Explosive Ordnance Disposal Equipment Market Report

Published Date: 03 February 2026 | Report Code: explosive-ordnance-disposal-equipment

Explosive Ordnance Disposal Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Explosive Ordnance Disposal Equipment market, covering trends, forecasts, segmentation, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

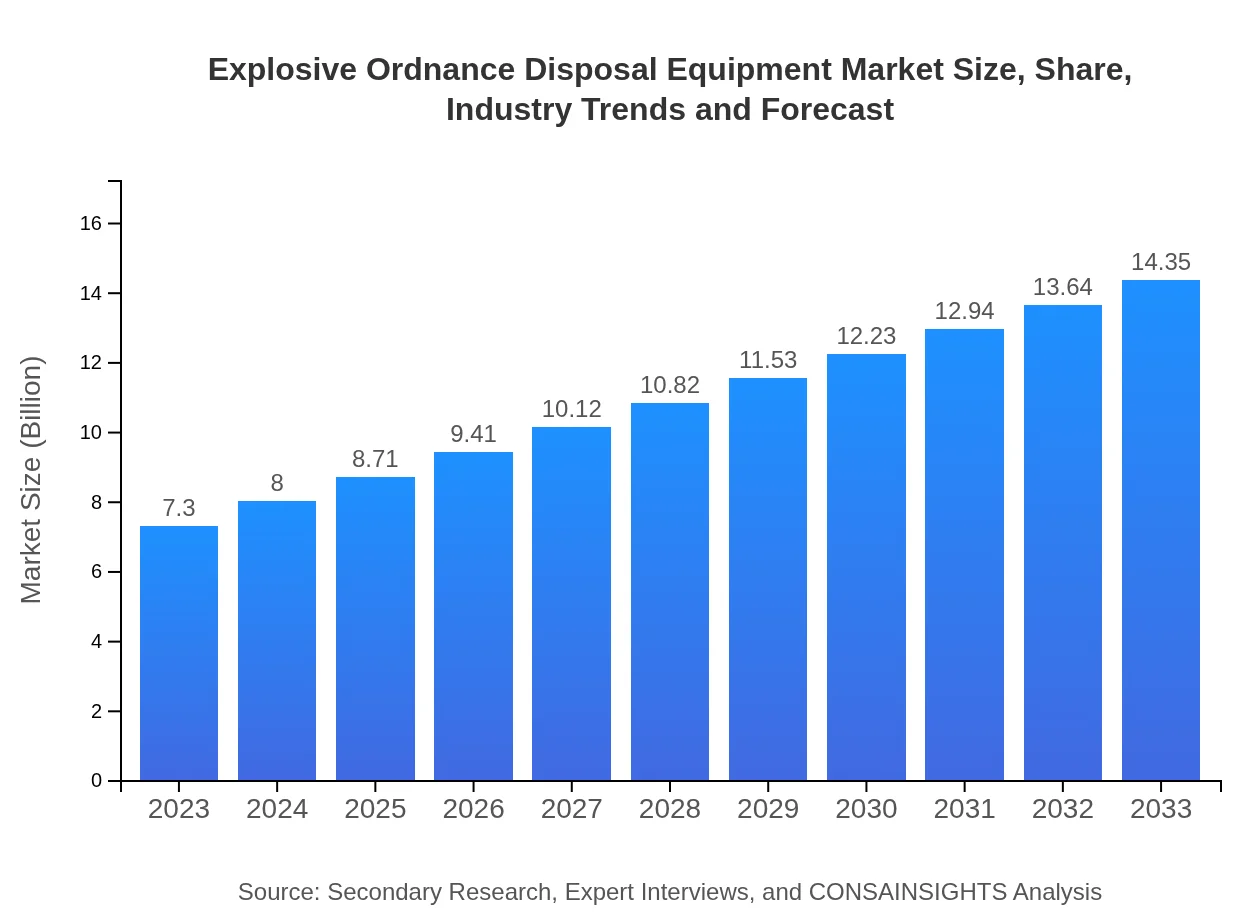

| 2023 Market Size | $7.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.35 Billion |

| Top Companies | Northrop Grumman, BAE Systems, Remotec, iRobot, L3Harris Technologies |

| Last Modified Date | 03 February 2026 |

Explosive Ordnance Disposal Equipment Market Overview

Customize Explosive Ordnance Disposal Equipment Market Report market research report

- ✔ Get in-depth analysis of Explosive Ordnance Disposal Equipment market size, growth, and forecasts.

- ✔ Understand Explosive Ordnance Disposal Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Explosive Ordnance Disposal Equipment

What is the Market Size & CAGR of Explosive Ordnance Disposal Equipment market in 2023?

Explosive Ordnance Disposal Equipment Industry Analysis

Explosive Ordnance Disposal Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Explosive Ordnance Disposal Equipment Market Analysis Report by Region

Europe Explosive Ordnance Disposal Equipment Market Report:

The European EOD Equipment market is anticipated to grow from USD 2.30 billion in 2023 to USD 4.51 billion in 2033. Heightened security concerns following various terror attacks have compelled European nations to enhance their EOD capabilities, leading to increased procurement of advanced equipment.Asia Pacific Explosive Ordnance Disposal Equipment Market Report:

In the Asia Pacific region, the EOD Equipment market is forecasted to grow from USD 1.36 billion in 2023 to USD 2.68 billion in 2033. Factors contributing to this growth include increasing military budgets and the rise of insurgent activities. Countries like India and Japan are investing heavily in sophisticated EOD technologies to bolster security.North America Explosive Ordnance Disposal Equipment Market Report:

In North America, the market is projected to expand significantly from USD 2.55 billion in 2023 to USD 5.00 billion in 2033. Continuous investments by the U.S. government and defense agencies in advanced EOD technologies are driving this growth. The region's focus on counter-terrorism initiatives is further propelling market dynamics.South America Explosive Ordnance Disposal Equipment Market Report:

The South American market, although smaller, is expected to grow from USD 0.61 billion in 2023 to USD 1.20 billion by 2033. Growth drivers include the need for enhanced national security measures amid political unrest and crime-related violence, creating demand for reliable EOD solutions.Middle East & Africa Explosive Ordnance Disposal Equipment Market Report:

In the Middle East and Africa, the market is expected to grow from USD 0.48 billion in 2023 to USD 0.95 billion in 2033. Ongoing conflicts in the region and the rising threat of terrorism are driving demand for EOD equipment from both military and civilian sectors.Tell us your focus area and get a customized research report.

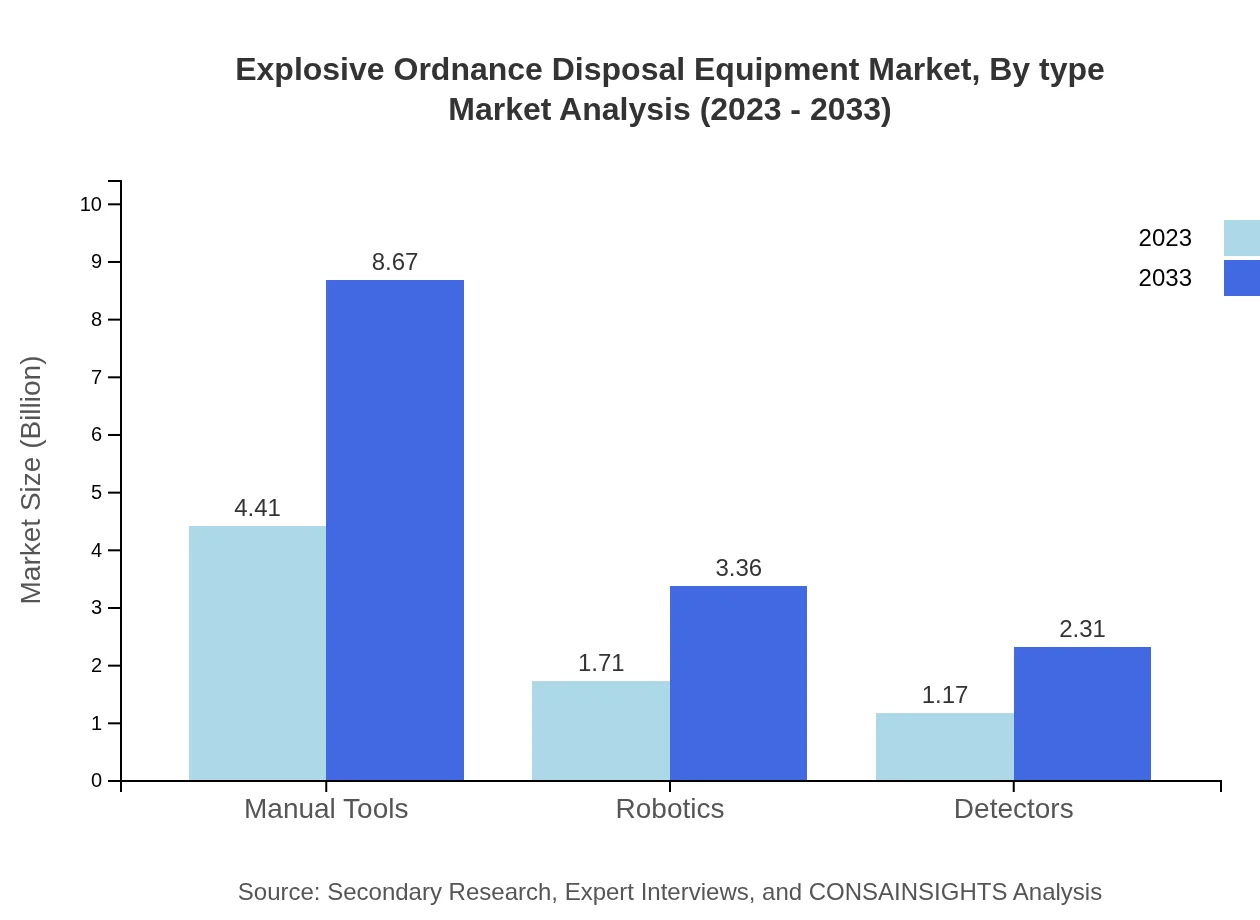

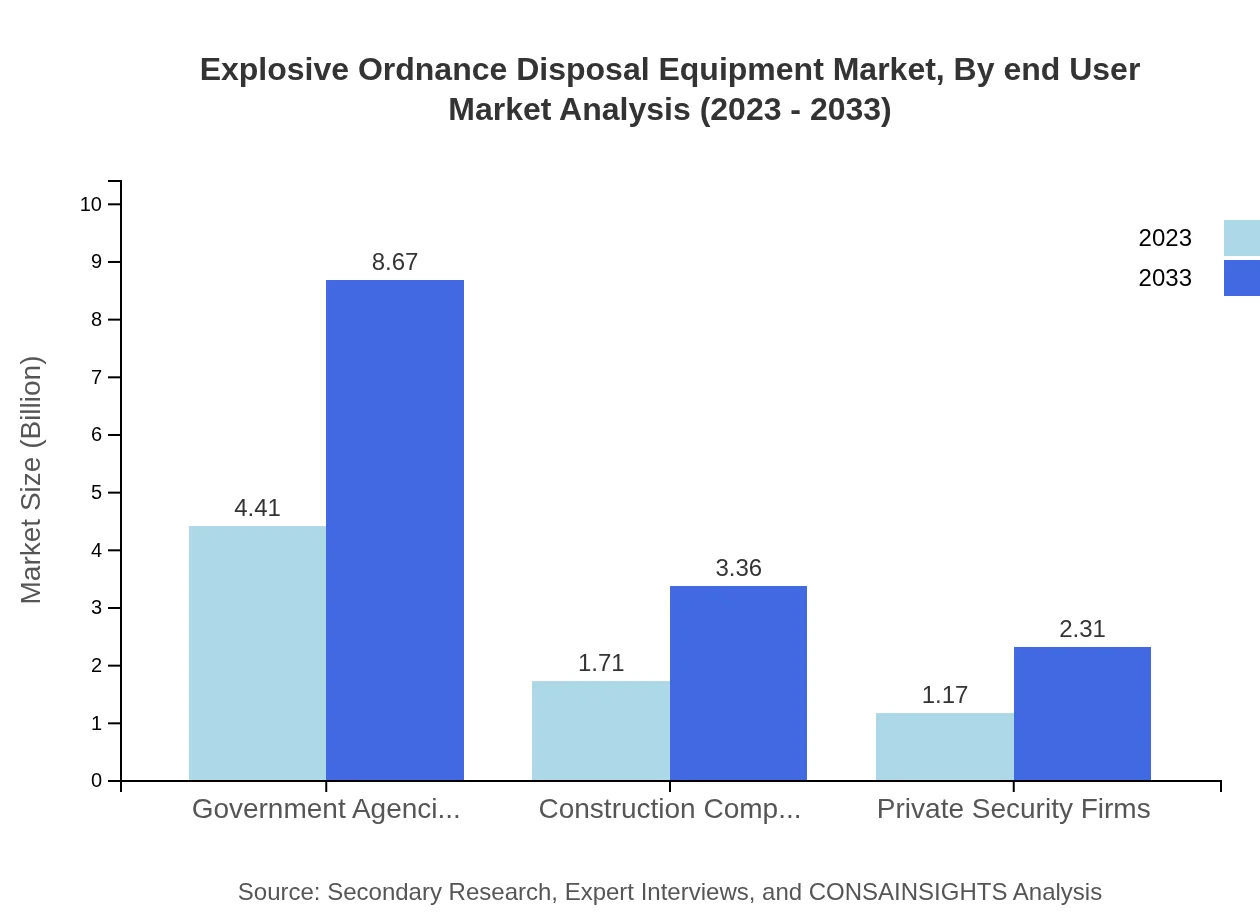

Explosive Ordnance Disposal Equipment Market Analysis By Type

The market for EOD Equipment is categorized primarily into manual tools, robotics, and detectors. Manual tools encompass traditional equipment used for direct handling of explosive threats, with market size projected to grow from USD 4.41 billion in 2023 to USD 8.67 billion by 2033. Robotics, an increasingly vital segment, covers autonomous systems that enhance safety in dangerous scenarios, with growth from USD 1.71 billion in 2023 to USD 3.36 billion by 2033. Detectors, crucial for identifying explosives, will see growth from USD 1.17 billion in 2023 to USD 2.31 billion by 2033.

Explosive Ordnance Disposal Equipment Market Analysis By Application

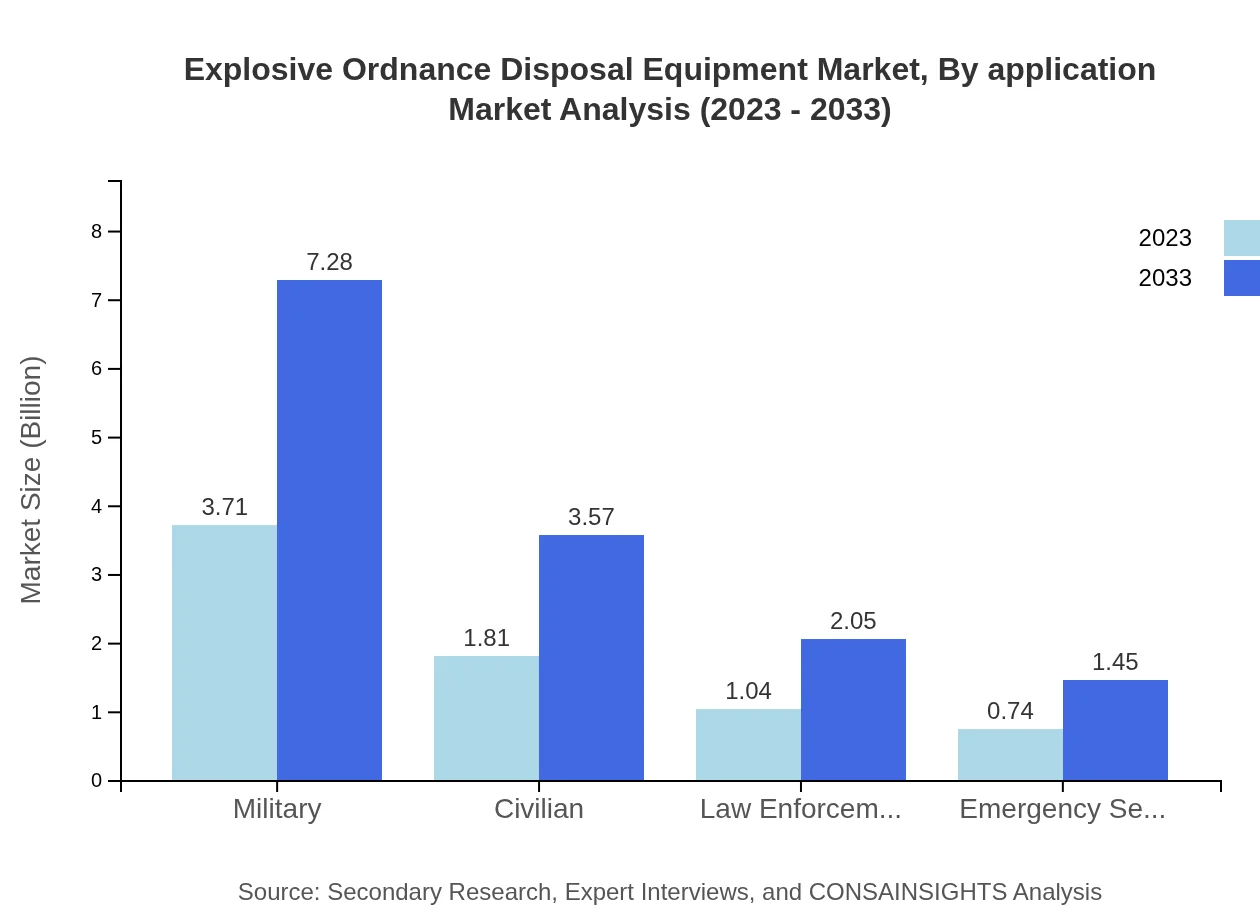

Application-wise, the military sector is the largest end-user, with a market size of USD 3.71 billion in 2023, expected to rise to USD 7.28 billion by 2033. Law enforcement follows closely, growing from USD 1.04 billion to USD 2.05 billion over the same period. Civilian applications, including emergency services and private security firms, are also expanding, projected to advance from USD 1.81 billion to USD 3.57 billion.

Explosive Ordnance Disposal Equipment Market Analysis By Technology

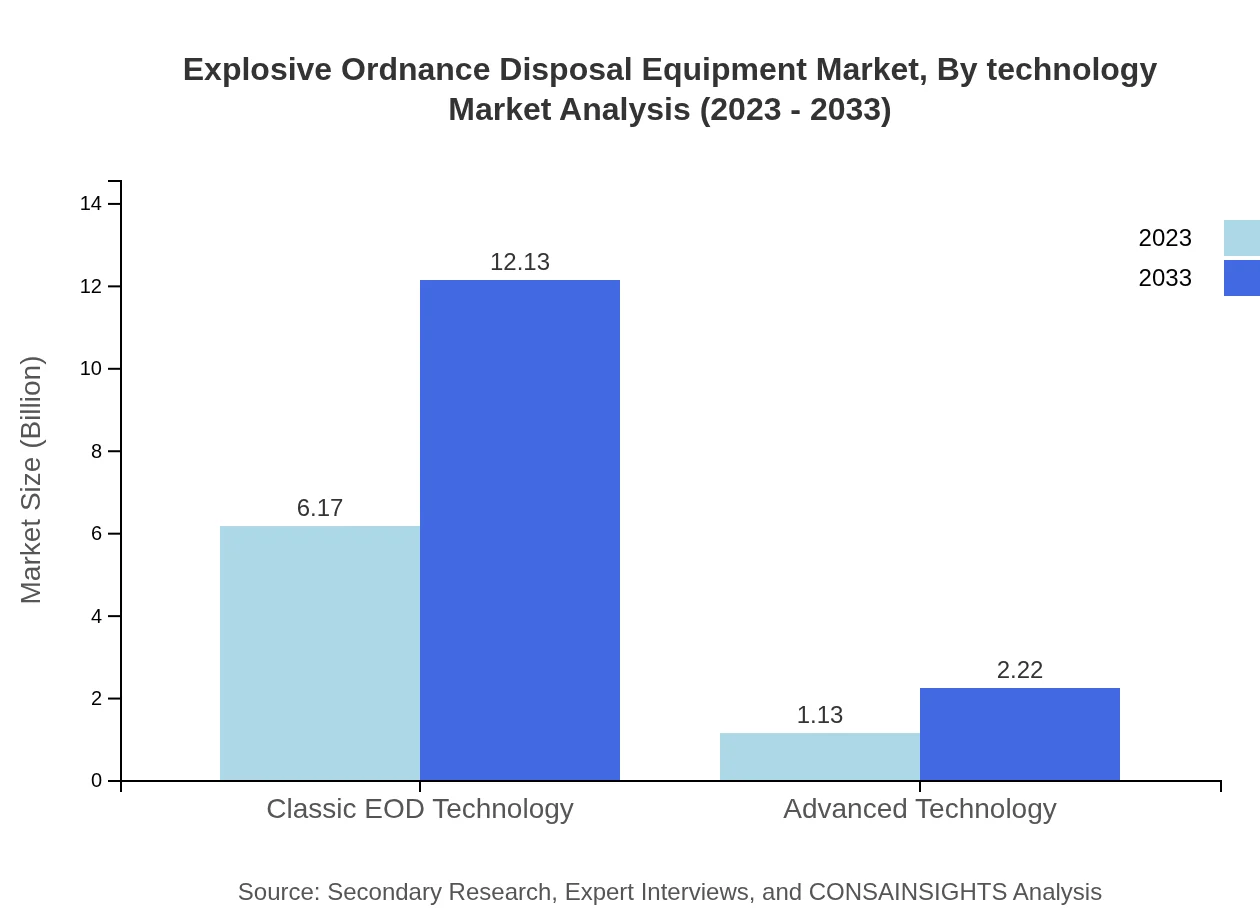

The technology segment showcases classic EOD technology as dominating the landscape, accounting for 84.56% of the market share in 2023 with a size of USD 6.17 billion, expected to reach USD 12.13 billion by 2033. Advanced technology, including robotics and artificial intelligence, accounts for a smaller share but is anticipated to grow from USD 1.13 billion in 2023 to USD 2.22 billion by 2033, reflecting increasing interest in sophisticated EOD systems.

Explosive Ordnance Disposal Equipment Market Analysis By End User

The market sees significant demand from military end-users, maintaining 50.77% market share and expected to grow from USD 3.71 billion to USD 7.28 billion. Government agencies, including law enforcement, hold steady shares, while civilian applications from emergency services and private security firms contribute growing share segments, expanding from USD 1.04 billion to USD 2.05 billion by 2033.

Explosive Ordnance Disposal Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Explosive Ordnance Disposal Equipment Industry

Northrop Grumman:

A leader in aerospace and defense technologies, Northrop Grumman provides advanced robotics and autonomous systems essential for EOD operations.BAE Systems:

BAE Systems delivers integrated and innovative solutions for defense, contributing significantly to the EOD equipment landscape with its advanced technology.Remotec:

Specializes in remote-controlled vehicles and robotic systems for EOD applications, enhancing operational effectiveness and safety for military and law enforcement.iRobot:

Known for its tactical robots, iRobot provides EOD solutions utilized by various governmental and military organizations worldwide.L3Harris Technologies:

L3Harris Technologies develops advanced electronic systems and solutions, playing a key role in EOD through innovative detection and monitoring technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of explosive Ordnance Disposal Equipment?

The global explosive ordnance disposal equipment market is valued at approximately $7.3 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8%. By 2033, the market is expected to grow significantly as demand for advanced safety measures increases.

What are the key market players or companies in this explosive Ordnance Disposal Equipment industry?

Key players in the explosive ordnance disposal equipment industry include major defense contractors and specialized manufacturers, focusing on innovative technologies and solutions to enhance safety and efficiency. Companies are investing in R&D to maintain a competitive edge.

What are the primary factors driving the growth in the explosive Ordnance Disposal Equipment industry?

Factors driving growth include increasing military spending, rising global terrorism threats, advancements in technology, and growing emphasis on public safety. These elements collectively contribute to increasing investments in explosive ordnance disposal equipment.

Which region is the fastest Growing in the explosive Ordnance Disposal Equipment?

The fastest-growing region for explosive ordnance disposal equipment is North America, projected to grow from $2.55 billion in 2023 to $5.00 billion by 2033. Other significant markets include Europe and Asia-Pacific, reflecting growing security concerns.

Does ConsaInsights provide customized market report data for the explosive Ordnance Disposal Equipment industry?

Yes, ConsaInsights offers customized market report data, tailored to meet specific needs within the explosive ordnance disposal equipment industry. This includes in-depth analysis and insights based on unique requirements.

What deliverables can I expect from this explosive Ordnance Disposal Equipment market research project?

Deliverables include detailed market analysis, segmented reports by region and product type, trends analysis, competitor profiles, and actionable insights to guide strategic decisions. Expect comprehensive coverage to inform business strategies.

What are the market trends of explosive Ordnance Disposal Equipment?

Market trends include increased adoption of robotics in EOD operations, enhanced focus on advanced technologies, and integration of artificial intelligence. Growing collaborations between defense agencies and private firms are also shaping the future landscape.