Enteral Feeding Tubes Market Report

Published Date: 31 January 2026 | Report Code: enteral-feeding-tubes

Enteral Feeding Tubes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the enteral feeding tubes market, covering key insights, market size, segmentation, and trends from 2023 to 2033. It aims to inform stakeholders about current conditions and future forecasts in the industry.

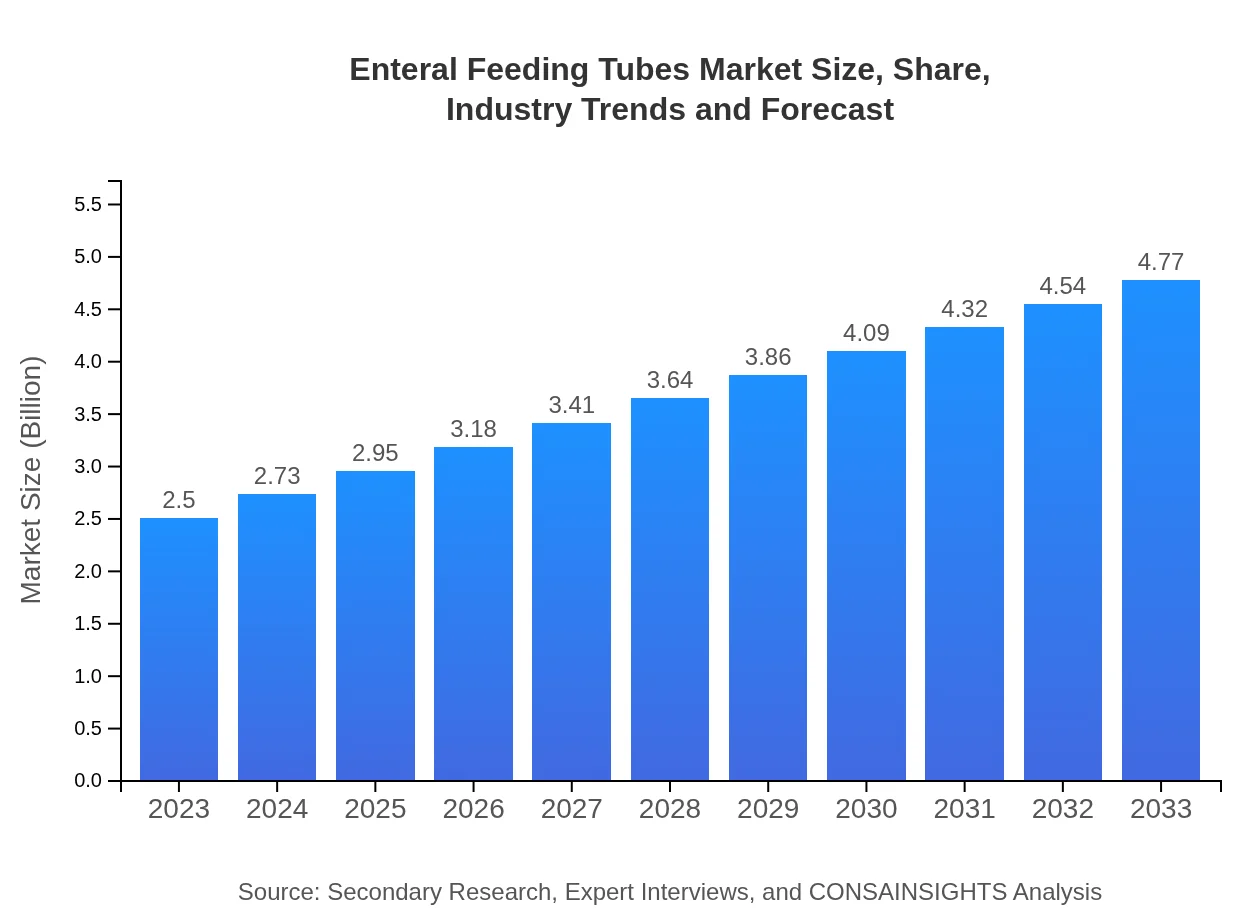

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $4.77 Billion |

| Top Companies | Abbott Laboratories, Boston Scientific, Fresenius Kabi AG, Medtronic |

| Last Modified Date | 31 January 2026 |

Enteral Feeding Tubes Market Overview

Customize Enteral Feeding Tubes Market Report market research report

- ✔ Get in-depth analysis of Enteral Feeding Tubes market size, growth, and forecasts.

- ✔ Understand Enteral Feeding Tubes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enteral Feeding Tubes

What is the Market Size & CAGR of Enteral Feeding Tubes market in 2033?

Enteral Feeding Tubes Industry Analysis

Enteral Feeding Tubes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enteral Feeding Tubes Market Analysis Report by Region

Europe Enteral Feeding Tubes Market Report:

Europe's enteral feeding tubes market is forecasted to expand from $0.77 billion in 2023 to $1.46 billion by 2033. An increasing number of geriatric patients and initiatives promoting enteral nutrition in critical care settings are propelling market growth in this region.Asia Pacific Enteral Feeding Tubes Market Report:

In the Asia Pacific region, the enteral feeding tubes market is projected to grow from $0.44 billion in 2023 to $0.84 billion by 2033. This region is witnessing rapid healthcare advancements, increasing investments in healthcare infrastructure, and a growing population of elderly individuals requiring nutritional assistance.North America Enteral Feeding Tubes Market Report:

North America maintains a significant market share and is expected to see growth from $0.93 billion in 2023 to $1.78 billion by 2033. Factors driving this growth include the well-established healthcare infrastructure, high prevalence of chronic diseases, and increasing adoption of home healthcare solutions.South America Enteral Feeding Tubes Market Report:

The South American market is expected to grow from $0.15 billion in 2023 to $0.28 billion by 2033, supported by improving access to healthcare services and rising health awareness among the population regarding enteral feeding applications.Middle East & Africa Enteral Feeding Tubes Market Report:

In the Middle East and Africa, the market is projected to grow from $0.21 billion in 2023 to $0.41 billion by 2033. Enhancements in the region's healthcare systems and rising incidences of malnutrition are critical factors bolstering market expansion.Tell us your focus area and get a customized research report.

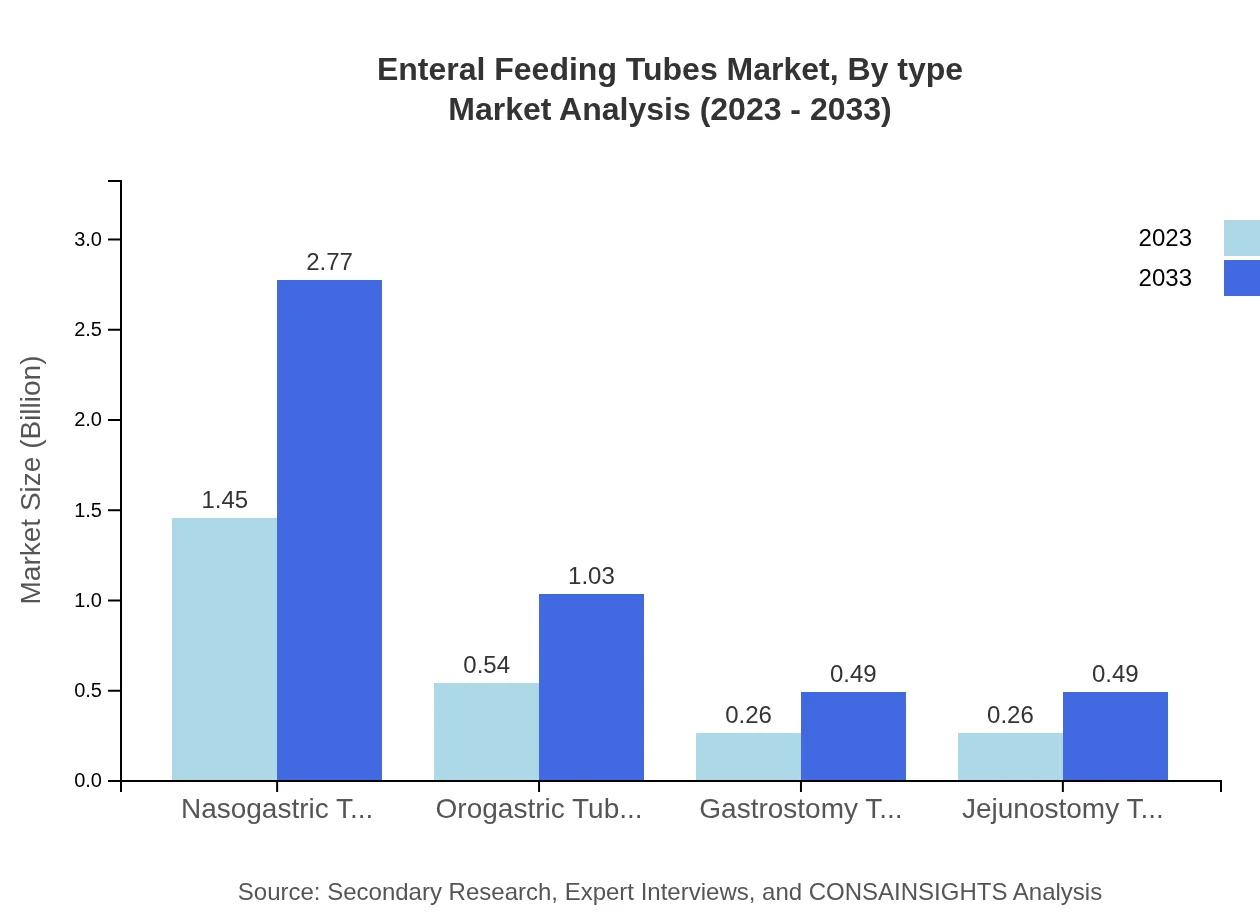

Enteral Feeding Tubes Market Analysis By Type

The market is dominated by Nasogastric Tubes, which are forecasted to increase from $1.45 billion in 2023 to $2.77 billion by 2033, holding a share of 58%. Orogastric and Gastrostomy tubes are also significant, expected to grow from $0.54 billion to $1.03 billion and from $0.26 billion to $0.49 billion, respectively, each maintaining shares of approximately 21% and 10%.

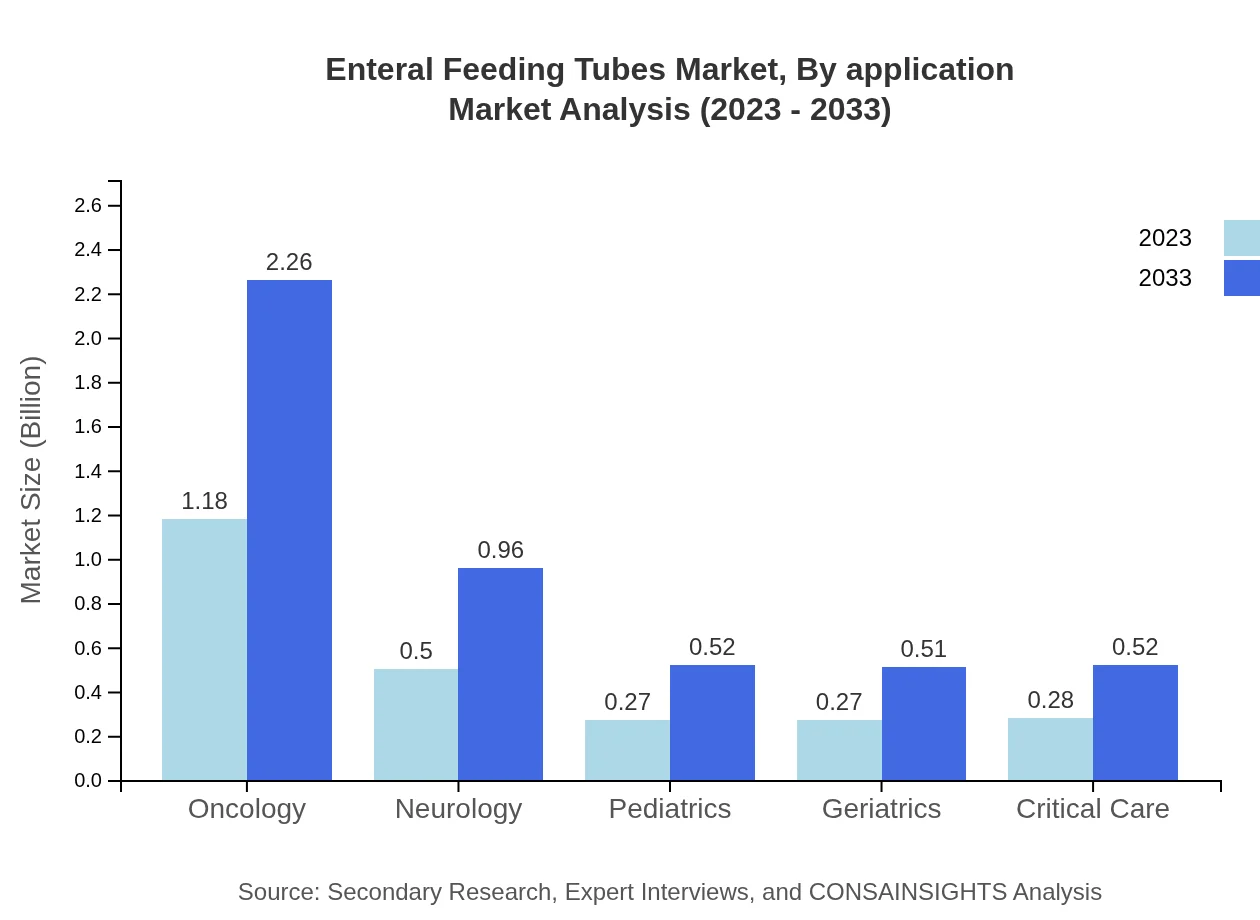

Enteral Feeding Tubes Market Analysis By Application

The oncology application segment leads with a market size of $1.18 billion in 2023, expected to reach $2.26 billion by 2033, holding a share of 47%. The neurology segment follows, projected to double from $0.50 billion to $0.96 billion, while pediatrics and geriatrics segments are also on a growth trajectory from $0.27 billion to $0.51 billion.

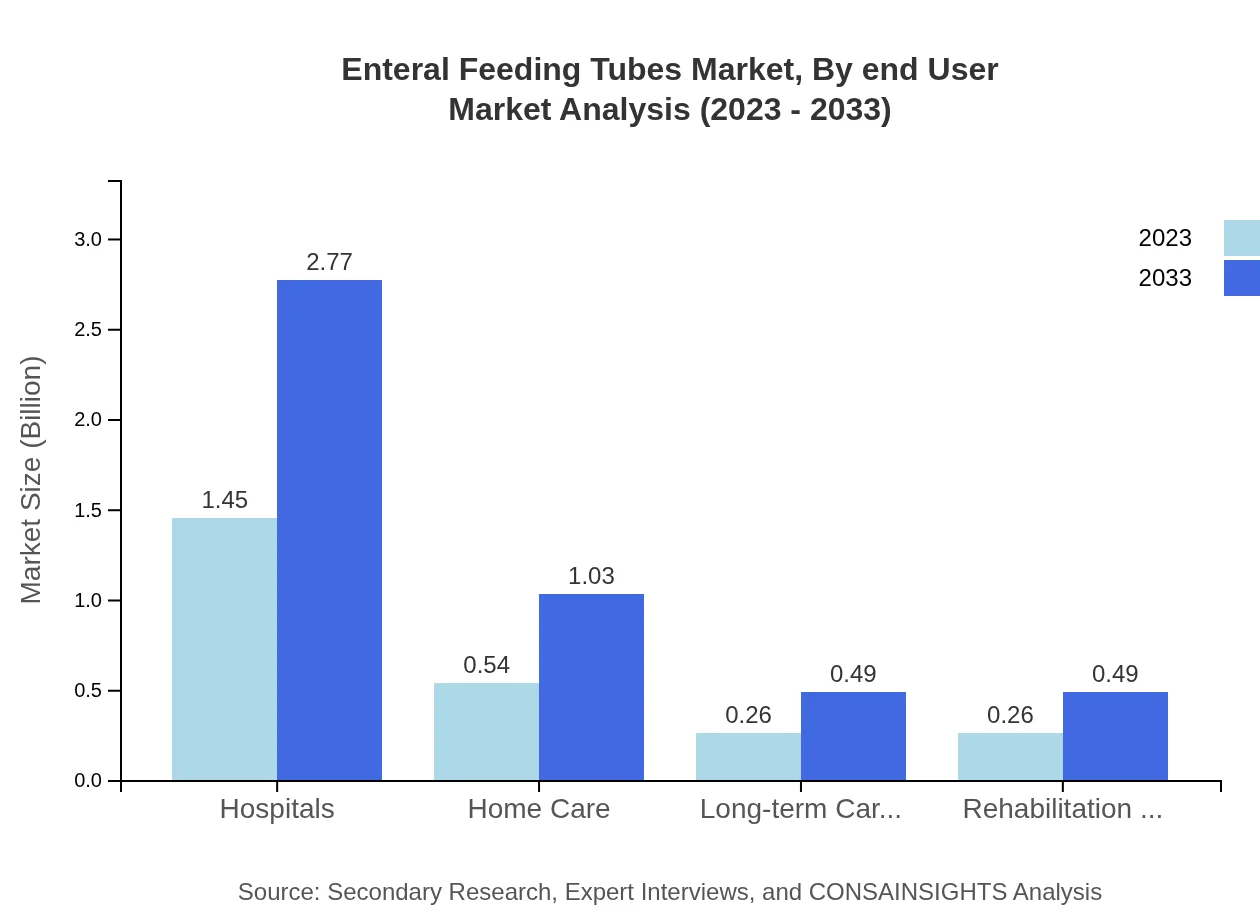

Enteral Feeding Tubes Market Analysis By End User

Hospitals remain the largest end-user segment, showing a constant market size of $1.45 billion in 2023 to $2.77 billion in 2033. Home care settings and long-term care facilities are also important markets, anticipated to grow significantly due to the increasing trend of out-of-hospital care.

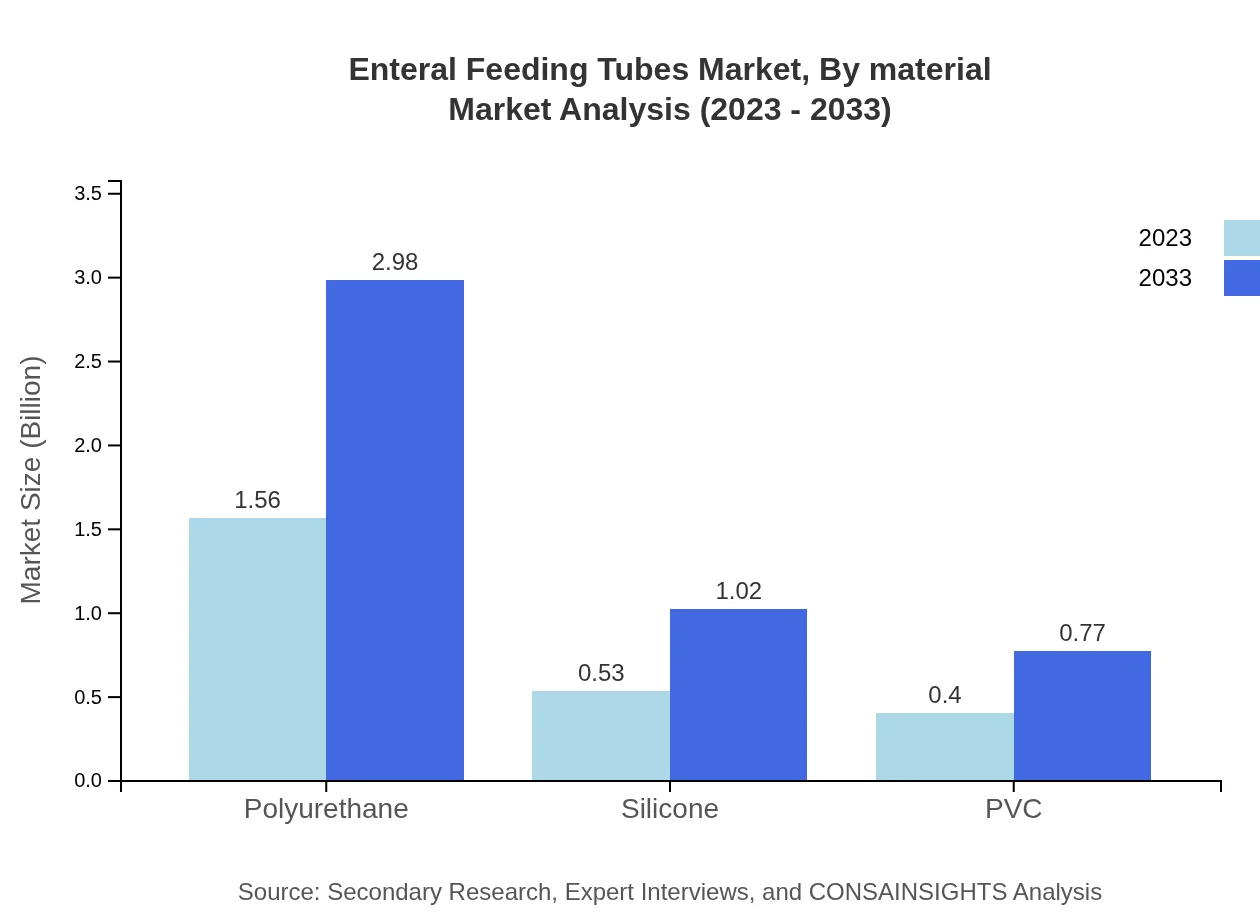

Enteral Feeding Tubes Market Analysis By Material

Polyurethane tubes dominate the market, with sizes growing from $1.56 billion to $2.98 billion (62%). Silicon tubes and PVC tubes are also relevant segments, with silicone anticipated to witness growth from $0.53 billion to $1.02 billion.

Enteral Feeding Tubes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enteral Feeding Tubes Industry

Abbott Laboratories:

A leading player in medical devices, Abbott offers various feeding tube products catering to different medical needs with a strong focus on quality and innovation.Boston Scientific:

Known for its advances in medical technology, Boston Scientific's enteral feeding solutions are critical for patient care, emphasizing product reliability and efficiency.Fresenius Kabi AG:

A prominent supplier of enteral nutrition products, Fresenius Kabi invests significantly in R&D to enhance patient outcomes related to nutritional therapies.Medtronic :

Medtronic has established itself by developing advanced feeding tube technologies that improve safety and ease of use for patients and healthcare providers alike.We're grateful to work with incredible clients.

FAQs

What is the market size of enteral Feeding Tubes?

The global enteral feeding tubes market is valued at approximately $2.5 billion in 2023. It is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5%, reaching significant market positions by 2033.

What are the key market players or companies in this enteral Feeding Tubes industry?

Key players in the enteral feeding tubes market include industry giants who specialize in medical devices and materials. These companies contribute to innovation and market expansion, enhancing product offerings with advanced features and improved patient care solutions.

What are the primary factors driving the growth in the enteral feeding tubes industry?

Growth in the enteral feeding tubes market is driven by increasing prevalence of chronic diseases, a rising geriatric population, and advancements in medical technologies. These factors boost the demand for effective nutritional delivery systems in healthcare settings.

Which region is the fastest Growing in the enteral feeding tubes market?

The fastest-growing region in the enteral feeding tubes market from 2023 to 2033 is Europe, where the market is expected to increase from $0.77 billion to $1.46 billion, reflecting high demand for healthcare improvements and innovative feeding solutions.

Does ConsaInsights provide customized market report data for the enteral feeding tubes industry?

Yes, ConsaInsights offers tailored market report data for the enteral feeding tubes industry. Clients can obtain specific insights and analyses tailored to their unique business needs, ensuring relevant data and strategies.

What deliverables can I expect from this enteral feeding tubes market research project?

Deliverables from this research project include comprehensive market analysis, trends, competitive landscape reports, and segment performance insights, helping stakeholders make informed decisions in the enteral feeding tubes market.

What are the market trends of enteral feeding tubes?

Current market trends indicate a significant shift towards advanced materials, with polyurethane leading the share at 62.47%. Additionally, the rise in home care solutions is enhancing market dynamics and usage patterns.