Explosive Ordnance Disposal Market Report

Published Date: 03 February 2026 | Report Code: explosive-ordnance-disposal

Explosive Ordnance Disposal Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Explosive Ordnance Disposal (EOD) market from 2023 to 2033, encompassing market size, growth trends, segmentation, and regional insights, alongside identifying key industry players and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

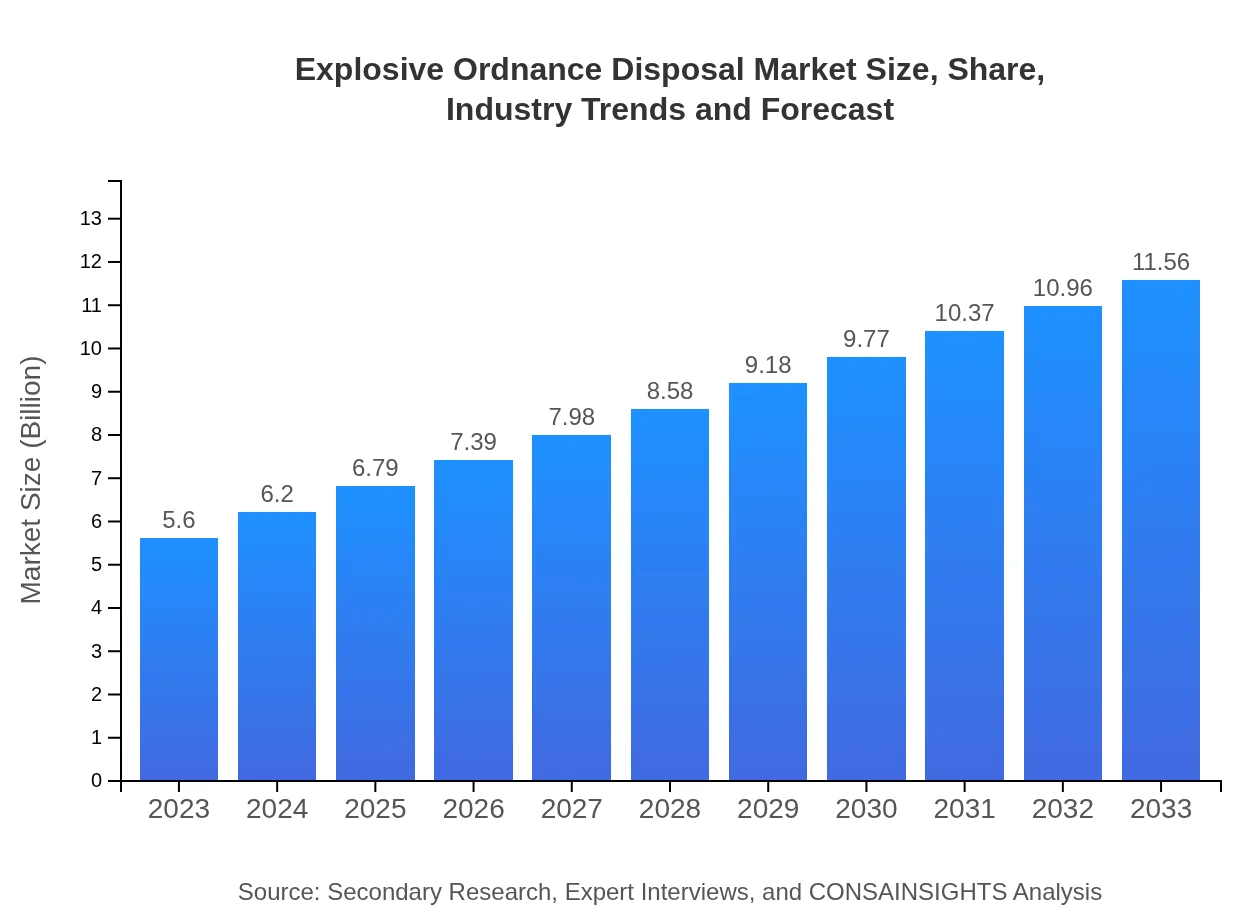

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | Northrop Grumman Corporation, SAAB AB, Lockheed Martin, Thales Group, FLIR Systems, Inc. |

| Last Modified Date | 03 February 2026 |

Explosive Ordnance Disposal Market Overview

Customize Explosive Ordnance Disposal Market Report market research report

- ✔ Get in-depth analysis of Explosive Ordnance Disposal market size, growth, and forecasts.

- ✔ Understand Explosive Ordnance Disposal's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Explosive Ordnance Disposal

What is the Market Size & CAGR of Explosive Ordnance Disposal market in 2023?

Explosive Ordnance Disposal Industry Analysis

Explosive Ordnance Disposal Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Explosive Ordnance Disposal Market Analysis Report by Region

Europe Explosive Ordnance Disposal Market Report:

Europe's market is estimated to grow from $1.88 billion in 2023 to $3.89 billion by 2033. Political instability and evolving security dynamics in the region are prompting governments to bolster their EOD capabilities significantly.Asia Pacific Explosive Ordnance Disposal Market Report:

The Asia Pacific region's EOD market is projected to grow from $0.97 billion in 2023 to $2.01 billion by 2033, driven by rising defense budgets and increasing terrorist threats. Countries such as India, China, and Japan are enhancing their EOD capabilities to counteract these risks.North America Explosive Ordnance Disposal Market Report:

The North American EOD market is forecasted to rise from $1.97 billion in 2023 to $4.07 billion in 2033. The U.S. military's continuous investment in advanced EOD technologies and services, coupled with the demand from law enforcement agencies, fuels this growth.South America Explosive Ordnance Disposal Market Report:

In South America, the market is expected to grow from $0.13 billion in 2023 to $0.27 billion by 2033. Increased collaboration with international security agencies and a focus on improving national security measures are key drivers.Middle East & Africa Explosive Ordnance Disposal Market Report:

In the Middle East and Africa, the market is expected to grow from $0.64 billion in 2023 to $1.32 billion by 2033, driven by ongoing conflicts and the necessity to secure borders and public spaces from explosive threats.Tell us your focus area and get a customized research report.

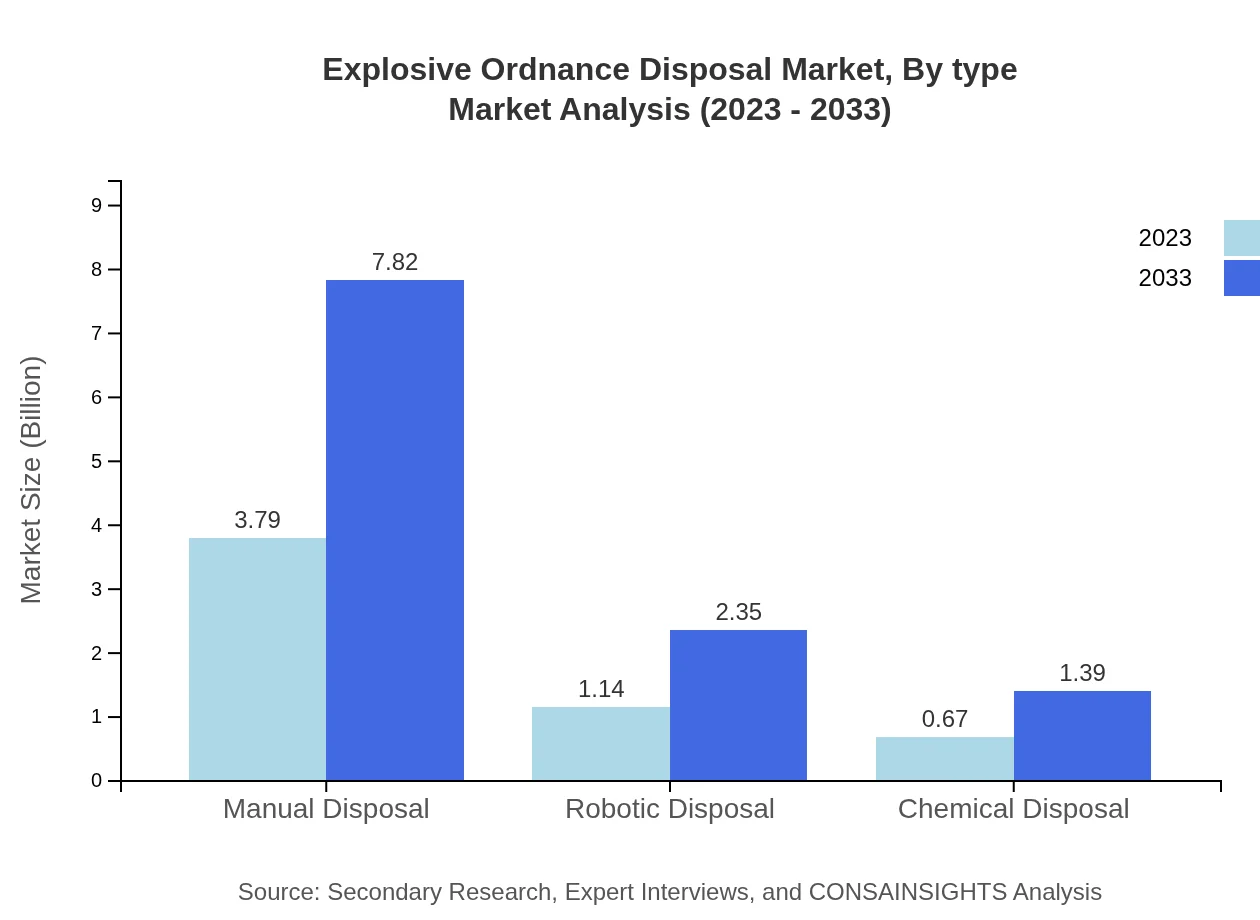

Explosive Ordnance Disposal Market Analysis By Type

Manual Disposal remains the largest segment, projected to grow from $3.79 billion in 2023 to $7.82 billion by 2033, maintaining a substantial market share. Robotic Disposal is anticipated to rise from $1.14 billion in 2023 to $2.35 billion by 2033, reflecting an increased preference for safety and efficiency. Chemical Disposal, while smaller, is also seeing growth from $0.67 billion to $1.39 billion during the same period.

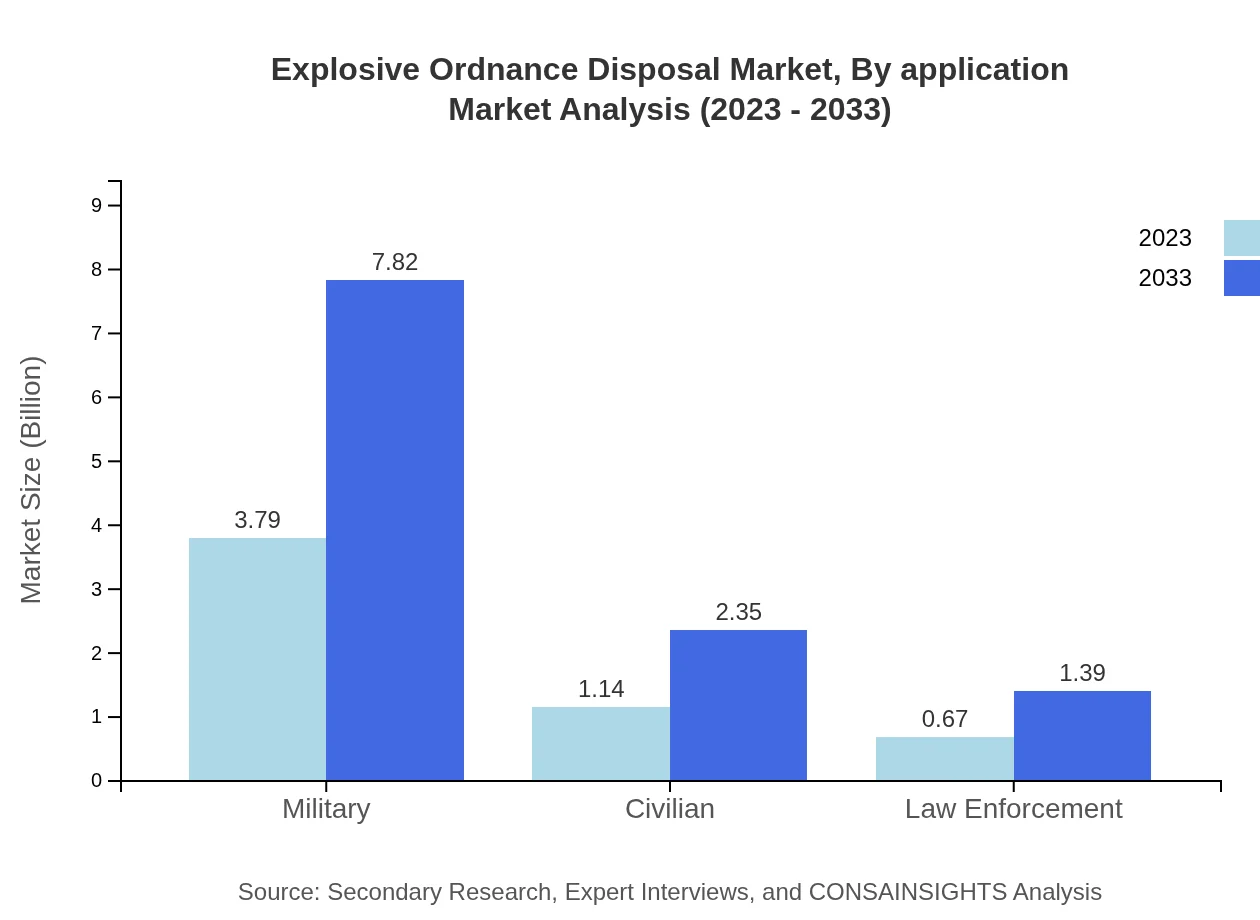

Explosive Ordnance Disposal Market Analysis By Application

The military application dominates the landscape, projected to hold a market share of 67.67% in both 2023 and 2033, while Civilian applications are expected to maintain a steady share of 20.31%. Law enforcement applications are small but growing, with a market share of 12.02%.

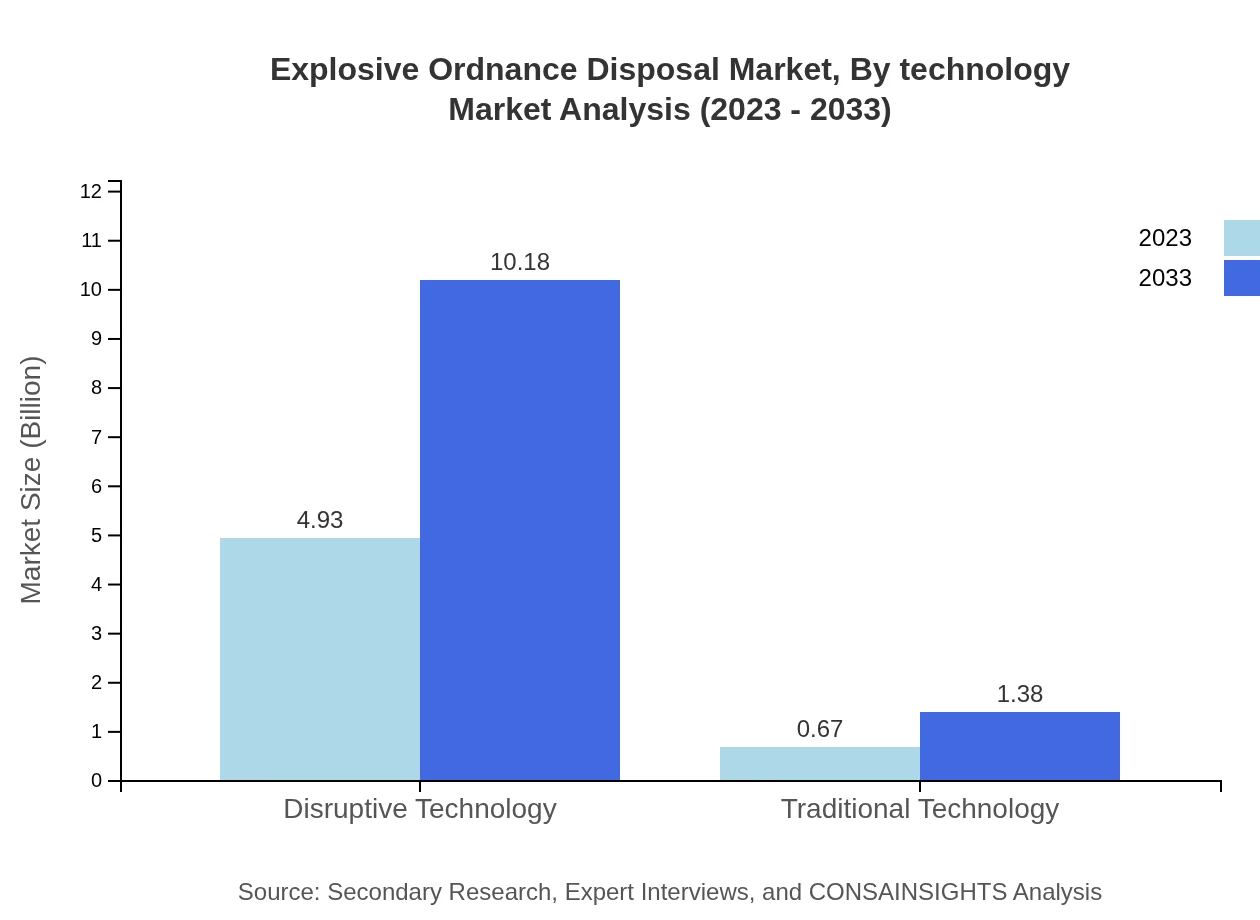

Explosive Ordnance Disposal Market Analysis By Technology

Disruptive Technology represents the forward-looking trend, growing from $4.93 billion in 2023 to $10.18 billion in 2033, indicative of rapid advancements in robotics and AI. Traditional Technology maintains a smaller share, expected to grow modestly from $0.67 billion to $1.38 billion.

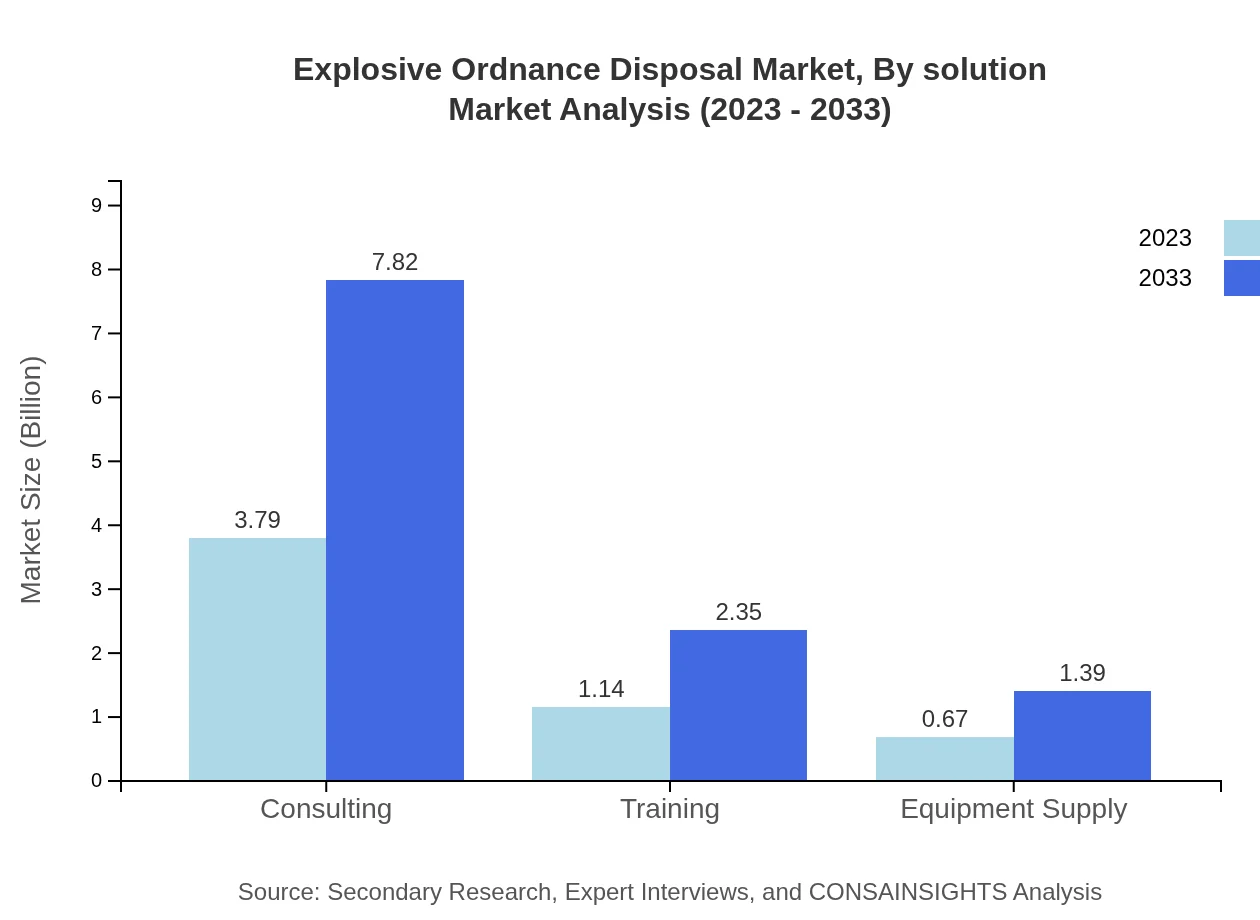

Explosive Ordnance Disposal Market Analysis By Solution

Consulting services are projected to grow alongside EOD market demands, remaining stable at 67.67% market share from 2023 to 2033, while Training and Equipment Supply solutions are also significant, maintaining the same shares of 20.31% and 12.02% respectively.

Explosive Ordnance Disposal Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Explosive Ordnance Disposal Industry

Northrop Grumman Corporation:

Leading provider of advanced aerospace and defense technologies with a strong focus on EOD systems and solutions.SAAB AB:

Swedish aerospace and defense company, known for its innovative EOD systems and robotic solutions.Lockheed Martin:

Major defense contractor with a strong portfolio in EOD technology and military applications.Thales Group:

A prominent player in providing advanced EOD solutions and systems for military and civilian applications.FLIR Systems, Inc.:

Specializes in thermal imaging technologies and robotic systems used in EOD operations.We're grateful to work with incredible clients.

FAQs

What is the market size of explosive Ordnance Disposal?

The explosive ordnance disposal market is valued at approximately $5.6 billion in 2023, and is projected to grow at a CAGR of 7.3%, reaching significant milestones by 2033.

What are the key market players or companies in this explosive Ordnance Disposal industry?

Key market players include major defense contractors, robotics firms specializing in bomb disposal technology, and consultancies providing strategic support in explosive ordnance disposal solutions.

What are the primary factors driving the growth in the explosive Ordnance Disposal industry?

Growth is driven by increasing geopolitical tensions, advancements in technology enhancing disposal methods, and rising investments from governments in defense and security sectors.

Which region is the fastest Growing in the explosive Ordnance Disposal?

North America is the fastest-growing region, scaling from a market size of $1.97 billion in 2023 to $4.07 billion by 2033, followed closely by Europe and Asia-Pacific.

Does ConsaInsights provide customized market report data for the explosive Ordnance Disposal industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the explosive ordnance disposal sector, ensuring relevant and actionable insights.

What deliverables can I expect from this explosive Ordnance Disposal market research project?

Deliverables typically include comprehensive reports outlining market size, forecasts, competitive analysis, and detailed segmentation on technology, application, and region.

What are the market trends of explosive Ordnance Disposal?

Key trends include increased reliance on robotic disposal technologies, heightened investment in military and civilian EOD training programs, and a shift towards disruptive technologies in ordnance disposal.