Esports Market Report

Published Date: 31 January 2026 | Report Code: esports

Esports Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the esports market from 2023 to 2033, highlighting insights, market trends, regional analyses, and competitive landscapes in the industry.

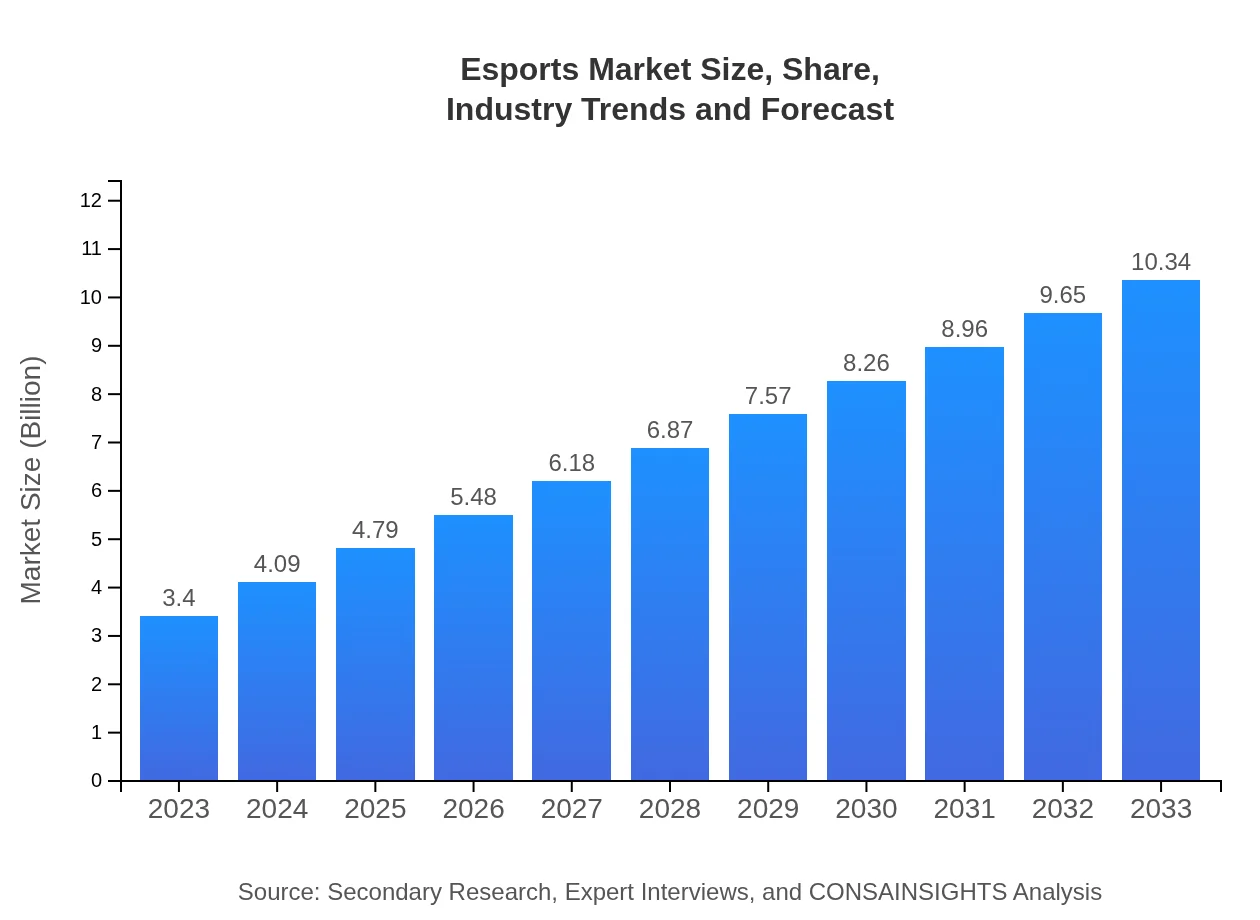

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 11.3% |

| 2033 Market Size | $10.34 Billion |

| Top Companies | Riot Games, Activision Blizzard, Valve Corporation, Epic Games, PUBG Corporation |

| Last Modified Date | 31 January 2026 |

Esports Market Overview

Customize Esports Market Report market research report

- ✔ Get in-depth analysis of Esports market size, growth, and forecasts.

- ✔ Understand Esports's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Esports

What is the Market Size & CAGR of the Esports market in 2033?

Esports Industry Analysis

Esports Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Esports Market Analysis Report by Region

Europe Esports Market Report:

The European esports market, valued at approximately $0.99 billion in 2023, is expected to reach $3.02 billion by 2033. Major contributing factors include a strong gaming community, regulatory support for esports, and a burgeoning tournament scene that attracts international participants.Asia Pacific Esports Market Report:

The Asia Pacific region is the largest market for esports, valued at approximately $0.73 billion in 2023 and projected to grow to $2.21 billion by 2033. This growth is propelled by a strong gaming culture, extensive internet access, and governmental support for digital initiatives, particularly in countries like China and South Korea.North America Esports Market Report:

North America is projected to see a significant increase in its esports market, growing from $1.10 billion in 2023 to $3.35 billion by 2033. The region benefits from a well-established gaming infrastructure, extensive sponsorships, and collaborations between traditional sports leagues and esports organizations that drive viewership.South America Esports Market Report:

In South America, the esports market is expected to grow from $0.30 billion in 2023 to $0.92 billion by 2033. Factors contributing to this growth include increasing youth engagement in gaming, rising internet accessibility, and local tournament initiatives that foster competitive play.Middle East & Africa Esports Market Report:

The esports market in the Middle East and Africa is still developing, with projections from $0.27 billion in 2023 to $0.83 billion by 2033. Growth drivers include increasing smartphone adoption and a youthful demographic that is enthusiastic about gaming.Tell us your focus area and get a customized research report.

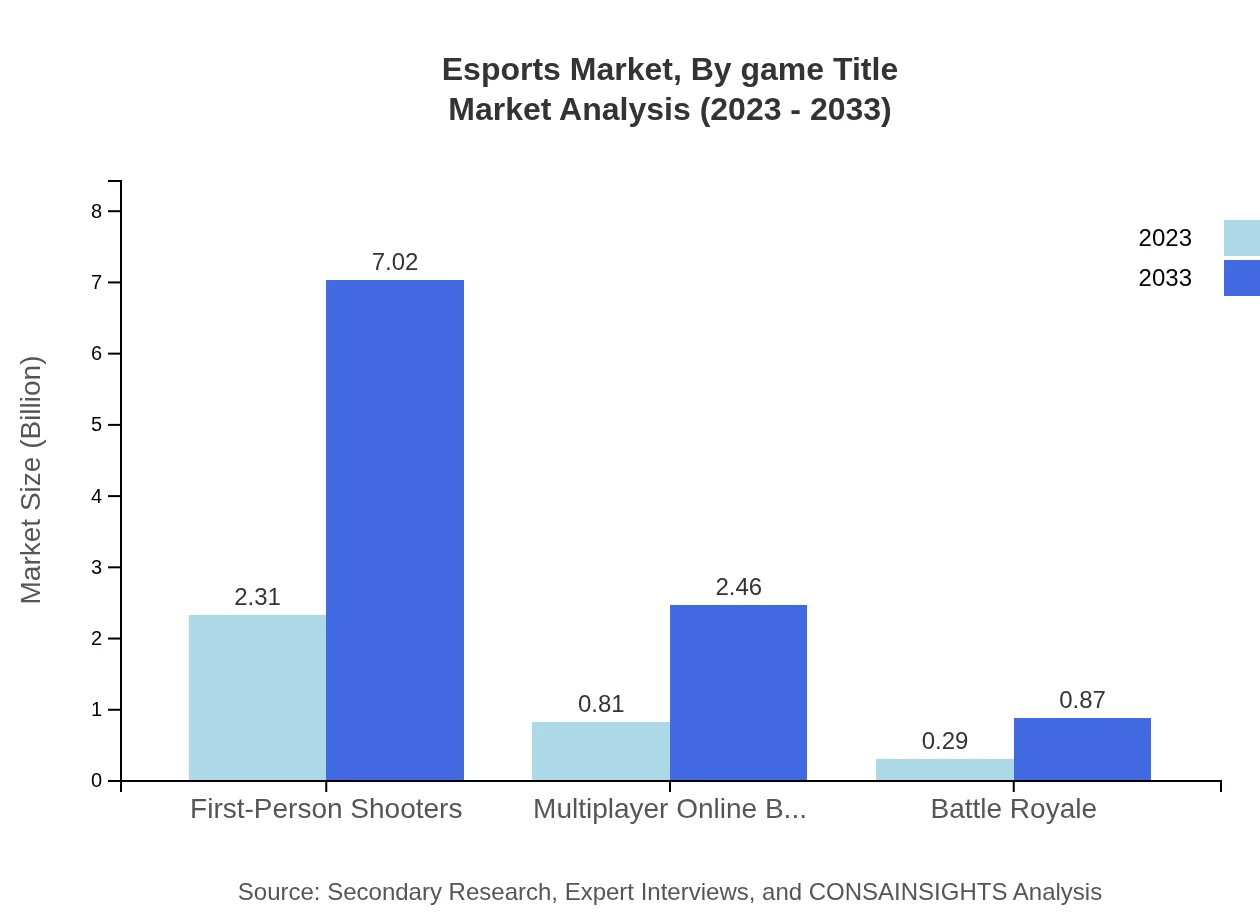

Esports Market Analysis By Game Title

The Esports Market is dominated by genres such as First-Person Shooters (FPS), Multiplayer Online Battle Arena (MOBA), and Battle Royale games. By 2033, the FPS segment is expected to grow to $7.02 billion, while MOBA games will expand to approximately $2.46 billion and Battle Royale games will increase to around $0.87 billion. These segments continue to evolve with new titles and player engagement strategies.

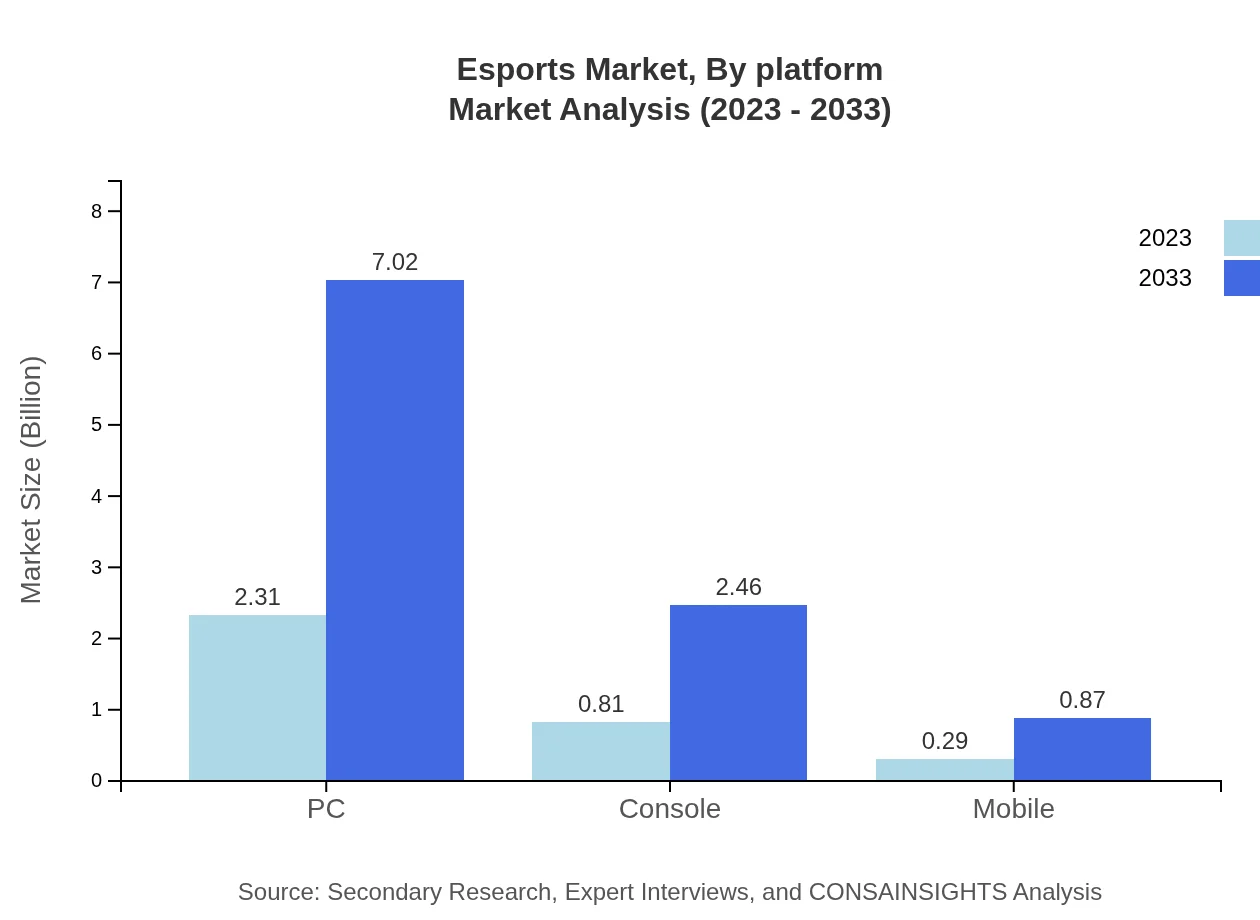

Esports Market Analysis By Platform

The market segmented by platform reveals significant insights, with PC gaming leading at $2.31 billion in 2023 and projected to grow to $7.02 billion by 2033. Console gaming is expected to expand from $0.81 billion to $2.46 billion in the same period, while mobile esports, though smaller, is anticipated to reach $0.87 billion by 2033, reflecting the increasing accessibility of mobile devices for gamers.

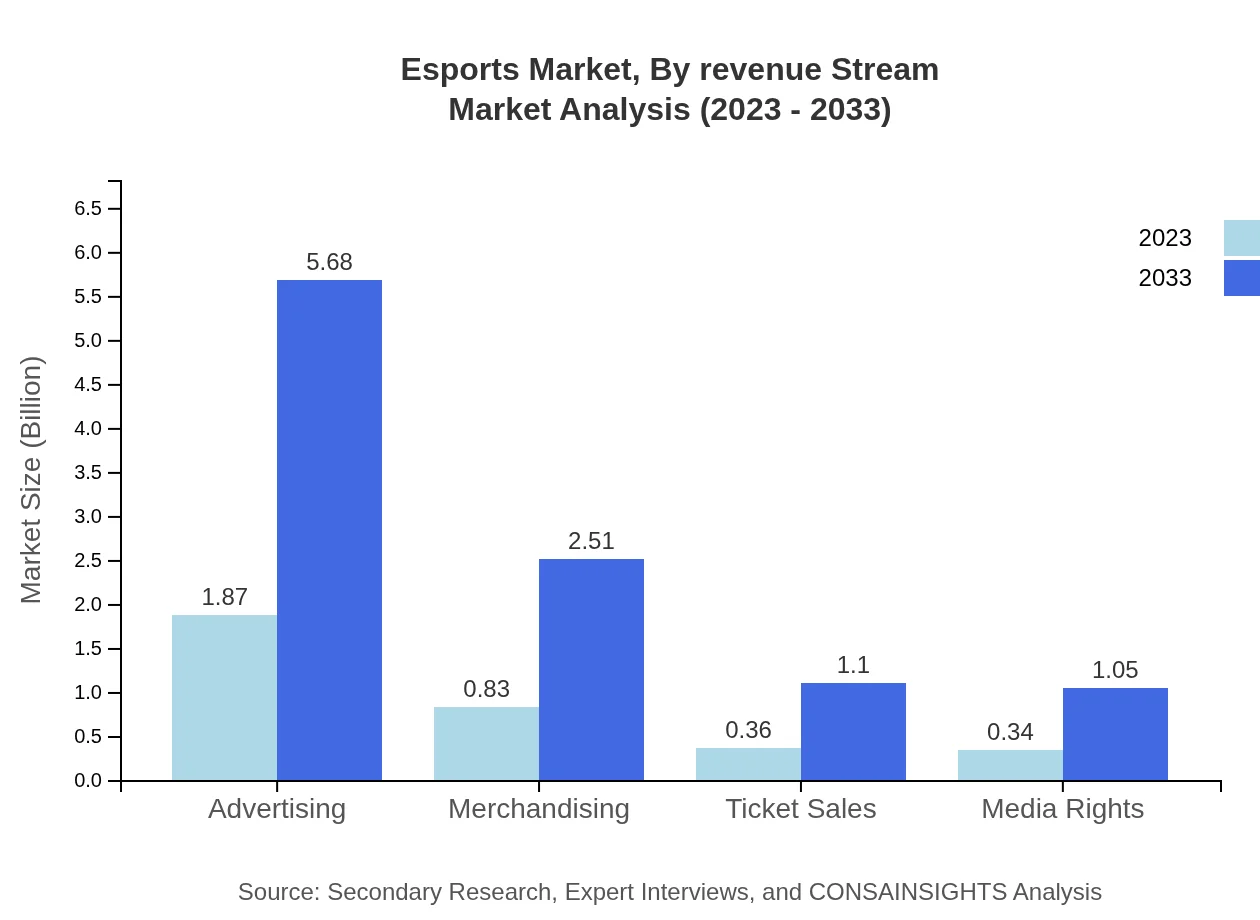

Esports Market Analysis By Revenue Stream

Diverse revenue streams drive the esports market, with advertising being the largest segment at $1.87 billion in 2023, expected to rise to $5.68 billion by 2033. Ticket sales, merchandising, and media rights also contribute significantly, reflecting the multifaceted nature of revenue generation in this industry.

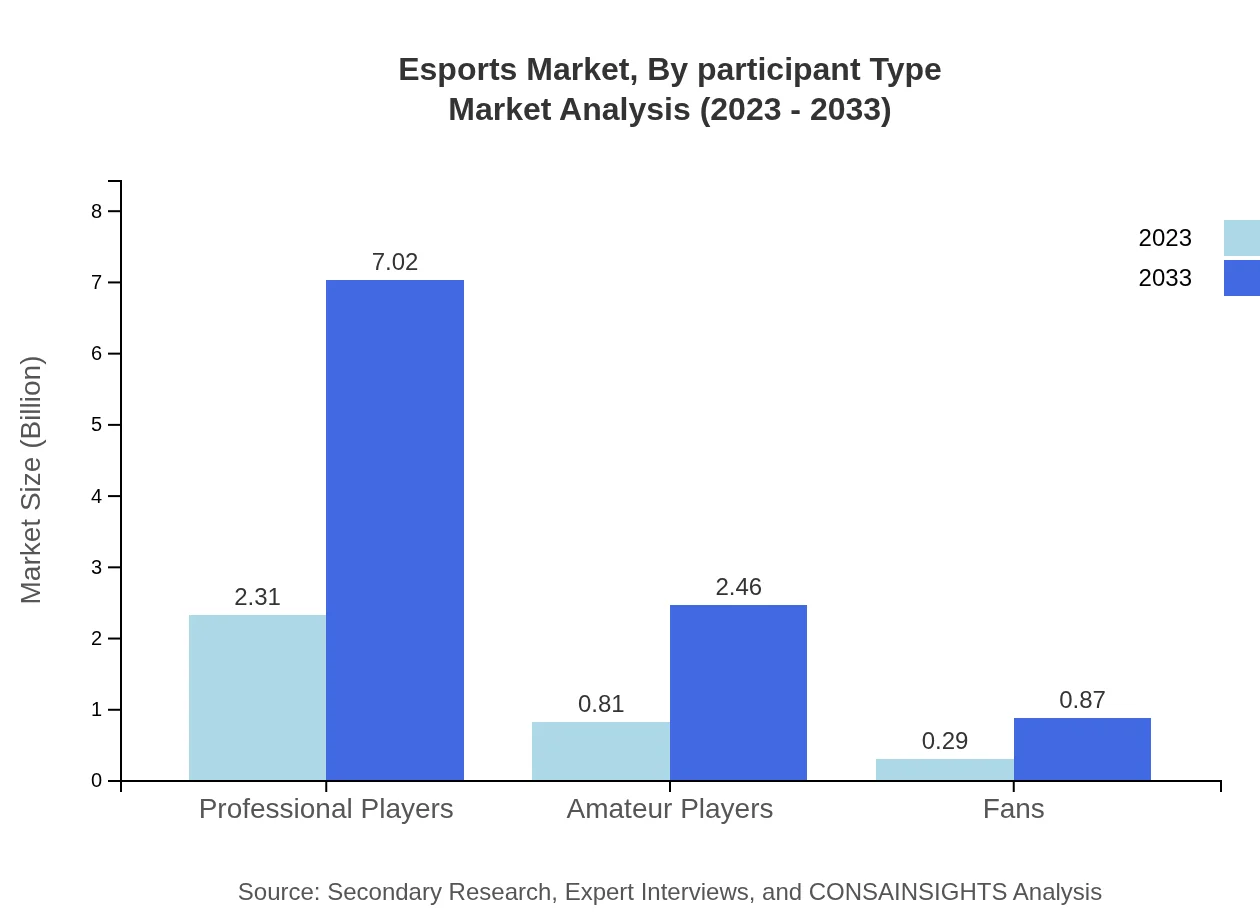

Esports Market Analysis By Participant Type

The market distinguishes between professional players, who dominate the landscape at $2.31 billion in 2023, and amateur players, with a projected market size of $0.81 billion. Over the next decade, the professional players segment is expected to maintain a dominant share due to an increasing number of professional leagues and media coverage.

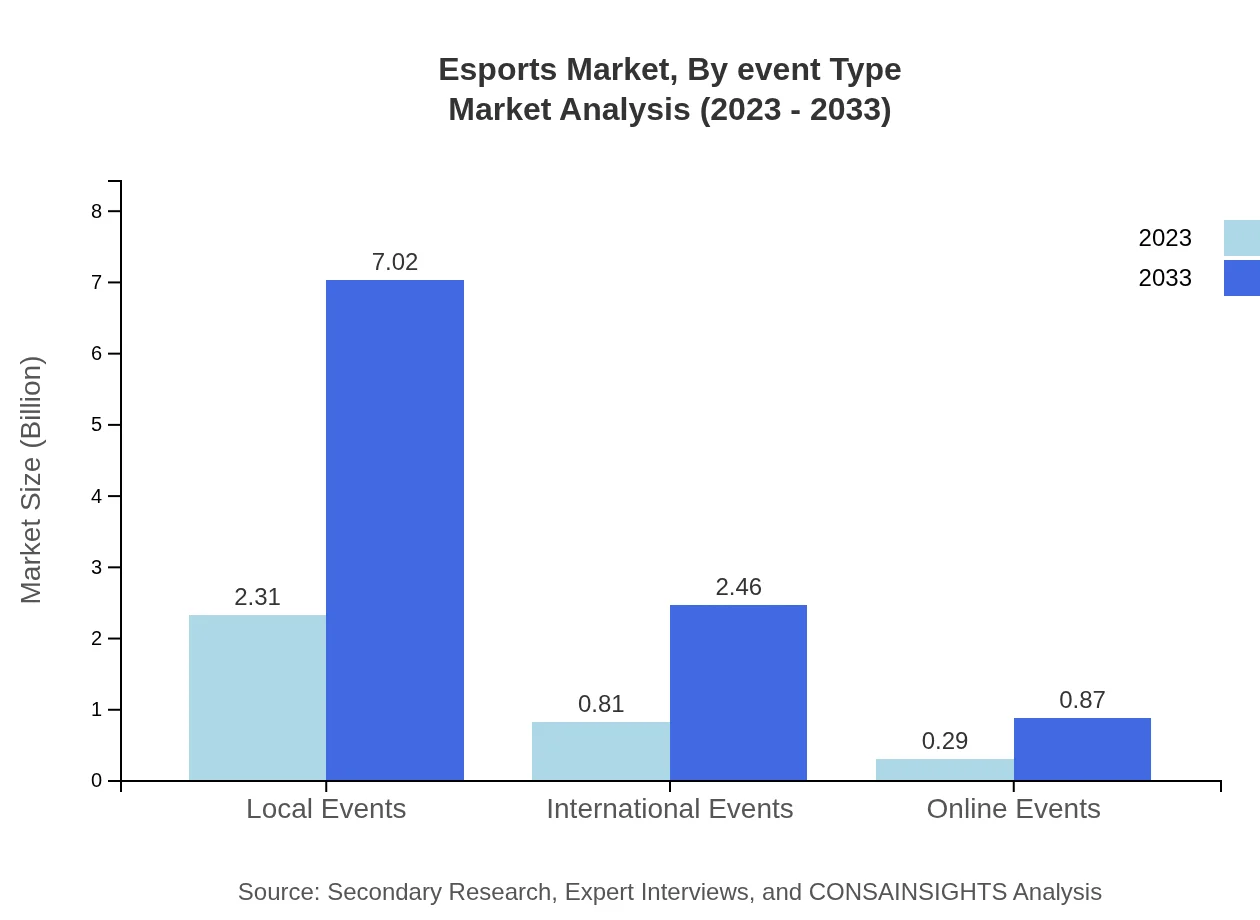

Esports Market Analysis By Event Type

The event segment is diversified into local, international, and online events. Local events account for a large share at $2.31 billion with expectations to grow significantly, supported by grassroots initiatives. International events are also projected to expand from $0.81 billion to $2.46 billion, showcasing the growing global nature of competitive gaming.

Esports Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Esports Industry

Riot Games:

Known for titles like League of Legends, Riot Games has a firm grip on the esports scene and organizes massive global tournaments like the Worlds Championship.Activision Blizzard:

With franchises such as Overwatch and Call of Duty, Activision Blizzard hosts significant esports events and engages millions of viewers through competitive gaming.Valve Corporation:

Creator of Steam and major esports titles like Dota 2 and Counter-Strike: Global Offensive, Valve drives engagement through an active community and extensive tournaments.Epic Games:

The developers of Fortnite have revolutionized the esports landscape with innovative event formats and massive prize pools, attracting global viewership.PUBG Corporation:

As the creator of PlayerUnknown's Battlegrounds (PUBG), this company plays a hard-hitting role in the battle royale sector of esports, running competitions worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of esports?

The global esports market is projected to reach a size of $3.4 billion by 2033, growing at a impressive CAGR of 11.3% from 2023.

What are the key market players or companies in the esports industry?

Key players in the esports industry include major game developers, streaming platforms, and tournament organizers, with influential companies such as Riot Games, Blizzard Entertainment, and Twitch shaping the market landscape.

What are the primary factors driving the growth in the esports industry?

Major growth drivers for the esports industry include increased mobile game accessibility, the rise of streaming platforms, and a growing global audience desiring immersive entertainment experiences combined with competitive gaming.

Which region is the fastest Growing in the esports market?

The Asia Pacific region is the fastest-growing esports market, projected to grow from $0.73 billion in 2023 to $2.21 billion by 2033, reflecting a rising gaming culture and investment in esports infrastructure.

Does ConsaInsights provide customized market report data for the esports industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the esports industry, allowing stakeholders to access relevant trends, forecasts, and market insights.

What deliverables can I expect from this esports market research project?

From this esports market research project, expect comprehensive reports including market size, growth forecasts, competitive analysis, regional insights, and segment data across different gaming platforms and audience demographics.

What are the market trends of esports?

Market trends in esports include a shift towards mobile gaming, increasing sponsorship deals, growing online viewership, and an expansion of esports events and tournaments, enhancing overall market engagement.