Enterprise Information Archiving Market Report

Published Date: 31 January 2026 | Report Code: enterprise-information-archiving

Enterprise Information Archiving Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Enterprise Information Archiving market, including size, growth patterns, and trends from 2023 to 2033. Insights on regional performance and major industry players are discussed to offer a comprehensive understanding of future directions.

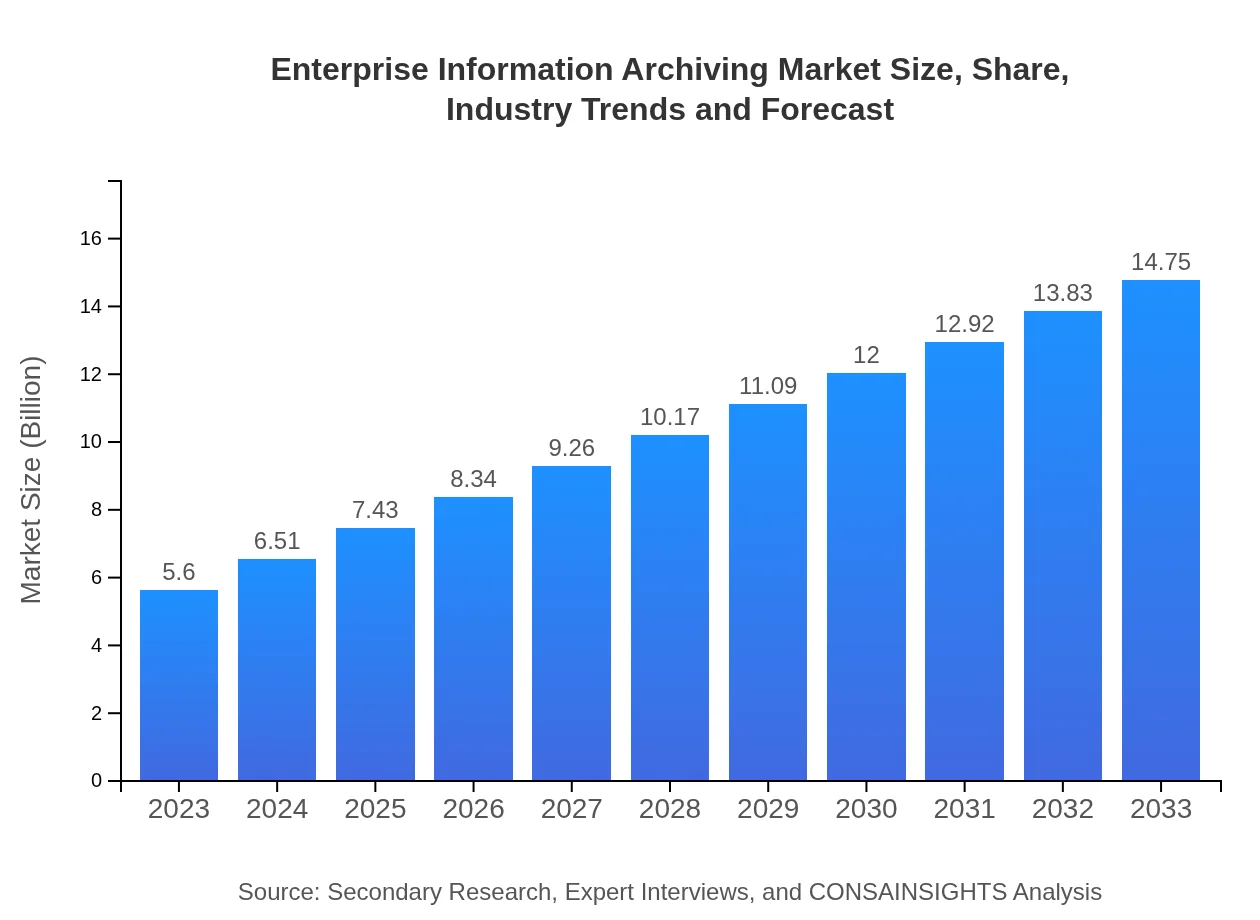

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $14.75 Billion |

| Top Companies | Veritas Technologies, Barracuda Networks, IBM, Micro Focus |

| Last Modified Date | 31 January 2026 |

Enterprise Information Archiving Market Overview

Customize Enterprise Information Archiving Market Report market research report

- ✔ Get in-depth analysis of Enterprise Information Archiving market size, growth, and forecasts.

- ✔ Understand Enterprise Information Archiving's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Information Archiving

What is the Market Size & CAGR of the Enterprise Information Archiving market in 2023?

Enterprise Information Archiving Industry Analysis

Enterprise Information Archiving Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Information Archiving Market Analysis Report by Region

Europe Enterprise Information Archiving Market Report:

Europe’s market size is forecasted to grow from $1.82 billion in 2023 to $4.79 billion by 2033. Increasing data protection regulations, particularly GDPR, and the rising adoption of cloud-based systems are significant growth drivers, compelling organizations to invest in comprehensive archiving solutions.Asia Pacific Enterprise Information Archiving Market Report:

The Asia Pacific region is projected to witness significant growth in the Enterprise Information Archiving market, with market size rising from $1.00 billion in 2023 to $2.62 billion by 2033. This growth reflects a surge in digital transformation initiatives, heightened regulatory compliance, and an influx of data storage needs driven by rapidly growing economies.North America Enterprise Information Archiving Market Report:

North America is the largest market for Enterprise Information Archiving, expanding from $1.98 billion in 2023 to around $5.21 billion in 2033. The dominance of this region can be attributed to stringent regulatory frameworks, a strong emphasis on data compliance, and the presence of major technology contributors fostering innovation in EIA solutions.South America Enterprise Information Archiving Market Report:

In South America, the market is expected to expand from $0.46 billion in 2023 to approximately $1.21 billion in 2033. Factors such as an increase in IT investments and the requirement for modern data management solutions are propelling this trend. Additionally, growing concerns over data security are encouraging organizations to adopt archiving solutions.Middle East & Africa Enterprise Information Archiving Market Report:

The Middle East and Africa region is projected to witness steady growth, with the market size increasing from $0.35 billion in 2023 to $0.92 billion by 2033. Factors such as digital transformation in sectors like government and finance, alongside rising compliance needs, are contributing to a burgeoning demand for EIA solutions in this region.Tell us your focus area and get a customized research report.

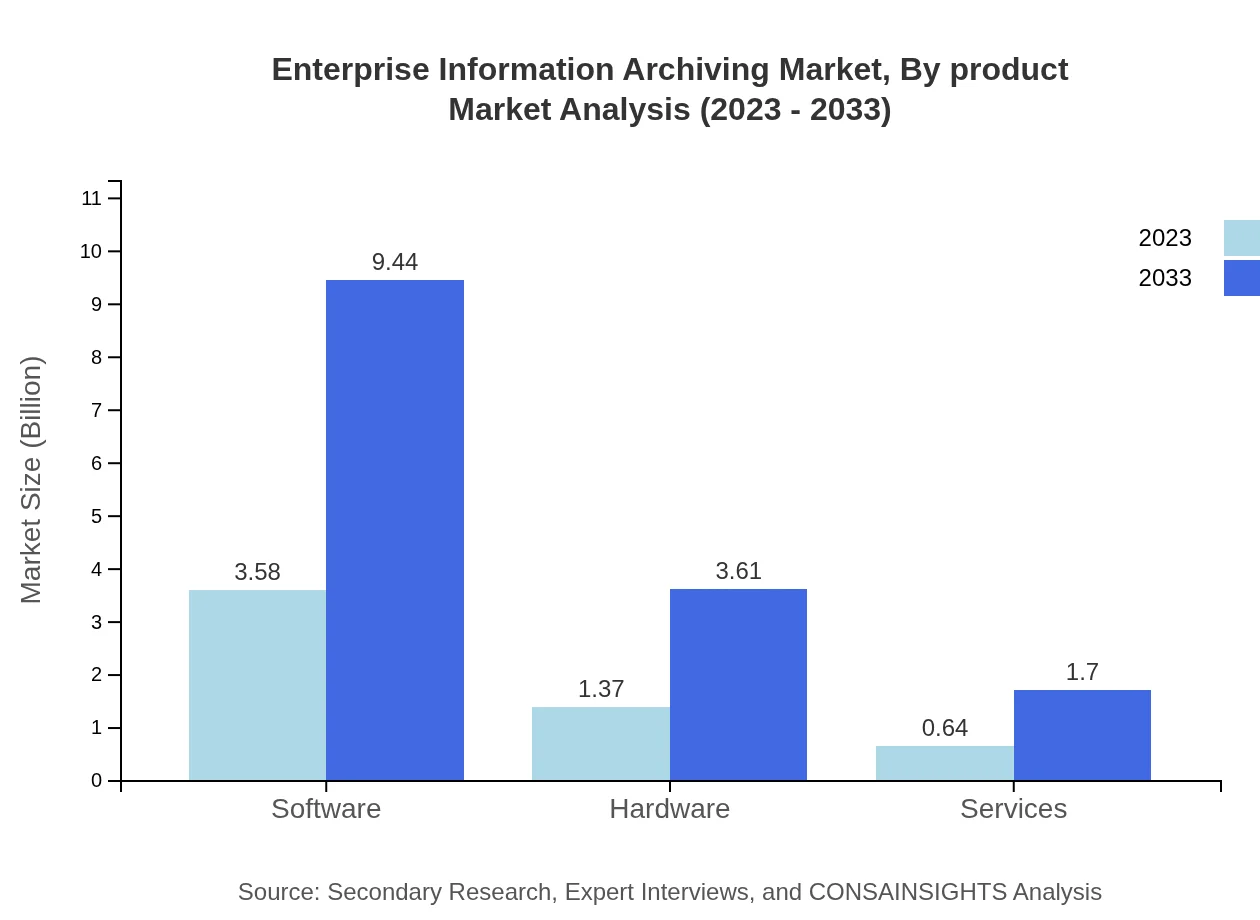

Enterprise Information Archiving Market Analysis By Product

The product segmentation of the Enterprise Information Archiving market includes software, hardware, and services. The software segment leads the market, accounting for $3.58 billion in 2023 and projected to reach $9.44 billion by 2033 with 63.99% market share. Hardware includes storage systems and appliances, growing from $1.37 billion to $3.61 billion, while services such as consulting and support involve significant opportunities for growth.

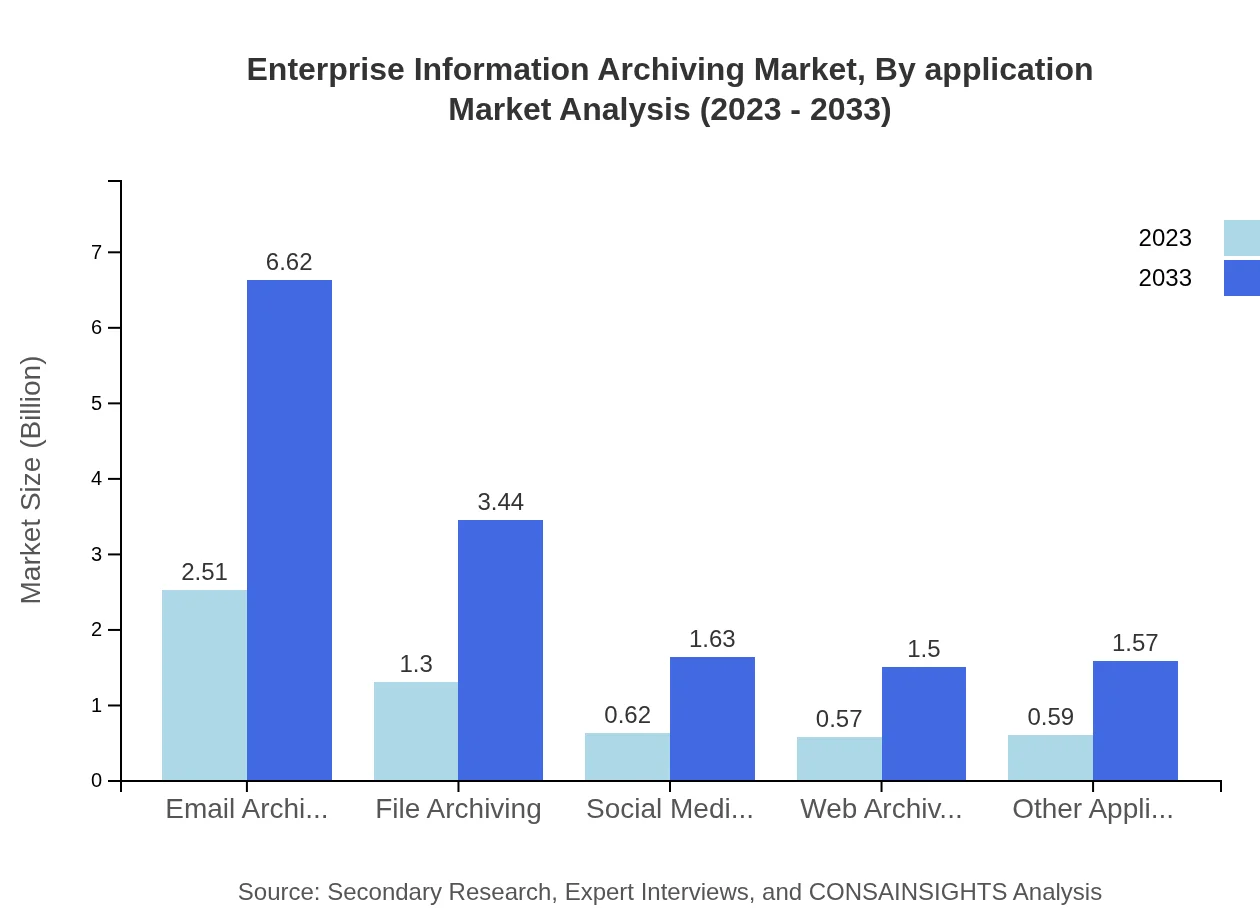

Enterprise Information Archiving Market Analysis By Application

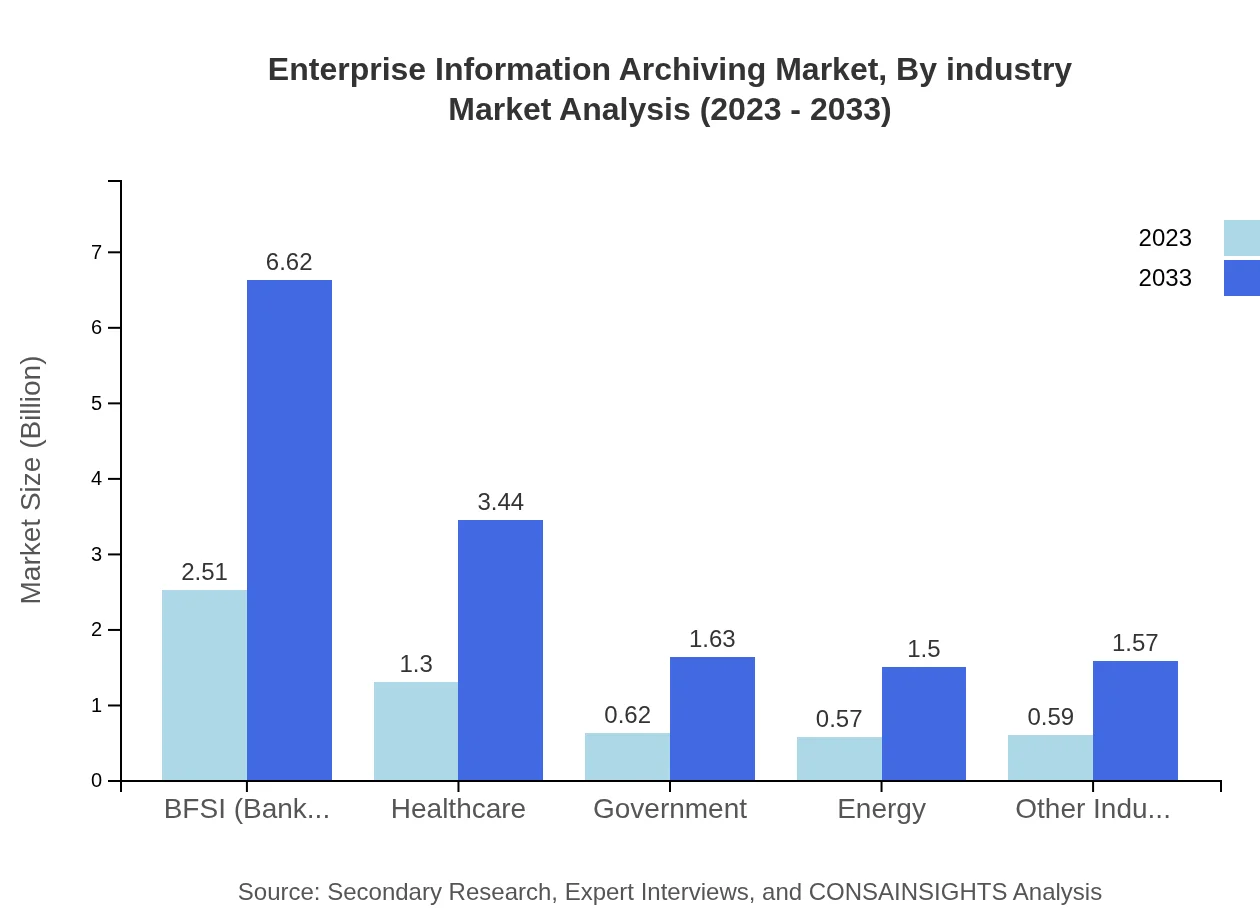

By application, the BFSI sector holds the largest share, valued at $2.51 billion in 2023 and expected to rise to $6.62 billion by 2033. Healthcare also represents a substantial segment at $1.30 billion, influenced by regulations requiring patient data archiving. The growing emphasis on compliance across various industries exemplifies the critical role of archiving solutions.

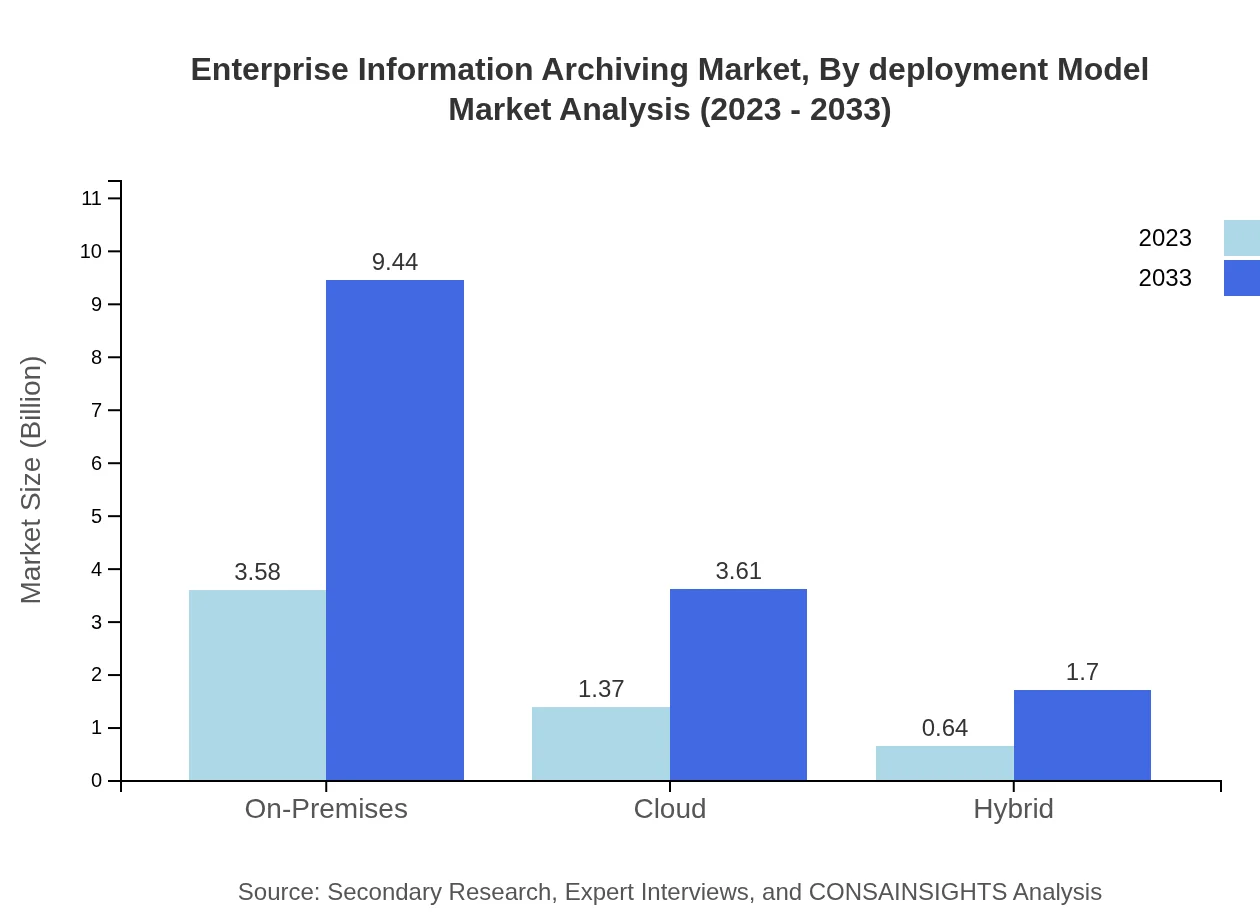

Enterprise Information Archiving Market Analysis By Deployment Model

The deployment models within the market include on-premises, cloud, and hybrid solutions. On-premises solutions dominate the market at $3.58 billion in 2023, maintaining a 63.99% share, but cloud solutions are gaining traction, projected to grow from $1.37 billion to $3.61 billion by 2033. Hybrid models are also emerging as viable alternatives, exhibiting a significant upward trend.

Enterprise Information Archiving Market Analysis By Industry

Industries such as BFSI, healthcare, and government are the primary consumers of Enterprise Information Archiving solutions. The BFSI sector alone accounted for $2.51 billion in 2023, driven by the need for strict compliance and auditing procedures. The healthcare sector is equally significant, with growing healthcare data posing vast archiving challenges.

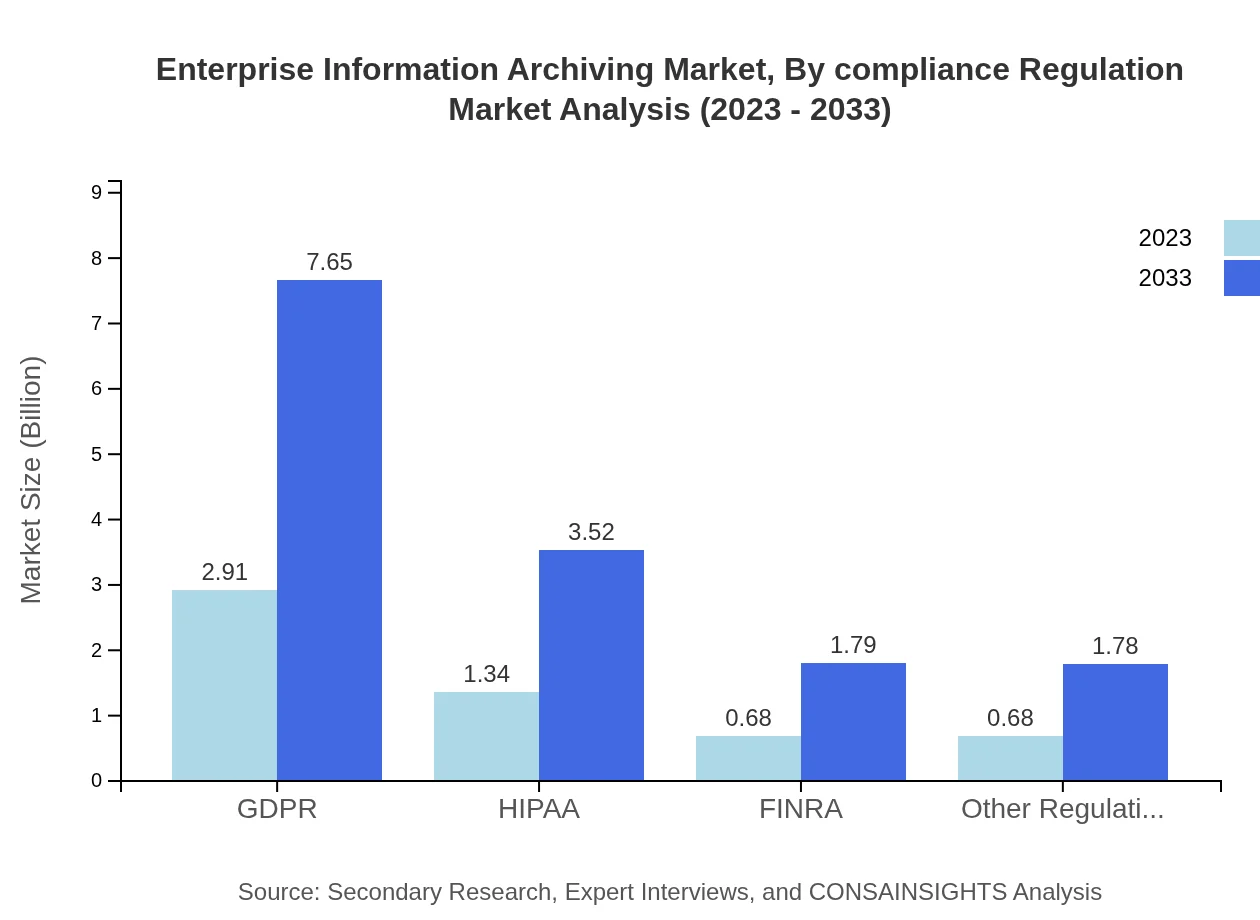

Enterprise Information Archiving Market Analysis By Compliance Regulation

Key compliance regulations driving the market include GDPR, HIPAA, and others. The GDPR segment is anticipated to reach $2.91 billion by 2033, reflecting increasing data protection concerns. Similarly, HIPAA compliance remains crucial for healthcare organizations, emphasizing the necessity for reliable archiving solutions.

Enterprise Information Archiving Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Information Archiving Industry

Veritas Technologies:

Specializing in backup and recovery solutions, Veritas offers robust archiving products catering to enterprise-level data governance and compliance requirements.Barracuda Networks:

Barracuda provides cloud-enabled archiving solutions designed to protect and manage critical data across diverse enterprise environments, enhancing compliance and accessibility.IBM:

IBM delivers comprehensive archiving solutions as part of its broader data management strategy, focused on innovation and regulatory compliance for organizations worldwide.Micro Focus:

Micro Focus' products offer efficient archiving for enterprise messaging and applications, addressing specific regulatory needs through innovative data management solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Information Archiving?

The global Enterprise Information Archiving market was valued at approximately $5.6 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 9.8%, indicating robust growth potential through 2033.

What are the key market players or companies in this enterprise Information Archiving industry?

Key players in the Enterprise Information Archiving sector include major software vendors and cloud service providers, along with niche archiving solution specialists, which are pivotal to market innovation and competition.

What are the primary factors driving the growth in the enterprise Information Archiving industry?

Growth in the enterprise information archiving industry is driven by increasing data regulatory requirements, rising digital data volumes, and the need for efficient data retrieval and compliance in various sectors.

Which region is the fastest Growing in the enterprise Information Archiving market?

The North American region is currently the fastest-growing market for enterprise information archiving, anticipated to grow from $1.98 billion in 2023 to $5.21 billion by 2033, reflecting significant demand.

Does ConsaInsights provide customized market report data for the enterprise Information Archiving industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise information archiving sector, helping stakeholders make informed decisions based on nuanced market insights.

What deliverables can I expect from this enterprise Information Archiving market research project?

Expect comprehensive reports including market size, growth forecasts, competitive analysis, segmentation, and regional breakdowns, aiding strategic planning and investment decisions in the enterprise information archiving landscape.

What are the market trends of enterprise Information Archiving?

Current trends in enterprise information archiving include a shift towards cloud-based solutions, growing concerns about data privacy regulations, and the integration of artificial intelligence for smarter data management.