Enterprise Performance Management Market Report

Published Date: 31 January 2026 | Report Code: enterprise-performance-management

Enterprise Performance Management Market Size, Share, Industry Trends and Forecast to 2033

This market report explores the landscape of the Enterprise Performance Management (EPM) sector, providing valuable insights, forecasts, and analytical data for the period from 2023 to 2033.

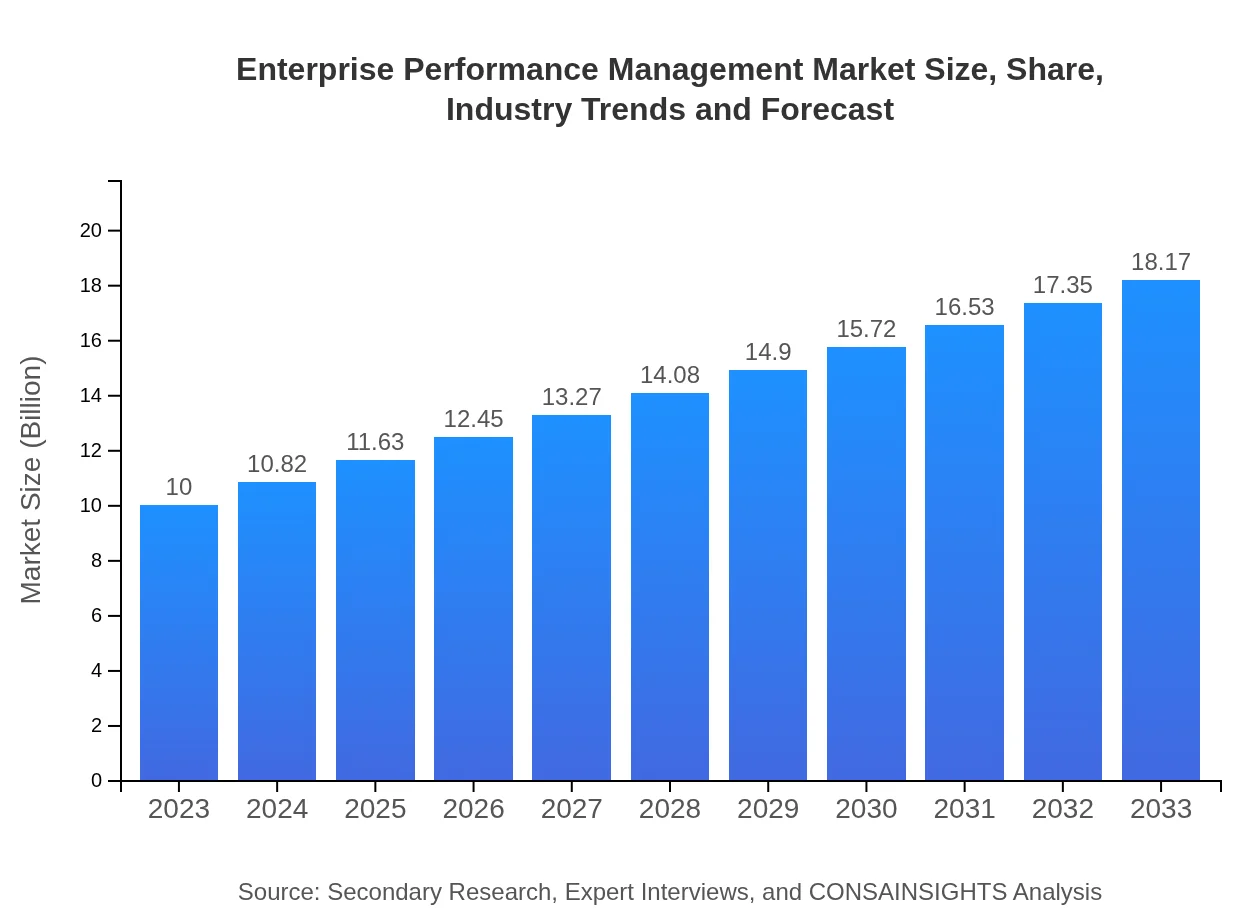

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $18.17 Billion |

| Top Companies | Oracle Corporation, SAP SE, IBM Corporation, Anaplan, Inc., Workday, Inc. |

| Last Modified Date | 31 January 2026 |

Enterprise Performance Management Market Overview

Customize Enterprise Performance Management Market Report market research report

- ✔ Get in-depth analysis of Enterprise Performance Management market size, growth, and forecasts.

- ✔ Understand Enterprise Performance Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Performance Management

What is the Market Size & CAGR of Enterprise Performance Management market in 2023?

Enterprise Performance Management Industry Analysis

Enterprise Performance Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Performance Management Market Analysis Report by Region

Europe Enterprise Performance Management Market Report:

With a market value of $2.74 billion in 2023, Europe's EPM landscape is expected to reach $4.98 billion by 2033. European organizations increasingly focus on regulatory compliance and data governance, with a marked preference for cloud-based solutions, propelling steady growth in the market.Asia Pacific Enterprise Performance Management Market Report:

In 2023, the EPM market in the Asia-Pacific region is valued at approximately $1.90 billion, with projections estimating growth to about $3.45 billion by 2033. The rapid adoption of advanced technologies and the increasing number of global enterprises establishing operations in this region are significant growth factors. Additionally, countries like China and India are emphasizing digital transformation, further propelling the demand for EPM solutions.North America Enterprise Performance Management Market Report:

The North American market is projected to grow from $3.86 billion in 2023 to $7.01 billion by 2033. The region remains a leader in technological advancements and has a high concentration of major EPM solution providers. Continuous investments in innovative performance management frameworks by large corporations enhance market growth in the USA and Canada.South America Enterprise Performance Management Market Report:

The South American EPM market is expected to see an increase from $0.79 billion in 2023 to $1.43 billion by 2033. Although currently smaller compared to other regions, the growing interest in digitization and improving operational efficiencies, alongside economic improvements, is likely to boost the market in this region significantly in the coming years.Middle East & Africa Enterprise Performance Management Market Report:

The EPM market in the Middle East and Africa is projected to expand from $0.71 billion in 2023 to about $1.29 billion by 2033. Factors such as digital transformation initiatives, growing SMEs, and the increasing need for efficiency in public and private sectors are driving EPM adoption throughout the region.Tell us your focus area and get a customized research report.

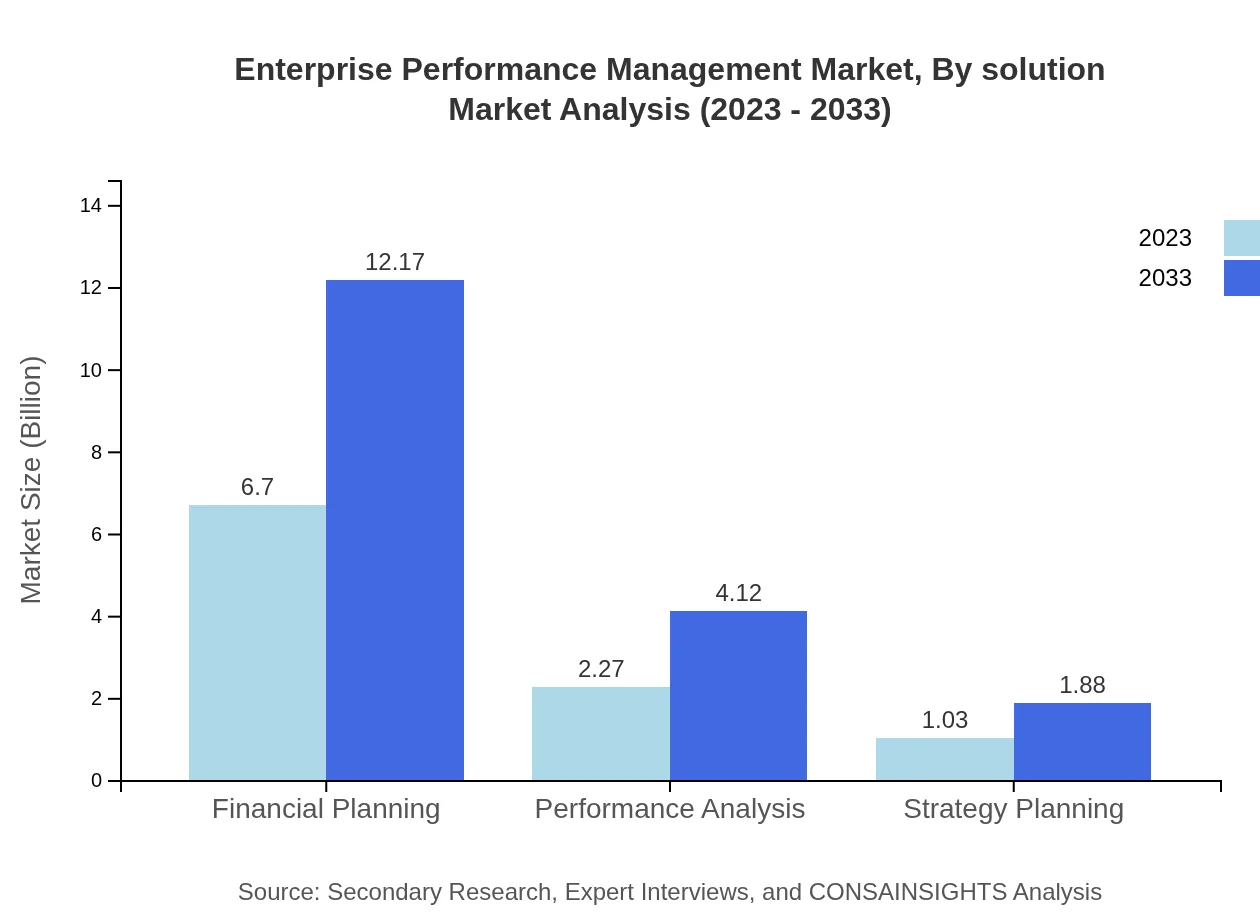

Enterprise Performance Management Market Analysis By Solution

The market for Enterprise Performance Management solutions is substantial, with financial planning leading the way in 2023 at $6.70 billion, expected to grow to $12.17 billion by 2033. Other notable segments include strategy planning ($1.03 billion in 2023) and performance analysis ($2.27 billion). The need for comprehensive performance management solutions in diverse industries propels further growth in this segment.

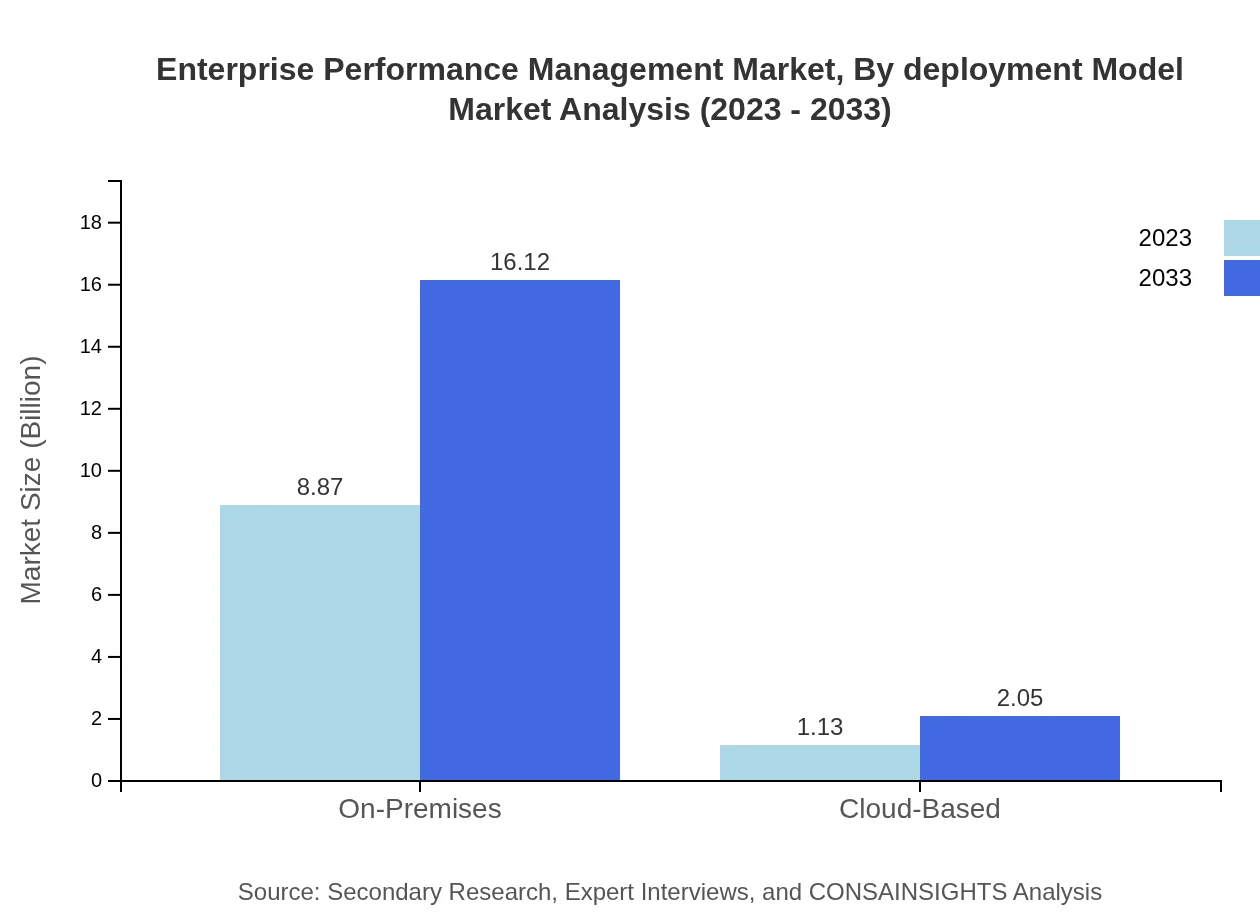

Enterprise Performance Management Market Analysis By Deployment Model

EPM solutions can be deployed on-premises or through the cloud. The on-premises segment is dominant with a market size of $8.87 billion in 2023 and projected growth to $16.12 billion by 2033. However, cloud-based deployment is rapidly gaining traction, expected to rise from $1.13 billion to $2.05 billion in the same timeframe, driven by the flexibility and cost efficiency it offers.

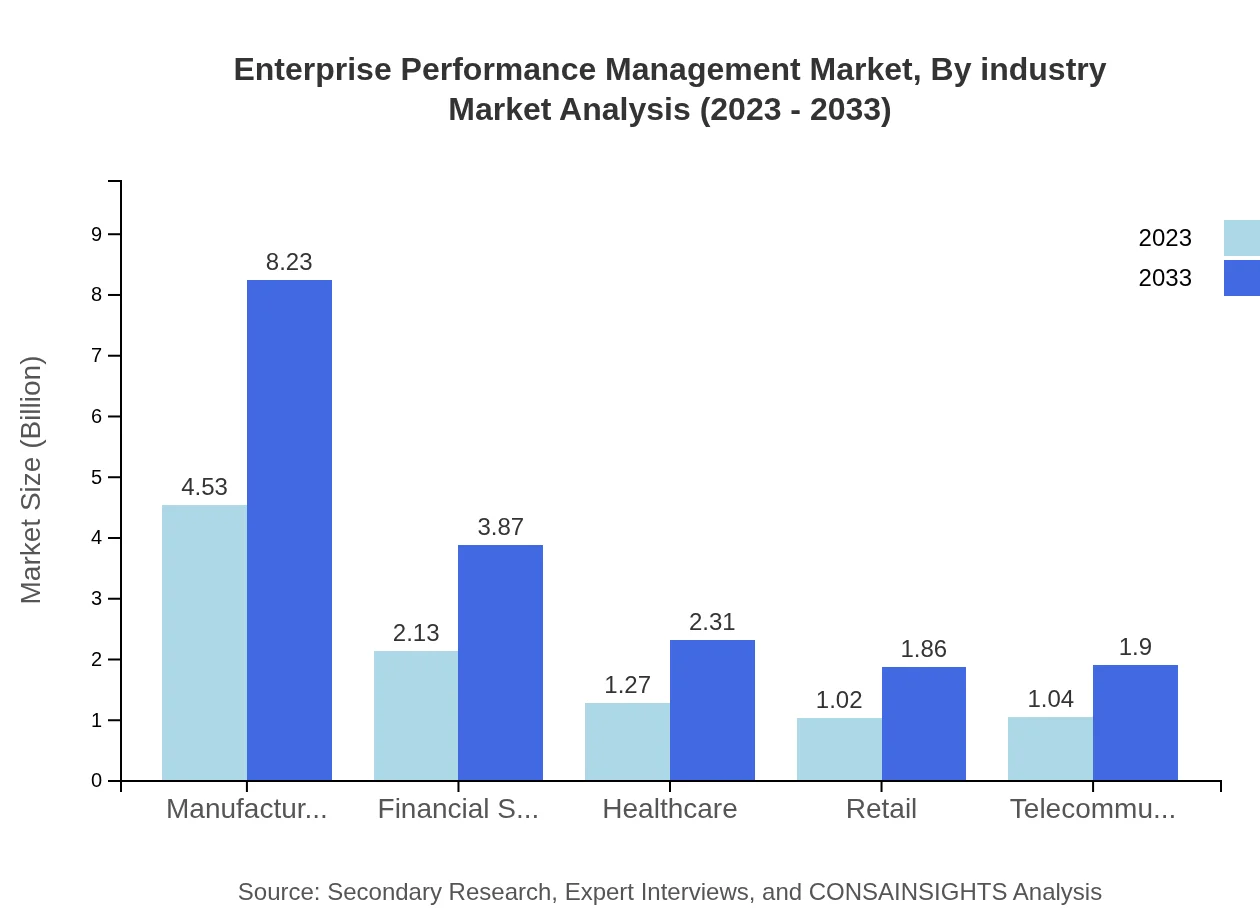

Enterprise Performance Management Market Analysis By Industry

The manufacturing sector commands a significant share of the EPM market, with a size of $4.53 billion in 2023, expanding to $8.23 billion by 2033. Financial services and healthcare follow closely, with significant market sizes of $2.13 billion and $1.27 billion respectively in 2023, both projected to increase. The importance of operational efficiency and regulatory compliance in these industries is fueling EPM adoption.

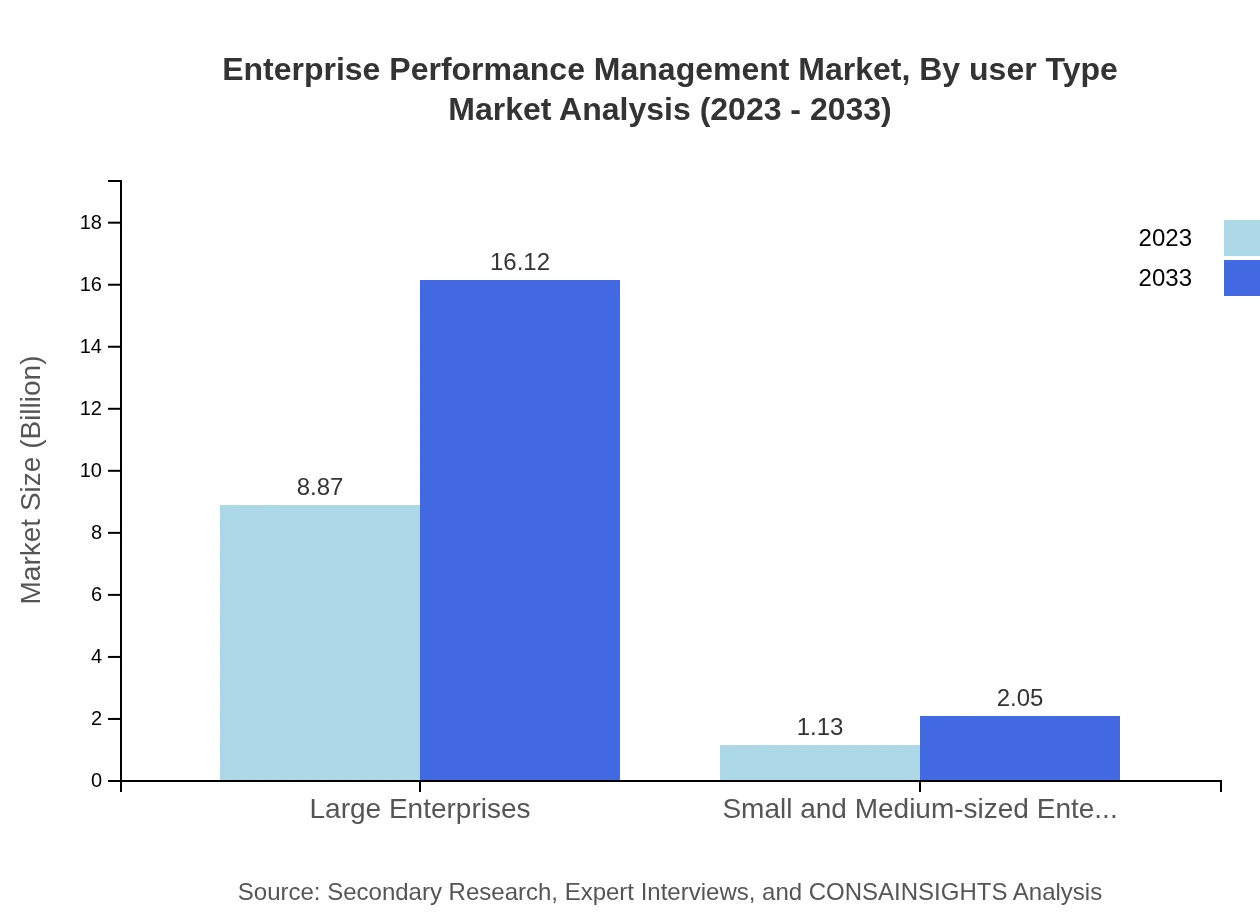

Enterprise Performance Management Market Analysis By User Type

Large enterprises represent the largest user base of EPM systems, with a market size of $8.87 billion in 2023, forecast to grow to $16.12 billion by 2033. Small and medium-sized enterprises (SMEs) are also growing in this realm, with a 2023 market size of $1.13 billion predicted to increase as they embrace performance management solutions to enhance efficiencies.

Enterprise Performance Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Performance Management Industry

Oracle Corporation:

A key player in the EPM sector, Oracle provides a comprehensive suite of cloud-based and on-premises EPM solutions designed to enhance enterprise performance and operational efficiency.SAP SE:

SAP's EPM solutions empower organizations to drive better performance outcomes, leveraging advanced technologies for analytics and decision-making enhancements.IBM Corporation:

IBM delivers robust EPM platforms that integrate artificial intelligence, providing companies with valuable insights for strategic performance management.Anaplan, Inc.:

Anaplan is known for its cloud-based planning solutions that facilitate agile performance management across various industries.Workday, Inc.:

Workday provides intuitive EPM tools that focus on finance and human capital management, designed to improve efficiencies through automation.We're grateful to work with incredible clients.

FAQs

What is the market size of Enterprise Performance Management?

The Enterprise Performance Management market is currently valued at $10 billion, with a projected CAGR of 6% from 2023 to 2033. By 2033, the market is expected to grow significantly, reflecting increasing demand for integrated performance solutions.

What are the key market players or companies in the Enterprise Performance Management industry?

Key players in the Enterprise Performance Management industry include software giants like SAP, Oracle, and IBM, which dominate through innovative solutions and comprehensive software capabilities tailored to enhance organizational performance and strategic planning.

What are the primary factors driving the growth in the Enterprise Performance Management industry?

The growth in the Enterprise Performance Management industry is driven by digital transformation, increasing demand for effective financial planning, and the need for real-time data analysis to support decision-making processes across various sectors.

Which region is the fastest Growing in the Enterprise Performance Management market?

The fastest-growing region in the Enterprise Performance Management market is North America, expected to grow from $3.86 billion in 2023 to $7.01 billion by 2033. This growth is fueled by technological advancements and investment in cloud-based solutions.

Does ConsaInsights provide customized market report data for the Enterprise Performance Management industry?

Yes, ConsaInsights offers customized market report data for the Enterprise Performance Management industry, allowing clients to access tailored insights and analyses specific to their unique business needs or regional focuses.

What deliverables can I expect from this Enterprise Performance Management market research project?

Deliverables from the Enterprise Performance Management market research project include comprehensive market analysis, trends, forecasts, competitive landscape insights, and detailed segmentation reports that enrich the decision-making process.

What are the market trends of Enterprise Performance Management?

Current market trends in Enterprise Performance Management include a shift towards cloud-based solutions, increased automation in performance tracking, and a growing emphasis on data-driven decision-making, which are reshaping strategic business operations.