Enteric Empty Capsules Sales Market Report

Published Date: 31 January 2026 | Report Code: enteric-empty-capsules-sales

Enteric Empty Capsules Sales Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of the Enteric Empty Capsules Sales market, highlighting key trends, forecasts, and insights from 2023 to 2033. It covers market size, segmentation, regional analysis, industry leaders, and future market dynamics.

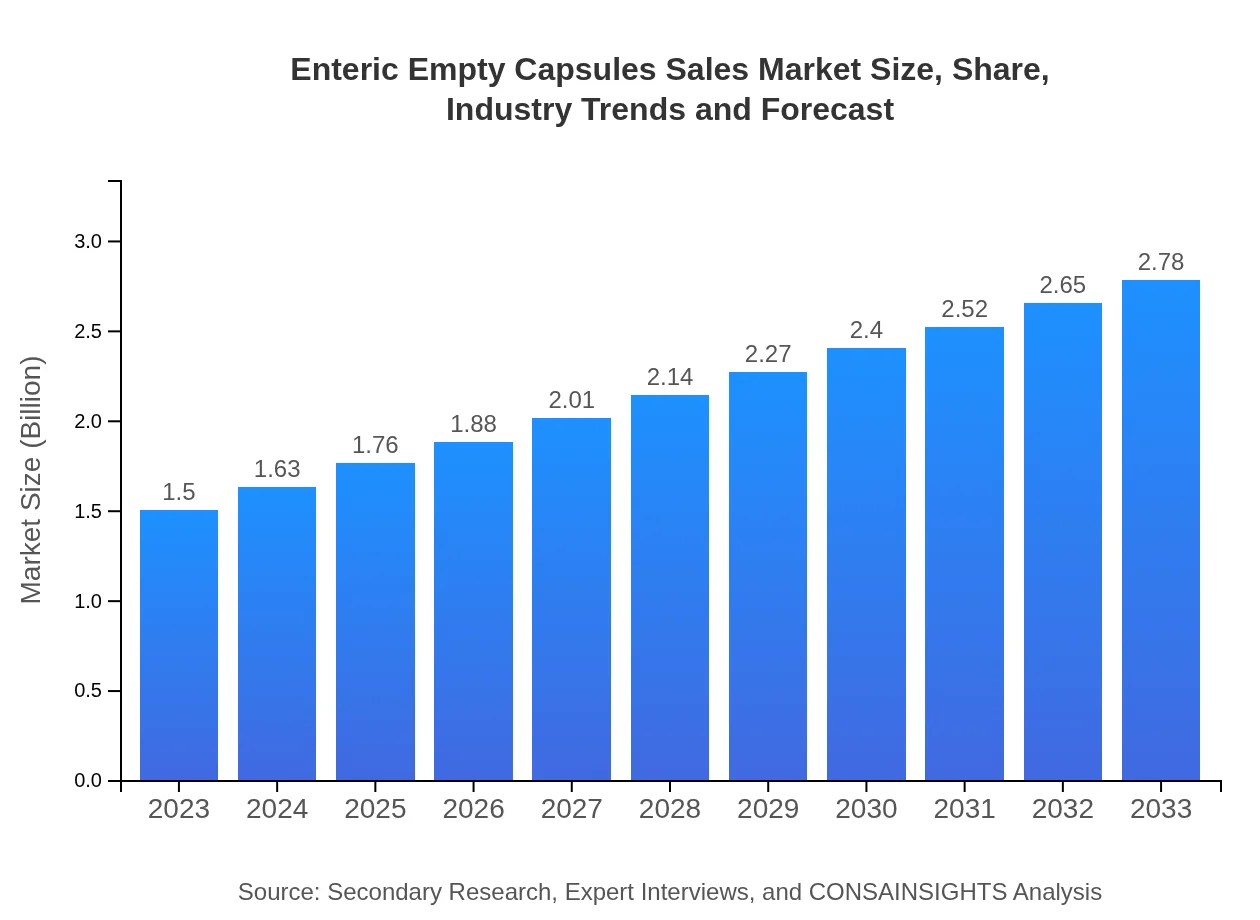

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $2.78 Billion |

| Top Companies | Capsugel, Lonza Group, Qualicaps, Suheung |

| Last Modified Date | 31 January 2026 |

Enteric Empty Capsules Sales Market Overview

Customize Enteric Empty Capsules Sales Market Report market research report

- ✔ Get in-depth analysis of Enteric Empty Capsules Sales market size, growth, and forecasts.

- ✔ Understand Enteric Empty Capsules Sales's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enteric Empty Capsules Sales

What is the Market Size & CAGR of Enteric Empty Capsules Sales market in 2033?

Enteric Empty Capsules Sales Industry Analysis

Enteric Empty Capsules Sales Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enteric Empty Capsules Sales Market Analysis Report by Region

Europe Enteric Empty Capsules Sales Market Report:

The European market is expected to grow from $0.36 billion in 2023 to $0.67 billion by 2033. The emphasis on innovative drug delivery systems and stringent regulatory frameworks promoting patient safety are key drivers here. Growing demand for nutraceuticals and increased investments in health technologies are also expected to bolster growth in this region.Asia Pacific Enteric Empty Capsules Sales Market Report:

In the Asia Pacific region, the enteric empty capsules market is expected to grow from $0.31 billion in 2023 to $0.57 billion by 2033. This growth is driven by increasing healthcare spending, rising awareness of advanced drug delivery methods, and a growing pharmaceutical sector in countries like India and China. The boom in the nutraceutical industry further supports market expansion in this region.North America Enteric Empty Capsules Sales Market Report:

North America holds a dominant position in the enteric empty capsules market, projected to escalate from $0.57 billion in 2023 to $1.06 billion by 2033. The region's growth is propelled by a strong pharmaceutical landscape, rising health-conscious consumer behavior, and significant investments in R&D, especially in the United States. Regulatory support for novel delivery systems is also favorable for market growth.South America Enteric Empty Capsules Sales Market Report:

The South American market, initially at $0.12 billion in 2023, is predicted to rise to $0.23 billion by 2033. The increasing consumer awareness of dietary supplements and the expanding pharmaceutical industry are pivotal factors contributing to market growth. However, regulatory challenges may affect the pace at which this region's market develops.Middle East & Africa Enteric Empty Capsules Sales Market Report:

In the Middle East and Africa, the market is projected to increase from $0.14 billion in 2023 to $0.25 billion by 2033. Growing awareness of health and wellness, along with the expansion of the healthcare infrastructure, is contributing to market growth. However, political instability and economic challenges may hinder the pace of development in certain areas.Tell us your focus area and get a customized research report.

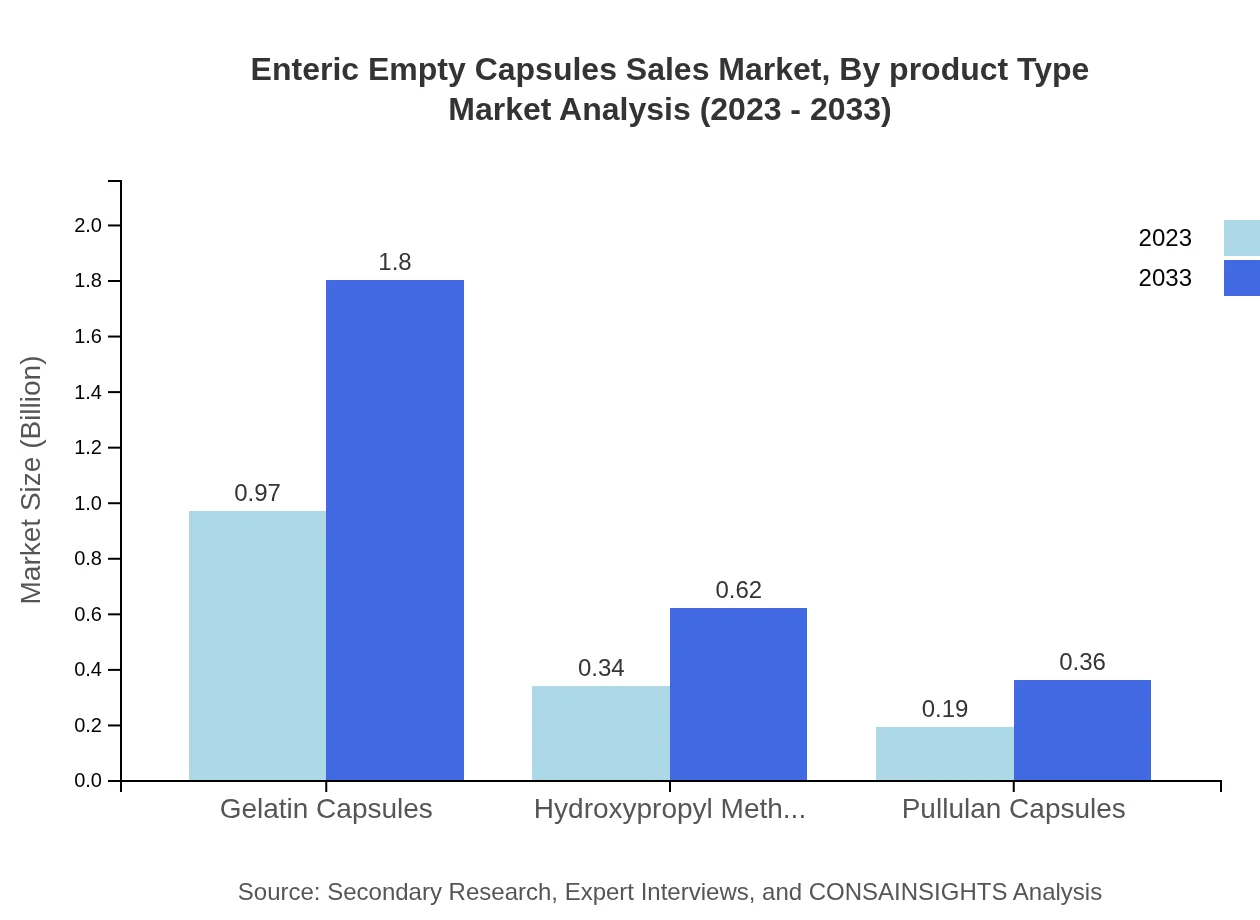

Enteric Empty Capsules Sales Market Analysis By Product Type

The enteric empty capsules market analysis indicates that gelatin capsules dominate the market, followed by HPMC and pullulan capsules. Gelatin capsules account for 64.74% of the market share due to their established efficacy and broad acceptance in various sectors. HPMC capsules represent a growing segment due to their vegetarian composition and increasing demand for plant-based products.

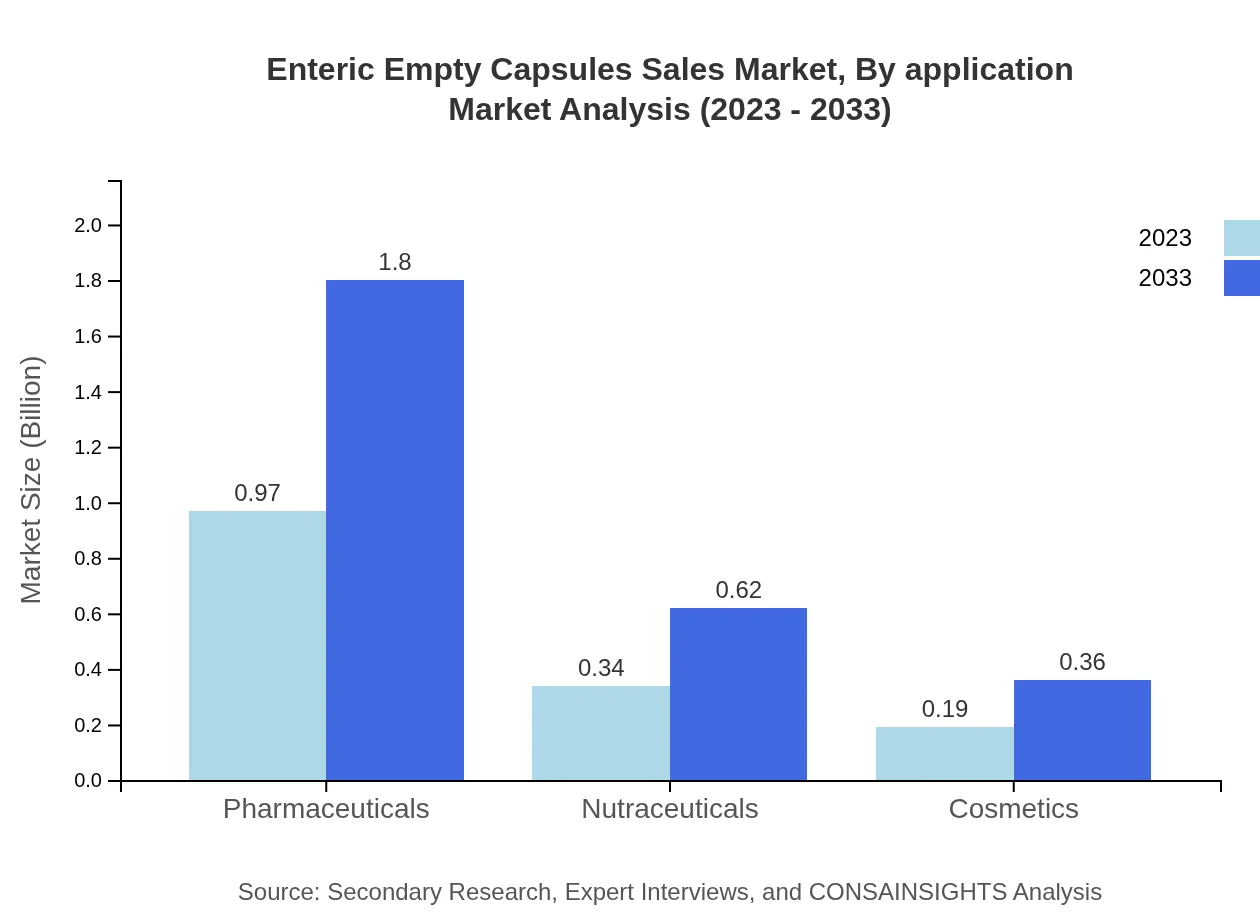

Enteric Empty Capsules Sales Market Analysis By Application

Pharmaceutical companies account for the most significant share in the enteric empty capsules market, representing 64.74% in 2023. This is followed by nutraceuticals and cosmetics at 22.38% and 12.88%, respectively. The application segments are driven by rising consumer demand for effective drug delivery solutions in various health-related applications.

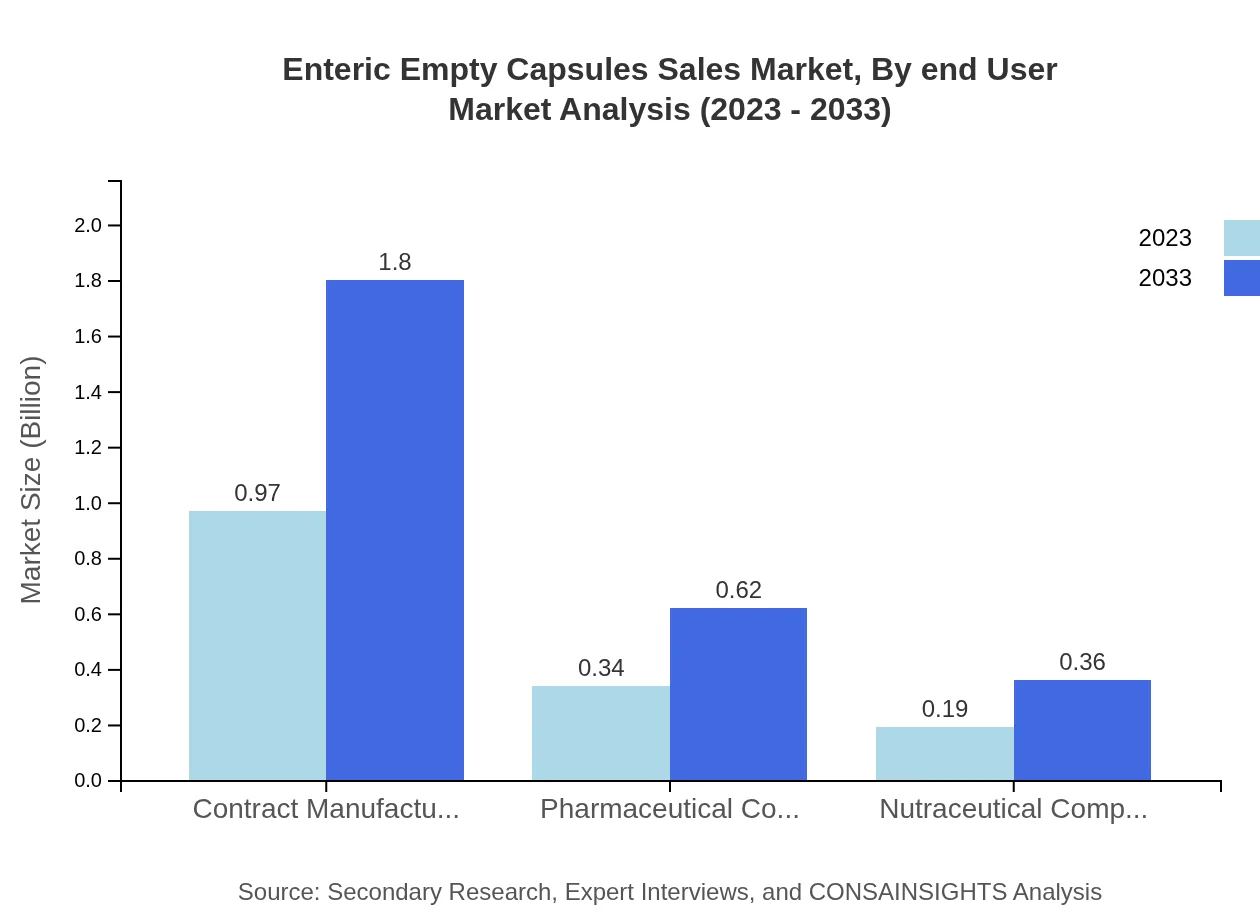

Enteric Empty Capsules Sales Market Analysis By End User

The end-user distribution of the enteric empty capsules market is primarily led by pharmaceutical companies, reflecting the growing trend of capsules in drug formulations. The nutraceutical industry is gaining traction as consumer health awareness rises, highlighting the importance of tailored delivery methods in nutrient supplements.

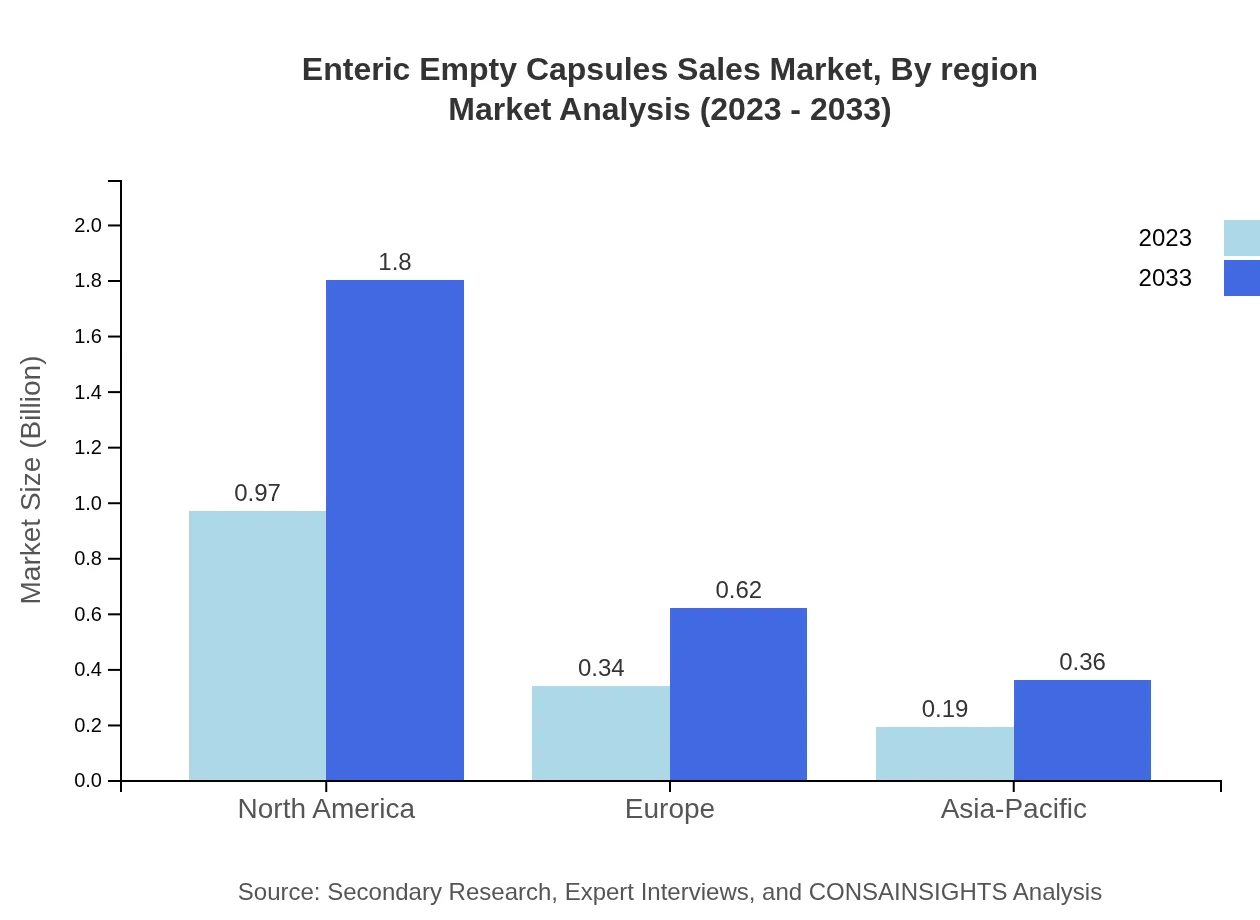

Enteric Empty Capsules Sales Market Analysis By Region

Regional trends exhibit varying growth patterns, with North America leading, accompanied by robust growth in Asia-Pacific. The integration of innovative technologies and favorable economic conditions in these regions significantly bolster market performance.

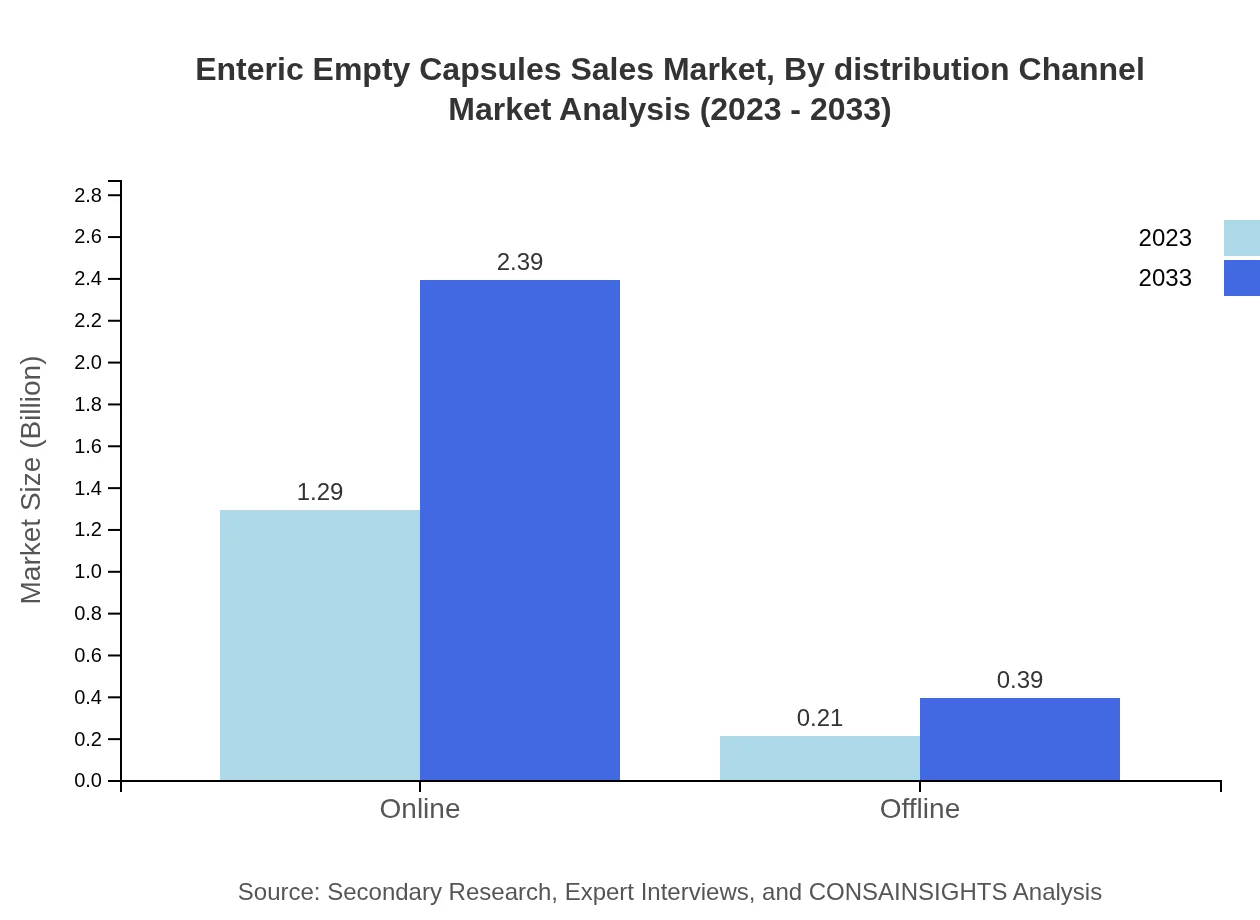

Enteric Empty Capsules Sales Market Analysis By Distribution Channel

Online distribution channels dominate the market with a share of 85.91% in 2023, supported by changes in consumer purchasing behaviors facilitating easier access to enteric empty capsules. The offline segment continues to play a significant role, particularly in traditional and local businesses catering to varying consumer preferences.

Enteric Empty Capsules Sales Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enteric Empty Capsules Sales Industry

Capsugel:

Capsugel, a major player in the pharmaceutical industry, is renowned for its advanced capsule delivery technologies and a wide range of enteric capsules catering to diverse therapeutic needs.Lonza Group:

A leading provider of integrated healthcare solutions, Lonza Group is known for its innovative capsule products, including HPMC and gelatin capsules, which have a strong presence in the global market.Qualicaps:

Qualicaps specializes in the manufacturing of capsule products for nutritional and pharmaceutical use, focusing on quality and innovative solutions to meet market demands.Suheung:

Suheung offers a variety of capsule formulations, including enteric, focusing on customer-specific requirements and efficiencies in production.We're grateful to work with incredible clients.

FAQs

What is the market size of enteric Empty Capsules Sales?

The enteric empty capsules sales market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.2%. This growth signals a strong demand for advanced pharmaceuticals and nutraceuticals utilizing enteric technology.

What are the key market players or companies in this enteric Empty Capsules Sales industry?

The key players in the enteric empty capsules industry include major pharmaceuticals, contract manufacturers, and nutraceutical companies. Notable names are Capsugel, Qualicaps, and Suheung, contributing significantly to market dynamics and innovations.

What are the primary factors driving the growth in the enteric Empty Capsules Sales industry?

Key factors driving the growth of enteric empty capsules include increasing health awareness, rising demand for dietary supplements, and advancements in capsule technology for improved drug delivery. Additionally, the rise of contract manufacturing bolsters market responsiveness.

Which region is the fastest Growing in the enteric Empty Capsules Sales?

The fastest-growing region for enteric empty capsules sales is North America, projected to grow from $0.57 billion in 2023 to $1.06 billion by 2033. Other regions like Asia-Pacific also show growth potential, increasing from $0.31 billion to $0.57 billion in the same period.

Does ConsaInsights provide customized market report data for the enteric Empty Capsules Sales industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs within the enteric empty capsules industry. Clients can request detailed insights based on unique parameters, ensuring relevance and accuracy.

What deliverables can I expect from this enteric Empty Capsules Sales market research project?

From the market research project on enteric empty capsules, clients can expect comprehensive reports, executive summaries, detailed segment analysis, regional insights, and forecasting data. Customization options are also available.

What are the market trends of enteric Empty Capsules Sales?

Market trends for enteric empty capsules include the rise of vegetarian or vegan alternatives, sustainability in manufacturing processes, and a growing preference for online sales channels. Increased innovation in capsule formulations is also notable.