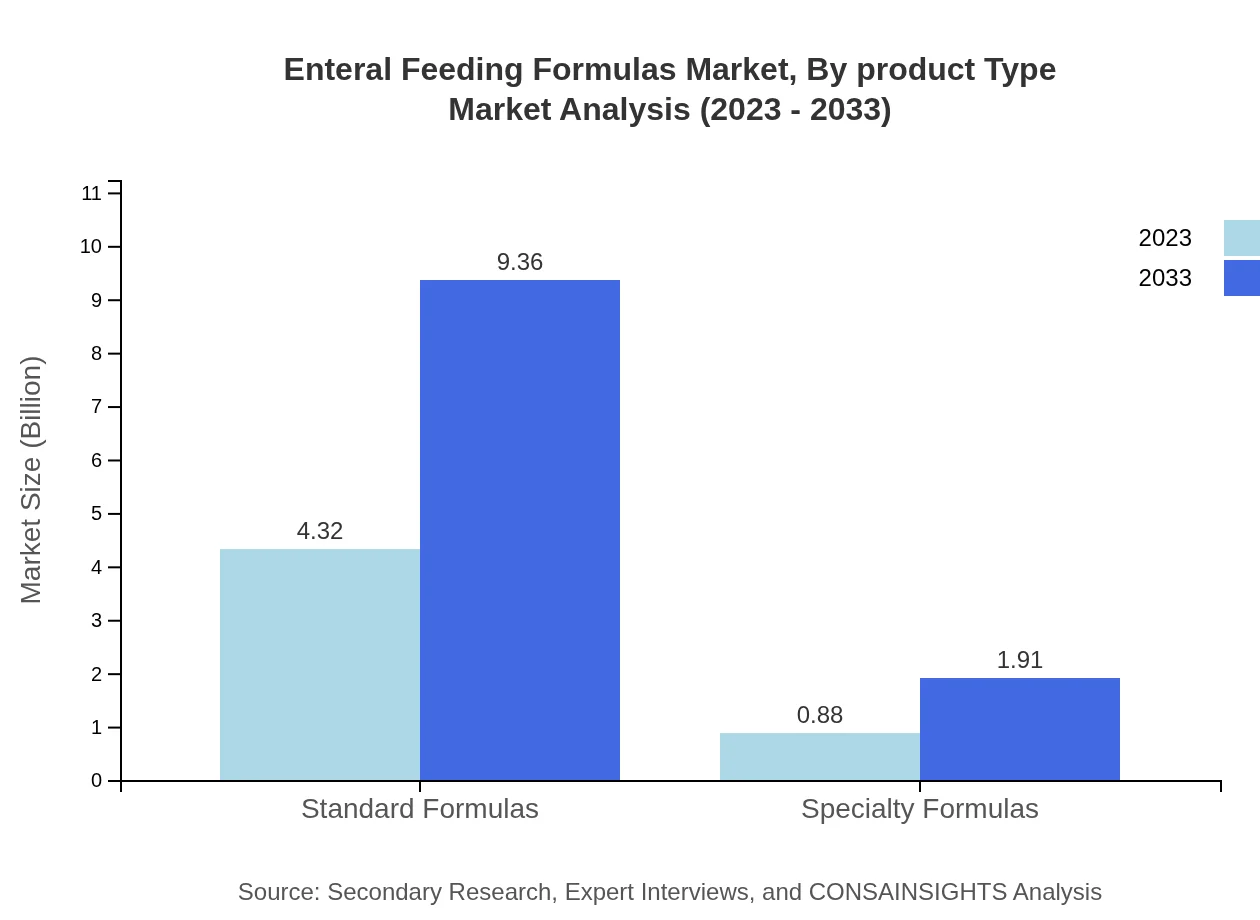

Enteral Feeding Formulas Market Analysis By Product Type

The market segmentation by product type shows a considerable favor towards standard formulas, accounting for approximately 83.04% market share in 2023, representing a market size of $4.32 billion. Specialty formulas, although smaller, are experiencing significant growth, expanding from $0.88 billion in 2023 to $1.91 billion by 2033 as awareness grows about specialized nutritional needs.

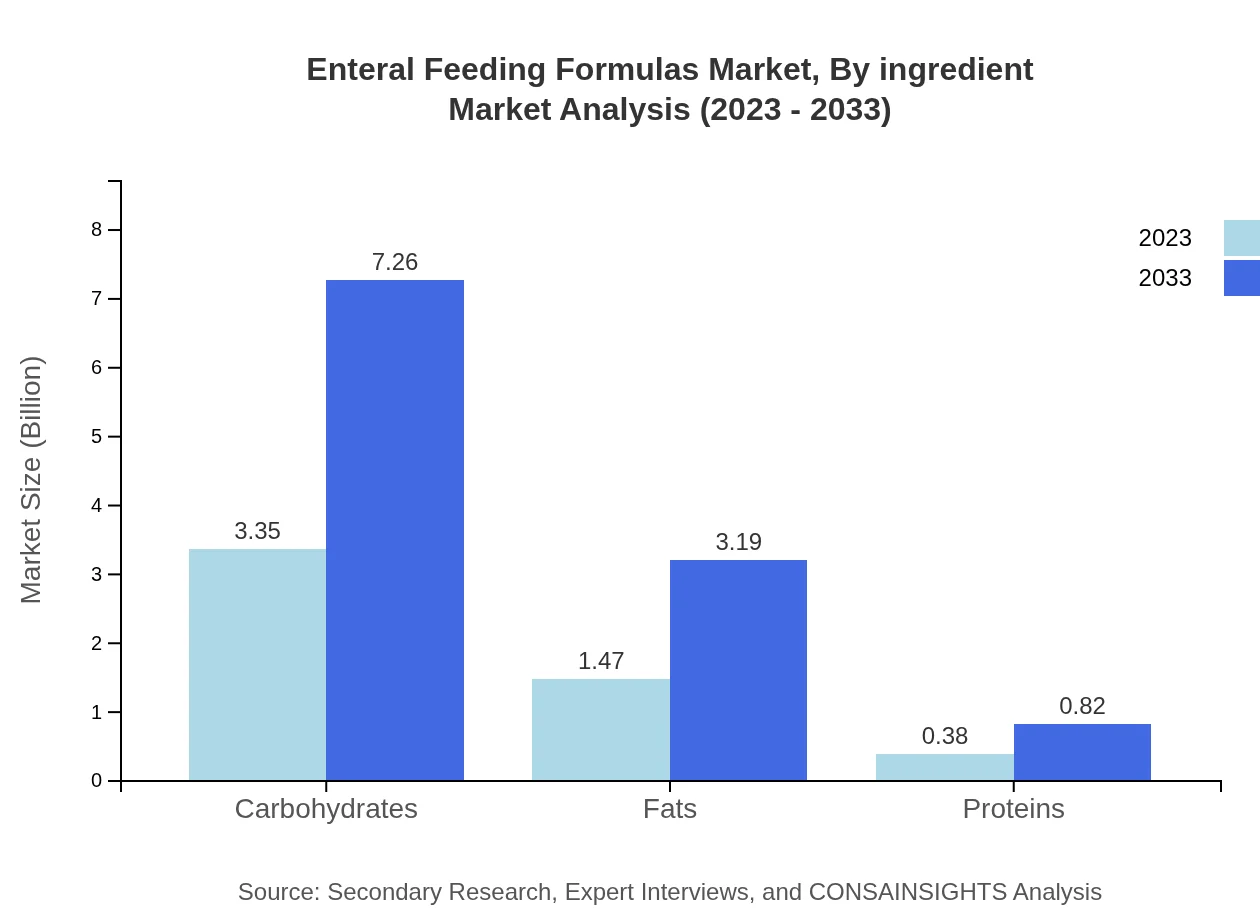

Enteral Feeding Formulas Market Analysis By Ingredient

Carbohydrates dominate the ingredient segment of the Enteral Feeding Formulas market, representing a market size of $3.35 billion with a share of 64.37% in 2023. Fats and proteins follow, with market sizes of $1.47 billion and $0.38 billion respectively. The market is expected to grow significantly, with carbohydrates moving to $7.26 billion and fats to $3.19 billion by 2033.

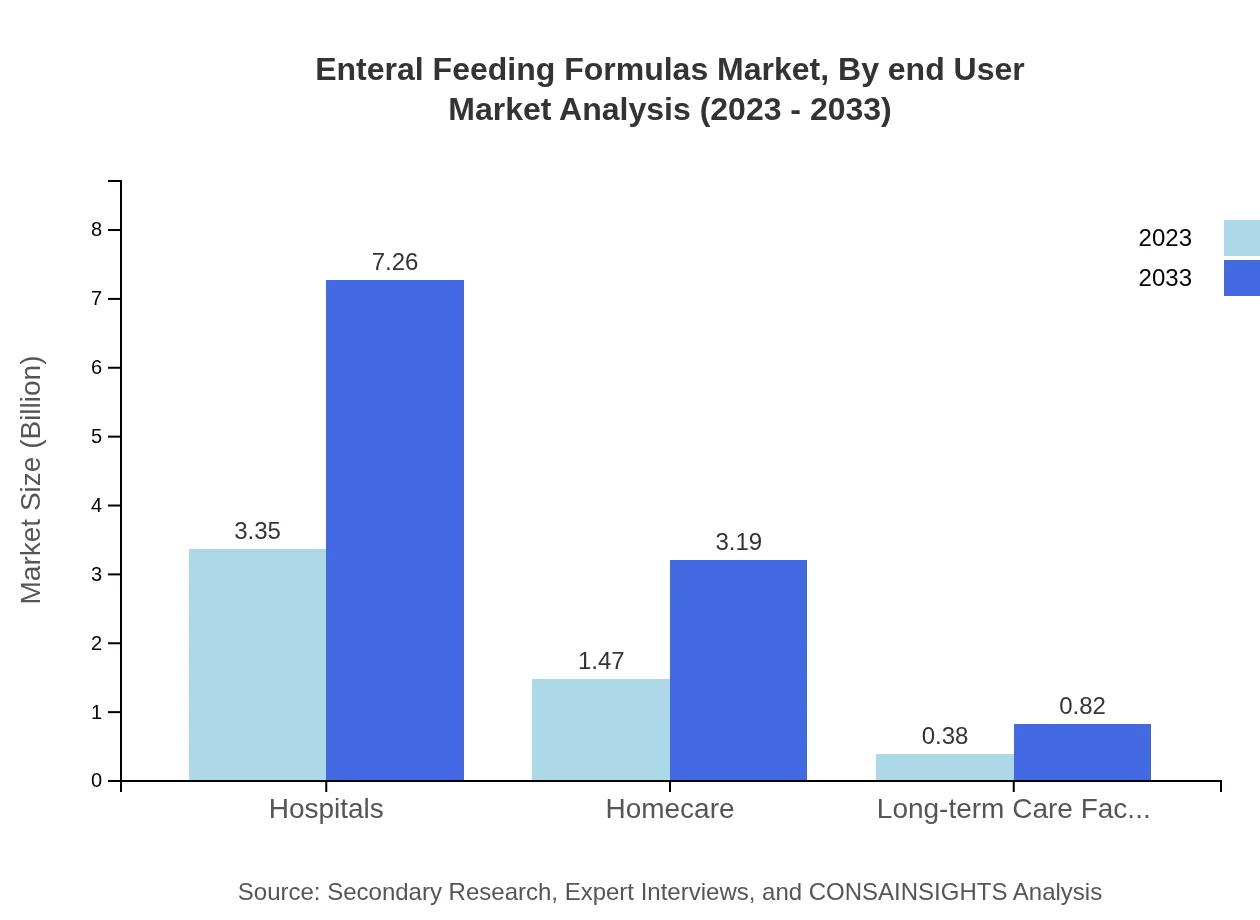

Enteral Feeding Formulas Market Analysis By End User

Hospitals are the largest end-user of Enteral Feeding Formulas, commanding a share of 64.37% with a market size of $3.35 billion in 2023, predicted to rise to $7.26 billion by 2033. The homecare segment holds significant potential as well, expanding from $1.47 billion in 2023 to $3.19 billion by 2033, driven by the increasing preference for home-based care.

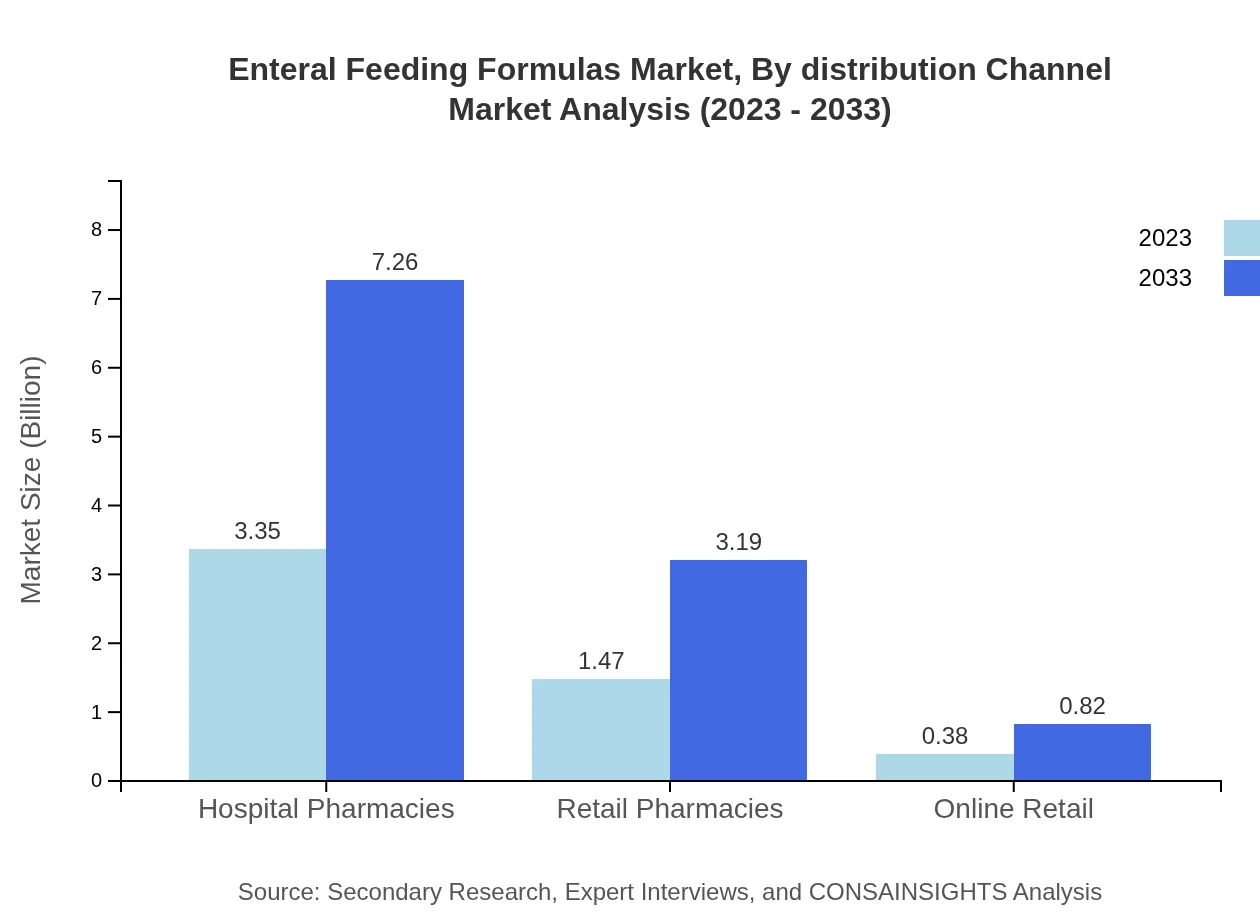

Enteral Feeding Formulas Market Analysis By Distribution Channel

Hospital pharmacies account for a significant share in distribution channels, holding 64.37% of the market in 2023 valued at $3.35 billion and expected to grow to $7.26 billion by 2033. Retail pharmacies and online platforms are also integral to distribution, with market sizes of $1.47 billion and $0.38 billion respectively in 2023.

Enteral Feeding Formulas Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enteral Feeding Formulas Industry

Abbott Laboratories:

A leading global healthcare company known for its innovative nutritional products including Ensure and Glucerna, catering to various dietary needs.Danone S.A.:

A multinational food products corporation with a strong focus on health and nutrition, offering a range of enteral feeding products suited for patients with specific medical conditions.Nestlé Health Science:

Specializing in nutritional science, Nestlé provides a wide array of enteral feeding formulas that support patient recovery and nutritional needs.Fresenius Kabi AG:

A global leader in lifesaving medicines and technologies for infusion, transfusion, and clinical nutrition, Fresenius Kabi develops enteral nutrition products tailored to the healthcare environment.We're grateful to work with incredible clients.

FAQs

What is the market size of enteral feeding formulas?

The enteral feeding formulas market is valued at approximately $5.2 billion in 2023, with an impressive CAGR of 7.8% projected towards 2033. This growth reflects the increasing demand for nutritional support in various healthcare settings.

What are the key market players or companies in this enteral feeding formulas industry?

Key players in the enteral feeding formulas industry include Abbott Laboratories, Fresenius Kabi, Danone Nutricia, Nestlé Health Science, and B. Braun Melsungen AG. These companies are pivotal in driving innovation, quality, and market competition.

What are the primary factors driving the growth in the enteral feeding formulas industry?

The growth in enteral feeding formulas is primarily driven by the rising prevalence of chronic diseases, an aging population requiring nutritional support, advancements in enteral nutrition technologies, and increased awareness of the benefits of specialized diets in clinical settings.

Which region is the fastest Growing in the enteral feeding formulas?

The fastest-growing region for enteral feeding formulas is Europe, expected to grow from $1.59 billion in 2023 to $3.44 billion by 2033. Asia Pacific also shows significant growth potential, from $1.01 billion to $2.19 billion in the same period.

Does ConsaInsights provide customized market report data for the enteral feeding formulas industry?

Yes, ConsaInsights offers tailored market reports for the enteral feeding formulas industry, allowing clients to receive insights and data specific to their needs, including market size estimates, trends, and competitive analysis.

What deliverables can I expect from this enteral feeding formulas market research project?

From the enteral feeding formulas market research project, you can expect detailed market size analysis, growth forecasts, competitive landscape assessment, segment analysis, and regional insights, all presented in comprehensive and easy-to-understand reports.

What are the market trends of enteral feeding formulas?

Current market trends for enteral feeding formulas include a shift towards personalized nutrition, increased adoption of home enteral feeding, innovations in formula types, and a rise in demand for plant-based, high-protein options to cater to diverse patient needs.