Enterprise Governance Risk And Compliance Market Report

Published Date: 31 January 2026 | Report Code: enterprise-governance-risk-and-compliance

Enterprise Governance Risk And Compliance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Governance Risk And Compliance (GRC) market from 2023 to 2033, covering market dynamics, growth forecasts, segmental insights, regional assessments, and the technological advancements shaping the industry.

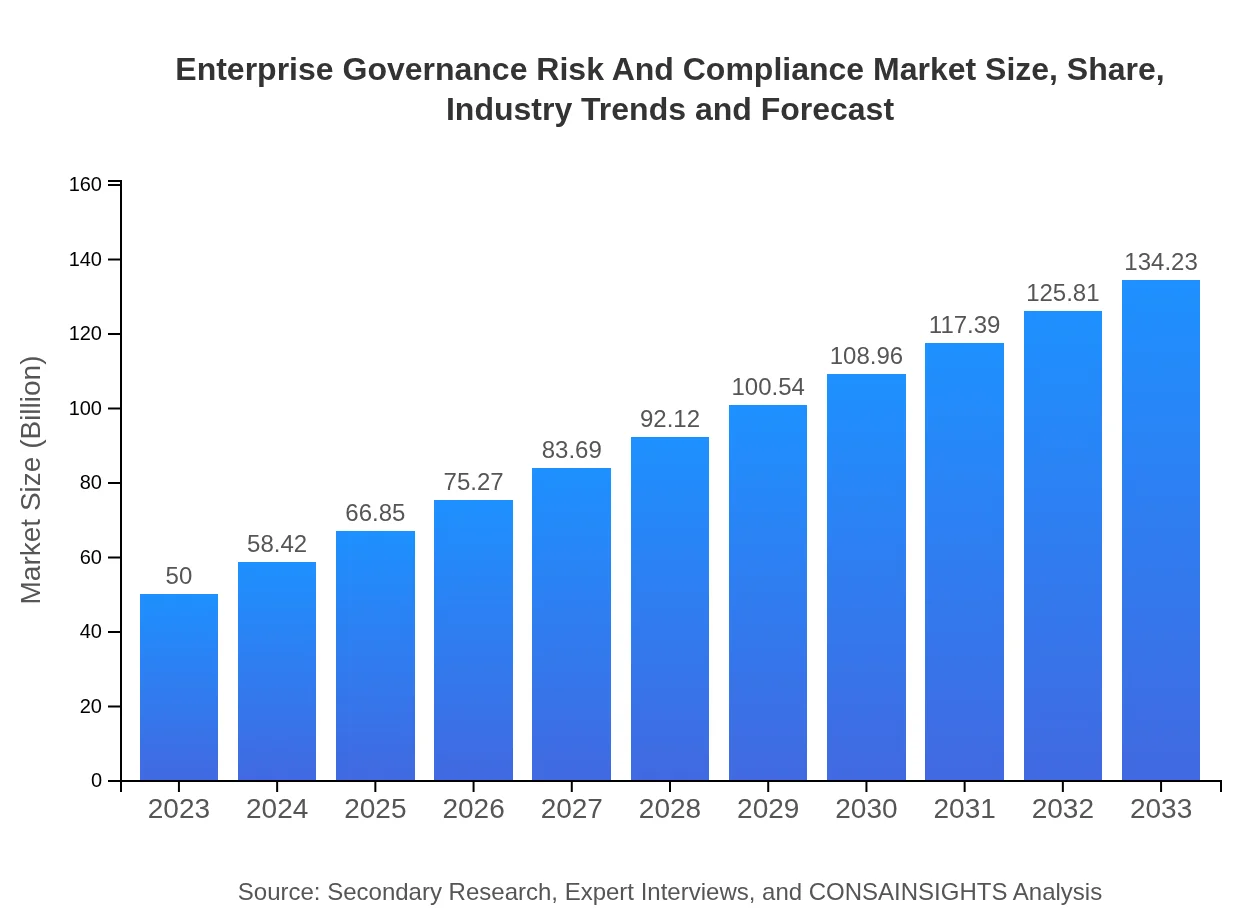

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | SAP SE, IBM Corporation, Oracle Corporation, RSA Security, MetricStream |

| Last Modified Date | 31 January 2026 |

Enterprise Governance Risk And Compliance Market Overview

Customize Enterprise Governance Risk And Compliance Market Report market research report

- ✔ Get in-depth analysis of Enterprise Governance Risk And Compliance market size, growth, and forecasts.

- ✔ Understand Enterprise Governance Risk And Compliance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Governance Risk And Compliance

What is the Market Size & CAGR of Enterprise Governance Risk And Compliance market in 2023?

Enterprise Governance Risk And Compliance Industry Analysis

Enterprise Governance Risk And Compliance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Governance Risk And Compliance Market Analysis Report by Region

Europe Enterprise Governance Risk And Compliance Market Report:

Europe’s GRC market is forecasted to grow from $14.16 billion in 2023 to $38.03 billion by 2033. GDPR is a significant driver of this expansion, with organizations investing heavily in compliance mechanisms. Additionally, the emphasis on corporate governance and sustainability is spurring the adoption of GRC frameworks.Asia Pacific Enterprise Governance Risk And Compliance Market Report:

In the Asia-Pacific region, the Enterprise GRC market is expected to grow from $9.54 billion in 2023 to $25.61 billion by 2033. The rapid growth of digital commerce, coupled with increasing cybersecurity threats, drives demand for robust GRC solutions. Countries such as China and India are witnessing heightened regulatory scrutiny, making GRC essential for compliance and governance.North America Enterprise Governance Risk And Compliance Market Report:

North America is the largest market, expected to escalate from $16.63 billion in 2023 to $44.65 billion by 2033. The driving forces include stringent regulations in the finance and healthcare sectors, alongside the presence of major GRC software firms. Organizations in this region are increasingly leveraging technology to address complex compliance landscapes.South America Enterprise Governance Risk And Compliance Market Report:

The South American market is projected to increase from $3.82 billion in 2023 to $10.27 billion in 2033. The adoption of GRC solutions is on the rise due to growing regulatory frameworks and consumer protection laws, particularly in Brazil and Argentina, where compliance is becoming increasingly critical for businesses.Middle East & Africa Enterprise Governance Risk And Compliance Market Report:

The Middle East and Africa region anticipates growth from $5.84 billion in 2023 to $15.68 billion by 2033. The increasing focus on fiscal governance and risk management in the public and private sectors is fostering a demand for GRC solutions, particularly in the UAE and South Africa, as they strive for global compliance standards.Tell us your focus area and get a customized research report.

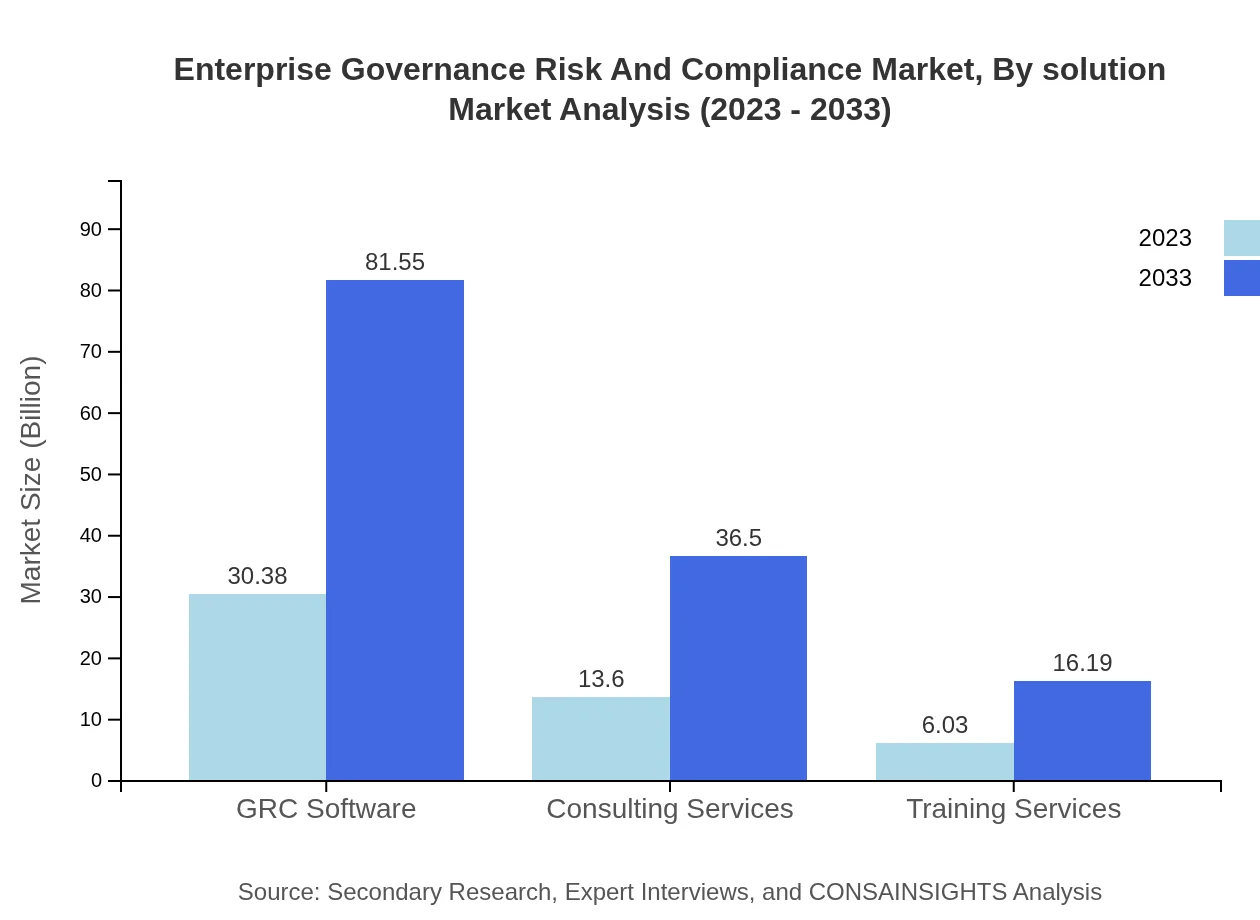

Enterprise Governance Risk And Compliance Market Analysis By Solution

The GRC market by solution is primarily divided into GRC Software and Consulting Services. In 2023, the GRC Software segment holds a substantial market share of approximately 60.75%, expanding from $30.38 billion in 2023 to $81.55 billion in 2033, addressing automation in risk mitigation and compliance processes. Meanwhile, Consulting Services are projected to rise from $13.60 billion to $36.50 billion over the same period, indicating a growing reliance on expert guidance to navigate increasing complexities in compliance.

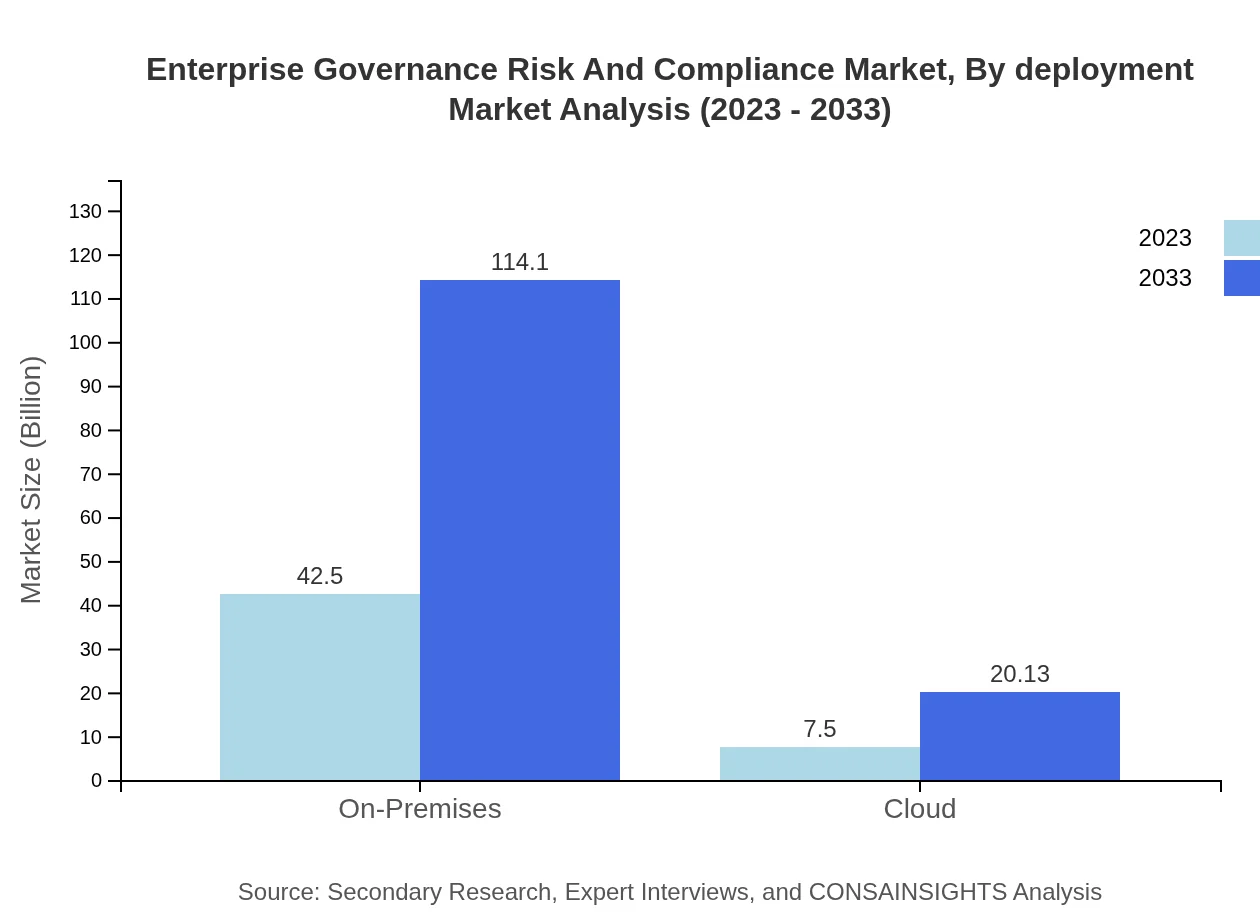

Enterprise Governance Risk And Compliance Market Analysis By Deployment

Market segmentation by deployment type shows a strong preference for On-Premises solutions, accounting for 85% in 2023 and expected to increase from $42.50 billion to $114.10 billion by 2033. However, Cloud-based solutions are gaining traction due to flexibility and cost-effectiveness, growing from $7.50 billion to $20.13 billion by 2033, reflecting an evolving IT landscape.

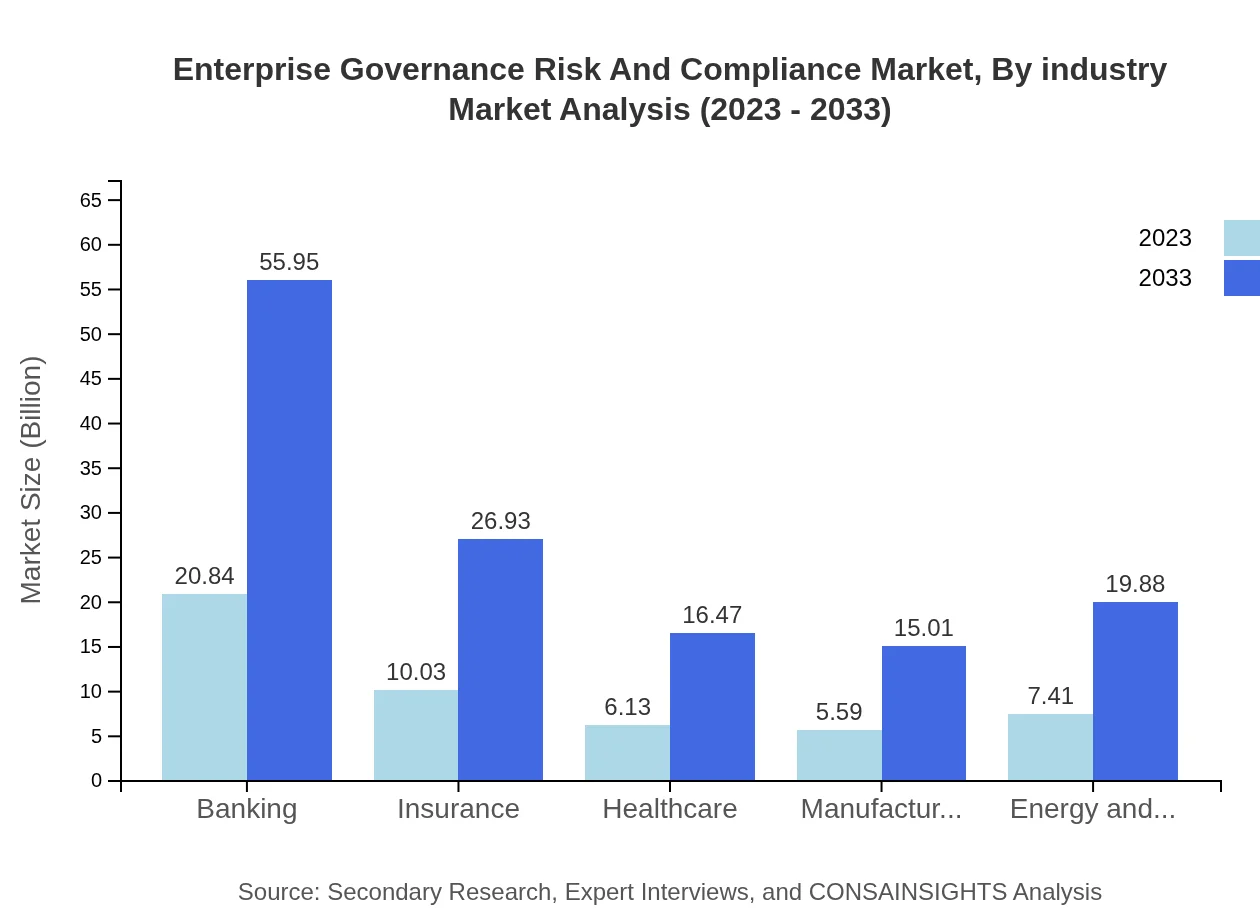

Enterprise Governance Risk And Compliance Market Analysis By Industry

In the industry-specific analysis, Banking holds the largest market share of 41.68% in 2023, forecasted to grow from $20.84 billion to $55.95 billion by 2033. This is followed by the Insurance sector, which is expected to rise from $10.03 billion to $26.93 billion. Healthcare, Manufacturing, and Energy sectors are also expanding their GRC capabilities, indicating a spreading recognition of compliance importance across all industries.

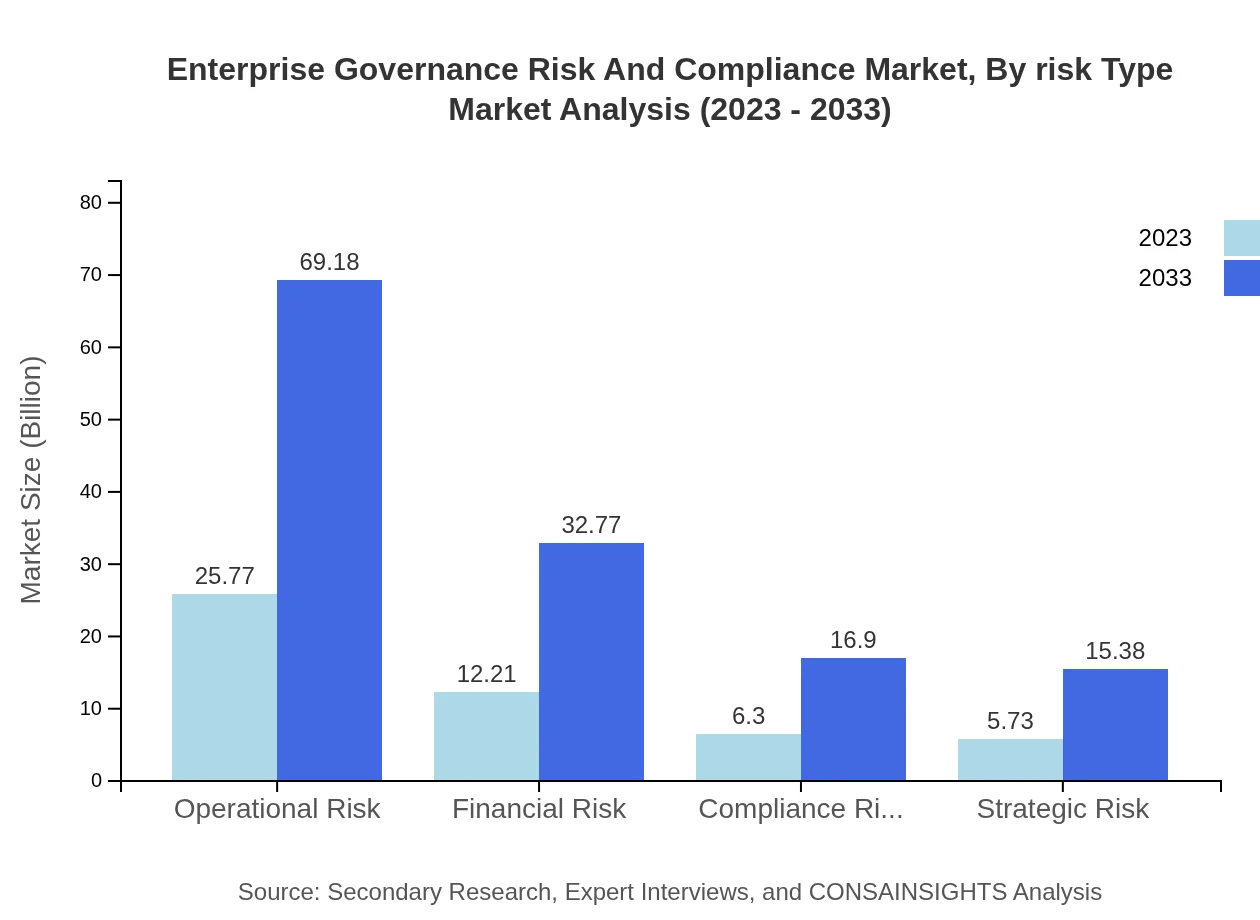

Enterprise Governance Risk And Compliance Market Analysis By Risk Type

The market segmentation by risk type highlights Operational Risk as the predominant segment, valued at $25.77 billion in 2023 and expected to escalate to $69.18 billion by 2033. Financial risk and Compliance risks also contribute significantly, with revenues expected to grow, reflecting organizations’ proactive stances in risk management.

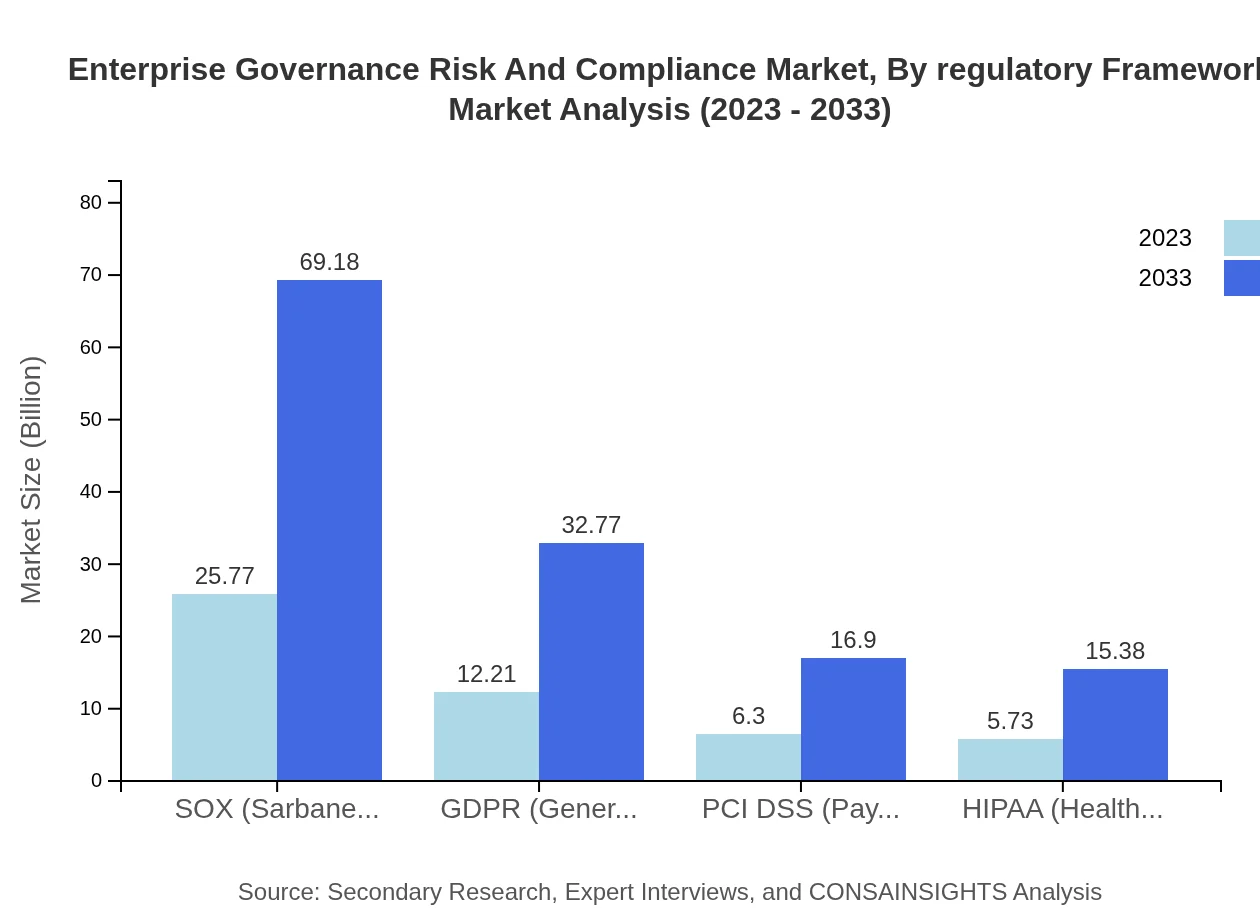

Enterprise Governance Risk And Compliance Market Analysis By Regulatory Framework

Analyzing the market by regulatory framework, SOX (Sarbanes-Oxley Act) leads with a market size of $25.77 billion in 2023, doubling to $69.18 billion by 2033. GDPR also shows robust growth, reflecting the mounting significance of data protection regulations, and is expected to expand from $12.21 billion to $32.77 billion in the same timeframe.

Enterprise Governance Risk And Compliance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Governance Risk And Compliance Industry

SAP SE:

SAP SE offers a comprehensive suite of GRC solutions that integrate with its business software, enabling organizations to streamline compliance processes and manage risk effectively.IBM Corporation:

IBM provides innovative GRC solutions powered by AI, helping organizations automate compliance workflows and enhance risk assessments to meet dynamic regulatory requirements.Oracle Corporation:

Oracle's GRC solutions facilitate real-time risk monitoring and compliance management, enabling organizations to ensure visibility and control over their operations.RSA Security:

RSA Security specializes in integrated risk management solutions that empower organizations to reduce risks associated with governance and compliance.MetricStream:

MetricStream offers cloud-based GRC platforms that optimize governance functions, enhance risk visibility, and improve regulatory compliance across industries.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise governance risk and compliance?

The enterprise governance, risk, and compliance (GRC) market is projected to reach approximately $50 billion by the year 2033, growing at a CAGR of 10% from its current size in 2023.

What are the key market players or companies in the enterprise governance risk and compliance industry?

Key players in the enterprise GRC market include major software vendors and consulting firms that provide cybersecurity, assurance, and compliance solutions, contributing to innovation and market expansion globally.

What are the primary factors driving the growth in the enterprise governance risk and compliance industry?

The growth in the enterprise GRC industry is driven by increasing regulatory pressures, the need for risk management solutions, and the expansion of digital infrastructures requiring compliance adherence across sectors.

Which region is the fastest Growing in the enterprise governance risk and compliance?

The fastest-growing region in the enterprise GRC market is North America, expanding from $16.63 billion in 2023 to $44.65 billion by 2033, followed closely by Asia-Pacific.

Does ConsaInsights provide customized market report data for the enterprise governance risk and compliance industry?

Yes, ConsaInsights offers customized market reports tailored to specific enterprise GRC needs, providing in-depth analysis, data segmentation, and insights based on client requirements.

What deliverables can I expect from this enterprise governance risk and compliance market research project?

Deliverables from the enterprise GRC market research project include comprehensive reports, executive summaries, data analytics dashboards, and market segmentation details showcasing key trends and forecasts.

What are the market trends of enterprise governance risk and compliance?

Current trends in the enterprise GRC market include advancements in cloud solutions, increasing reliance on advanced analytics, and a focus on integrated risk management systems that enhance operational efficiency.