Enterprise Firewall Market Report

Published Date: 31 January 2026 | Report Code: enterprise-firewall

Enterprise Firewall Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Firewall market, covering insights into market trends, sizes, and growth forecasts from 2023 to 2033, along with a segmented analysis by product, deployment mode, end-user industry, and implementation type.

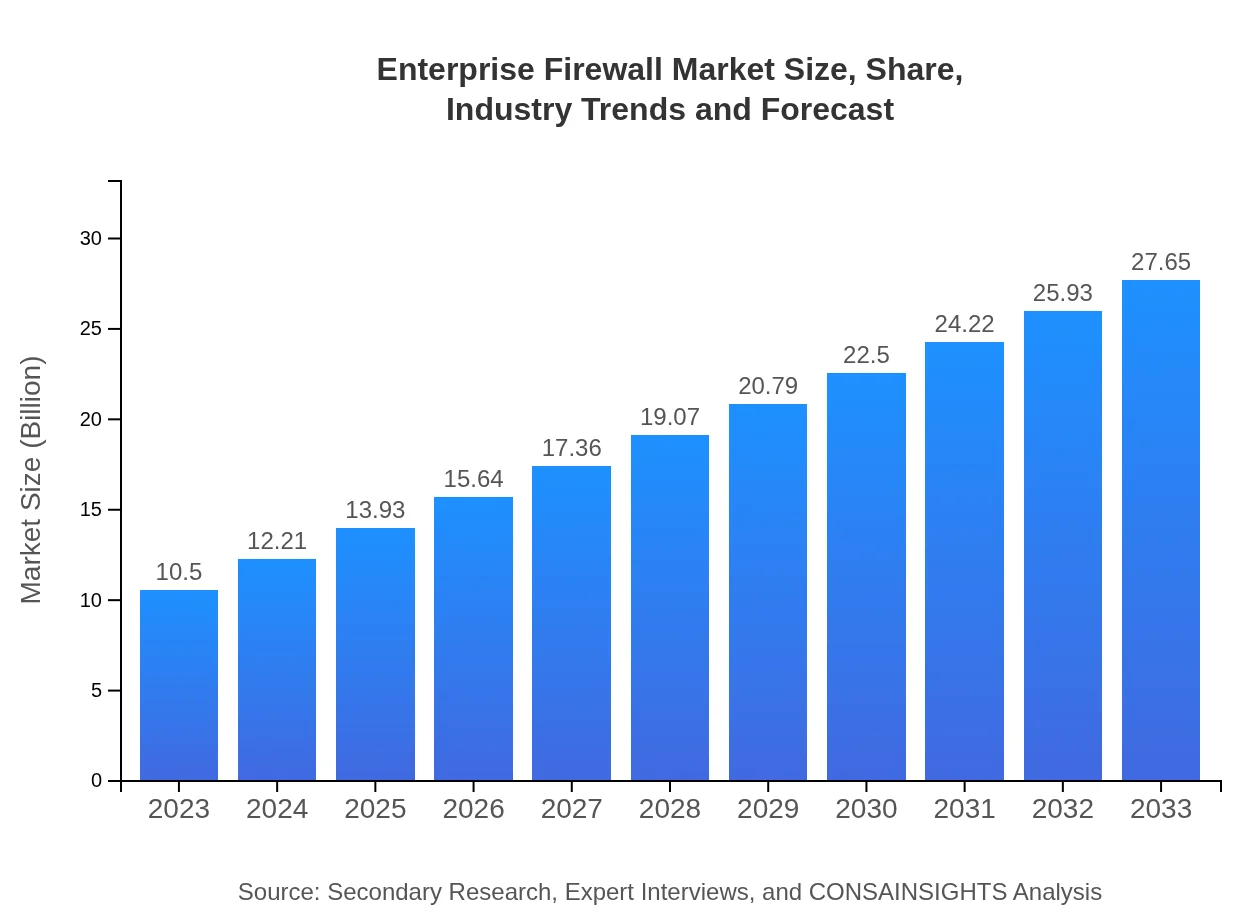

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $27.65 Billion |

| Top Companies | Palo Alto Networks, Cisco, Check Point Software Technologies, Fortinet, Barracuda Networks |

| Last Modified Date | 31 January 2026 |

Enterprise Firewall Market Overview

Customize Enterprise Firewall Market Report market research report

- ✔ Get in-depth analysis of Enterprise Firewall market size, growth, and forecasts.

- ✔ Understand Enterprise Firewall's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Firewall

What is the Market Size & CAGR of the Enterprise Firewall market in 2023?

Enterprise Firewall Industry Analysis

Enterprise Firewall Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Firewall Market Analysis Report by Region

Europe Enterprise Firewall Market Report:

Europe's market is estimated to grow from $3.26 billion in 2023 to $8.57 billion by 2033, attributed to stringent regulations such as GDPR necessitating robust cybersecurity measures. Enterprises across sectors are seeking effective firewall solutions to mitigate risks associated with data privacy and compliance issues.Asia Pacific Enterprise Firewall Market Report:

In the Asia Pacific region, the market is projected to grow from $2.01 billion in 2023 to $5.29 billion by 2033. The rapid digitalization in countries like India and China, coupled with increasing government regulations regarding data protection, is fuelling this growth. Enterprises are investing in both hardware and software firewall solutions to secure their networks amidst growing cyber threats.North America Enterprise Firewall Market Report:

North America is leading the market with a valuation expected to grow from $3.62 billion in 2023 to $9.52 billion by 2033. The presence of major cybersecurity firms, coupled with a high rate of IT spending and increasing incidents of data breaches, is driving market expansion. Additionally, the trend towards hybrid cloud solutions promotes investment in next-generation firewall technologies.South America Enterprise Firewall Market Report:

South America is expected to witness growth from $0.66 billion in 2023 to $1.74 billion by 2033. This growth can be attributed to the rising awareness around cybersecurity as businesses increasingly face sophisticated cyberattacks. The focus on strengthening cybersecurity measures in industries such as BFSI and government sectors is leading to greater investments.Middle East & Africa Enterprise Firewall Market Report:

The Middle East and Africa market size is projected to increase from $0.96 billion in 2023 to $2.52 billion by 2033. The expansion of digital platforms and cloud services in this region is prompting businesses to adopt advanced firewall solutions. Furthermore, the focus on improving infrastructure security against emerging threats is driving growth.Tell us your focus area and get a customized research report.

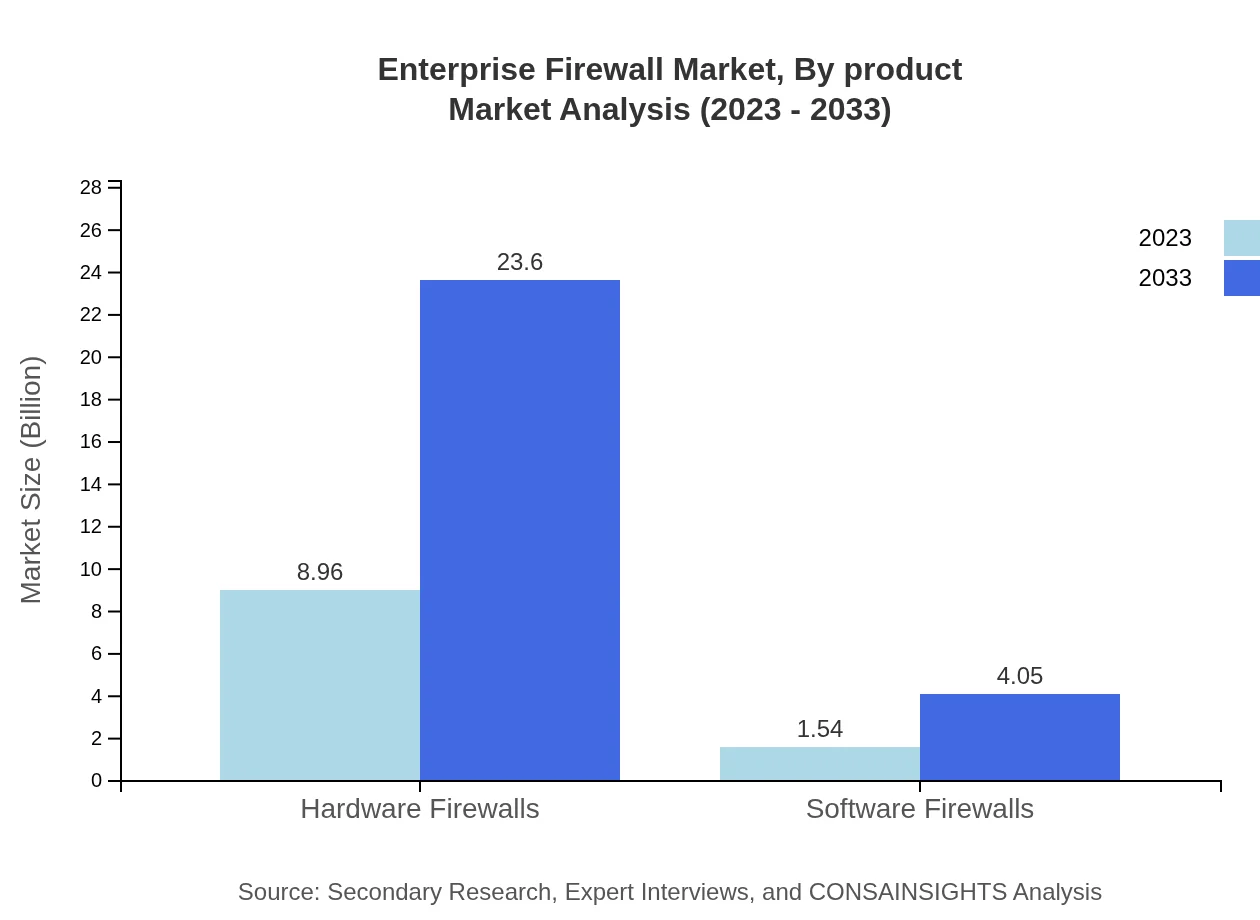

Enterprise Firewall Market Analysis By Product

The Enterprise Firewall market is divided into two main product categories: Hardware Firewalls and Software Firewalls. Hardware Firewalls are projected to constitute the majority of the market, growing from a value of $8.96 billion in 2023 to $23.60 billion by 2033, maintaining a market share of 85.35%. Software Firewalls are also expected to grow during this period, increasing from $1.54 billion in 2023 to $4.05 billion by 2033, representing a market share of 14.65%.

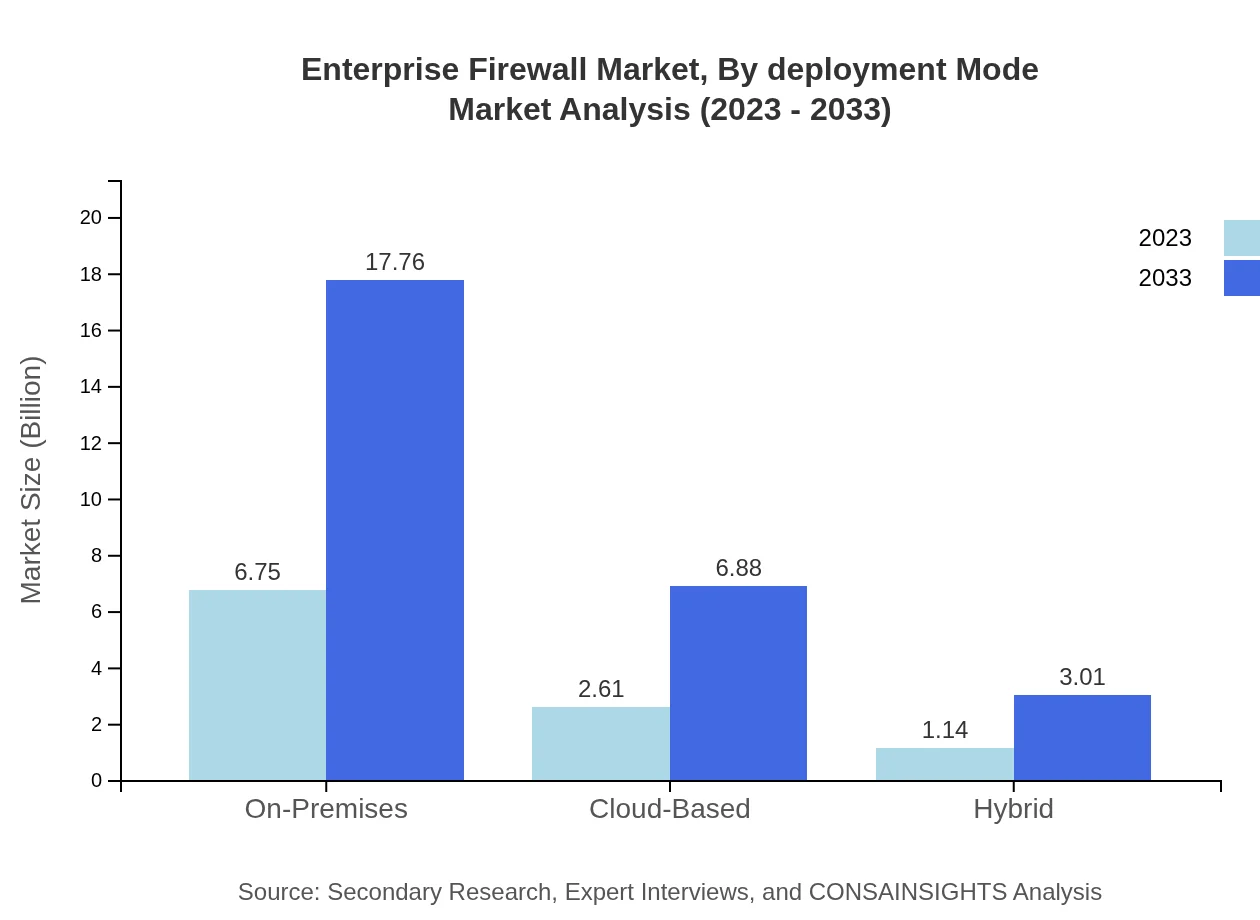

Enterprise Firewall Market Analysis By Deployment Mode

With increasing preferences for flexible solutions, the deployment mode is categorized into On-Premises, Cloud-Based, and Hybrid. The On-Premises firewalls segment leads with an expected market value increase from $6.75 billion to $17.76 billion by 2033, constituting 64.25% of the market. The Cloud-Based segment is also gaining traction, with growth projected from $2.61 billion to $6.88 billion, holding a market share of 24.88%. Hybrid deployments, while smaller, are showing growth potential as businesses adopt a mixed approach to security.

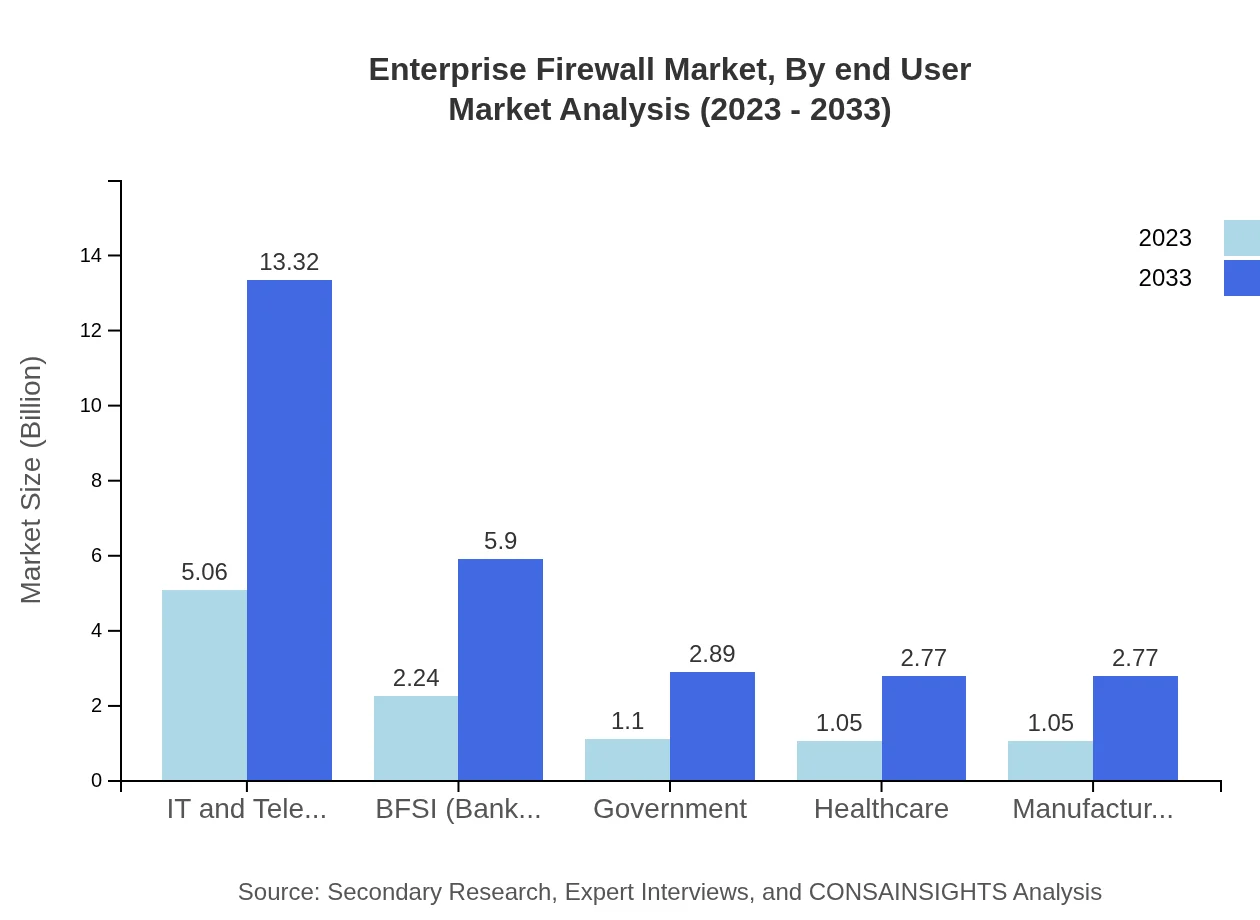

Enterprise Firewall Market Analysis By End User

The Enterprise Firewall market is significantly influenced by various industry sectors, including IT & Telecom, BFSI, Government, Healthcare, and Manufacturing. IT & Telecom leads the market with a size expected to increase from $5.06 billion to $13.32 billion by 2033, capturing 48.16% of the market share. The BFSI sector follows, growing from $2.24 billion to $5.90 billion, representing a share of 21.33%. Other sectors such as Healthcare and Government are also projected to grow, although at a slower rate.

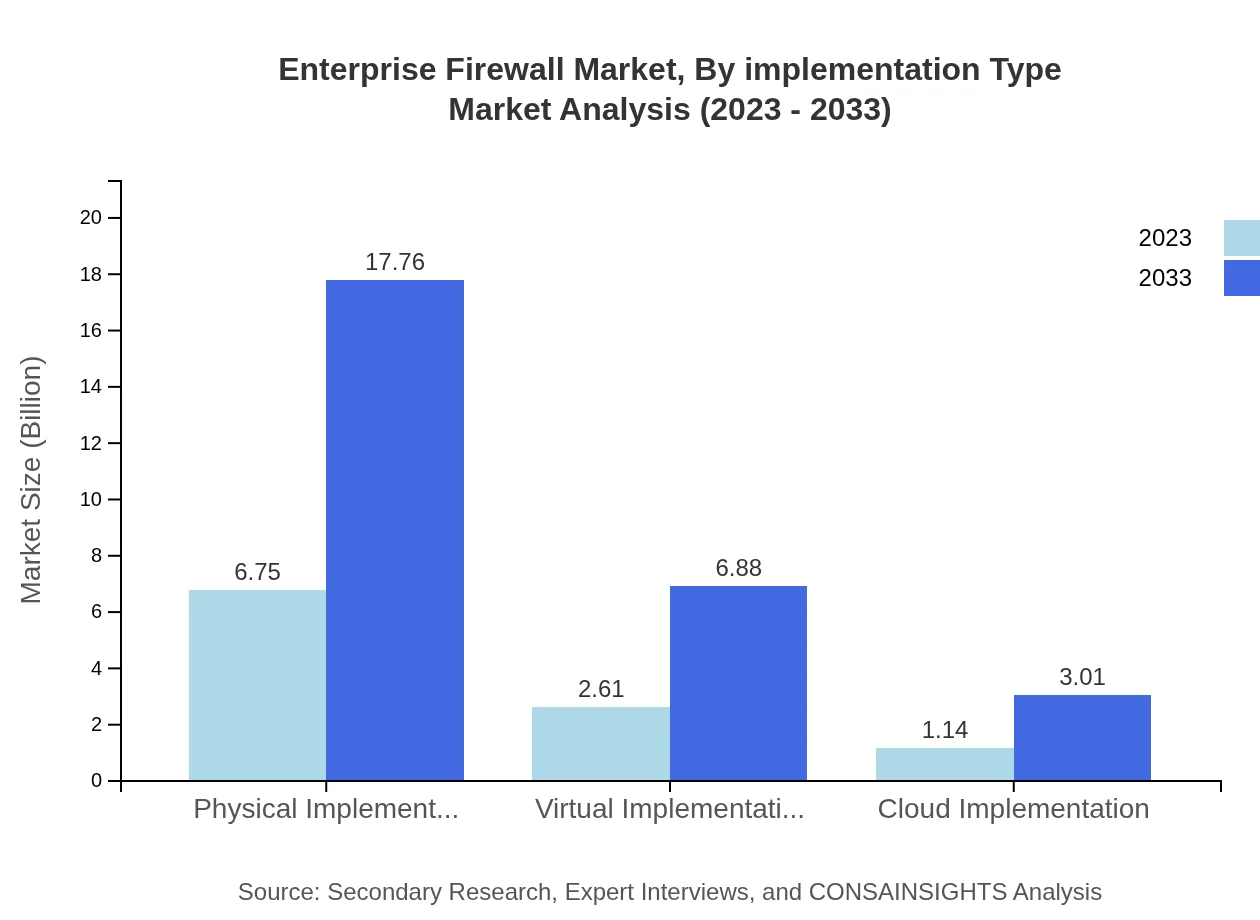

Enterprise Firewall Market Analysis By Implementation Type

The implementation type of firewalls falls under Physical, Virtual, and Cloud implementations. Physical implementation dominates the market, with a growth forecast from $6.75 billion to $17.76 billion, maintaining a consistent share of 64.25%. Virtual implementations, which emphasize flexibility and cost-efficient solutions, are projected to grow from $2.61 billion to $6.88 billion, accounting for 24.88% of the market. Cloud implementations are also gaining attention as enterprises shift towards cloud infrastructures, expected to grow from $1.14 billion to $3.01 billion.

Enterprise Firewall Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Firewall Industry

Palo Alto Networks:

A leader in next-generation cybersecurity, offering a comprehensive range of firewall solutions that integrate advanced security features with cloud-delivered applications.Cisco:

Known for its extensive networking hardware and software solutions, Cisco provides robust firewall offerings that protect enterprise networks from sophisticated threats.Check Point Software Technologies:

Provides innovative cybersecurity solutions, including firewalls, designed to protect against cyber threats while ensuring compliance with global regulations.Fortinet:

Delivers high-performance and comprehensive security solutions, including advanced firewalls that support various deployment models, catering to enterprise needs.Barracuda Networks:

Focuses on providing cloud-enabled security, including firewall solutions that are known for their ease of use and efficiency in protecting against malware and threats.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Firewall?

The global enterprise firewall market is projected to grow from $10.5 billion in 2023 to a significant size over the next decade, with a compound annual growth rate (CAGR) of 9.8%. This growth highlights the increasing demand for robust cybersecurity solutions.

What are the key market players or companies in the enterprise Firewall industry?

Key players in the enterprise firewall market include Palo Alto Networks, Fortinet, Cisco Systems, Check Point Software Technologies, and Sophos. These companies have established strong footholds with innovative solutions and broad customer bases.

What are the primary factors driving the growth in the enterprise Firewall industry?

The growth of the enterprise firewall market is driven by increasing cyber threats, rising awareness about cybersecurity, regulatory compliance requirements, and the shift towards cloud-based solutions and remote work environments that necessitate enhanced security measures.

Which region is the fastest Growing in the enterprise Firewall market?

The North America region leads in the enterprise firewall market growth, projected to rise from $3.62 billion in 2023 to $9.52 billion in 2033. Europe's market is also significant, growing from $3.26 billion to $8.57 billion in the same period.

Does ConsaInsights provide customized market report data for the enterprise Firewall industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise firewall industry. This ensures clients receive insights relevant to their unique market dynamics and competitive landscape.

What deliverables can I expect from this enterprise Firewall market research project?

The deliverables for the enterprise firewall market research project include detailed market analysis, competitive landscape assessment, segmental performance insights, region-specific data, and actionable recommendations based on the latest industry trends.

What are the market trends of enterprise Firewall?

Market trends in the enterprise firewall industry include a shift towards integrated security solutions, the rising adoption of cloud-based firewalls, an emphasis on AI and machine learning for threat detection, and increasing investments in regulatory compliance initiatives.