Esim Market Report

Published Date: 31 January 2026 | Report Code: esim

Esim Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Esim market, including current trends, market size, and projections for growth through 2033. Insights into regional performance and key industry players are also highlighted.

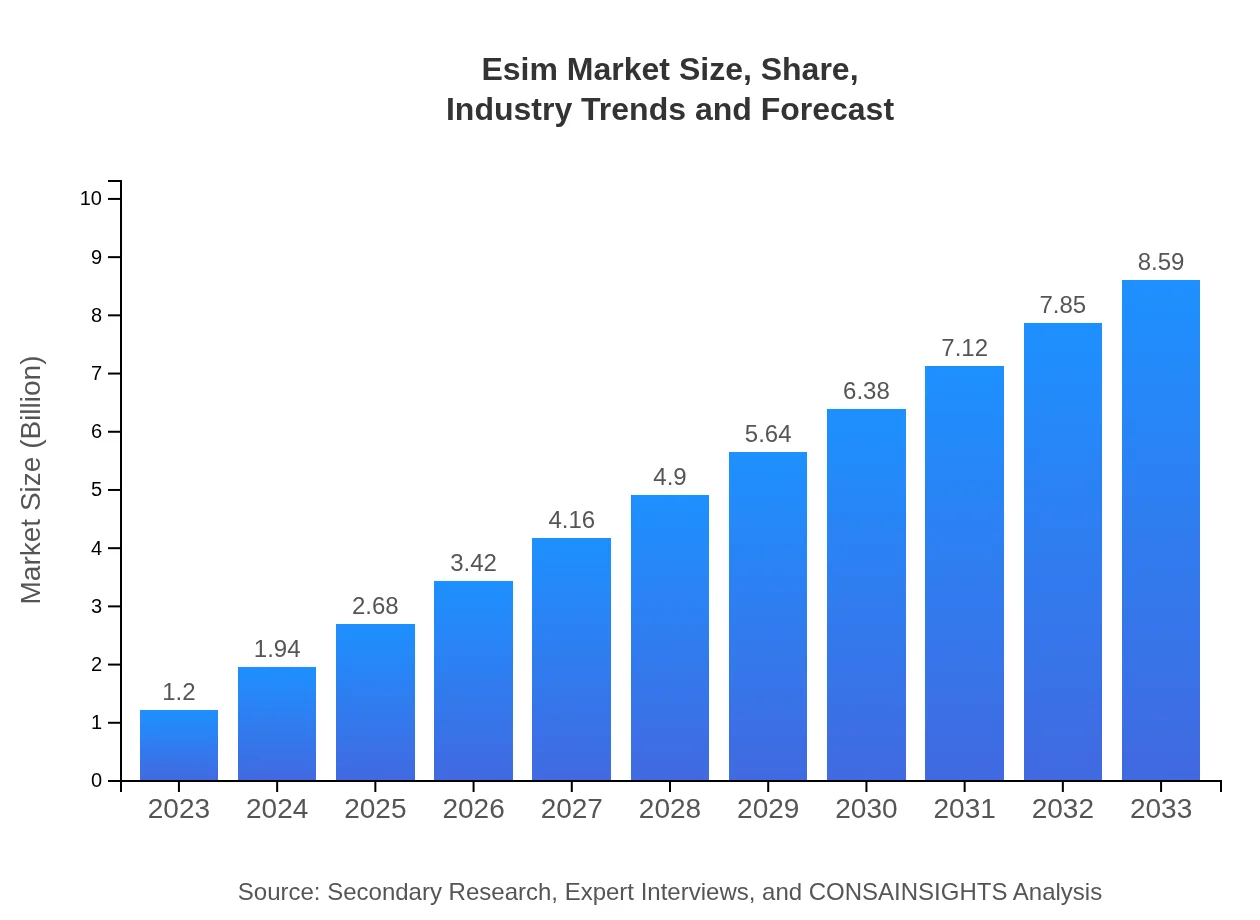

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 20.5% |

| 2033 Market Size | $8.59 Billion |

| Top Companies | Gemalto N.V., Giesecke+Devrient GmbH, Sierra Wireless, Thales Group |

| Last Modified Date | 31 January 2026 |

Esim Market Overview

Customize Esim Market Report market research report

- ✔ Get in-depth analysis of Esim market size, growth, and forecasts.

- ✔ Understand Esim's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Esim

What is the Market Size & CAGR of Esim market in 2023?

Esim Industry Analysis

Esim Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Esim Market Analysis Report by Region

Europe Esim Market Report:

Europe, valued at $0.41 billion in 2023, will grow to $2.93 billion by 2033. The European market benefits from regulatory support and the push towards digital connectivity, paving the way for innovation in eSIM applications across various industries.Asia Pacific Esim Market Report:

The Asia-Pacific region, valued at $0.22 billion in 2023, is set to grow to $1.58 billion by 2033, showcasing a significant CAGR driven by the rapid expansion of mobile networks and the increasing adoption of IoT devices. Major markets include China and India, where telecom operators are actively investing in eSIM technology to enhance connectivity.North America Esim Market Report:

North America, estimated at $0.40 billion in 2023, is expected to reach $2.85 billion by 2033. The region is a leader in eSIM deployment due to a high concentration of advanced technology companies and strong demand for IoT solutions across automotive, telecommunications, and consumer electronics.South America Esim Market Report:

South America presents a nascent yet promising market for eSIM technology, increasing from $0.03 billion in 2023 to $0.24 billion by 2033. The growth is supported by rising mobile and internet penetration rates combined with a growing consumer interest in mobile connectivity solutions.Middle East & Africa Esim Market Report:

The Middle East and Africa market, valued at $0.14 billion in 2023, is projected to expand to $0.99 billion by 2033, driven by increasing mobile operations and the need for enhanced connectivity solutions in emerging economies.Tell us your focus area and get a customized research report.

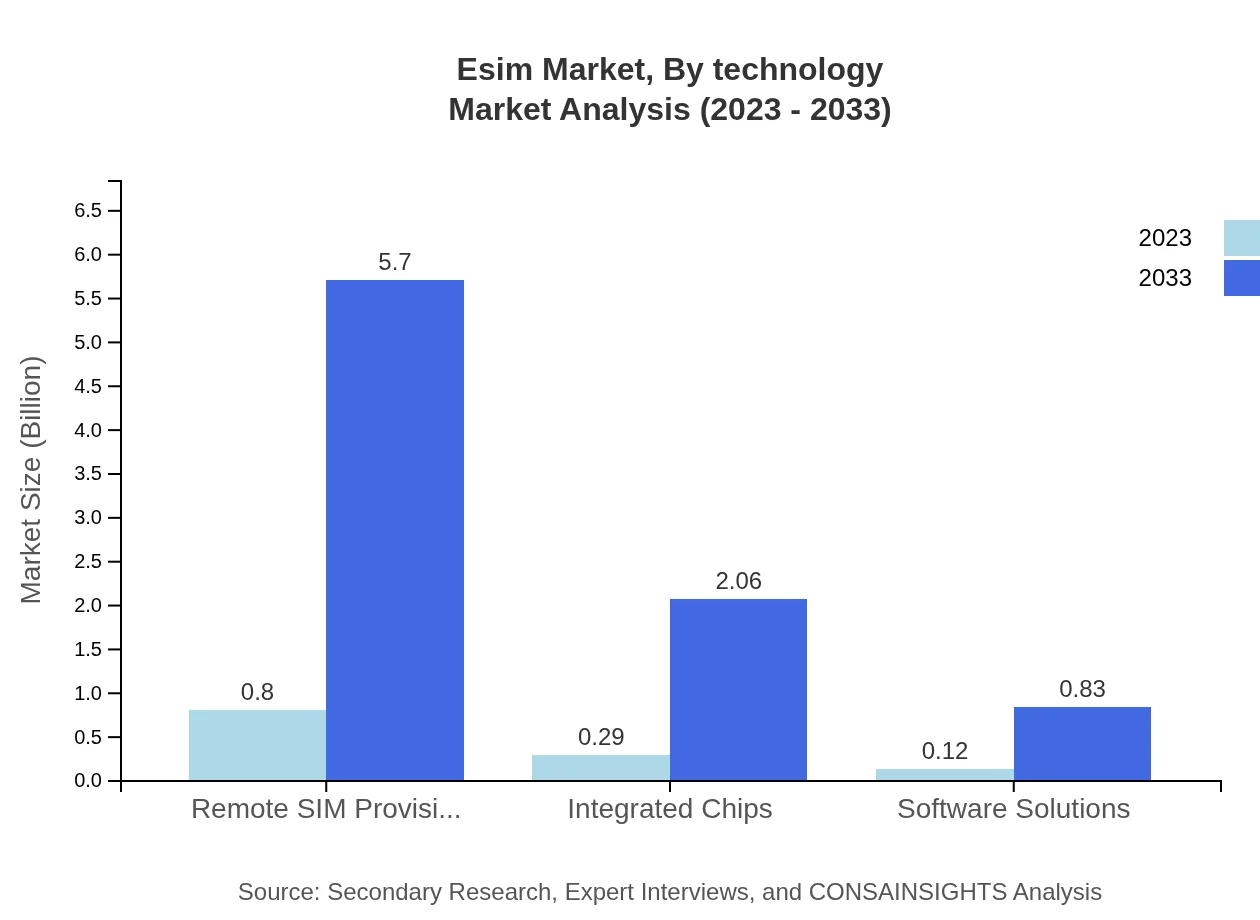

Esim Market Analysis By Technology

The eSIM market is predominantly driven by remote SIM provisioning technology. This technology allows operators to remotely manage SIM profiles, enhancing the user experience by reducing the need for physical SIM swaps. As of 2023, the remote SIM provisioning segment is valued at approximately $0.80 billion and is expected to grow to $5.70 billion by 2033.

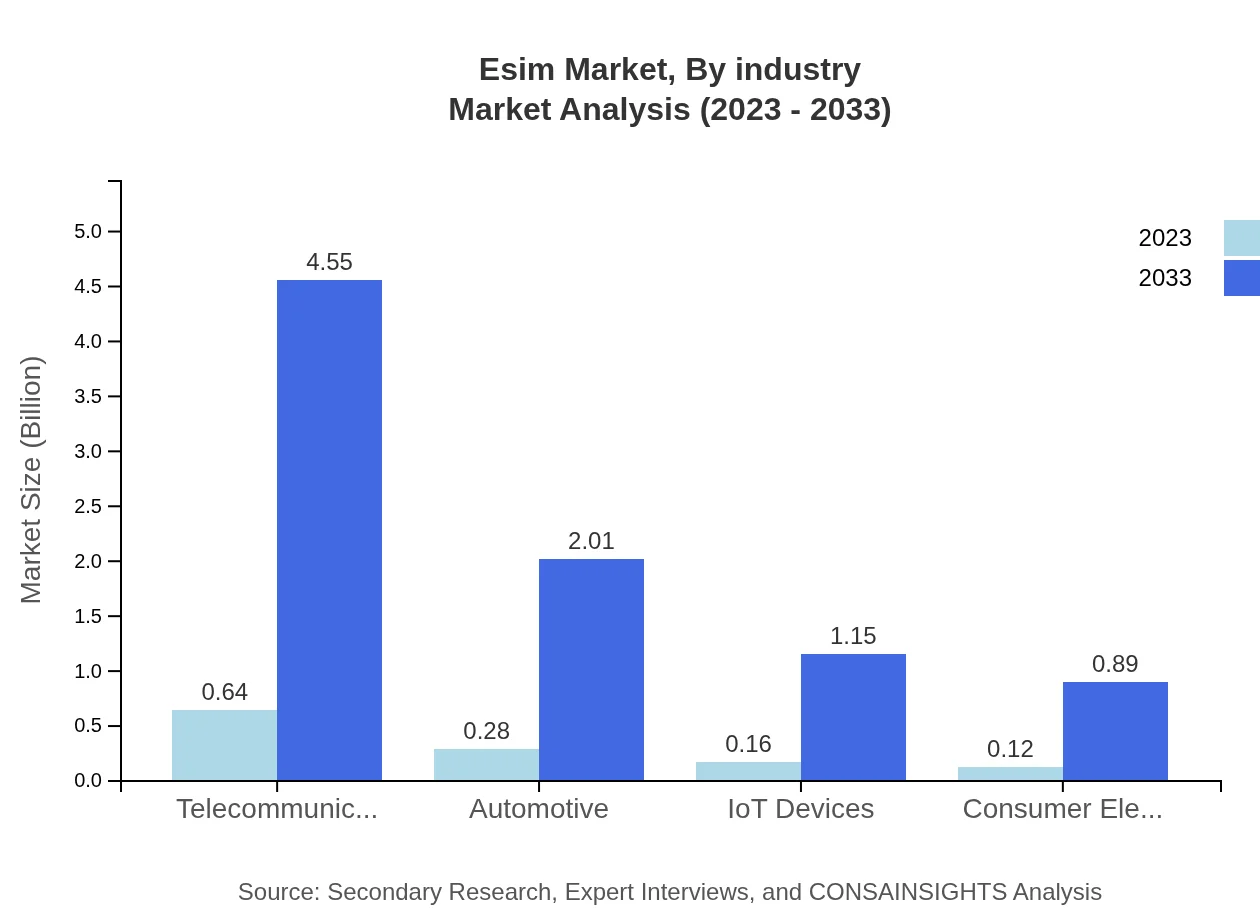

Esim Market Analysis By Industry

Telecommunications is the leading industry segment, with a market size of $0.64 billion in 2023, projected to reach $4.55 billion by 2033. The automotive industry follows closely, reflecting a growing inclination towards connected vehicles. The growing connected devices marketplace is propelling IoT-related eSIM applications significantly.

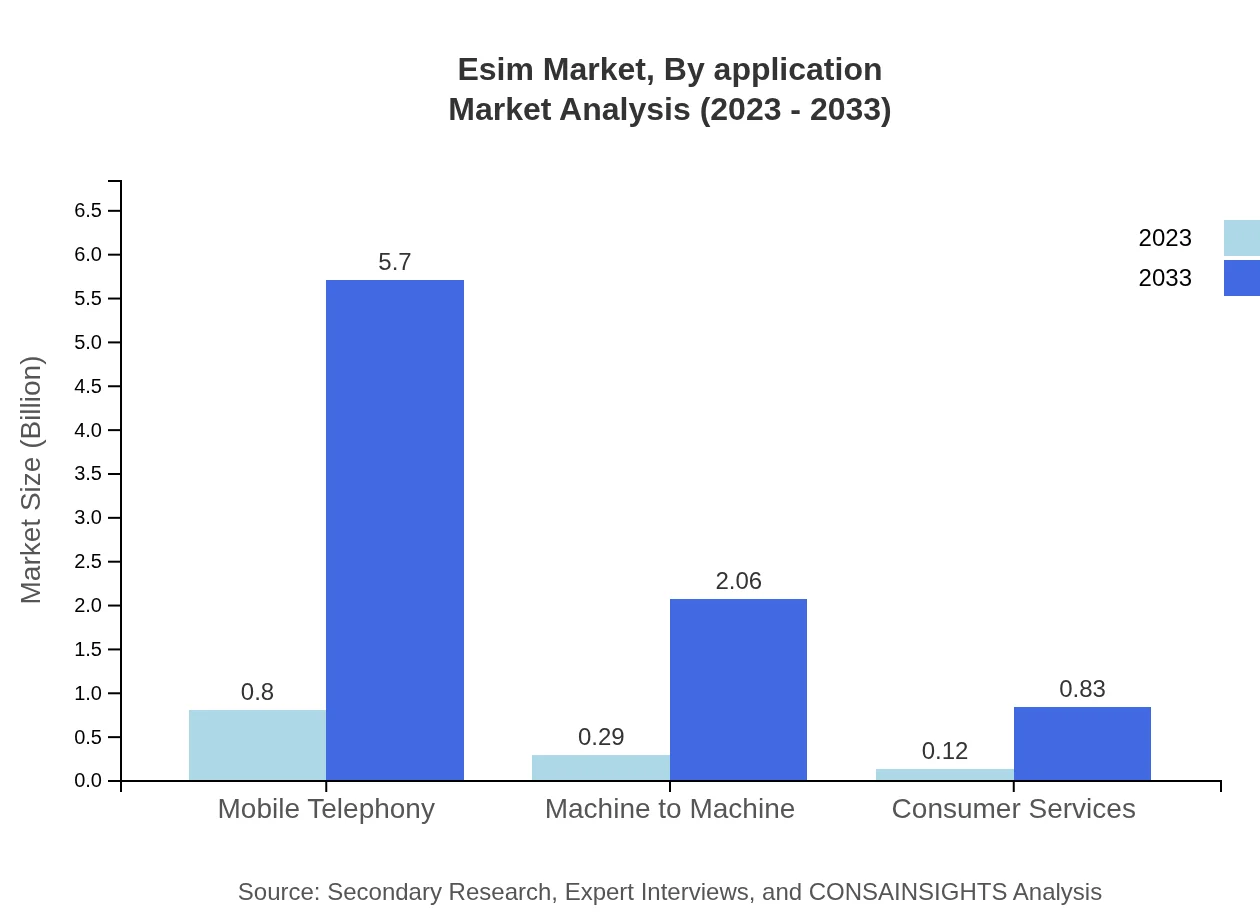

Esim Market Analysis By Application

Various applications are emerging where eSIM technology is making significant inroads, from mobile telephony and machine-to-machine communications to IoT devices and consumer services. The mobile telephony segment is substantial, with a market share of 66.33% in 2023, reflecting its primary role in the current eSIM landscape.

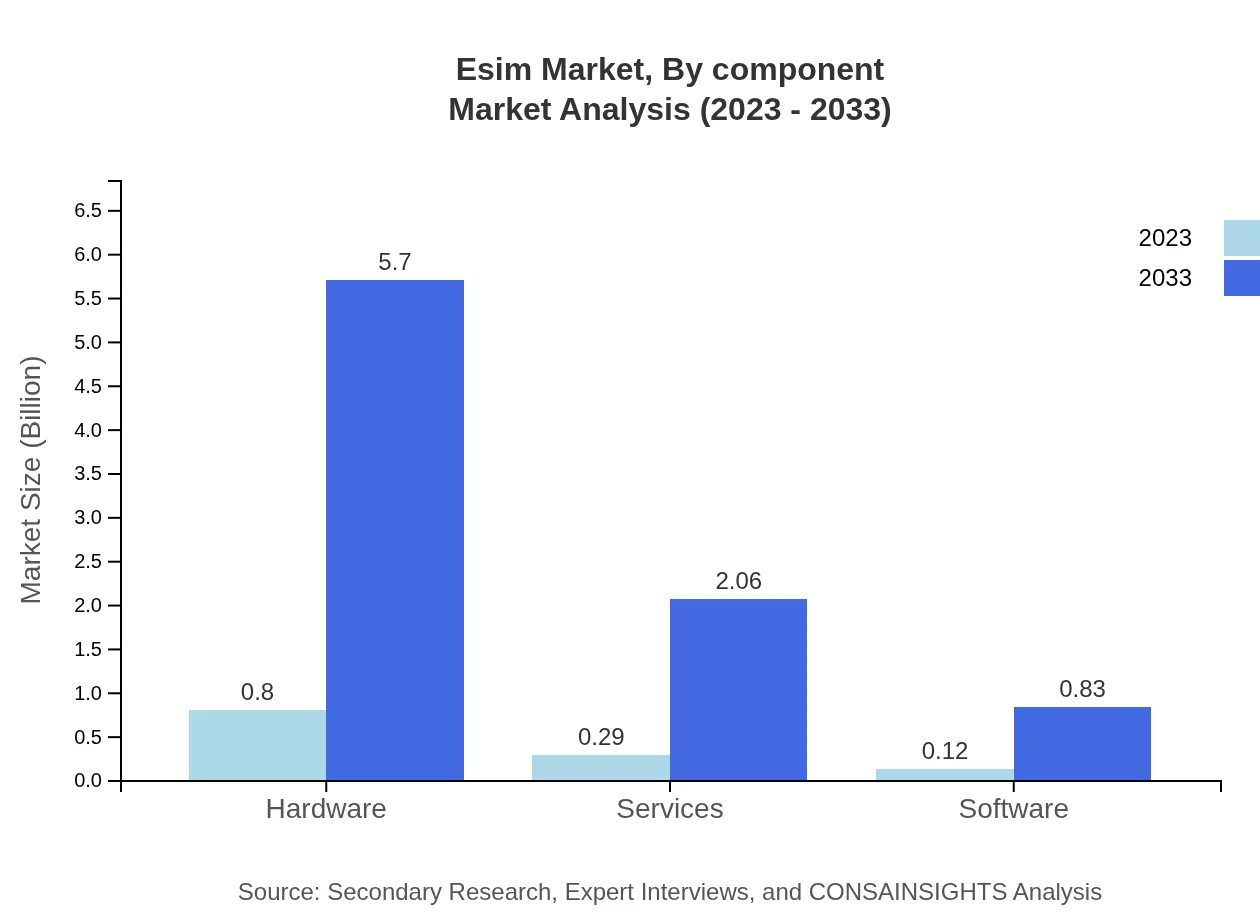

Esim Market Analysis By Component

Key components in this market include hardware and software solutions that enable connectivity, remote provisioning, and management. As of 2023, hardware makes up 66.33% of the overall market share, illustrating the significance of robust device infrastructure in supporting eSIM services.

Esim Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Esim Industry

Gemalto N.V.:

A leader in digital security, Gemalto provides advanced eSIM solutions that enhance mobile connectivity and security for a variety of sectors.Giesecke+Devrient GmbH:

Specializes in digital security solutions, Giesecke+Devrient is a key player in the eSIM market, offering various products including remote SIM provisioning technology.Sierra Wireless:

Known for IoT solutions, Sierra Wireless supports eSIM technology to provide connectivity across its wide range of IoT devices.Thales Group:

Thales Group provides comprehensive eSIM solutions across sectors, focusing on security and seamless provisioning.We're grateful to work with incredible clients.

FAQs

What is the market size of eSIM?

The global eSIM market is valued at approximately $1.2 billion in 2023, with a remarkable CAGR of 20.5%. By 2033, this market is expected to reach significant growth, reflecting advancing trends in connectivity and technology.

What are the key market players or companies in the eSIM industry?

Key players in the eSIM market include major telecommunications companies, hardware manufacturers, and software solution providers. These companies are leveraging innovation to enhance their service offerings and address growing consumer demands.

What are the primary factors driving the growth in the eSIM industry?

Several primary factors are driving growth in the eSIM industry, including the increasing adoption of IoT devices, advancements in remote SIM provisioning technologies, and the rising demand for flexible connectivity solutions among consumers and businesses.

Which region is the fastest Growing in the eSIM market?

Among the various regions, Europe is experiencing the fastest growth, projected to rise from a market size of $0.41 billion in 2023 to $2.93 billion by 2033. Other growing regions include Asia Pacific and North America.

Does ConsaInsights provide customized market report data for the eSIM industry?

Yes, ConsaInsights offers tailored market reports for the eSIM industry, allowing clients to gain insights specific to their business needs while focusing on unique factors such as regional performance and segment analysis.

What deliverables can I expect from this eSIM market research project?

Clients can expect comprehensive deliverables including detailed market analysis, segmented data breakdown, regional insights, trends forecasting, and competitive landscape assessments to aid strategic decision-making.

What are the market trends of eSIM?

Current market trends in the eSIM sector include a rapid shift towards IoT integration, increased mobile device connectivity, and a growing emphasis on consumer convenience through robust software solutions for remote SIM provisioning.