Enterprise Mobility In Energy Sector Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-in-energy-sector

Enterprise Mobility In Energy Sector Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Mobility in the Energy Sector, covering market size, trends, segmentation, and forecasts from 2023 to 2033. It showcases insights into regional dynamics and key players shaping the industry's future.

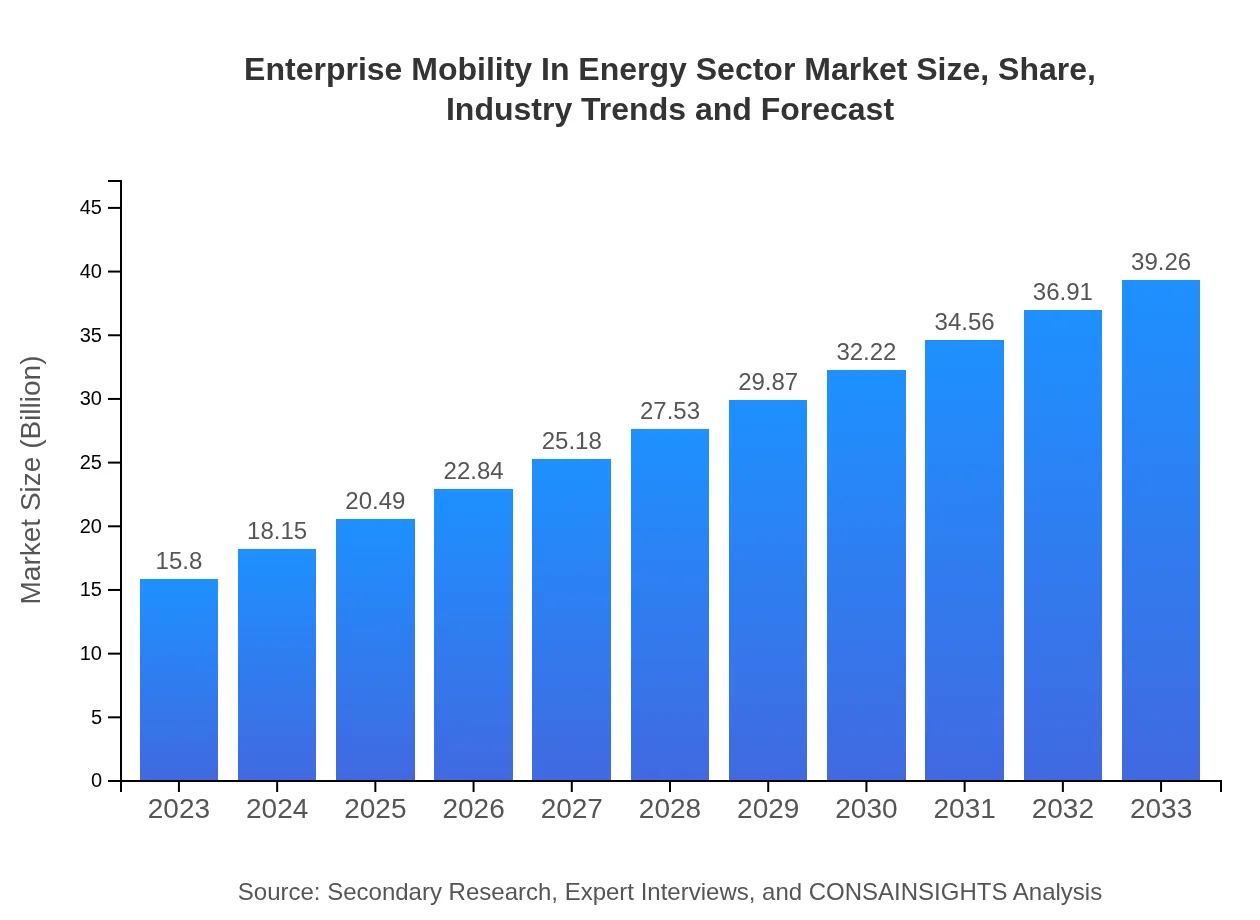

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.80 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $39.26 Billion |

| Top Companies | IBM, Microsoft, SAP, Oracle, Siemens |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility In Energy Sector Market Overview

Customize Enterprise Mobility In Energy Sector Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility In Energy Sector market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility In Energy Sector's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility In Energy Sector

What is the Market Size & CAGR of Enterprise Mobility In Energy Sector market in 2023?

Enterprise Mobility In Energy Sector Industry Analysis

Enterprise Mobility In Energy Sector Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility In Energy Sector Market Analysis Report by Region

Europe Enterprise Mobility In Energy Sector Market Report:

In Europe, the market is expected to expand from $4.86 billion in 2023 to $12.06 billion in 2033, driven by regulatory pressures for sustainability and digital transformation initiatives. The increasing integration of smart technologies within energy networks enables improved data management and operational efficiencies across the sector.Asia Pacific Enterprise Mobility In Energy Sector Market Report:

In Asia Pacific, the market is anticipated to grow from $3.27 billion in 2023 to $8.12 billion in 2033. With countries like India and China focusing on infrastructural development and smart grids, the region's demand for mobile solutions is soaring. Technological advancements alongside a growing workforce in the renewable energy segment are crucial contributors to this growth.North America Enterprise Mobility In Energy Sector Market Report:

North America dominates the Enterprise Mobility market in the Energy Sector, starting at $5.20 billion in 2023 and forecasted to rise to $12.92 billion by 2033. The region is characterized by a strong adoption of innovative technologies and substantial investments in renewable energy projects, positioning companies to prioritize mobility solutions to maximize efficiency.South America Enterprise Mobility In Energy Sector Market Report:

The South American market is projected to increase from $0.83 billion in 2023 to $2.07 billion in 2033. Factors driving this growth include investments in infrastructure and mobile connectivity in energy distribution networks, particularly in Brazil and Argentina, spurred by government initiatives to enhance energy efficiency.Middle East & Africa Enterprise Mobility In Energy Sector Market Report:

In the Middle East and Africa, the market is projected to grow from $1.64 billion in 2023 to $4.08 billion by 2033. The drive for energy diversification amid fluctuating oil prices and the necessity for improved operational effectiveness in energy management systems are pivotal factors behind this growth.Tell us your focus area and get a customized research report.

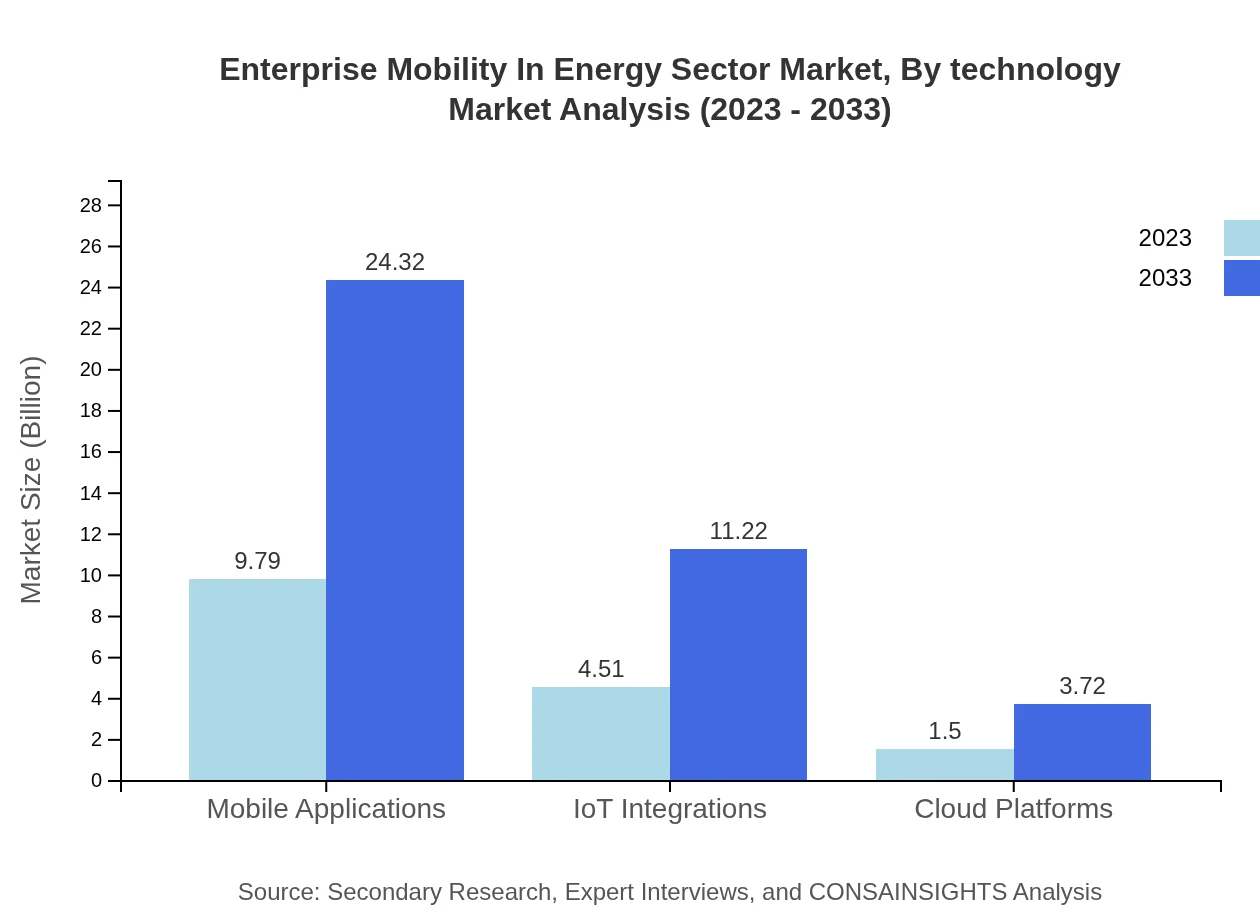

Enterprise Mobility In Energy Sector Market Analysis By Technology

The Enterprise Mobility market in Energy Sector is segmented into mobile applications, IoT integrations, and cloud platforms. Mobile applications hold a leading market share, with a size of $9.79 billion in 2023 growing to $24.32 billion by 2033. IoT integrations followed, expanding from $4.51 billion to $11.22 billion. Cloud platforms also show significant growth, increasing from $1.50 billion to $3.72 billion during the same period.

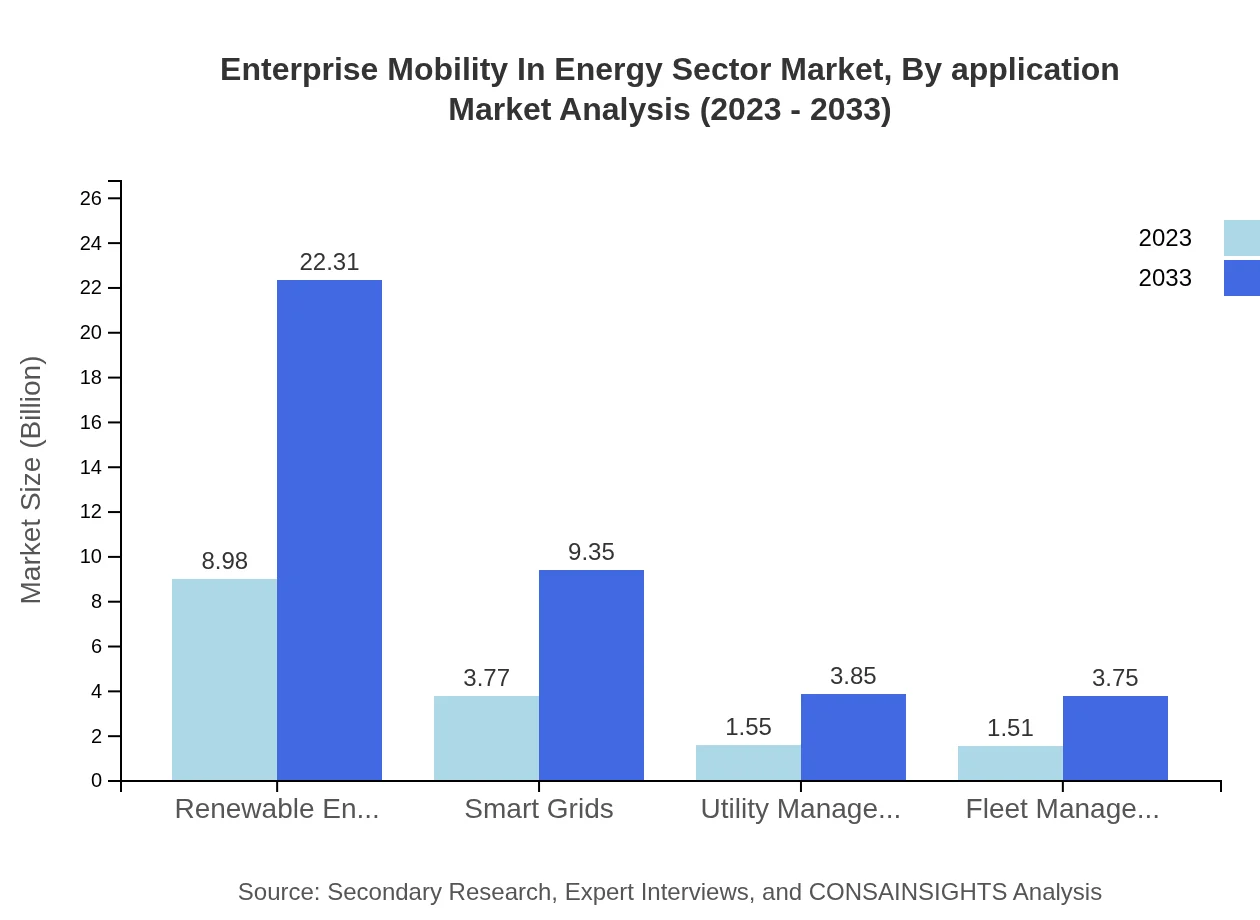

Enterprise Mobility In Energy Sector Market Analysis By Application

Key applications within the Enterprise Mobility segment include energy production, distribution, and management. In 2023, energy producers segment is expected to reach $9.79 billion and grow to $24.32 billion by 2033, while energy distributors are forecast to rise from $4.51 billion to $11.22 billion, showcasing the essential role of mobility solutions across these critical applications.

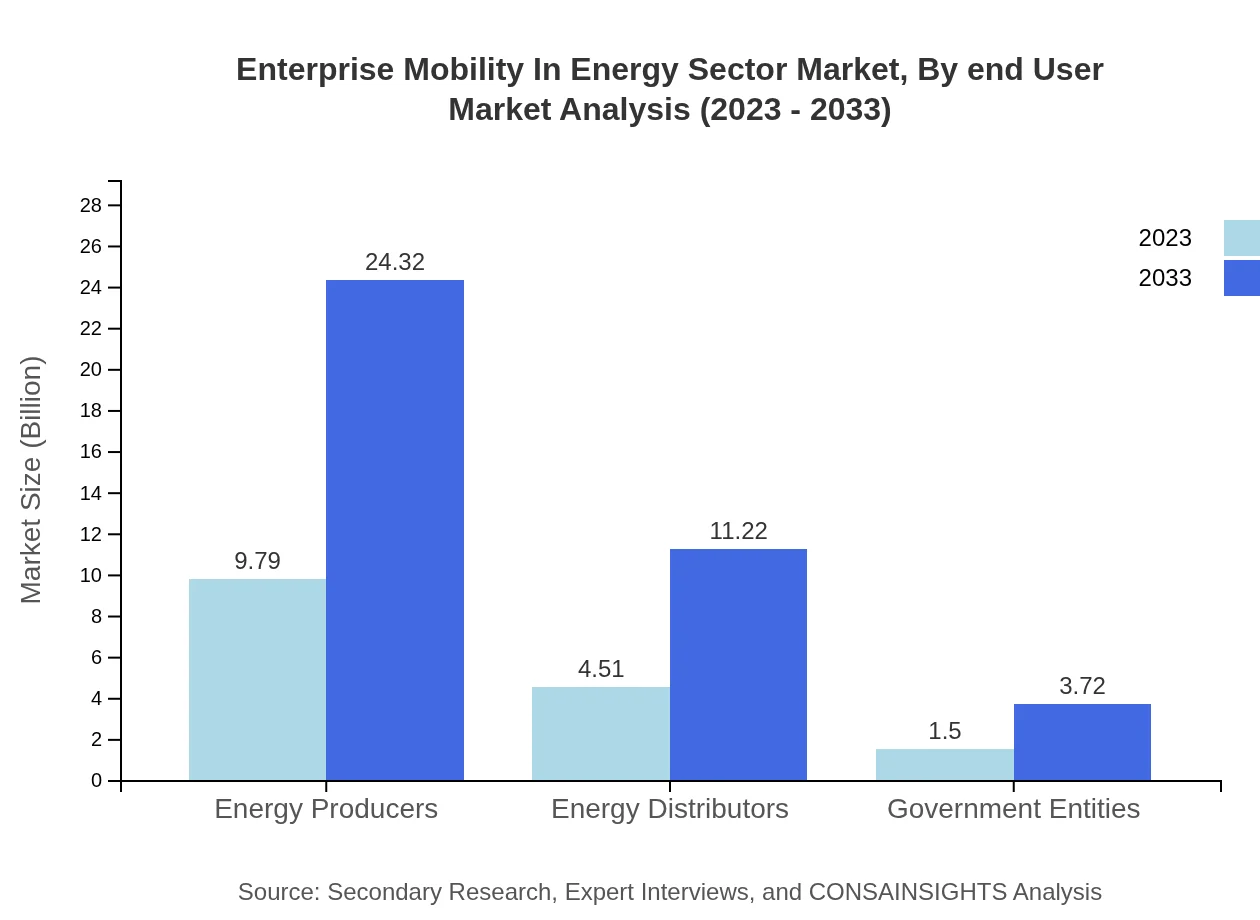

Enterprise Mobility In Energy Sector Market Analysis By End User

The end-user analysis reveals significant engagement from energy producers, distributors, and government entities. Notably, energy producers occupy the largest share and market size, with end-user market totals expected to reach $9.79 billion by 2023 to $24.32 billion by 2033. Government entities are predicted to exhibit consistent growth from $1.50 billion to $3.72 billion.

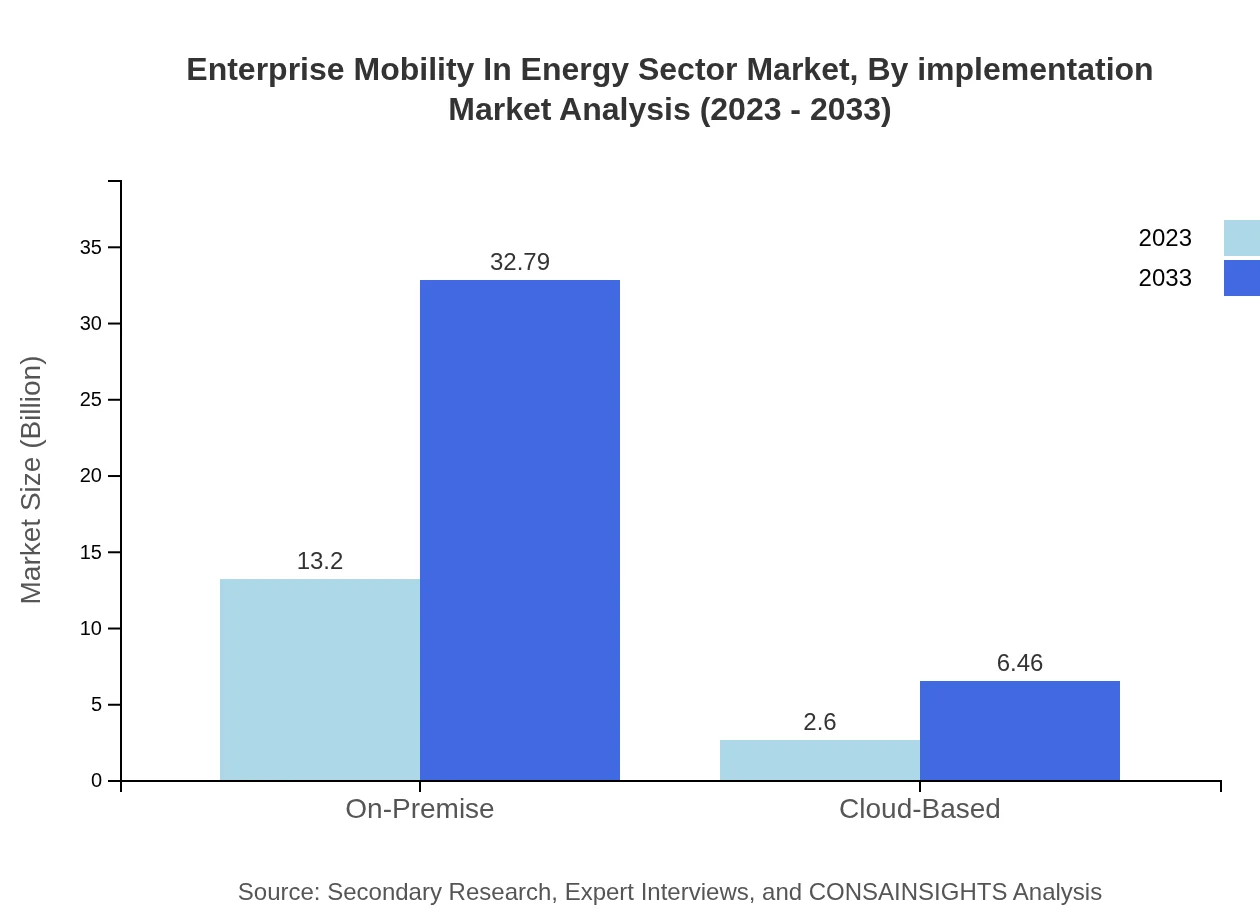

Enterprise Mobility In Energy Sector Market Analysis By Implementation

The implementation methods can be divided into on-premise and cloud-based solutions. The on-premise segment remains dominant, expected to grow from $13.20 billion in 2023 to $32.79 billion by 2033. Cloud-based solutions are also growing steadily, moving from $2.60 billion to $6.46 billion, indicating a gradual shift towards more flexible and scalable implementations.

Enterprise Mobility In Energy Sector Market Analysis By Customer Type

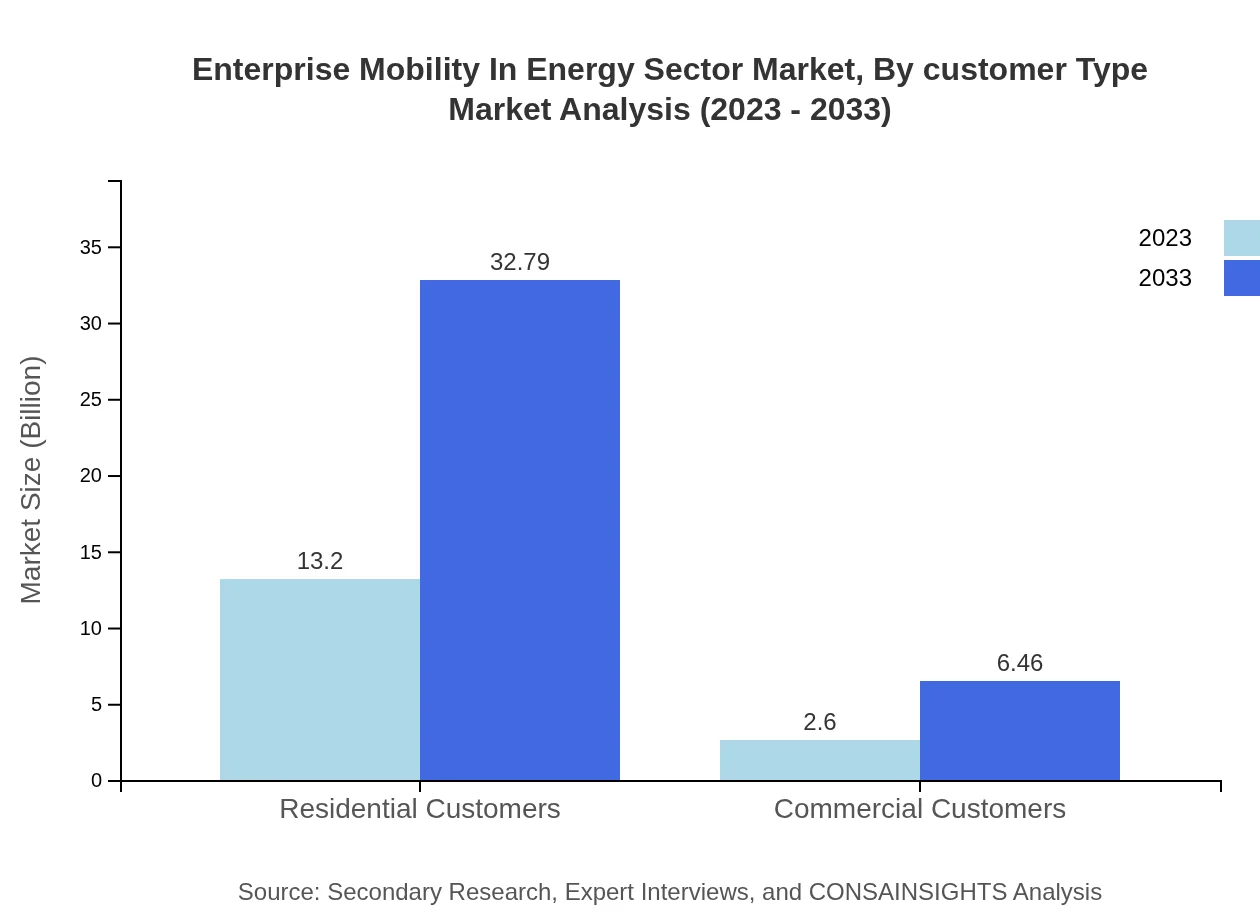

Customer types in this sector are segmented into residential and commercial customers. Residential customers lead the market substantially with a projected size of $13.20 billion in 2023 escalating to $32.79 billion by 2033, while commercial customers are seen growing from $2.60 billion to $6.46 billion, addressing their unique mobility needs.

Enterprise Mobility In Energy Sector Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility In Energy Sector Industry

IBM:

IBM provides cutting-edge mobility solutions and cloud services tailored for the Energy Sector, focusing on innovative analytics and AI technologies to enhance operational efficiencies.Microsoft:

Microsoft delivers comprehensive mobility platforms offering Azure-based solutions facilitating seamless application integration and data analytics, empowering companies to optimize their operations within the energy industry.SAP:

SAP offers an extensive suite of enterprise mobility solutions designed for the energy industry, focusing on resource management, operational excellence, and regulatory compliance.Oracle:

Oracle provides innovative mobile applications tailored to the energy sector, enabling advanced data management, reporting, and analytics from anywhere, thereby improving decision-making processes.Siemens :

Siemens focuses on mobility solutions that streamline operations in energy production and distribution, integrating IoT technologies to improve overall system responsiveness and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise mobility in the energy sector?

The enterprise mobility in the energy sector is projected to reach a market size of $15.8 billion by 2033, growing at a CAGR of 9.2%. This reflects the increasing need for mobility solutions in energy management.

What are the key market players or companies in the enterprise mobility in the energy sector industry?

Key players in the enterprise mobility in the energy sector include large energy producers, software developers, and IT service providers, which continuously innovate to enhance service efficiency and integrate advanced mobile applications.

What are the primary factors driving the growth in the enterprise mobility in the energy sector industry?

The growth is driven by the increasing demand for efficiency in energy management, adoption of mobile technologies, and the shift towards IoT and smart grids, facilitating better operational functions and data accessibility.

Which region is the fastest Growing in the enterprise mobility in the energy sector?

Europe is the fastest-growing region, with the market projected to grow from $4.86 billion in 2023 to $12.06 billion by 2033, demonstrating substantial investment in mobility solutions and renewable integration.

Does ConsaInsights provide customized market report data for the enterprise mobility in the energy sector industry?

Yes, ConsaInsights offers customized market report data tailored to client needs, allowing companies to gain insights specific to their market scenarios and strategic priorities in the energy sector.

What deliverables can I expect from this enterprise mobility in the energy sector market research project?

Deliverables typically include detailed market analysis, segmented data, growth forecasts, regional insights, competitive landscape assessments, and recommendations to inform strategic decisions.

What are the market trends of enterprise mobility in the energy sector?

Current trends include the rise in mobile application usage for energy management, increasing reliance on IoT integrations, and the transition to cloud platforms, enhancing operational continuity and real-time data management.