Exterior Insulation And Finish System Eifs Market Report

Published Date: 22 January 2026 | Report Code: exterior-insulation-and-finish-system-eifs

Exterior Insulation And Finish System Eifs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Exterior Insulation And Finish System (EIFS) market, highlighting trends, regional insights, and future forecasts from 2023 to 2033.

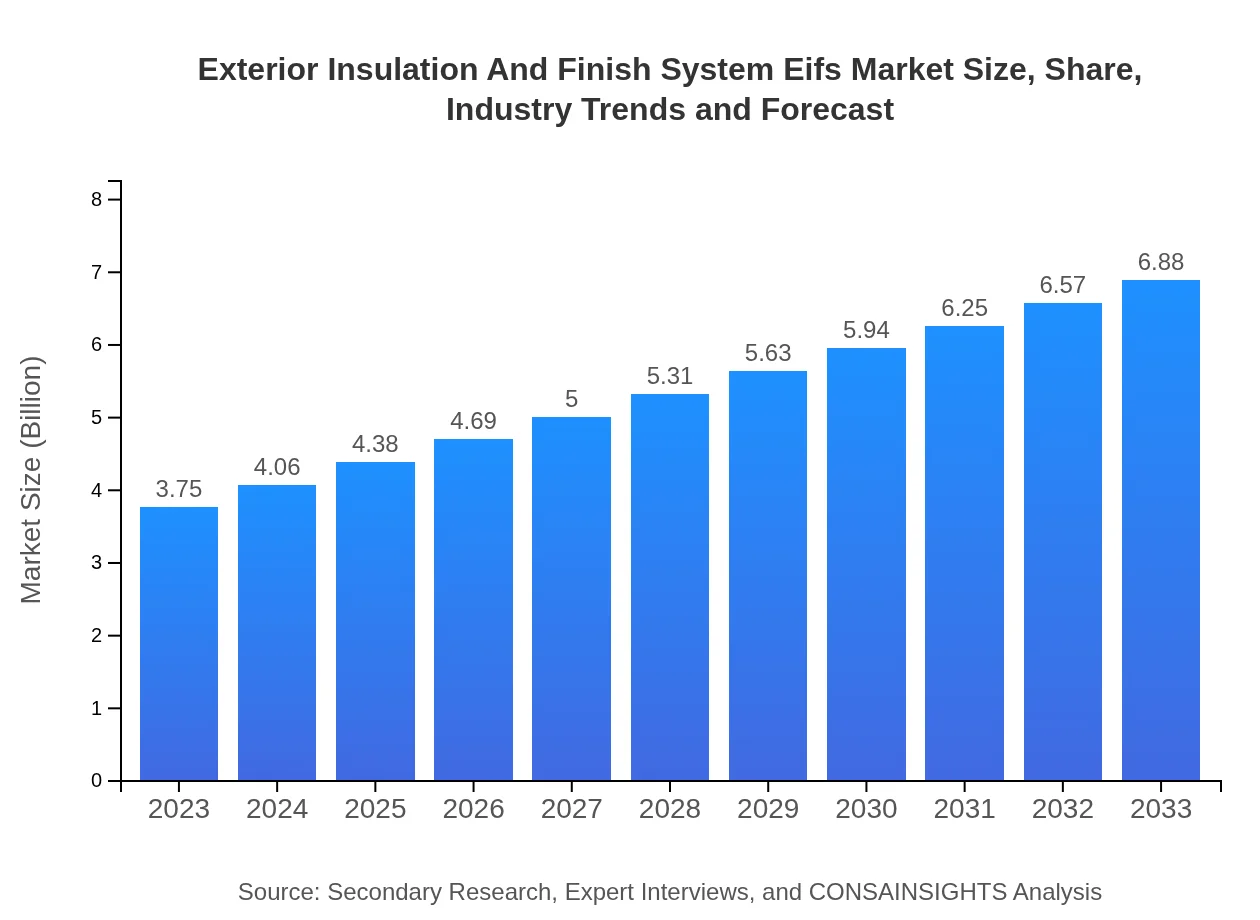

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.75 Billion |

| CAGR (2023-2033) | 6.1% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Sto Corp, Sika AG, BASF SE, ACI Building Systems |

| Last Modified Date | 22 January 2026 |

Exterior Insulation And Finish System Eifs Market Overview

Customize Exterior Insulation And Finish System Eifs Market Report market research report

- ✔ Get in-depth analysis of Exterior Insulation And Finish System Eifs market size, growth, and forecasts.

- ✔ Understand Exterior Insulation And Finish System Eifs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Exterior Insulation And Finish System Eifs

What is the Market Size & CAGR of Exterior Insulation And Finish System Eifs market in 2023?

Exterior Insulation And Finish System Eifs Industry Analysis

Exterior Insulation And Finish System Eifs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

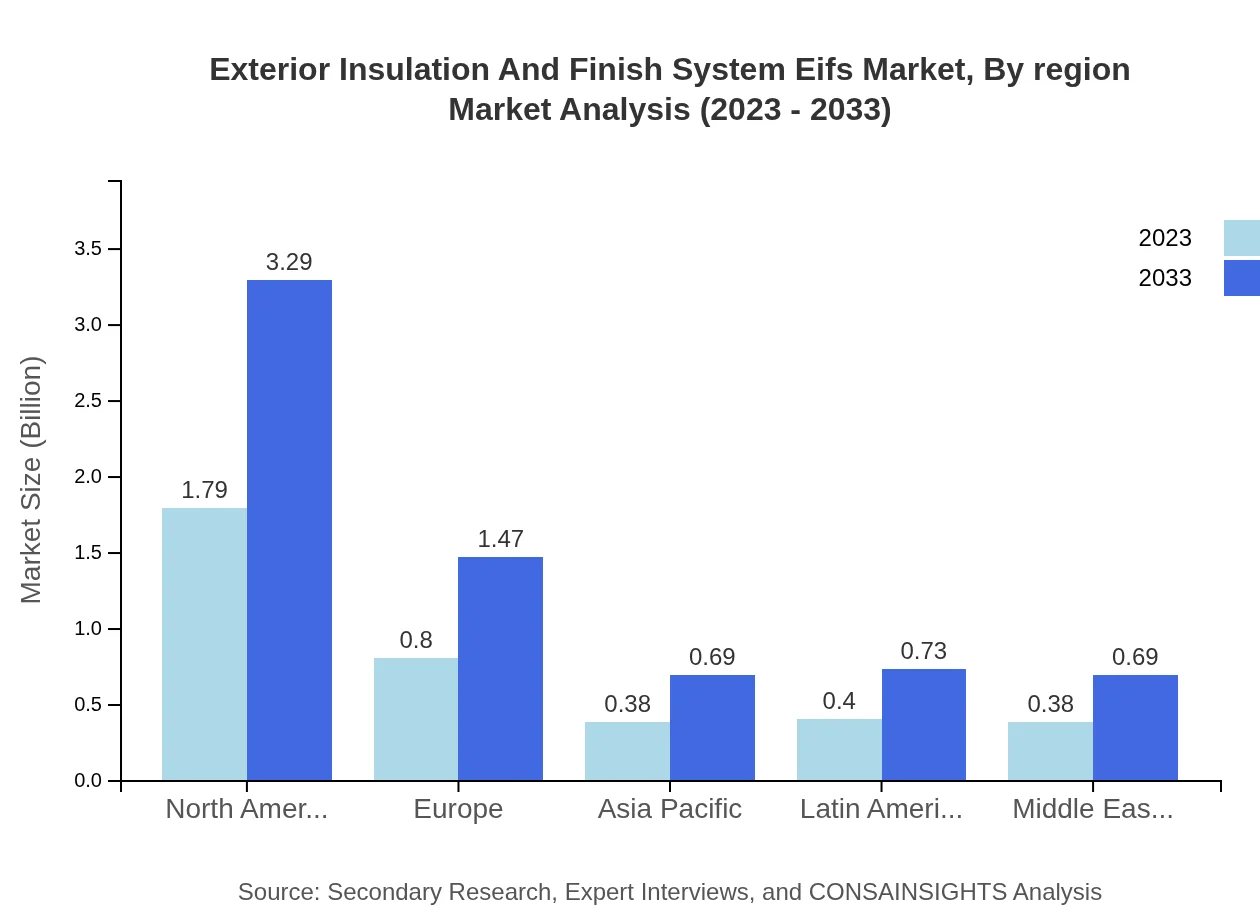

Exterior Insulation And Finish System Eifs Market Analysis Report by Region

Europe Exterior Insulation And Finish System Eifs Market Report:

Europe's EIFS market will grow from $0.95 billion in 2023 to $1.74 billion in 2033. Key regions such as Germany and France are implementing rigorous energy conservation strategies, influencing a preference for EIFS in both residential and commercial projects.Asia Pacific Exterior Insulation And Finish System Eifs Market Report:

In Asia Pacific, the EIFS market is projected to grow from $0.77 billion in 2023 to $1.42 billion by 2033. The growth is fueled by rapid urbanization, government initiatives promoting energy-efficient buildings, and a rising middle-class population. Countries like China and India are expected to dominate the market due to their significant construction activities.North America Exterior Insulation And Finish System Eifs Market Report:

North America is a driving force in the EIFS market, with a size increase from $1.38 billion in 2023 to $2.53 billion by 2033. The U.S. leads this growth, supported by stringent building codes driving energy efficiency projects and a shift towards sustainable building practices.South America Exterior Insulation And Finish System Eifs Market Report:

The South American EIFS market is anticipated to expand from $0.30 billion in 2023 to $0.56 billion by 2033. Brazil and Argentina are leading the charge, leveraging governmental policies to enhance energy efficiency in residential and commercial buildings as infrastructure development continues to gain momentum.Middle East & Africa Exterior Insulation And Finish System Eifs Market Report:

The Middle East and Africa demonstrate a promising growth trajectory, increasing from $0.35 billion in 2023 to $0.64 billion by 2033. Driven by infrastructural expansions and a focus on green buildings, markets in UAE and South Africa are leading the adoption of EIFS technologies.Tell us your focus area and get a customized research report.

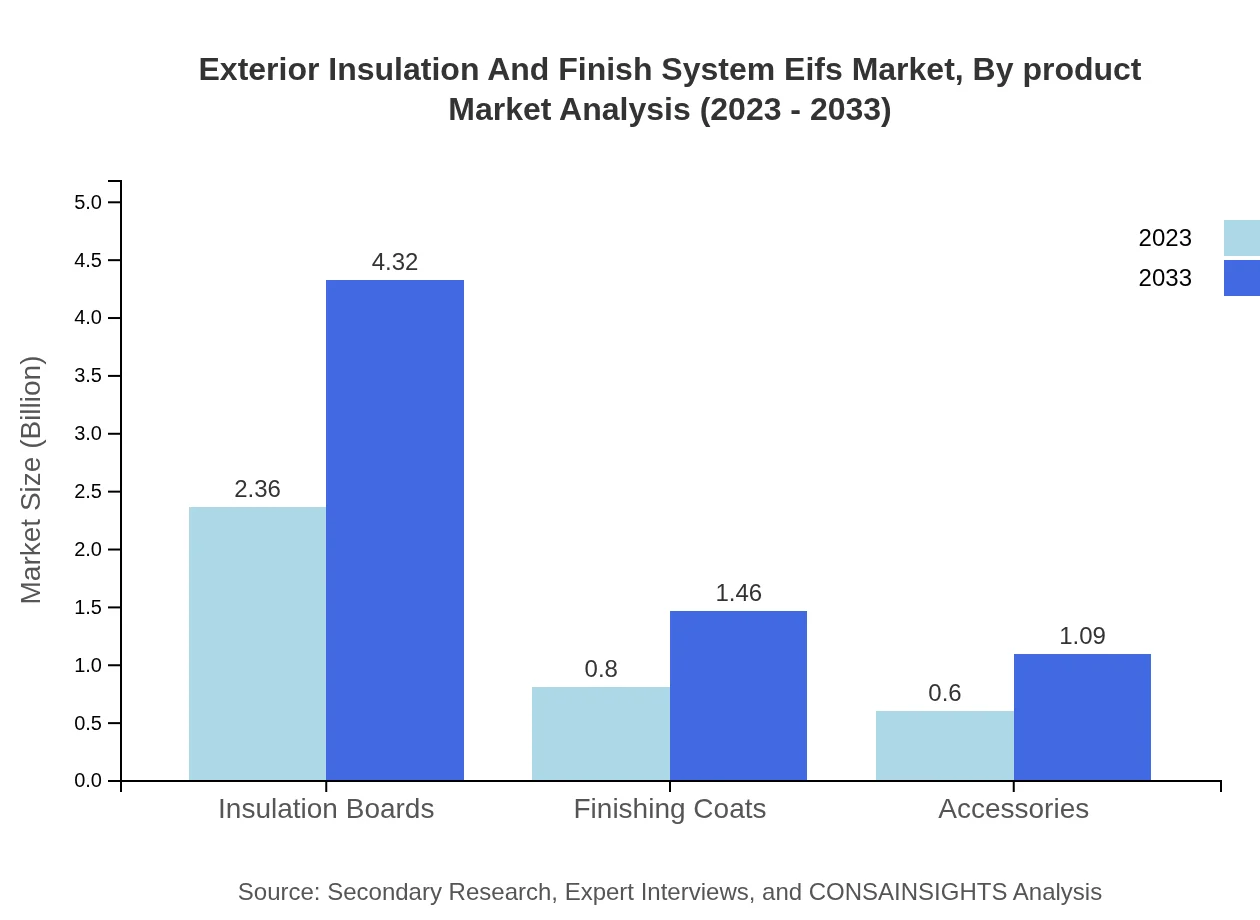

Exterior Insulation And Finish System Eifs Market Analysis By Product

The EIFS market is significantly influenced by product types such as insulation boards, finishing coats, and accessories. In 2023, insulation boards dominated the market with a size of $2.36 billion, holding 62.82% of the market share. This segment is projected to reach $4.32 billion by 2033. Finishing coats followed, with a 21.29% share and a growth forecast from $0.80 billion to $1.46 billion over the same period, while accessories accounted for 15.89%, moving from $0.60 billion to $1.09 billion.

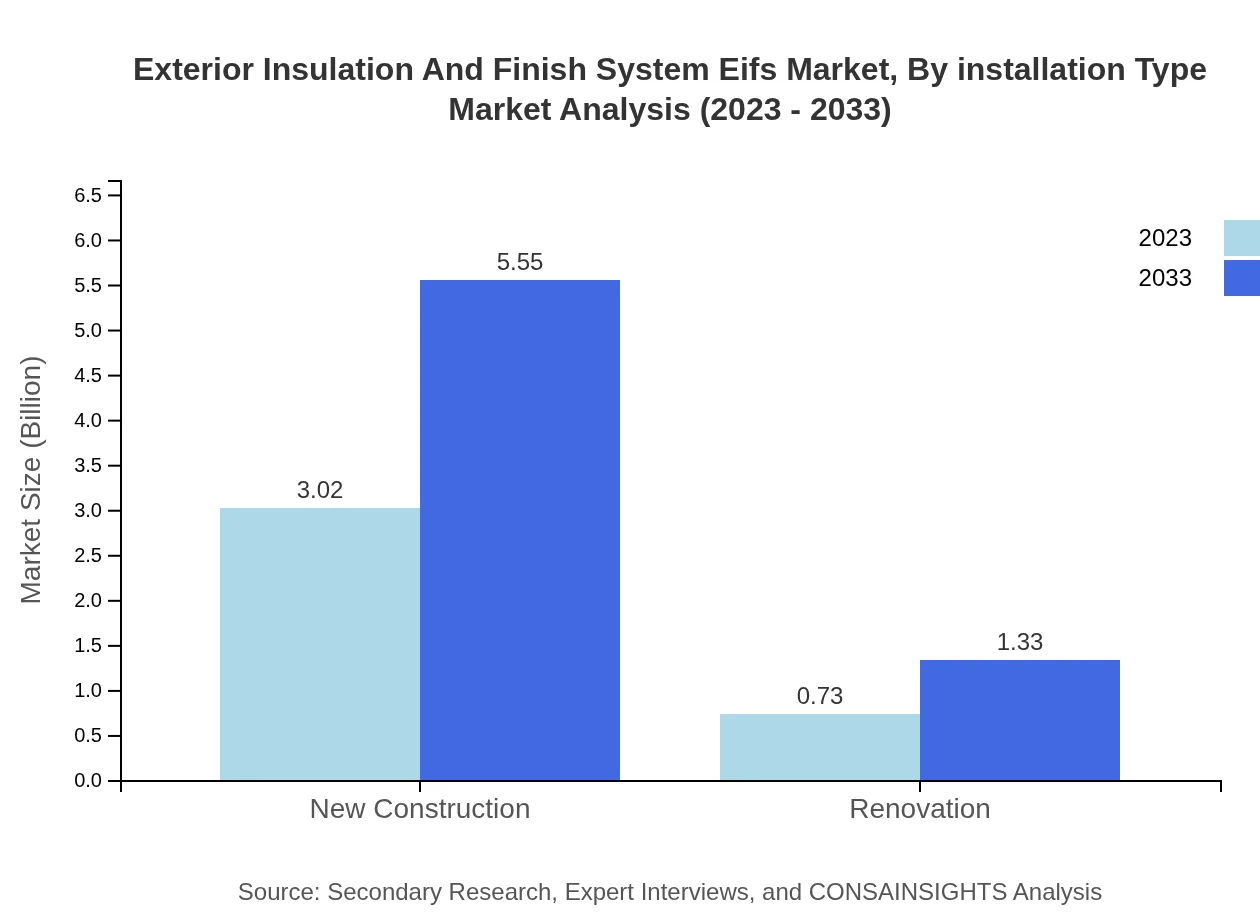

Exterior Insulation And Finish System Eifs Market Analysis By Installation Type

The EIFS market can also be segmented by installation type, categorized into new construction and renovation. New construction projects comprise the majority market share of 80.61%, valued at $3.02 billion in 2023 and expected to rise to $5.55 billion by 2033. Renovation projects, though smaller at 19.39% with a market size of $0.73 billion in 2023, are anticipated to grow to $1.33 billion, reflecting increasing investment in the retrofit of existing buildings.

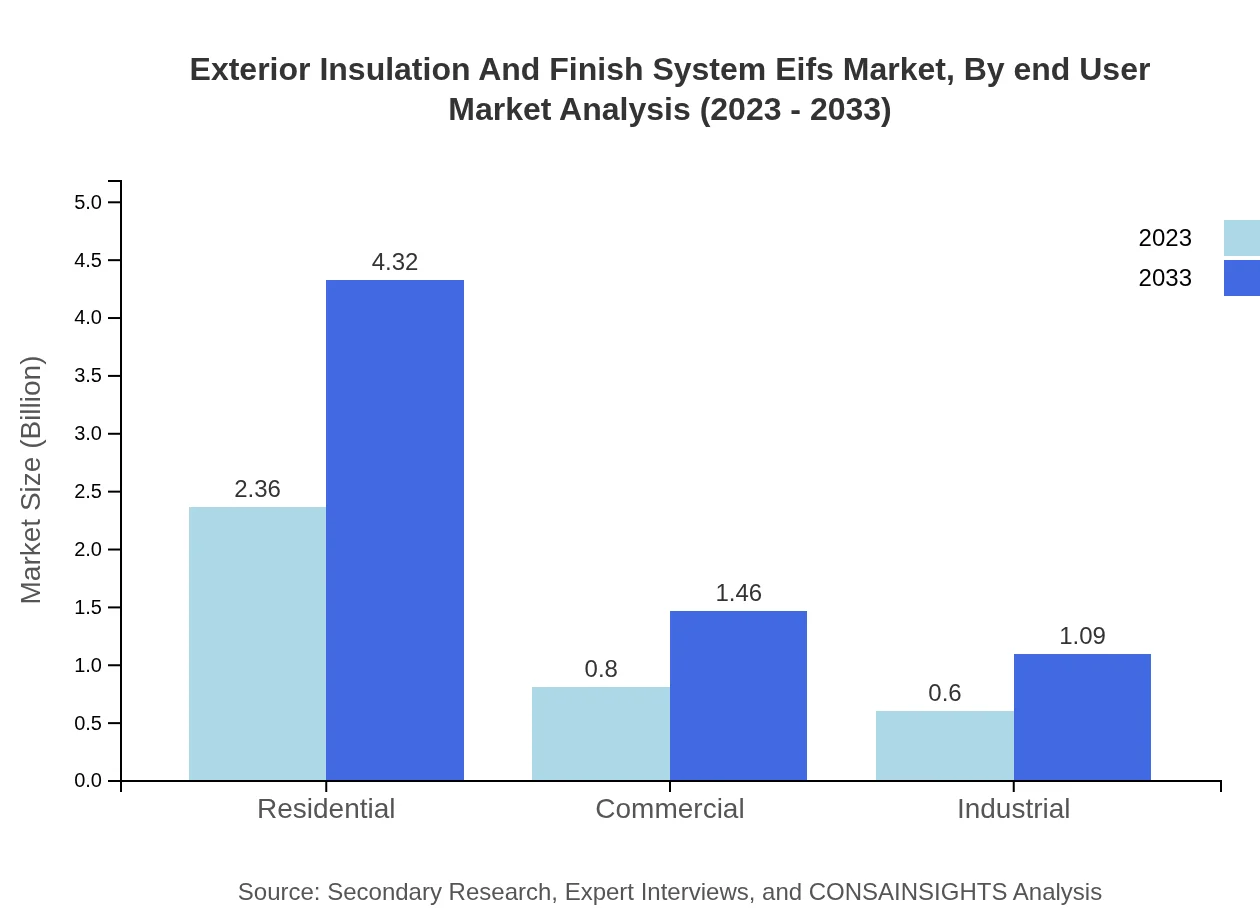

Exterior Insulation And Finish System Eifs Market Analysis By End User

The EIFS market observes significant variations across end-user segments. In 2023, the residential segment led with a market size of $2.36 billion (62.82% share), predicted to grow to $4.32 billion by 2033. The commercial end-user segment captures a 21.29% share, starting at $0.80 billion in 2023 and ending at $1.46 billion. The industrial segment, though smaller at a 15.89% share, is notable for its growth potential, expanding from $0.60 billion to $1.09 billion.

Exterior Insulation And Finish System Eifs Market Analysis By Region

As detailed earlier, the regional analysis highlights North America's leading market position, anticipated to grow significantly. Europe follows, focusing on energy efficiency, while Asia Pacific's rapid urbanization accelerates its EIFS adoption. South America's construction growth and the Middle East and Africa’s focus on sustainable buildings are vital for market progress.

Exterior Insulation And Finish System Eifs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Exterior Insulation And Finish System Eifs Industry

Sto Corp:

Sto Corp is a significant player in the EIFS market, renowned for its innovative and energy-efficient insulation solutions that enhance building aesthetics and performance.Sika AG:

Sika AG offers a wide range of high-quality EIFS products and solutions, focusing on sustainability and advanced construction techniques to meet evolving market demands.BASF SE:

BASF SE delivers a comprehensive portfolio of construction chemicals and EIFS solutions, emphasizing energy efficiency and durability in building applications.ACI Building Systems:

ACI Building Systems specializes in customized EIFS and offers advanced solutions aimed at maximizing thermal performance and aesthetic appeal.We're grateful to work with incredible clients.

FAQs

What is the market size of exterior Insulation And Finish System Eifs?

The Exterior Insulation and Finish System (EIFS) market is valued at approximately $3.75 billion in 2023. With a projected CAGR of 6.1%, the market is expected to grow significantly, driven by increasing demand and technological advancements.

What are the key market players or companies in this exterior Insulation And Finish System Eifs industry?

Key players in the EIFS industry include leading manufacturers such as BASF, Saint-Gobain, Dryvit Systems, Sto Corp, and Sika AG. These companies are recognized for their innovative solutions and extensive market reach, contributing to the overall market growth.

What are the primary factors driving the growth in the exterior Insulation And Finish System Eifs industry?

Primary growth drivers include rising demand for energy-efficient building solutions, increasing construction activities globally, and the push for sustainable building materials. Additionally, innovations in EIFS technology enhance insulation properties, further fueling market expansion.

Which region is the fastest Growing in the exterior Insulation And Finish System Eifs?

The North American region exhibits the fastest growth in the EIFS market, with a market size projected to increase from $1.38 billion in 2023 to $2.53 billion by 2033. Factors include urbanization and stringent building codes advocating for energy efficiency.

Does ConsaInsights provide customized market report data for the exterior Insulation And Finish System Eifs industry?

Yes, ConsaInsights offers tailored market reports for the EIFS industry. These customized reports provide in-depth insights, including specific geographical data, market trends, and segment analysis to cater to unique business needs.

What deliverables can I expect from this exterior Insulation And Finish System Eifs market research project?

Expected deliverables include comprehensive market analysis, segmented data, trend forecasts, and competitive landscape assessments. Additionally, clients receive actionable insights to inform strategic decisions and investment planning in the EIFS domain.

What are the market trends of exterior Insulation And Finish System Eifs?

Current trends in the EIFS market include a shift towards greener construction practices, increased use of advanced materials, and integration of innovative insulation technologies. These trends aim to enhance energy efficiency and sustainability in building design.