Epitaxial Wafer Market Report

Published Date: 31 January 2026 | Report Code: epitaxial-wafer

Epitaxial Wafer Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Epitaxial Wafer market from 2023 to 2033, focusing on market size, trends, segmentation, regional insights, technological advancements, and the leading companies within the industry.

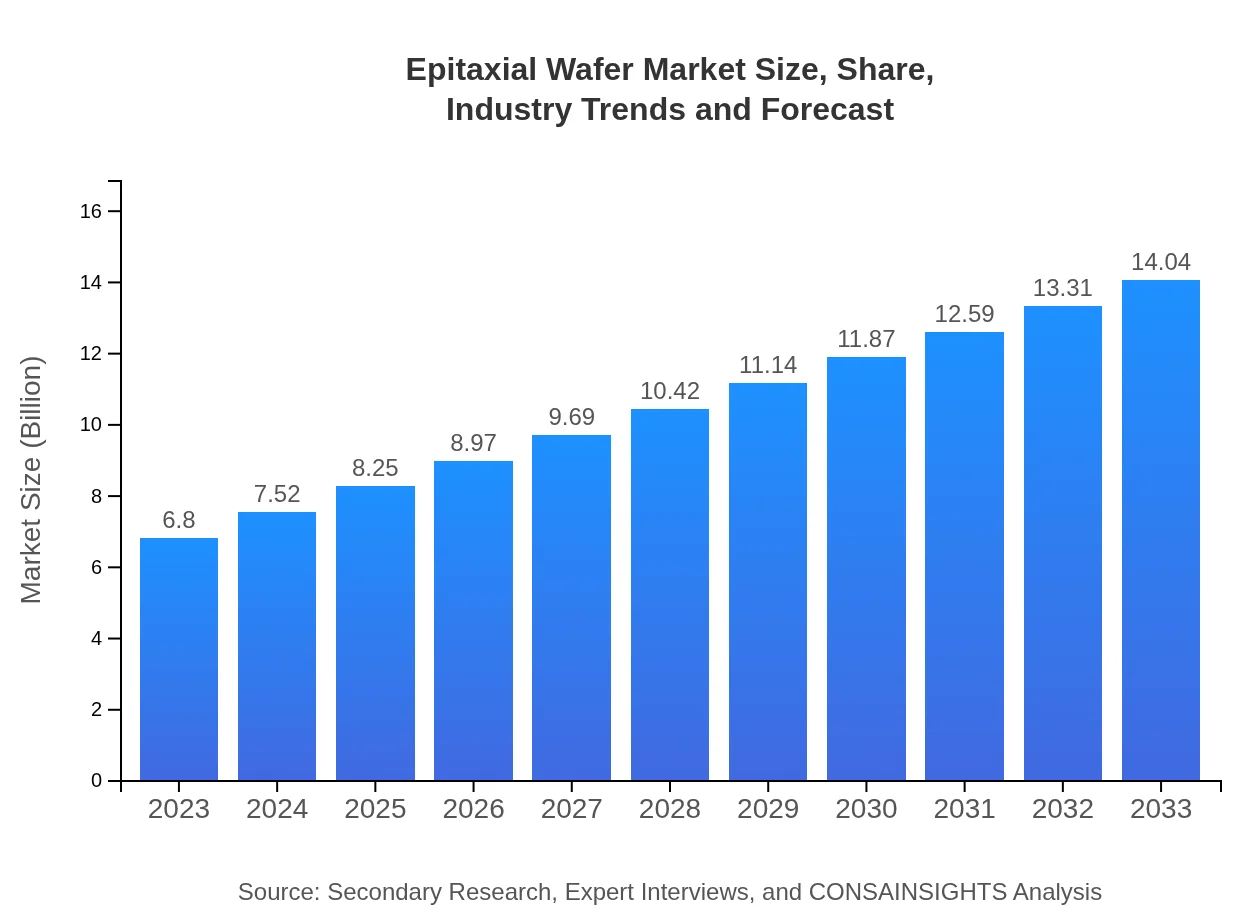

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $14.04 Billion |

| Top Companies | Silicon Wafer Inc., Wacker Chemie AG, Freiberger Compound Materials, MTI Corporation |

| Last Modified Date | 31 January 2026 |

Epitaxial Wafer Market Overview

Customize Epitaxial Wafer Market Report market research report

- ✔ Get in-depth analysis of Epitaxial Wafer market size, growth, and forecasts.

- ✔ Understand Epitaxial Wafer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Epitaxial Wafer

What is the Market Size & CAGR of Epitaxial Wafer market in 2023 and 2033?

Epitaxial Wafer Industry Analysis

Epitaxial Wafer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Epitaxial Wafer Market Analysis Report by Region

Europe Epitaxial Wafer Market Report:

The European Epitaxial Wafer market is valued at $1.97 billion in 2023, with expectations to grow to $4.07 billion by 2033. Innovation in the automotive industry, particularly electric vehicles and autonomous driving technologies, along with significant government initiatives in renewable energy, are key drivers.Asia Pacific Epitaxial Wafer Market Report:

The Asia Pacific region held the largest share of the Epitaxial Wafer market in 2023, valued at $1.45 billion, and is expected to grow to $2.99 billion by 2033. This growth is driven by rapid industrialization, the increasing production of consumer electronics, and investments in semiconductor manufacturing across countries like China, Japan, and South Korea.North America Epitaxial Wafer Market Report:

North America's Epitaxial Wafer market was valued at $2.29 billion in 2023 and is predicted to reach $4.72 billion by 2033. The growth is primarily due to the mature semiconductor industry and significant R&D investments in advanced technologies by leading firms, especially in the United States.South America Epitaxial Wafer Market Report:

In South America, the Epitaxial Wafer market was valued at $0.58 billion in 2023 and is projected to grow to $1.20 billion by 2033, fueled by an expanding automotive sector and the adoption of renewable energy solutions, particularly in Brazil and Argentina.Middle East & Africa Epitaxial Wafer Market Report:

In the Middle East and Africa, the Epitaxial Wafer market size was $0.51 billion in 2023, anticipated to grow to $1.05 billion by 2033. Growth is aided by increased investments in telecommunications and infrastructure development, particularly in the UAE and South Africa.Tell us your focus area and get a customized research report.

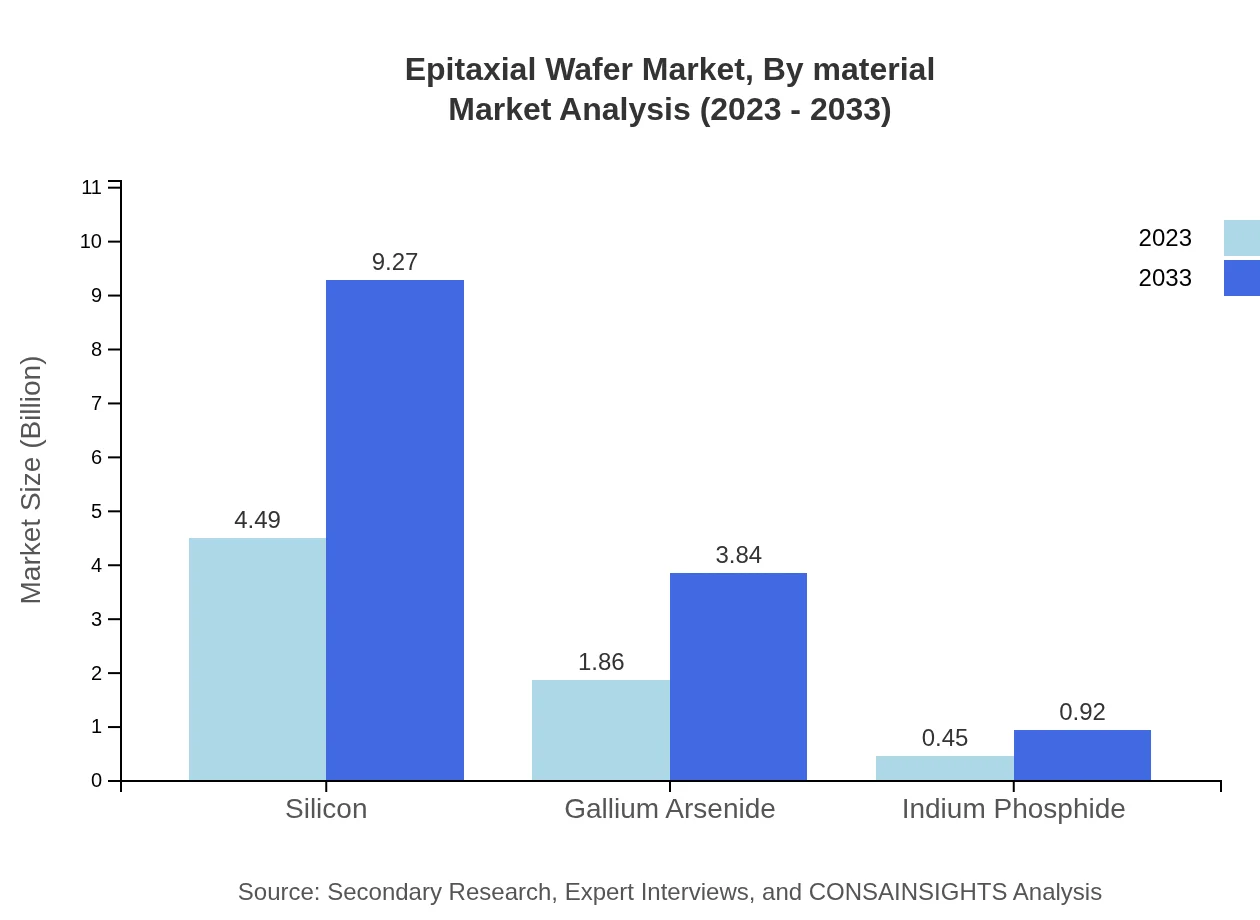

Epitaxial Wafer Market Analysis By Material

Silicon continues to dominate the Epitaxial Wafer market, accounting for 66.06% share in 2023, projected to maintain this lead through increasing demand in semiconductors and solar cells. Gallium arsenide follows with approximately 27.36% share, primarily used in optoelectronics and RF applications. Indium phosphide, while smaller at 6.58%, has niche applications in high-speed communication technologies.

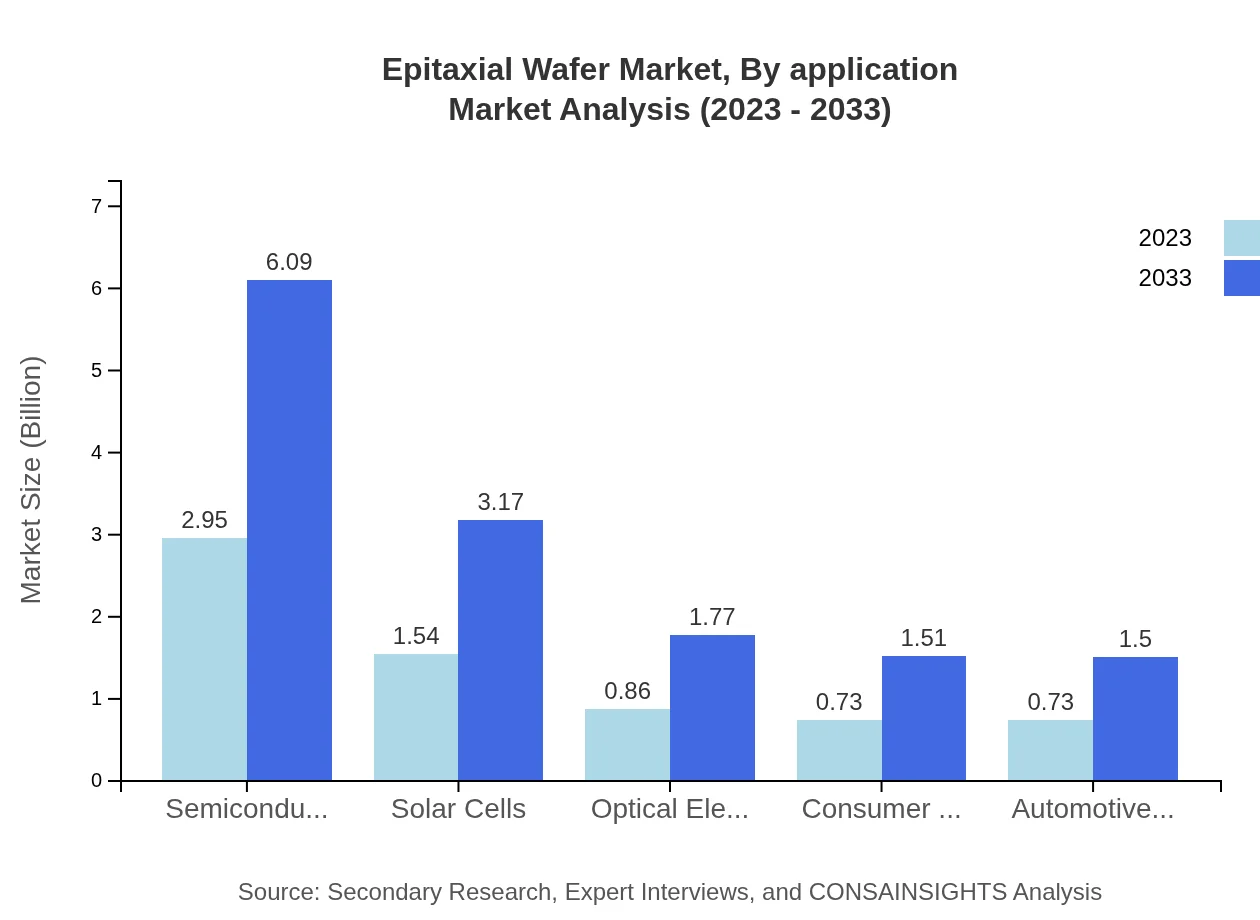

Epitaxial Wafer Market Analysis By Application

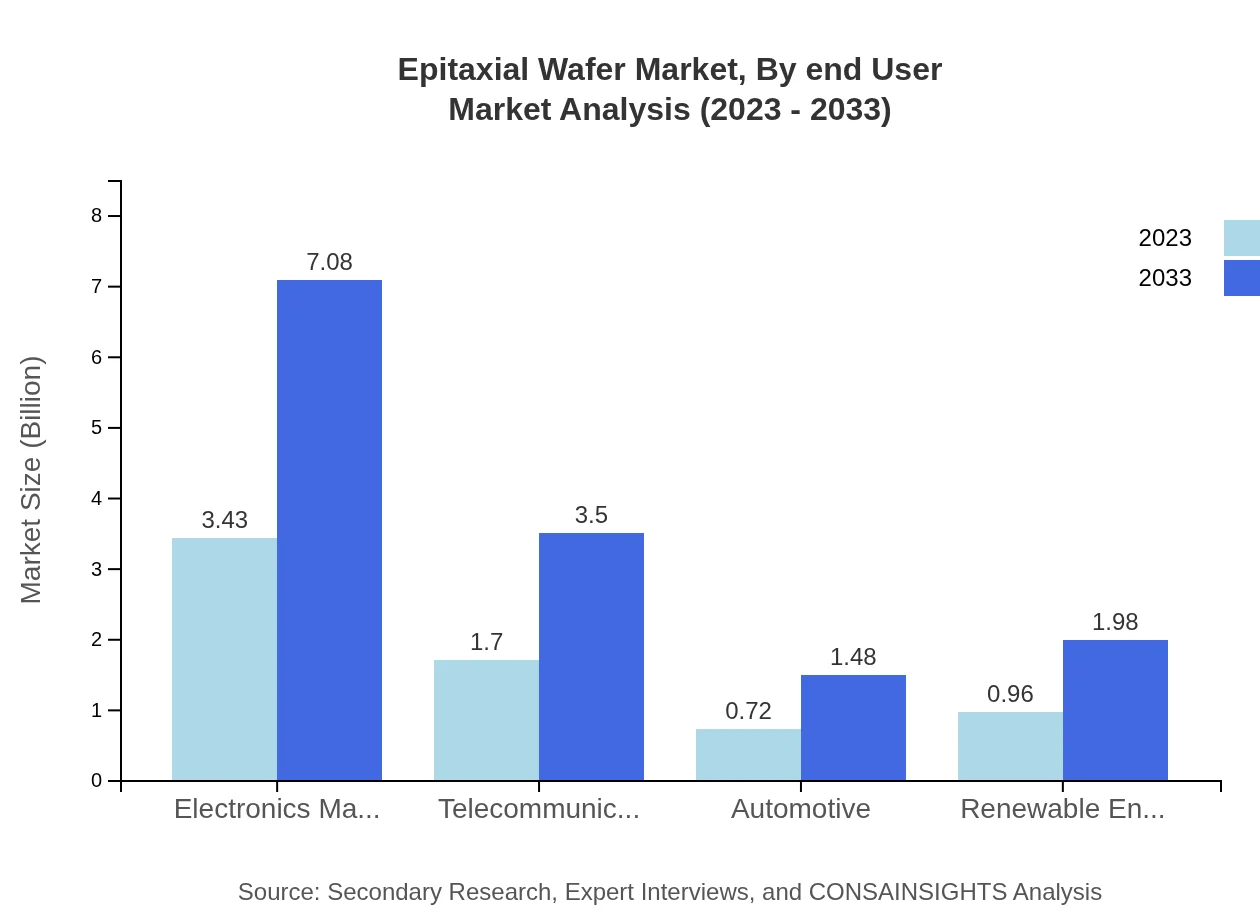

Electronics manufacturing is the largest application segment, anticipated to grow from $3.43 billion in 2023 to $7.08 billion by 2033. Telecommunications accounts for $1.70 billion with expectations to reach $3.50 billion due to the growing demand for advanced communication systems. Automotive applications are expected to expand, particularly in electric vehicle manufacturing.

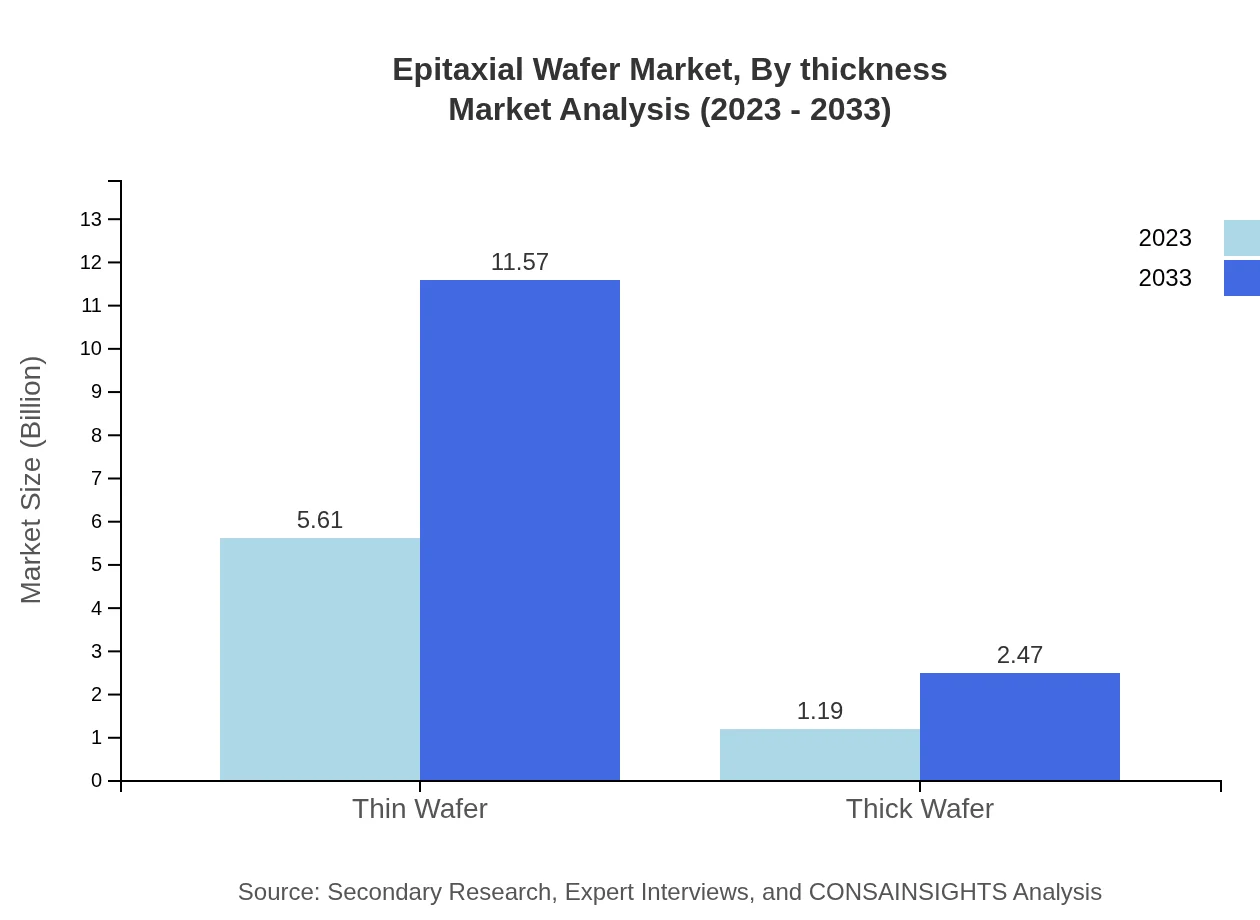

Epitaxial Wafer Market Analysis By Thickness

Thin wafers represent the majority of the segment with an 82.43% market share in 2023, driven by demands for compact electronic devices. Thick wafers, while a smaller segment, are gaining traction in specialized applications like power electronics, with growth anticipated from $1.19 billion in 2023 to $2.47 billion by 2033.

Epitaxial Wafer Market Analysis By End User

Major end-user industries include consumer electronics, automotive electronics, and renewable energy. Consumer electronics accounted for $0.73 billion in 2023 and is projected to reach $1.51 billion by 2033. In contrast, the automotive electronics segment also shows significant growth potential fueled by a rise in electric vehicle production.

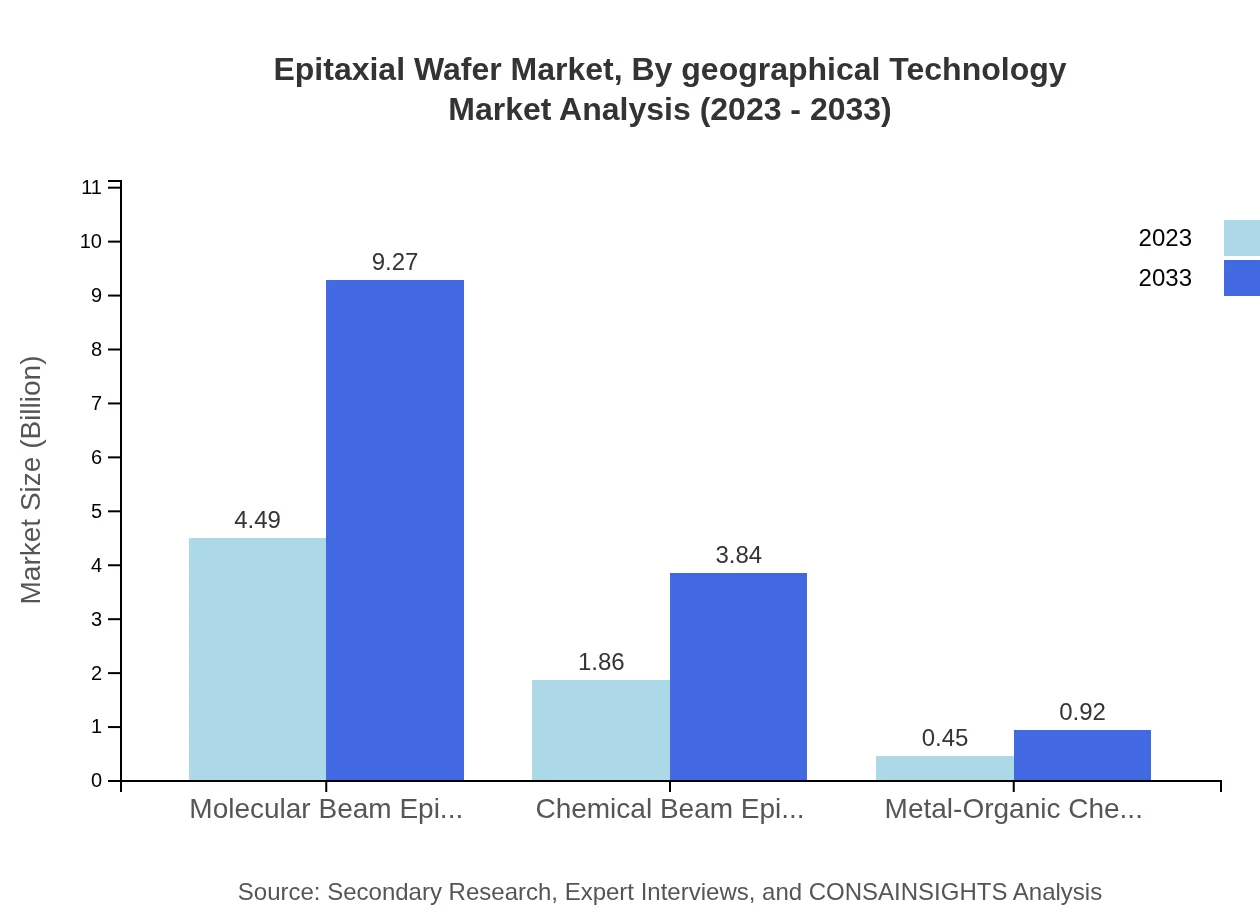

Epitaxial Wafer Market Analysis By Geographical Technology

The Epitaxial Wafer market is influenced by geographical technology developments. North America leads in R&D for advanced materials, particularly in MBE and CBE technologies, while Asia Pacific focuses on scale production and cost optimization strategies. Europe emphasizes quality control and sustainability in manufacturing processes.

Epitaxial Wafer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Epitaxial Wafer Industry

Silicon Wafer Inc.:

Silicon Wafer Inc. is a leading manufacturer of silicon wafers, known for their high-quality products used in various electronic applications, contributing significantly to advancements in semiconductor technologies.Wacker Chemie AG:

Wacker Chemie AG is a prominent player in the Epitaxial Wafer market, specializing in chemical processing and producing high-performance epitaxial silicon wafers for semiconductor applications.Freiberger Compound Materials:

Freiberger Compound Materials focuses on the development and production of compound wafers, especially gallium arsenide, catering to optoelectronics and high-frequency applications.MTI Corporation:

MTI Corporation is known for its innovation in epitaxial wafer production techniques and solid market presence in North America, providing solutions for a variety of electronic devices.We're grateful to work with incredible clients.

FAQs

What is the market size of epitaxial Wafer?

The epitaxial wafer market is estimated to be valued at $6.8 billion in 2023, with a projected compound annual growth rate (CAGR) of 7.3%, indicating significant growth through 2033.

What are the key market players or companies in this epitaxial Wafer industry?

Key players in the epitaxial wafer industry include major semiconductor manufacturers, specialized wafer suppliers, and technology innovators focused on scaling production and meeting the growing demand for advanced materials.

What are the primary factors driving the growth in the epitaxial Wafer industry?

Growth in the epitaxial wafer industry is driven by advancements in semiconductor technology, increasing demand for consumer electronics, and the expansion of electric vehicles, alongside innovations in renewable energy applications.

Which region is the fastest Growing in the epitaxial Wafer?

The fastest-growing region in the epitaxial wafer market is Europe, projected to grow from $1.97 billion in 2023 to $4.07 billion by 2033, with Asia-Pacific also experiencing significant expansion.

Does ConsaInsights provide customized market report data for the epitaxial Wafer industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the epitaxial wafer industry, ensuring comprehensive insights that align with the client's business objectives.

What deliverables can I expect from this epitaxial Wafer market research project?

The market research project delivers detailed reports including market size analysis, growth forecasts, competitive landscape assessments, and segmentation insights covering various applications and regions.

What are the market trends of epitaxial Wafer?

Current trends in the epitaxial wafer market include a shift towards thinner wafers, an emphasis on sustainable manufacturing processes, and increased collaboration between technology firms for innovation.

What segments are driving the epitaxial Wafer market growth?

Significant segments contributing to market growth include electronics manufacturing, semiconductors, and renewable energy, with silicon-based products leading at $4.49 billion in 2023, expected to reach $9.27 billion by 2033.