Ev Battery Market Report

Published Date: 02 February 2026 | Report Code: ev-battery

Ev Battery Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the electric vehicle (EV) battery market, covering pivotal insights into market size, growth rates, key players, and technological advancements from 2023 to 2033.

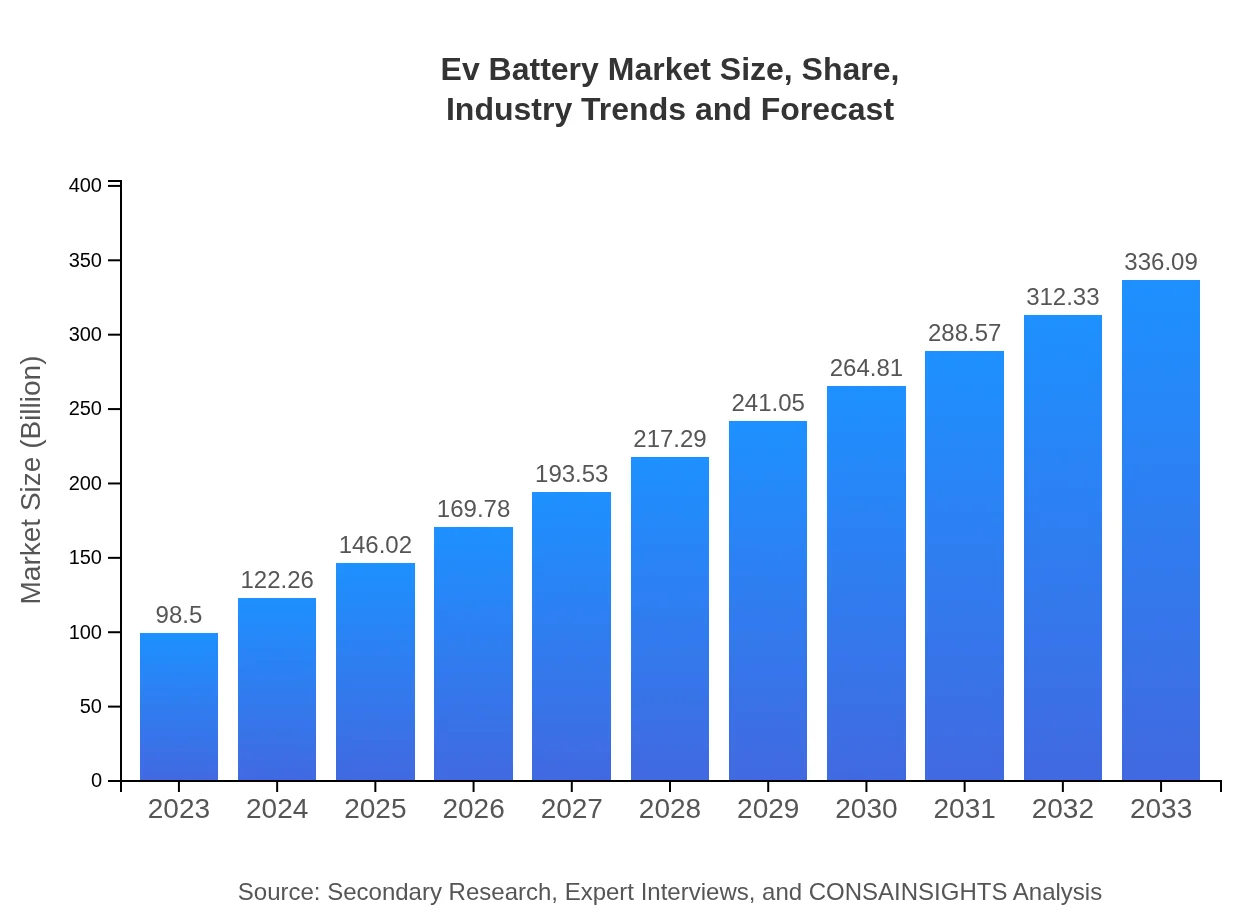

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $98.50 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $336.09 Billion |

| Top Companies | Tesla, Inc., LG Chem Ltd., Panasonic Corporation, Samsung SDI, Contemporary Amperex Technology Co. (CATL) |

| Last Modified Date | 02 February 2026 |

Ev Battery Market Overview

Customize Ev Battery Market Report market research report

- ✔ Get in-depth analysis of Ev Battery market size, growth, and forecasts.

- ✔ Understand Ev Battery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ev Battery

What is the Market Size & CAGR of Ev Battery market in 2023 and 2033?

Ev Battery Industry Analysis

Ev Battery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ev Battery Market Analysis Report by Region

Europe Ev Battery Market Report:

Europe's market size is 27.85 billion USD in 2023, anticipated to soar to 95.01 billion USD by 2033. The strict regulatory environment and aggressive emissions targets are propelling investments in EV and battery technology.Asia Pacific Ev Battery Market Report:

In 2023, the Asia Pacific region holds a market size of 18.97 billion USD and is anticipated to reach 64.73 billion USD by 2033. The region benefits from a robust manufacturing base and is home to leading battery manufacturers. Governments' initiatives to promote electric vehicles are spurring growth.North America Ev Battery Market Report:

In North America, the market starts at 36.48 billion USD in 2023 and is expected to reach 124.49 billion USD by 2033. The United States is a key player, with strong demand driven by technological advancements and substantial government incentives.South America Ev Battery Market Report:

The South American market for EV batteries in 2023 is estimated at 4.74 billion USD, projected to grow to 16.17 billion USD by 2033. Brazil and Argentina are leading the charge, catalyzed by increasing investments in renewable energy.Middle East & Africa Ev Battery Market Report:

The Middle East and Africa market is valued at 10.46 billion USD in 2023, with projections reaching 35.69 billion USD by 2033. Growing urbanization and government initiatives to diversify economies away from oil dependence are key factors.Tell us your focus area and get a customized research report.

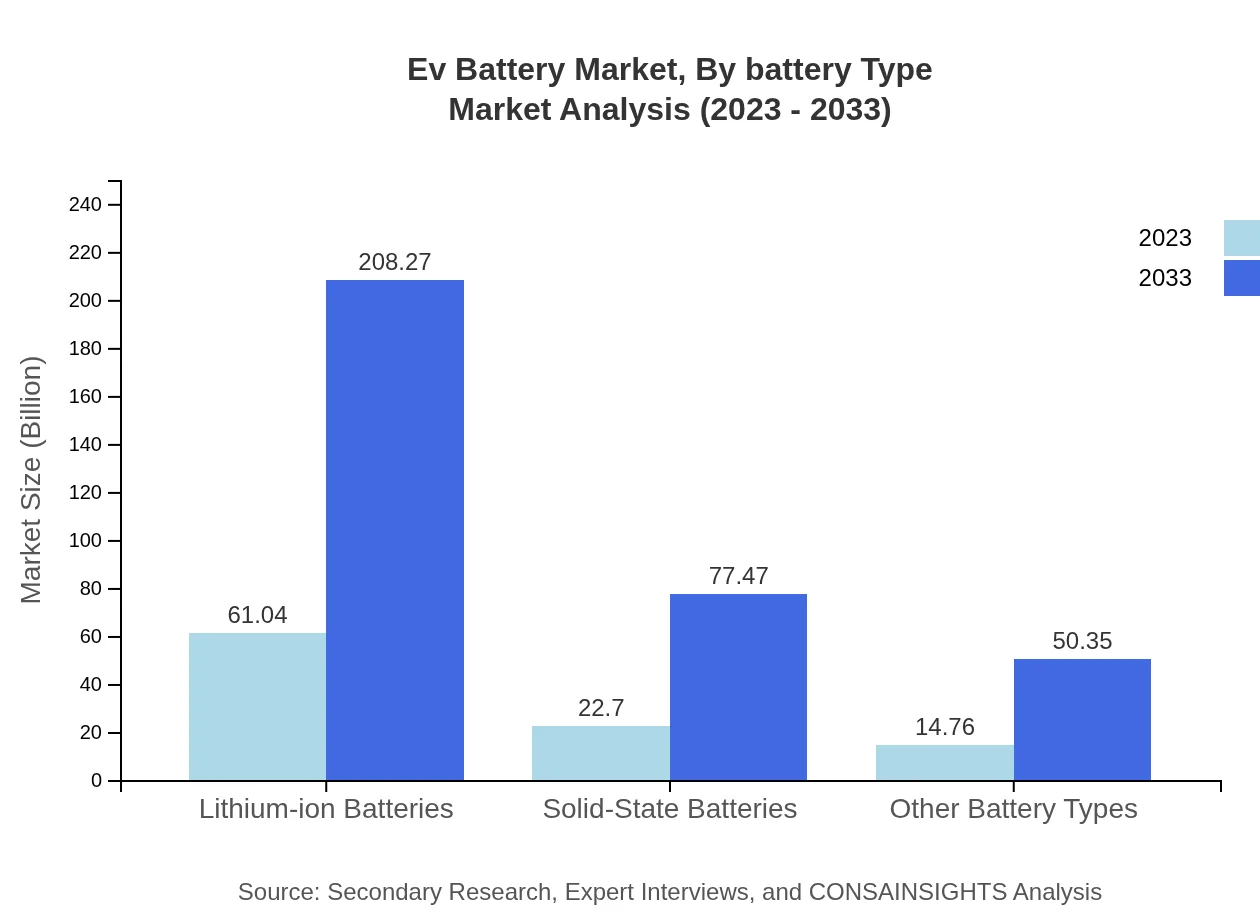

Ev Battery Market Analysis By Battery Type

The market is significantly dominated by lithium-ion batteries, which command a notable market size of 61.04 billion USD in 2023, expected to rise to 208.27 billion USD by 2033. Solid-state batteries are emerging, currently at 22.70 billion USD and projected to reach 77.47 billion USD. The Nickel Manganese Cobalt (NMC) type also plays a vital role, with a size of 53.10 billion USD and reaching 181.18 billion USD by 2033.

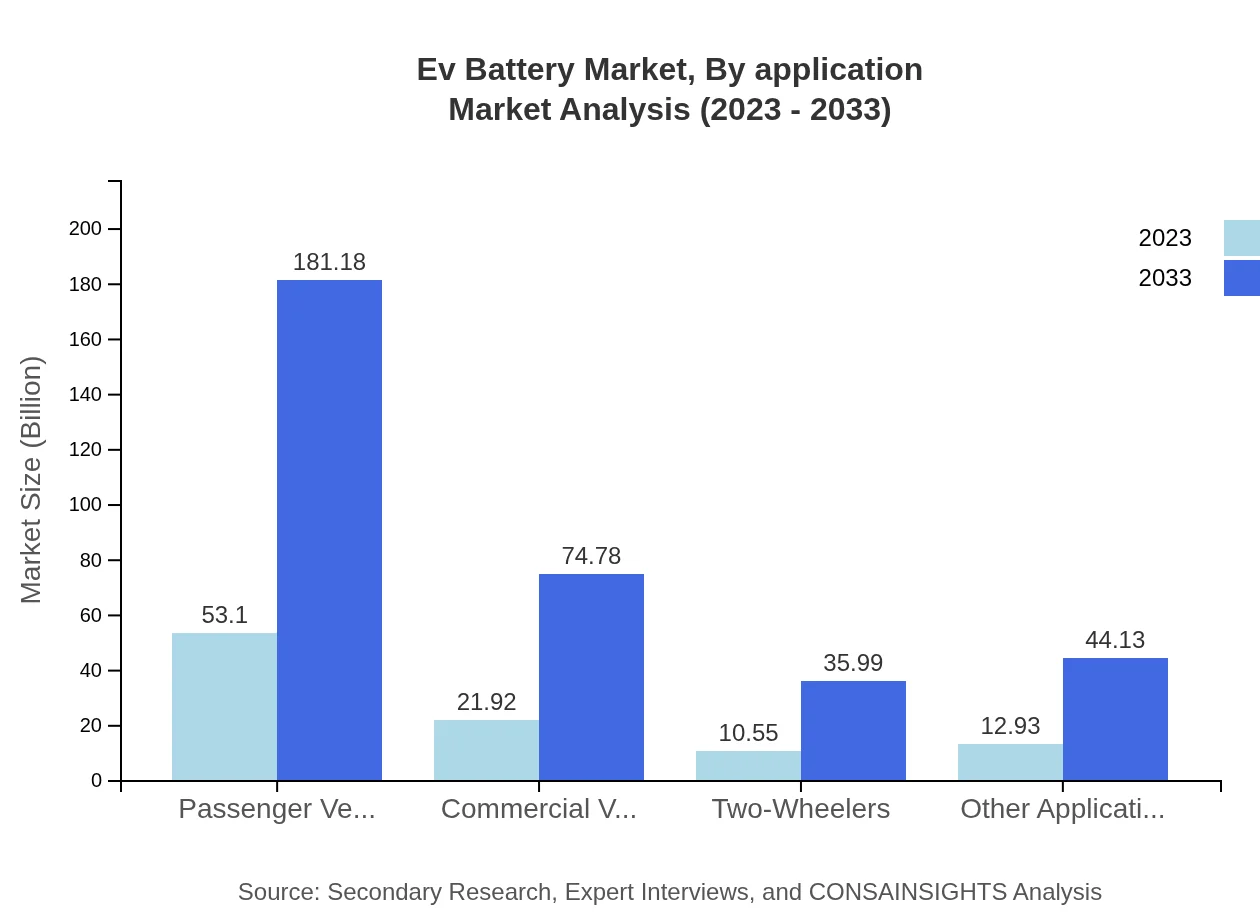

Ev Battery Market Analysis By Application

The passenger vehicles segment is the largest contributor to the market, with a size of 53.10 billion USD in 2023 and projecting to rise to 181.18 billion USD by 2033. Commercial vehicles follow, starting at 21.92 billion USD and expected to grow to 74.78 billion USD, while two-wheelers are also gaining traction due to their increasing adoption in urban areas.

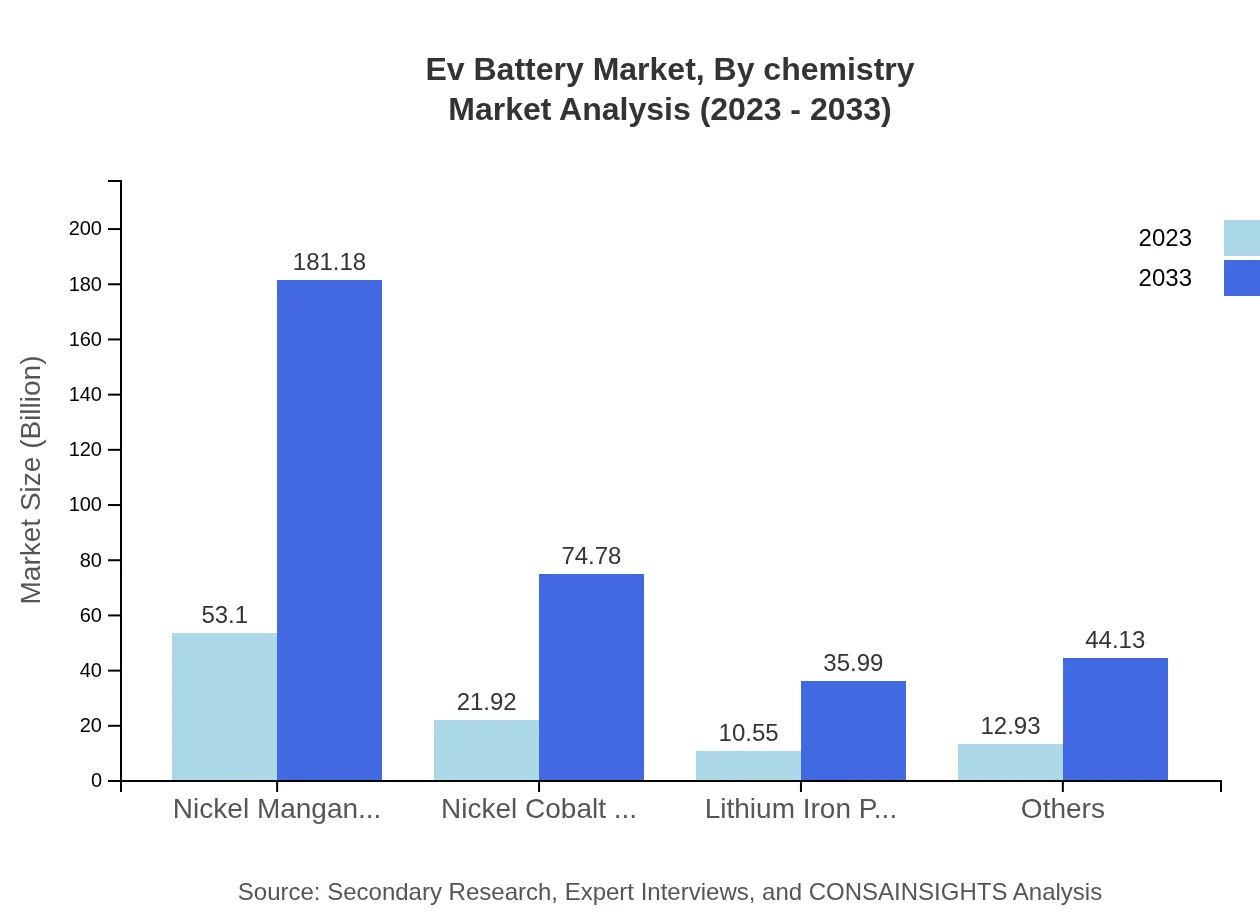

Ev Battery Market Analysis By Chemistry

Nickel-cobalt-aluminum (NCA) chemistry is particularly significant, showing substantial growth from 21.92 billion USD in 2023 to 74.78 billion USD by 2033. Lithium Iron Phosphate (LFP) is gaining traction as well, with a market size of 10.55 billion USD and an expected rise to 35.99 billion USD.

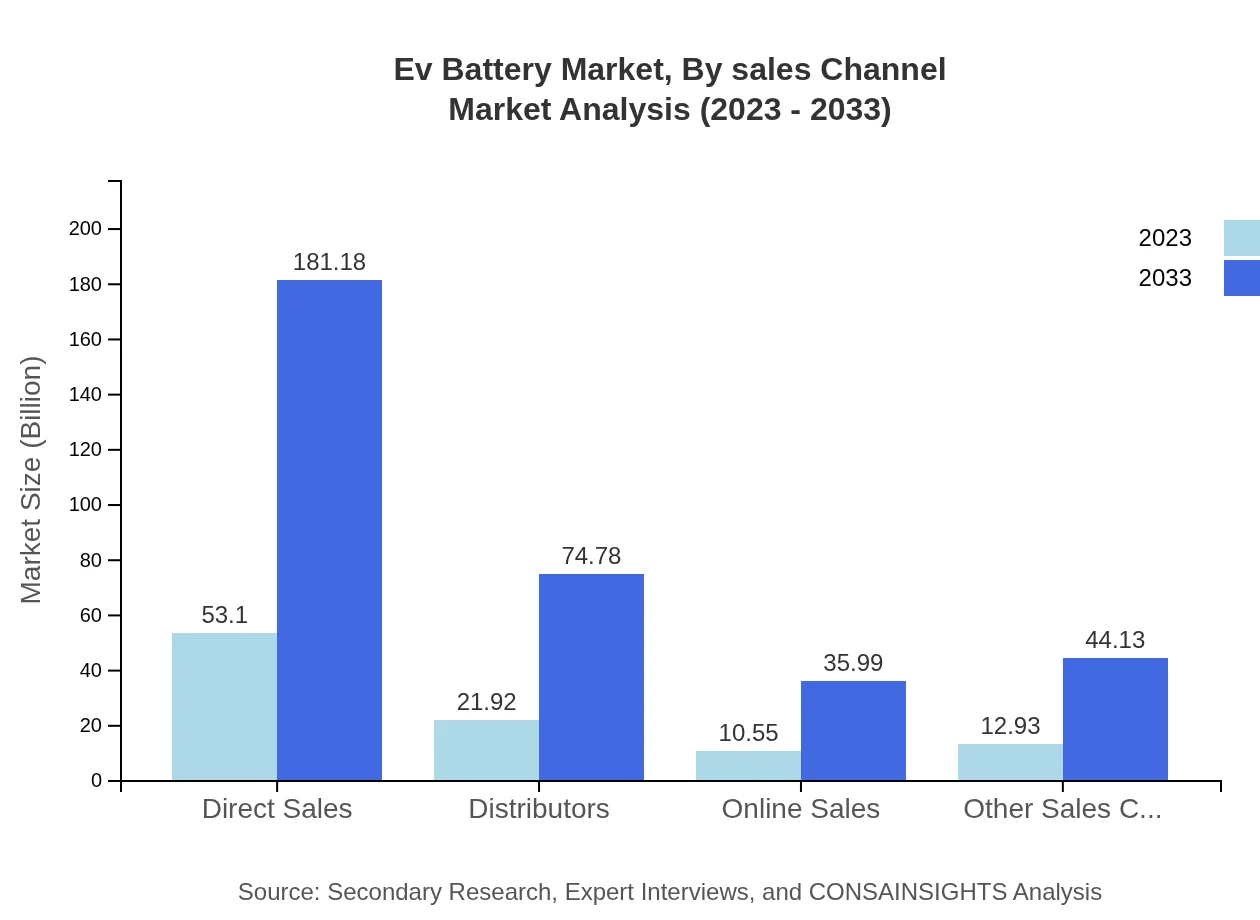

Ev Battery Market Analysis By Sales Channel

Direct sales currently lead the market with a size of 53.10 billion USD projected to reach 181.18 billion USD by 2033. Distributors stand at 21.92 billion USD and are projected to grow to 74.78 billion USD. Online sales are emerging as a significant channel, growing from 10.55 billion USD to 35.99 billion USD in the same period.

Ev Battery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ev Battery Industry

Tesla, Inc.:

Tesla is a key innovator in lithium-ion battery technology, significantly integrating advanced battery solutions into its electric vehicle offerings.LG Chem Ltd.:

A global electronics giant, LG Chem is a major supplier of batteries for electric vehicles and is involved in extensive research to enhance battery performance.Panasonic Corporation:

Panasonic has been instrumental in developing high-performance battery solutions, particularly for electric vehicles, collaborating closely with automakers.Samsung SDI:

Samsung SDI specializes in manufacturing advanced lithium-ion batteries and is a leading supplier for multiple international automotive brands.Contemporary Amperex Technology Co. (CATL):

As one of the largest battery manufacturers in the world, CATL focuses on the research and development of battery technologies and mass production.We're grateful to work with incredible clients.

FAQs

What is the market size of ev Battery?

The global EV battery market is valued at approximately $98.5 billion in 2023, anticipating a growth at a CAGR of 12.5% through 2033. This significant expansion reflects the increasing demand and adoption of electric vehicles worldwide.

What are the key market players or companies in the ev Battery industry?

Key players in the EV battery market include Tesla, Panasonic, Samsung SDI, LG Chem, and CATL. These companies are leading innovation and development in battery technology, shaping the future of the electric vehicle industry.

What are the primary factors driving the growth in the ev Battery industry?

Driving factors include rising environmental concerns, government regulations promoting electric mobility, technological advancements in battery technology, and the growing infrastructure for electric vehicles, all fueling the shift towards sustainable transportation.

Which region is the fastest Growing in the ev Battery?

The North American region is the fastest-growing market for EV batteries, projected to rise from $36.48 billion in 2023 to $124.49 billion by 2033, driven by increased adoption of electric vehicles and government initiatives.

Does ConsaInsights provide customized market report data for the ev Battery industry?

Yes, ConsaInsights offers customized market research reports tailored to the specific needs of clients, providing insights on market trends, competitive landscape, and growth opportunities within the EV battery sector.

What deliverables can I expect from this ev Battery market research project?

Deliverables from the ev-battery market research project include comprehensive market reports, demographic insights, forecasts, competitor analysis, and strategic recommendations to aid in decision-making and strategic planning.

What are the market trends of ev Battery?

Market trends include a shift towards higher capacity batteries such as Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP), increasing emphasis on solid-state batteries, and a growing focus on sustainability and recycling within battery production.