Erythropoietin Drugs Market Report

Published Date: 31 January 2026 | Report Code: erythropoietin-drugs

Erythropoietin Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report examines the Erythropoietin Drugs market from 2023 to 2033, providing insights on market size, trends, growth factors, and regional analysis, including industry dynamics and competitive landscape.

| Metric | Value |

|---|---|

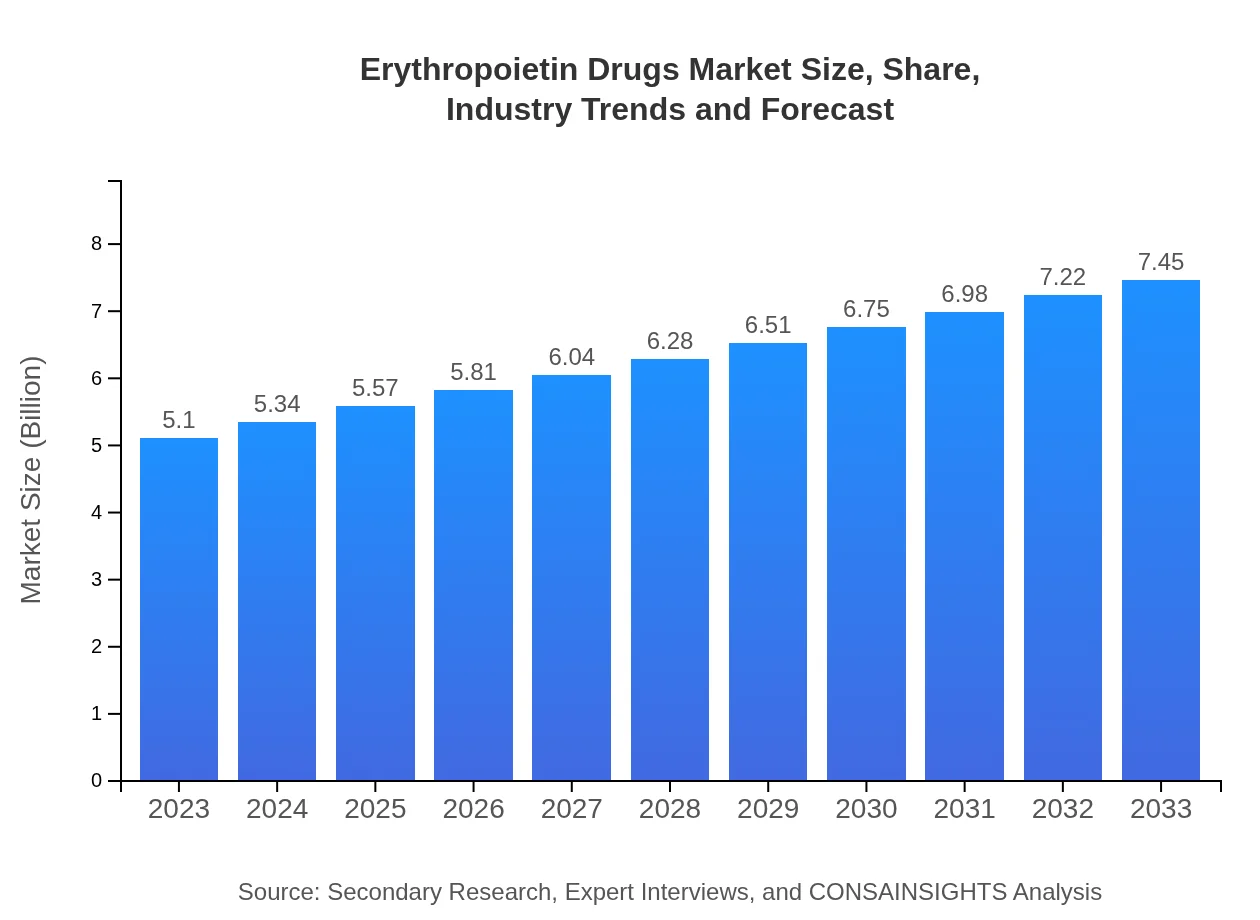

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.10 Billion |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $7.45 Billion |

| Top Companies | Amgen Inc., Johnson & Johnson, Roche, Pfizer Inc. |

| Last Modified Date | 31 January 2026 |

Erythropoietin Drugs Market Overview

Customize Erythropoietin Drugs Market Report market research report

- ✔ Get in-depth analysis of Erythropoietin Drugs market size, growth, and forecasts.

- ✔ Understand Erythropoietin Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Erythropoietin Drugs

What is the Market Size & CAGR of the Erythropoietin Drugs market in 2023?

Erythropoietin Drugs Industry Analysis

Erythropoietin Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Erythropoietin Drugs Market Analysis Report by Region

Europe Erythropoietin Drugs Market Report:

Europe is expected to show substantial growth, moving from $1.60 billion in 2023 to $2.35 billion by 2033. Increased prevalence of anemia related to chronic conditions and ongoing clinical research are key contributing factors to this trend.Asia Pacific Erythropoietin Drugs Market Report:

The Asia-Pacific market for Erythropoietin drugs is projected to grow from $0.84 billion in 2023 to $1.23 billion by 2033. The growth is driven by an increase in renal disease diagnoses and supportive healthcare policies promoting drug accessibility.North America Erythropoietin Drugs Market Report:

The North American Erythropoietin drugs market is the largest, with a size estimated at $1.93 billion in 2023 and expected to reach $2.82 billion by 2033. This growth is attributed to advanced healthcare infrastructure, high healthcare expenditure, and rising awareness of EPO therapies.South America Erythropoietin Drugs Market Report:

In South America, the market is expected to expand from $0.17 billion in 2023 to $0.25 billion by 2033. Increasing healthcare investments and improvements in the management of chronic diseases are key drivers for this growth.Middle East & Africa Erythropoietin Drugs Market Report:

The Middle East and Africa market for Erythropoietin drugs is anticipated to grow from $0.55 billion in 2023 to $0.80 billion by 2033. With ongoing health improvements and increased access to treatment options, the market shows promising potential.Tell us your focus area and get a customized research report.

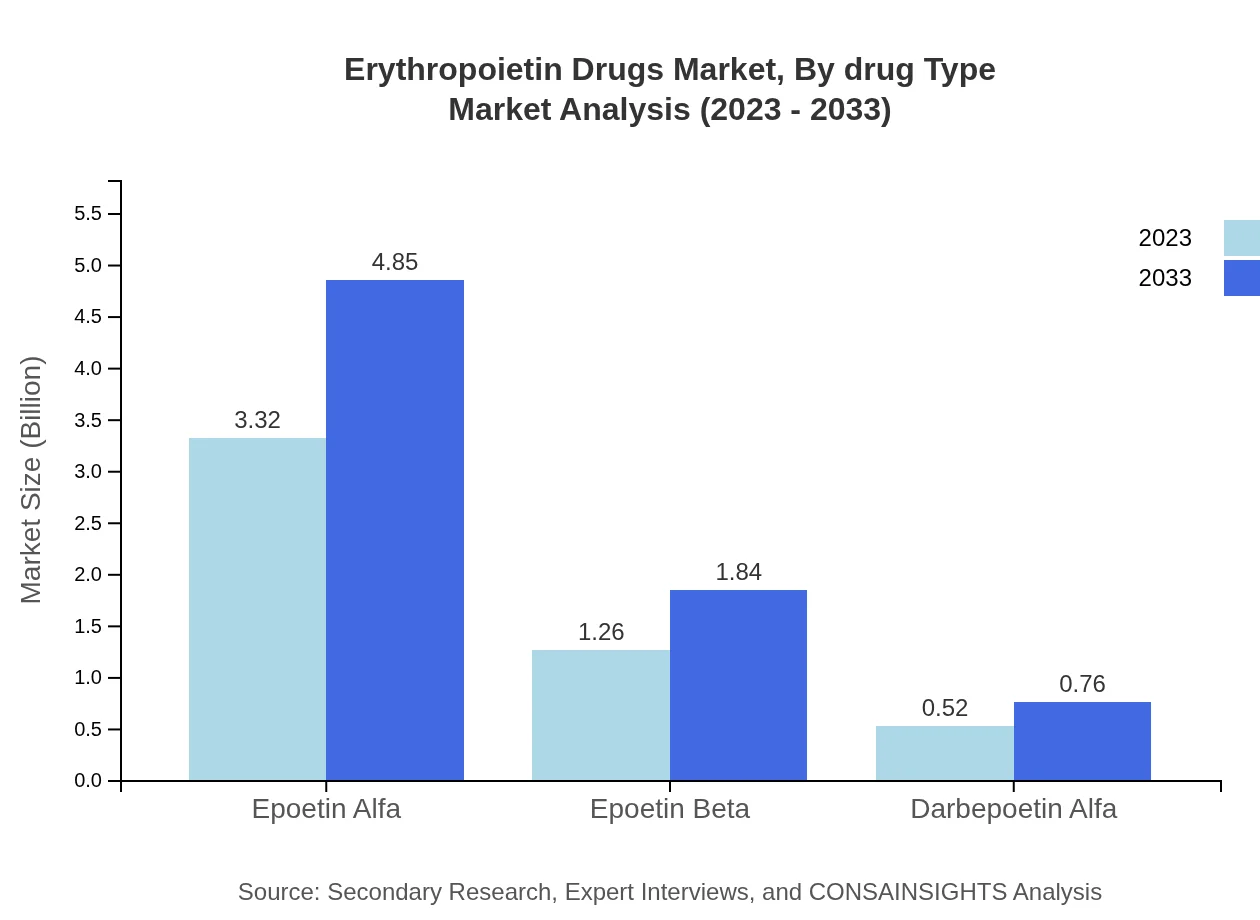

Erythropoietin Drugs Market Analysis By Drug Type

Epoetin Alfa remains the most significant drug type in the Erythropoietin market, expected to maintain a size of $3.32 billion in 2023, reaching $4.85 billion by 2033. Following it, Epoetin Beta and Darbepoetin Alfa are also crucial, but with smaller shares, indicating a diversified drug landscape.

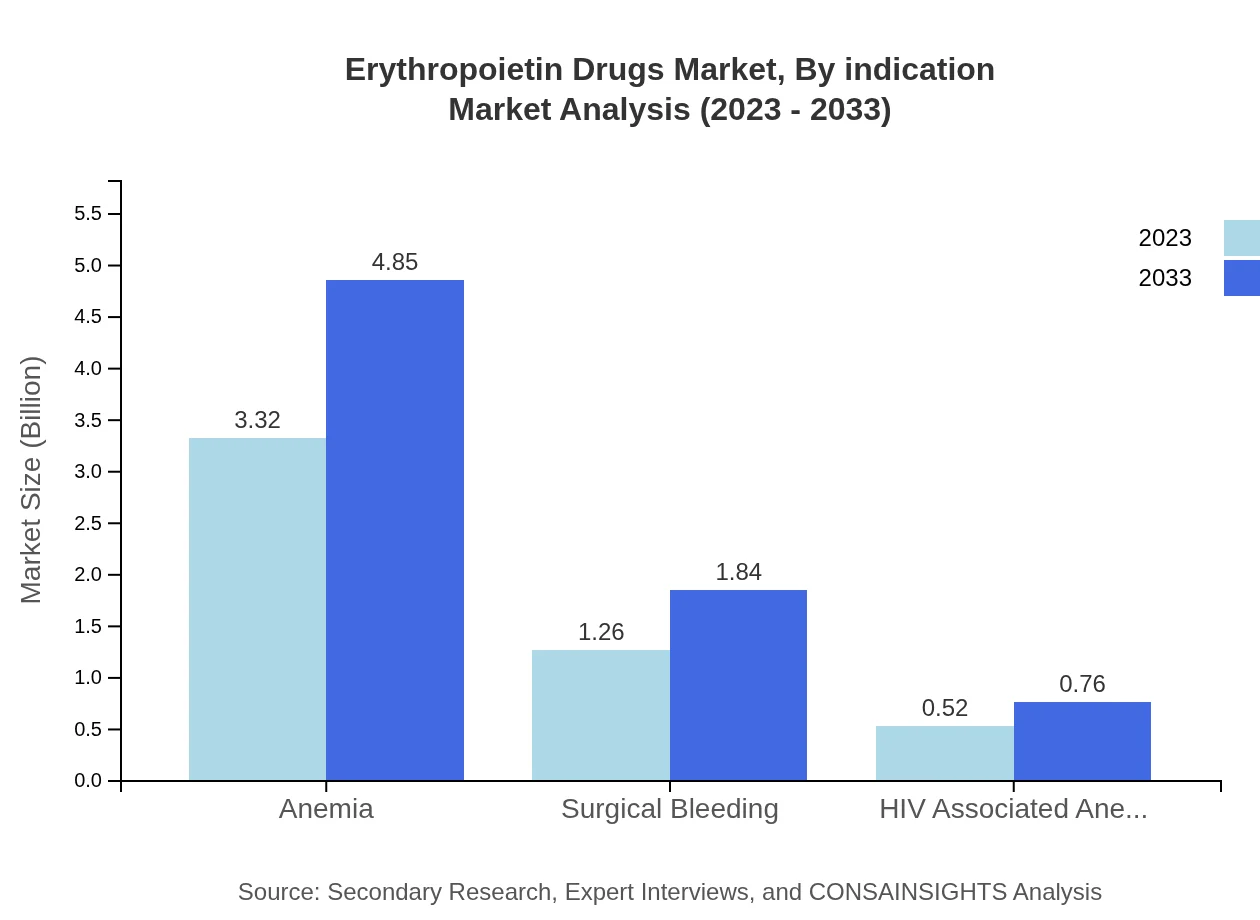

Erythropoietin Drugs Market Analysis By Indication

The Erythropoietin drugs market is largely driven by indications such as Anemia, Surgical Bleeding, and HIV Associated Anemia, collectively dominating the treatment landscape and showcasing a growth trajectory driven by the increasing prevalence of these conditions.

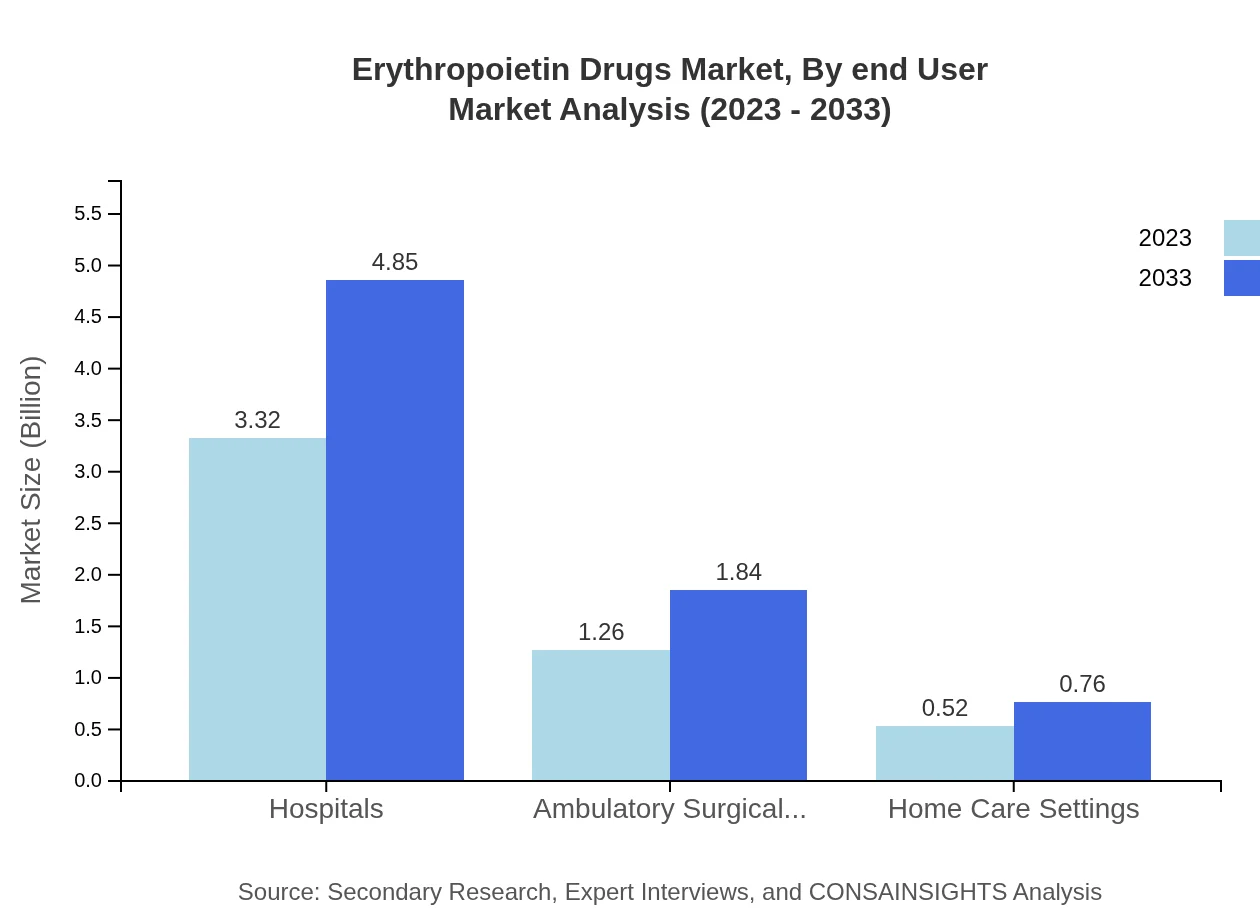

Erythropoietin Drugs Market Analysis By End User

Hospitals are the primary end-user segment, expected to hold a dominant share of 65.13% in 2023. Ambulatory Surgical Centers and Home Care Settings contribute significantly, enhancing patient-centric approaches in the administration of EPO drugs.

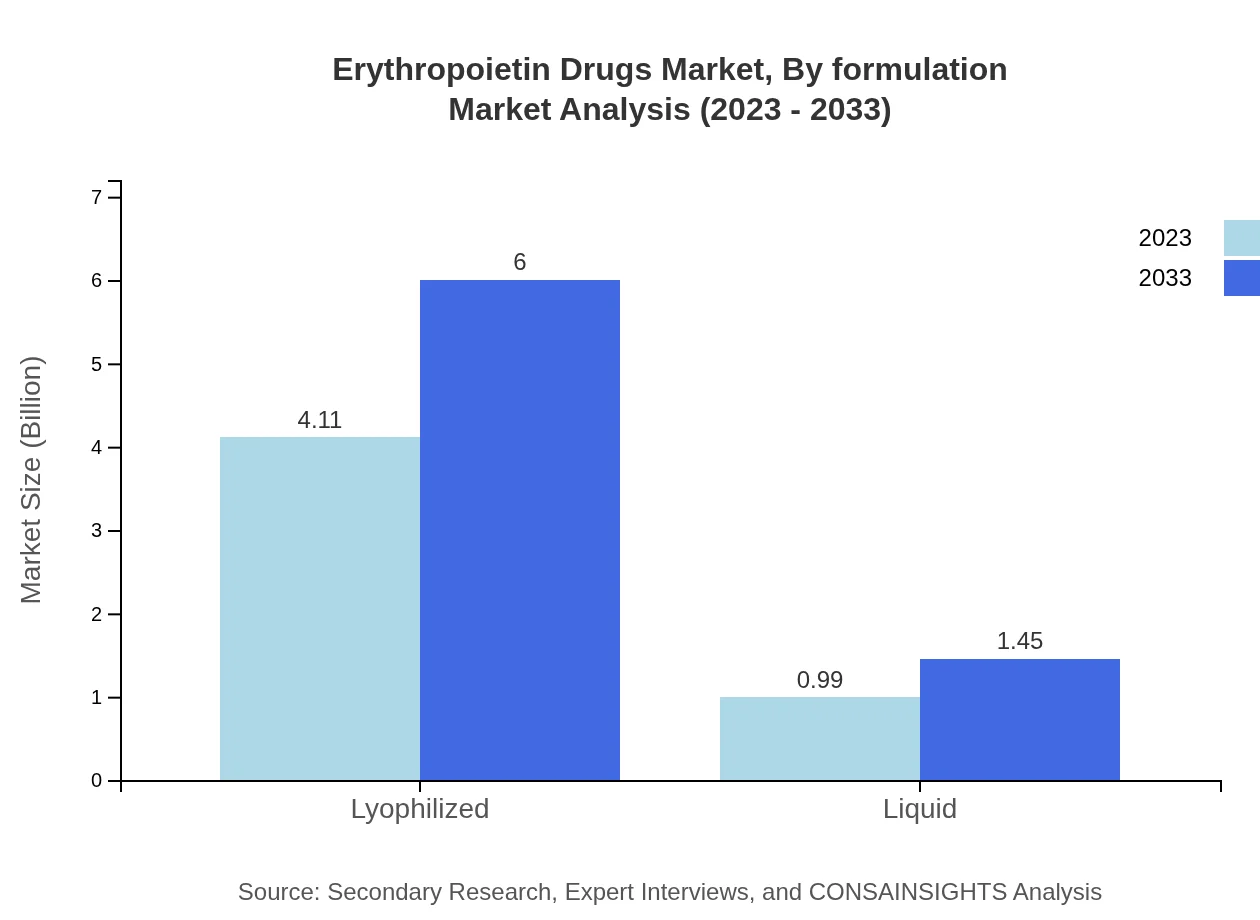

Erythropoietin Drugs Market Analysis By Formulation

The Lyophilized formulation leads the market with an 80.5% share, capitalizing on its stability and efficacy. Meanwhile, Liquid formulations account for 19.5%, creating opportunities for targeted product development strategies.

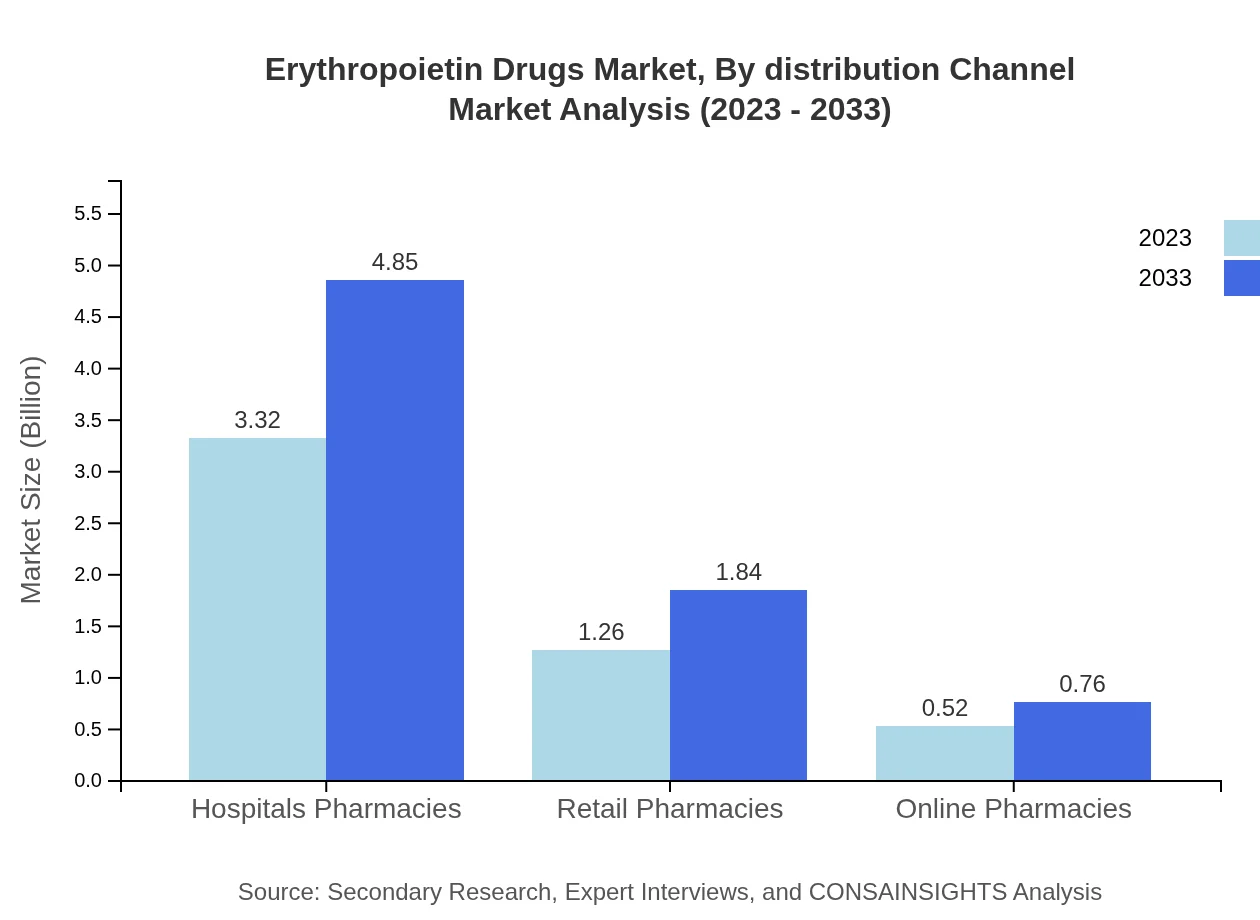

Erythropoietin Drugs Market Analysis By Distribution Channel

Hospital Pharmacies dominate the distribution channels accounting for 65.13% in 2023, followed by Retail Pharmacies at 24.71%, reflecting the critical role of institutional procurement in drug availability.

Erythropoietin Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Erythropoietin Drugs Industry

Amgen Inc.:

Amgen is a pioneer in biotechnology, known for its innovative Erythropoietin drug, Aranesp, which revolutionized anemia treatment paradigms.Johnson & Johnson:

Johnson & Johnson provides comprehensive healthcare solutions and is recognized for producing Erythropoietin products that meet diverse patient needs.Roche:

Roche specializes in pharmaceuticals and diagnostics, contributing significantly to the Erythropoietin market with its product portfolio aimed at improving patient outcomes.Pfizer Inc.:

Pfizer is a global leader in medicine, providing effective Erythropoietin therapies that address various medical conditions, especially in oncology.We're grateful to work with incredible clients.

FAQs

What is the market size of erythropoietin Drugs?

The global market size for erythropoietin drugs is anticipated to reach approximately $5.1 billion by 2033, with a compound annual growth rate (CAGR) of 3.8% from 2023 to 2033. This growth reflects increasing demand in healthcare sectors.

What are the key market players or companies in the erythropoietin Drugs industry?

Key players in the erythropoietin-drugs market include Amgen Inc., Johnson & Johnson, Roche, and Pfizer. These companies dominate the market, focusing on innovative product development and cost-effective solutions to meet patient needs.

What are the primary factors driving the growth in the erythropoietin Drugs industry?

Key factors driving growth in the erythropoietin-drugs market include rising incidences of chronic kidney diseases, increased awareness of anemia treatment, and advancements in drug formulations. Additionally, the growing elderly population significantly contributes to market expansion.

Which region is the fastest Growing in the erythropoietin Drugs?

The Asia Pacific region is projected to be the fastest-growing market in the erythropoietin-drugs sector, expanding from $0.84 billion in 2023 to $1.23 billion by 2033. This growth is driven by improving healthcare infrastructure and rising healthcare expenditures.

Does ConsaInsights provide customized market report data for the erythropoietin Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to the specifics of the erythropoietin-drugs industry. Clients can request detailed insights based on particular interests or requirements for their strategic planning.

What deliverables can I expect from this erythropoietin Drugs market research project?

From the erythropoietin-drugs market research project, clients can expect comprehensive reports, executive summaries, market forecasts, competitive analysis, and segmented data, covering key regions and market dynamics effectively.

What are the market trends of erythropoietin Drugs?

Market trends in erythropoietin-drugs indicate a shift toward biosimilars, an uptick in personalized medicine, and increasing collaborations among pharmaceutical firms. Additionally, there's a strong movement towards digital health integration in treatment plans.