Enterprise Manufacturing Intelligence Market Report

Published Date: 31 January 2026 | Report Code: enterprise-manufacturing-intelligence

Enterprise Manufacturing Intelligence Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Manufacturing Intelligence market, detailing market size, trends, and forecast data from 2023 to 2033. It includes insights into regional performance, industry dynamics, segmentation, and key market players, offering a well-rounded picture of current and future market conditions.

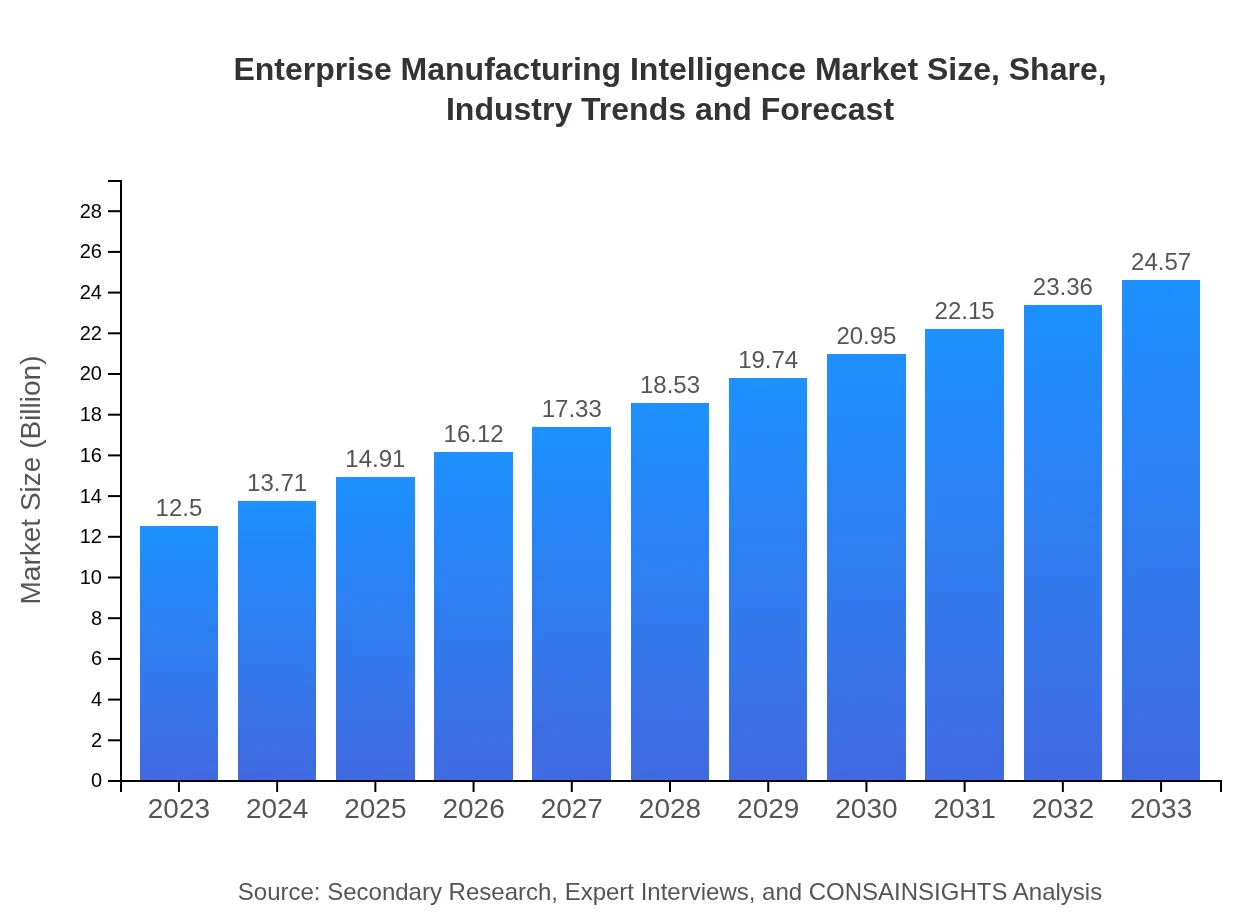

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Siemens AG, Honeywell International Inc., IBM Corporation, SAP SE |

| Last Modified Date | 31 January 2026 |

Enterprise Manufacturing Intelligence Market Overview

Customize Enterprise Manufacturing Intelligence Market Report market research report

- ✔ Get in-depth analysis of Enterprise Manufacturing Intelligence market size, growth, and forecasts.

- ✔ Understand Enterprise Manufacturing Intelligence's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Manufacturing Intelligence

What is the Market Size & CAGR of Enterprise Manufacturing Intelligence market in 2023?

Enterprise Manufacturing Intelligence Industry Analysis

Enterprise Manufacturing Intelligence Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Manufacturing Intelligence Market Analysis Report by Region

Europe Enterprise Manufacturing Intelligence Market Report:

The European EMI market is expected to grow from USD 4.10 billion in 2023 to USD 8.06 billion by 2033. The region emphasizes strict compliance to quality standards and sustainability, driving companies to adopt advanced EMI strategies for better governance and efficiency in manufacturing operations.Asia Pacific Enterprise Manufacturing Intelligence Market Report:

In 2023, the Asia Pacific market for Enterprise Manufacturing Intelligence is valued at USD 2.11 billion, projected to grow to USD 4.14 billion by 2033. The swift industrialization, increasing investments in manufacturing technologies, and a booming consumer base are key drivers in this region. Countries like China and India are leading the way with significant adoption of EMI solutions, bolstering productivity and operational management.North America Enterprise Manufacturing Intelligence Market Report:

North America remains the largest market, valued at USD 4.60 billion in 2023, growing to USD 9.04 billion by 2033. The region is characterized by advanced technological adoption and significant investments in automation and analytics, with industries focusing heavily on enhancing productivity and quality through EMI solutions.South America Enterprise Manufacturing Intelligence Market Report:

The South American EMI market is relatively nascent, valued at USD 0.56 billion in 2023, with an expected growth to USD 1.10 billion by 2033. The slow adoption is primarily due to infrastructural constraints; however, emerging economies like Brazil are gradually embracing digital transformation in manufacturing.Middle East & Africa Enterprise Manufacturing Intelligence Market Report:

In 2023, the Middle East and Africa market stands at USD 1.14 billion, anticipated to reach USD 2.23 billion by 2033. As countries in this region invest in infrastructure modernization and industrial capabilities, the demand for EMI solutions is set to increase, particularly in oil and gas, and automotive sectors.Tell us your focus area and get a customized research report.

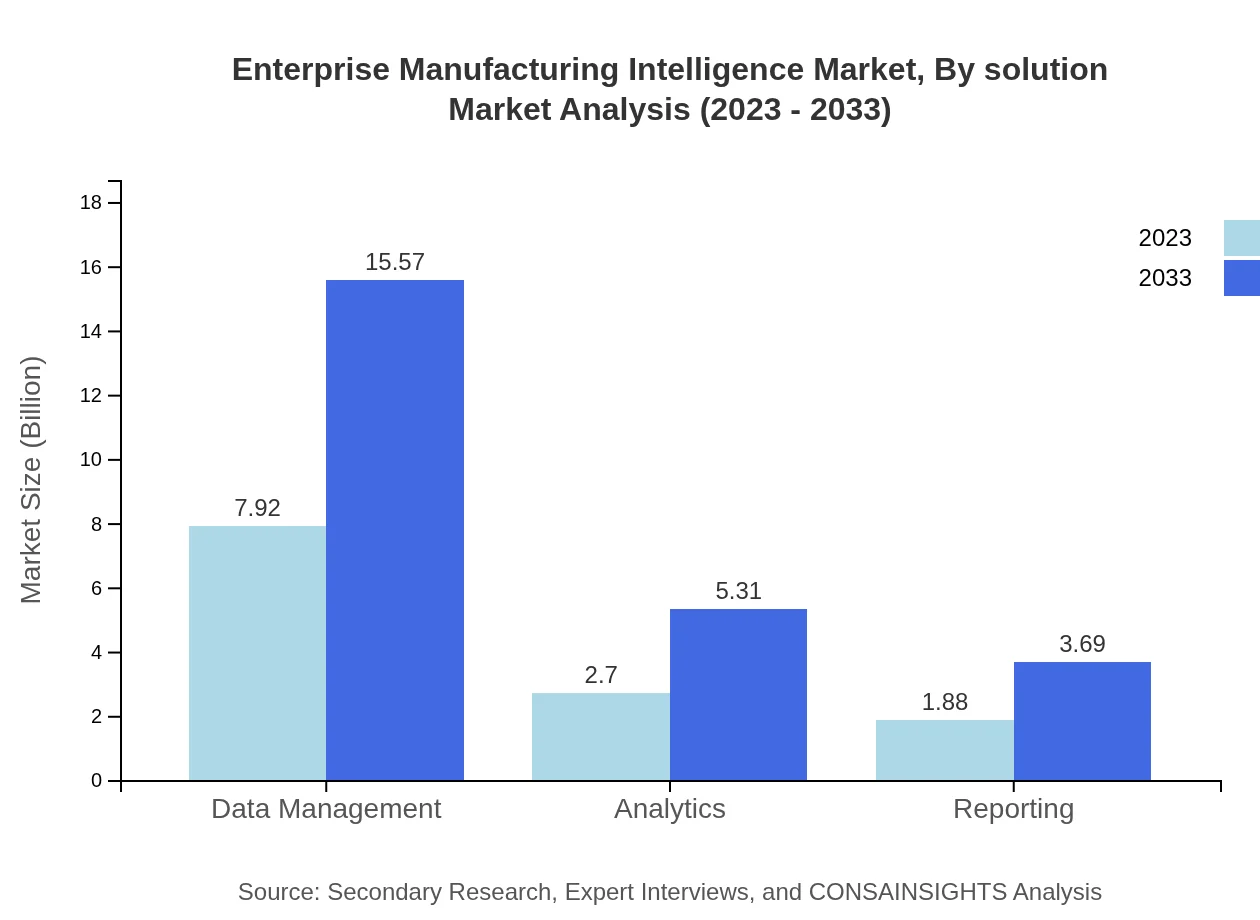

Enterprise Manufacturing Intelligence Market Analysis By Solution

In terms of solutions, the data management segment is projected to dominate, with a market size of USD 7.92 billion in 2023, expected to reach USD 15.57 billion by 2033. Analytics follows closely with USD 2.70 billion currently, forecasted to rise to USD 5.31 billion. Reporting and manufacturing operations are also significant, reflecting the core functionalities that modern manufacturers prioritize. Each solution is pivotal in enhancing operational efficiency and decision-making.

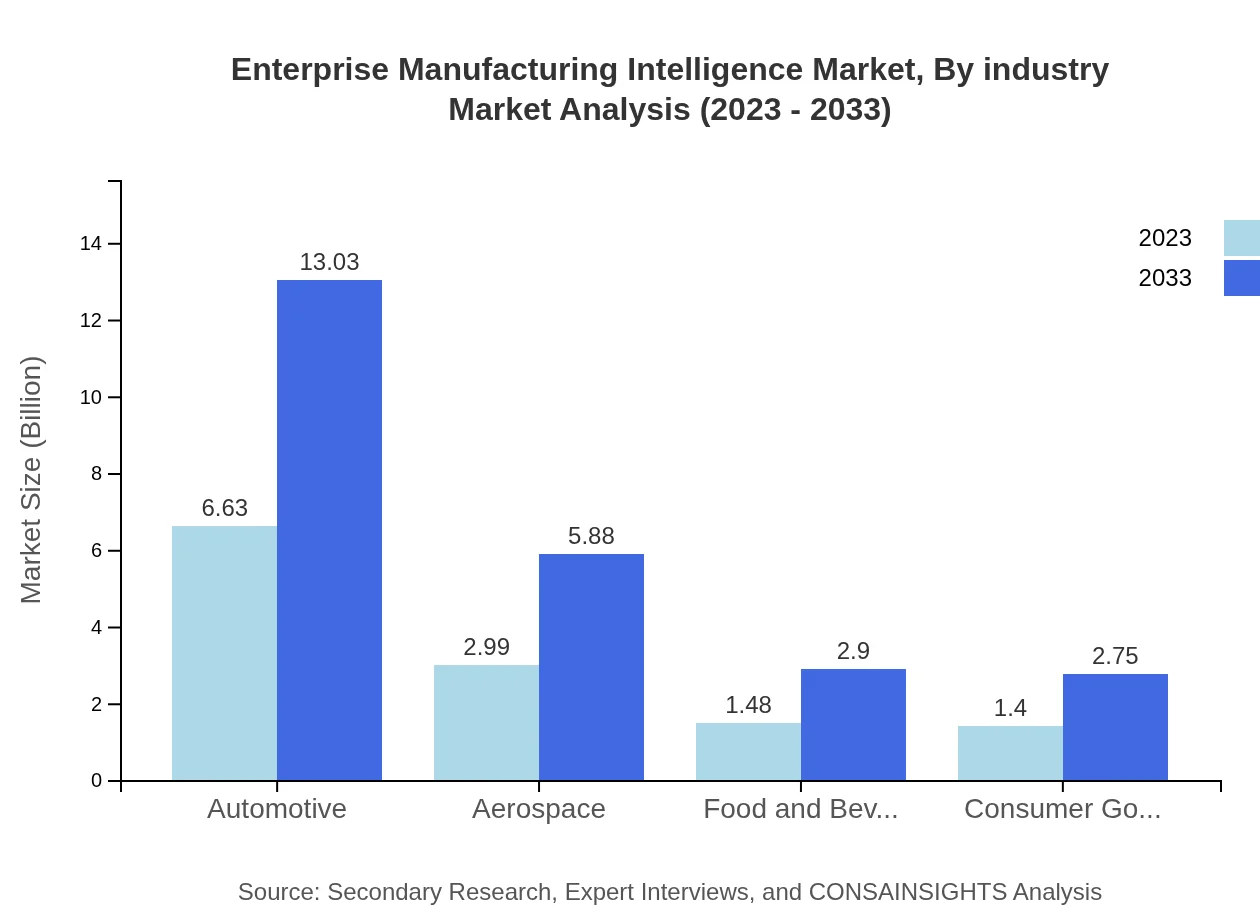

Enterprise Manufacturing Intelligence Market Analysis By Industry

The industry analysis reveals that the automotive sector leads the market with a size of USD 6.63 billion in 2023, anticipated to grow to USD 13.03 billion by 2033. Following the automotive market, aerospace and food and beverage industries showcase considerable growth, reflecting the significant investments in automation and data-driven approaches for process improvement.

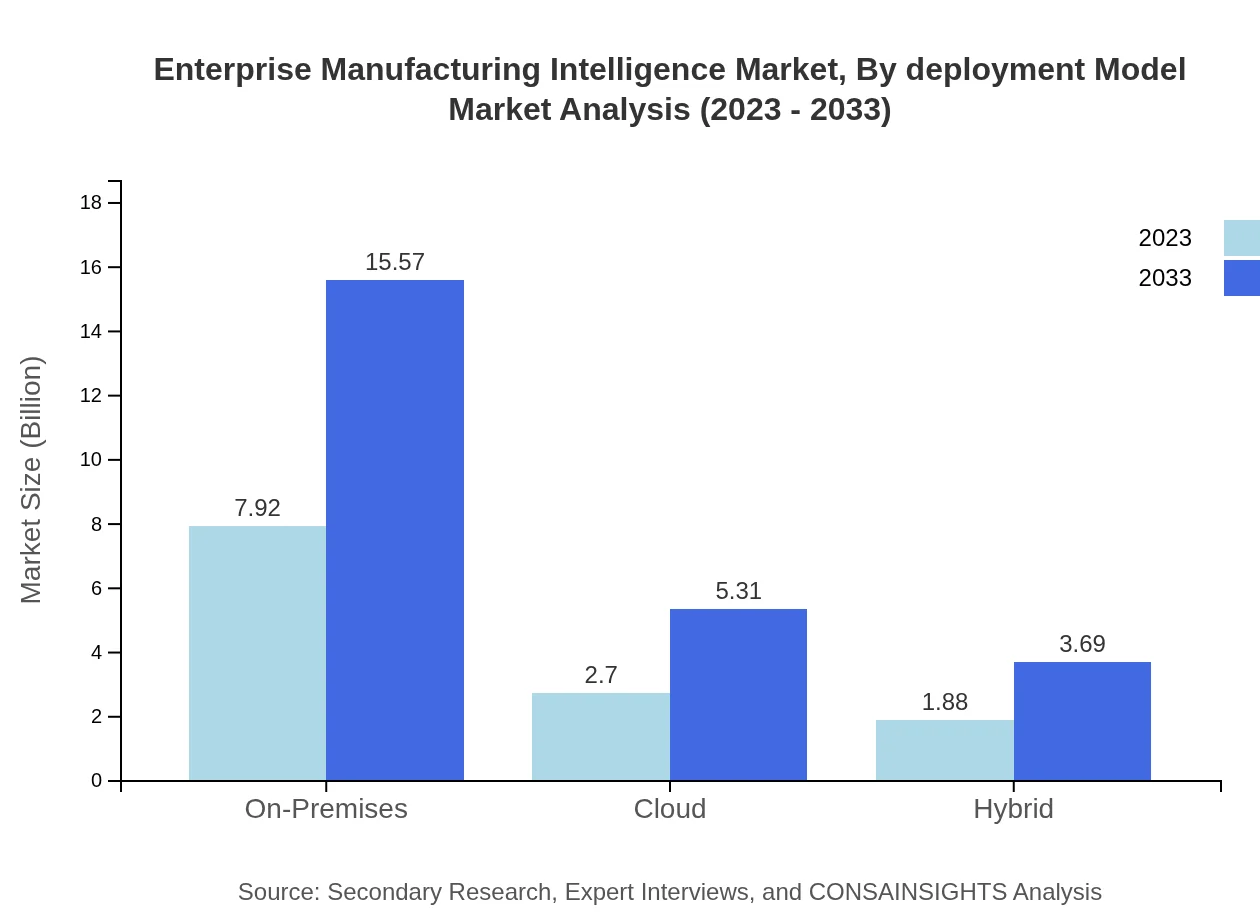

Enterprise Manufacturing Intelligence Market Analysis By Deployment Model

The on-premises deployment model dominates the market, accounting for USD 7.92 billion in size in 2023, with a projected increase to USD 15.57 billion by 2033. This trend is largely driven by organizations' need for control over their data and infrastructure, despite cloud solutions gaining traction due to flexibility and scalability.

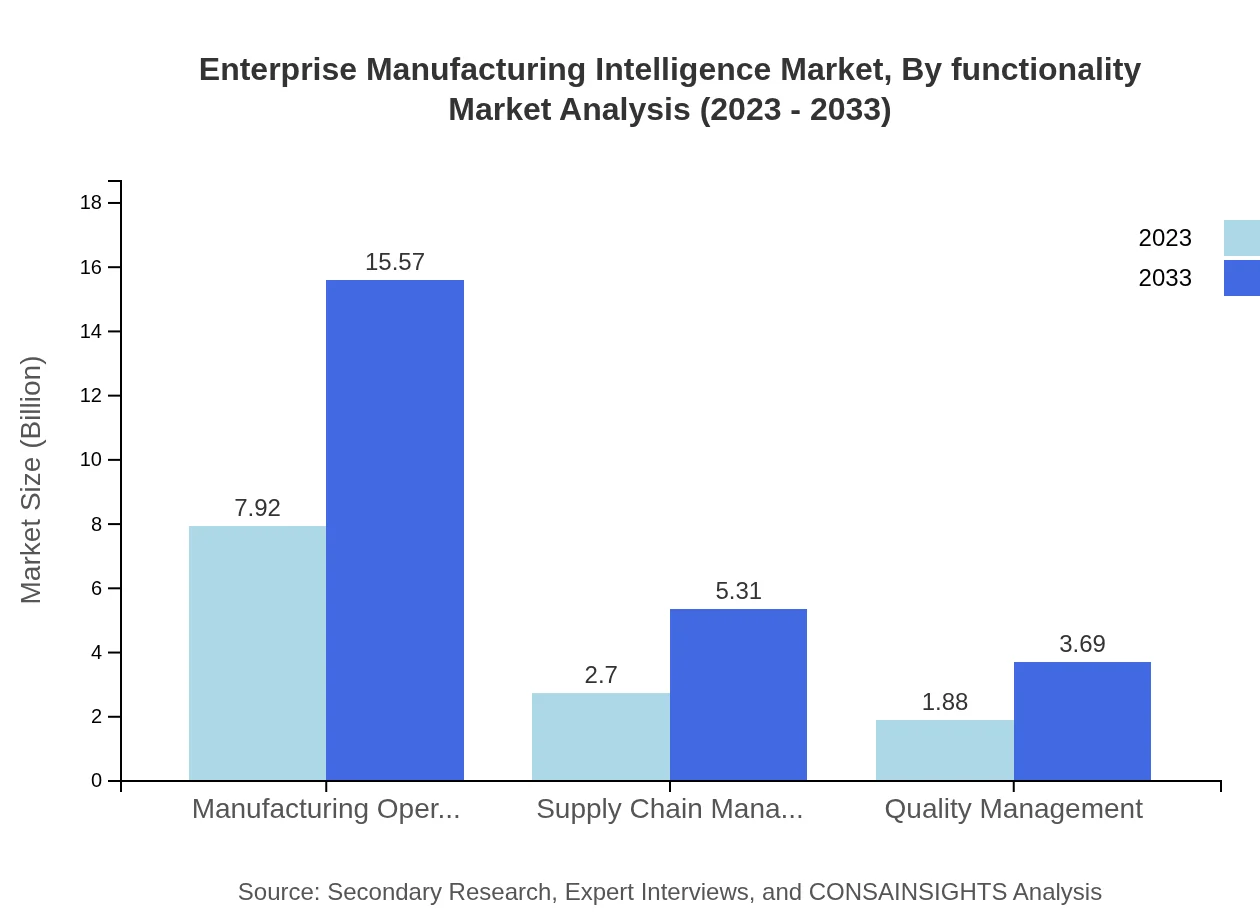

Enterprise Manufacturing Intelligence Market Analysis By Functionality

Analyzing customer needs, functionalities such as supply chain management and quality management are crucial, translating into USD 2.70 billion and USD 1.88 billion markets in 2023 respectively. Anticipated growth underscores the importance placed on operational efficiency and adherence to quality standards.

Enterprise Manufacturing Intelligence Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Manufacturing Intelligence Industry

Siemens AG:

Siemens AG is a technology company renowned for its automation, electrification, and digitalization solutions in manufacturing, heavily investing in EMI technologies to streamline production processes.Honeywell International Inc.:

Honeywell offers various EMI solutions focusing on innovative software that enhances operational efficiency and provides data analytics for improved decision-making in manufacturing.IBM Corporation:

IBM has a strong foothold in the EMI market with its Watson IoT platform, delivering cutting-edge AI-driven insights and analytics to revolutionize manufacturing processes.SAP SE:

SAP provides comprehensive software solutions that integrate and optimize manufacturing processes, ensuring data-driven insights are accessible for operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of Enterprise Manufacturing Intelligence?

The global Enterprise Manufacturing Intelligence market is valued at approximately $12.5 billion in 2023, with a projected CAGR of 6.8% through 2033, expanding its influence across various industrial sectors.

What are the key market players or companies in the Enterprise Manufacturing Intelligence industry?

Key market players include leading technology firms specializing in manufacturing solutions, data analytics, and operational efficiency. These companies drive innovation and contribute to the industry's growth through strategic partnerships and advanced software solutions.

What are the primary factors driving the growth in the Enterprise Manufacturing Intelligence industry?

Growth is primarily driven by the increasing need for operational efficiency, advancements in data analytics, demand for real-time insights, and the adoption of Industry 4.0 technologies, enabling manufacturers to enhance productivity and decision-making.

Which region is the fastest Growing in the Enterprise Manufacturing Intelligence?

The fastest-growing region is North America, expected to grow from $4.60 billion in 2023 to $9.04 billion by 2033. Other growth areas include Europe and Asia Pacific, highlighting the global expansion of manufacturing intelligence solutions.

Does ConsaInsights provide customized market report data for the Enterprise Manufacturing Intelligence industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Enterprise Manufacturing Intelligence industry. Clients can receive insights catered to their unique requirements, enhancing strategic decision-making.

What deliverables can I expect from this Enterprise Manufacturing Intelligence market research project?

Deliverables typically include comprehensive reports, trend analyses, market forecasts, competitive landscape assessments, and tailored insights on regional and segment-specific performance, facilitating informed business planning.

What are the market trends of Enterprise Manufacturing Intelligence?

Current market trends include a rising emphasis on cloud-based solutions, increased investment in automation and AI, a shift towards data-driven decision-making, and growing integration of IoT in manufacturing processes, driving operational enhancements.