Enterprise Mobility Software Market Report

Published Date: 31 January 2026 | Report Code: enterprise-mobility-software

Enterprise Mobility Software Market Size, Share, Industry Trends and Forecast to 2033

This report covers a detailed analysis of the Enterprise Mobility Software market, exploring insights from 2023 to 2033. It provides data on market size, growth trends, industry dynamics, key players, and regional analyses that are critical for stakeholders looking to navigate this evolving landscape.

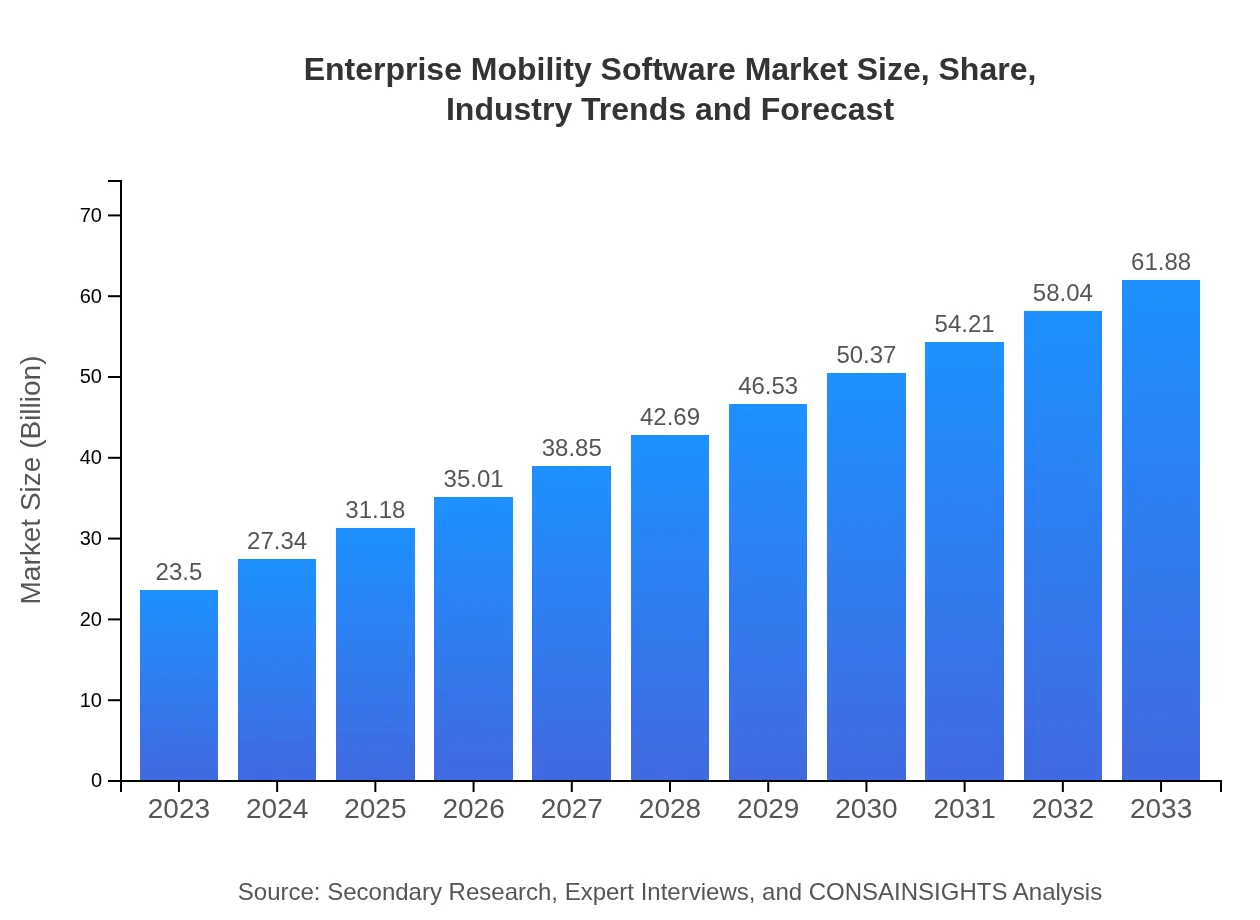

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $61.88 Billion |

| Top Companies | IBM, SAP, Microsoft, VMware, Citrix |

| Last Modified Date | 31 January 2026 |

Enterprise Mobility Software Market Overview

Customize Enterprise Mobility Software Market Report market research report

- ✔ Get in-depth analysis of Enterprise Mobility Software market size, growth, and forecasts.

- ✔ Understand Enterprise Mobility Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Mobility Software

What is the Market Size & CAGR of Enterprise Mobility Software market in 2023?

Enterprise Mobility Software Industry Analysis

Enterprise Mobility Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Mobility Software Market Analysis Report by Region

Europe Enterprise Mobility Software Market Report:

Europe's market is projected to grow from 6.41 billion USD in 2023 to 16.89 billion USD by 2033. Factors such as stringent regulations favoring data security and privacy, along with the rise of remote work, have triggered the adoption of enterprise mobility software.Asia Pacific Enterprise Mobility Software Market Report:

In Asia Pacific, the Enterprise Mobility Software market is projected to grow from approximately 4.70 billion USD in 2023 to 12.38 billion USD by 2033. This growth is fueled by the increasing smartphone penetration, rapid urbanization, and rising demand for mobile solutions in nations like China and India.North America Enterprise Mobility Software Market Report:

North America remains the largest market for Enterprise Mobility Software, forecasted to reach 22.96 billion USD by 2033, up from 8.72 billion USD in 2023. This significant growth is attributed to the high concentration of technology companies, early adoption of new solutions, and the increasing demand for mobile applications in enterprises.South America Enterprise Mobility Software Market Report:

The South American market is expected to experience growth from 0.50 billion USD in 2023 to 1.32 billion USD by 2033, driven by an increasing focus on digital transformation and the adoption of mobility solutions across various sectors, particularly retail and education.Middle East & Africa Enterprise Mobility Software Market Report:

The Middle East and Africa market is expected to expand from 3.17 billion USD in 2023 to 8.34 billion USD by 2033, propelled by increasing connectivity, the shift towards smart technologies, and investments in infrastructure.Tell us your focus area and get a customized research report.

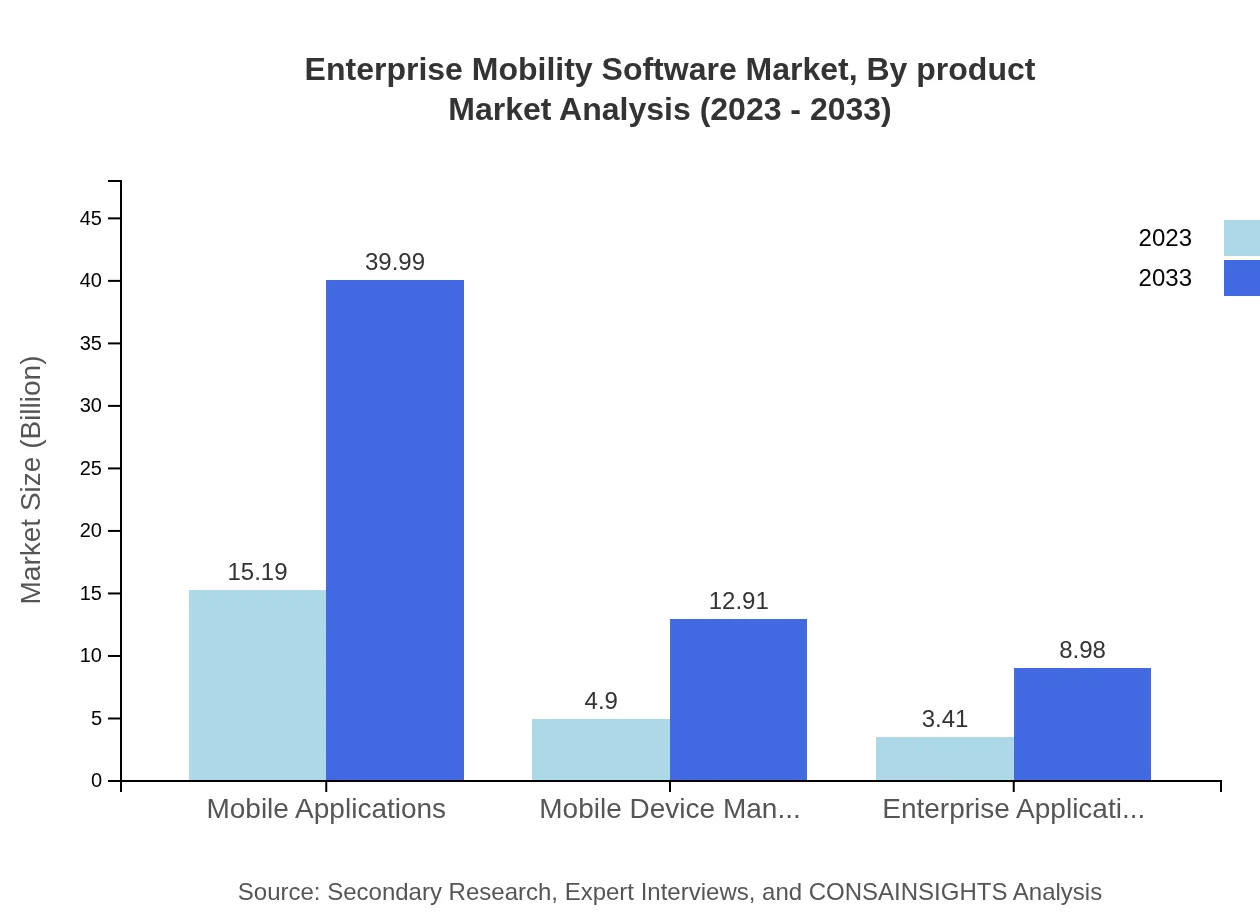

Enterprise Mobility Software Market Analysis By Product

The Mobile Applications segment leads the Enterprise Mobility Software market, with growth from 15.19 billion USD in 2023 to 39.99 billion USD by 2033. This segment represents 64.62% of the market share. Furthermore, Mobile Device Management is projected to achieve 12.91 billion USD in 2033 from 4.90 billion USD in 2023, holding a 20.87% share. Enterprise Applications, including specific industry solutions, are also growing, with a market size of 8.98 billion USD forecasted by 2033. The Healthcare sector, at 10.69 billion USD in 2023, also showcases strong growth, anticipating a rise to 28.14 billion USD by 2033.

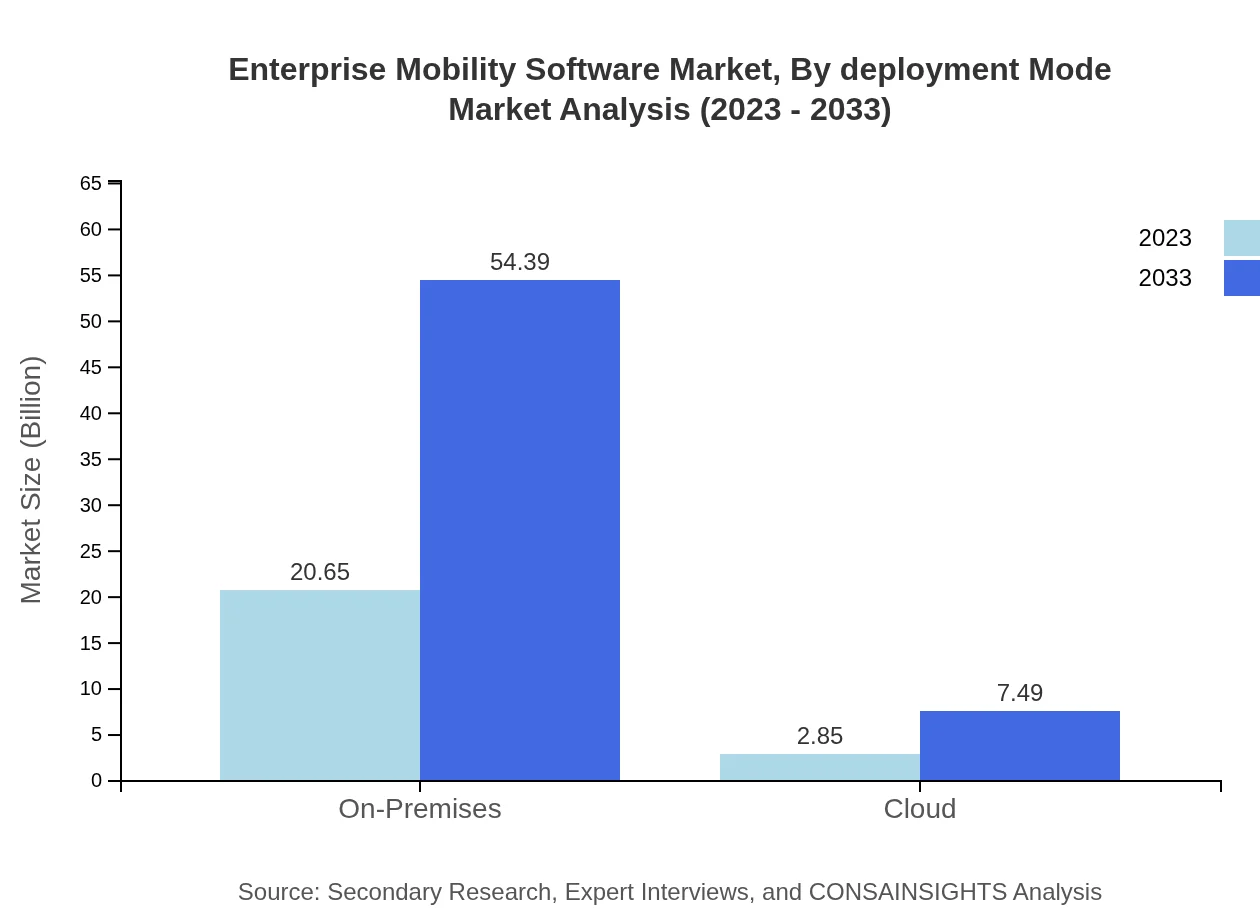

Enterprise Mobility Software Market Analysis By Deployment Mode

Deployment modes primarily include On-Premises and Cloud. The On-Premises solution will grow from 20.65 billion USD in 2023 to 54.39 billion USD by 2033, accounting for 87.89% of the market share. In contrast, Cloud deployment will reach 7.49 billion USD by 2033 from 2.85 billion USD in 2023, growing steadily as businesses increasingly embrace cloud-based solutions.

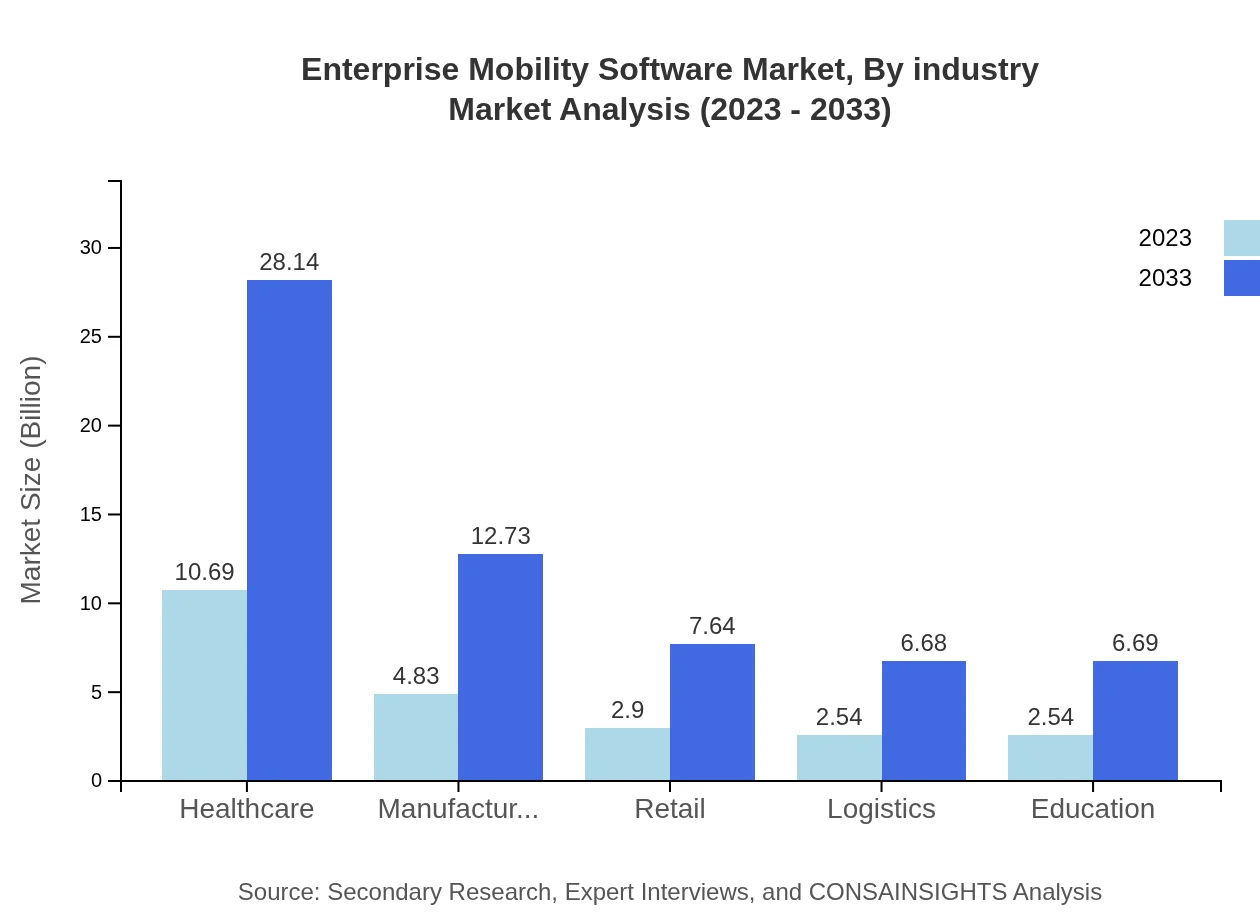

Enterprise Mobility Software Market Analysis By Industry

Industries adopting mobility solutions extensively include Healthcare, Manufacturing, Retail, Logistics, and Education. Healthcare will lead with a notable market share of 45.47%, increasing from 10.69 billion USD in 2023 to 28.14 billion USD by 2033. Manufacturing will see significant growth as well, with an increase from 4.83 billion USD in 2023 to 12.73 billion USD.

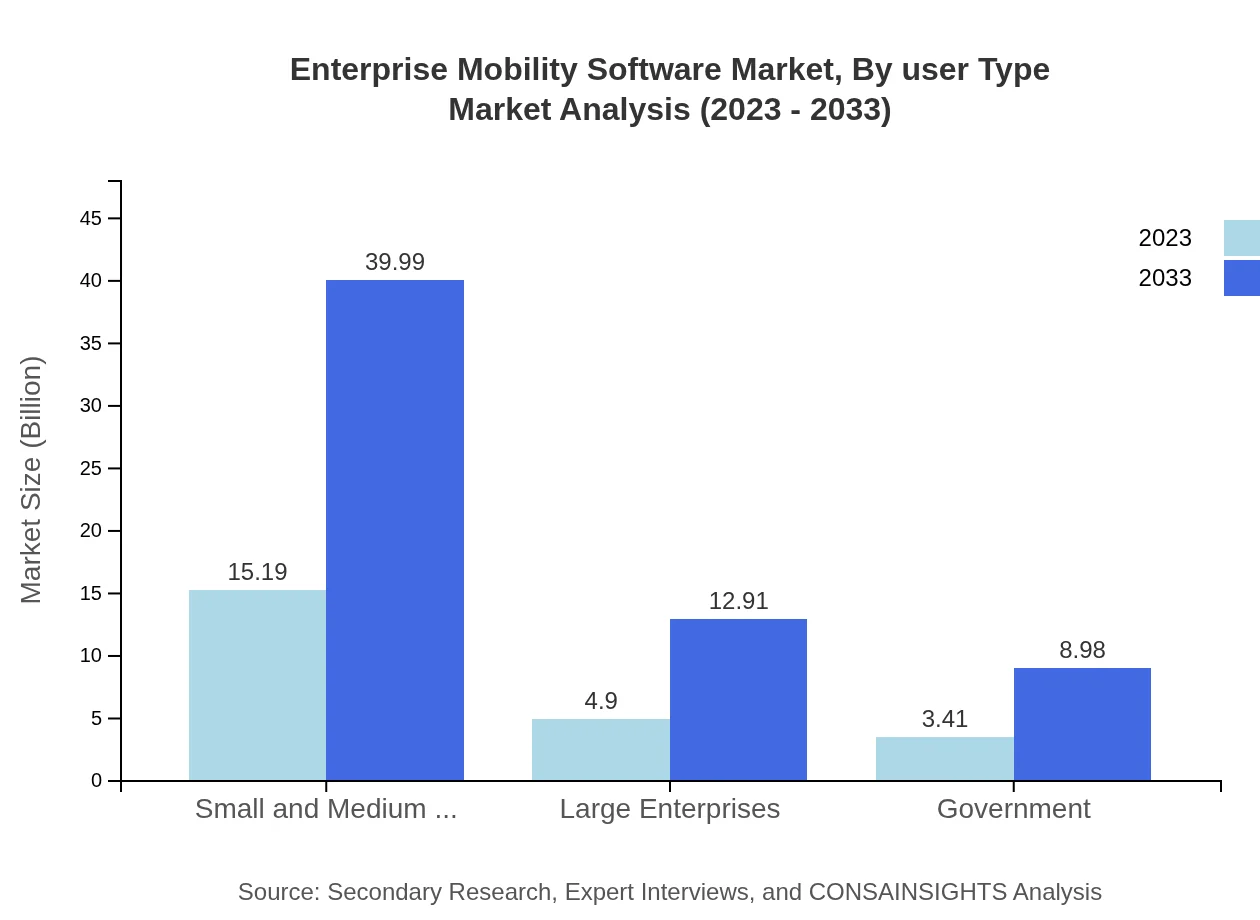

Enterprise Mobility Software Market Analysis By User Type

The market segments into Small and Medium Businesses (SMBs) and Large Enterprises. SMBs currently hold a dominant share, at 64.62%, expected to grow from 15.19 billion USD in 2023 to 39.99 billion USD by 2033. Large Enterprises will also expand, from 4.90 billion USD in 2023 to 12.91 billion USD, capturing 20.87% of the market share.

Enterprise Mobility Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Mobility Software Industry

IBM:

IBM provides comprehensive enterprise mobility solutions, emphasizing mobile security and device management. Their product offerings enable organizations to integrate mobile technologies effectively into their business operations.SAP:

SAP offers cloud-based mobile solutions tailored for business applications. Their enterprise applications empower organizations to enhance operational efficiencies and improve user experience across mobile devices.Microsoft:

Microsoft’s enterprise mobility services help organizations manage and secure their mobile infrastructures, while their seamless integration with Azure Cloud enhances cloud adoption among global enterprises.VMware:

VMware specializes in mobile device management and application solutions that guarantee security across various devices, allowing companies to implement unified endpoint management in hybrid environments.Citrix:

Citrix provides solutions focusing on secure access and remote working, facilitating a frictionless digital workspace for enterprises amid increasing demand for flexible working arrangements.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise mobility software?

The enterprise mobility software market is projected to reach a size of approximately $23.5 billion by 2033, growing at a CAGR of 9.8% from its current size in 2023.

What are the key market players or companies in the enterprise mobility software industry?

Key players in the enterprise mobility software industry include major technology companies like Microsoft, IBM, VMware, Citrix, and SAP. These companies play a vital role in providing innovative mobility solutions.

What are the primary factors driving the growth in the enterprise mobility software industry?

Growth in the enterprise mobility software industry is driven by increasing smartphone adoption, cloud technology advancements, and the need for enhanced workforce productivity and flexibility among businesses.

Which region is the fastest Growing in the enterprise mobility software?

The fastest-growing region in the enterprise mobility software market is North America, projected to grow from $8.72 billion in 2023 to $22.96 billion by 2033.

Does ConsaInsights provide customized market report data for the enterprise mobility software industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the enterprise mobility software industry, ensuring clients receive relevant insights and analytics.

What deliverables can I expect from this enterprise mobility software market research project?

Deliverables from the market research project include detailed market analysis reports, regional insights, segment data, trends, competitive landscape assessments, and forecasts for future growth.

What are the market trends of enterprise mobility software?

Current trends in the enterprise mobility software market include a rise in mobile device management solutions, increased integration of AI technologies, and a shift towards cloud-based deployment models.