Entertainment Insurance Market Report

Published Date: 31 January 2026 | Report Code: entertainment-insurance

Entertainment Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Entertainment Insurance market, covering market size, growth projections, segmentation, and regional analysis from 2023 to 2033.

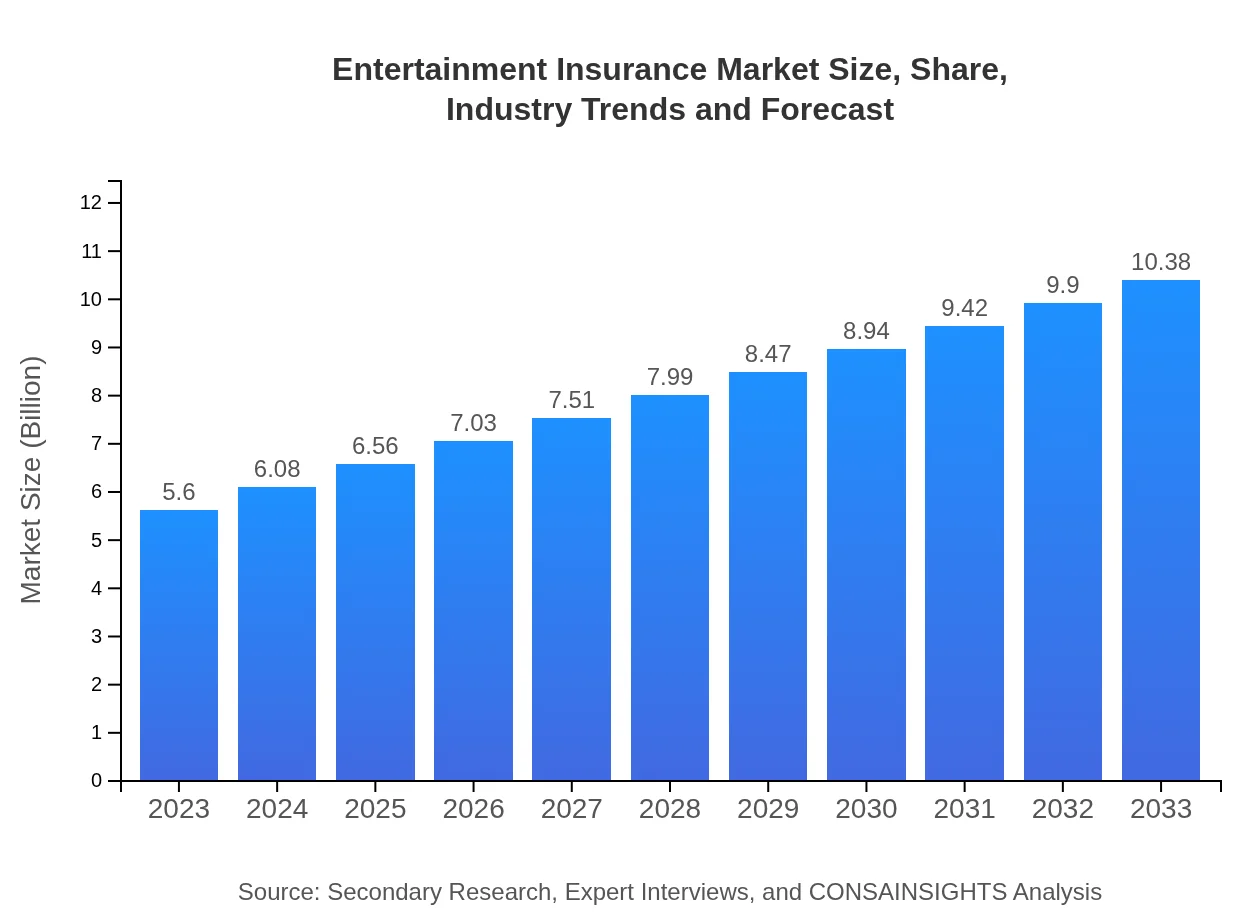

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | Aon, Marsh & McLennan, Zurich Insurance Group, Chubb, Liberty Mutual |

| Last Modified Date | 31 January 2026 |

Entertainment Insurance Market Overview

Customize Entertainment Insurance Market Report market research report

- ✔ Get in-depth analysis of Entertainment Insurance market size, growth, and forecasts.

- ✔ Understand Entertainment Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Entertainment Insurance

What is the Market Size & CAGR of Entertainment Insurance market in 2023?

Entertainment Insurance Industry Analysis

Entertainment Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Entertainment Insurance Market Analysis Report by Region

Europe Entertainment Insurance Market Report:

Europe's market, evaluated at $1.77 billion in 2023, is anticipated to reach approximately $3.28 billion by 2033, supported by a strong emphasis on protection against production delays and liability issues due to stringent regulations. Key countries include the UK, France, and Germany.Asia Pacific Entertainment Insurance Market Report:

The Asia-Pacific region, valued at $1.07 billion in 2023, is projected to grow to approximately $1.98 billion by 2033, driven by increasing investments in local film production and entertainment events. Emerging markets, particularly India and China, are expected to contribute significantly to this growth.North America Entertainment Insurance Market Report:

North America remains the largest market for Entertainment Insurance, with a size of $1.91 billion in 2023, forecasted to grow to $3.54 billion by 2033. The substantial presence of Hollywood and numerous live events reignites demand for specialized insurance products.South America Entertainment Insurance Market Report:

In South America, the Entertainment Insurance market is estimated at $0.40 billion in 2023, with projections to reach $0.73 billion by 2033. The growth is attributed to rising interest in cultural festivals and local productions, which increase the demand for comprehensive coverage.Middle East & Africa Entertainment Insurance Market Report:

The Middle East and Africa market, standing at $0.45 billion in 2023, is projected to grow to $0.84 billion by 2033. Factors driving growth include the development of entertainment hubs and an increase in large-scale events across the region.Tell us your focus area and get a customized research report.

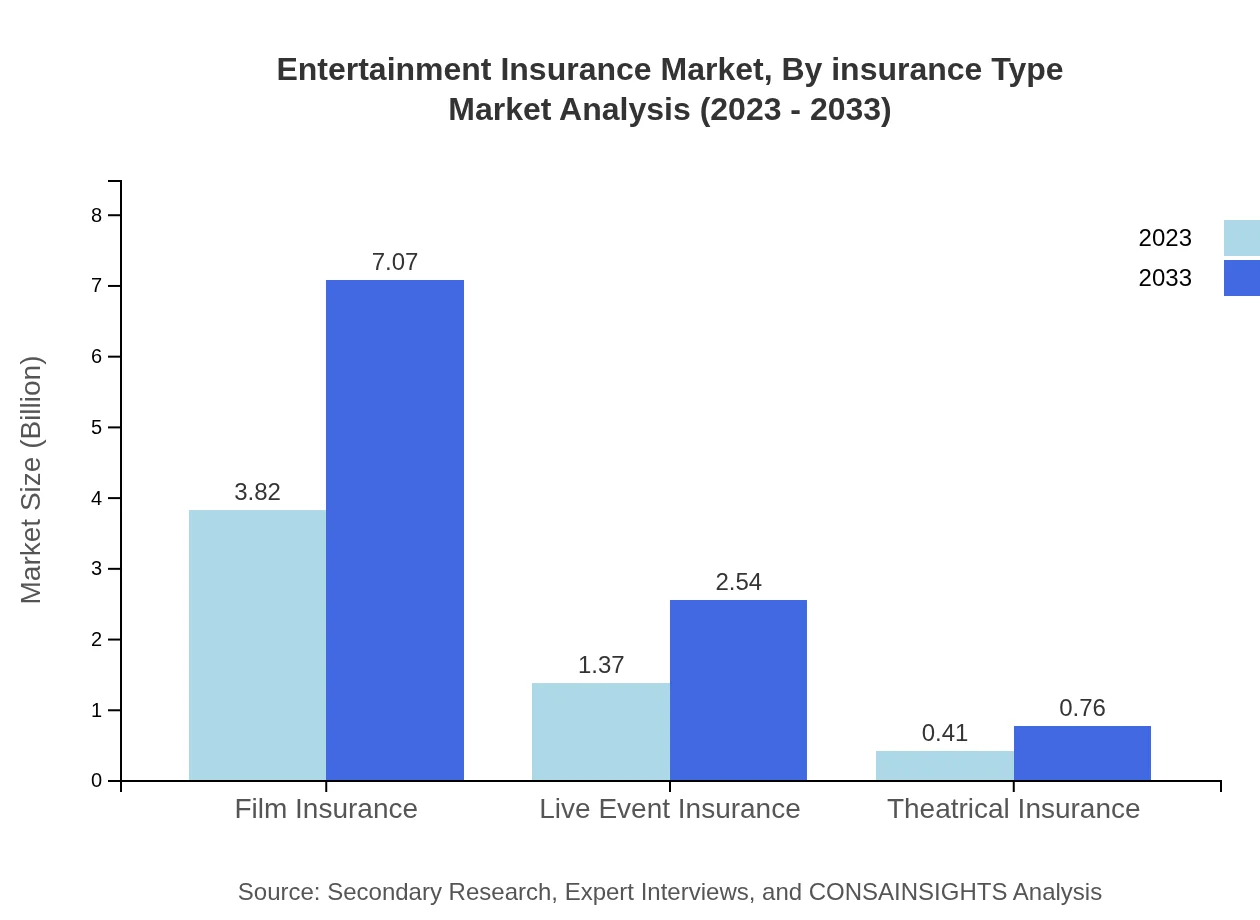

Entertainment Insurance Market Analysis By Insurance Type

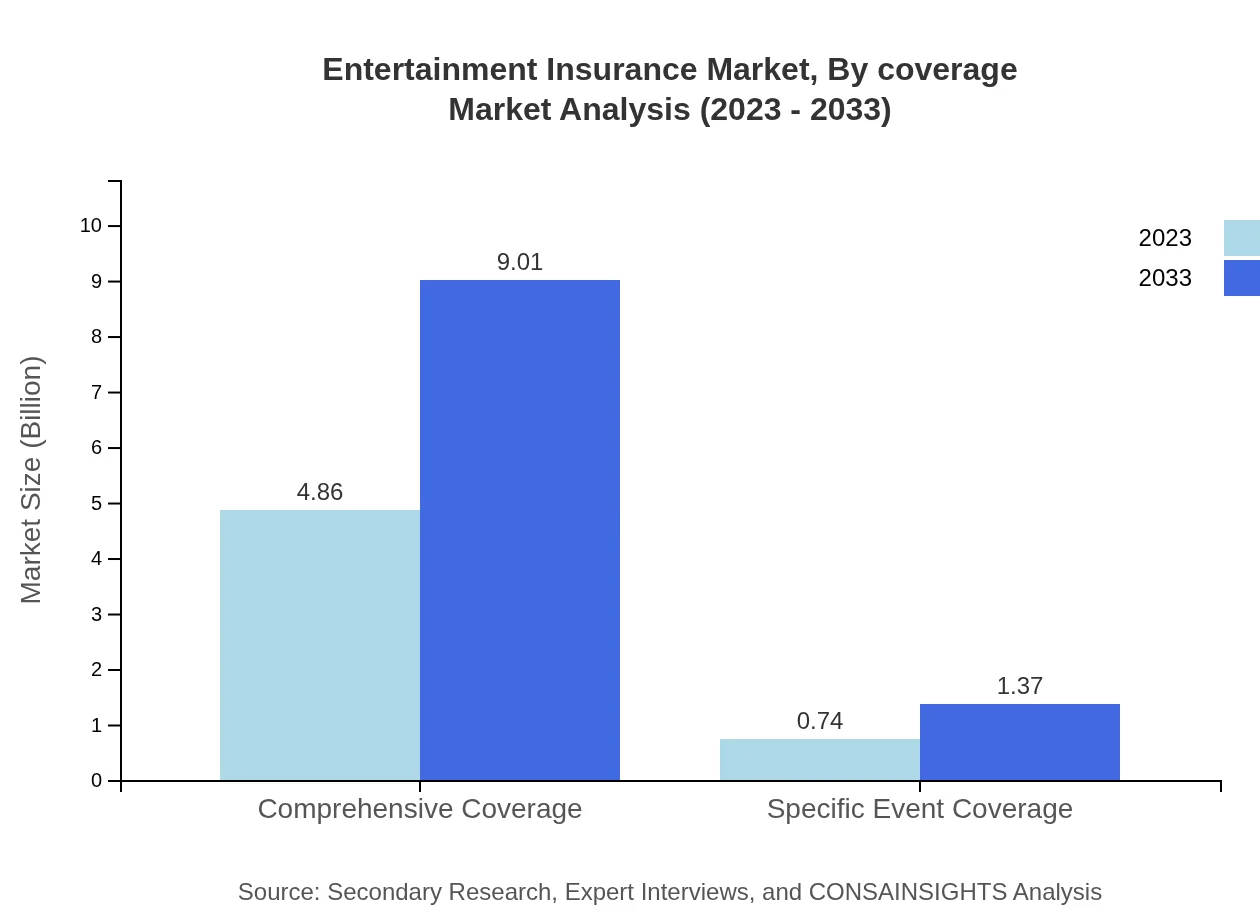

The market for Entertainment Insurance is primarily divided into Comprehensive Coverage and Specific Event Coverage. Comprehensive Coverage is the dominant segment, valued at $4.86 billion in 2023 and expected to reach $9.01 billion by 2033, making up approximately 86.8% of the total market share. Specific Event Coverage, though smaller, shows significant growth potential, projected to grow from $0.74 billion in 2023 to $1.37 billion by 2033.

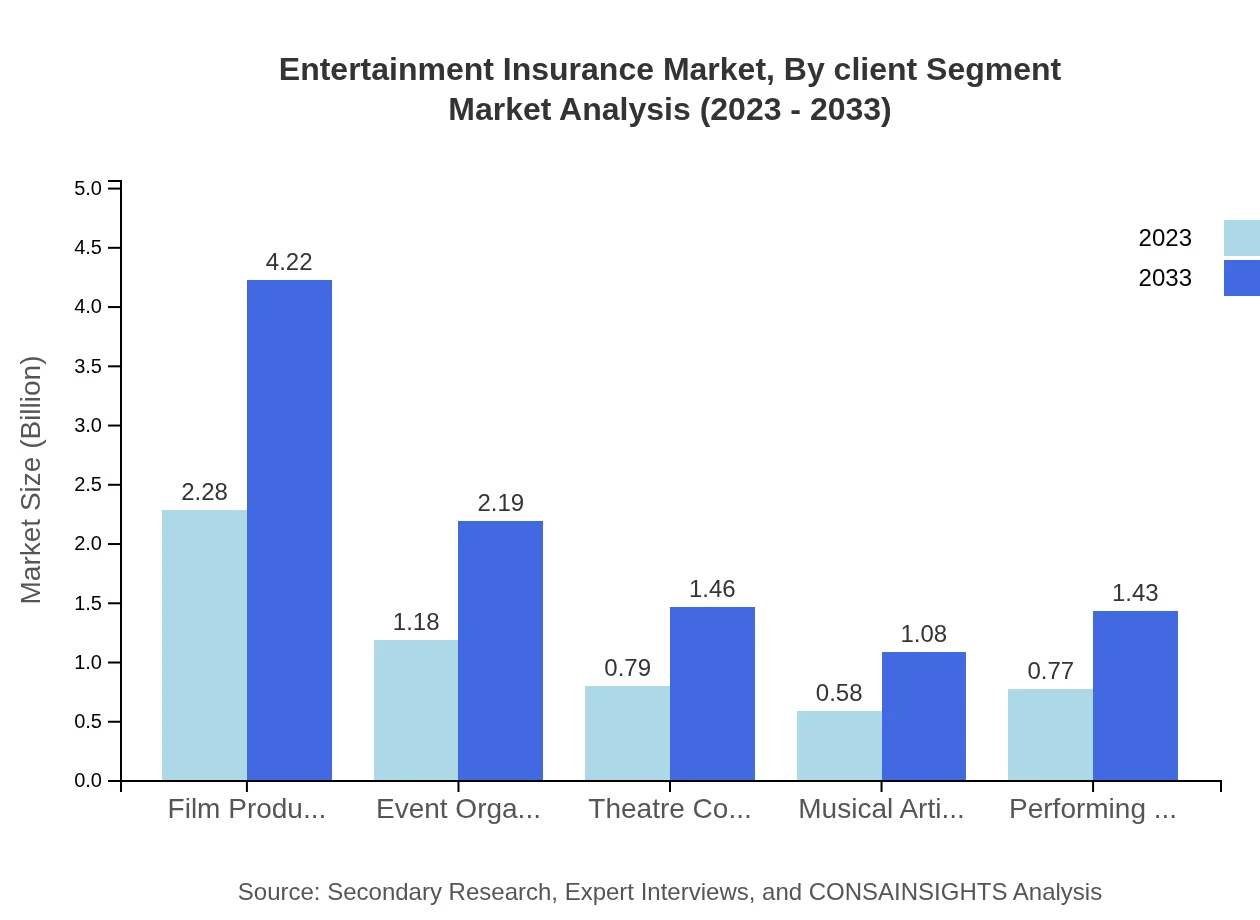

Entertainment Insurance Market Analysis By Client Segment

Client segments include Film Production Companies, Event Organizers, Theatre Companies, Musical Artists, and Performing Arts Groups. Film Production Companies hold a significant share, valued at $2.28 billion in 2023, expected to increase to $4.22 billion by 2033, representing 40.65% of the market. Event Organizers follow with a current market share of 21.07%, valued at $1.18 billion and projected to reach $2.19 billion by 2033.

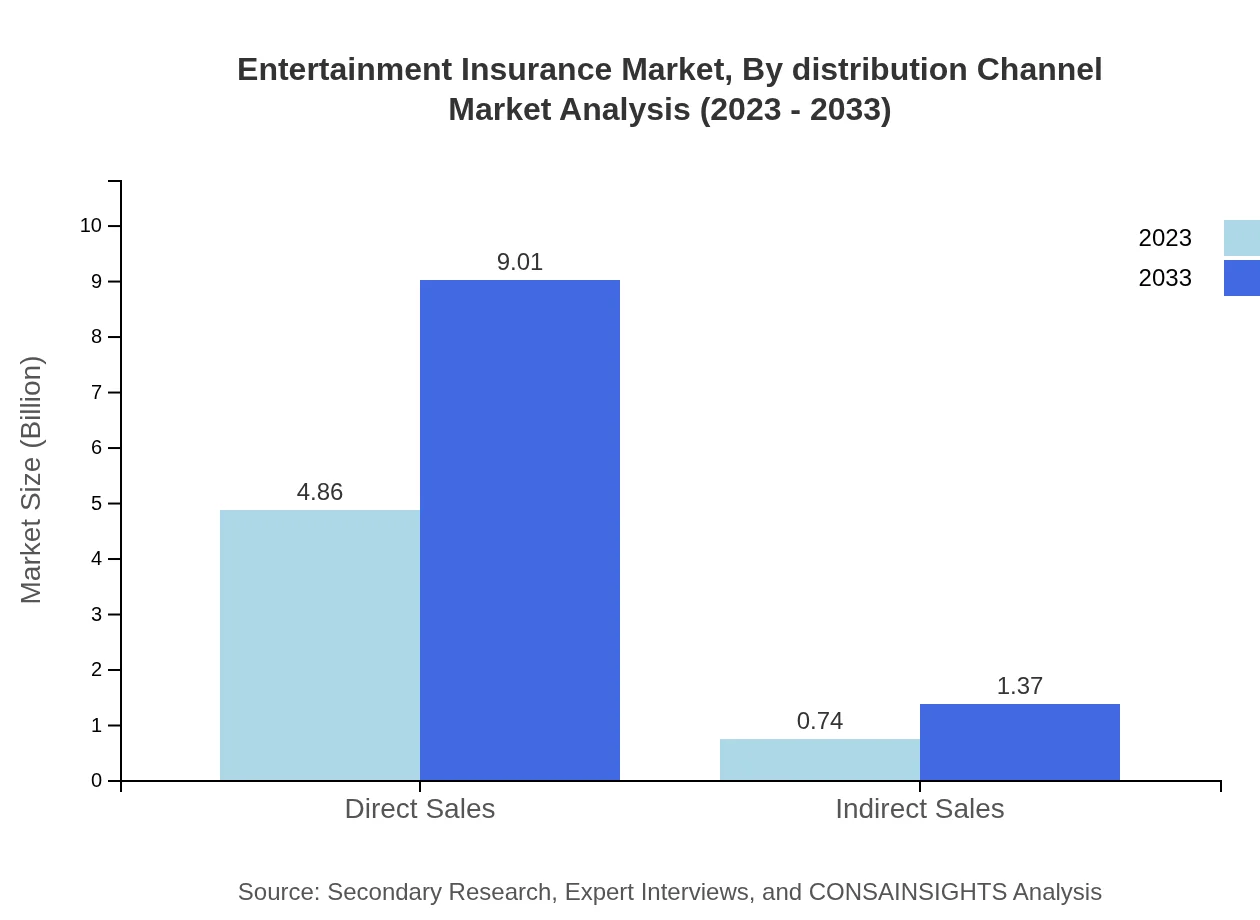

Entertainment Insurance Market Analysis By Distribution Channel

The market is segmented by distribution channels, comprising Direct Sales and Indirect Sales. Direct Sales currently dominate the market, with a valuation of $4.86 billion in 2023 and a projected growth to $9.01 billion by 2033, equating to 86.8% of the market share. Indirect Sales, while smaller, are growing steadily and expected to reach $1.37 billion from $0.74 billion in 2033.

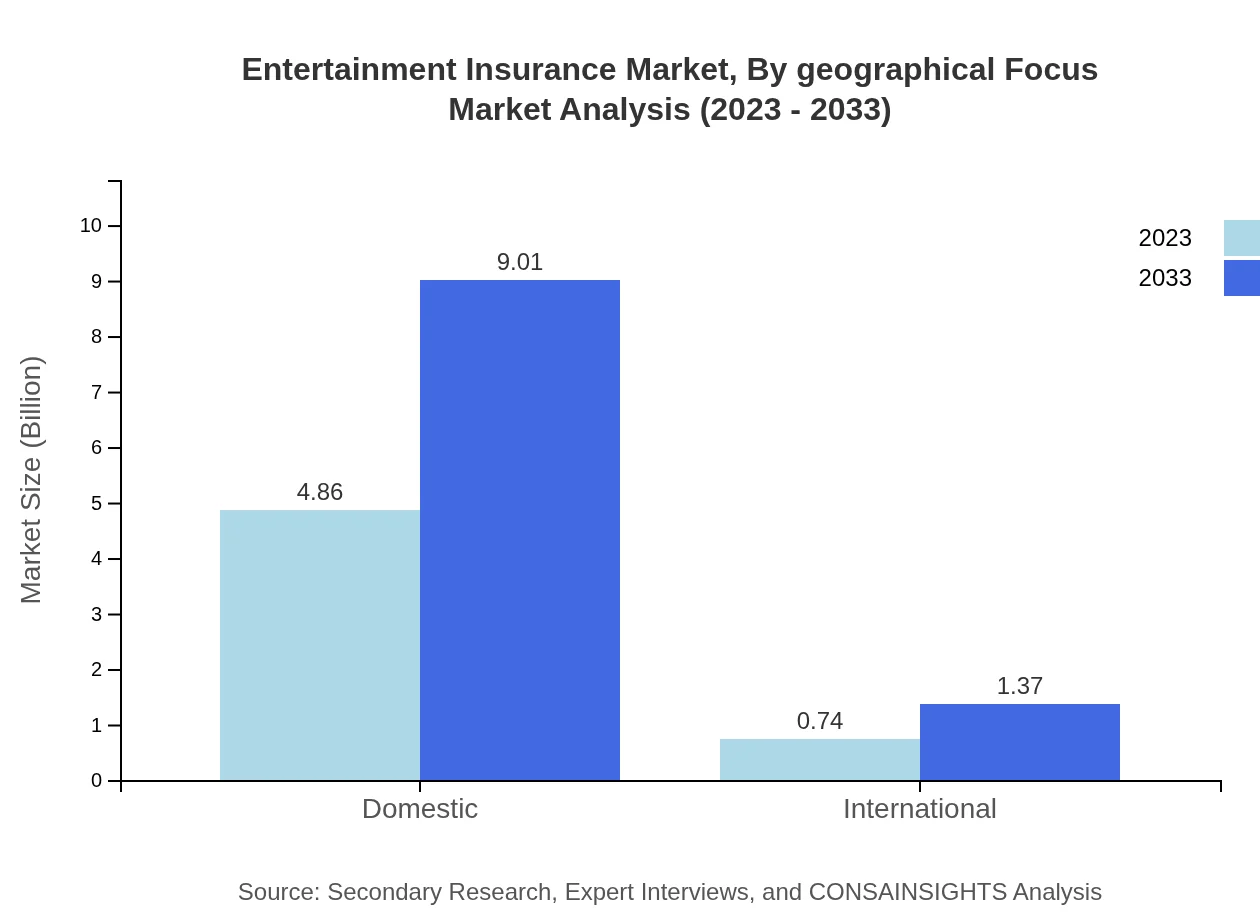

Entertainment Insurance Market Analysis By Geographical Focus

Geographically, the market can be examined through various regional focuses. Each territory presents unique challenges and opportunities influenced by local regulations, cultural practices, and industry standards. North America leads, followed by Europe and the rapidly growing Asia-Pacific region.

Entertainment Insurance Market Analysis By Coverage

Various insurance products cater to diverse coverage needs, primarily Comprehensive Coverage and Specific Event Coverage. Comprehensive Coverage is expected to remain a robust component, covering a majority of risks in production and events, while Specific Event Coverage addresses particular contingencies.

Entertainment Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Entertainment Insurance Industry

Aon:

Aon is a leading global professional services firm providing a broad range of risk, retirement and health solutions. Their expertise in insuring entertainment risks makes them a key player in this market.Marsh & McLennan:

Marsh & McLennan is a prominent insurance broker and risk management firm that serves various industries, including entertainment. Their comprehensive solutions offer robust coverage for production companies and event organizers.Zurich Insurance Group:

Zurich provides a diverse portfolio of insurance products tailored for the entertainment industry, including film, theatre, and live events, contributing significantly to risk management solutions.Chubb:

Chubb is recognized for its extensive offering in entertainment insurance, helping film and event producers mitigate financial risks associated with unforeseen occurrences.Liberty Mutual:

Liberty Mutual provides innovative insurance solutions that shield entertainment entities from various risks, significantly impacting the industry’s stability and growth.We're grateful to work with incredible clients.

FAQs

What is the market size of entertainment insurance?

The global entertainment insurance market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.2% until 2033, indicating strong growth in this sector.

What are the key market players or companies in this entertainment insurance industry?

Key players in the entertainment insurance industry include major companies that specialize in risk management and coverage for film production, live events, and performances, ensuring comprehensive and tailored coverage for diverse entertainment segments.

What are the primary factors driving the growth in the entertainment insurance industry?

The growth in the entertainment insurance sector is driven by the increasing number of live events, higher production costs in film and media, and a growing awareness of risk management in the entertainment industry, leading to greater demand for specialized insurance coverage.

Which region is the fastest Growing in the entertainment insurance?

The fastest-growing region for entertainment insurance is expected to be Europe, with market growth from $1.77 billion in 2023 to $3.28 billion by 2033, indicating a strong demand for insurance services in the entertainment sector across the region.

Does ConsaInsights provide customized market report data for the entertainment insurance industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the entertainment insurance industry, providing valuable insights and analytics to help businesses navigate this dynamic market.

What deliverables can I expect from this entertainment insurance market research project?

Expect comprehensive deliverables including detailed market analysis, regional data segmentation, growth forecasts, and insights into key market players, trends, and drivers affecting the entertainment insurance landscape.

What are the market trends of entertainment insurance?

Current trends in the entertainment insurance market include increased demand for comprehensive coverage options, enhanced digital services for policy management, and a rise in specialized insurance products catering to unique events and productions.