Enterprise Mobility In Retail Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-in-retail

Enterprise Mobility In Retail Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Enterprise Mobility in Retail market, providing comprehensive insights into market trends, size, segmentation, and regional analysis, with a forecast extending to 2033.

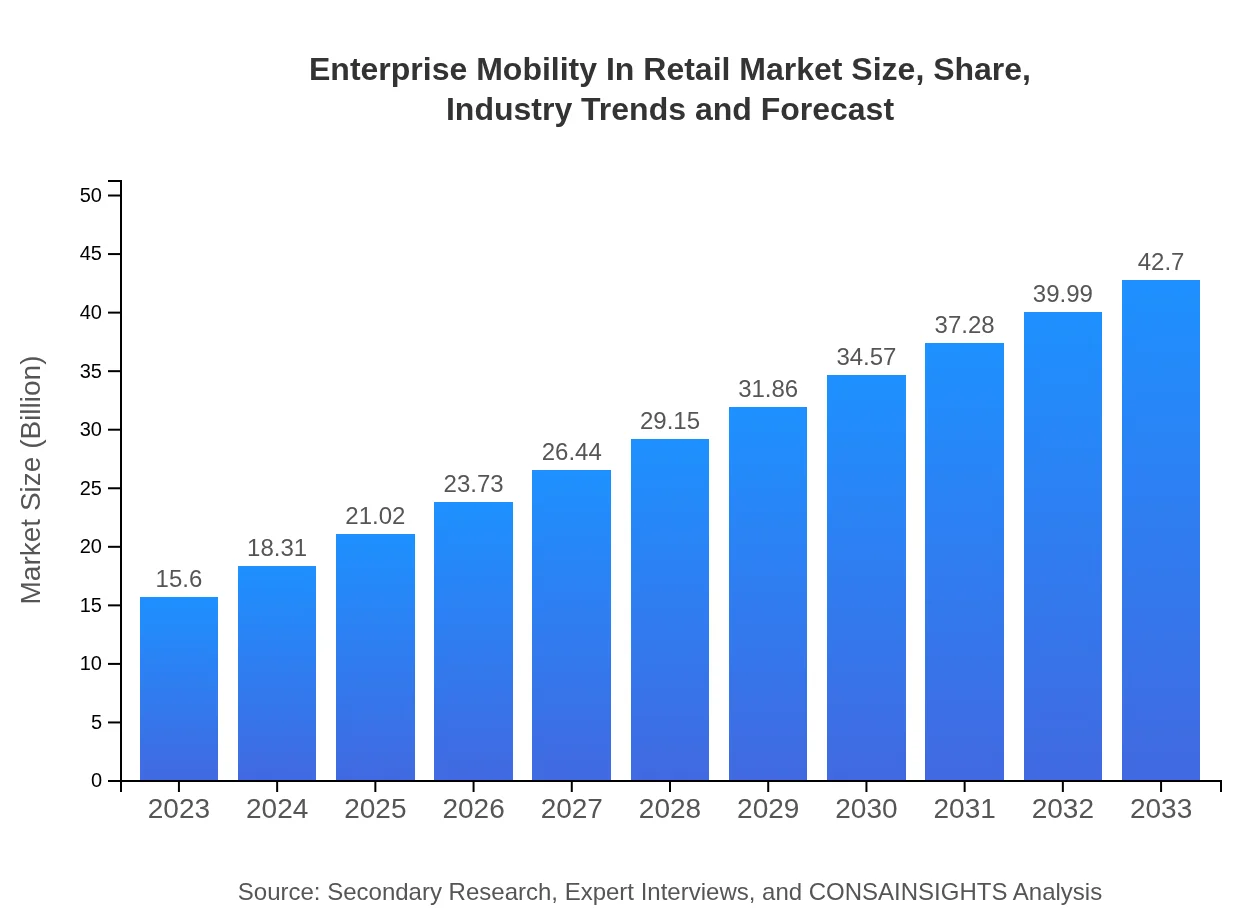

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $42.70 Billion |

| Top Companies | SAP SE, Oracle Corporation, Microsoft Corporation, IBM Corporation, Salesforce.com, Inc. |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility In Retail Market Overview

Customize Enterprise Mobility In Retail Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility In Retail market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility In Retail's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility In Retail

What is the Market Size & CAGR of Enterprise Mobility In Retail market in 2023?

Enterprise Mobility In Retail Industry Analysis

Enterprise Mobility In Retail Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility In Retail Market Analysis Report by Region

Europe Enterprise Mobility In Retail Market Report:

Europe's enterprise mobility market is expected to grow from $4.44 billion in 2023 to $12.15 billion in 2033. The European market is driven by stringent regulations on data privacy and security, prompting retailers to adopt advanced mobility solutions that ensure compliance while improving efficiency.Asia Pacific Enterprise Mobility In Retail Market Report:

The Asia Pacific region is expected to see significant growth, with the market projected to grow from $2.92 billion in 2023 to $7.99 billion in 2033. This growth is propelled by increasing smartphone penetration, expanding e-commerce platforms, and a growing focus on enhancing customer experience through mobile technology.North America Enterprise Mobility In Retail Market Report:

North America is leading the market with projected growth from $5.99 billion in 2023 to $16.39 billion in 2033. The region's strong technological infrastructure and early adoption of innovative solutions have positioned it favorably for high growth, supported by a focus on customer-centric retail strategies.South America Enterprise Mobility In Retail Market Report:

In South America, the enterprise mobility market in retail is anticipated to expand from $1.29 billion in 2023 to $3.52 billion by 2033. Factors contributing to this growth include rising internet connectivity and an increase in retail digitization efforts spurred by competitive pressures.Middle East & Africa Enterprise Mobility In Retail Market Report:

The Middle East and Africa region's market is expected to increase from $0.97 billion in 2023 to $2.65 billion in 2033, aided by investments in technological infrastructure and an increasing focus on enhancing customer experience in retail.Tell us your focus area and get a customized research report.

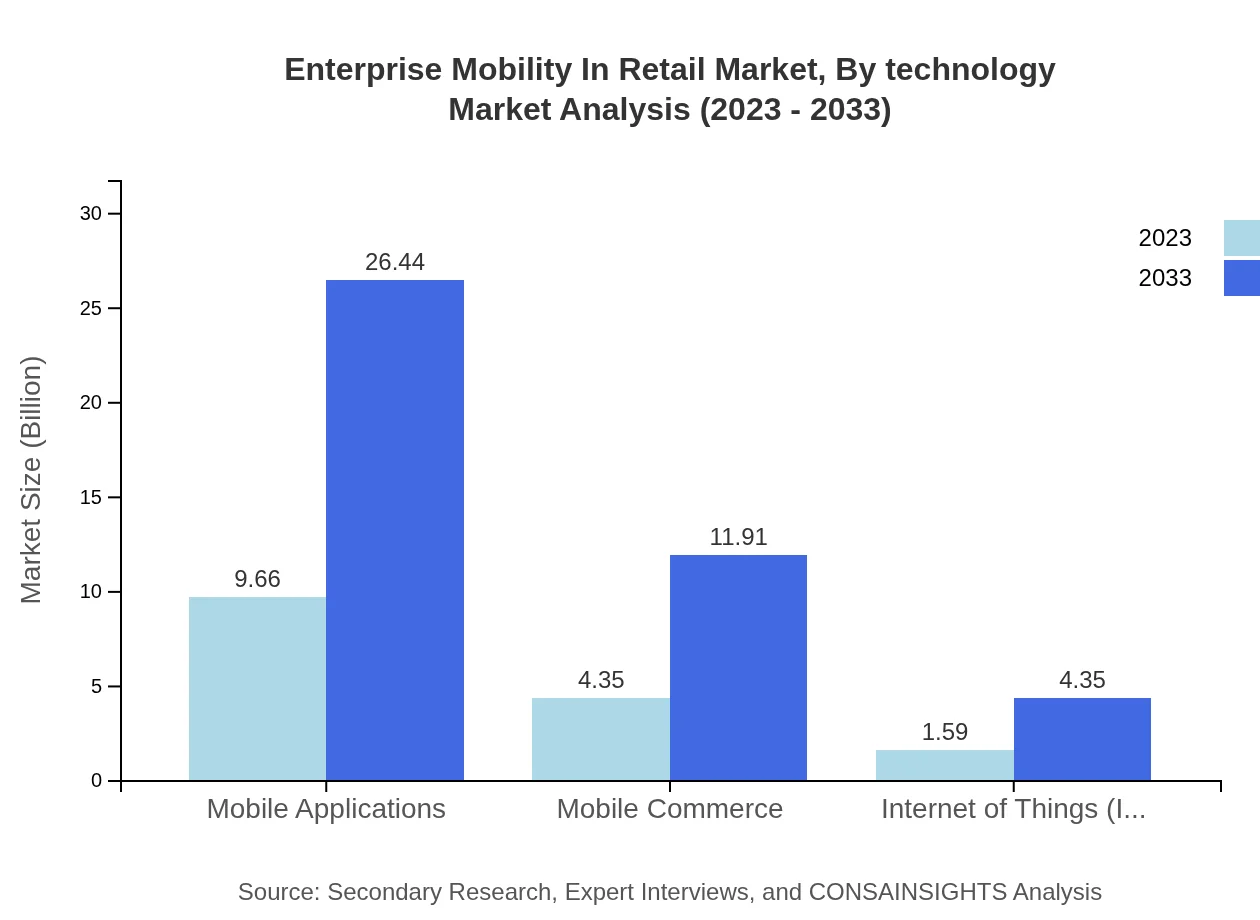

Enterprise Mobility In Retail Market Analysis By Technology

In 2023, the major contributing technology segment 'Mobile Applications' is expected to account for approximately $9.66 billion, increasing to $26.44 billion by 2033. The dominance of mobile applications is driven by their ability to facilitate transactions, enhance customer engagement, and streamline processes. IoT technology is projected to grow from $1.59 billion in 2023 to $4.35 billion in 2033, integrating smart devices into retail operations for better inventory and customer management.

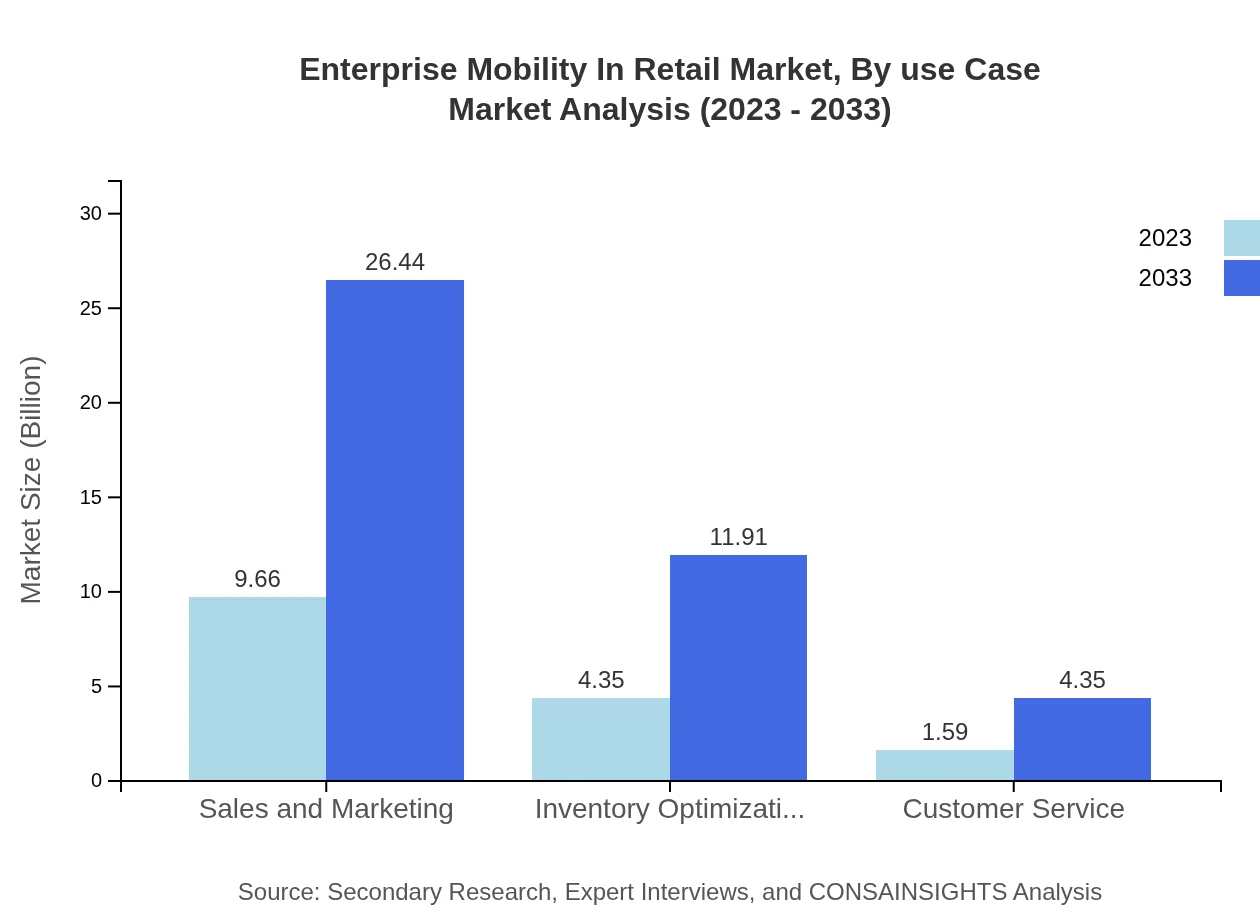

Enterprise Mobility In Retail Market Analysis By Use Case

Sales and Marketing is the largest use case segment, valued at $9.66 billion in 2023 and expected to reach $26.44 billion by 2033. This segment illustrates the critical role of mobility in engaging customers and driving sales. Inventory Optimization and Customer Service also play crucial roles, with valuations of $4.35 billion and $1.59 billion in 2023, expected to grow significantly through effective use of mobile technology.

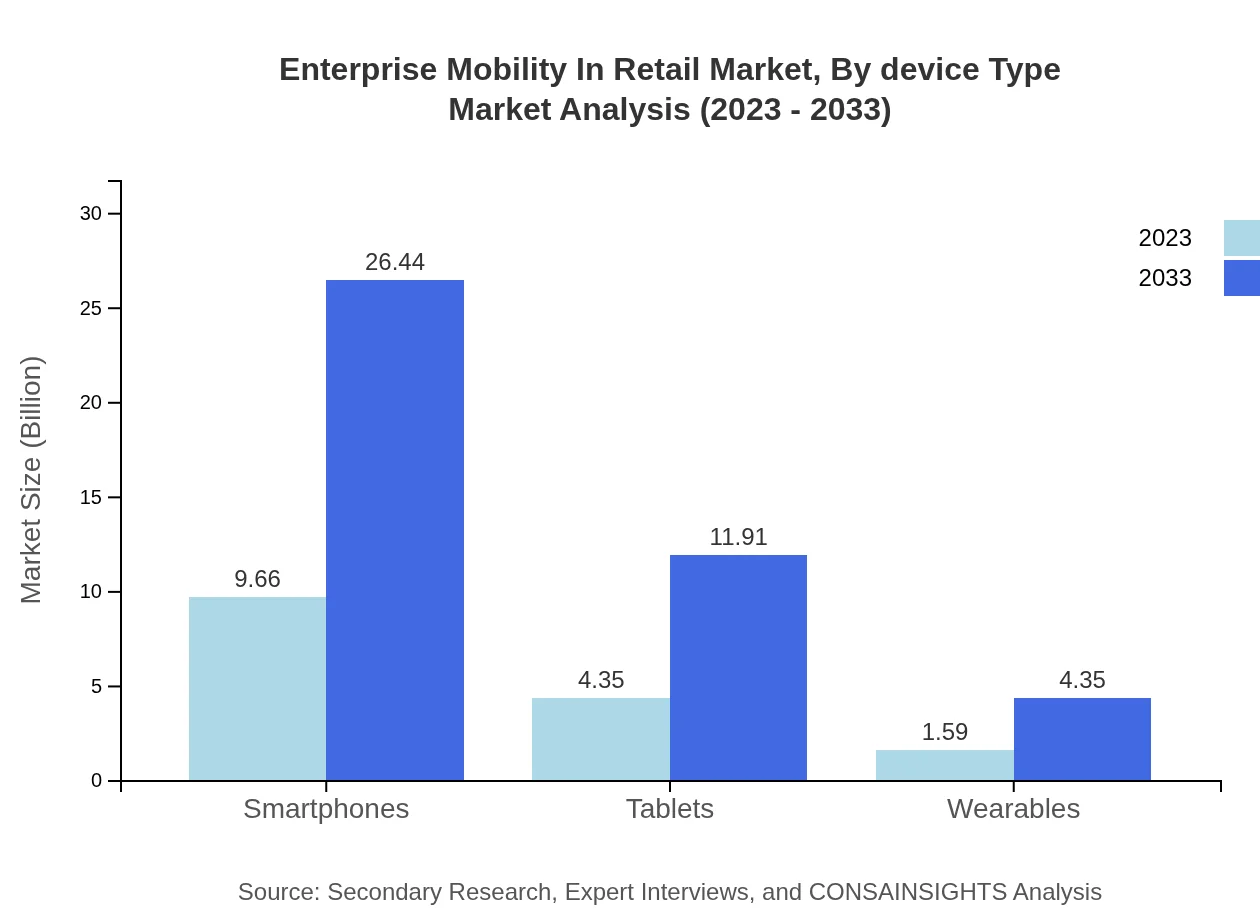

Enterprise Mobility In Retail Market Analysis By Device Type

Smartphones lead the device type segment, with revenues projected at $9.66 billion in 2023 and $26.44 billion by 2033. Tablets follow, representing significant market shares of $4.35 billion and $11.91 billion, respectively. Wearables, while smaller in size at $1.59 billion, are gaining traction due to their usability for real-time data access and customer interaction.

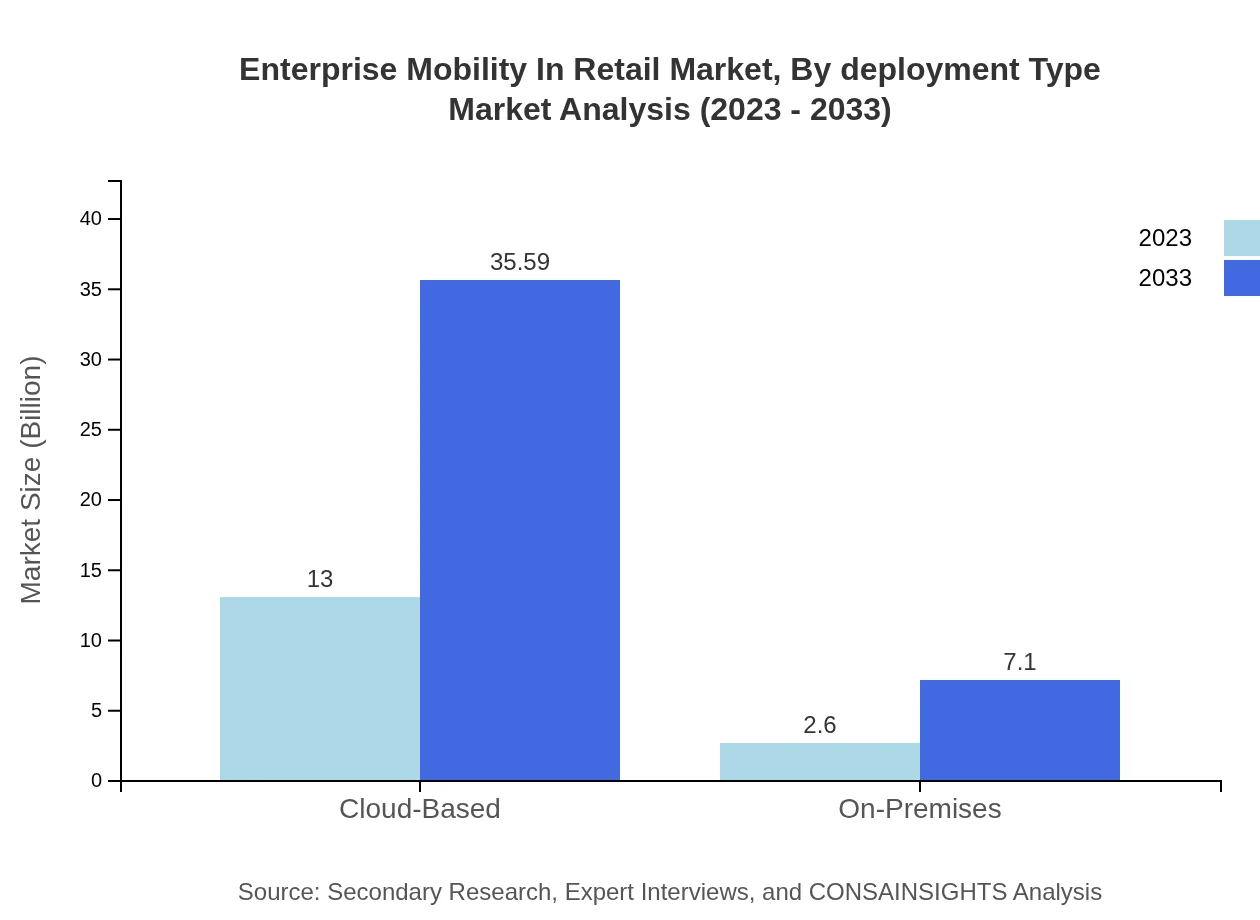

Enterprise Mobility In Retail Market Analysis By Deployment Type

Cloud-based solutions dominate the deployment landscape, forecasted to grow from $13.00 billion in 2023 to $35.59 billion by 2033, driven by their flexibility and scalability. On-premises solutions, while trailing, are also expected to grow from $2.60 billion to $7.10 billion, particularly among retailers with specific data security needs.

Enterprise Mobility In Retail Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility In Retail Industry

SAP SE:

A leader in enterprise software, SAP provides solutions that enable retailers to enhance their operational efficiencies through integrated mobile management systems.Oracle Corporation:

Oracle offers a comprehensive range of enterprise mobility solutions tailored for the retail industry, leveraging cloud technologies to optimize customer interactions and inventory management.Microsoft Corporation:

With its Azure cloud platform and Power Apps, Microsoft empowers retailers to create custom mobile applications that drive innovation and efficiency.IBM Corporation:

IBM provides mobile solutions with advanced analytics capabilities, helping retailers to understand consumer behavior and optimize supply chains.Salesforce.com, Inc.:

Specializing in customer relationship management, Salesforce offers mobile solutions that enhance customer service and engagement throughout the retail experience.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise mobility in retail?

The enterprise mobility in retail market size was valued at approximately $15.6 billion in 2023. The market is anticipated to grow at a CAGR of 10.2%, reaching significant milestones over the next decade.

What are the key market players or companies in this enterprise mobility in retail industry?

Key players in the enterprise mobility in retail industry include major technology firms and specialized service providers. These companies drive innovation and set benchmarks in mobility solutions tailored for retail operations.

What are the primary factors driving the growth in the enterprise mobility in retail industry?

The growth of enterprise mobility in retail is driven by the increasing demand for enhanced customer experience, the rise of mobile commerce, and advancements in IoT technologies, all contributing to a more efficient retail operation.

Which region is the fastest Growing in the enterprise mobility in retail?

North America is the fastest-growing region in enterprise mobility in retail, projected to grow from $5.99 billion in 2023 to $16.39 billion by 2033, fueled by rapid technological adoption and consumer demand.

Does ConsaInsights provide customized market report data for the enterprise mobility in retail industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise mobility in retail industry, enabling businesses to gain insights that are relevant and actionable.

What deliverables can I expect from this enterprise mobility in retail market research project?

Deliverables include comprehensive market analysis, detailed segmentation data, regional insights, and industry trends, providing a thorough understanding of the enterprise mobility landscape within retail.

What are the market trends of enterprise mobility in retail?

Market trends in enterprise mobility for retail include the growing emphasis on cloud-based solutions, the integration of IoT, and the rise of mobile applications to enhance operational efficiency and customer engagement.