External Fixators Market Report

Published Date: 31 January 2026 | Report Code: external-fixators

External Fixators Market Size, Share, Industry Trends and Forecast to 2033

This report presents an in-depth analysis of the External Fixators market, covering its growth dynamics, trends, and forecasts from 2023 to 2033. Insights include market size, segmentation, regional analysis, and profiles of key industry players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

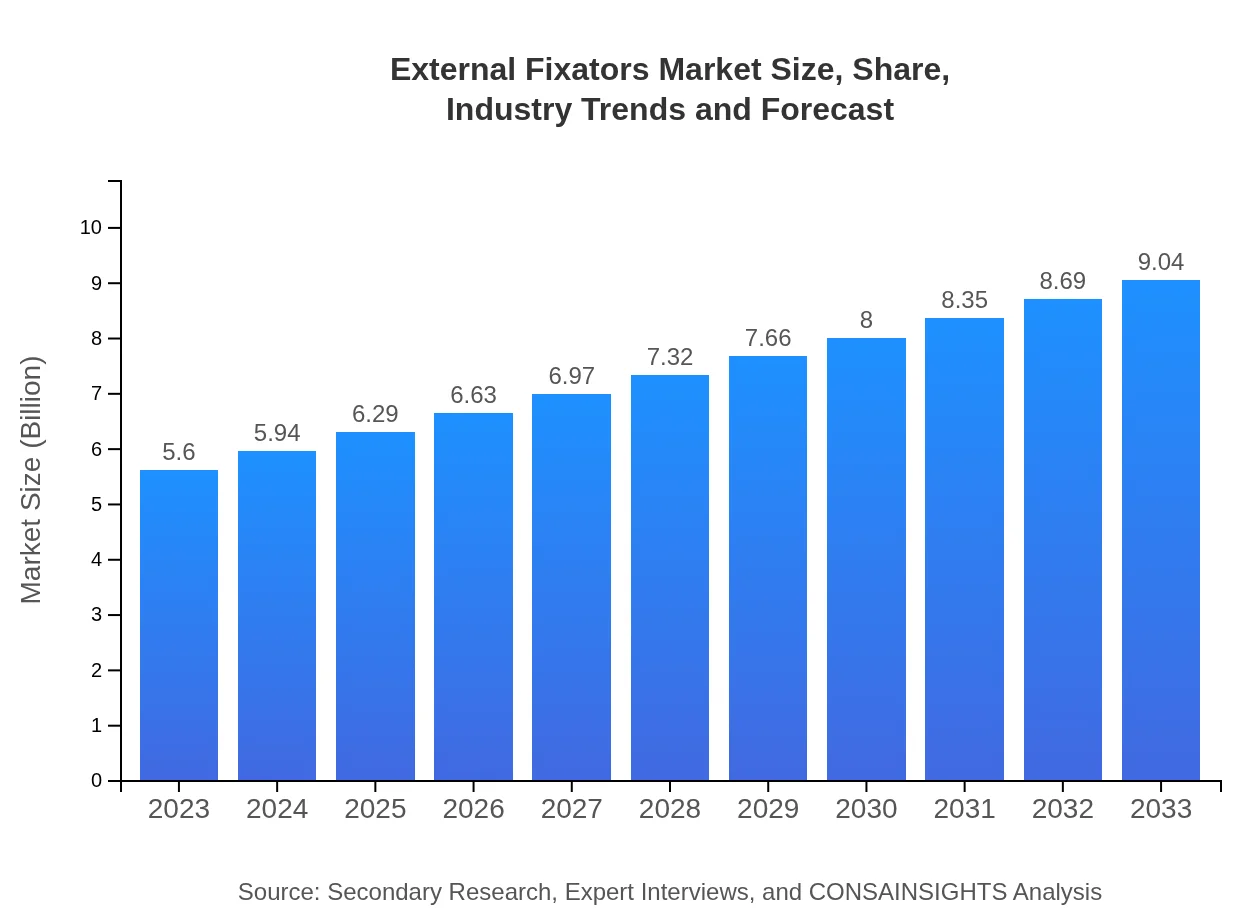

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $9.04 Billion |

| Top Companies | Stryker Corporation, DePuy Synthes, Zimmer Biomet, Smith & Nephew, Medtronic |

| Last Modified Date | 31 January 2026 |

External Fixators Market Overview

Customize External Fixators Market Report market research report

- ✔ Get in-depth analysis of External Fixators market size, growth, and forecasts.

- ✔ Understand External Fixators's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in External Fixators

What is the Market Size & CAGR of External Fixators market in 2023?

External Fixators Industry Analysis

External Fixators Market Segmentation and Scope

Tell us your focus area and get a customized research report.

External Fixators Market Analysis Report by Region

Europe External Fixators Market Report:

Europe's market, commencing at $1.94 billion in 2023, is forecasted to grow to $3.12 billion by 2033, fueled by a collaborative healthcare environment and increased government investments in medical technology.Asia Pacific External Fixators Market Report:

In the Asia-Pacific region, the External Fixators market is valued at approximately $1.05 billion in 2023, projected to reach $1.69 billion by 2033, growing due to expanding healthcare infrastructure and increasing surgical procedures.North America External Fixators Market Report:

Valued at $1.85 billion in 2023, the North American External Fixators market is anticipated to grow to $2.98 billion by 2033, driven by advanced healthcare technologies and a high incidence of orthopedic disorders.South America External Fixators Market Report:

The South American market starts at $0.03 billion in 2023, expected to rise to $0.05 billion by 2033, influenced by the gradual enhancement of healthcare services and rising adoption of orthopedic devices.Middle East & Africa External Fixators Market Report:

The Middle East and Africa market begins at $0.74 billion in 2023, climbing to $1.19 billion by 2033, as healthcare access and surgical services improve across various countries.Tell us your focus area and get a customized research report.

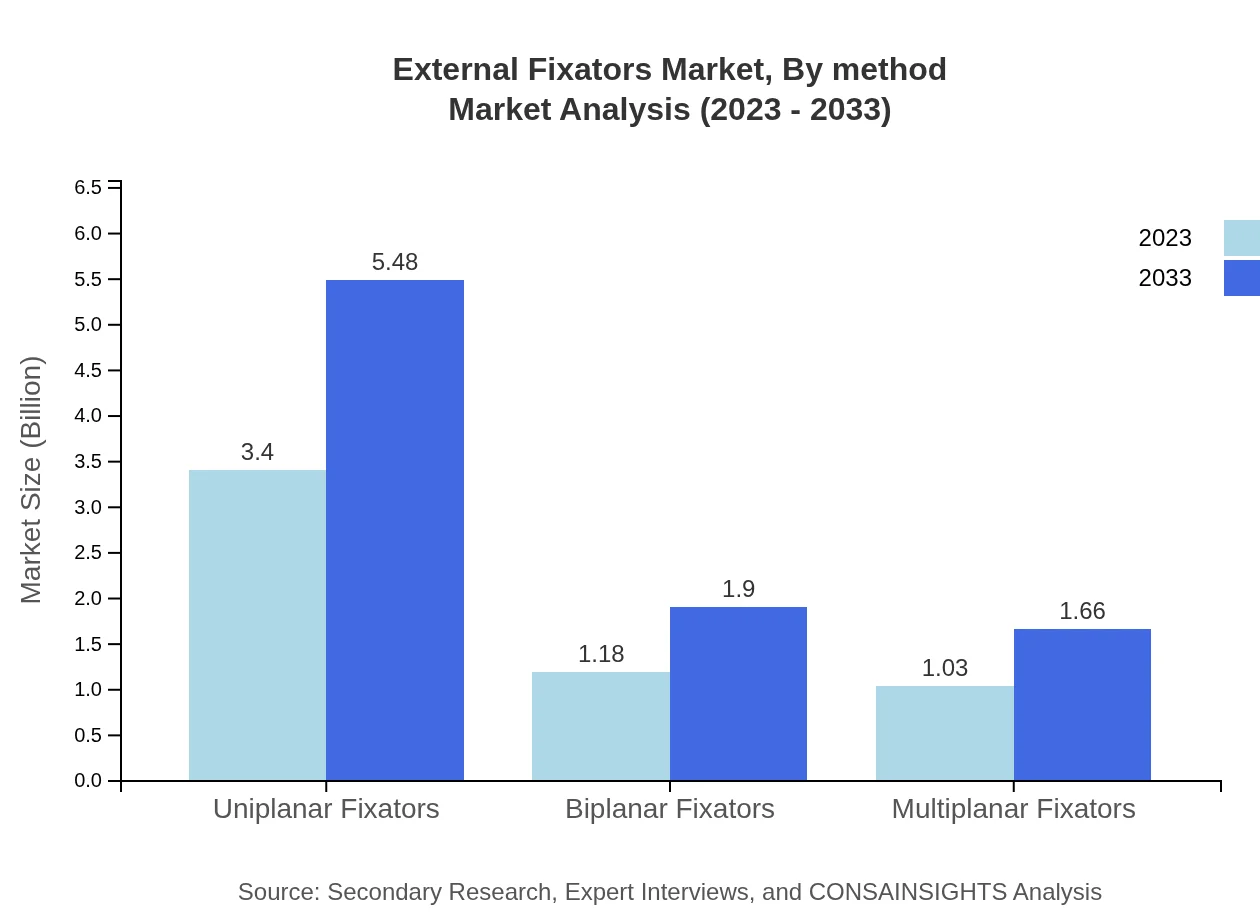

External Fixators Market Analysis By Method

The segment dominated by Uniplanar Fixators accounts for a significant share of the market. The market for Uniplanar Fixators is forecasted to grow from $3.40 billion in 2023 to $5.48 billion by 2033, signaling a steady demand in orthopedic applications. Biplanar Fixators and Multiplanar Fixators follow, expected to rise in popularity as surgical techniques evolve.

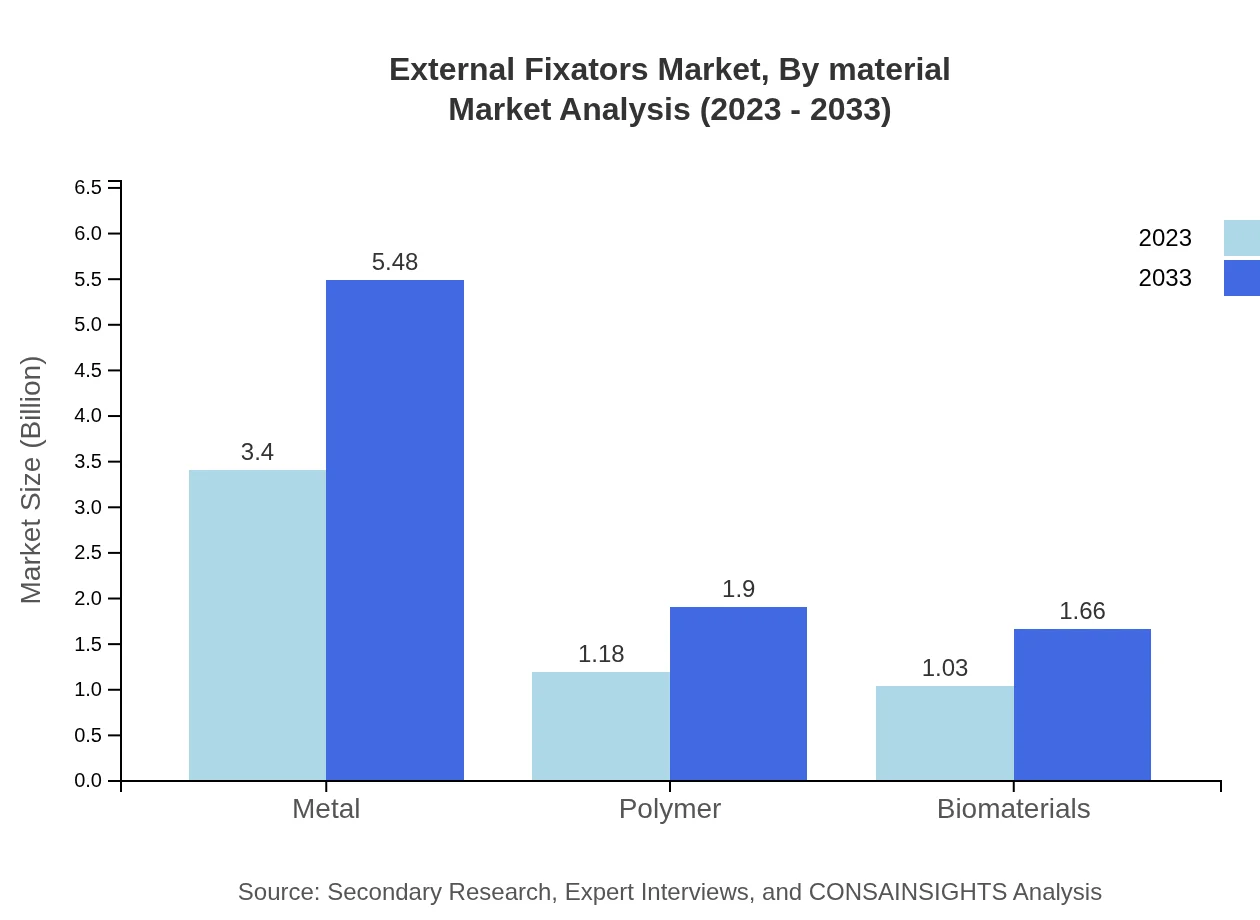

External Fixators Market Analysis By Material

Metal as a material leads the segment with expected revenues growing from $3.40 billion in 2023 to $5.48 billion by 2033, holding a notable market share due to durability and high performance. Polymer and biomaterials are also gaining traction, aimed at patients requiring lightweight and biocompatible options.

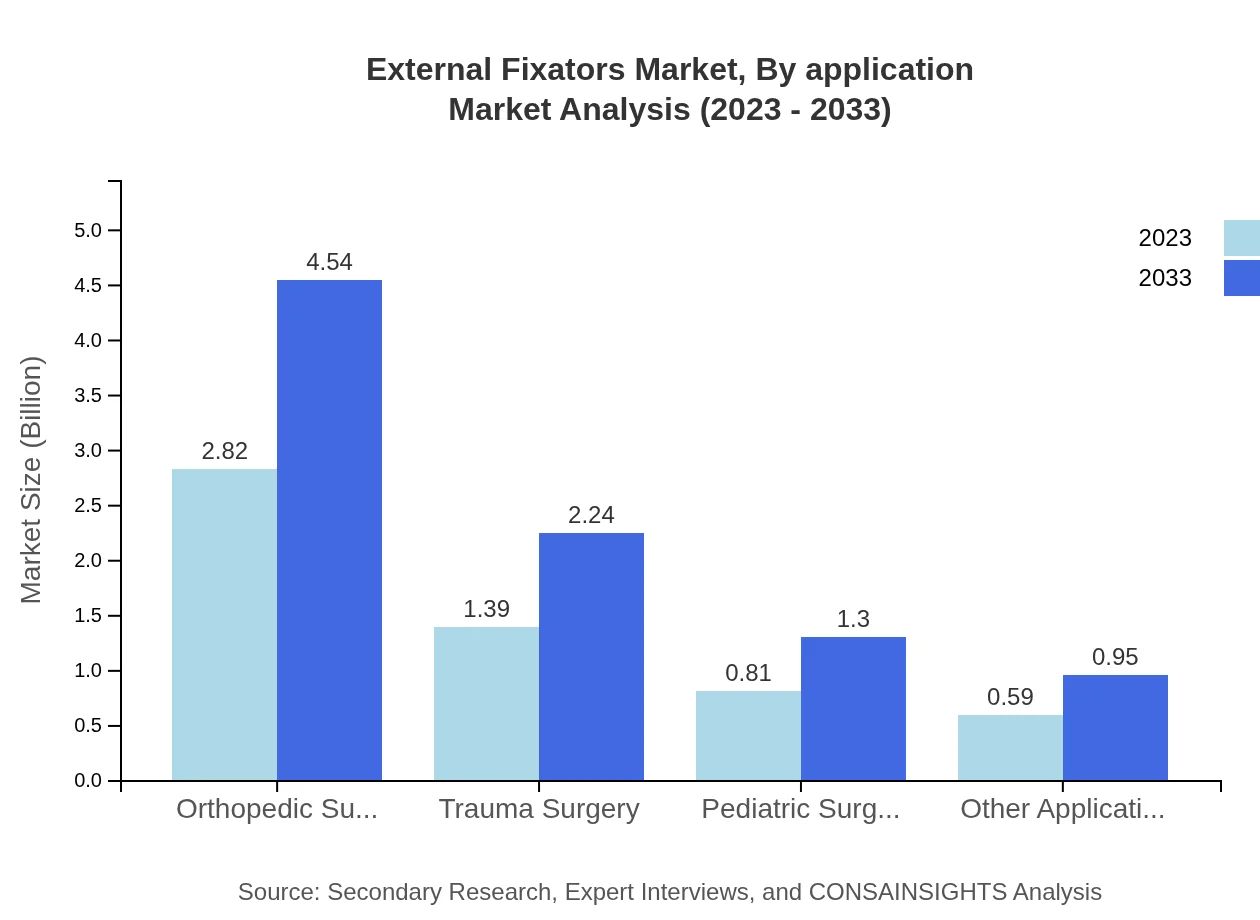

External Fixators Market Analysis By Application

The market by application predominantly features Orthopedic Surgery, which commands a strong share of approximately 50.28% in 2023, translating to $2.82 billion. Trauma Surgery follows closely, indicating a growing need as injury cases surge due to accidents and sports.

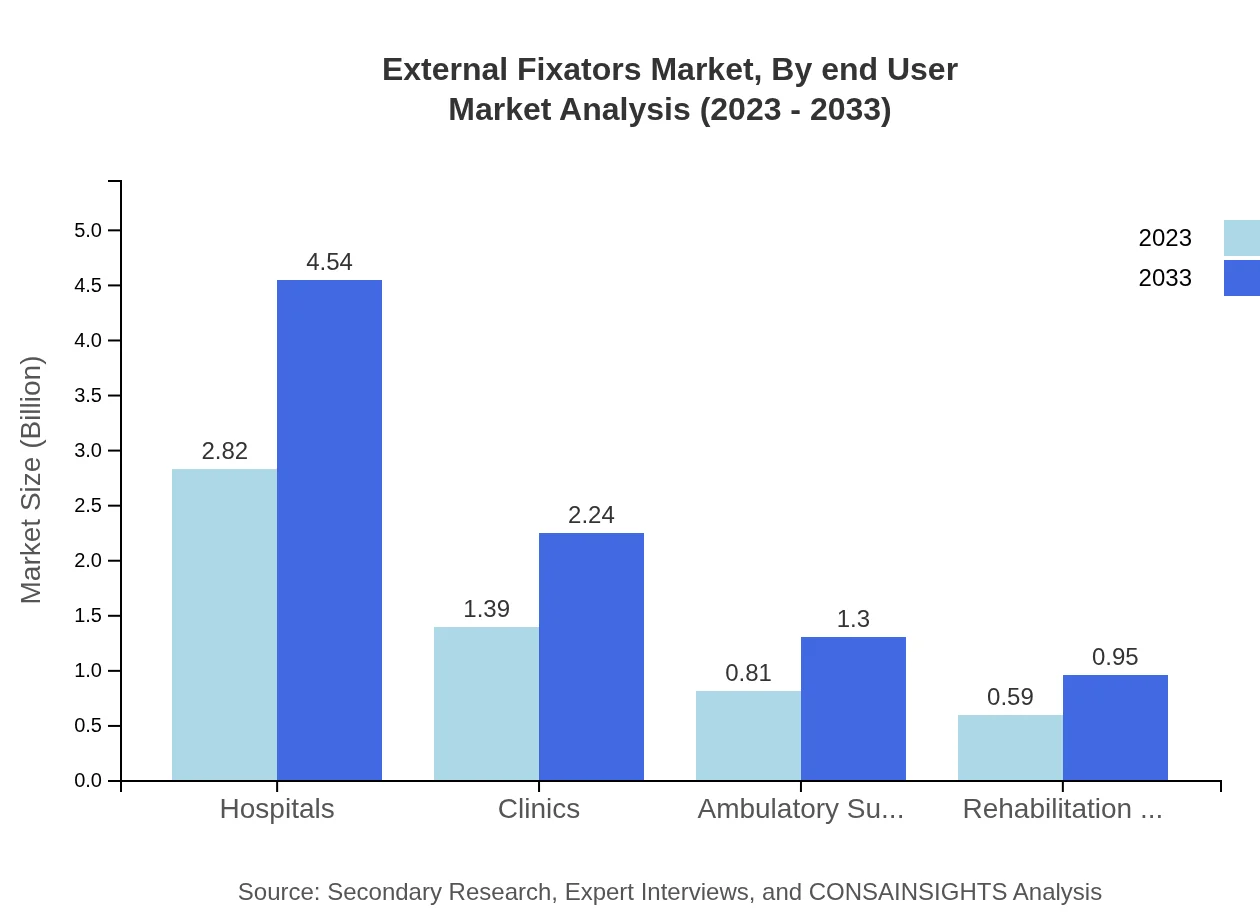

External Fixators Market Analysis By End User

Hospitals represent the largest segment in the end-user category, projected to rise from $2.82 billion in 2023 to $4.54 billion by 2033. This trend is supported by the growing volume of surgical procedures and the expansion of specialized orthopedic centers.

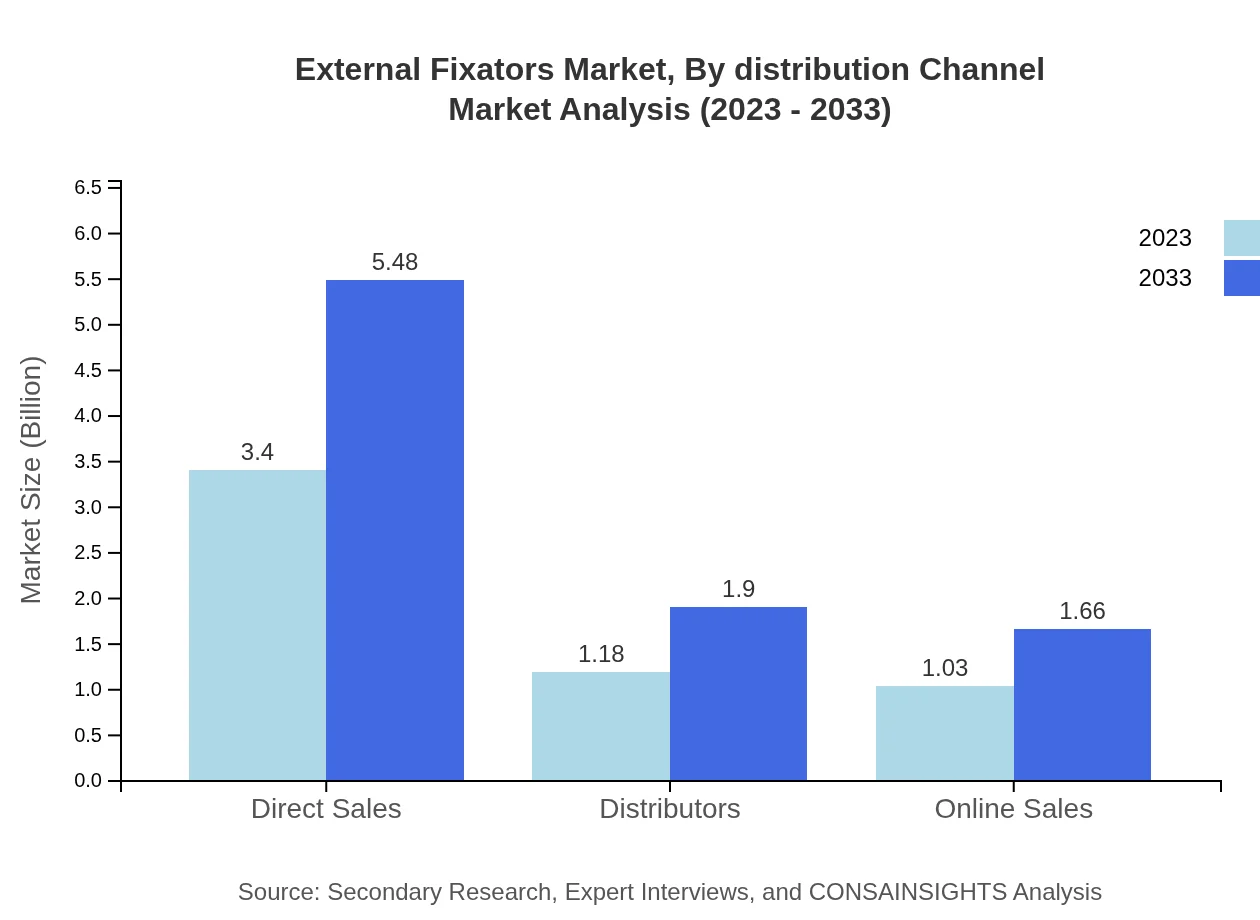

External Fixators Market Analysis By Distribution Channel

Direct sales channels dominate the market, giving companies significant reach, with growth expected from $3.40 billion in 2023 to $5.48 billion by 2033. Furthermore, online sales are anticipated to grow, transforming the purchasing landscape in the medical device industry.

External Fixators Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in External Fixators Industry

Stryker Corporation:

Stryker is a global leader in medical technologies, particularly in the orthopedic segment providing innovative external fixators and comprehensive surgical solutions.DePuy Synthes:

Part of Johnson & Johnson, DePuy Synthes specializes in orthopedic devices, offering a wide range of external fixators recognized for their quality and performance.Zimmer Biomet:

Zimmer Biomet develops and manufactures a range of orthopedic products including advanced external fixators that meet the needs of healthcare providers globally.Smith & Nephew:

Smith & Nephew offers innovative external fixation solutions, emphasizing the importance of patient care and surgical efficiency through its products.Medtronic :

Medtronic, a pioneer in the healthcare industry, provides external fixators with cutting-edge technology that enhances surgical outcomes and patient recovery.We're grateful to work with incredible clients.

FAQs

What is the market size of external fixators?

The global external fixators market is valued at approximately $5.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.8% through to 2033, reflecting its significant growth potential.

What are the key market players or companies in the external fixators industry?

Key players in the external fixators market include prominent companies such as Stryker Corporation, Smith & Nephew, Zimmer Biomet, and DePuy Synthes, which are pivotal for driving innovation and product development.

What are the primary factors driving the growth in the external fixators industry?

Growth in the external fixators industry is primarily driven by the increasing incidences of bone fractures, rising demand for orthopedic surgeries, and advancements in medical technology improving treatment effectiveness.

Which region is the fastest Growing in the external fixators market?

Asia Pacific is expected to be the fastest-growing region in the external fixators market, with a growth projection from $1.05 billion in 2023 to $1.69 billion by 2033, indicating a robust market expansion.

Does ConsaInsights provide customized market report data for the external fixators industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the external fixators industry, providing insights that align with individual business strategies and market conditions.

What deliverables can I expect from this external fixators market research project?

Deliverables from the external fixators market research project include comprehensive reports detailing market analysis, segment data, growth forecasts, and competitive landscapes specific to the industry.

What are the market trends of external fixators?

Key trends in the external fixators market include the rise in minimally invasive surgeries, focus on patient-centric designs, and increased adoption of biodegradable materials for improved outcomes.