Enterprise Ar Software Market Report

Published Date: 31 January 2026 | Report Code: enterprise-ar-software

Enterprise Ar Software Market Size, Share, Industry Trends and Forecast to 2033

This report delivers a comprehensive analysis of the Enterprise AR Software market between 2023 and 2033, offering insights into market trends, size, regional insights, and key players to inform strategic decisions.

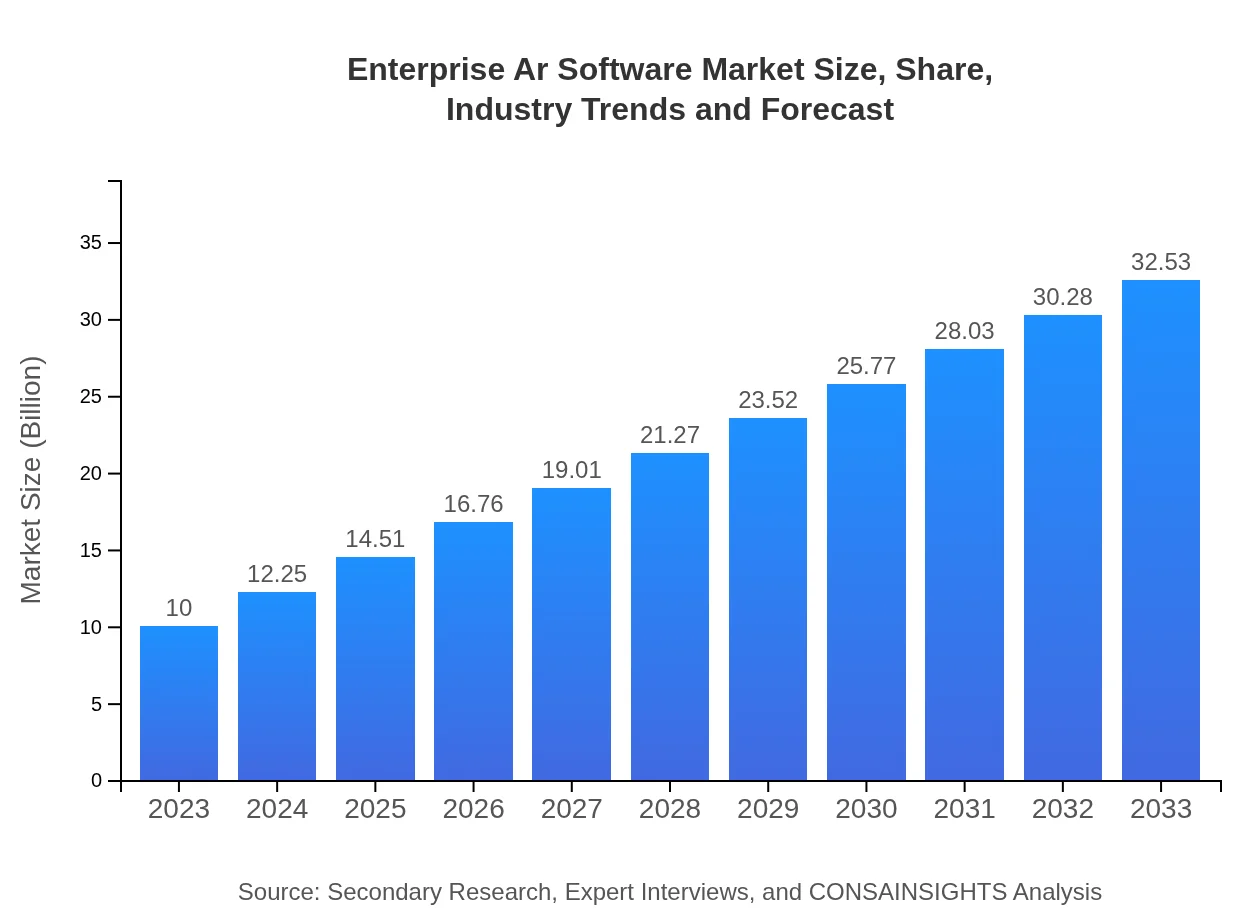

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $32.53 Billion |

| Top Companies | Microsoft, Google, PTC, Apple , SAP |

| Last Modified Date | 31 January 2026 |

Enterprise AR Software Market Overview

Customize Enterprise Ar Software Market Report market research report

- ✔ Get in-depth analysis of Enterprise Ar Software market size, growth, and forecasts.

- ✔ Understand Enterprise Ar Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Ar Software

What is the Market Size & CAGR of Enterprise AR Software market in 2023?

Enterprise AR Software Industry Analysis

Enterprise AR Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise AR Software Market Analysis Report by Region

Europe Enterprise Ar Software Market Report:

Europe's Enterprise AR Software market, currently valued at $2.84 billion, is expected to escalate to $9.25 billion in 2033. The region is experiencing heightened demand for AR in various industries, particularly automotive and manufacturing, due to its strong push towards innovation.Asia Pacific Enterprise Ar Software Market Report:

The Asia Pacific region is poised for substantial growth, with a market size expected to expand from $1.93 billion in 2023 to $6.27 billion by 2033. The region's increasing investment in digital transformation and favorability towards cutting-edge technologies are prime catalysts for this growth.North America Enterprise Ar Software Market Report:

The North America market is projected to reach $12.09 billion by 2033, up from $3.71 billion in 2023. The region's advanced technological ecosystem, coupled with significant investments from enterprises seeking innovative solutions, positions it as a leader in the AR software domain.South America Enterprise Ar Software Market Report:

In South America, the Enterprise AR Software market is forecasted to grow from $0.39 billion in 2023 to $1.28 billion by 2033. Factors driving growth include accelerating digitalization and widespread adoption of mobile technologies impacting enterprise operations.Middle East & Africa Enterprise Ar Software Market Report:

The Middle East and Africa market is anticipated to grow from $1.12 billion in 2023 to $3.65 billion by 2033. The region's growing focus on improving infrastructure and adopting smart technologies is creating favorable conditions for AR integration in enterprise operations.Tell us your focus area and get a customized research report.

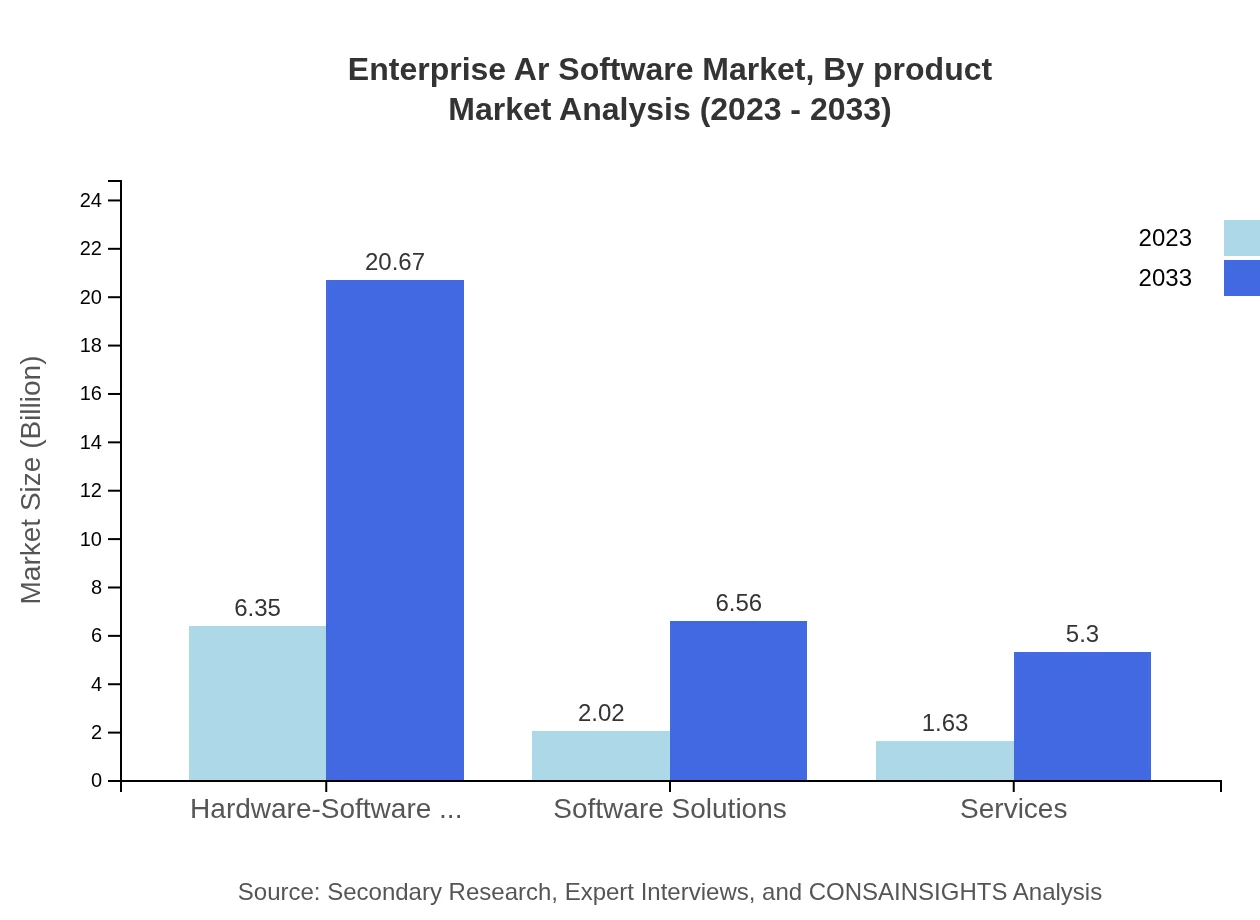

Enterprise Ar Software Market Analysis By Product

The Enterprise AR Software market, by product type, consists of Hardware-Software Integrations and Software Solutions. Hardware-software integrations are leading the market, accounting for $6.35 billion in 2023 and expected to reach $20.67 billion by 2033. Software solutions, while smaller, are projected to grow robustly from $2.02 billion to $6.56 billion in the same period, showcasing the demand for various application forms.

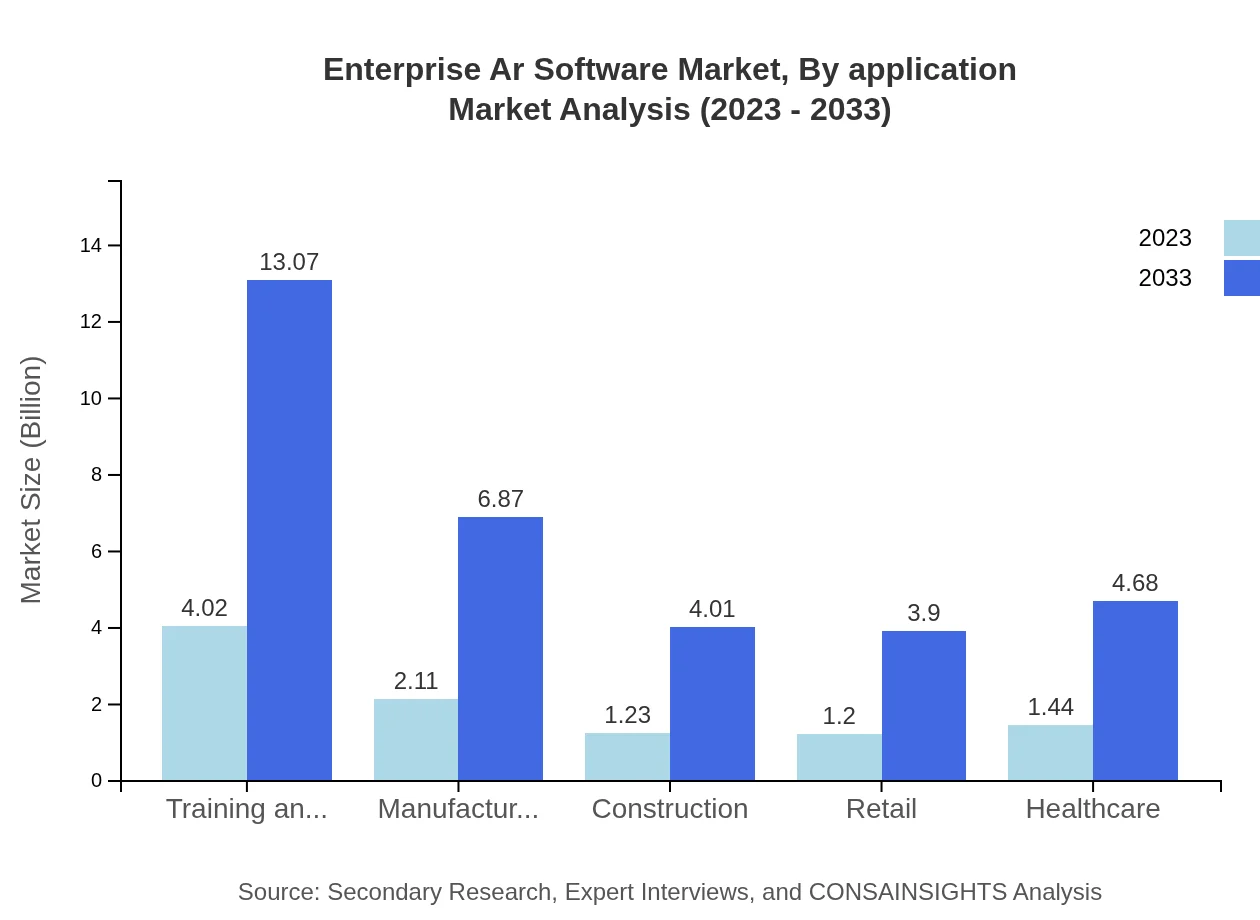

Enterprise Ar Software Market Analysis By Application

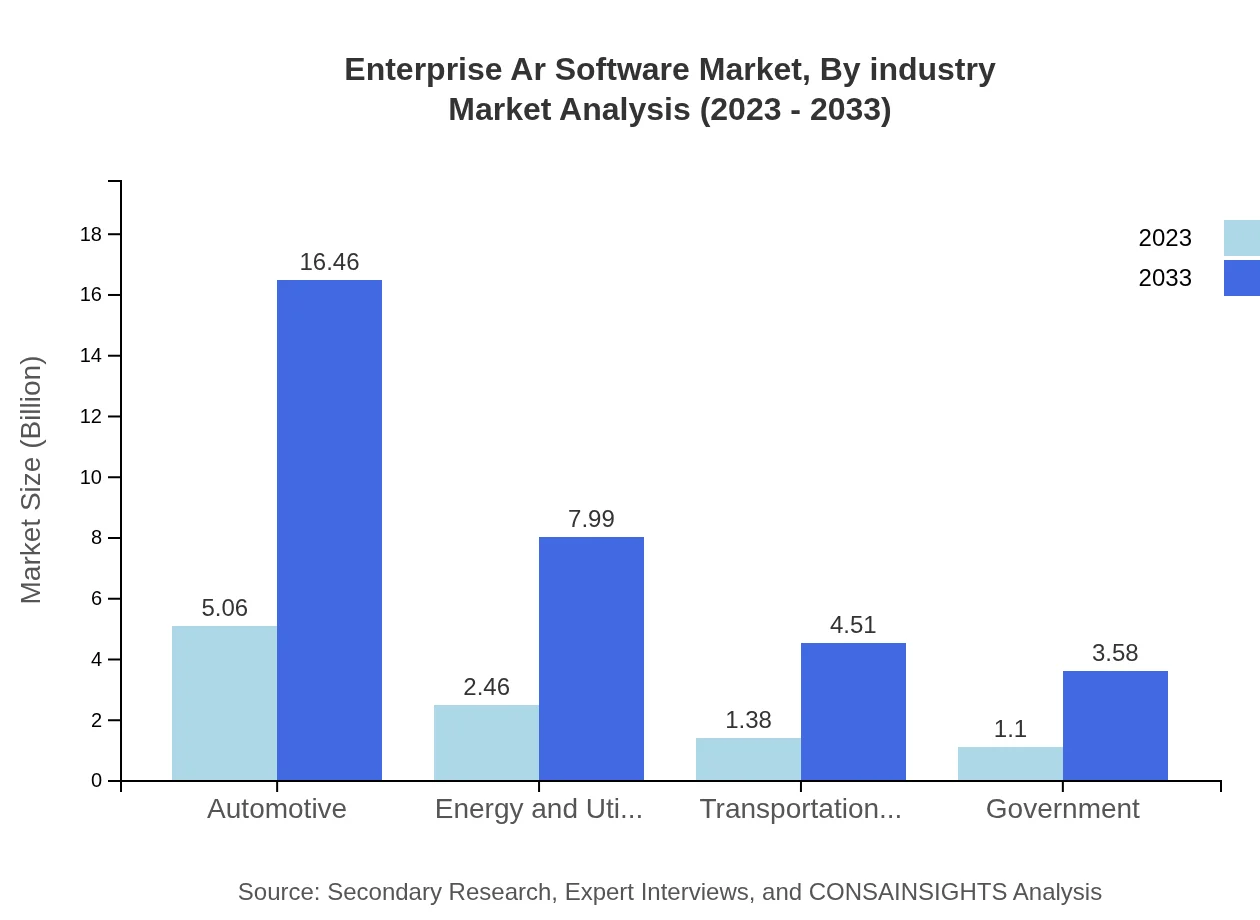

Analyzing by application, the automotive sector leads with a current market value of $5.06 billion, set to increase to $16.46 billion by 2033. The training and education sector is also significant, expecting growth from $4.02 billion to $13.07 billion. This illustrates the importance of AR in enhancing educational methodologies and operational training.

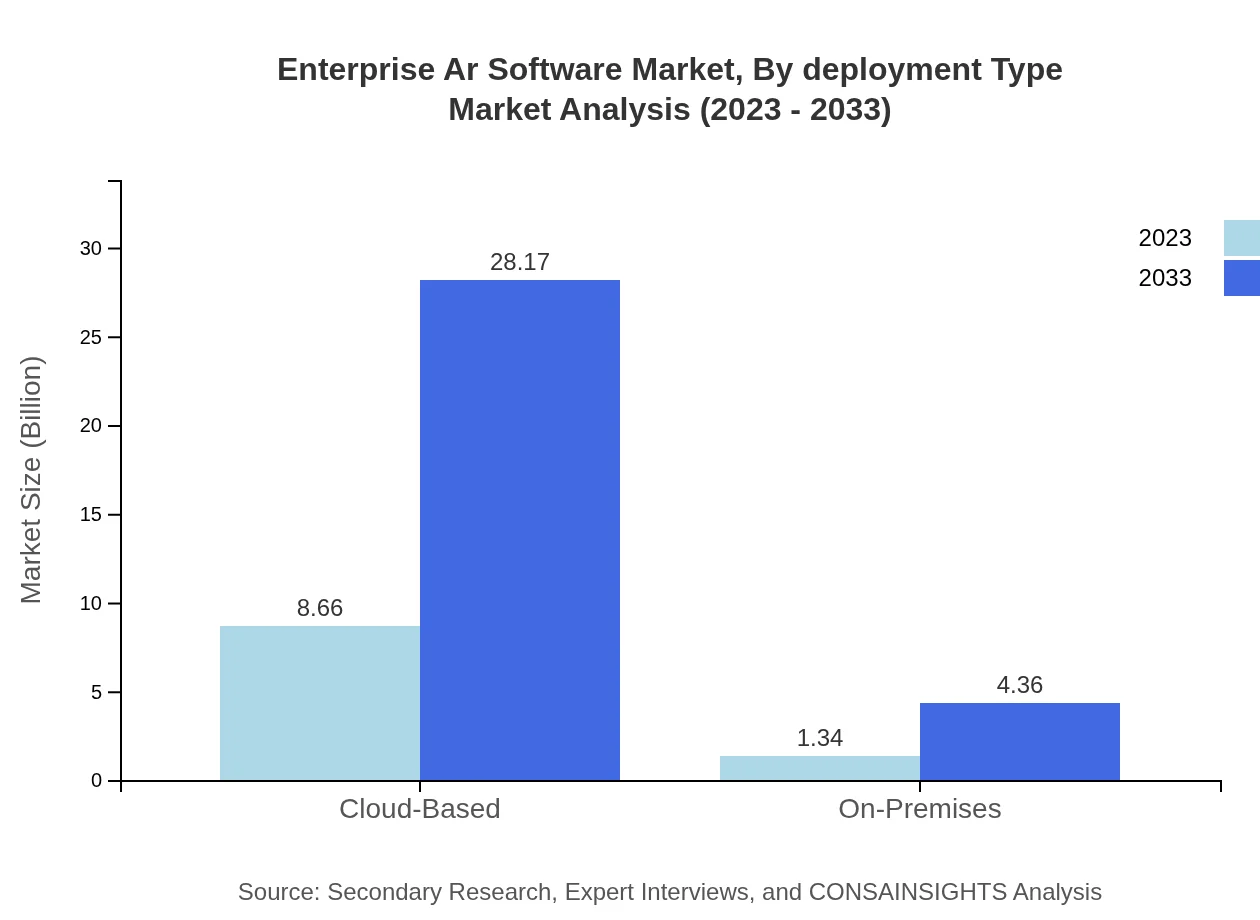

Enterprise Ar Software Market Analysis By Deployment Type

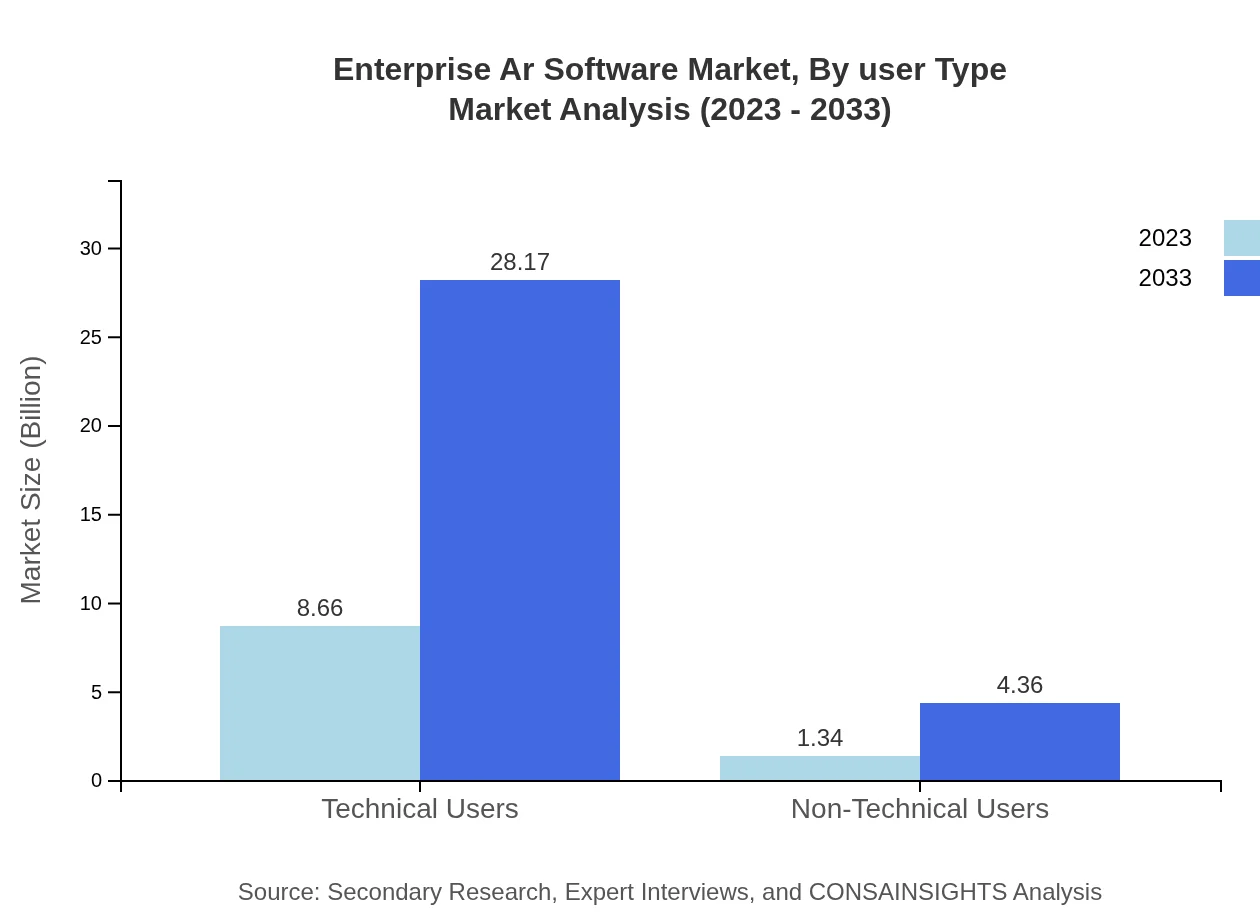

Deployment types in the Enterprise AR Software market include Cloud-based and On-Premises solutions. Cloud-based solutions dominate with a market size of $8.66 billion in 2023, projected to grow to $28.17 billion by 2033, reflecting the industry's inclination towards flexibility and scalability.

Enterprise Ar Software Market Analysis By Industry

Various industries utilize Enterprise AR Software, with manufacturing significantly engaging AR, expanding from $2.11 billion to $6.87 billion over the forecast period. The healthcare sector also shows promise, growing from $1.44 billion to $4.68 billion, underlining AR’s pivotal role in evolving industry standards.

Enterprise Ar Software Market Analysis By User Type

When analyzing user types, Technical Users currently dominate the market with a size of $8.66 billion in 2023, equating to 86.6% market share. Non-Technical Users, while smaller, are expanding from $1.34 billion to $4.36 billion, illustrating the increasing accessibility of AR tools. This shift is essential for businesses aiming to integrate AR broadly into their operations.

Enterprise AR Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise AR Software Industry

Microsoft:

A pioneer in cloud computing and AR, Microsoft offers various enterprise solutions integrating AR with their HoloLens and Dynamics 365, empowering businesses to enhance efficiency and collaboration.Google:

With its investment in ARCore and various enterprise tools, Google is advancing AR applications across industries, focusing on enhancing customer engagement and operational insights.PTC:

PTC fosters digital transformation using its Vuforia AR platform, offering tools for manufacturing, training, and service operations, rebirthing the efficiency of enterprise functions.Apple :

Apple’s ARKit provides robust solutions for developers aiming to integrate AR into their applications, significantly influencing user experience in multiple sectors.SAP:

SAP leads in enterprise software, integrating AR capabilities into its business applications, enabling real-time data overlay for improved decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Ar Software?

The enterprise AR software market is currently valued at approximately $10 billion in 2023, with a projected compound annual growth rate (CAGR) of 12%. This robust growth underscores the increasing adoption of augmented reality solutions across various sectors.

What are the key market players or companies in this enterprise Ar Software industry?

Key players in the enterprise AR software market include industry leaders and innovative startups. They compete by offering advanced solutions, contributing to a dynamic landscape evolving with technological advancements and customer needs.

What are the primary factors driving the growth in the enterprise Ar Software industry?

Growth in the enterprise AR software market is primarily driven by the need for enhanced operational efficiency, adoption of AR in training and education, and increasing investments in digital transformation initiatives across sectors.

Which region is the fastest Growing in the enterprise Ar Software?

Asia Pacific is the fastest-growing region in the enterprise AR software market, projected to increase from $1.93 billion in 2023 to $6.27 billion by 2033. However, North America remains the largest market, expected to reach $12.09 billion.

Does ConsaInsights provide customized market report data for the enterprise Ar Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise AR software industry, ensuring that clients receive the most relevant insights and analyses for their target market segments.

What deliverables can I expect from this enterprise Ar Software market research project?

Clients can expect comprehensive deliverables including detailed market analysis, competitive intelligence, regional insights, and forecasts that cover various segments and trends in the enterprise AR software industry.

What are the market trends of enterprise Ar Software?

Market trends in enterprise AR software include a surge in cloud-based solutions, increasing integration of AI technologies, and a focus on enhancing user experiences across industries such as manufacturing, healthcare, and education.