Enterprise Asset Management Market Report

Published Date: 31 January 2026 | Report Code: enterprise-asset-management

Enterprise Asset Management Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the Enterprise Asset Management (EAM) market analyzes current trends, future forecasts, and key regional insights from 2023 to 2033, offering valuable data for industry stakeholders and investors.

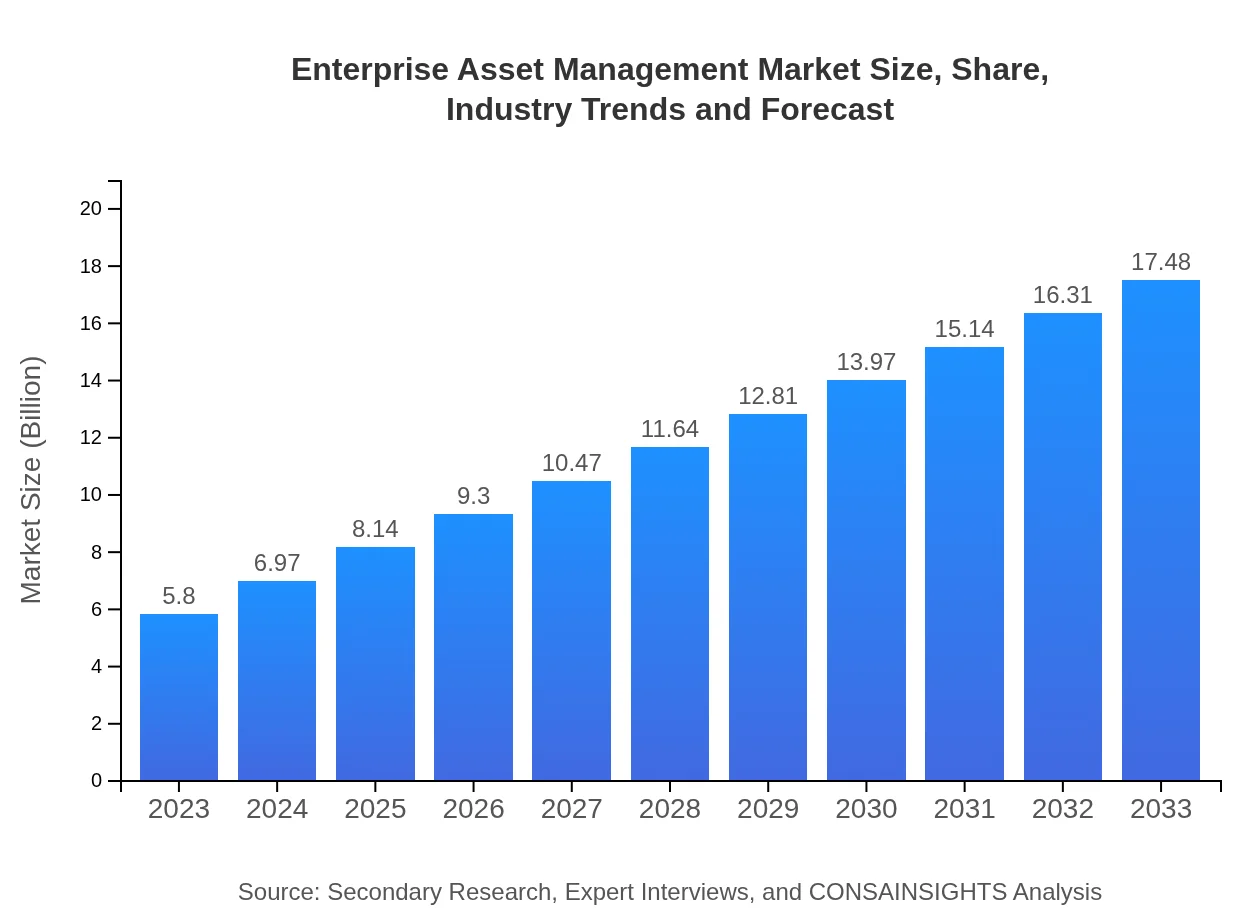

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 11.2% |

| 2033 Market Size | $17.48 Billion |

| Top Companies | IBM Corporation, SAP SE, Oracle Corporation, Infor, IFS |

| Last Modified Date | 31 January 2026 |

Enterprise Asset Management Market Overview

Customize Enterprise Asset Management Market Report market research report

- ✔ Get in-depth analysis of Enterprise Asset Management market size, growth, and forecasts.

- ✔ Understand Enterprise Asset Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Asset Management

What is the Market Size & CAGR of Enterprise Asset Management market in 2023?

Enterprise Asset Management Industry Analysis

Enterprise Asset Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Asset Management Market Analysis Report by Region

Europe Enterprise Asset Management Market Report:

Europe's EAM market is anticipated to grow from $1.64 billion in 2023 to $4.93 billion by 2033, influenced by stringent regulations regarding asset management and combined trends of digital transformation and sustainability initiatives.Asia Pacific Enterprise Asset Management Market Report:

In the Asia-Pacific region, the EAM market is projected to grow from $1.14 billion in 2023 to $3.43 billion by 2033. This growth is driven by increasing industrialization, infrastructure development, and the need for enhanced asset visibility and compliance in sectors like manufacturing and utilities.North America Enterprise Asset Management Market Report:

North America stands as the largest market for EAM, with an expected growth from $1.99 billion in 2023 to approximately $6.01 billion by 2033. This growth is largely attributed to the high adoption rate of advanced technologies and the significant presence of leading EAM vendors in the region.South America Enterprise Asset Management Market Report:

For South America, the EAM market is set to expand from $0.29 billion in 2023 to $0.87 billion by 2033, as organizations seek to improve operational efficiency and drive accountability across their asset management processes, particularly in utilities and construction sectors.Middle East & Africa Enterprise Asset Management Market Report:

The EAM market in the Middle East and Africa is forecasted to increase from $0.74 billion in 2023 to $2.24 billion by 2033. Growth in this region is facilitated by rising investments in smart infrastructure and the growing adoption of digital technologies in sectors such as oil and gas.Tell us your focus area and get a customized research report.

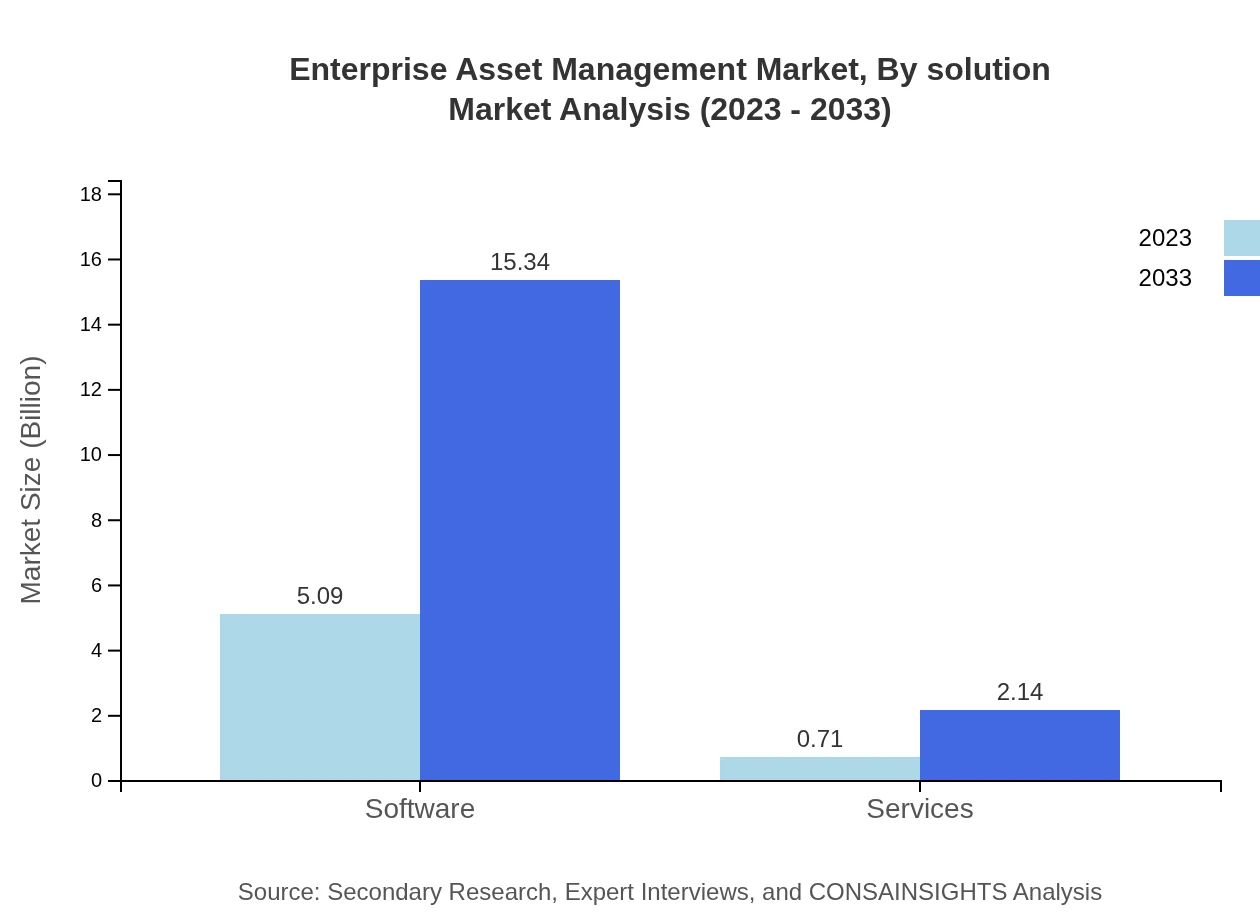

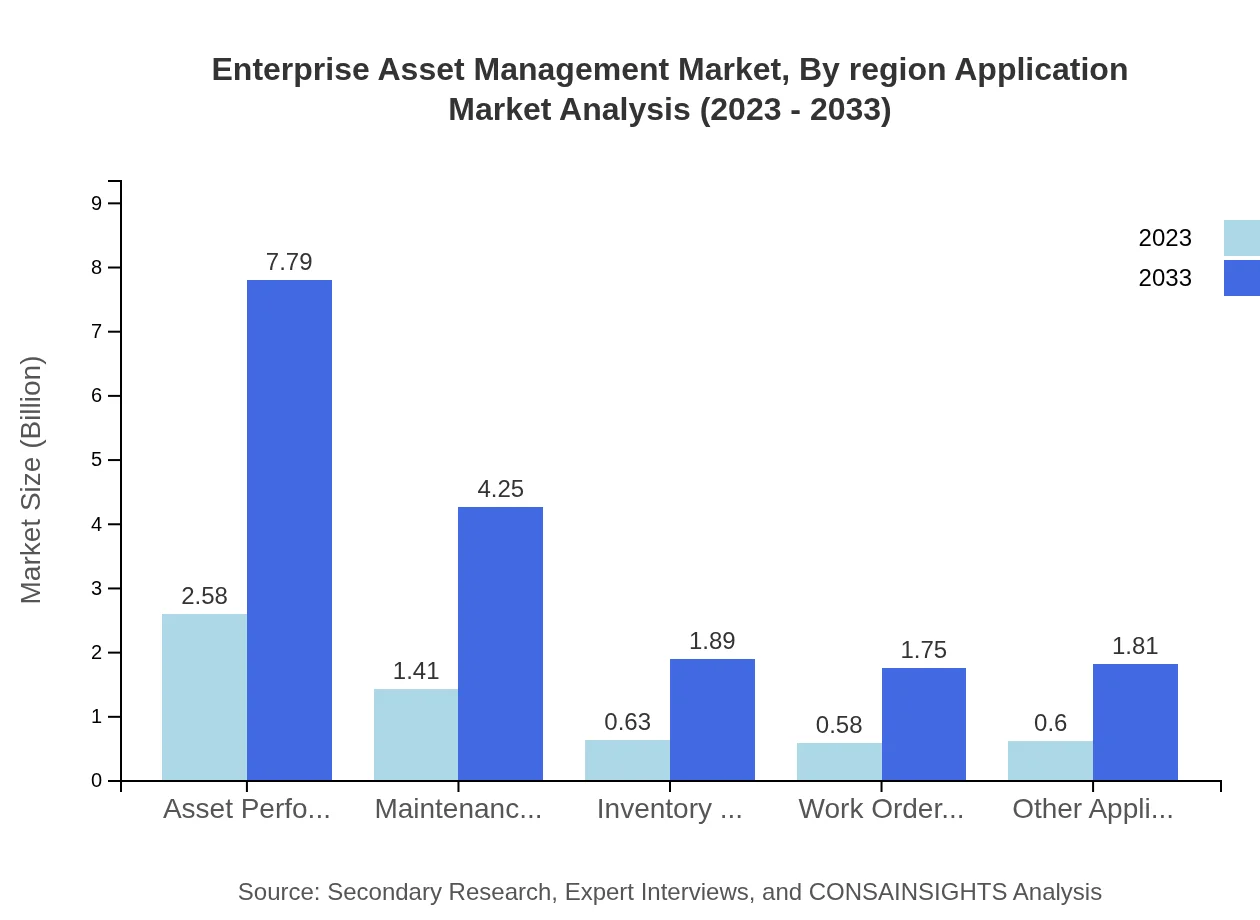

Enterprise Asset Management Market Analysis By Solution

The EAM market by solution is dominated by asset performance management, accounting for an estimated 44.55% of the total market share in 2023, with projections for growth leading to a $7.79 billion valuation by 2033. Maintenance management follows closely, representing 24.29% of the market in 2023, and is expected to expand significantly during the forecast period.

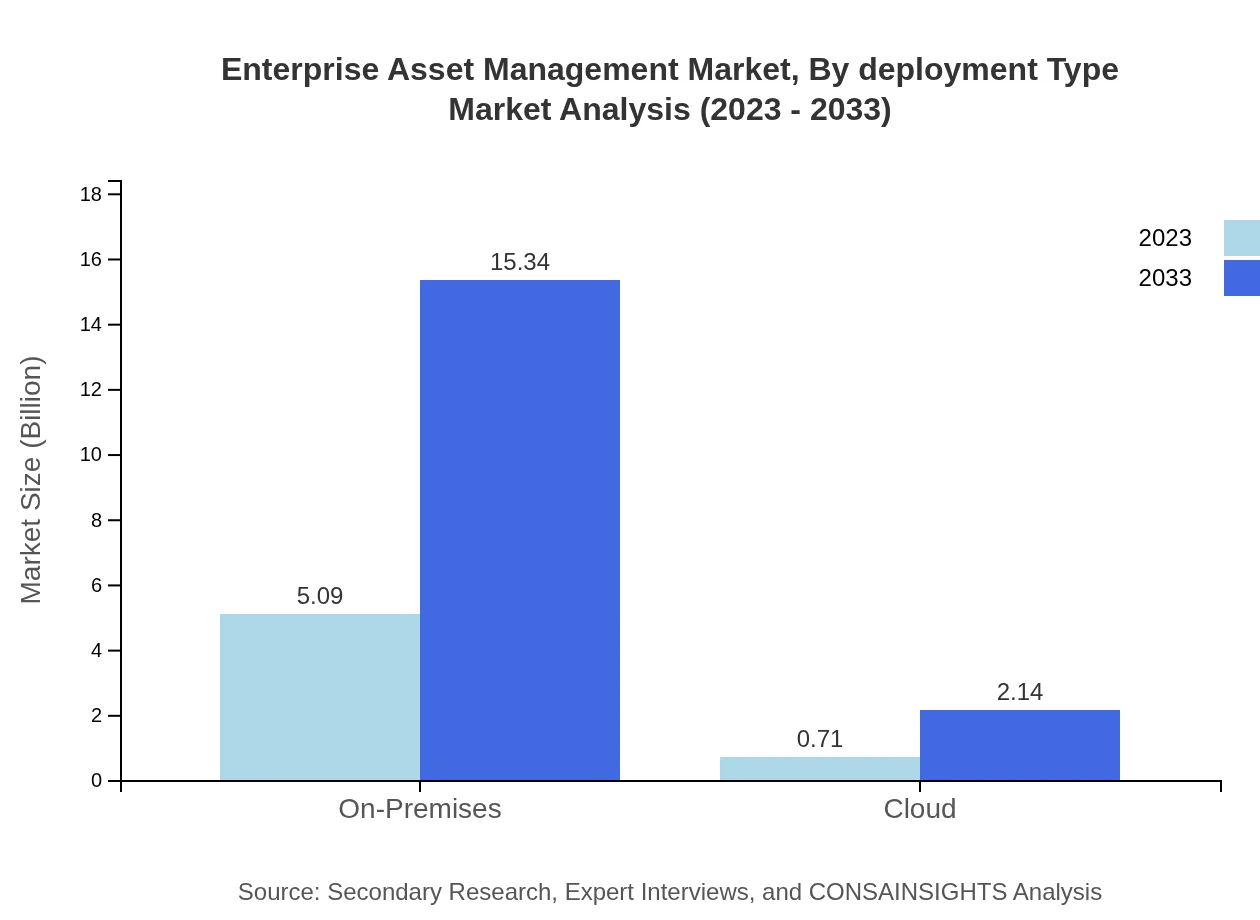

Enterprise Asset Management Market Analysis By Deployment Type

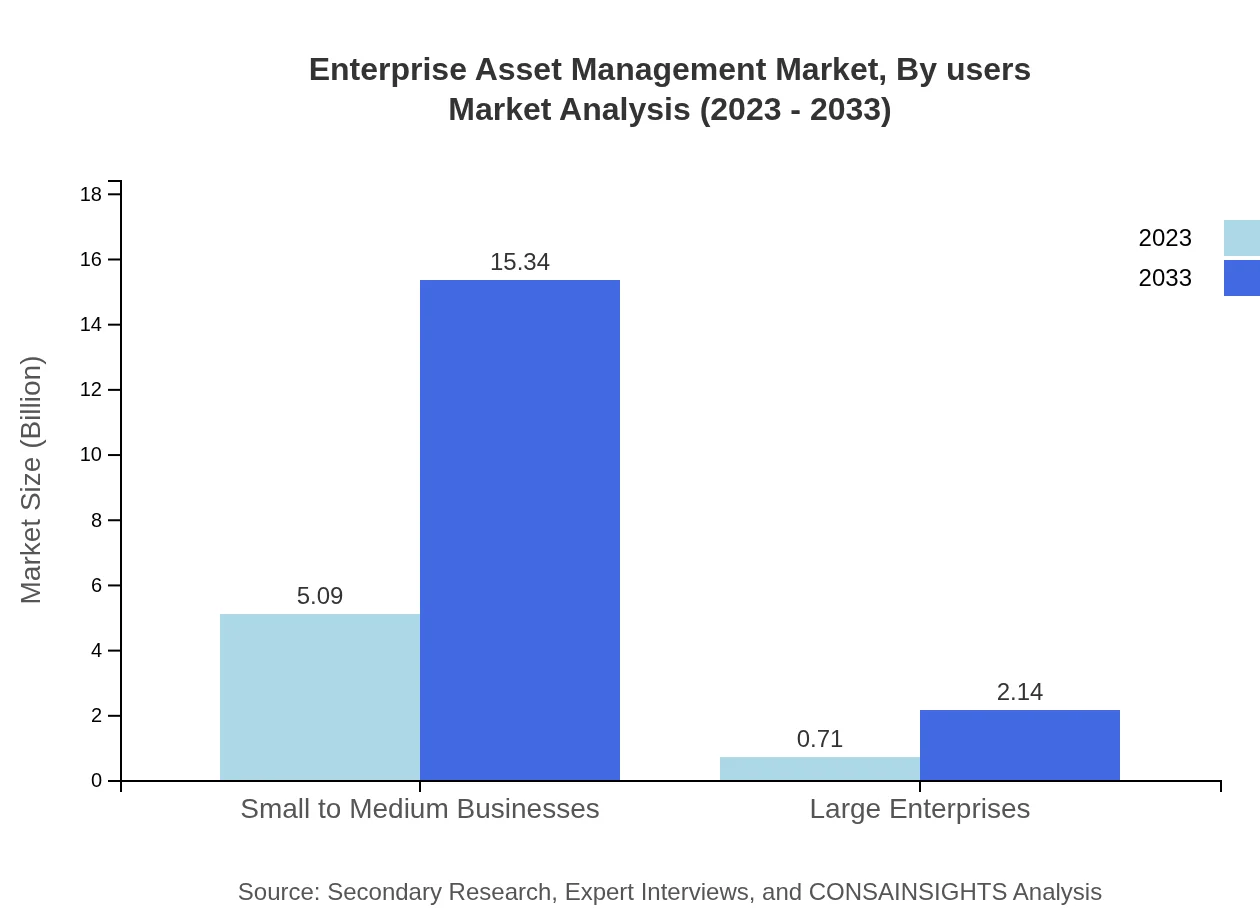

In terms of deployment type, the on-premises model holds a significant share during 2023, accounting for approximately 87.78%. However, cloud-based EAM solutions are expected to see rapid growth, increasing from $0.71 billion in 2023 to $2.14 billion by 2033, driven by organizations seeking flexibility and reduced IT infrastructure costs.

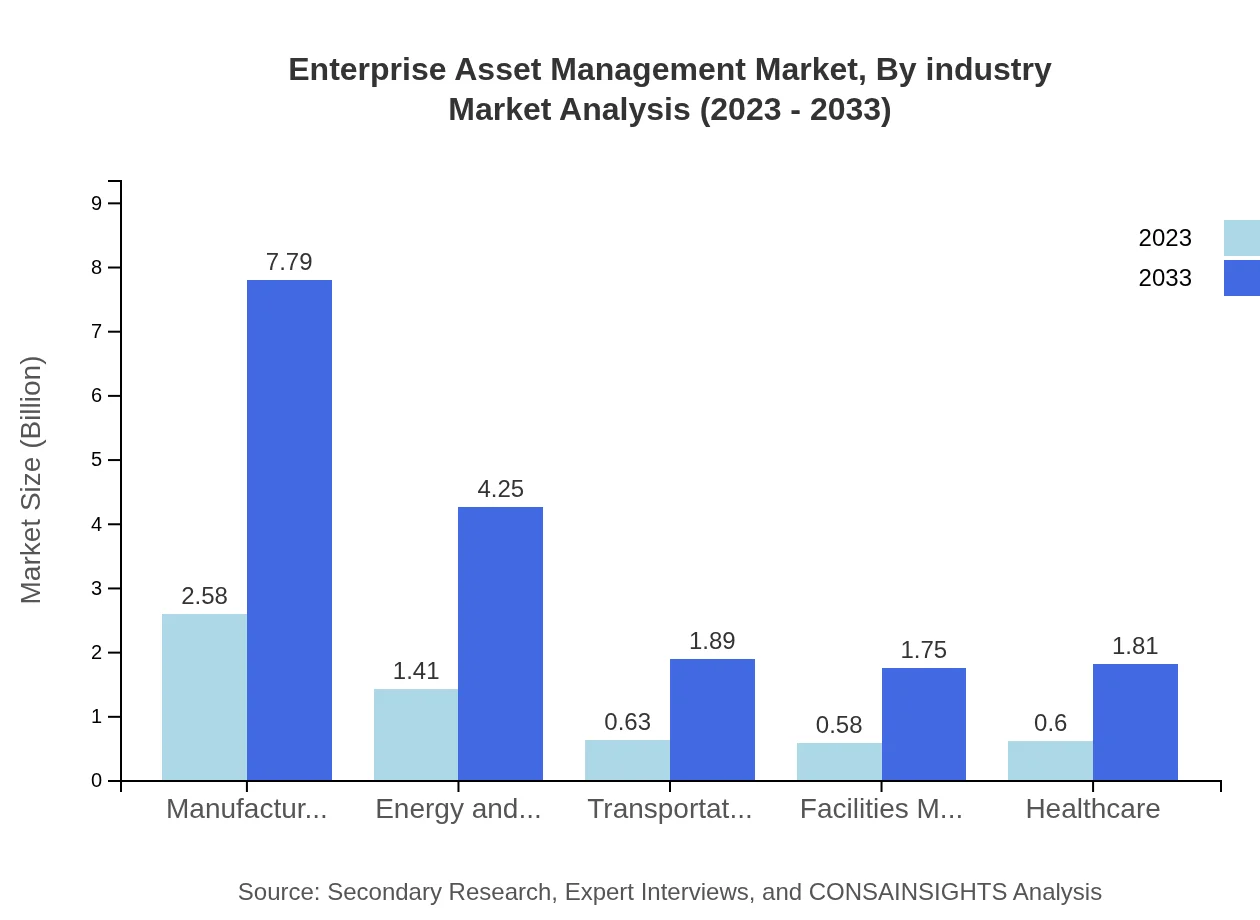

Enterprise Asset Management Market Analysis By Industry

The manufacturing sector is the leading user of EAM solutions, with a market share of 44.55%. As industries focus on optimizing operations, manufacturing EAM is projected to grow from $2.58 billion in 2023 to $7.79 billion by 2033. The energy and utilities sectors will also contribute significantly, increasing from $1.41 billion to $4.25 billion in the same timeframe.

Enterprise Asset Management Market Analysis By Region Application

The applications of EAM span across various functionalities, with work order management, inventory management, and asset maintenance leading in demand. Notably, work order management is anticipated to hold 10.01% of the market share in 2023. These applications address specific operational needs of businesses, supporting asset coordination and efficiency.

Enterprise Asset Management Market Analysis By Users

The user type segmentation reveals that small to medium businesses dominate the market, with a market share of 87.78%. The focus on scalable EAM solutions is primarily driving this segment, as these businesses leverage technology to enhance their asset management capabilities. Conversely, large enterprises are also growing their share in the EAM market, with projected growth leading to a total of $2.14 billion.

Enterprise Asset Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Asset Management Industry

IBM Corporation:

IBM offers a comprehensive EAM solution that leverages Watson IoT for asset optimization and predictive maintenance, enhancing operational efficiency across industries.SAP SE:

SAP provides enterprise-grade EAM solutions that integrate seamlessly with ERP systems, enabling better tracking and performance management for assets.Oracle Corporation:

Oracle's EAM solutions focus on providing cloud capabilities, enabling organizations to better manage assets and enhance decision-making through data analytics.Infor:

Infor delivers industry-specific EAM solutions that cater to manufacturing and healthcare, emphasizing the need for operational efficiency and compliance.IFS:

IFS specializes in EAM solutions that cater to the aerospace and defense, utilities, and manufacturing sectors, enhancing asset lifecycle management.We're grateful to work with incredible clients.

FAQs

What is the market size of Enterprise Asset Management?

The Enterprise Asset Management market is projected to grow from $5.8 billion in 2023 to significant levels by 2033, exhibiting a compound annual growth rate (CAGR) of 11.2%. This reflects a robust expansion trajectory over the next decade.

What are the key market players or companies in the Enterprise Asset Management industry?

The Enterprise Asset Management industry includes major players such as IBM, SAP, Oracle, and Infor. These companies lead in innovation and technology development, driving competition and enhancements in asset management solutions.

What are the primary factors driving the growth in the Enterprise Asset Management industry?

Key growth factors include increasing automation in asset management, the rise of IoT for real-time asset tracking, and the need for cost reduction and efficiency. Additionally, regulatory compliance and sustainability initiatives also propel market demand.

Which region is the fastest Growing in the Enterprise Asset Management?

The North American region is witnessing rapid growth, projected to increase from $1.99 billion in 2023 to $6.01 billion by 2033. Europe and Asia Pacific also show significant growth, indicating a thriving global market.

Does ConsaInsights provide customized market report data for the Enterprise Asset Management industry?

Yes, ConsaInsights offers tailored market report data for the Enterprise Asset Management industry, allowing businesses to gain specific insights relevant to their operational needs and strategic planning.

What deliverables can I expect from this Enterprise Asset Management market research project?

Expect comprehensive insights including market size analysis, growth forecasts, competitive landscape, regional breakdowns, and detailed segment data. This will aid in informed decision-making and strategic planning.

What are the market trends of Enterprise Asset Management?

Current trends include increased adoption of cloud-based solutions, focus on asset performance management, enhanced analytics capabilities, and integration of AI. Businesses are prioritizing flexibility and real-time data accessibility in asset management.