Ethernet Over Coax Equipment And Subscribers Market Report

Published Date: 31 January 2026 | Report Code: ethernet-over-coax-equipment-and-subscribers

Ethernet Over Coax Equipment And Subscribers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Ethernet Over Coax Equipment and Subscribers market, covering key insights into market trends, size forecasts, and analysis by technology and region for the period 2023 to 2033.

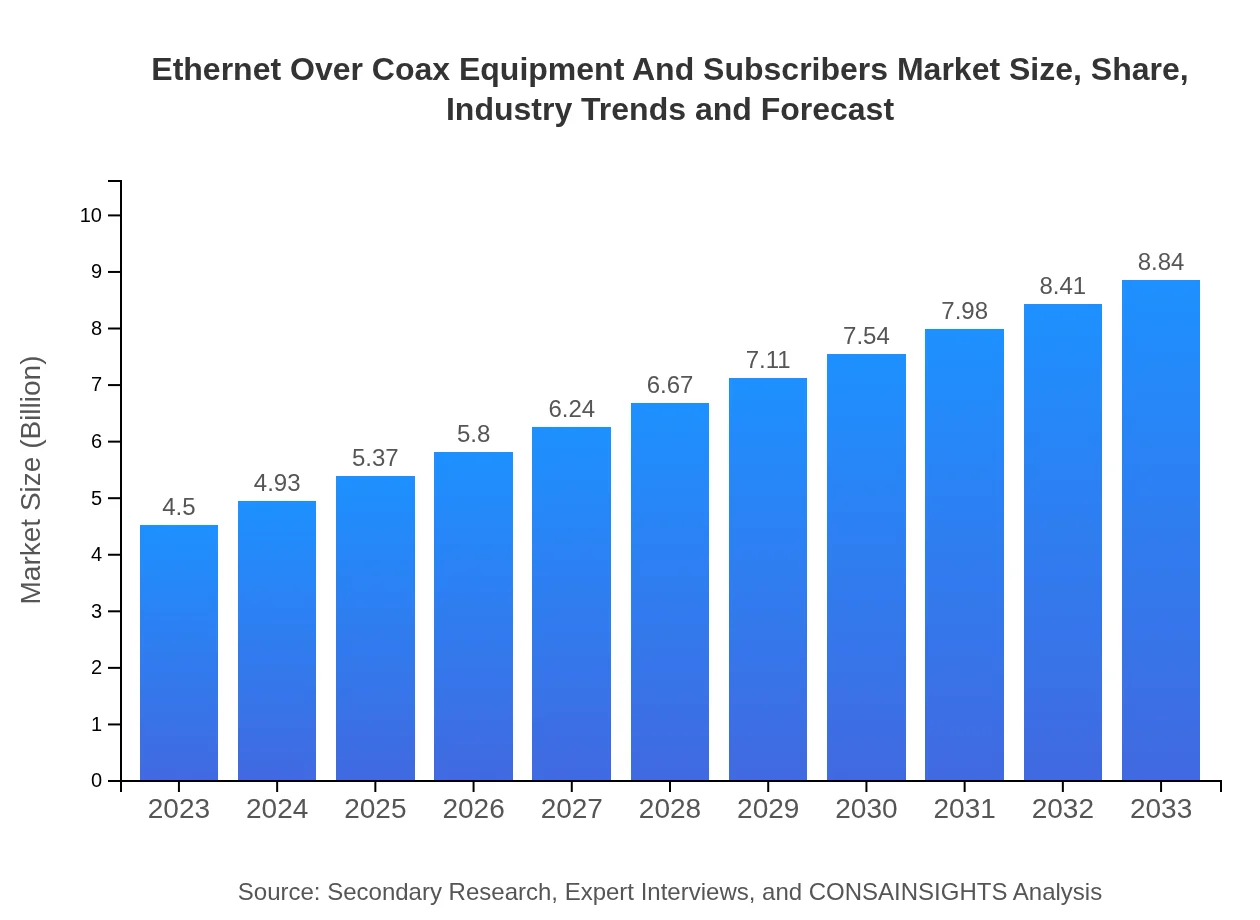

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $8.84 Billion |

| Top Companies | ARRIS International, Netgear, Inc., Cisco Systems, Inc., TP-Link Technologies Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Ethernet Over Coax Equipment And Subscribers Market Overview

Customize Ethernet Over Coax Equipment And Subscribers Market Report market research report

- ✔ Get in-depth analysis of Ethernet Over Coax Equipment And Subscribers market size, growth, and forecasts.

- ✔ Understand Ethernet Over Coax Equipment And Subscribers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ethernet Over Coax Equipment And Subscribers

What is the Market Size & CAGR of Ethernet Over Coax Equipment And Subscribers market?

Ethernet Over Coax Equipment And Subscribers Industry Analysis

Ethernet Over Coax Equipment And Subscribers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ethernet Over Coax Equipment And Subscribers Market Analysis Report by Region

Europe Ethernet Over Coax Equipment And Subscribers Market Report:

The European market is also on a growth trajectory, expected to grow from $1.10 billion in 2023 to $2.15 billion by 2033. This growth is enhanced by regulatory support for broadband rollouts and increased demand for high-speed internet in urban areas.Asia Pacific Ethernet Over Coax Equipment And Subscribers Market Report:

In the Asia Pacific region, the market is expected to grow from $0.96 billion in 2023 to approximately $1.89 billion by 2033, driven by the rapid digitalization of economies and the push for higher bandwidth solutions.North America Ethernet Over Coax Equipment And Subscribers Market Report:

North America leads the market with a projected growth from $1.52 billion in 2023 to $2.99 billion by 2033, propelled by high adoption rates of broadband and competitive pricing strategies by telecom operators.South America Ethernet Over Coax Equipment And Subscribers Market Report:

South America shows considerable potential, with the market anticipated to rise from $0.31 billion in 2023 to $0.61 billion by 2033. This growth is attributed to increasing connectivity needs as internet service providers expand their offerings.Middle East & Africa Ethernet Over Coax Equipment And Subscribers Market Report:

The Middle East and Africa region is projected to expand from $0.61 billion in 2023 to $1.20 billion by 2033, spurred by increasing investment in telecommunications infrastructure and a growing population of internet users.Tell us your focus area and get a customized research report.

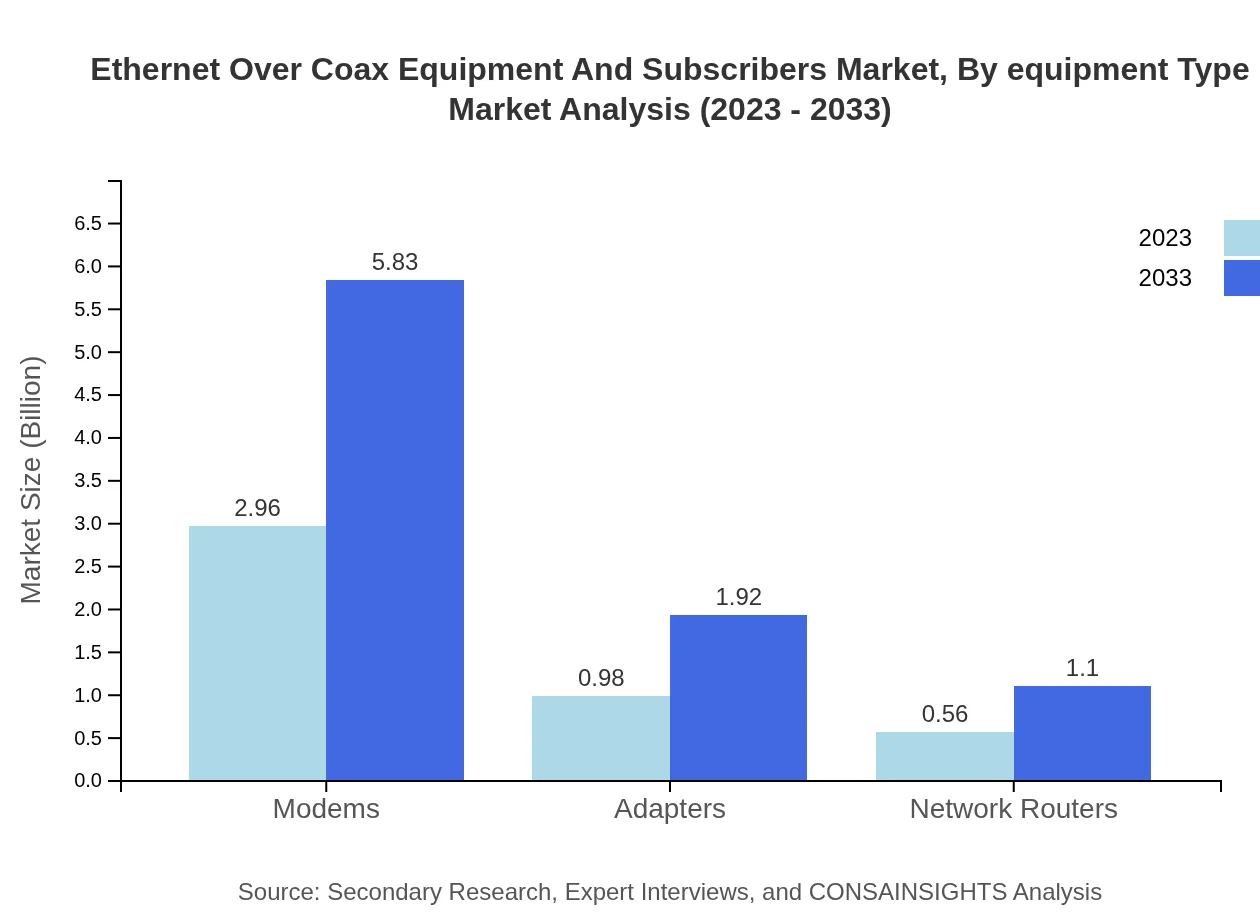

Ethernet Over Coax Equipment And Subscribers Market Analysis By Equipment Type

The primary products within Ethernet-over-Coax Equipment include modems, adapters, and network routers. In 2023, modems hold the majority market share at approximately 65.87%, and they are expected to continue leading through 2033. The steady growth of adapters and routers, currently at 21.72% and 12.41% market shares respectively, reflects the increasing demand for efficient internet connectivity solutions in homes and enterprises.

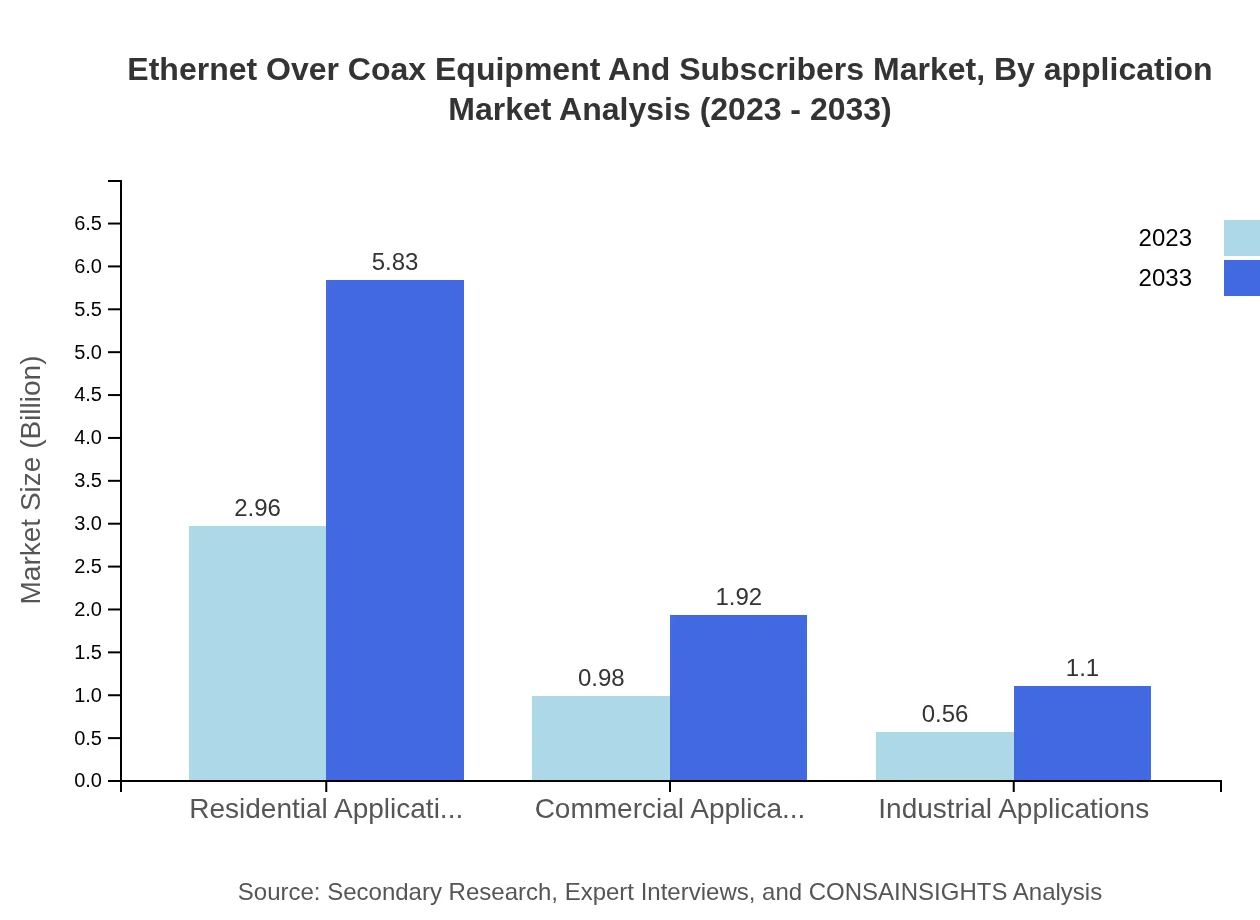

Ethernet Over Coax Equipment And Subscribers Market Analysis By Application

Residential applications dominate the Ethernet-over-Coax Subscribers market, accounting for about 65.87% of the overall market share in 2023, with a projected growth to 65.87% by 2033 as the demand for broadband services in households continues to rise. Commercial applications also show growth potential, expected to maintain a share of 21.72% throughout the decade.

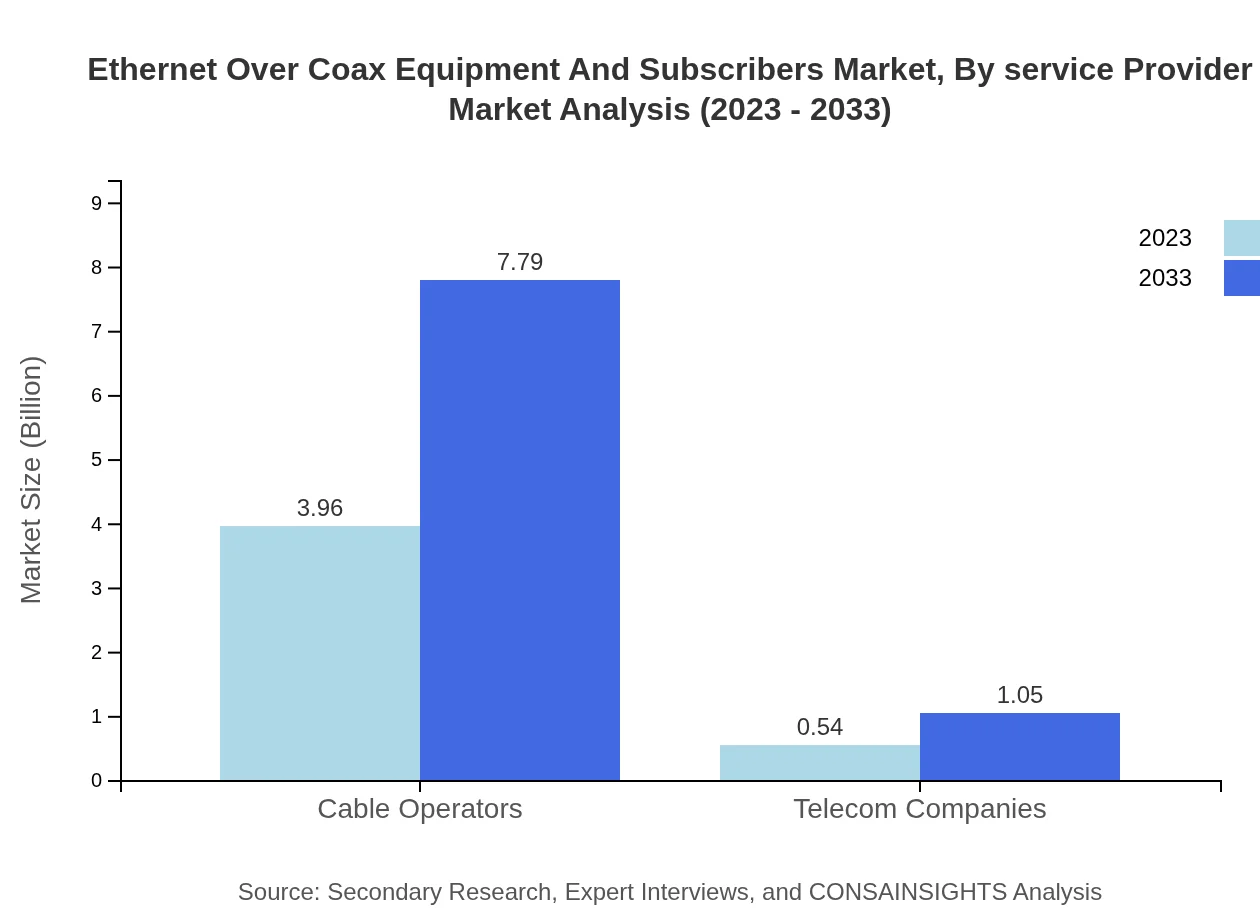

Ethernet Over Coax Equipment And Subscribers Market Analysis By Service Provider

The service provider segment is crucial, with cable operators controlling about 88.08% of the market in 2023, expected to remain stable through 2033. Telecom companies also play a role, currently constituting 11.92% of the market share, reflecting a growing trend where hybrid solutions are being adopted by consumers.

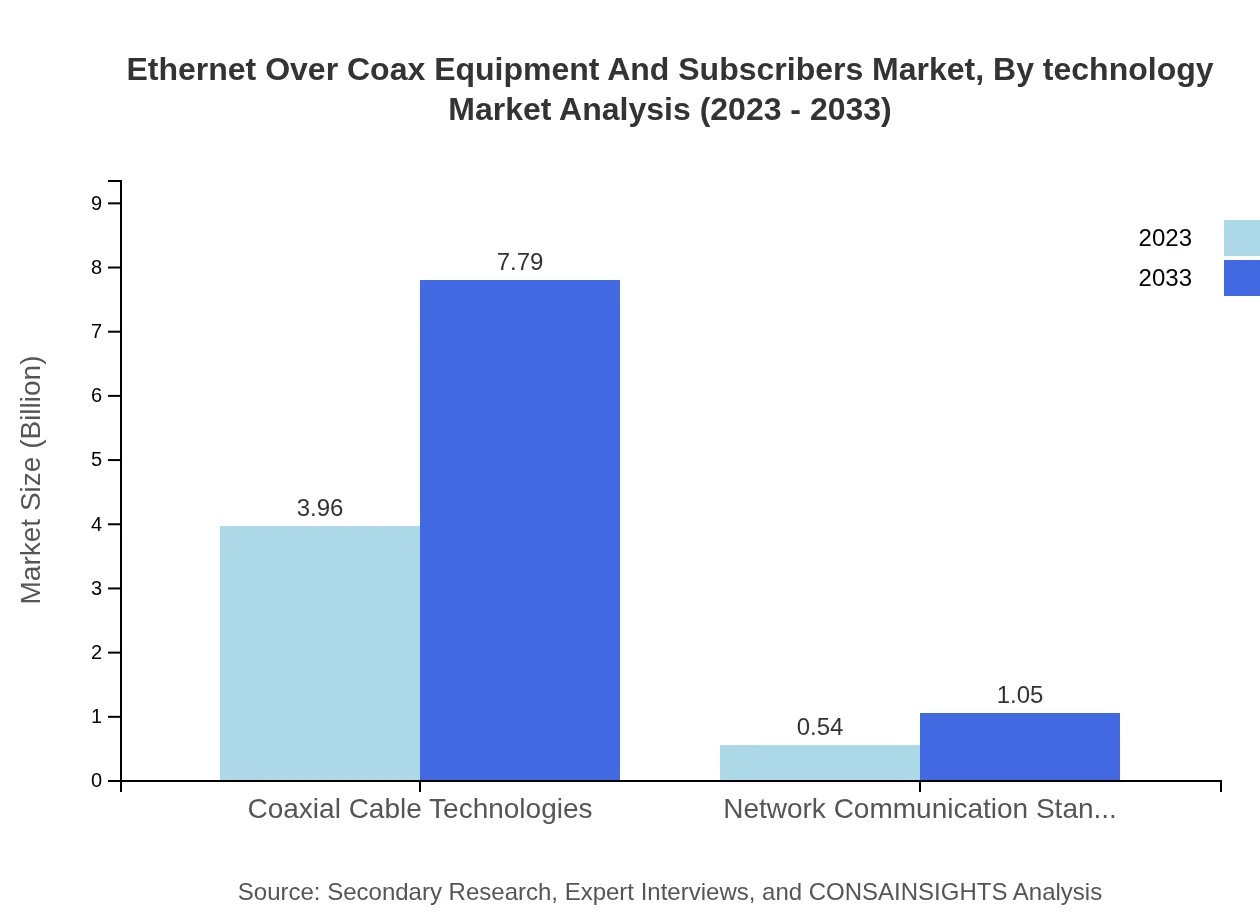

Ethernet Over Coax Equipment And Subscribers Market Analysis By Technology

The core technologies supporting Ethernet-over-Coax equipment include Coaxial Cable Technologies, which dominate the market with an 88.08% share in 2023, projected to grow steadily alongside advancements. Network communication standards currently represent 11.92% of the market, showcasing the importance of adhering to industry standards for service reliability.

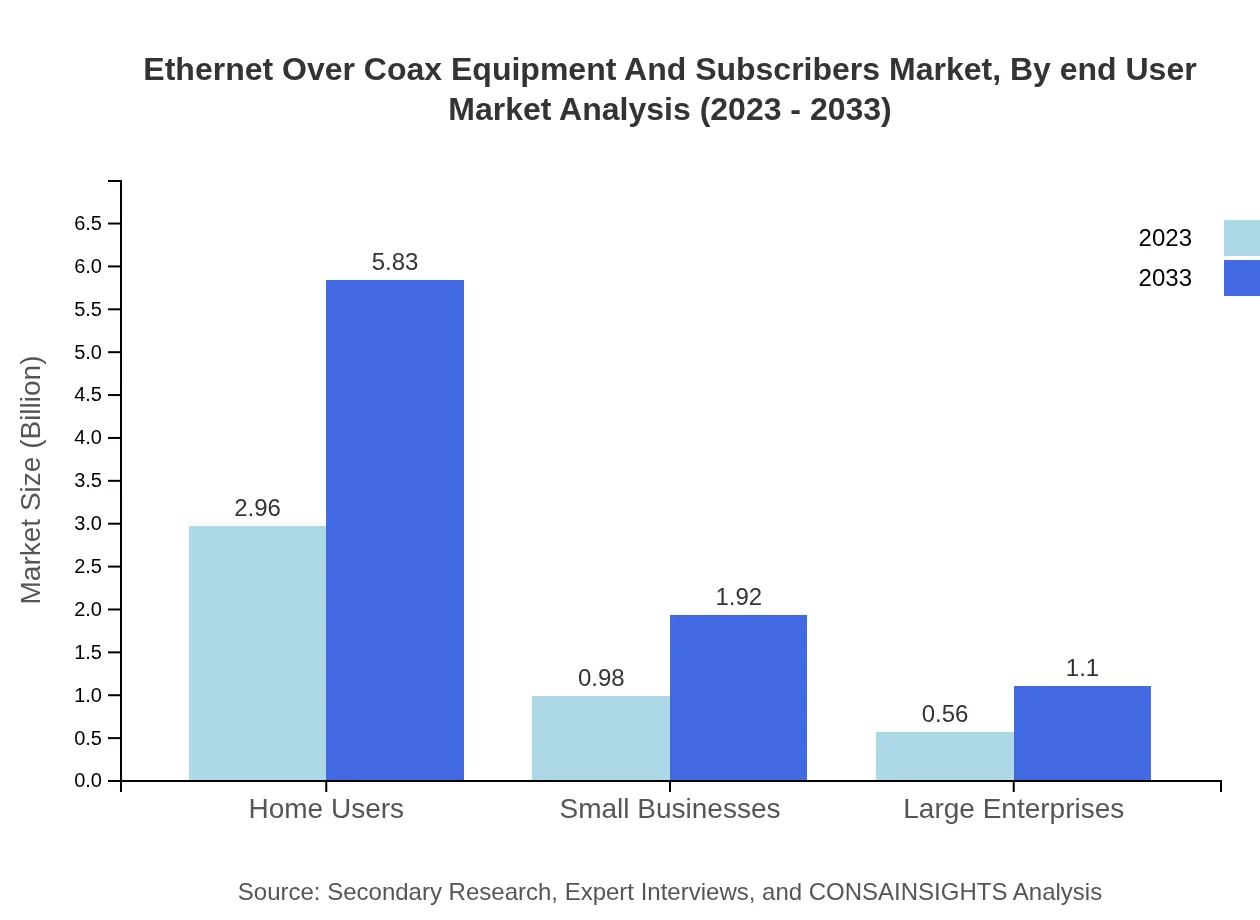

Ethernet Over Coax Equipment And Subscribers Market Analysis By End User

The end-user segment is beneficial, with home users representing a significant share of 65.87% in 2023, demonstrating a dominance that is expected to continue. Small businesses and large enterprises hold respective shares of 21.72% and 12.41%, reflecting the growing emphasis on high-speed internet for business operations.

Ethernet Over Coax Equipment And Subscribers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ethernet Over Coax Equipment And Subscribers Industry

ARRIS International:

ARRIS is a leading provider of technology solutions for the telecommunications industry, specializing in broadband access and connectivity solutions.Netgear, Inc.:

Netgear focuses on innovative networking products and solutions that cater to both home and small business users, enhancing their internet experiences.Cisco Systems, Inc.:

Cisco is known for advanced networking and communication technologies, providing critical infrastructure for Ethernet-over-Coax applications.TP-Link Technologies Co., Ltd.:

TP-Link manufactures a range of networking products, including Ethernet over Coax solutions that link consumers to the internet efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of ethernet Over Coax Equipment And Subscribers?

The ethernet-over-coax equipment and subscribers market is valued at approximately $4.5 billion in 2023, with a projected CAGR of 6.8%. This suggests a growing demand and expansion until 2033, indicating a healthy market trajectory.

What are the key market players or companies in this ethernet Over Coax Equipment And Subscribers industry?

Key players in the ethernet-over-coax market include prominent providers in telecommunications and broadband technology. Companies like Cisco, ARRIS, and Technicolor are instrumental in driving innovations and maintaining competitive advantages in this sector.

What are the primary factors driving the growth in the ethernet Over Coax Industry?

The growth in this industry is driven by increasing demand for high-speed internet, expansion of smart homes, advancements in coaxial technology, and the need for cost-effective communication solutions among consumers and businesses.

Which region is the fastest Growing in the ethernet Over Coax market?

The fastest-growing region for the ethernet-over-coax market is expected to be Europe, with market size scaling from $1.10 billion in 2023 to $2.15 billion by 2033, reflecting significant growth potential in the next decade.

Does ConsaInsights provide customized market report data for the ethernet Over Coax industry?

Yes, ConsaInsights offers customized market report data tailored for the ethernet-over-coax industry, allowing clients to gain specific insights according to their unique business needs and market inquiries.

What deliverables can I expect from this ethernet Over Coax market research project?

From the ethernet-over-coax market research project, clients can expect detailed reports including market analysis, segment insights, competitive landscape, growth projections, and customized strategic recommendations for better decision-making.

What are the market trends of ethernet Over Coax?

Current market trends include increasing adoption of coaxial-based broadband technologies, growth in residential applications, and a focus on introducing innovative networking solutions, highlighting the sector's evolution in response to consumer demands.