Enterprise Flash Storage Market Report

Published Date: 31 January 2026 | Report Code: enterprise-flash-storage

Enterprise Flash Storage Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Flash Storage market, covering key insights, trends, and projections from 2023 to 2033. It includes market size estimates, segmentation, regional analysis, and future growth forecasts.

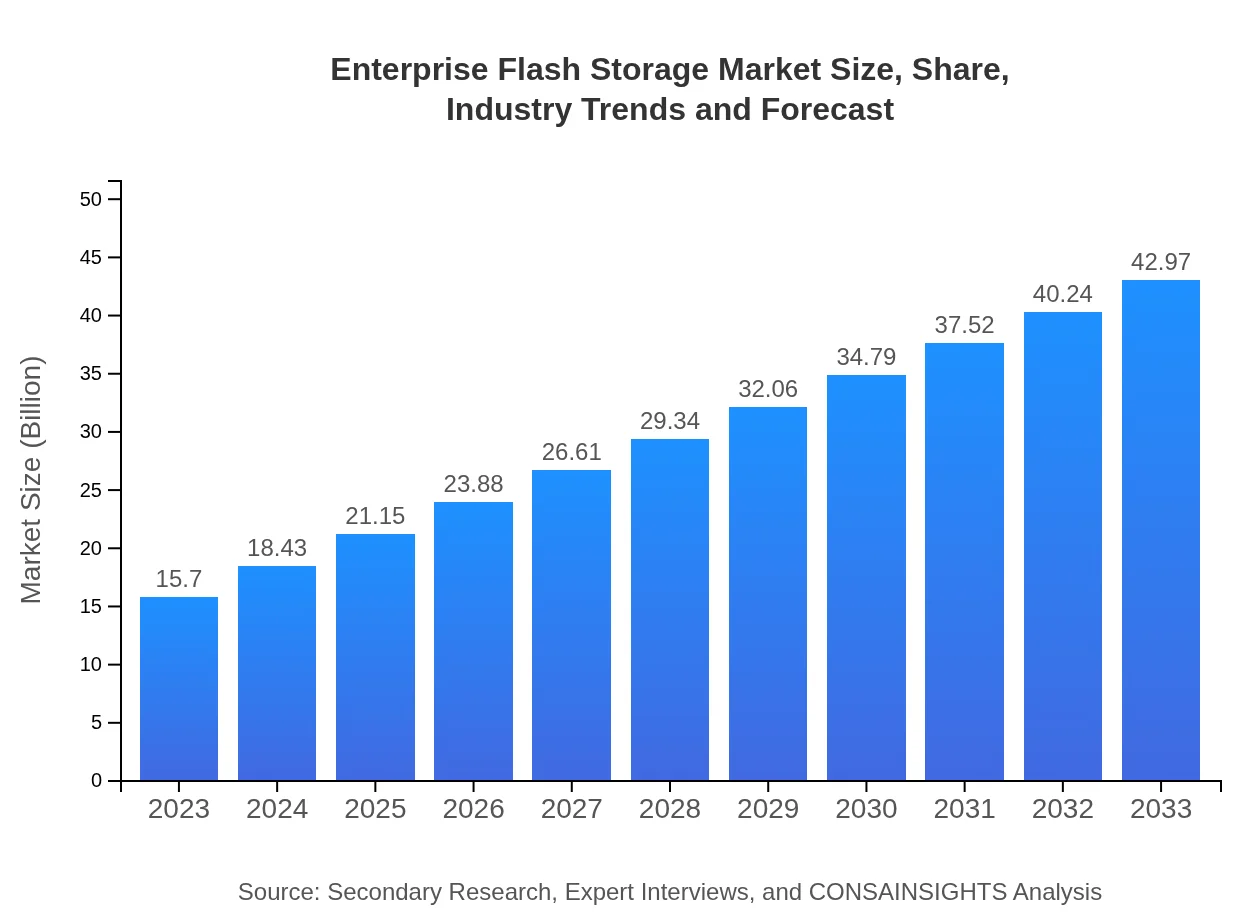

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.70 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $42.97 Billion |

| Top Companies | Samsung Electronics, Western Digital Corporation, Intel Corporation, Micron Technology, SanDisk |

| Last Modified Date | 31 January 2026 |

Enterprise Flash Storage Market Overview

Customize Enterprise Flash Storage Market Report market research report

- ✔ Get in-depth analysis of Enterprise Flash Storage market size, growth, and forecasts.

- ✔ Understand Enterprise Flash Storage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Flash Storage

What is the Market Size & CAGR of Enterprise Flash Storage market in 2023?

Enterprise Flash Storage Industry Analysis

Enterprise Flash Storage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Flash Storage Market Analysis Report by Region

Europe Enterprise Flash Storage Market Report:

In Europe, the market is projected to grow from $4.24 billion in 2023 to $11.61 billion by 2033. The increasing regulatory requirements related to data storage and management, along with the growing trend of digitalization among enterprises, are significant growth factors in this region.Asia Pacific Enterprise Flash Storage Market Report:

In the Asia Pacific region, the Enterprise Flash Storage market is forecasted to grow from $2.99 billion in 2023 to $8.18 billion by 2033, driven by increasing IT investments and demand for high-speed storage solutions in countries like China and India. The proliferation of cloud services and digital transformation initiatives in businesses is further propelling market growth.North America Enterprise Flash Storage Market Report:

North America holds a significant market share, expected to expand from $6.07 billion in 2023 to $16.61 billion by 2033. This growth is primarily driven by technology leaders and early adopters of flash storage technology, extensive research and development efforts, and a robust infrastructure to support data centers and cloud services.South America Enterprise Flash Storage Market Report:

The South American market for Enterprise Flash Storage is expected to rise from $0.79 billion in 2023 to $2.17 billion by 2033. The growth is attributed to the increasing number of small to medium enterprises adopting advanced storage solutions to manage the growing volume of data. Government initiatives to improve digital infrastructure also contribute to market expansion.Middle East & Africa Enterprise Flash Storage Market Report:

The Middle East and Africa market is forecasted to increase from $1.61 billion in 2023 to $4.40 billion by 2033. The development of smart cities and investments in technological advancements in the region are driving demand for innovative storage solutions.Tell us your focus area and get a customized research report.

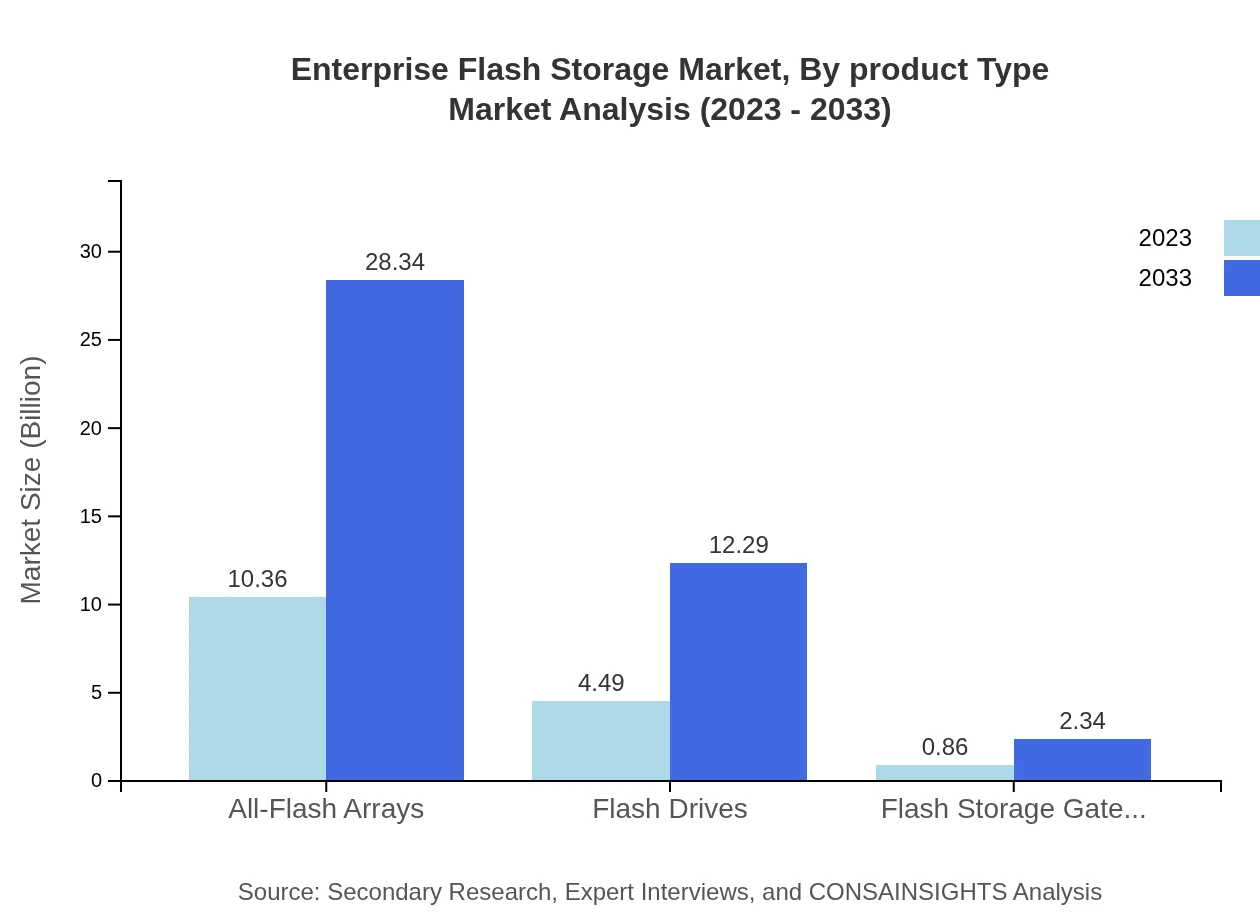

Enterprise Flash Storage Market Analysis By Product Type

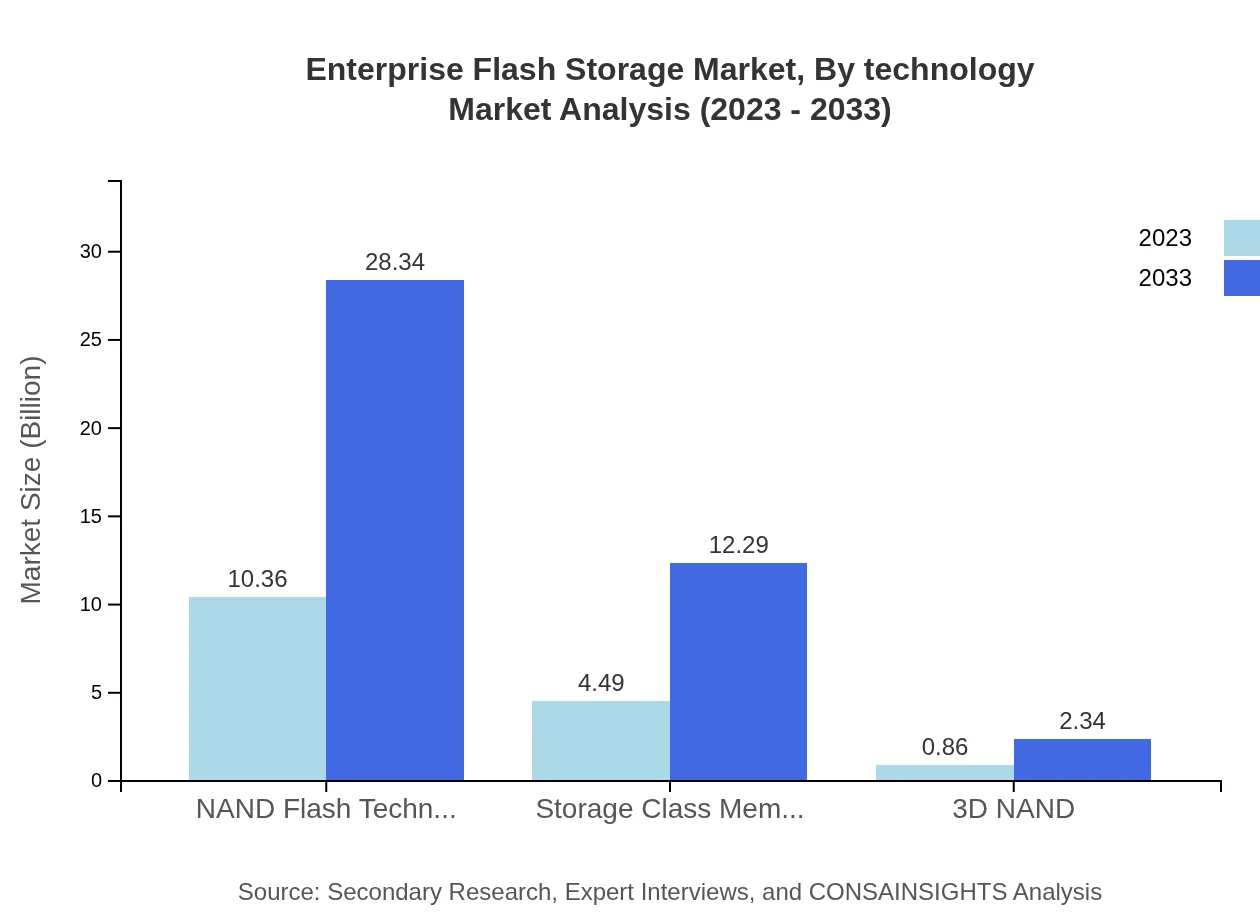

The Enterprise Flash Storage market, segmented by product type, includes technologies such as NAND Flash Technology, Storage Class Memory, 3D NAND, All-Flash Arrays, Flash Drives, and Flash Storage Gateways. NAND Flash holds the largest market share, valued at $10.36 billion in 2023 and projected to grow to $28.34 billion by 2033. Storage Class Memory and All-Flash Arrays also significantly contribute to market dynamics with substantial growth estimates.

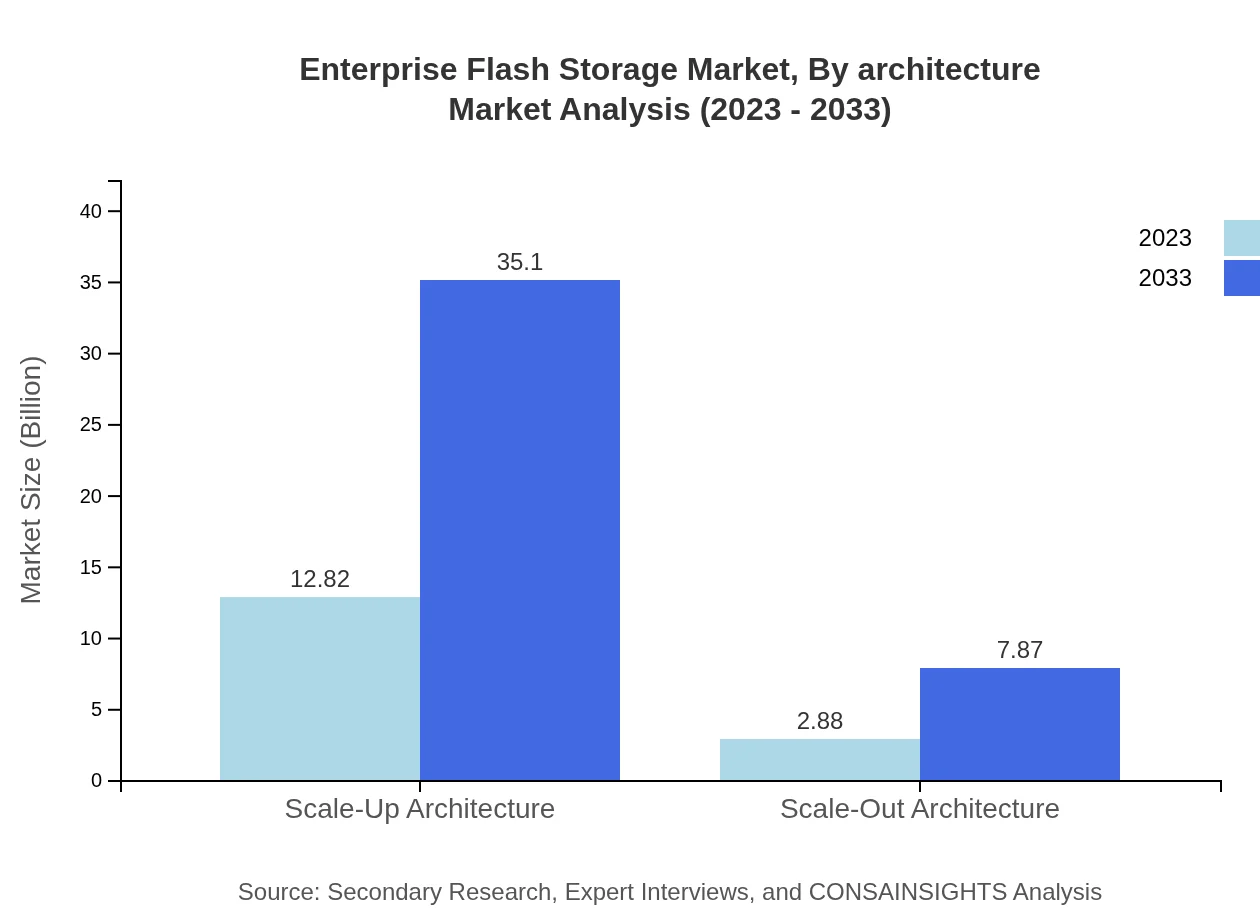

Enterprise Flash Storage Market Analysis By Architecture

Market segmentation by architecture identifies Scale-Up and Scale-Out architectures as essential components. Scale-Up Architecture dominates with a market size of $12.82 billion in 2023, anticipated to reach $35.10 billion by 2033. Scale-Out Architecture, while smaller, is expected to grow from $2.88 billion to $7.87 billion within the same period, emphasizing flexibility and resource management in storage deployments.

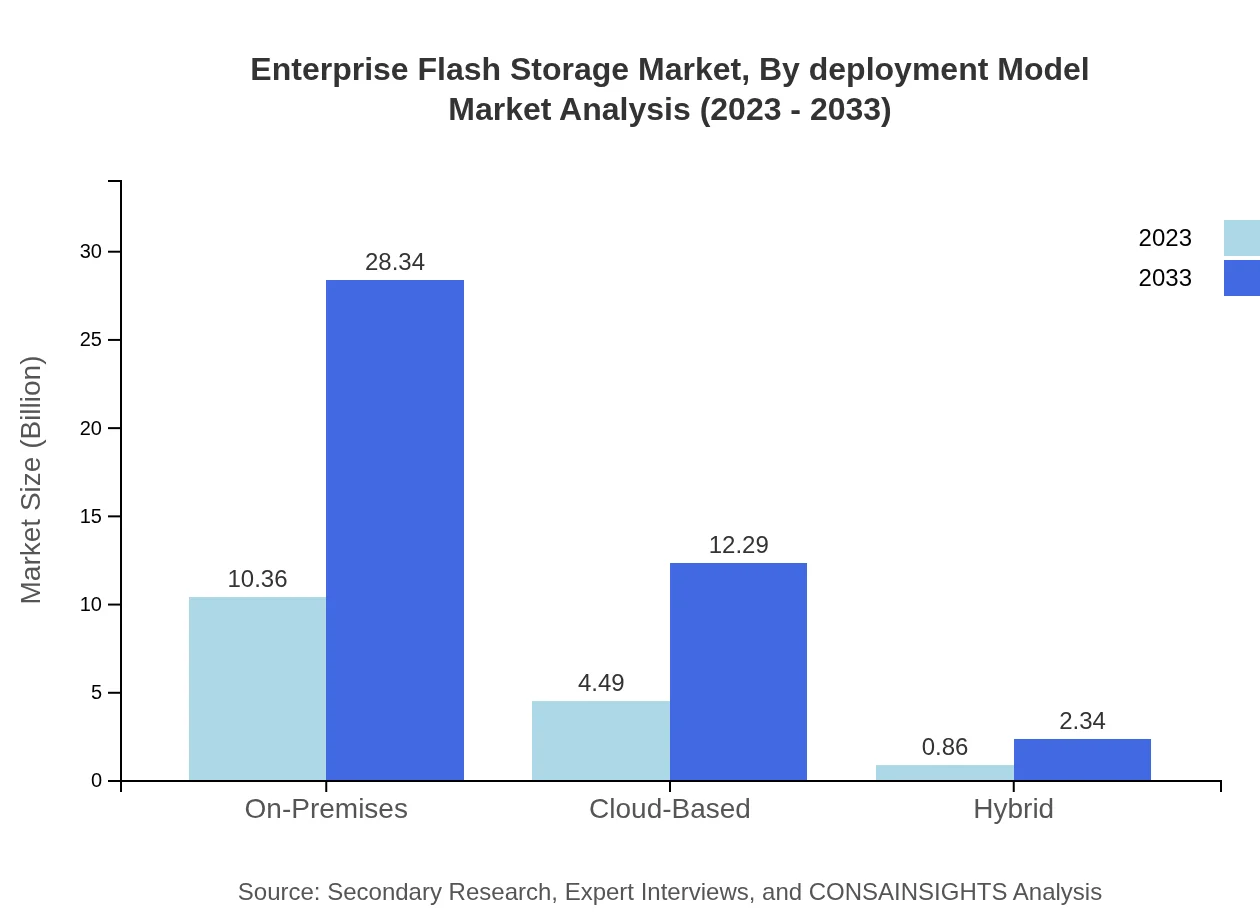

Enterprise Flash Storage Market Analysis By Deployment Model

The analysis of deployment models reveals On-Premises storage to have the highest market share, with $10.36 billion in 2023 and a forecast growth to $28.34 billion by 2033. Cloud-Based solutions follow closely, showcasing a market size of $4.49 billion in 2023, which is expected to rise to $12.29 billion as enterprises continue to migrate toward cloud environments for scalability and flexibility.

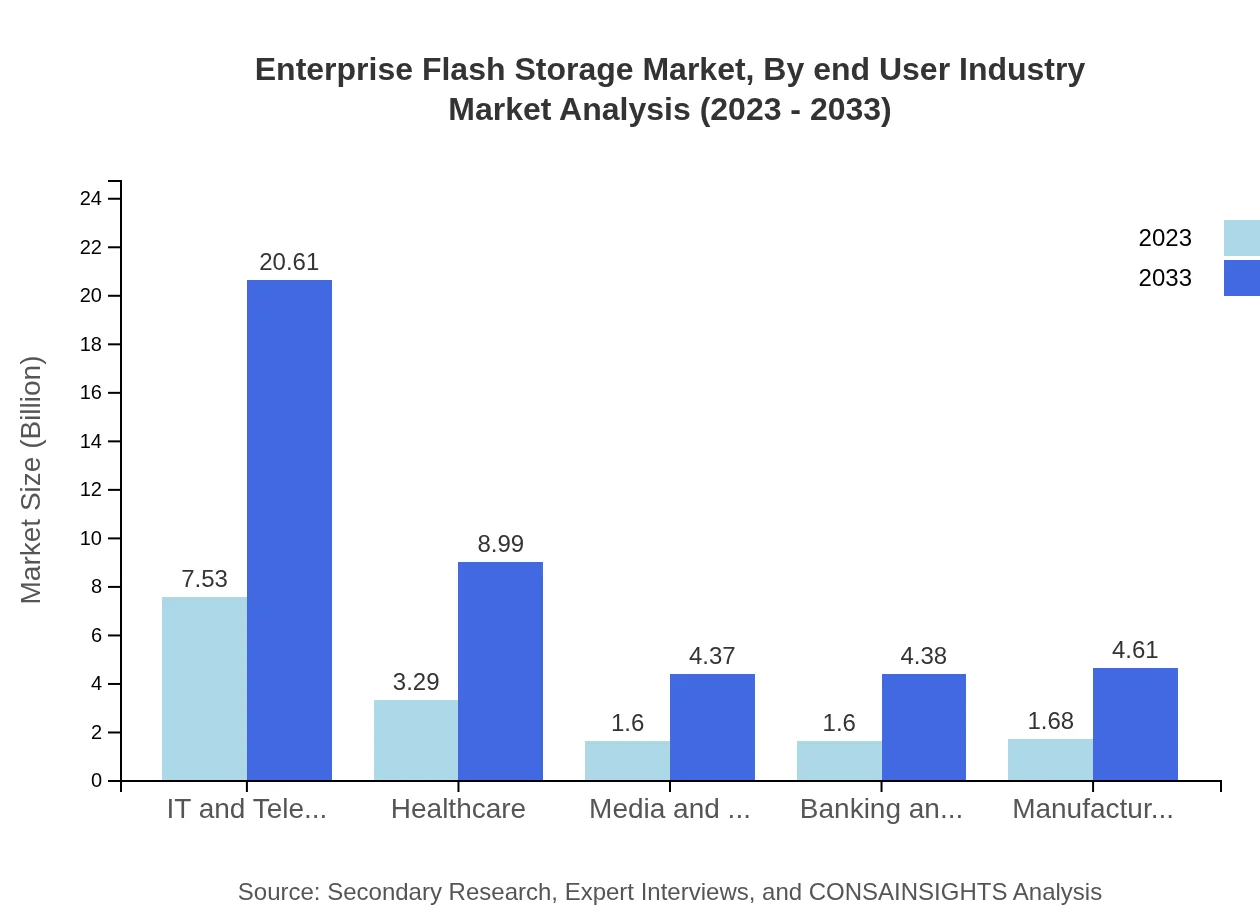

Enterprise Flash Storage Market Analysis By End User Industry

Key end-user industries include IT and Telecom, Healthcare, Media and Entertainment, Banking and Financial Services, and Manufacturing. The IT and Telecom sector leads with a market size of $7.53 billion in 2023, expected to expand to $20.61 billion by 2033. Healthcare and Banking sectors are also significant contributors, reflecting the increasing need for secure and efficient data storage solutions.

Enterprise Flash Storage Market Analysis By Technology

Technologically, the market is led by NAND Flash with a size rising from $10.36 billion to $28.34 billion, maintaining a significant share of 65.96%. Innovations in Storage Class Memory are also noteworthy, showing growth from $4.49 billion to $12.29 billion and representing 28.59% of the market by 2033. Continuous advancements in flash memory technologies are expected to drive further growth in this segment.

Enterprise Flash Storage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Flash Storage Industry

Samsung Electronics:

A leading manufacturer of NAND flash memory and storage technologies, providing innovative solutions for enterprise-level applications.Western Digital Corporation:

Known for its advanced storage solutions, Western Digital offers a wide range of flash storage products targeted at enterprise customers.Intel Corporation:

A key player in the flash memory market, Intel focuses on high-performance memory solutions, driving advancements in enterprise flash storage.Micron Technology:

Specializes in memory and storage solutions, including high-quality flash memory products that serve enterprise and industrial markets.SanDisk:

A pioneer in flash memory technology, SanDisk provides comprehensive flash storage solutions for enterprise applications.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Flash Storage?

The global market size of the enterprise flash storage industry is projected to reach $15.7 billion by 2033 with a CAGR of 10.2%. In 2023, the market is valued at $15.7 billion.

What are the key market players or companies in the enterprise Flash Storage industry?

Key players in the enterprise flash storage market include Dell Technologies, Samsung Electronics, and Western Digital. These companies lead in innovation, storage solutions, and market share globally, driving competition and development in the industry.

What are the primary factors driving the growth in the enterprise Flash Storage industry?

Growth drivers include increasing data generation, demand for high-speed storage solutions, and the adoption of cloud services. Additionally, advancements in NAND flash technology and rising enterprise investment in IT infrastructure fuel market expansion.

Which region is the fastest Growing in the enterprise Flash Storage market?

The Asia Pacific region is the fastest-growing market for enterprise flash storage, expected to grow from $2.99 billion in 2023 to $8.18 billion by 2033, reflecting the rapid technological adoption in various industries.

Does ConsaInsights provide customized market report data for the enterprise Flash Storage industry?

Yes, ConsaInsights offers customized market report data tailored to the enterprise flash storage industry. Clients can request specific insights and tailored analysis to address unique business needs or strategic queries.

What deliverables can I expect from this enterprise Flash Storage market research project?

Deliverables include comprehensive market analysis reports, segmentation data, competitive landscapes, and projections. Clients receive actionable insights and strategic recommendations to inform decision-making and investment planning.

What are the market trends of enterprise Flash Storage?

Current trends include increased adoption of all-flash arrays, growth in hybrid cloud deployments, and rising demand for high-performance storage solutions. Additionally, enhanced focus on security and data management technologies is evident in the market.