Equipment Monitoring Market Report

Published Date: 22 January 2026 | Report Code: equipment-monitoring

Equipment Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Equipment Monitoring market, covering market size, industry trends, and forecasts from 2023 to 2033. It aims to deliver insights into various segments and regions driving the market expansion, alongside profiles of key market players.

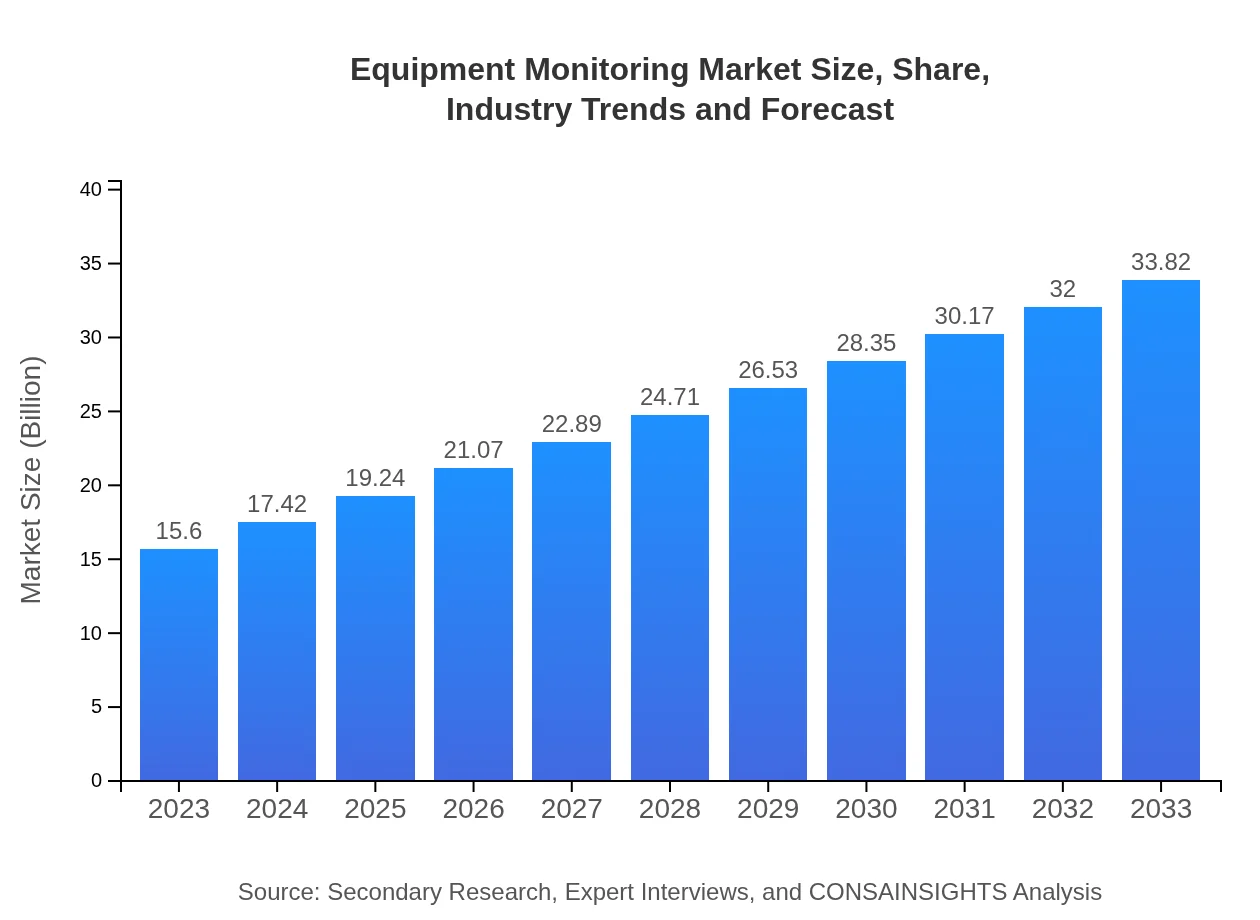

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $33.82 Billion |

| Top Companies | Siemens AG, Schneider Electric, GE Digital, Honeywell International Inc., Rockwell Automation |

| Last Modified Date | 22 January 2026 |

Equipment Monitoring Market Overview

Customize Equipment Monitoring Market Report market research report

- ✔ Get in-depth analysis of Equipment Monitoring market size, growth, and forecasts.

- ✔ Understand Equipment Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Equipment Monitoring

What is the Market Size & CAGR of Equipment Monitoring market in 2023?

Equipment Monitoring Industry Analysis

Equipment Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Equipment Monitoring Market Analysis Report by Region

Europe Equipment Monitoring Market Report:

The Equipment Monitoring market in Europe is projected to grow from $3.87 billion in 2023 to $8.40 billion by 2033. The increase is attributed to stringent regulatory measures, workforce safety concerns, and a rich industrial base that drives investment in monitoring systems across various sectors.Asia Pacific Equipment Monitoring Market Report:

In 2023, the Equipment Monitoring market in the Asia Pacific is valued at $3.32 billion and is projected to reach $7.20 billion by 2033. The growth in this region is supported by rapid industrialization, increased adoption of smart technologies, and government initiatives promoting automation across various sectors. Countries like China and India lead the way in investments in manufacturing and infrastructure.North America Equipment Monitoring Market Report:

In North America, the market is anticipated to grow from $5.35 billion in 2023 to $11.59 billion by 2033. The region is a leader in technology integration within industrial processes, with a burgeoning focus on IoT and automation solutions, reflecting a substantial push toward preventive maintenance approaches.South America Equipment Monitoring Market Report:

The South American Equipment Monitoring market is estimated at $1.14 billion in 2023, growing to $2.48 billion by 2033. Factors driving growth include increased governmental investments in infrastructure and energy projects, alongside a growing emphasis on operational efficiency in manufacturing and utilities.Middle East & Africa Equipment Monitoring Market Report:

The Middle East and Africa Equipment Monitoring market, starting at $1.92 billion in 2023, is estimated to reach $4.16 billion by 2033. The growth is driven by significant investments in oil and gas and energy sectors, alongside emerging manufacturing hubs looking to improve operational efficiencies through advanced monitoring technologies.Tell us your focus area and get a customized research report.

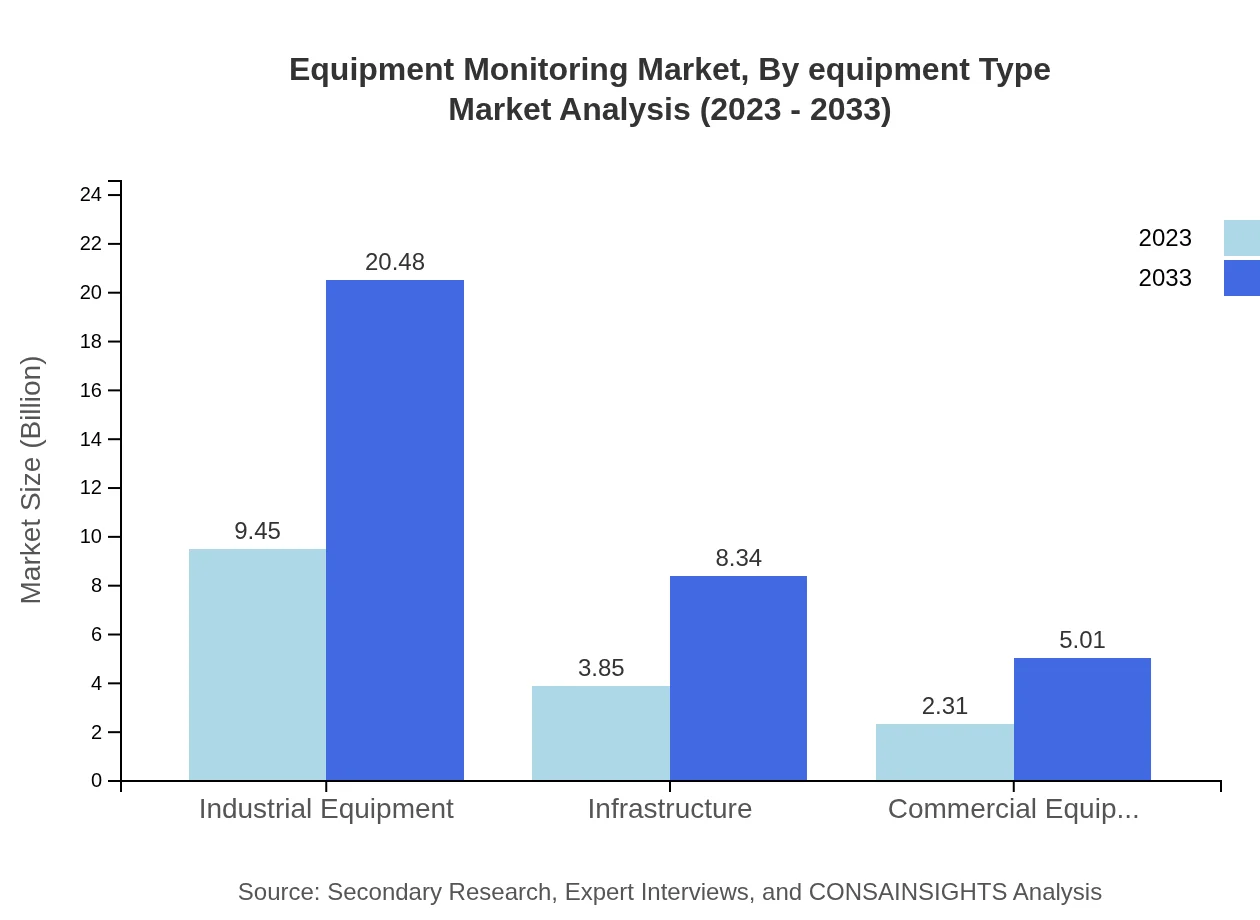

Equipment Monitoring Market Analysis By Equipment Type

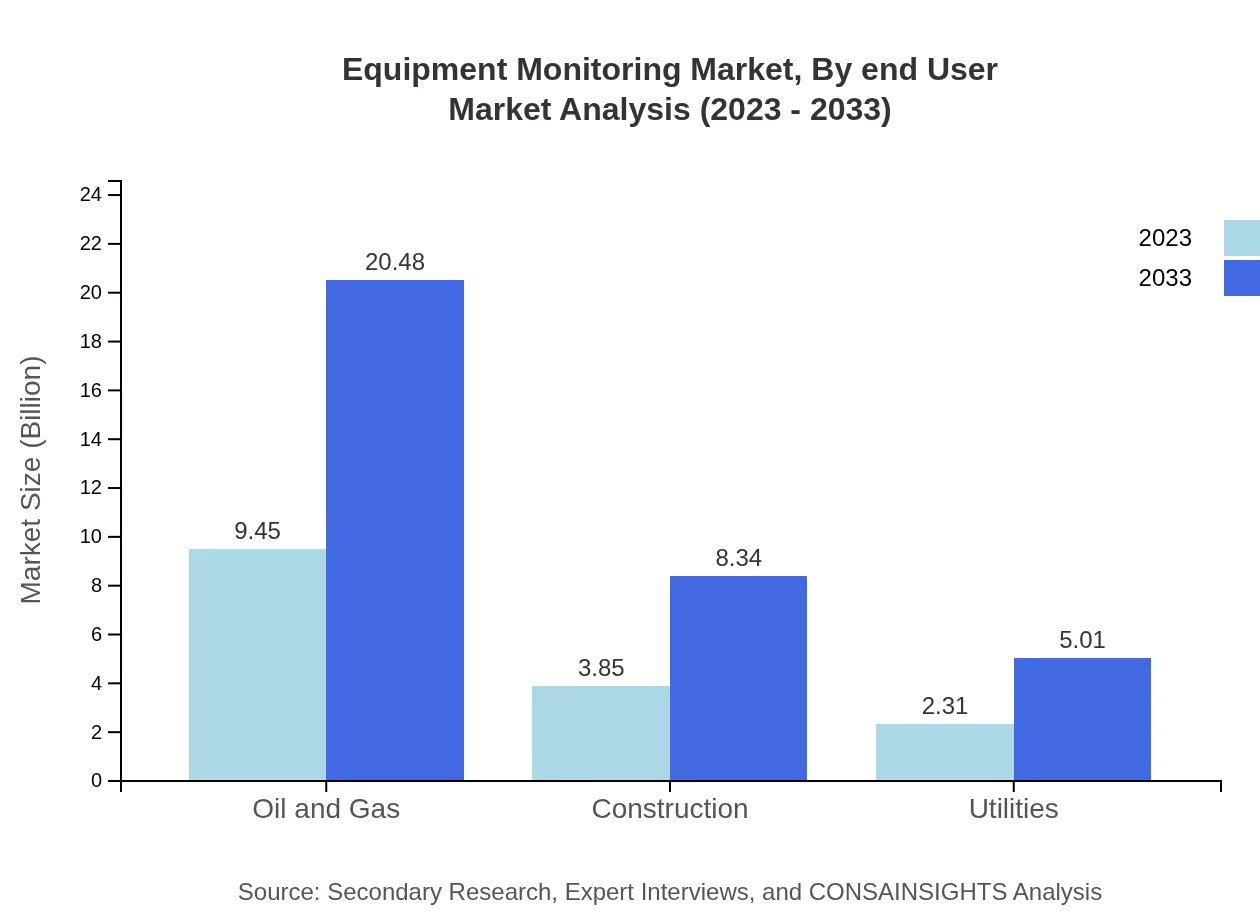

The analysis shows that the Oil and Gas sector dominates the Equipment Monitoring market, with a size of $9.45 billion in 2023, expected to rise to $20.48 billion by 2033. This sector holds a significant market share of 60.55%. Other notable sectors include Construction, Utilities, and Manufacturing, which each contribute substantially to market growth.

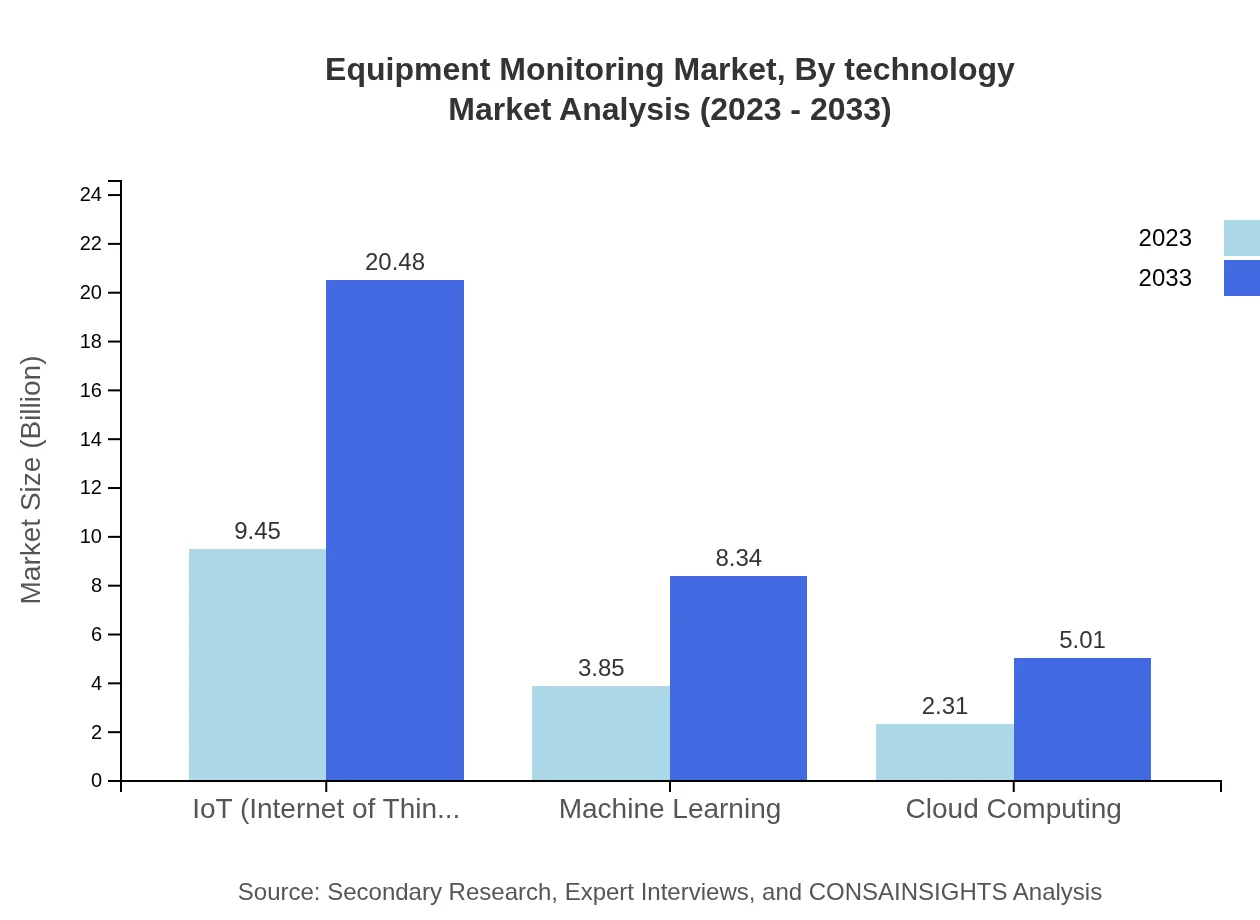

Equipment Monitoring Market Analysis By Technology

Technologies such as IoT lead the Equipment Monitoring market with a size of $9.45 billion in 2023, projected to reach $20.48 billion by 2033. This technology accounts for 60.55% of the market share, driving innovation in real-time monitoring and advanced analytics across industries.

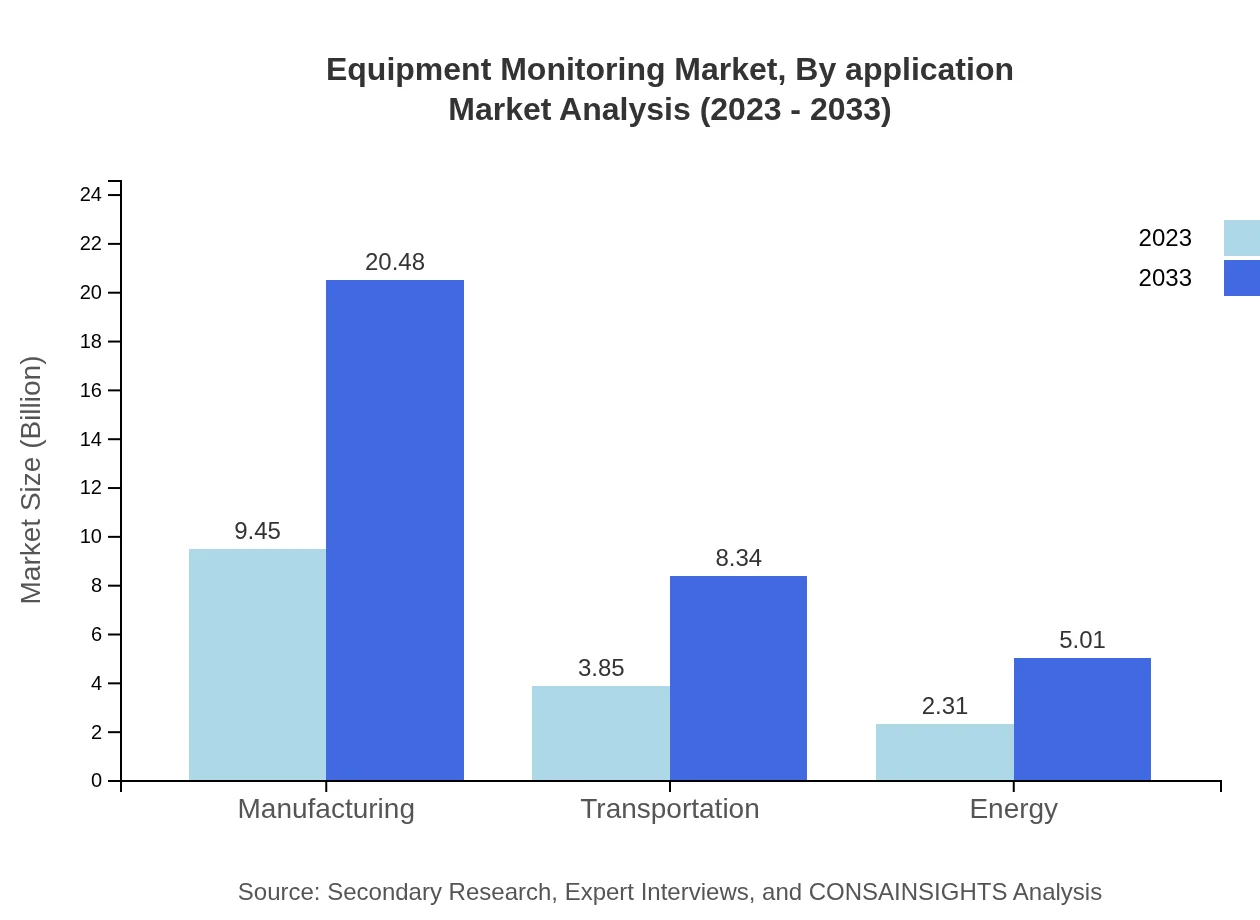

Equipment Monitoring Market Analysis By Application

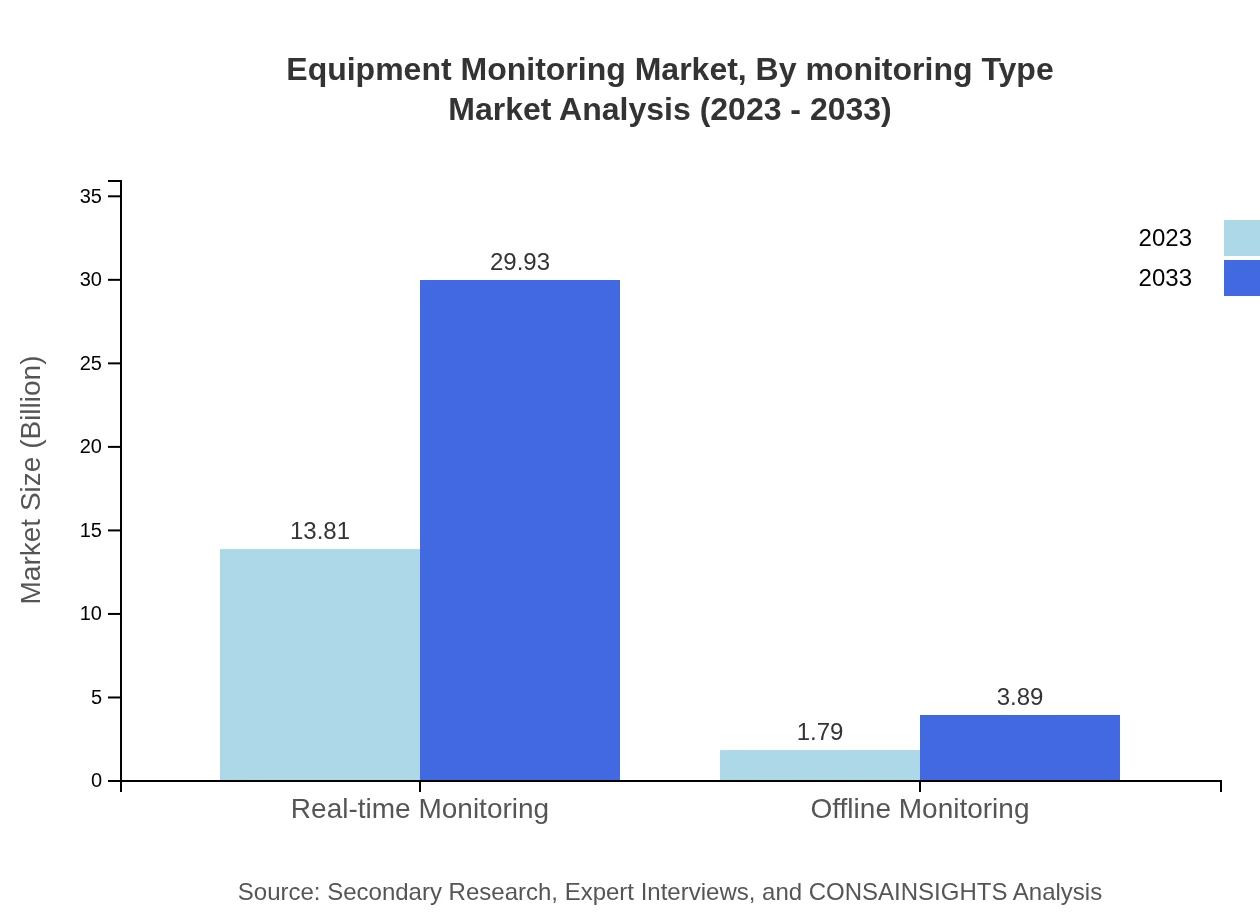

By application, the Equipment Monitoring market emphasizes real-time monitoring, which holds a significant size of $13.81 billion in 2023, growing to $29.93 billion by 2033, representing 88.51% market share. Predictive maintenance applications are also gaining traction as organizations seek to optimize asset performance.

Equipment Monitoring Market Analysis By End User

End-user analysis shows that the Manufacturing sector is a key player in the Equipment Monitoring market, contributing significantly with evolving needs for advanced monitoring solutions to optimize processes. Additionally, sectors like Oil and Gas and Energy are emerging as primary users of such technologies.

Equipment Monitoring Market Analysis By Monitoring Type

The Equipment Monitoring market by monitoring type highlights real-time monitoring, current size at $13.81 billion in 2023, projected to grow to $29.93 billion by 2033. Offline monitoring is also recognized, although it holds a smaller market share at $1.79 billion, expected to reach $3.89 billion.

Equipment Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Equipment Monitoring Industry

Siemens AG:

Siemens AG is a global leader in automation and digitalization across industries, providing advanced equipment monitoring solutions that enhance operational efficiency and safety.Schneider Electric:

With a focus on sustainability and efficiency, Schneider Electric offers a comprehensive portfolio of equipment monitoring and management solutions tailored to diverse industries.GE Digital:

GE Digital leverages extensive industry knowledge and advanced technologies to deliver precision monitoring solutions aimed at optimizing asset performance and reducing downtime.Honeywell International Inc.:

Honeywell has been a pioneer in developing cutting-edge monitoring equipment that enhances safety and operational effectiveness in various sectors, especially in oil and gas.Rockwell Automation:

Rockwell Automation focuses on creating integrated solutions that combine local and cloud-based equipment monitoring and analytics to drive efficiency and productivity.We're grateful to work with incredible clients.

FAQs

What is the market size of Equipment Monitoring?

The global equipment monitoring market is projected to reach approximately $15.6 billion in 2023, with a compound annual growth rate (CAGR) of 7.8% anticipated through 2033.

What are the key market players or companies in the Equipment Monitoring industry?

Key players in the equipment monitoring industry include prominent companies specializing in IoT solutions, machine learning technologies, and cloud computing services, which are essential for advancements in real-time data analytics and monitoring capabilities.

What are the primary factors driving the growth in the Equipment Monitoring industry?

Growth in the equipment monitoring industry is primarily driven by the increasing adoption of IoT technologies, rising demand for predictive maintenance, and the need to enhance operational efficiency in various sectors such as manufacturing and construction.

Which region is the fastest Growing in the Equipment Monitoring market?

Asia Pacific is currently the fastest-growing region in the equipment monitoring market, expected to grow from $3.32 billion in 2023 to $7.20 billion by 2033, reflecting the rapid industrialization and technology adoption in this region.

Does ConsaInsights provide customized market report data for the Equipment Monitoring industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the equipment monitoring industry, enabling companies to access relevant insights and strategic recommendations.

What deliverables can I expect from this Equipment Monitoring market research project?

Deliverables from the equipment monitoring market research project include comprehensive reports featuring market analysis, regional insights, competitive landscape breakdowns, segmentation data, and predictive growth modeling.

What are the market trends of Equipment Monitoring?

Key market trends in equipment monitoring include advancements in real-time monitoring technologies, increased investment in AI and machine learning solutions, and growing emphasis on sustainability and reduced downtime across industries.