Enterprise Mobility In Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-in-manufacturing

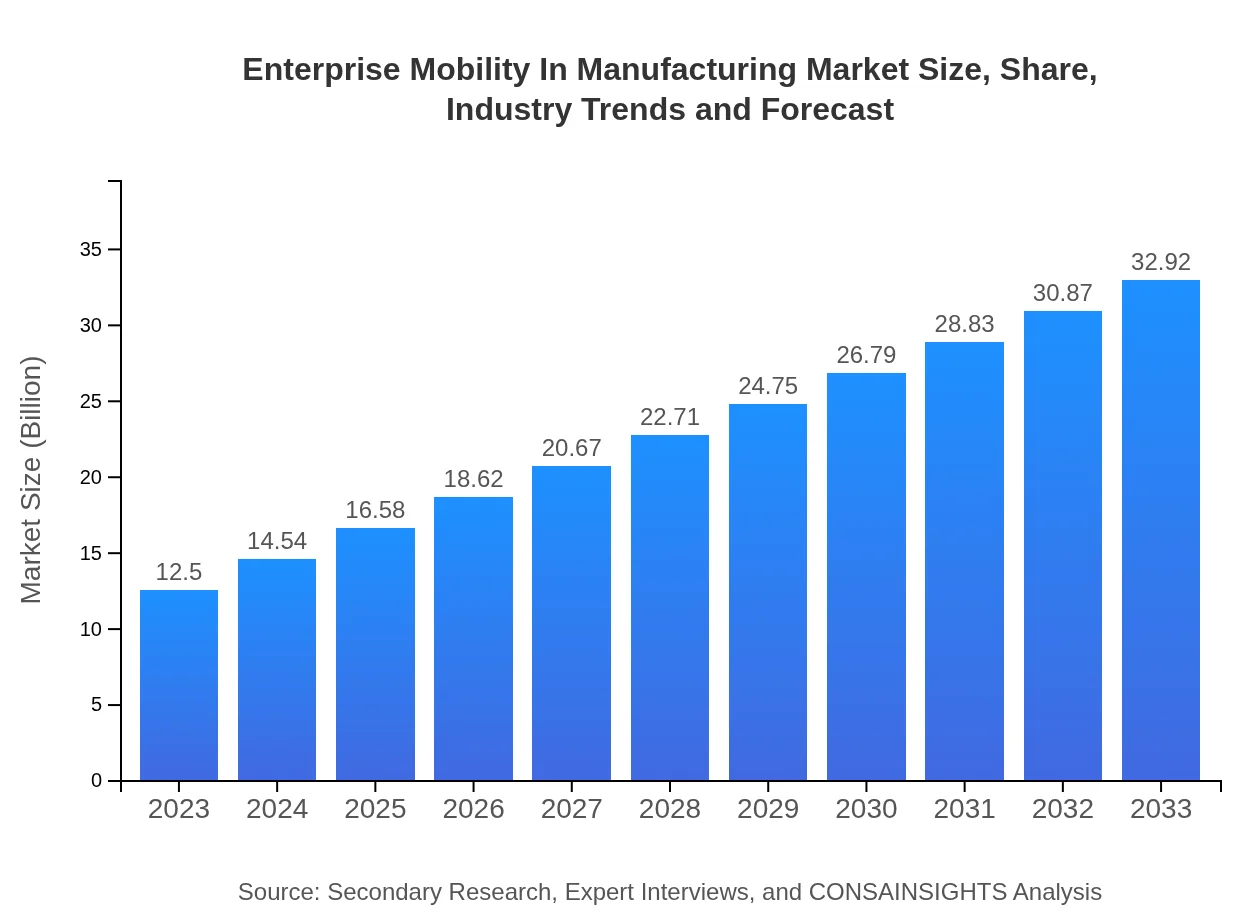

Enterprise Mobility In Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Mobility in Manufacturing market, offering insights from 2023 to 2033. It covers market size, growth rates, industry dynamics, regional performance, and trend forecasts, ensuring stakeholders have the necessary data for strategic planning.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $32.92 Billion |

| Top Companies | SAP SE, IBM Corporation, Microsoft Corporation, Oracle Corporation, Cisco Systems, Inc. |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility In Manufacturing Market Overview

Customize Enterprise Mobility In Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility In Manufacturing market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility In Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility In Manufacturing

What is the Market Size & CAGR of Enterprise Mobility In Manufacturing market in 2023?

Enterprise Mobility In Manufacturing Industry Analysis

Enterprise Mobility In Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility In Manufacturing Market Analysis Report by Region

Europe Enterprise Mobility In Manufacturing Market Report:

The European Enterprise Mobility market is set to expand from $3.36 billion in 2023 to $8.85 billion by 2033. The demand is supported by strict regulatory compliance ahead of Industry 4.0 adoption, coupled with an growing interest in sustainable manufacturing practices across major economies like Germany, France, and the UK.Asia Pacific Enterprise Mobility In Manufacturing Market Report:

In 2023, the Asia Pacific region's Enterprise Mobility in Manufacturing market is valued at approximately $2.45 billion, expected to grow to $6.45 billion by 2033. This growth is driven by rapid industrialization, increasing smartphone penetration, and a push towards smart manufacturing initiatives across countries like China and India, which are heavily investing in digital frameworks.North America Enterprise Mobility In Manufacturing Market Report:

North America represents a significant portion of the market, valued at $4.72 billion in 2023, projected to increase to $12.44 billion by 2033. The region's growth is largely attributed to the adoption of advanced manufacturing technologies, government initiatives promoting automation, and the presence of key market players.South America Enterprise Mobility In Manufacturing Market Report:

The South American market stands at $0.34 billion in 2023, with expectations to reach $0.89 billion by 2033. Growth is bolstered by increasing investments in technology adoption amid the region's manufacturing sectors, particularly in Brazil and Argentina, focusing on enhancing productivity through mobility solutions.Middle East & Africa Enterprise Mobility In Manufacturing Market Report:

The Middle East & Africa market started at $1.63 billion in 2023 and is expected to grow to $4.30 billion by 2033. Key drivers include increased manufacturing investments in the Gulf region and the push for smart factories, driven by regional governments' economic diversification plans.Tell us your focus area and get a customized research report.

Enterprise Mobility In Manufacturing Market Analysis Automotive

Global Enterprise Mobility in Manufacturing Market, By Automotive Segment (2023 - 2033)

The automotive sector considerably dominates the market, valued at $6.40 billion in 2023 and projected to reach $16.86 billion by 2033. This segment holds a 51.23% market share and is driven by the need for real-time data integration and improved supply chain management.

Enterprise Mobility In Manufacturing Market Analysis Electronics

Global Enterprise Mobility in Manufacturing Market, By Electronics Segment (2023 - 2033)

The electronics segment is valued at $2.98 billion in 2023, expected to increase to $7.86 billion by 2033, holding a market share of 23.87%. This growth is propelled by the increasing complexity of electronics manufacturing processes and enhanced collaboration through mobile platforms.

Enterprise Mobility In Manufacturing Market Analysis Pharmaceutical

Global Enterprise Mobility in Manufacturing Market, By Pharmaceutical Segment (2023 - 2033)

In the pharmaceutical segment, the market size is $1.75 billion in 2023, projected to grow to $4.61 billion by 2033. This segment, accounting for 14.01% of the share, emphasizes the necessity for compliance and traceability in manufacturing processes.

Enterprise Mobility In Manufacturing Market Analysis Food_and_beverage

Global Enterprise Mobility in Manufacturing Market, By Food and Beverage Segment (2023 - 2033)

The food and beverage sector is valued at $1.36 billion in 2023, with a forecast to reach $3.58 billion by 2033, making up 10.89% of the market share. Enhanced tracking and compliance with food safety standards drive investment in mobility solutions.

Enterprise Mobility In Manufacturing Market Analysis Mobility_management

Global Enterprise Mobility in Manufacturing Market, By Mobility Management Segment (2023 - 2033)

Mobility management is projected to grow from $8.51 billion in 2023 to $22.40 billion by 2033, representing a significant 68.06% share of the market. Its vital role in optimizing workforce productivity drives high investment levels in mobility management solutions.

Enterprise Mobility In Manufacturing Market Analysis Security_solutions

Global Enterprise Mobility in Manufacturing Market, By Security Solutions Segment (2023 - 2033)

Security solutions have a market size of $3.04 billion in 2023, with projections to reach $8.01 billion by 2033. This segment holds a 24.34% share as manufacturers seek to bolster data security amid increasing threats.

Enterprise Mobility In Manufacturing Market Analysis Analytics_solutions

Global Enterprise Mobility in Manufacturing Market, By Analytics Solutions Segment (2023 - 2033)

The analytics solutions market is valued at $0.95 billion in 2023 and is projected to expand to $2.50 billion by 2033, contributing a 7.6% share. The demand for data-driven decision-making propels this segment's growth in the manufacturing landscape.

Enterprise Mobility In Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility In Manufacturing Industry

SAP SE:

SAP SE leads the market by providing comprehensive enterprise mobility solutions tailored to manufacturing requirements, facilitating real-time data access and streamlined processes.IBM Corporation:

IBM offers innovative mobility solutions, leveraging AI and cloud technologies to enhance operational efficiencies and analytics in manufacturing.Microsoft Corporation:

Microsoft provides a robust platform for enterprise mobility, integrating productivity tools and cloud services specifically for the manufacturing sector.Oracle Corporation:

Oracle delivers enterprise application solutions that include mobility services aimed at improving supply chain visibility and operational performance in manufacturing.Cisco Systems, Inc.:

Cisco contributes solutions focused on secure connectivity and collaboration, essential for mobile manufacturing environments.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise mobility in manufacturing?

The Enterprise Mobility in Manufacturing market is valued at approximately $12.5 billion in 2023 and is projected to grow at a CAGR of 9.8% through 2033.

What are the key market players or companies in the enterprise mobility in manufacturing industry?

Key players include major technology firms specializing in mobile solutions and manufacturing optimization. Notable companies focus on integrating mobile platforms with manufacturing processes, enhancing efficiency and productivity.

What are the primary factors driving the growth in the enterprise mobility in manufacturing industry?

Growth is driven by increased demand for real-time data access, productivity improvements through mobile applications, and the rising need for enhanced operational efficiency in manufacturing processes.

Which region is the fastest Growing in the enterprise mobility in manufacturing?

The fastest-growing region is North America, where the market is expected to increase from $4.72 billion in 2023 to $12.44 billion by 2033, reflecting robust investment in mobility solutions.

Does ConsaInsights provide customized market report data for the enterprise mobility in manufacturing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing detailed insights and analyses relevant to enterprise mobility in manufacturing.

What deliverables can I expect from this enterprise mobility in manufacturing market research project?

Expect comprehensive reports including market segmentation, growth forecasts, competitive analysis, and regional performance insights, providing a holistic view of the enterprise mobility landscape.

What are the market trends of enterprise mobility in manufacturing?

Current trends include the rise of IoT solutions, an emphasis on data analytics for better decision-making, increased mobile security measures, and the integration of AI for enhanced operational efficiencies.