Enterprise Metadata Management Market Report

Published Date: 31 January 2026 | Report Code: enterprise-metadata-management

Enterprise Metadata Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Enterprise Metadata Management market from 2023 to 2033. It highlights market trends, size, growth forecasts, industry analysis, and insights across various regions and segments, offering valuable data for stakeholders and decision-makers.

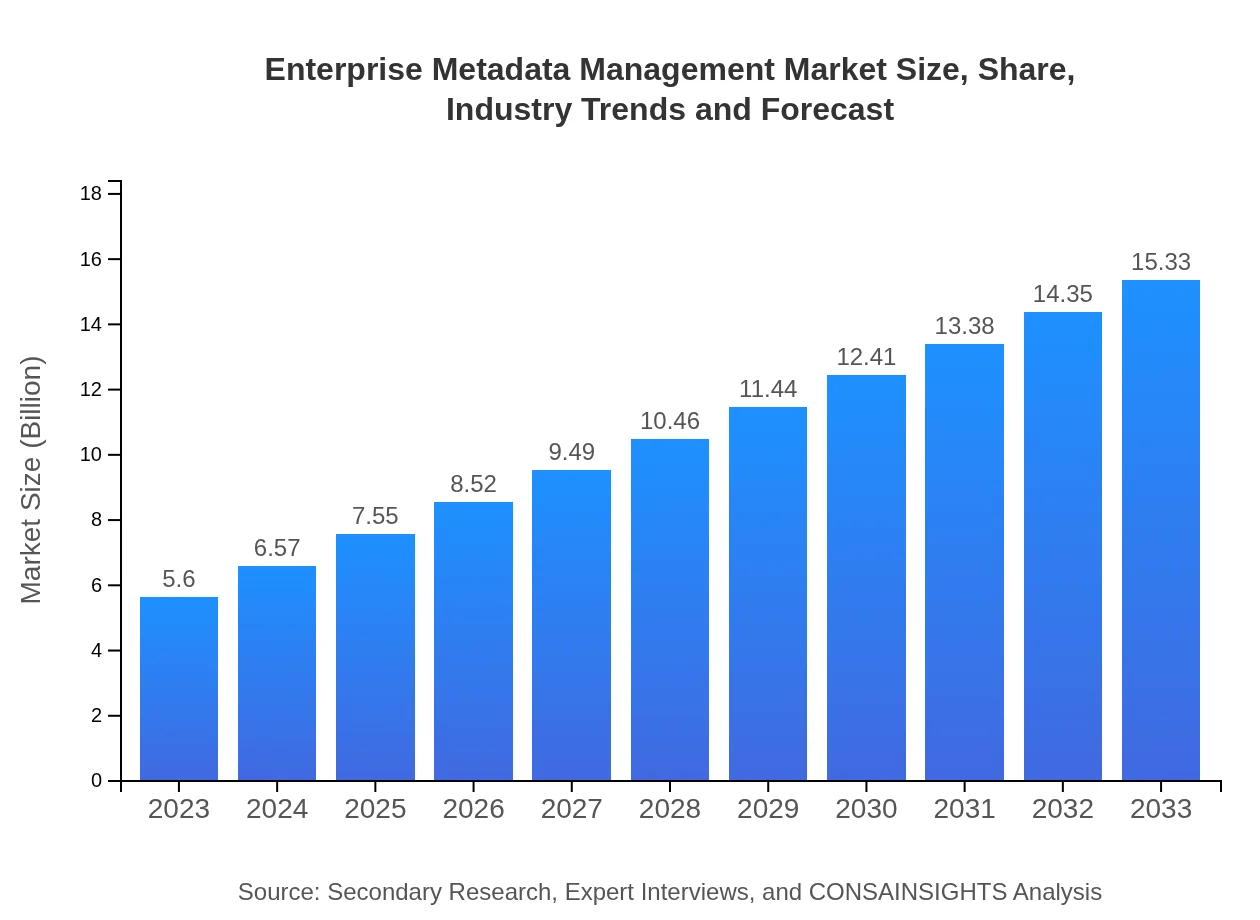

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $15.33 Billion |

| Top Companies | IBM, Oracle, Microsoft, Alation, Collibra |

| Last Modified Date | 31 January 2026 |

Enterprise Metadata Management Market Overview

Customize Enterprise Metadata Management Market Report market research report

- ✔ Get in-depth analysis of Enterprise Metadata Management market size, growth, and forecasts.

- ✔ Understand Enterprise Metadata Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Metadata Management

What is the Market Size & CAGR of Enterprise Metadata Management market in 2033?

Enterprise Metadata Management Industry Analysis

Enterprise Metadata Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Metadata Management Market Analysis Report by Region

Europe Enterprise Metadata Management Market Report:

Europe's market size is expected to witness considerable growth, ranging from $1.66 billion in 2023 to $4.54 billion by 2033. Stringent regulations regarding data protection and privacy, such as GDPR, are driving the demand for effective metadata management solutions.Asia Pacific Enterprise Metadata Management Market Report:

The Asia Pacific region is projected to witness substantial growth in the Enterprise Metadata Management market, increasing from $1.06 billion in 2023 to $2.90 billion by 2033. This growth can be attributed to the rapid digital transformation initiatives and an increasing focus on data governance in countries like China, India, and Japan.North America Enterprise Metadata Management Market Report:

North America is anticipated to remain the largest market for Enterprise Metadata Management, expanding from $2.05 billion in 2023 to $5.62 billion by 2033. The presence of leading technology firms and a high awareness of data compliance and governance significantly contribute to this growth.South America Enterprise Metadata Management Market Report:

In South America, the market is expected to grow from $0.34 billion in 2023 to $0.94 billion by 2033. The adoption of smart technologies and data analytics is driving this growth, especially within the healthcare and finance sectors.Middle East & Africa Enterprise Metadata Management Market Report:

The Middle East and Africa region is projected to grow from $0.49 billion in 2023 to $1.33 billion by 2033, supported by increasing investments in digital technologies and a rising awareness of data governance across various industries.Tell us your focus area and get a customized research report.

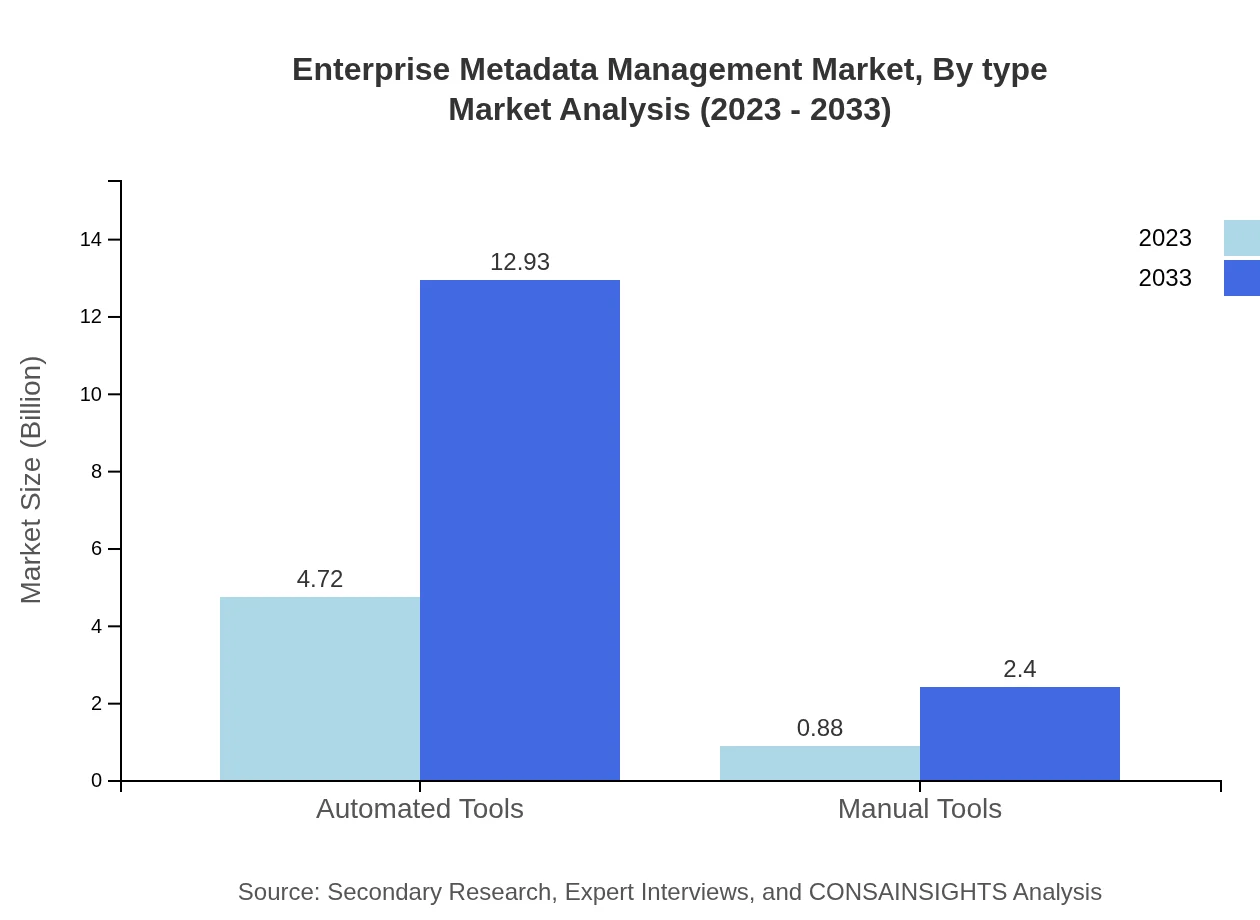

Enterprise Metadata Management Market Analysis By Type

The market is primarily segmented into Automated Tools and Manual Tools. Automated Tools represent a significant market share, valued at $4.72 billion in 2023, projected to reach $12.93 billion by 2033, due to their efficiency in managing large volumes of metadata. Manual Tools are projected to grow from $0.88 billion in 2023 to $2.40 billion by 2033. This segment accounts for a smaller share as organizations increasingly prefer automation.

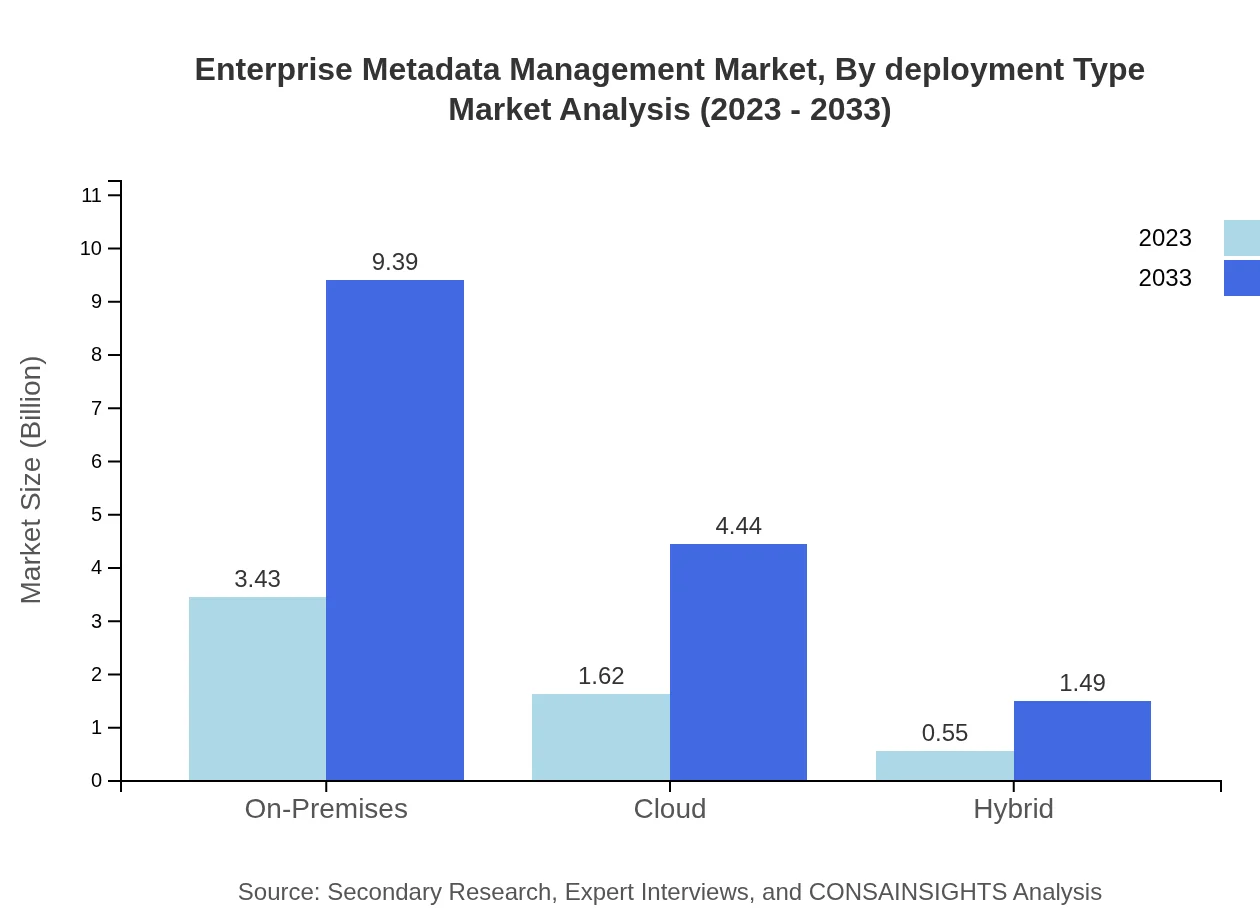

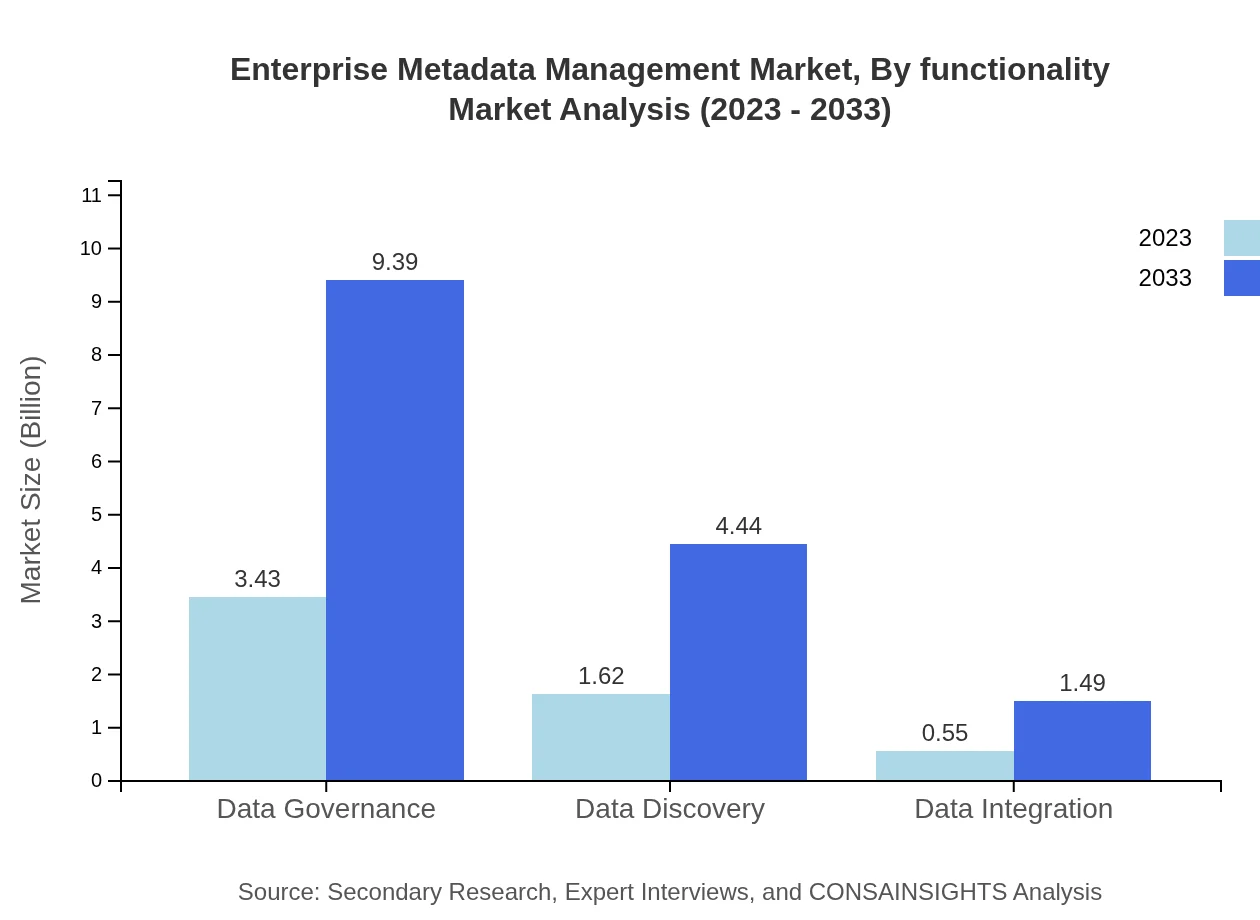

Enterprise Metadata Management Market Analysis By Deployment Type

The market consists of On-Premises, Cloud, and Hybrid solutions. On-Premises deployments dominate the market, valued at $3.43 billion in 2023, and expected to reach $9.39 billion by 2033. Cloud-based solutions are quickly gaining traction, growing from $1.62 billion in 2023 to $4.44 billion by 2033, driven by the demand for remote accessibility and flexibility. Hybrid solutions are also emerging, currently at $0.55 billion and expected to grow to $1.49 billion.

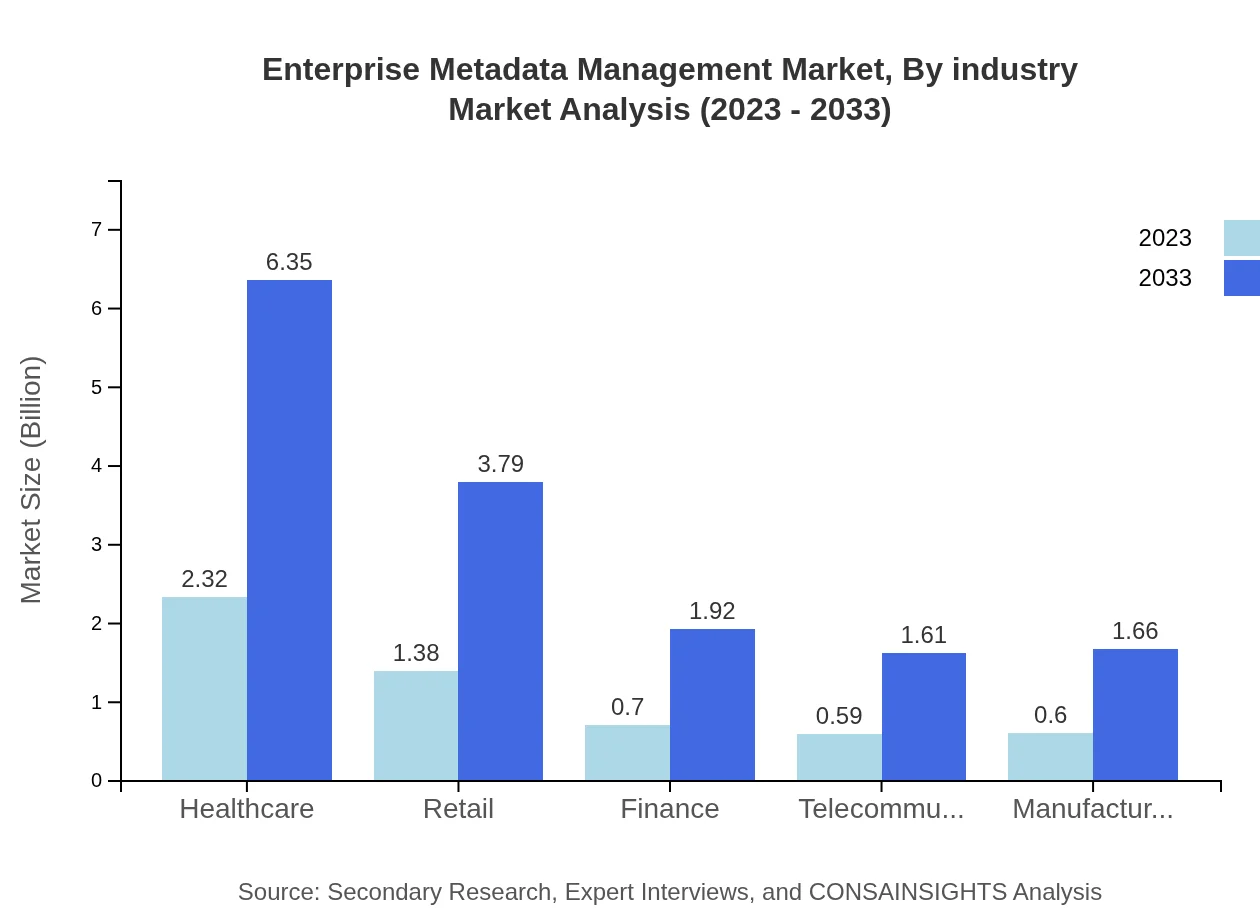

Enterprise Metadata Management Market Analysis By Industry

Industries such as Healthcare, Retail, Finance, Telecommunications, and Manufacturing have unique needs concerning metadata. Healthcare is forecasted to grow from $2.32 billion in 2023 to $6.35 billion by 2033. Retail is expected to reach $3.79 billion by 2033 from $1.38 billion in 2023. The finance sector is anticipated to expand from $0.70 billion to $1.92 billion, indicating that demand across industries will fuel overall growth.

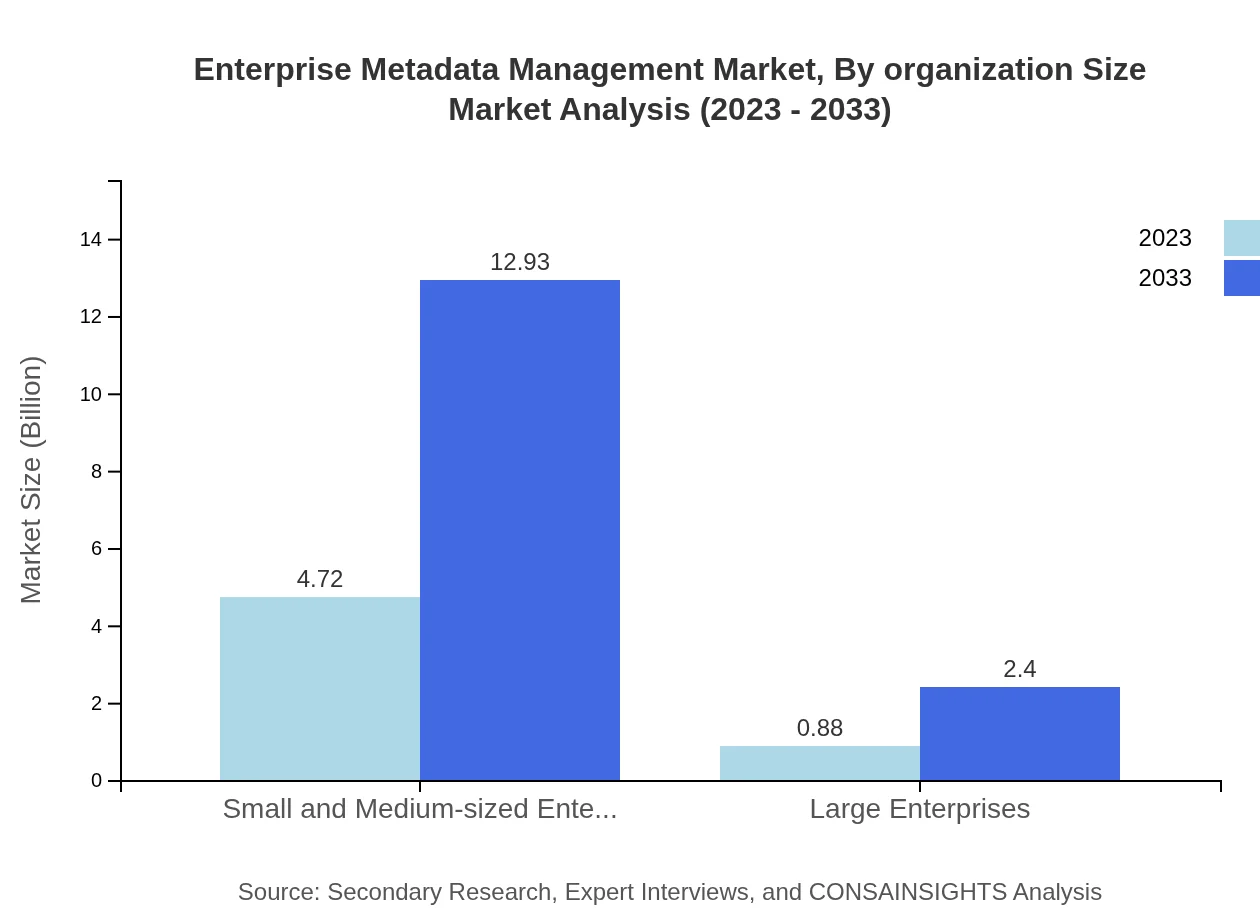

Enterprise Metadata Management Market Analysis By Organization Size

Small and Medium-sized Enterprises (SMEs) contribute significantly to the market, growing from $4.72 billion in 2023 to $12.93 billion by 2033, driven by increasing digitalization. Large enterprises see moderate growth, expanding from $0.88 billion to $2.40 billion over the same period, as they typically have established data management frameworks.

Enterprise Metadata Management Market Analysis By Functionality

Functionality segmentation includes Data Governance, Data Discovery, and Data Integration. Data Governance leads with a market value of $3.43 billion in 2023, projected to grow to $9.39 billion by 2033. Data Discovery is expected to increase from $1.62 billion to $4.44 billion, while Data Integration will grow from $0.55 billion to $1.49 billion, reflecting the need for comprehensive data management solutions.

Enterprise Metadata Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Metadata Management Industry

IBM:

IBM is a pioneer in information technology and offers comprehensive enterprise data management solutions, including robust metadata management capabilities designed to enhance data governance, analytics, and compliance.Oracle:

Oracle provides advanced metadata management tools that allow organizations to manage, audit, and leverage metadata efficiently across their data architectures, contributing to streamlined operations and improved decision-making.Microsoft:

Microsoft's enterprise solutions include Azure Data Catalog, which facilitates easy and automated metadata management, providing seamless integration with multiple data sources and applications.Alation:

Alation specializes in data cataloging and governance, with innovative tools that help organizations manage their metadata efficiently, driving data intelligence and collaboration.Collibra:

Collibra provides a comprehensive platform for data intelligence, focusing on data governance, data quality, and effective metadata management that empowers organizations in their data-driven initiatives.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Metadata Management?

The enterprise metadata management market is projected to reach approximately $5.6 billion by 2033, with a compound annual growth rate (CAGR) of 10.2%, indicating significant growth from 2023 onwards.

What are the key market players or companies in this enterprise Metadata Management industry?

Key players in the enterprise metadata management industry include major technology firms specializing in data management solutions. These often include established enterprises recognized for offering robust tools and services that enhance organizational data governance and management.

What are the primary factors driving the growth in the enterprise Metadata Management industry?

Factors driving growth include the increasing importance of data governance, rising data complexity, enhanced regulatory compliance requirements, and the escalation of digital transformation initiatives across sectors, compelling businesses to invest in effective metadata management solutions.

Which region is the fastest Growing in the enterprise Metadata Management?

The fastest-growing region in the enterprise metadata management market is projected to be Europe, expanding from $1.66 billion in 2023 to $4.54 billion by 2033, demonstrating a robust need for advanced data management solutions in this region.

Does ConsaInsights provide customized market report data for the enterprise Metadata Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise metadata management industry, allowing clients to gain insights that align with their unique business requirements and strategic goals.

What deliverables can I expect from this enterprise Metadata Management market research project?

Deliverables typically include comprehensive market analysis reports, trend forecasting, competitive landscape insights, user-friendly data visualizations, and tailored recommendations based on specific market segments relevant to enterprise metadata management.

What are the market trends of enterprise Metadata Management?

Emerging trends include increased automation in metadata management processes, a growing focus on data privacy and compliance, the rise of cloud-based solutions, and deeper integration of AI and machine learning technologies within enterprise metadata management tools.