Enterprise Application Market Report

Published Date: 31 January 2026 | Report Code: enterprise-application

Enterprise Application Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Enterprise Application market from 2023 to 2033, detailing market dynamics, size, industry trends, and forecasts. Insights cover segmentation, regional insights, technological advancements, and key players in the industry.

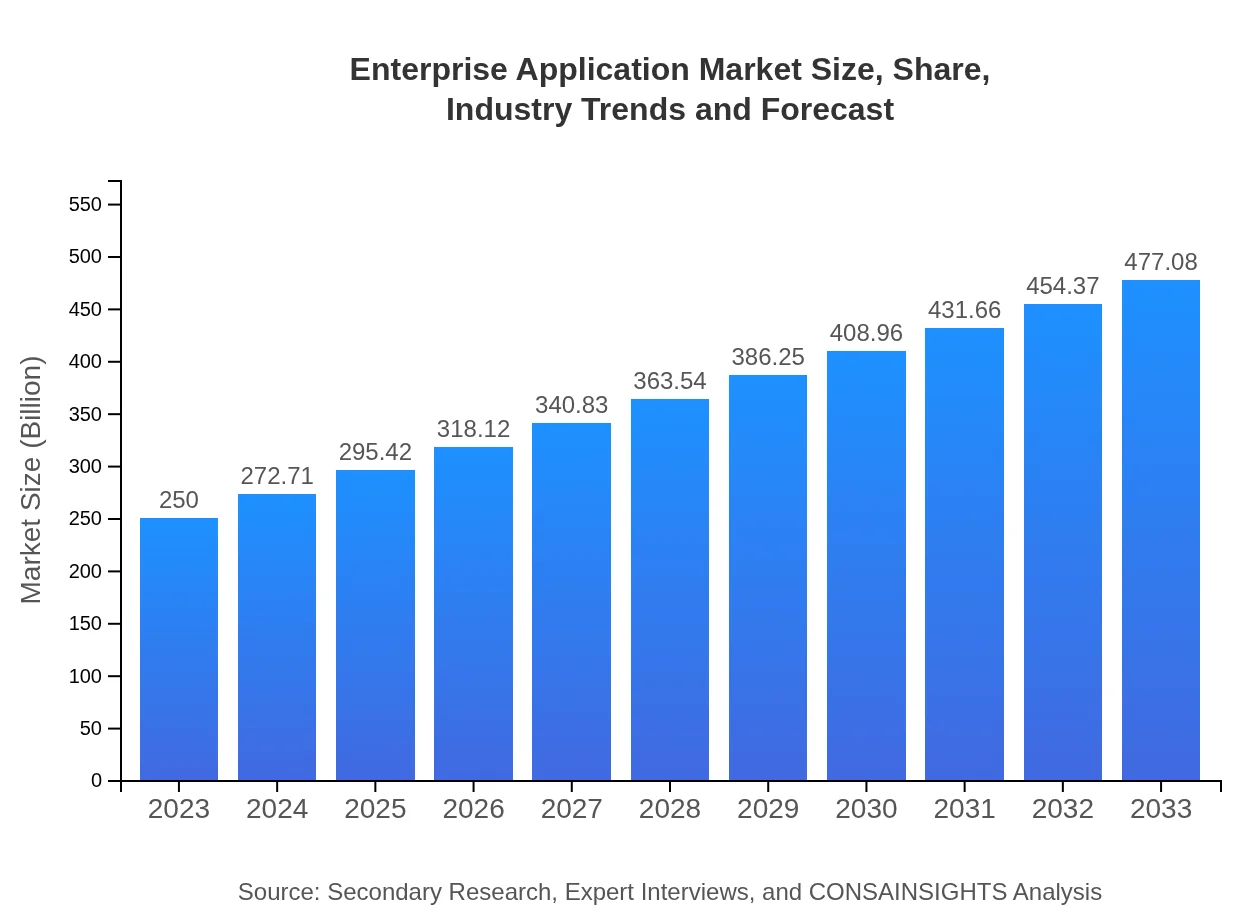

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $250.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $477.08 Billion |

| Top Companies | SAP SE, Oracle Corporation, Microsoft Corporation, Salesforce, IBM Corporation |

| Last Modified Date | 31 January 2026 |

Enterprise Application Market Overview

Customize Enterprise Application Market Report market research report

- ✔ Get in-depth analysis of Enterprise Application market size, growth, and forecasts.

- ✔ Understand Enterprise Application's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Application

What is the Market Size & CAGR of Enterprise Application market in 2023?

Enterprise Application Industry Analysis

Enterprise Application Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Application Market Analysis Report by Region

Europe Enterprise Application Market Report:

In Europe, the enterprise application market is expected to grow from $81.90 billion in 2023 to $156.29 billion by 2033. European countries are increasingly focusing on stringent regulations around data privacy and security, leading to enhanced investment in robust enterprise applications. The region's emphasis on sustainability and efficiency further fuels demand.Asia Pacific Enterprise Application Market Report:

In 2023, the Asia Pacific Enterprise Application market is valued at approximately $40.27 billion, and it is projected to grow to $76.86 billion by 2033. The growth is primarily driven by the rapid digital transformation of industries, increased adoption of cloud technologies, and government initiatives to enhance the digital economy. Countries like China and India are leading the charge, with substantial investments in enterprise solutions.North America Enterprise Application Market Report:

North America stands out with a market size of $92.25 billion in 2023, projected to reach $176.04 billion by 2033. The region is characterized by advanced technological infrastructure and a high level of digital maturity among enterprises. The presence of leading software vendors and high demand for innovative solutions drive continuous market expansion.South America Enterprise Application Market Report:

The South American Enterprise Application market is currently valued at $16.15 billion in 2023, expected to reach $30.82 billion by 2033. The region is witnessing a gradual shift towards digitalization, aided by improved internet access and mobile connectivity. Adoption of enterprise applications in sectors like retail and finance is expected to spur market growth.Middle East & Africa Enterprise Application Market Report:

The Middle East and Africa market is valued at $19.42 billion in 2023, with a forecast to grow to $37.07 billion by 2033. Growth in this region is supported by increasing digital adoption, especially in the UAE and Saudi Arabia, as businesses look to leverage technology for operational excellence and improved customer engagement.Tell us your focus area and get a customized research report.

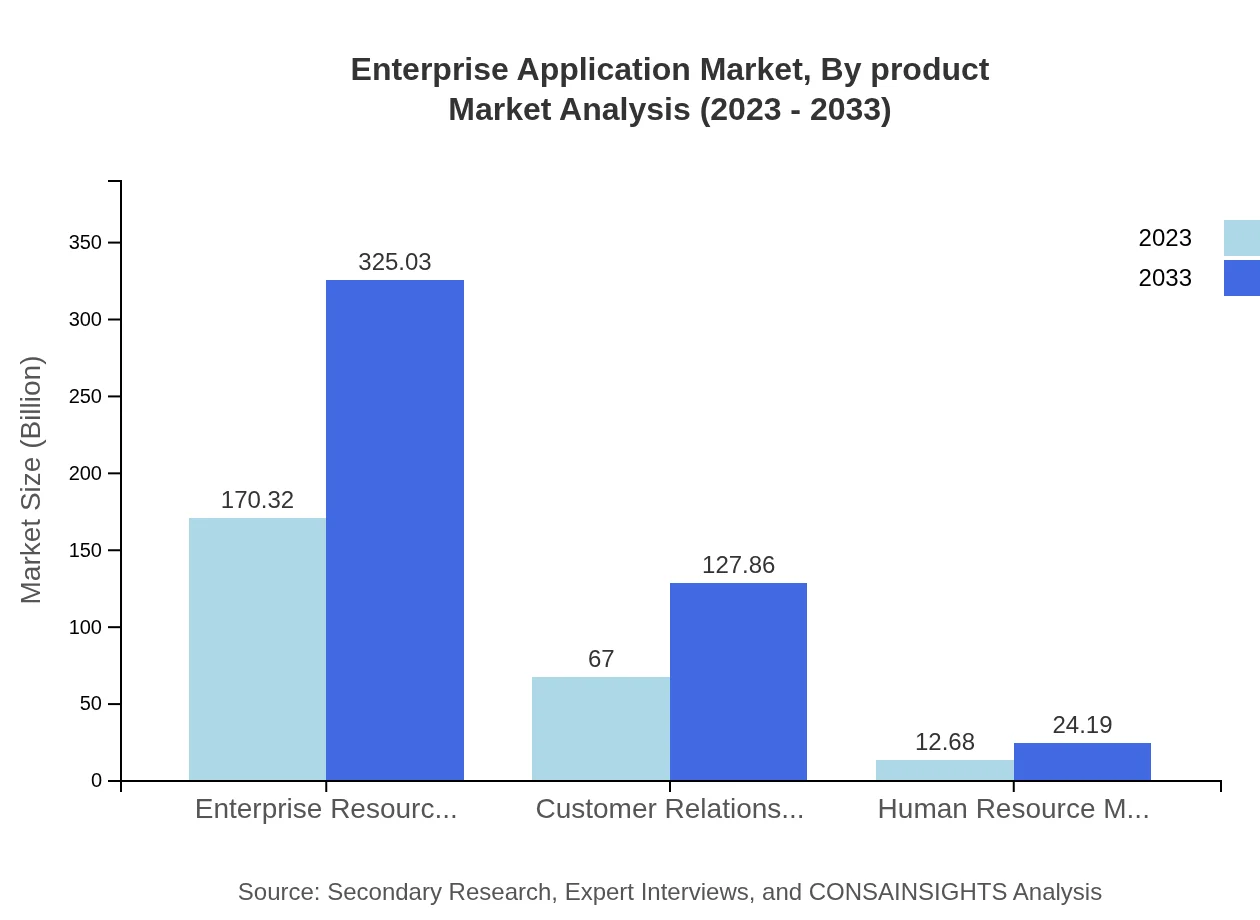

Enterprise Application Market Analysis By Product

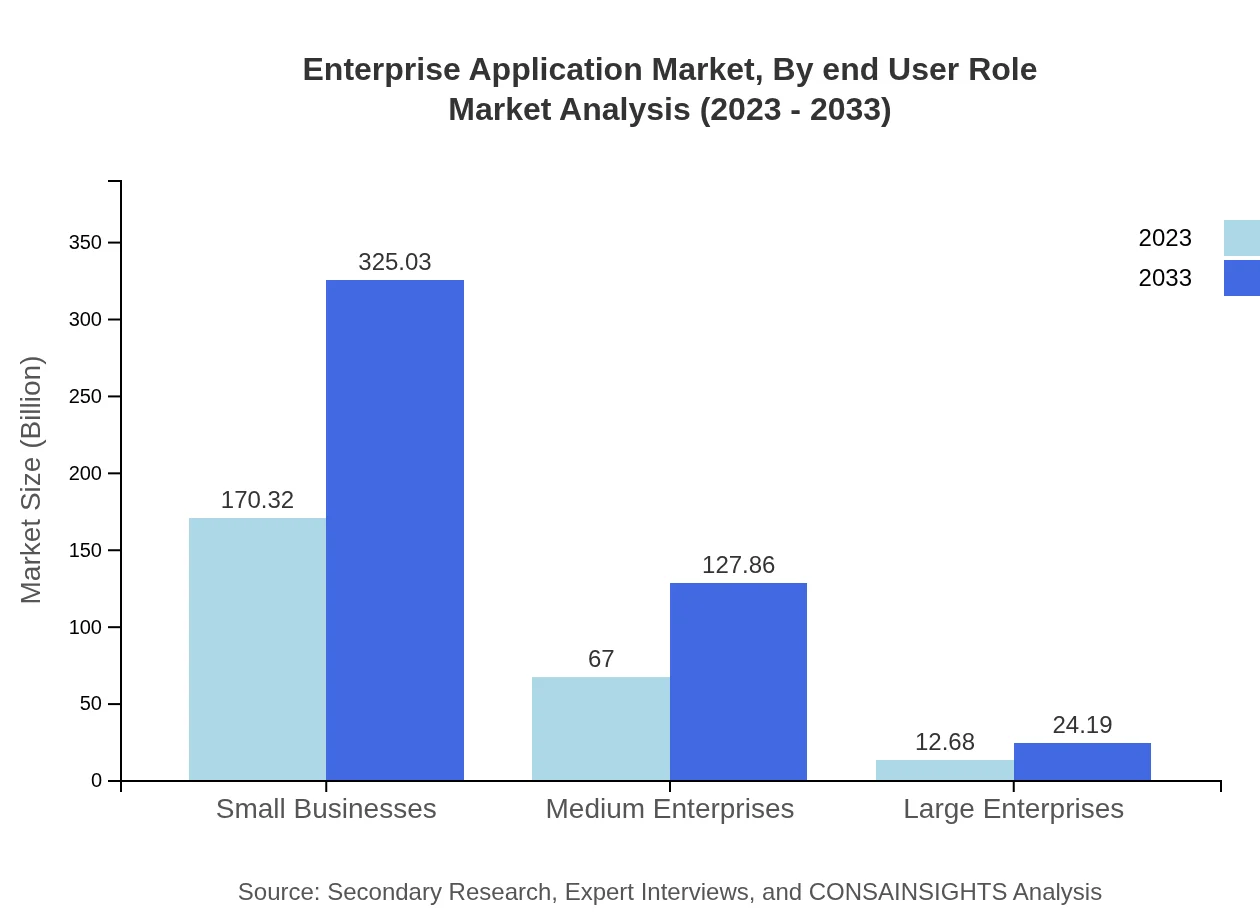

The largest segment in the Enterprise Application market is Enterprise Resource Planning (ERP), projected to grow from $170.32 billion in 2023 to $325.03 billion by 2033, while accounting for a significant share of the overall market. Additionally, Customer Relationship Management (CRM) solutions are also pivotal, with expected growth from $67.00 billion to $127.86 billion. Other segments such as Supply Chain Management and Human Resource Management are witnessing steady demand fueled by the necessity for optimized business processes.

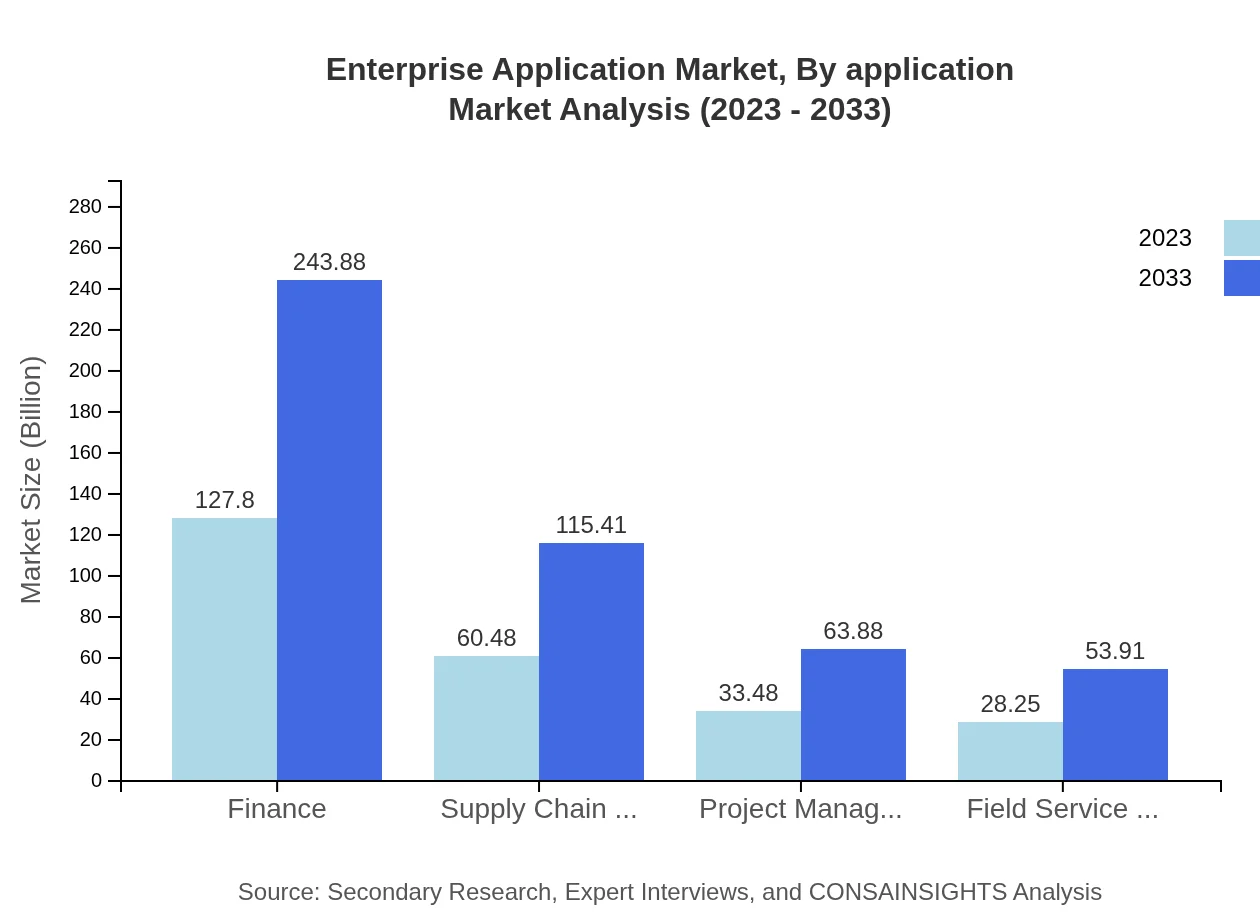

Enterprise Application Market Analysis By Application

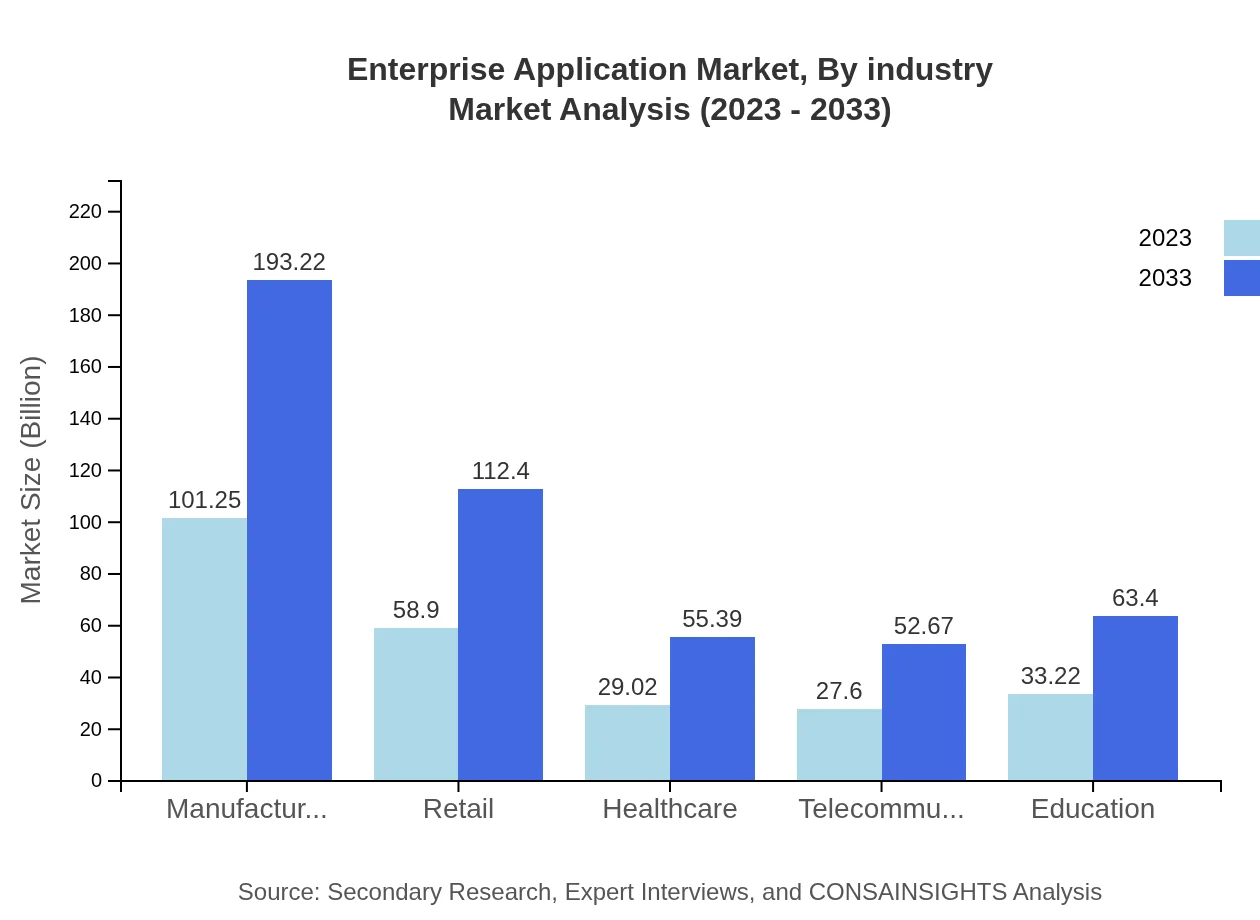

In terms of application, the finance and healthcare sectors appear to be the largest users of enterprise applications, with finance projected to grow from $127.80 billion in 2023 to $243.88 billion by 2033. The healthcare sector is also expected to show substantial growth, from $29.02 billion to $55.39 billion, driven by the increasing need for advanced patient management systems and compliance with regulatory standards.

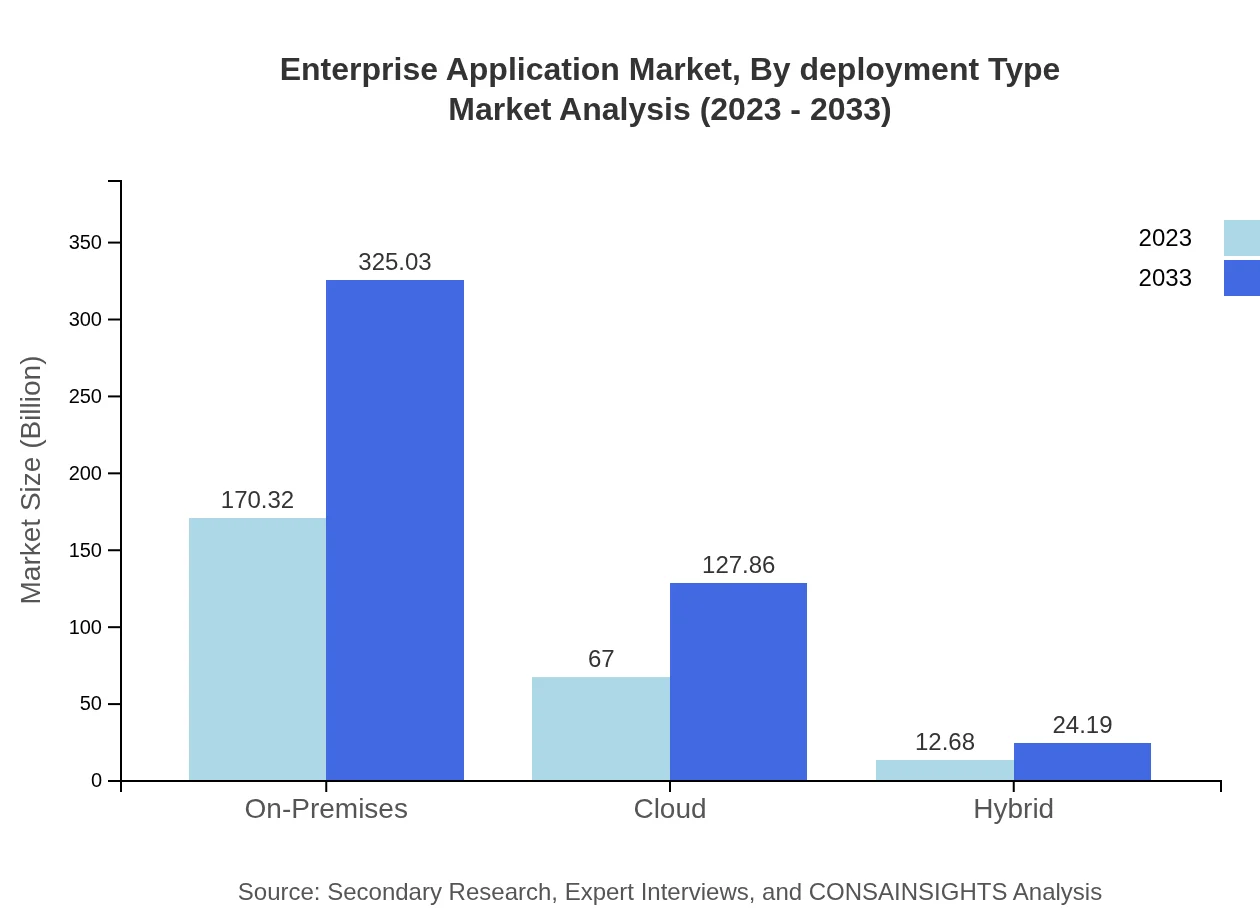

Enterprise Application Market Analysis By Deployment Type

The market is significantly impacted by the deployment type, with on-premises solutions anticipated to dominate and grow from $170.32 billion in 2023 to $325.03 billion by 2033. However, the cloud segment is gaining traction, projected to increase from $67.00 billion to $127.86 billion as organizations shift to flexible, scalable solutions.

Enterprise Application Market Analysis By Industry

Industries such as manufacturing and retail are essential for enterprise application growth. The manufacturing sector alone is expected to grow from $101.25 billion to $193.22 billion from 2023 to 2033, highlighting the need for automation and efficient resource allocation that enterprise applications provide.

Enterprise Application Market Analysis By End User Role

Small and medium enterprises represent a growing segment in the enterprise application landscape, with small businesses expected to expand from $170.32 billion to $325.03 billion by 2033. Larger enterprises will maintain a share, but the focus remains on providing cost-effective solutions for small and medium businesses to drive modernization efforts.

Enterprise Application Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Application Industry

SAP SE:

SAP SE is a multinational software corporation that provides enterprise software to manage business operations and customer relations. SAP is known for its ERP software, which is critical for many businesses around the globe.Oracle Corporation:

Oracle is a leader in database software and enterprise application technologies. It has a strong portfolio, including cloud applications and enterprise resource planning.Microsoft Corporation:

Microsoft offers a range of enterprise applications, including its Dynamics 365 suite for ERP and CRM. Its cloud offerings via Azure are transforming how enterprises operate.Salesforce:

Salesforce is a pioneer in CRM solutions, leveraging technology to improve customer engagement and streamline sales processes for businesses of all sizes.IBM Corporation:

IBM provides various enterprise solutions focused on cloud computing, AI, and analytics, helping businesses transform and innovate their IT infrastructures.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Application?

The global market size for enterprise applications is projected to reach approximately $250 billion by 2033, growing at a CAGR of 6.5%. This robust growth reflects the increasing demand for integrated solutions across various industry sectors.

What are the key market players or companies in this enterprise Application industry?

Key players in the enterprise application market include SAP, Oracle Corporation, Microsoft, Salesforce, and IBM. These companies dominate through innovation, strategic alliances, and extensive product portfolios catering to diverse business needs.

What are the primary factors driving the growth in the enterprise Application industry?

Growth drivers include the increasing need for automation, rising business data volume, enhanced customer engagement via technology, and the demand for cloud-based solutions that improve scalability and accessibility for enterprises.

Which region is the fastest Growing in the enterprise Application?

The Asia Pacific region is experiencing the fastest growth, projected to expand from $40.27 billion in 2023 to $76.86 billion by 2033. This growth is fueled by a surge in digital transformation initiatives and increasing IT investments.

Does ConsaInsights provide customized market report data for the enterprise Application industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs. Clients can request tailored insights to gain a competitive edge and meet their strategic objectives.

What deliverables can I expect from this enterprise Application market research project?

Deliverables include comprehensive market analysis, trend forecasting, detailed segmentation data, competitive landscape assessments, and actionable insights that guide decision-making and strategy formation.

What are the market trends of enterprise Application?

Trends include increased automation through AI and machine learning, a shift towards subscription-based models, and the growing importance of data analytics as companies seek to optimize operational efficiencies.