Expression Vectors Market Report

Published Date: 31 January 2026 | Report Code: expression-vectors

Expression Vectors Market Size, Share, Industry Trends and Forecast to 2033

This report covers a detailed analysis of the Expression Vectors market, providing insights on market size, trends, forecasts, and key players from 2023 to 2033. It aims to inform stakeholders about the current conditions and future projections in this growing industry.

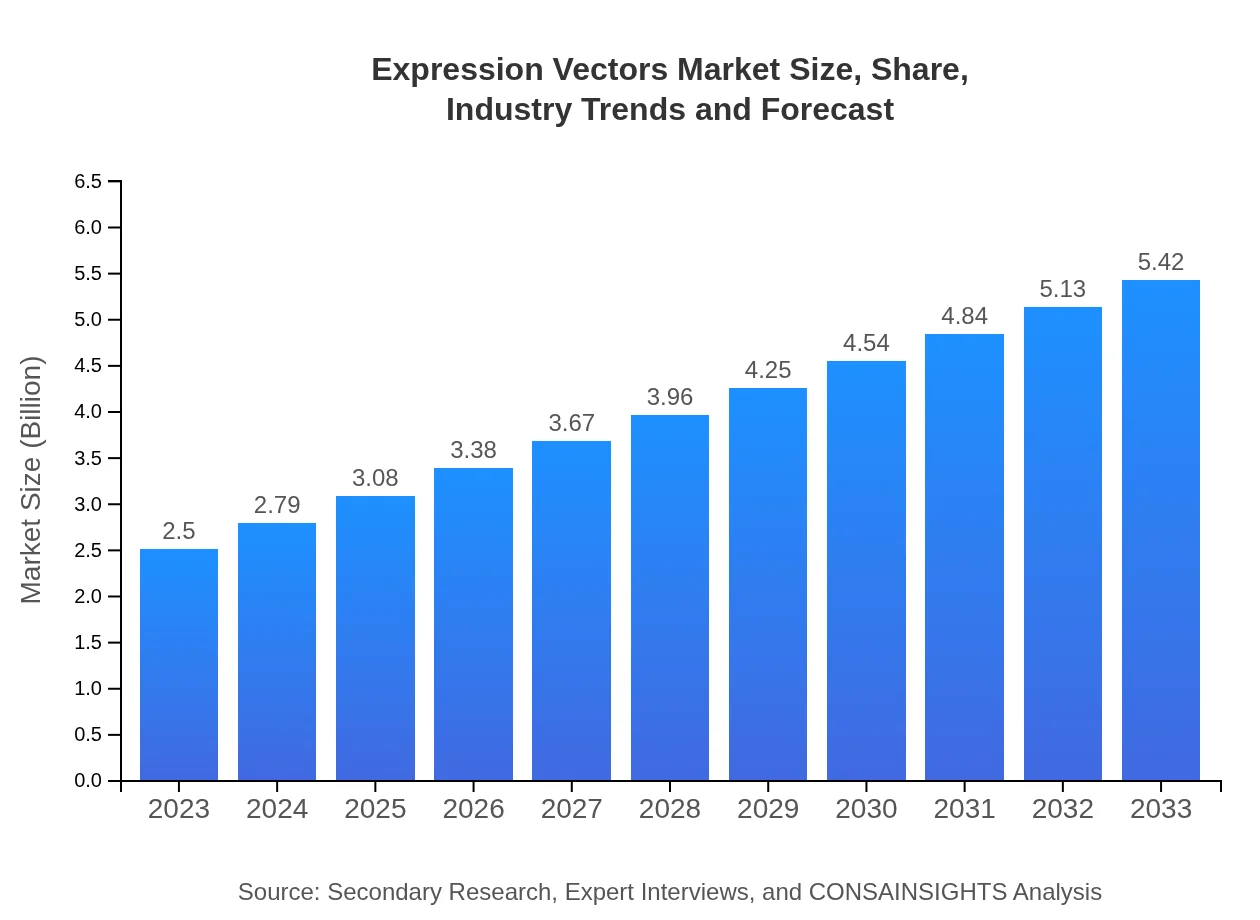

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Thermo Fisher Scientific, Qiagen N.V., Agilent Technologies, Roche Holdings AG, Lonza Group AG |

| Last Modified Date | 31 January 2026 |

Expression Vectors Market Overview

Customize Expression Vectors Market Report market research report

- ✔ Get in-depth analysis of Expression Vectors market size, growth, and forecasts.

- ✔ Understand Expression Vectors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Expression Vectors

What is the Market Size & CAGR of Expression Vectors market in 2023-2033?

Expression Vectors Industry Analysis

Expression Vectors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Expression Vectors Market Analysis Report by Region

Europe Expression Vectors Market Report:

Europe's expression vectors market is set to grow from $0.75 billion in 2023 to $1.62 billion by 2033. The region is known for its strong academic and research institutions and increasing focus on gene therapies, which contribute significantly to the rising demand for expression vectors.Asia Pacific Expression Vectors Market Report:

In the Asia Pacific region, the expression vectors market is gaining momentum, with a market value estimated to be $0.48 billion in 2023 and projected to reach $1.05 billion by 2033. Rising investments in biotechnological research and growing contract research activities are major factors propelling this growth. Additionally, increased collaborations among researchers and enterprises are fostering innovation.North America Expression Vectors Market Report:

North America is the largest market, valued at $0.86 billion in 2023, and anticipated to grow to $1.86 billion by 2033. The advanced healthcare infrastructure, high R&D expenditure, and presence of leading biotechnology firms signify a robust regional market for expression vectors.South America Expression Vectors Market Report:

The South America expression vectors market is relatively smaller, with a market size of $0.20 billion in 2023 expected to grow to $0.43 billion by 2033. The growth is driven by the rising number of research initiatives in gene-related fields, although limited healthcare funding presents challenges.Middle East & Africa Expression Vectors Market Report:

The Middle East and Africa region's market stands at $0.21 billion in 2023 and is likely to reach $0.46 billion by 2033. Despite some barriers related to biotechnology adoption, the region has an increasing interest in pharmaceutical innovations.Tell us your focus area and get a customized research report.

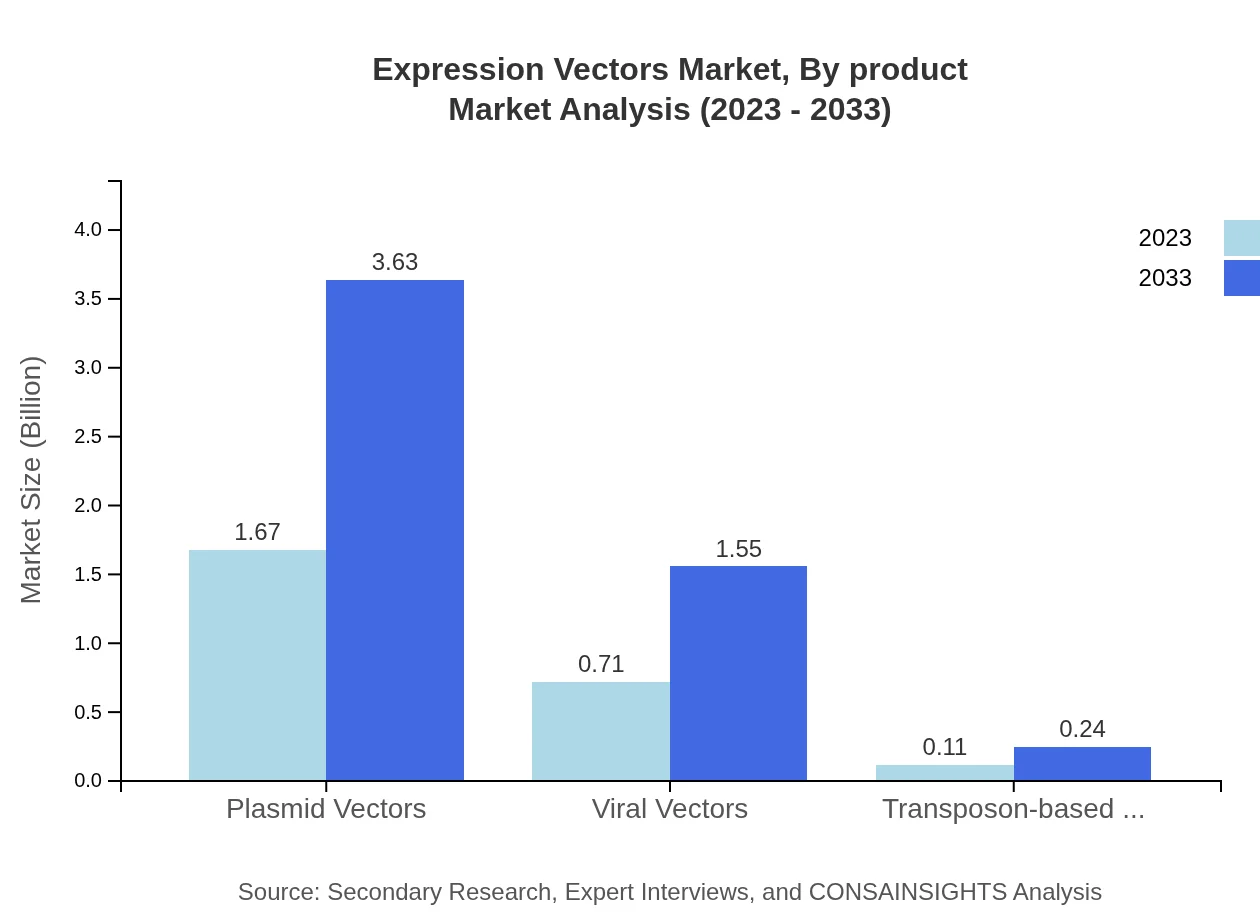

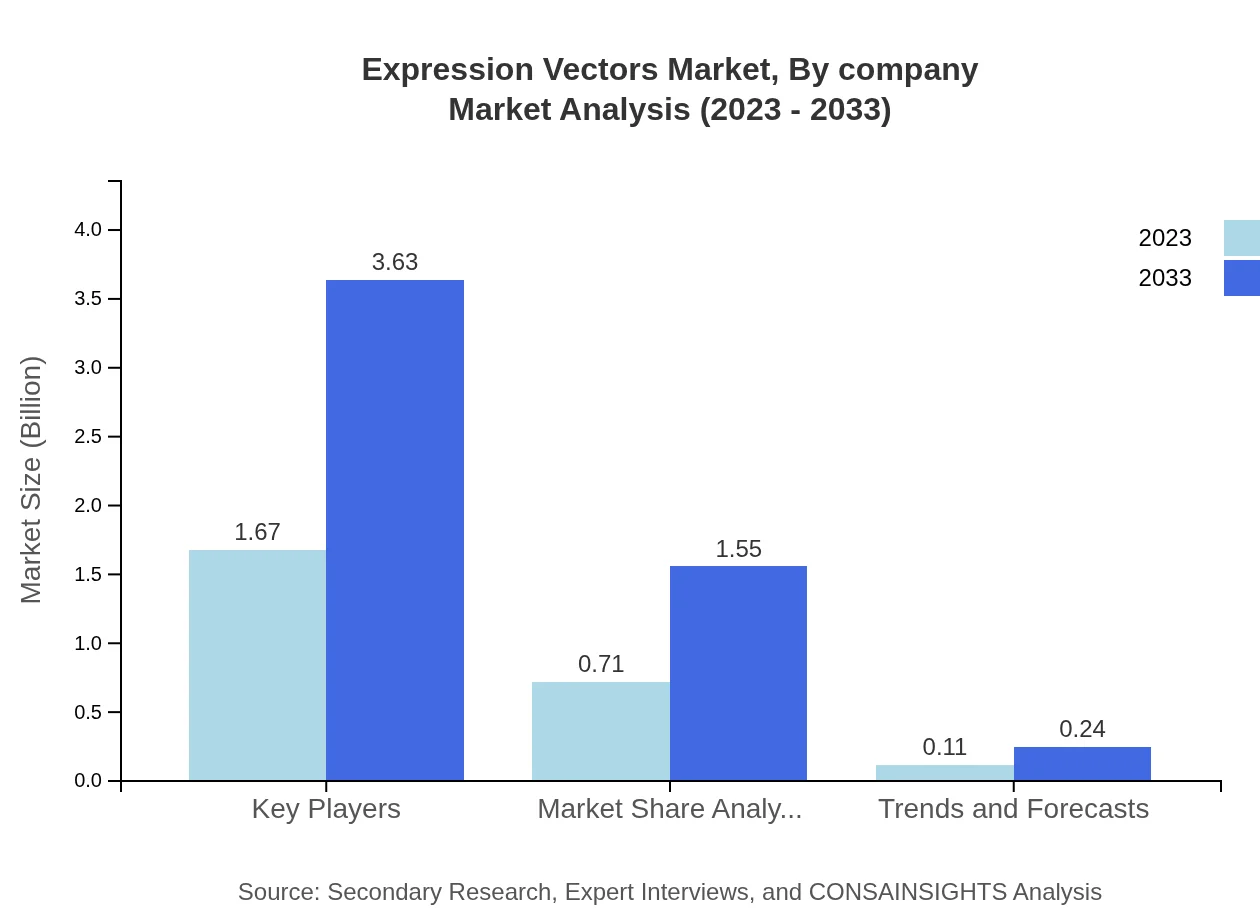

Expression Vectors Market Analysis By Product

The product type segment of expression vectors includes plasmid vectors, viral vectors, and transposon-based vectors. In 2023, plasmid vectors dominate the market with a valuation of $1.67 billion and are expected to reach $3.63 billion by 2033, holding 66.99% market share. Viral vectors, valued at $0.71 billion in 2023 and projected to grow to $1.55 billion by 2033, account for 28.52% of the market. Transposon-based vectors, while smaller, are expected to increase from $0.11 billion to $0.24 billion in the same timeframe.

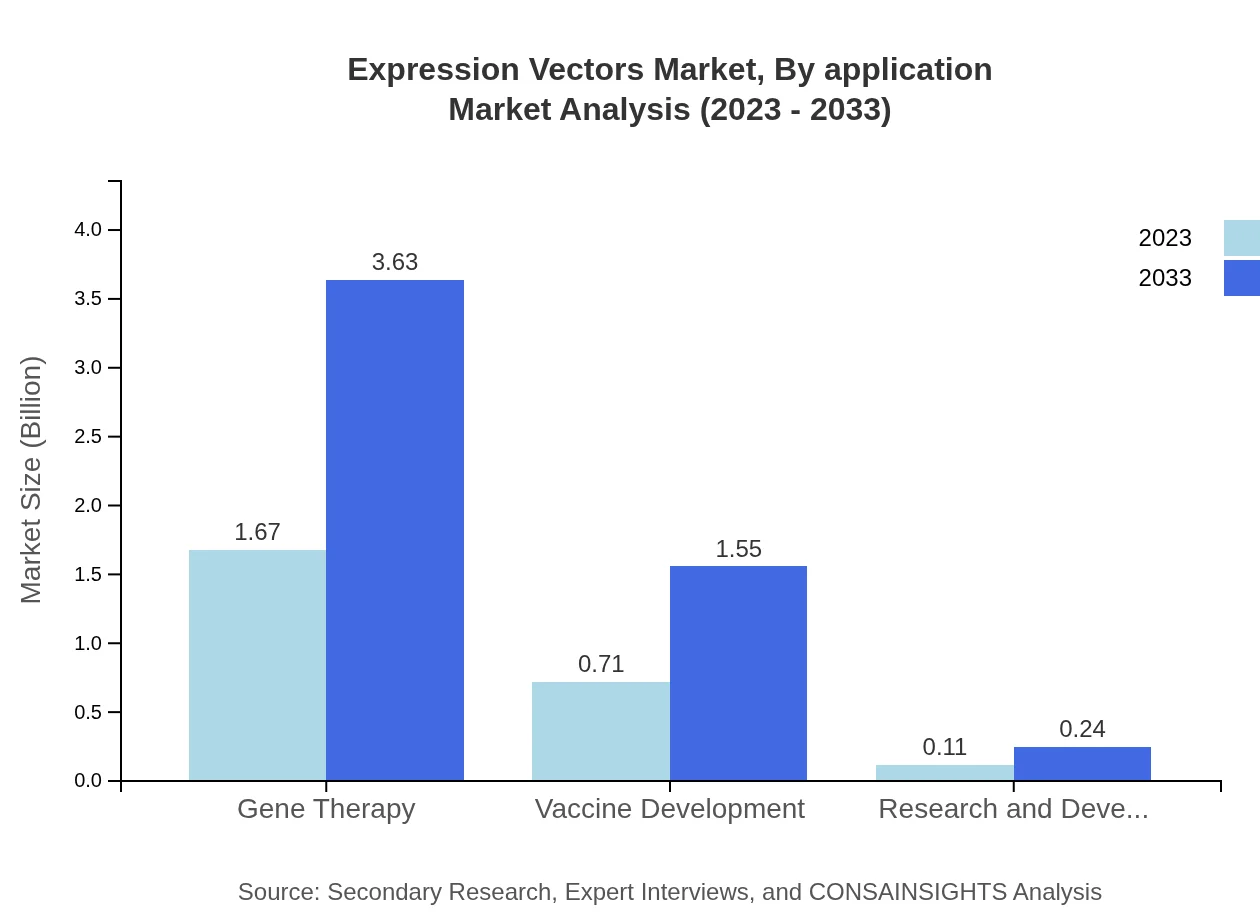

Expression Vectors Market Analysis By Application

This segment captures applications in gene therapy, vaccine development, and research & development. Gene therapy applications represent the largest share of the market, reflecting current innovations and advancements, with $1.67 billion in 2023 and expected to reach $3.63 billion by 2033. Vaccine development applications will grow from $0.71 billion to $1.55 billion within the same period.

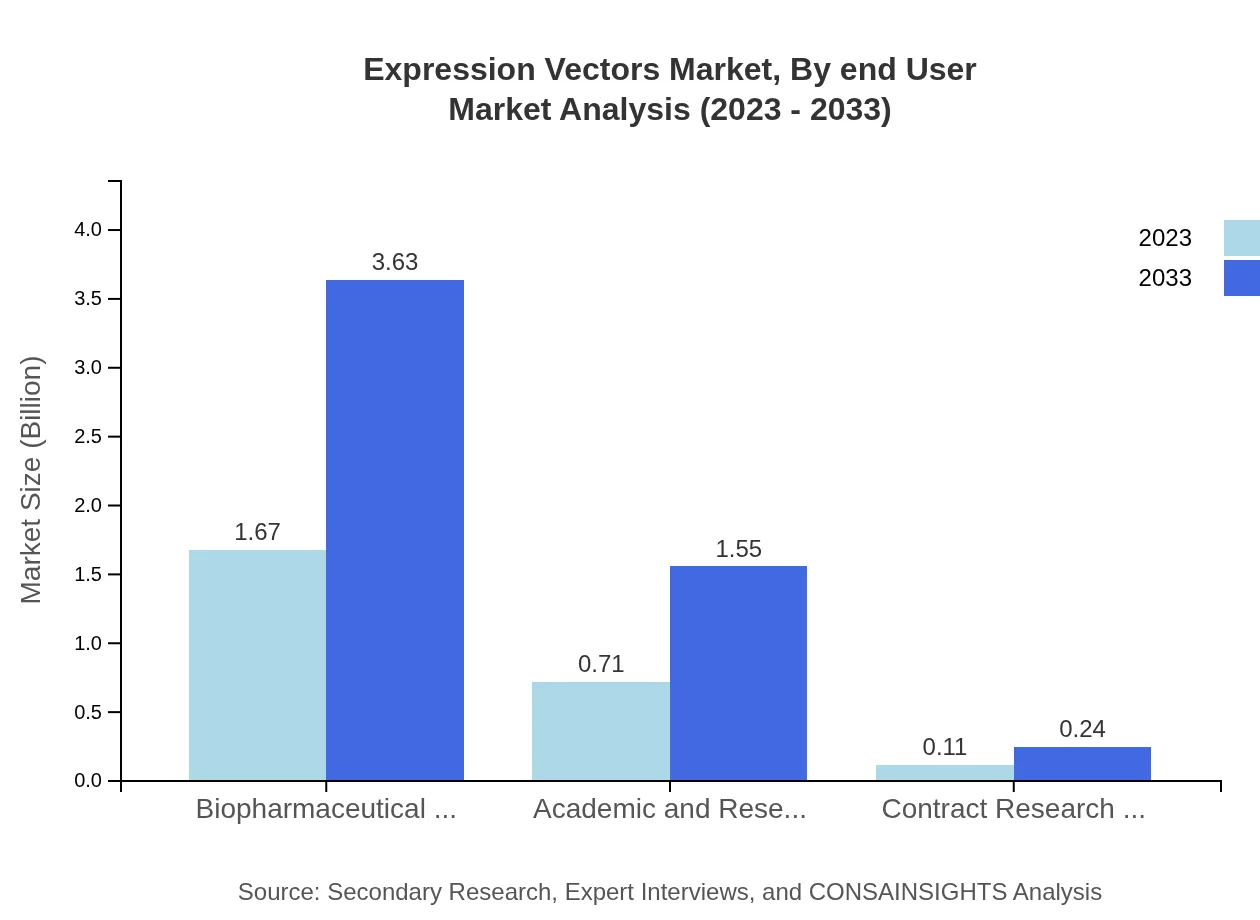

Expression Vectors Market Analysis By End User

End-users include biopharmaceutical companies, academic institutions, and contract research organizations. Biopharmaceutical companies lead the market with $1.67 billion in 2023, and a growth forecast to $3.63 billion by 2033. Academic institutions hold market value of $0.71 billion, predicting growth to $1.55 billion, while contract research organizations show smaller yet significant growth.

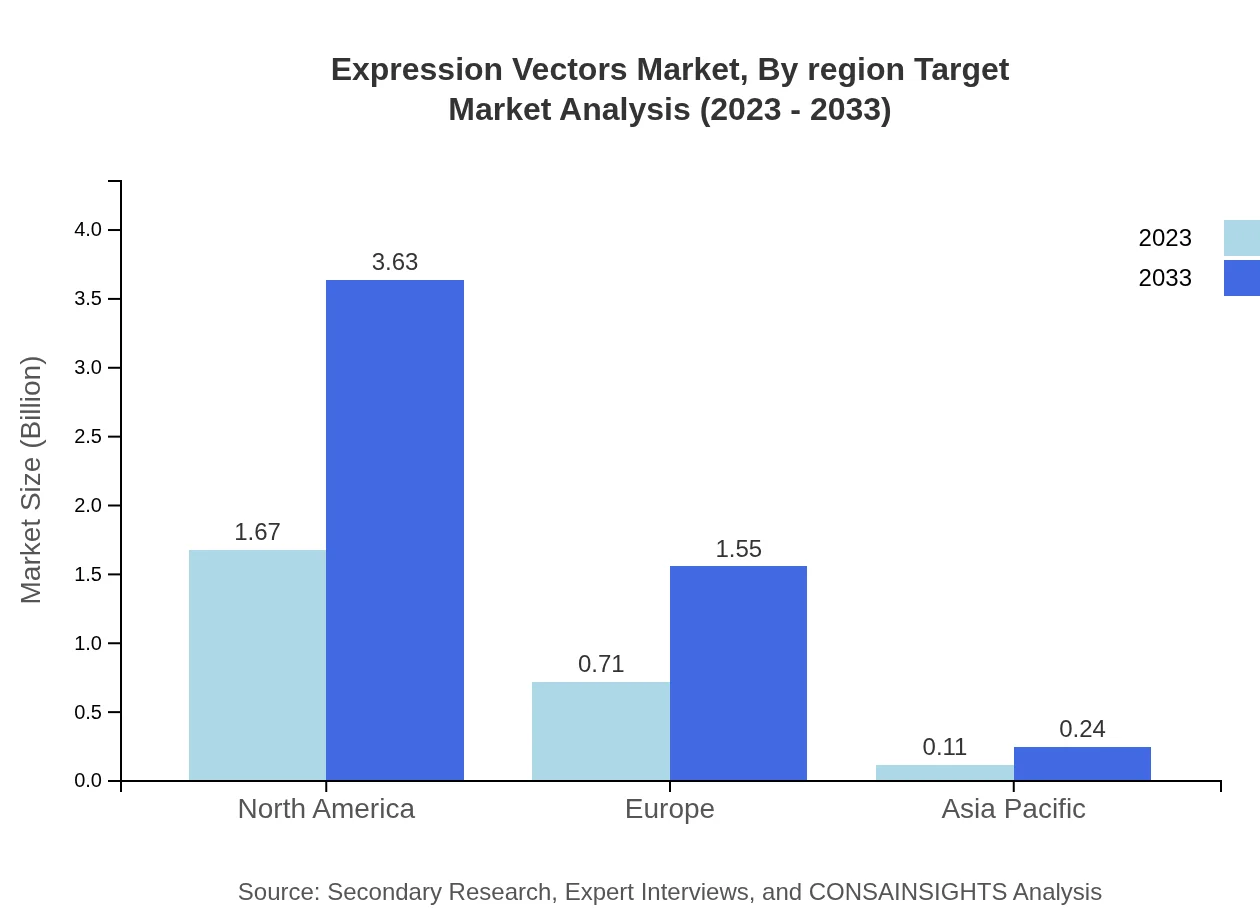

Expression Vectors Market Analysis By Region Target

This segment reflects regional dynamics affecting expression vector utilization, including North America, Europe, Asia Pacific, and others. Each region shows unique growth trajectories based on local regulatory landscapes, R&D activity, and market demand.

Expression Vectors Market Analysis By Company

Analysis of companies highlights dominance by a few key players, emphasizing their strategies and market share across the global market, as well as the competitive landscape shaping the industry.

Expression Vectors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Expression Vectors Industry

Thermo Fisher Scientific:

A leader in genetic materials and vectors, Thermo Fisher Scientific offers a wide range of solutions that support gene therapy and research applications.Qiagen N.V.:

Qiagen specializes in providing sample and assay technologies for molecular diagnostics, offering innovative expression vectors for the biotech industry.Agilent Technologies:

Agilent Technologies provides tools and services that contribute to advancements in expression vector technology, assisting researchers globally.Roche Holdings AG:

Roche is a major player in biopharmaceuticals, investing heavily in gene therapy products, including robust expression vector systems.Lonza Group AG:

Lonza focuses on biologics, providing tailored expression vectors for various applications, contributing to efficiencies in drug development.We're grateful to work with incredible clients.

FAQs

What is the market size of expression Vectors?

The global expression vectors market size is valued at approximately $2.5 billion in 2023, with a projected CAGR of 7.8% from 2023 to 2033.

What are the key market players or companies in this expression Vectors industry?

Key players in the expression vectors market include major biopharmaceutical companies, academic and research institutions, and contract research organizations that drive innovation and product development.

What are the primary factors driving the growth in the expression Vectors industry?

Growth in the expression vectors market is driven by advancements in genetic engineering technologies, rising demand for gene therapy solutions, and increased investments in biopharmaceutical research and development.

Which region is the fastest Growing in the expression Vectors?

The Asia Pacific region is witnessing rapid growth, with the market size expected to increase from $0.48 billion in 2023 to $1.05 billion by 2033, indicating strong development opportunities.

Does ConsaInsights provide customized market report data for the expression Vectors industry?

Yes, ConsaInsights offers customized market report data for the expression-vectors industry, tailored to meet specific client needs and research requirements.

What deliverables can I expect from this expression Vectors market research project?

Deliverables from the expression-vectors market research project include comprehensive market analysis reports, segment data, growth forecasts, competitive landscape assessments, and actionable insights.

What are the market trends of expression Vectors?

Current trends in the expression vectors market include the rise of plasmid vectors, advancements in viral vector technology, increased focus on gene therapy and vaccine development, and significant research investments.