Enterprise Server Market Report

Published Date: 31 January 2026 | Report Code: enterprise-server

Enterprise Server Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Enterprise Server market from 2023 to 2033, covering market size, growth trends, regional insights, key players, and future forecasts, offering valuable data and insights vital for informed decision-making.

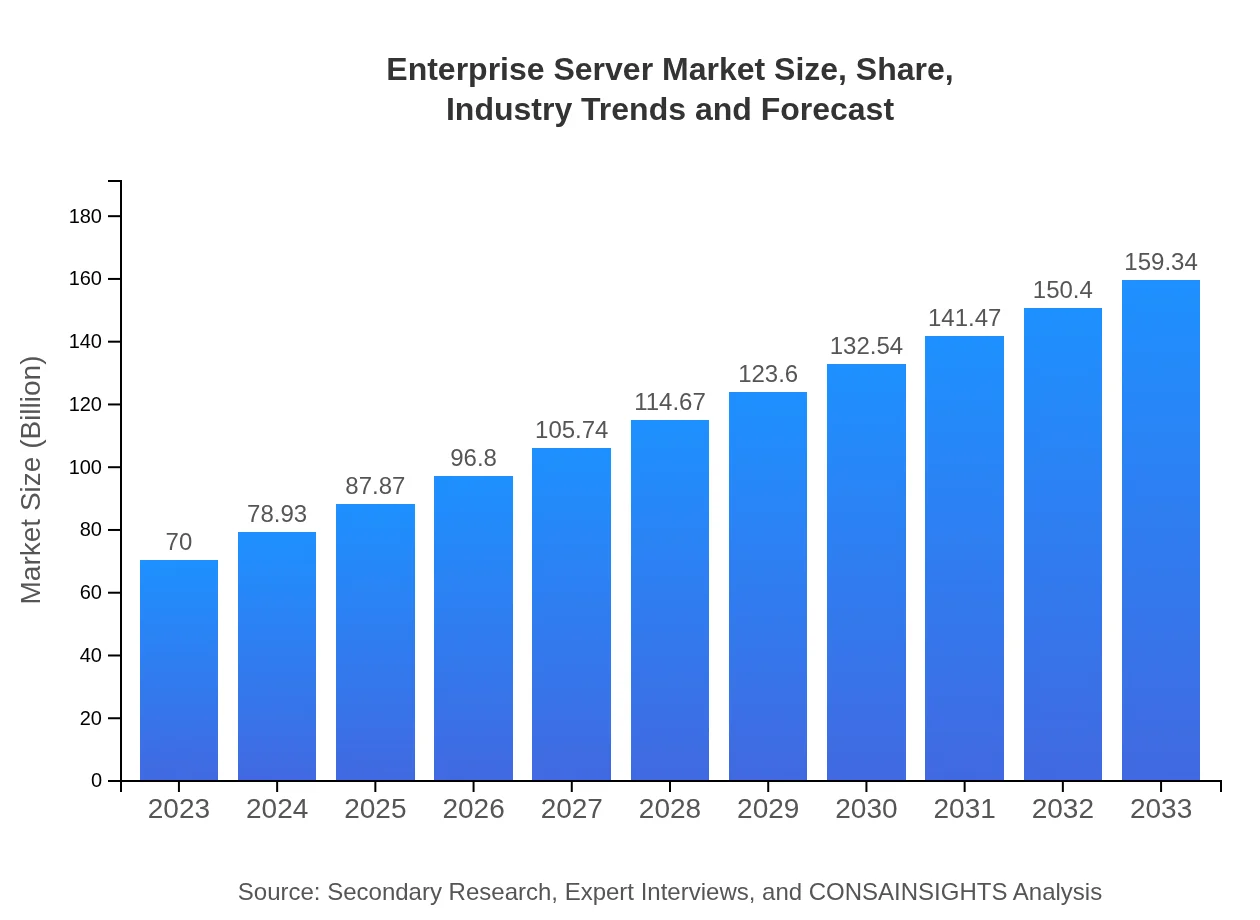

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $70.00 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $159.34 Billion |

| Top Companies | Dell Technologies, Hewlett Packard Enterprise (HPE), IBM, Lenovo , Cisco Systems |

| Last Modified Date | 31 January 2026 |

Enterprise Server Market Overview

Customize Enterprise Server Market Report market research report

- ✔ Get in-depth analysis of Enterprise Server market size, growth, and forecasts.

- ✔ Understand Enterprise Server's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Server

What is the Market Size & CAGR of the Enterprise Server market in 2023?

Enterprise Server Industry Analysis

Enterprise Server Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Server Market Analysis Report by Region

Europe Enterprise Server Market Report:

Europe's market, valued at $22.66 billion in 2023, is projected to reach $51.58 billion by 2033. The increasing emphasis on data security and compliance along with substantial investments in cloud services drive market expansion.Asia Pacific Enterprise Server Market Report:

In 2023, the Asia Pacific market is valued at $12.63 billion and is projected to grow to $28.74 billion by 2033. Factors driving this growth include digitalization and investments in IT infrastructure by emerging economies like India and China.North America Enterprise Server Market Report:

North America, being the largest market, has a valuation of $25.04 billion in 2023, anticipated to grow to $57.00 billion by 2033. The presence of key players and high IT budgets among enterprises play a crucial role in this regional growth.South America Enterprise Server Market Report:

The South American Enterprise Server market stands at $4.36 billion in 2023, expected to reach $9.93 billion by 2033. The rising focus on cloud adoption and enterprise digital transformation initiatives will stimulate market growth in this region.Middle East & Africa Enterprise Server Market Report:

The Middle East and Africa market is estimated at $5.31 billion in 2023, with expectations to grow to $12.09 billion by 2033, bolstered by ongoing digital transformation projects and government initiatives to enhance technological capabilities.Tell us your focus area and get a customized research report.

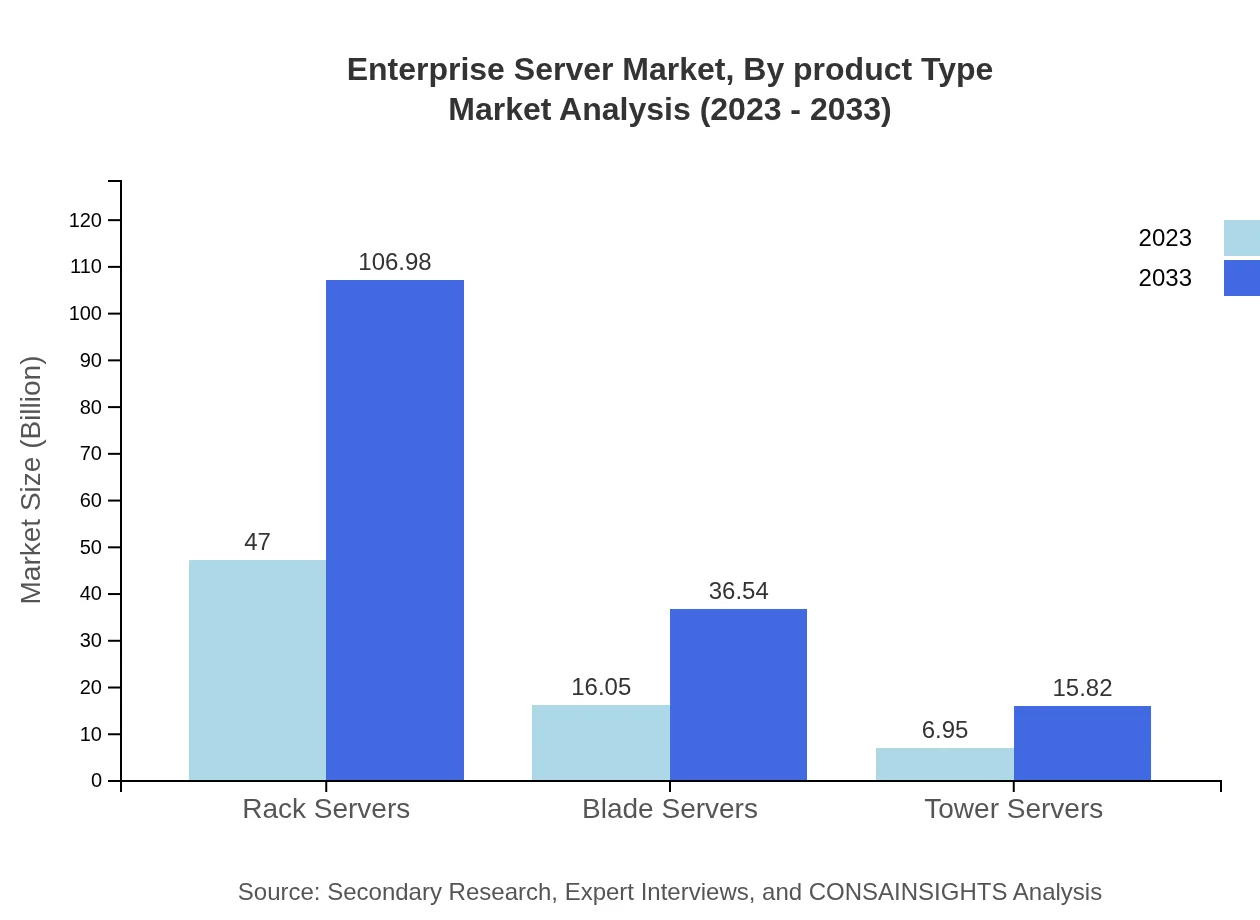

Enterprise Server Market Analysis By Product Type

The product types in the Enterprise Server market include Rack Servers, Blade Servers, and Tower Servers. Rack Servers dominate the market with a size of $47 billion in 2023 and predicted growth to $106.98 billion by 2033. Blade Servers and Tower Servers also contribute significantly, with growth influenced by specific enterprise needs and efficiency requirements.

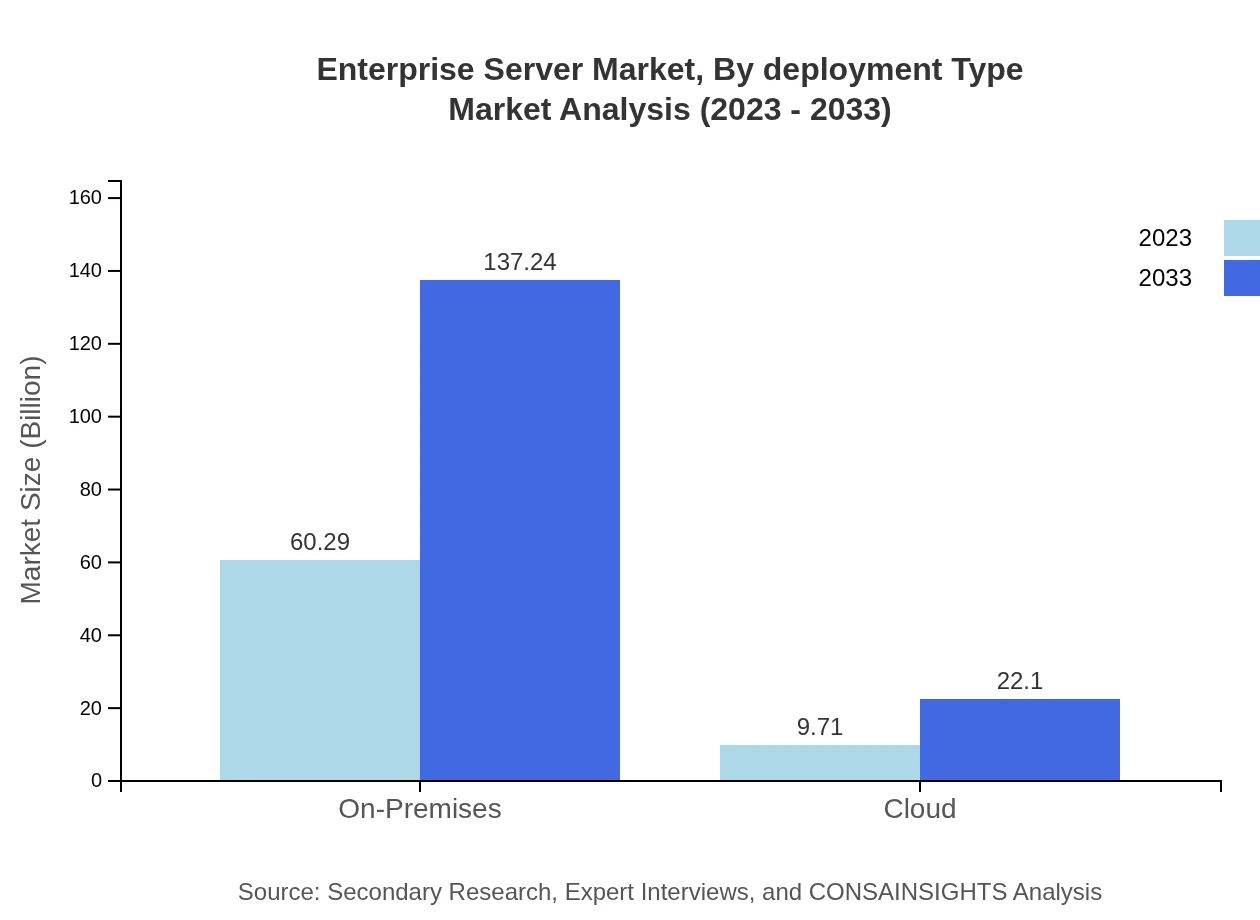

Enterprise Server Market Analysis By Deployment Type

The market is divided into On-Premises and Cloud segments. Currently, On-Premises solutions dominate with a size of $60.29 billion in 2023, expected to increase to $137.24 billion by 2033. Meanwhile, Cloud deployments are also gaining traction, growing from $9.71 billion in 2023 to $22.10 billion by 2033.

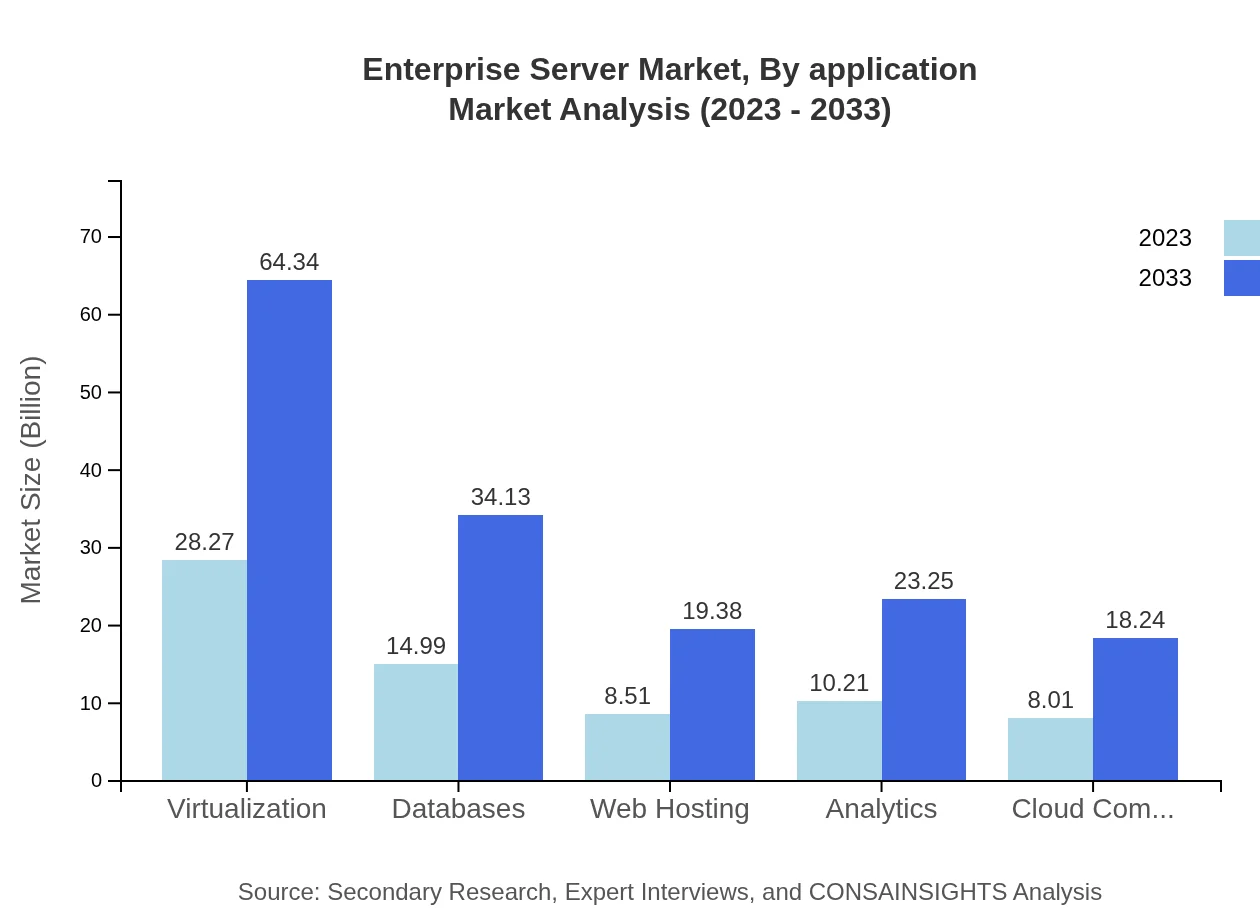

Enterprise Server Market Analysis By Application

Applications in the Enterprise Server market include Web Hosting, Analytics, Virtualization, and more. Web Hosting, valued at $8.51 billion in 2023, is projected to grow to $19.38 billion by 2033. Analytics is also on the rise from $10.21 billion to $23.25 billion in the same period.

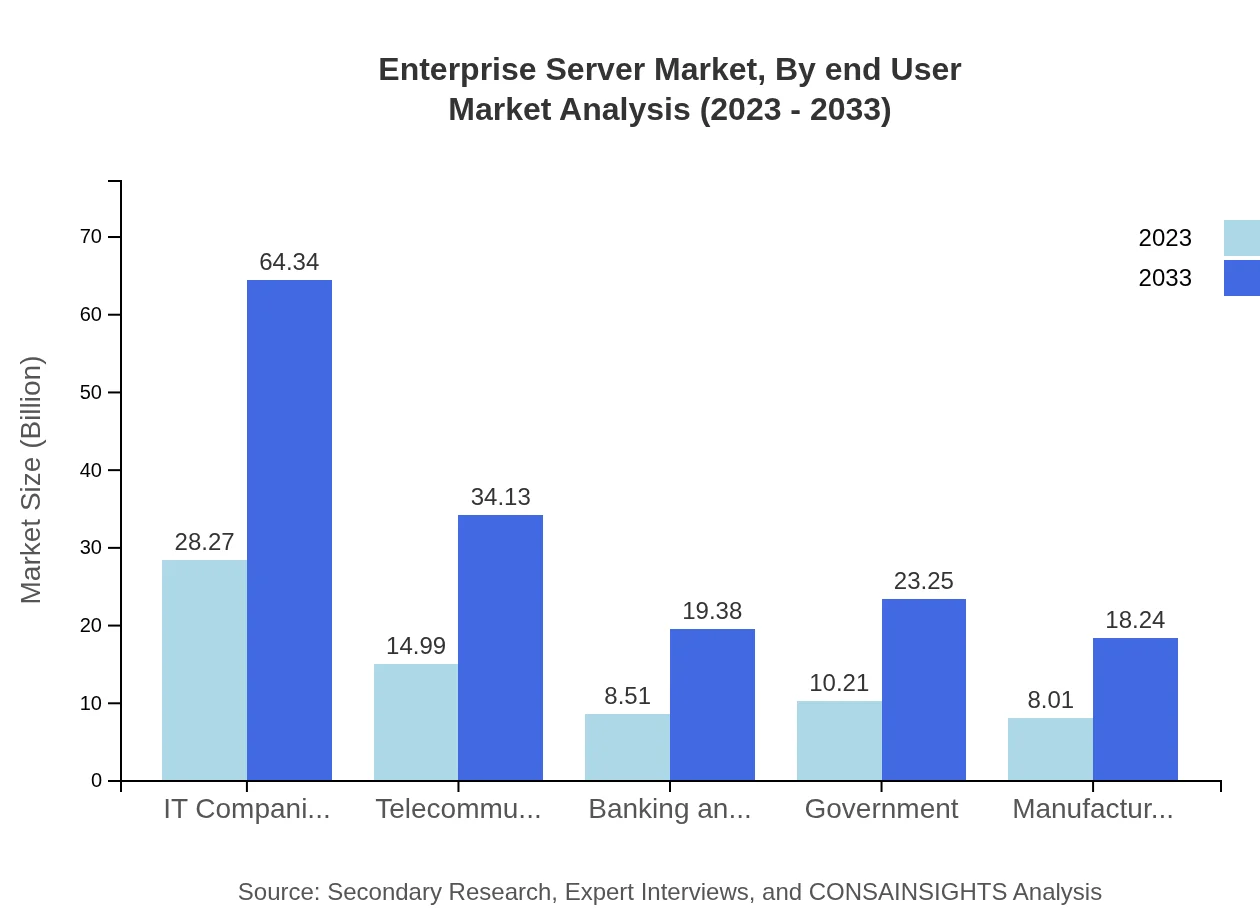

Enterprise Server Market Analysis By End User

Key end-users encompass sectors such as IT Companies, Telecommunications, Government, Banking and Financial Services, and Manufacturing. IT Companies hold the largest share, with revenues rising from $28.27 billion in 2023 to $64.34 billion by 2033.

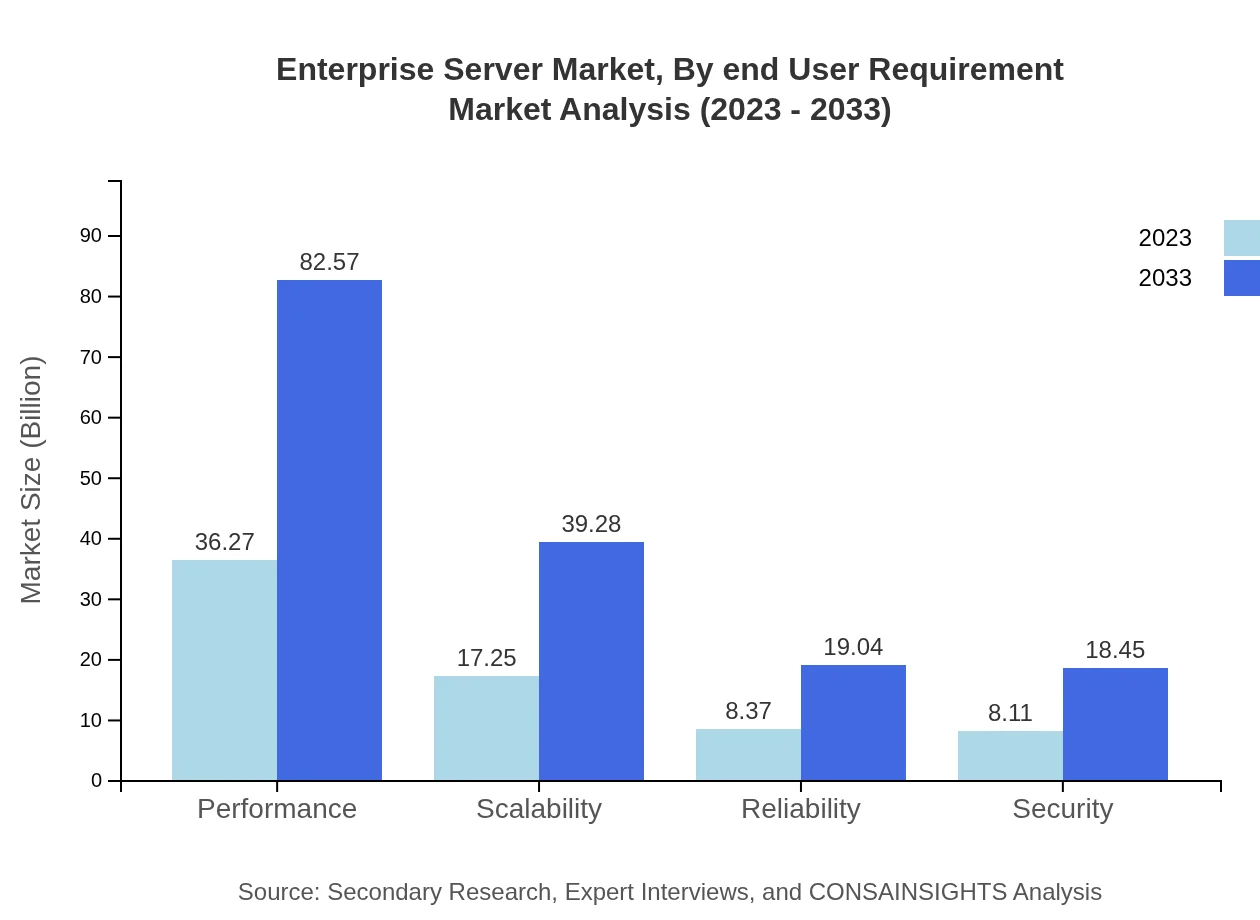

Enterprise Server Market Analysis By End User Requirement

End-user requirements are categorized based on performance, scalability, reliability, and security. Performance solutions alone are estimated to grow from $36.27 billion in 2023 to $82.57 billion by 2033, reflecting the importance of efficiency in server technology.

Enterprise Server Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Server Industry

Dell Technologies:

A leader in IT and enterprise solutions, Dell Technologies delivers a wide range of servers that cater to diverse business needs.Hewlett Packard Enterprise (HPE):

HPE is known for its innovative servers and cloud solutions, making it a key player in the Enterprise Server market.IBM:

IBM provides high-performance server solutions and are recognized for their primary focus on enterprise-grade computing.Lenovo :

Lenovo specializes in providing robust server solutions for businesses, emphasizing performance and reliability.Cisco Systems:

Cisco is a major player in enterprise server networking, integrating server and networking capabilities to enhance performance.We're grateful to work with incredible clients.

FAQs

What is the market size of enterprise Server?

The global enterprise server market is projected to reach approximately $70 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 8.3%. This significant growth underscores the increasing reliance on sophisticated server technologies within enterprises.

What are the key market players or companies in this enterprise Server industry?

Key players in the enterprise server market include industry giants like Dell Technologies, Hewlett Packard Enterprise (HPE), IBM, and Cisco Systems. These companies are at the forefront of innovation and market expansion, influencing trends and technologies.

What are the primary factors driving the growth in the enterprise Server industry?

Key drivers of growth in the enterprise server market include the rising demand for virtualization, increasing data storage needs, and growing reliance on cloud-based solutions. Additionally, advancements in server technology and scalability features propelling enterprise adoption play crucial roles.

Which region is the fastest Growing in the enterprise Server?

The North American region demonstrates remarkable growth in the enterprise server market. It is expected to expand from $25.04 billion in 2023 to $57.00 billion by 2033, propelled by high tech adoption rates and strong infrastructure investments.

Does ConsaInsights provide customized market report data for the enterprise Server industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the enterprise server industry. Clients can request detailed insights and analyses to support strategic decision-making and business planning.

What deliverables can I expect from this enterprise Server market research project?

From the enterprise server market research project, clients can expect comprehensive reports, executive summaries, detailed segment analyses, market forecasts, competitive landscape assessments, and data visualizations that facilitate informed decision-making.

What are the market trends of enterprise Server?

Current trends in the enterprise server market include a shift towards cloud computing solutions, increased emphasis on security and reliability, and the adoption of advanced performance metrics. Companies are investing heavily in innovative server technologies to maintain competitive advantages.