Esso Market Report

Published Date: 31 January 2026 | Report Code: esso

Esso Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Esso market, detailing current trends, market size, segmentation, regional insights, and projected growth from 2023 to 2033. It aims to equip stakeholders with essential data and forecasts for informed decision-making.

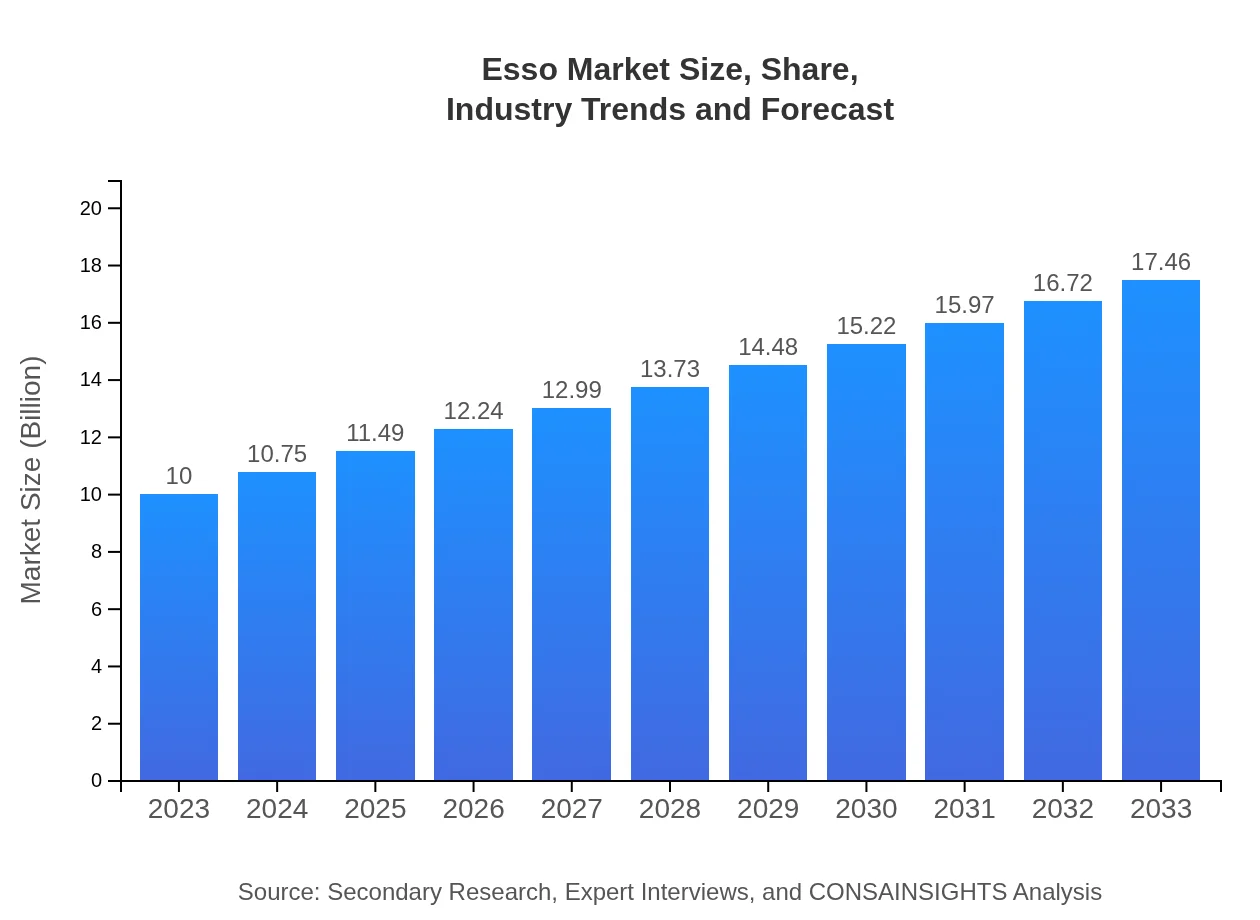

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $17.46 Billion |

| Top Companies | ExxonMobil, BP (British Petroleum), Royal Dutch Shell, Chevron |

| Last Modified Date | 31 January 2026 |

Esso Market Overview

Customize Esso Market Report market research report

- ✔ Get in-depth analysis of Esso market size, growth, and forecasts.

- ✔ Understand Esso's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Esso

What is the Market Size & CAGR of Esso market in 2023?

Esso Industry Analysis

Esso Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Esso Market Analysis Report by Region

Europe Esso Market Report:

Europe’s market is anticipated to grow from $3.26 billion in 2023 to $5.69 billion in 2033. European nations are increasingly moving towards renewable energies, resulting in a shift in the energy landscape that emphasizes biofuels.Asia Pacific Esso Market Report:

The Asia Pacific region is forecasted to grow from $1.53 billion in 2023 to $2.67 billion by 2033, driven by burgeoning transportation and industrial sectors. Growing urbanization and rising disposable income in countries like India and China are key growth factors.North America Esso Market Report:

North America represents one of the largest markets for Esso, expected to expand from $3.72 billion in 2023 to $6.50 billion by 2033. The US's vast oil and gas infrastructure combined with a shift towards diversified energy sources supports this growth.South America Esso Market Report:

In South America, the market is projected to increase from $0.53 billion in 2023 to $0.92 billion by 2033. Brazil remains a pivotal market, with efforts to enhance biofuel production in response to sustainability goals boosting demand.Middle East & Africa Esso Market Report:

In the Middle East and Africa, the market is expected to rise from $0.97 billion in 2023 to $1.69 billion by 2033. The region's oil reserves provide a foundation for growth, alongside increasing investments in refining technologies.Tell us your focus area and get a customized research report.

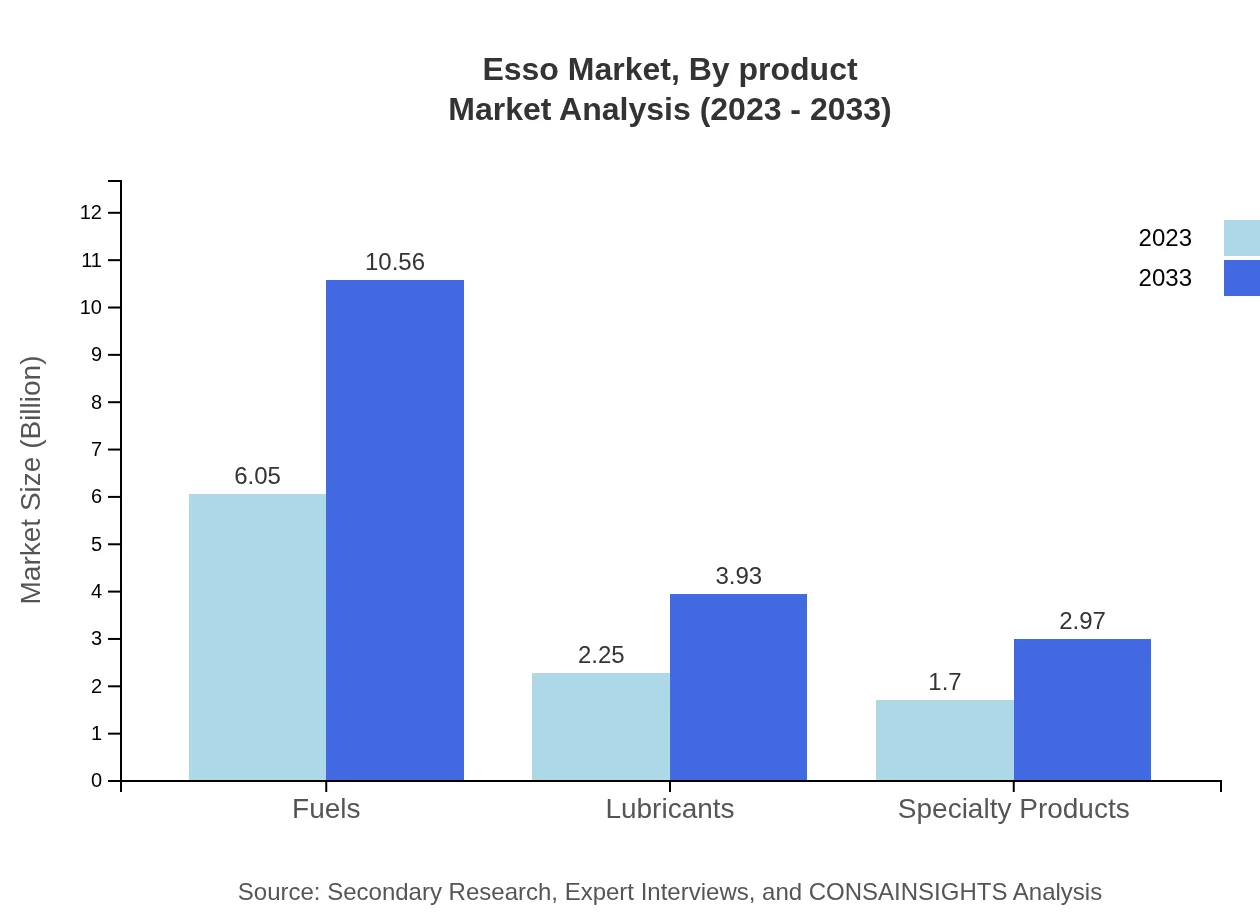

Esso Market Analysis By Product

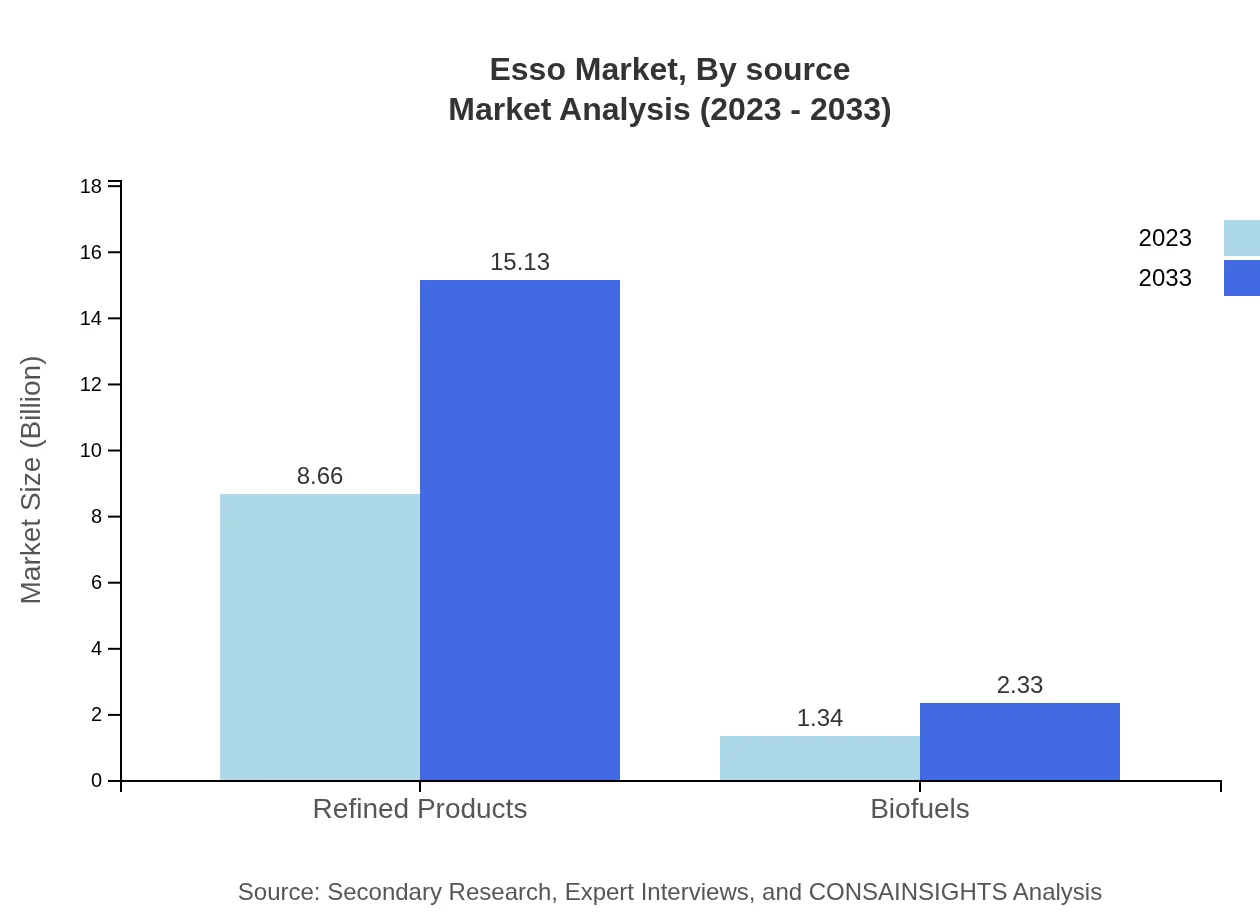

Refined products represent the largest segment of the Esso market, expected to grow from $8.66 billion in 2023 to $15.13 billion by 2033, accounting for 86.63% market share throughout this period. This segment primarily includes fuels such as gasoline, diesel, kerosene, and jet fuels, which continue to be in demand despite a gradual shift to greener alternatives.

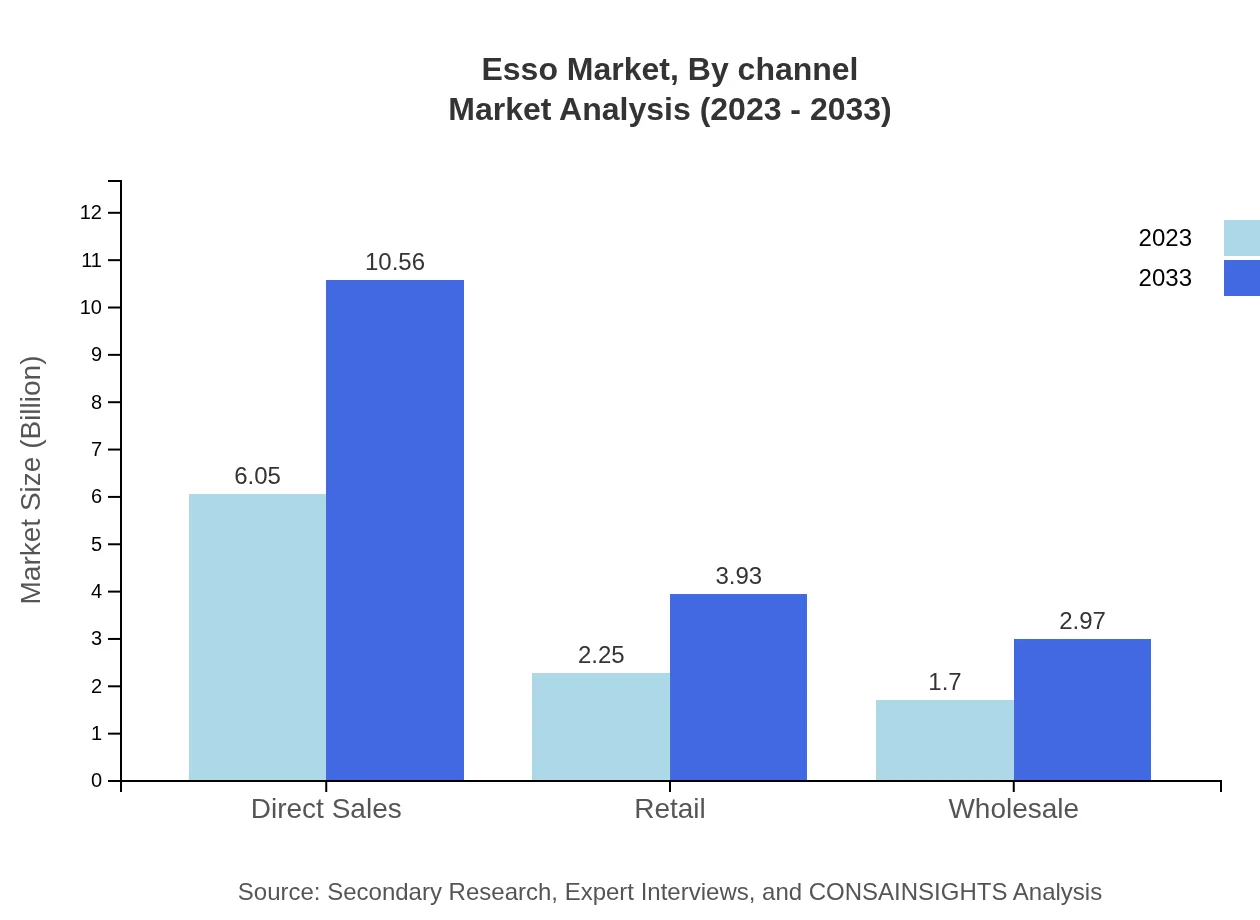

Esso Market Analysis By Channel

Direct sales currently dominate the market, representing a $6.05 billion share in 2023, with expectations to reach $10.56 billion by 2033 (60.47% share). Retail distribution channels will also witness growth due to increased consumer engagement and demand in urban areas.

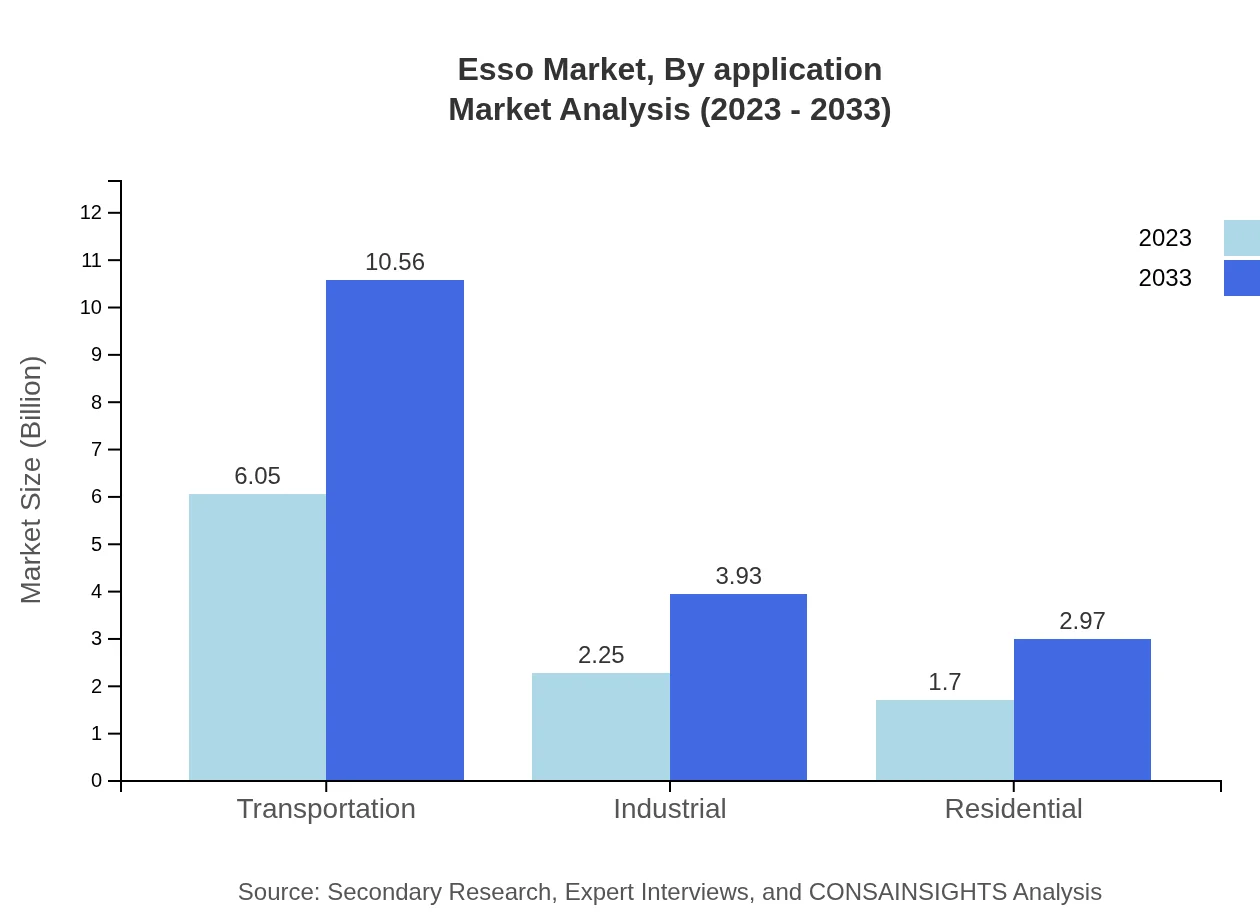

Esso Market Analysis By Application

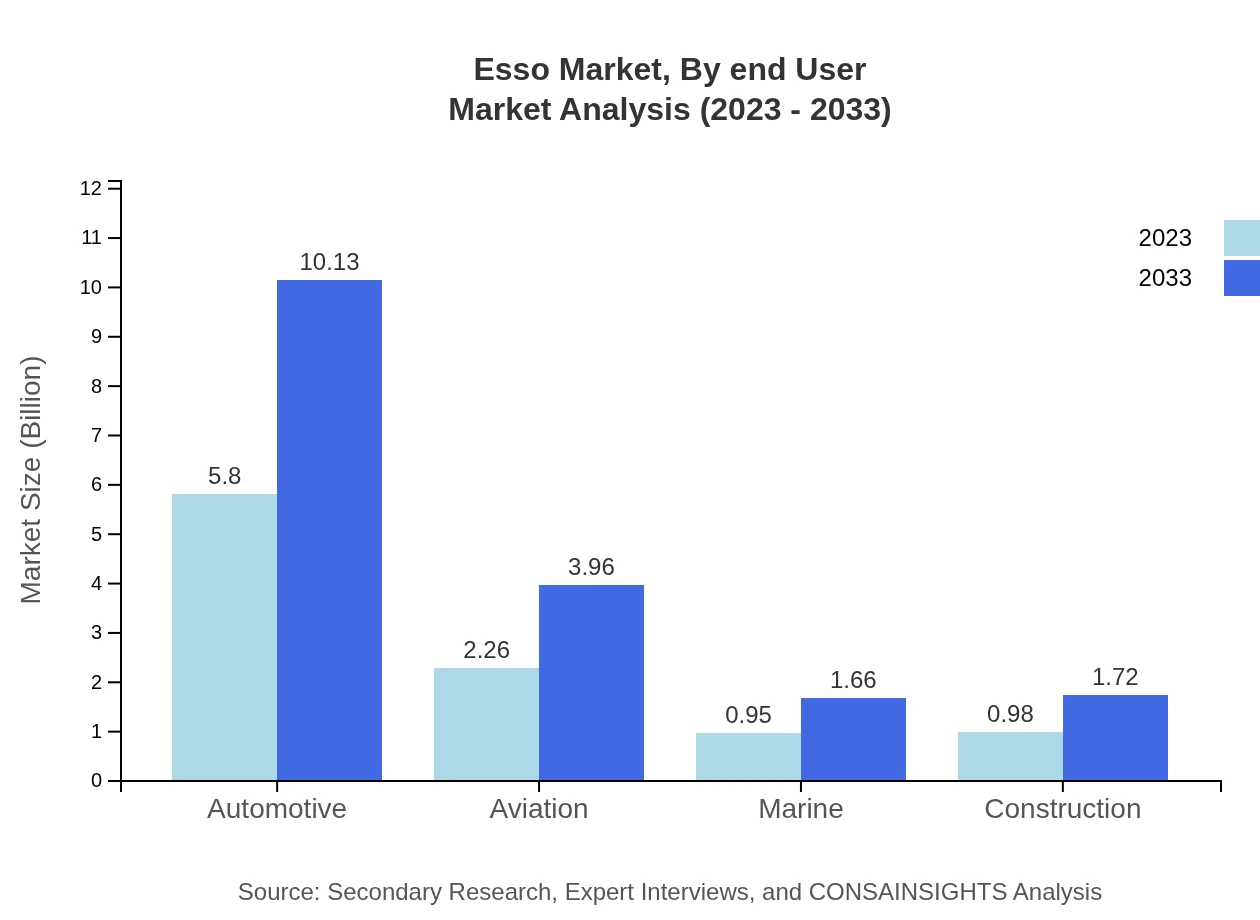

The automotive sector is the leading application segment, anticipated to rise from $5.80 billion in 2023 to $10.13 billion by 2033. Other critical applications include aviation and marine, which contribute substantially to overall market growth.

Esso Market Analysis By End User

Transportation maintains a dominant position in the Esso market, expected to constitute $6.05 billion in 2023 and grow to $10.56 billion by 2033. Other end-users encompass construction, industrial, and residential sectors, which are gradually adopting fuels with lower environmental impact.

Esso Market Analysis By Source

The sourcing of petroleum products continues to evolve, focusing on traditional oil extraction alongside budding investments in biofuels, which are expected to rise significantly over the next decade due to policy mandates and consumer preferences.

Esso Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Esso Industry

ExxonMobil:

The parent company of Esso, ExxonMobil is one of the world's largest publicly traded oil and gas companies, renowned for its extensive operations across the oil and gas value chain, including exploration, refining, and marketing.BP (British Petroleum):

A competitor in the market, BP is a multinational oil company with a commitment to diversifying energy sources and transitioning to more sustainable energy solutions, impacting market dynamics significantly.Royal Dutch Shell:

Shell is another key industry player, recognized for its integrated business model that includes upstream, downstream, and renewable segments, providing comprehensive energy solutions globally.Chevron:

Chevron operates across every aspect of the energy sector, focusing on developing advanced technologies for fossil fuel extraction and exploring sustainable energy alternatives, positioning itself as a market leader.We're grateful to work with incredible clients.

FAQs

What is the market size of Esso?

The Esso market is valued at approximately $10 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 5.6%. This growth reflects significant demand across various segments and regions, highlighting Esso's strong market presence.

What are the key market players or companies in the Esso industry?

Key players in the Esso industry include major oil and gas corporations such as ExxonMobil, Chevron, BP, and Shell. They dominate the market with their extensive network and diverse product offerings, contributing to competitive dynamics in the industry.

What are the primary factors driving the growth in the Esso industry?

Growth in the Esso industry is driven by rising global energy demand, technological advancements in extraction and refining processes, and an increasing emphasis on energy diversification. Additionally, sustainability trends are influencing investments in biofuels and alternative energy sources.

Which region is the fastest Growing in the Esso market?

In the Esso market, North America is the fastest-growing region, projected to reach approximately $6.50 billion by 2033, up from $3.72 billion in 2023. Other regions like Europe and Asia Pacific also show significant growth, driven by increasing fuel demands.

Does ConsaInsights provide customized market report data for the Esso industry?

Yes, ConsaInsights offers customized market report data tailored to client-specific needs in the Esso industry. Clients can obtain detailed insights based on market segments, regions, and other critical parameters to support strategic decision-making.

What deliverables can I expect from this Esso market research project?

From this Esso market research project, clients can expect comprehensive deliverables including detailed market analysis reports, segmentation data, regional overviews, trends analysis, and competitor insights to inform business strategies effectively.

What are the market trends of Esso?

Current market trends in the Esso industry include a shift towards cleaner energy solutions with a notable increase in biofuels, technological advancements in fuel production, and a growing emphasis on sustainability practices across all market segments.