Enterprise Mobility Management Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-management

Enterprise Mobility Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Mobility Management market, examining current trends, regional dynamics, technological advancements, and future forecasts from 2023 to 2033.

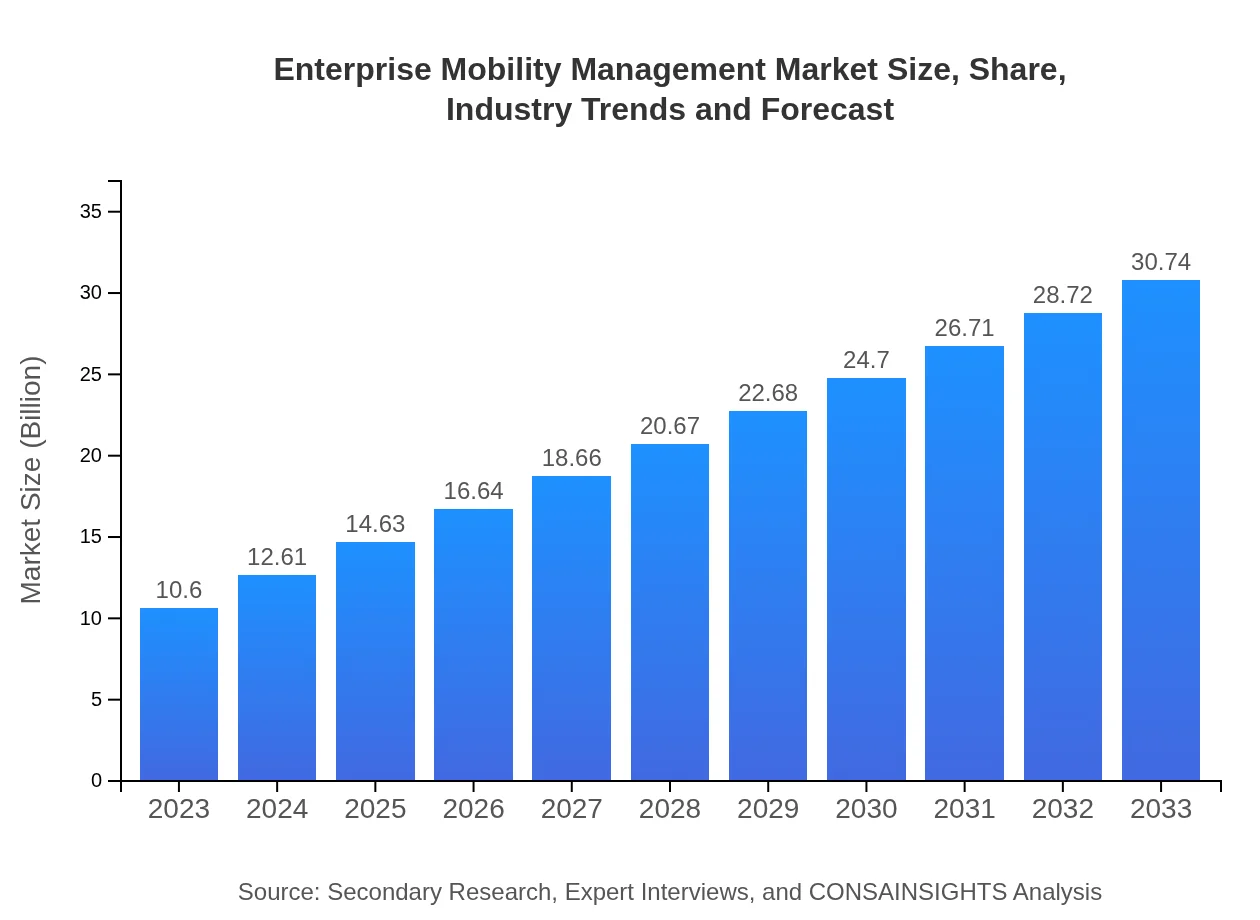

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.60 Billion |

| CAGR (2023-2033) | 10.8% |

| 2033 Market Size | $30.74 Billion |

| Top Companies | VMware, Microsoft, IBM, Citrix, MobileIron |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility Management Market Overview

Customize Enterprise Mobility Management Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility Management market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility Management

What is the Market Size & CAGR of Enterprise Mobility Management market in 2023?

Enterprise Mobility Management Industry Analysis

Enterprise Mobility Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility Management Market Analysis Report by Region

Europe Enterprise Mobility Management Market Report:

Europe's EMM market stands at $2.59 billion in 2023, projected to grow to $7.52 billion by 2033. The market's expansion is due to increasing mobile workforce needs and emphasis on data privacy compliance.Asia Pacific Enterprise Mobility Management Market Report:

The Asia Pacific region, valued at $2.07 billion in 2023, is projected to reach $6.00 billion by 2033. The growth in this region is driven by increasing mobile device penetration and rising investments in digital transformation initiatives among enterprises.North America Enterprise Mobility Management Market Report:

North America, currently the largest market at $3.76 billion in 2023, is forecasted to expand to $10.92 billion by 2033. The surge is attributed to the rapid adoption of mobile technologies and strict regulatory requirements for data security.South America Enterprise Mobility Management Market Report:

In South America, the EMM market, starting at $0.94 billion in 2023, is expected to grow to $2.72 billion by 2033. The adoption of EMM solutions in various sectors is spurred by the need to enhance operational efficiency and data security.Middle East & Africa Enterprise Mobility Management Market Report:

In the Middle East and Africa, the EMM market is valued at $1.24 billion in 2023, with projections of reaching $3.59 billion by 2033. The growth is driven by the rising adoption of mobile technologies and the urgency to secure organizational data.Tell us your focus area and get a customized research report.

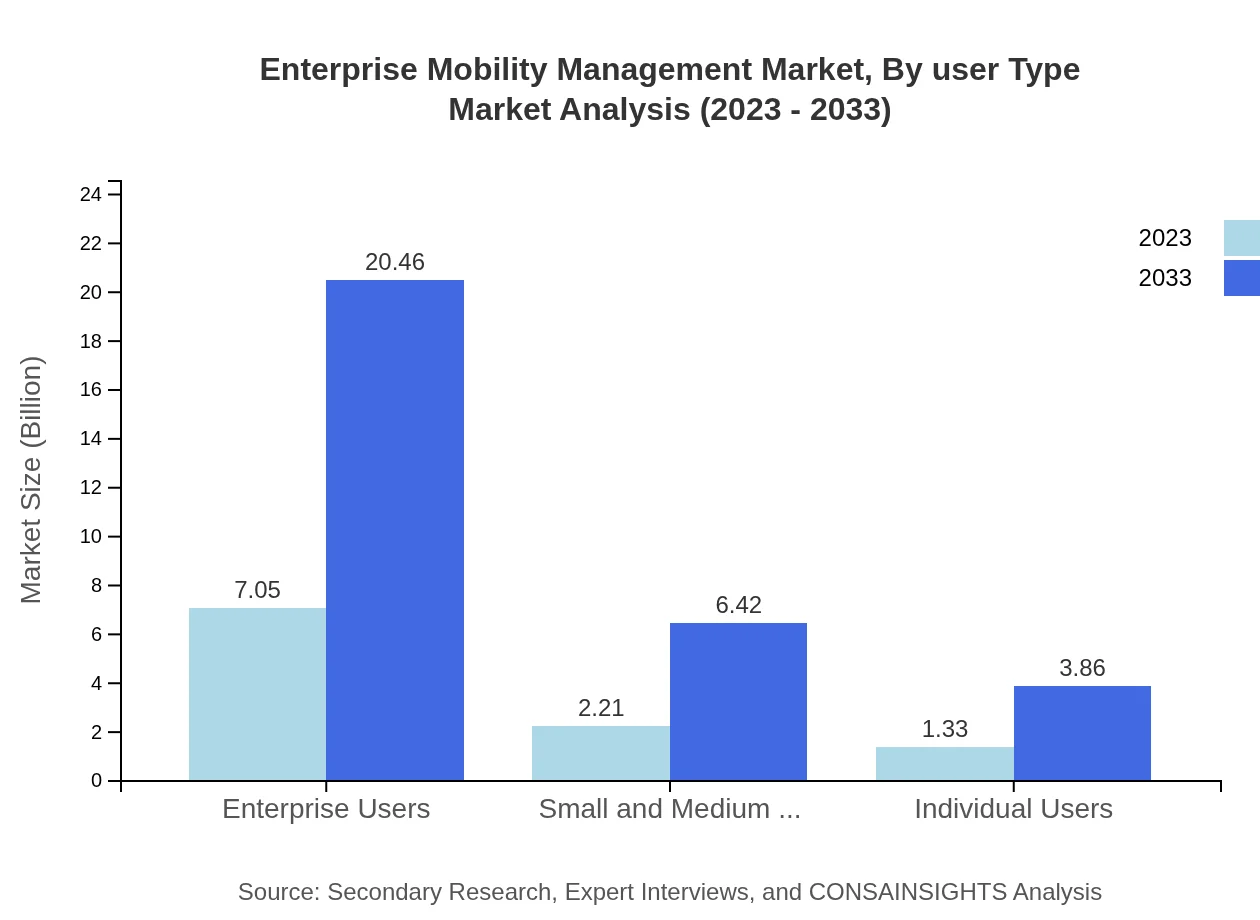

Enterprise Mobility Management Market Analysis By User Type

The user type segmentation reveals substantial opportunities in various categories. For Enterprise Users, the market size is expected to grow from $7.05 billion in 2023 to $20.46 billion in 2033, capturing 66.55% market share throughout the period. Small and Medium Businesses (SMBs) will also see growth from $2.21 billion to $6.42 billion, holding 20.88% market share. Individual Users represent a smaller segment growing from $1.33 billion to $3.86 billion, maintaining a 12.57% market share.

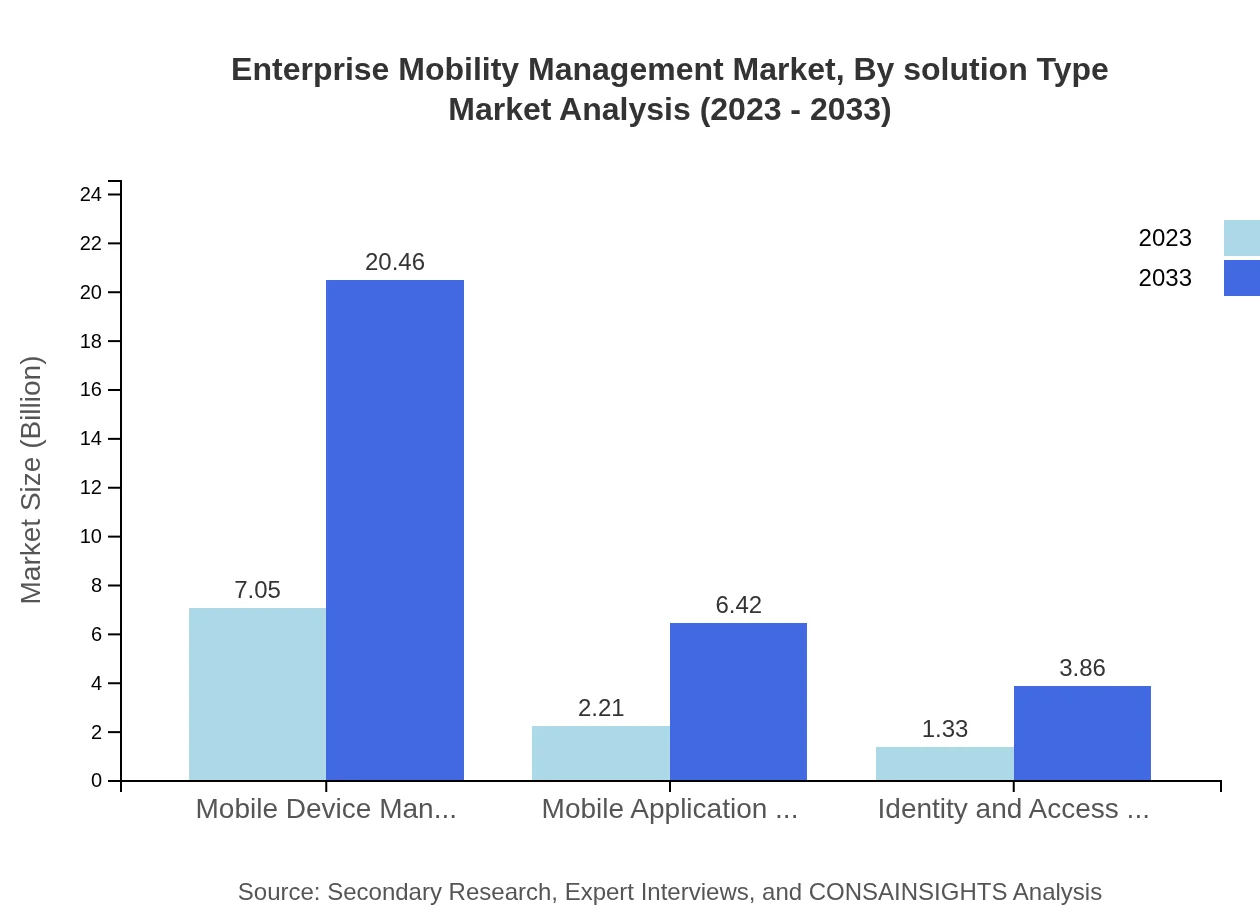

Enterprise Mobility Management Market Analysis By Solution Type

Analyzing solution types, Mobile Device Management (MDM) leads the segment with size projections from $7.05 billion in 2023 to $20.46 billion in 2033, maintaining a significant 66.55% share. Mobile Application Management (MAM) is expected to grow from $2.21 billion to $6.42 billion (20.88% share), while Identity and Access Management (IAM) will expand from $1.33 billion to $3.86 billion, also holding a steady 12.57% share.

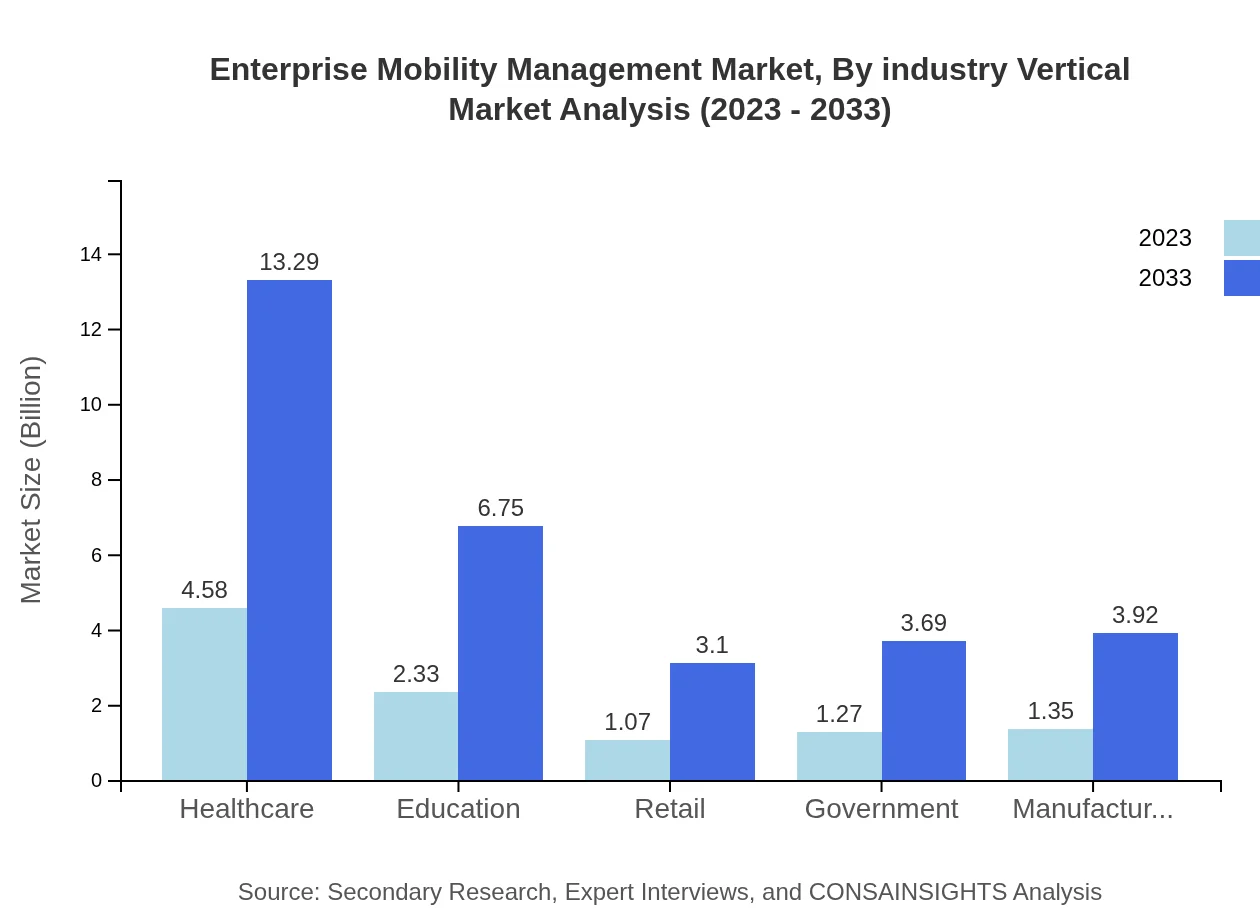

Enterprise Mobility Management Market Analysis By Industry Vertical

The industry vertical analysis showcases strong growth in Healthcare from $4.58 billion in 2023 to $13.29 billion by 2033 (43.22% share), Education from $2.33 billion to $6.75 billion (21.96% share), and Government from $1.27 billion to $3.69 billion (11.99% share). Other sectors like Retail and Manufacturing are also seeing growth, indicating a diverse adoption of EMM solutions across different fields.

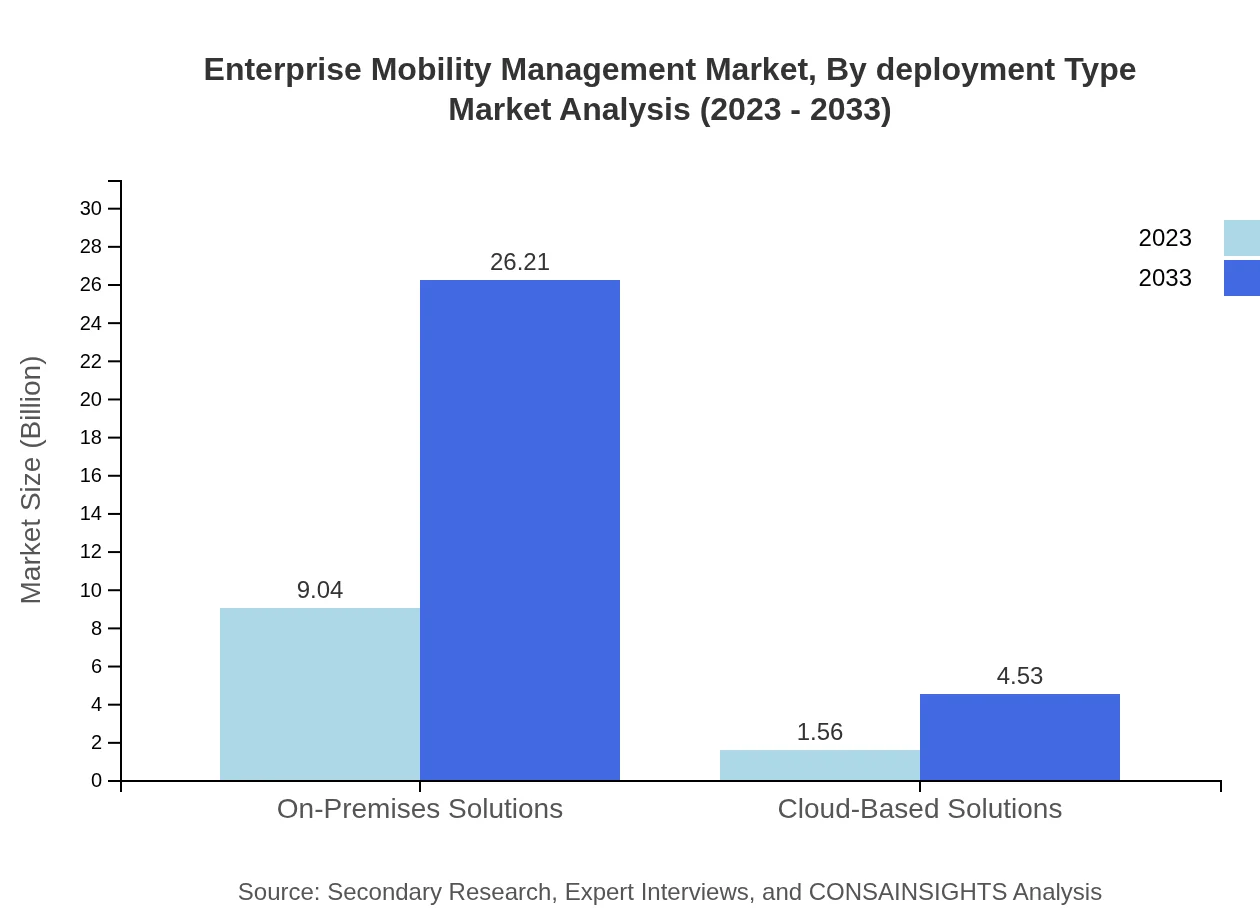

Enterprise Mobility Management Market Analysis By Deployment Type

The deployment type segmentation reveals On-Premises Solutions leading the way, projected to grow from $9.04 billion in 2023 to $26.21 billion in 2033, holding 85.26% market share. Cloud-Based Solutions are also gaining traction with growth forecasts from $1.56 billion to $4.53 billion, representing 14.74% share.

Enterprise Mobility Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility Management Industry

VMware:

A leading player in cloud infrastructure and digital workspace technology, VMware provides comprehensive EMM solutions that help businesses manage mobile devices and applications securely.Microsoft:

With its Intune platform, Microsoft offers robust mobile device and application management solutions, integrating seamlessly with enterprise systems to enhance productivity and security.IBM:

IBM delivers powerful enterprise mobility solutions focused on security and innovation, helping organizations manage risks associated with mobile technology.Citrix:

Citrix specializes in digital workspace solutions, offering EMM that empower employees by providing secure access to applications and data across devices.MobileIron:

A key player in mobile-centric security management, MobileIron offers solutions that allow organizations to secure their mobile fleets and ensure regulatory compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Mobility Management?

The Enterprise Mobility Management market is currently valued at approximately $10.6 billion and is projected to grow at a compound annual growth rate (CAGR) of 10.8% between 2023 and 2033.

What are the key market players or companies in this enterprise Mobility Management industry?

Key players in the Enterprise Mobility Management industry include major technology companies leading the mobility solutions space, focusing on mobile device management, security, and application management to enhance enterprise productivity.

What are the primary factors driving the growth in the enterprise Mobility Management industry?

The growth of the Enterprise Mobility Management industry is driven by increasing mobile workforce demands, the rise in BYOD policies, enhanced security requirements, and the growing need for effective mobile application management.

Which region is the fastest Growing in the enterprise Mobility Management?

North America is the fastest-growing region in the Enterprise Mobility Management market, projected to grow from $3.76 billion in 2023 to $10.92 billion by 2033, driven by high adoption rates of mobile technologies.

Does ConsaInsights provide customized market report data for the enterprise Mobility Management industry?

Yes, ConsaInsights offers tailored market report data specific to the Enterprise Mobility Management industry, addressing the unique needs of clients to provide precise insights and actionable data.

What deliverables can I expect from this enterprise Mobility Management market research project?

Expected deliverables from the Enterprise Mobility Management market research project include detailed market analysis, competitor insights, trend reports, and strategic recommendations drawn from comprehensive data collection.

What are the market trends of enterprise Mobility Management?

Key trends in the Enterprise Mobility Management market include increasing cloud adoption, a shift towards mobile application management, and an emphasis on security solutions as enterprises adapt to evolving mobile environments.