Enterprise Architecture Tools Market Report

Published Date: 31 January 2026 | Report Code: enterprise-architecture-tools

Enterprise Architecture Tools Market Size, Share, Industry Trends and Forecast to 2033

This report comprehensively analyzes the Enterprise Architecture Tools market, focusing on critical insights and data from 2023 to 2033. It covers market size, trends, segmentation, regional analysis, and an overview of key players in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

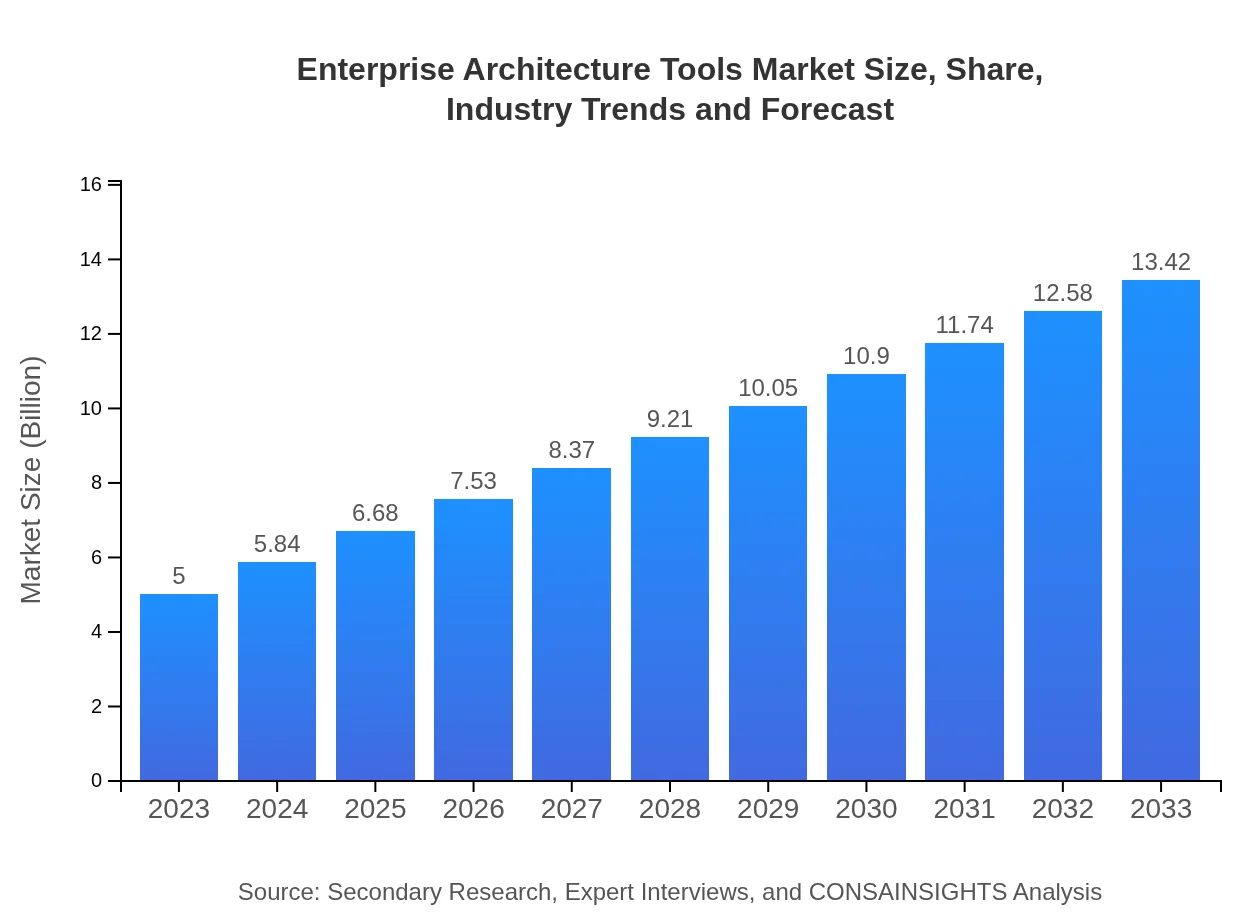

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $13.42 Billion |

| Top Companies | Sparx Systems, Software AG, IBM, Orbus Software, Avolution |

| Last Modified Date | 31 January 2026 |

Enterprise Architecture Tools Market Overview

Customize Enterprise Architecture Tools Market Report market research report

- ✔ Get in-depth analysis of Enterprise Architecture Tools market size, growth, and forecasts.

- ✔ Understand Enterprise Architecture Tools's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Architecture Tools

What is the Market Size & CAGR of Enterprise Architecture Tools market in 2023?

Enterprise Architecture Tools Industry Analysis

Enterprise Architecture Tools Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Architecture Tools Market Analysis Report by Region

Europe Enterprise Architecture Tools Market Report:

Europe's market will climb from $1.52 billion in 2023 to $4.09 billion by 2033, fueled by stringent regulatory requirements and an increasing focus on enhancing operational efficiencies and business resilience amidst economic fluctuations.Asia Pacific Enterprise Architecture Tools Market Report:

In the Asia Pacific region, the market is expected to grow from $0.92 billion in 2023 to $2.46 billion in 2033. This growth is driven by rapid digital transformation initiatives across countries like China, India, and Japan, where the adoption of cloud-based solutions and data analytics tools is gaining momentum significantly.North America Enterprise Architecture Tools Market Report:

North America maintains its position as a key market, with the value expected to rise from $1.89 billion in 2023 to $5.06 billion in 2033. The region's advanced infrastructure and high adoption of digital technologies drive investment in enterprise architecture tools dramatically.South America Enterprise Architecture Tools Market Report:

The South American market is projected to expand from $0.38 billion in 2023 to $1.02 billion by 2033. This growth is facilitated by increased awareness of enterprise architecture's benefits and a growing number of medium to large businesses focusing on strategic IT investment.Middle East & Africa Enterprise Architecture Tools Market Report:

In the Middle East and Africa, the market is expected to grow from $0.29 billion in 2023 to $0.79 billion by 2033, backed by rising investment in IT infrastructure and increased digital transformation efforts in both public and private sectors.Tell us your focus area and get a customized research report.

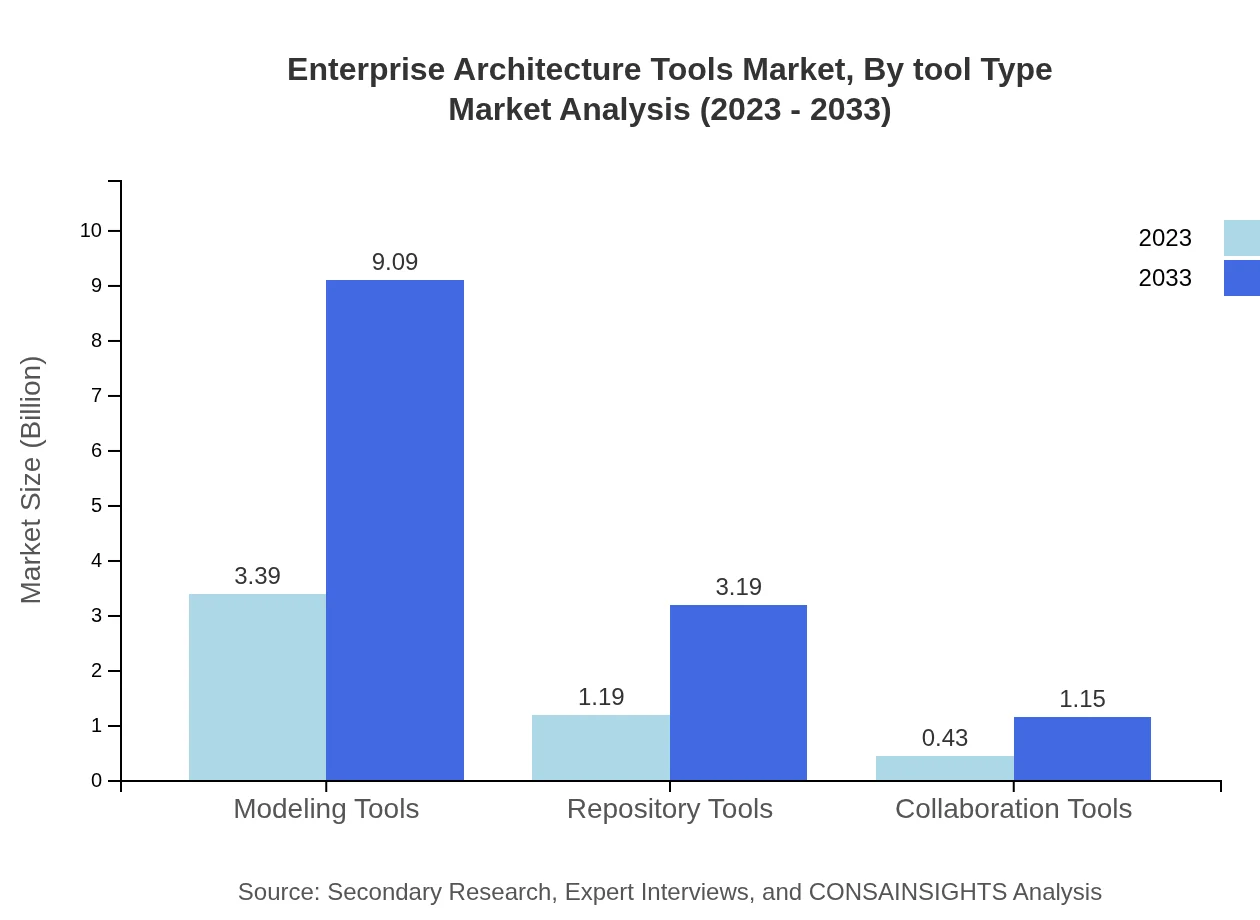

Enterprise Architecture Tools Market Analysis By Tool Type

The market segmentation by tool type reveals significant insights: Modeling Tools represent the largest share with a market size of $3.39 billion in 2023, growing to $9.09 billion by 2033. Repository Tools hold a market size of $1.19 billion in 2023, anticipated to reach $3.19 billion by 2033. Meanwhile, Collaboration Tools start with $0.43 billion in 2023 and are expected to grow to $1.15 billion by the end of the forecast period.

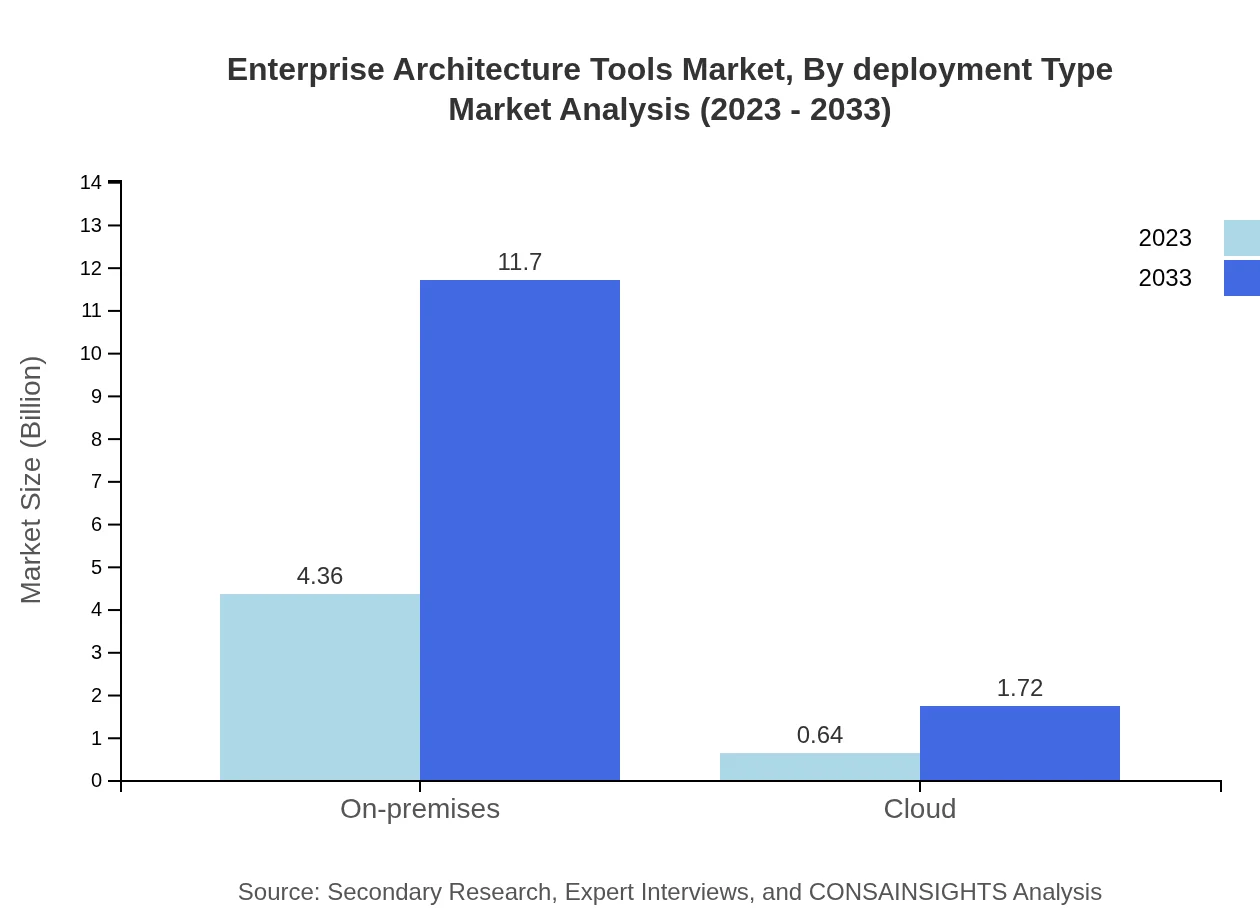

Enterprise Architecture Tools Market Analysis By Deployment Type

In terms of deployment, the On-premises segment dominates with a significant share of $4.36 billion in 2023, projected to increase to $11.70 billion by 2033. In comparison, the Cloud segment, valued at $0.64 billion in 2023, is growing rapidly and expected to reach $1.72 billion in 2033, reflecting a shift toward flexible and scalable solutions.

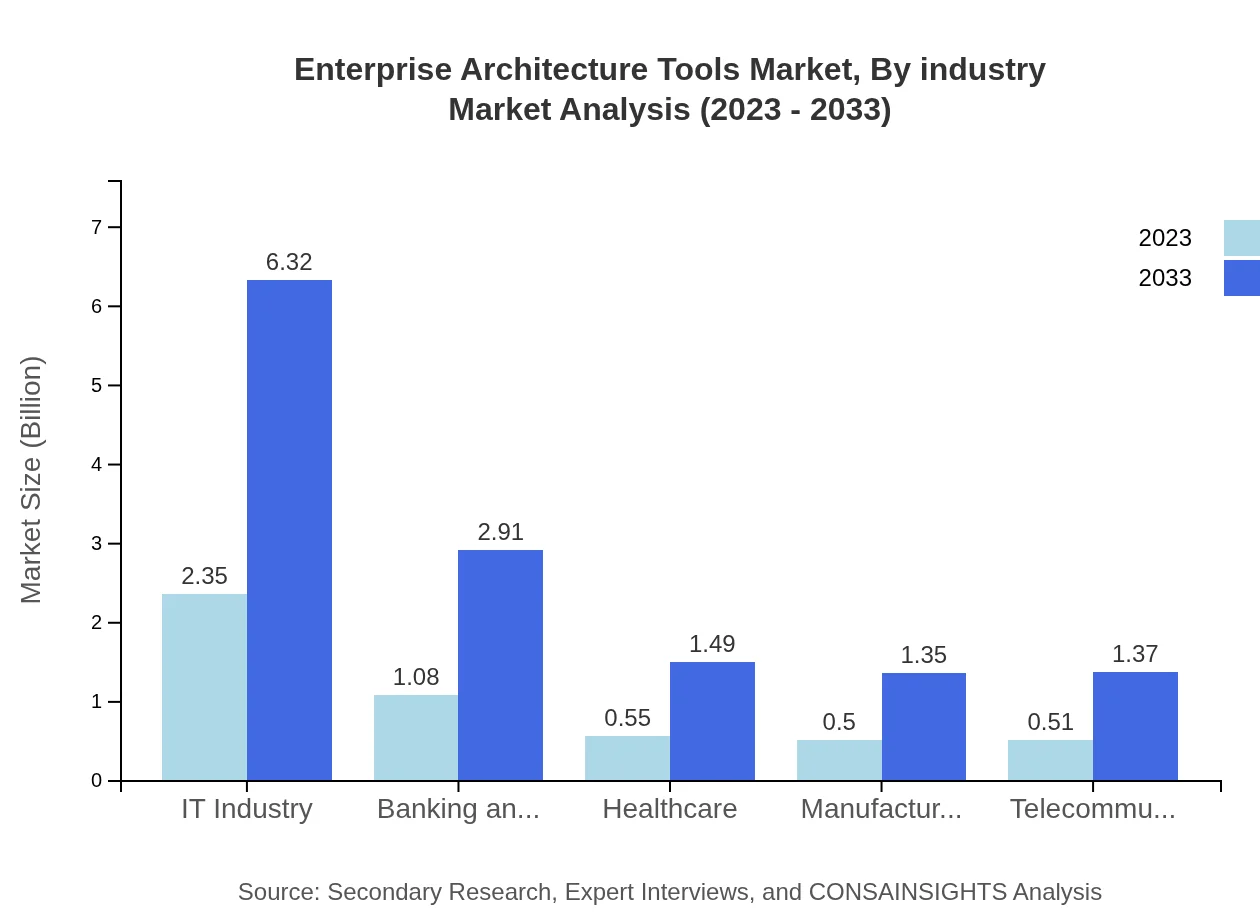

Enterprise Architecture Tools Market Analysis By Industry

The market segmentation by industry identifies IT as the primary sector, with a market size of $2.35 billion in 2023, anticipated to grow to $6.32 billion by 2033. Following IT, Banking and Financial Services holds a market position of $1.08 billion, increasing to $2.91 billion, while Healthcare, Manufacturing, and Telecommunications are also significant contributors.

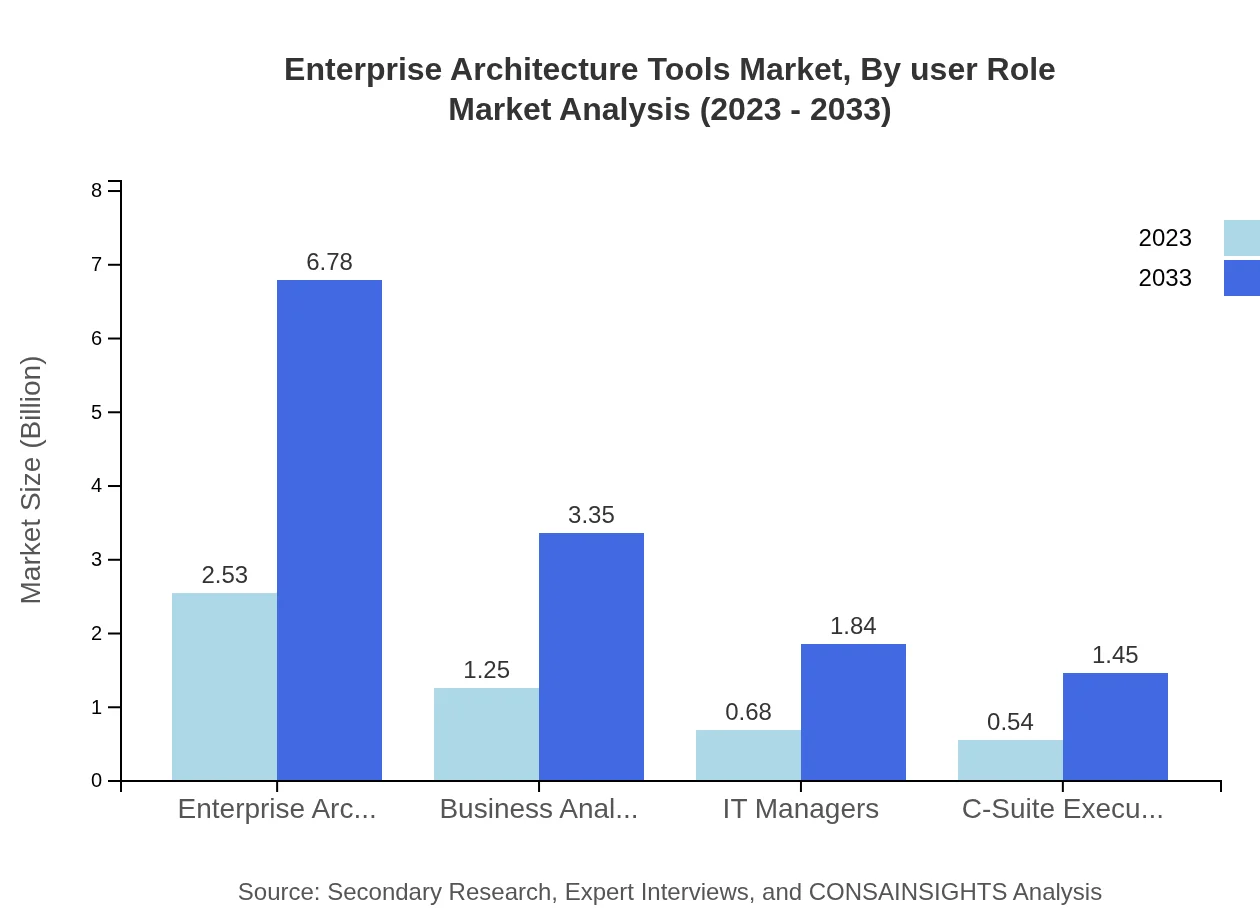

Enterprise Architecture Tools Market Analysis By User Role

The user role analysis highlights that Enterprise Architects command the largest segment at $2.53 billion in 2023, growing to $6.78 billion by 2033. Business Analysts, IT Managers, and C-Suite Executives contribute significantly with respective sizes of $1.25 billion, $0.68 billion, and $0.54 billion in 2023, indicating diverse functional needs across organizations.

Enterprise Architecture Tools Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Architecture Tools Industry

Sparx Systems:

Known for its Enterprise Architect tool, Sparx Systems is regarded as a pioneer in providing comprehensive modeling and design solutions, facilitating seamless enterprise architecture processes.Software AG:

Software AG offers a range of enterprise architecture tools and solutions tailored for digital transformation, emphasizing business process management and IT optimization.IBM:

IBM's solutions are designed to assist organizations in transforming their IT architecture through innovative methodologies and comprehensive frameworks.Orbus Software:

Orbus Software provides a suite of enterprise architecture and business process analysis tools aimed at improving business agility and IT alignment.Avolution:

Avolution specializes in enterprise architecture software that supports a wide range of frameworks and methodologies, driving strategies for transformation and operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Architecture Tools?

The enterprise architecture tools market is valued at $5 billion in 2023 and is projected to grow at a CAGR of 10% over the next decade, indicating strong demand for effective architecture solutions.

What are the key market players or companies in this enterprise Architecture Tools industry?

Key players in the enterprise architecture tools market include companies like TOGAF, Avolution, Sparx Systems, and IBM. These leaders dominate the market through innovative product offerings and strategic partnerships.

What are the primary factors driving the growth in the enterprise architecture tools industry?

Driving factors include the increasing complexity of IT environments, the demand for improved operational efficiency, and the need for alignment between business and IT strategies, fueling market growth.

Which region is the fastest Growing in the enterprise architecture tools market?

North America is poised as the fastest-growing region, with a market size projected to expand from $1.89 billion in 2023 to $5.06 billion by 2033, showcasing robust adoption of enterprise architecture tools.

Does ConsaInsights provide customized market report data for the enterprise architecture tools industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing in-depth data analysis, forecasts, and insights unique to the enterprise architecture tools sector.

What deliverables can I expect from this enterprise architecture tools market research project?

Deliverables include comprehensive market analysis, segment-wise breakdown, competitive landscape overview, regional insights, and tailored recommendations for strategic decision-making.

What are the market trends of enterprise architecture tools?

Key trends include the growing shift towards cloud-based solutions, increased integration capabilities, and a focus on collaboration tools, shaping the future of enterprise architecture tools.