Extruded Foods Market Report

Published Date: 31 January 2026 | Report Code: extruded-foods

Extruded Foods Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Extruded Foods market, detailing its current and future trends, market dynamics, segmentation, and geographical insights from 2023 to 2033.

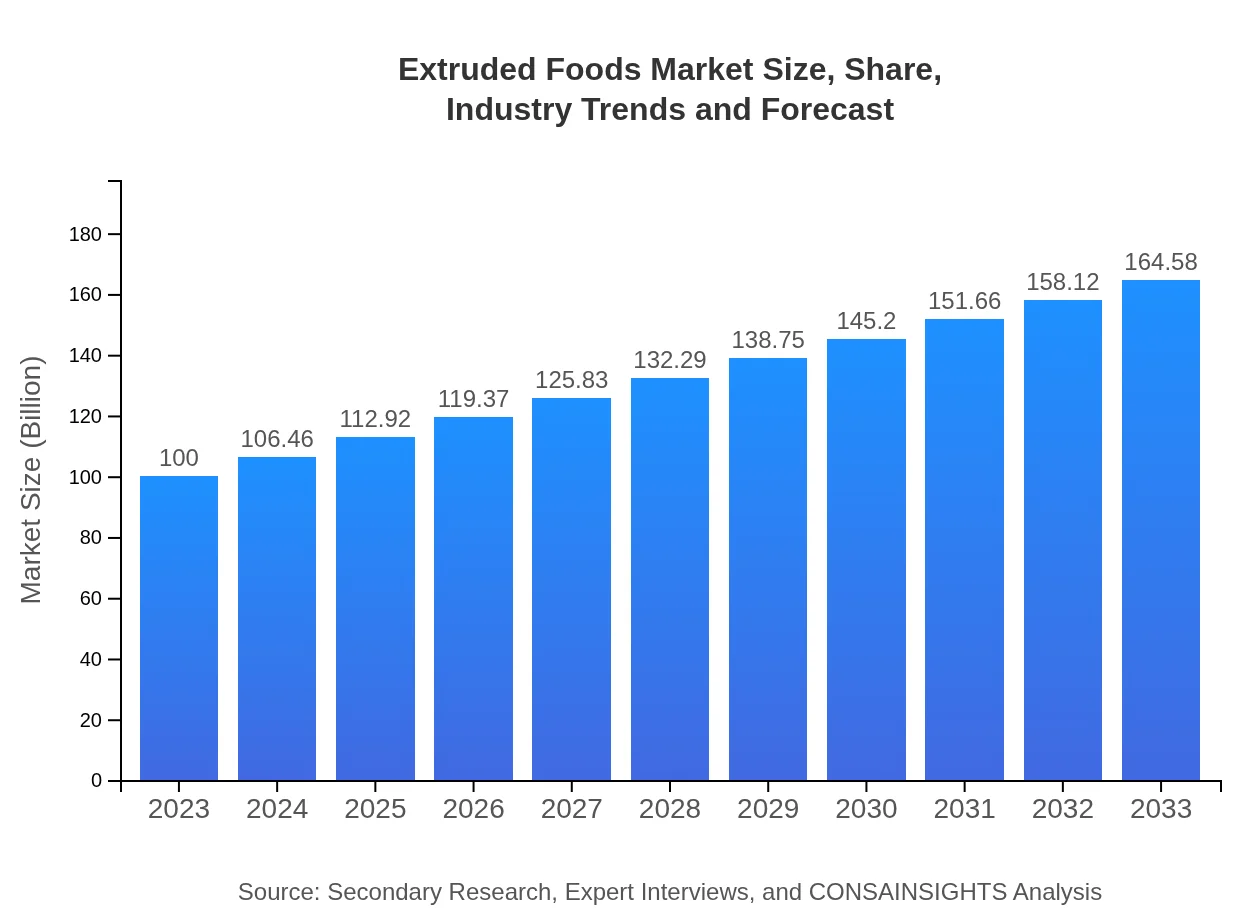

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | General Mills, PepsiCo, Kraft Heinz, Mars, Incorporated |

| Last Modified Date | 31 January 2026 |

Extruded Foods Market Overview

Customize Extruded Foods Market Report market research report

- ✔ Get in-depth analysis of Extruded Foods market size, growth, and forecasts.

- ✔ Understand Extruded Foods's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Extruded Foods

What is the Market Size & CAGR of Extruded Foods market in 2023?

Extruded Foods Industry Analysis

Extruded Foods Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Extruded Foods Market Analysis Report by Region

Europe Extruded Foods Market Report:

Europe's market, valued at approximately $31.00 billion in 2023, is projected to grow to $51.02 billion by 2033. An emphasis on sustainability and product quality drives innovations within the region. Increased consumption of extruded snacks and cereals positions Europe as a significant player.Asia Pacific Extruded Foods Market Report:

In the Asia Pacific region, the Extruded Foods market in 2023 was valued at approximately $19.46 billion, expected to rise to $32.03 billion by 2033. Key drivers include urbanization, rising disposable incomes, and demand for convenient food options. Innovations in processing technologies cater to local and international tastes, enhancing market growth.North America Extruded Foods Market Report:

North America shows a robust market with a value of $32.91 billion in 2023, expected to reach $54.16 billion by 2033. The demand for innovative and healthy snacks is rising, coupled with a growing focus on pet nutrition. The influence of e-commerce further propels retail opportunities.South America Extruded Foods Market Report:

The South American market, valued at around $5.05 billion in 2023, is projected to grow to $8.31 billion by 2033. This growth is attributed to increasing health awareness and a shift towards healthier snacks. Organic and natural extruded foods are gaining popularity among consumers in this region.Middle East & Africa Extruded Foods Market Report:

The Middle East and Africa market in 2023 was valued at around $11.58 billion, anticipated to grow to $19.06 billion by 2033. The rising demand for packaged foods and the youth segment's preference for snacks drive growth rates. Local ingredients and healthy options are becoming more prevalent in product formulations.Tell us your focus area and get a customized research report.

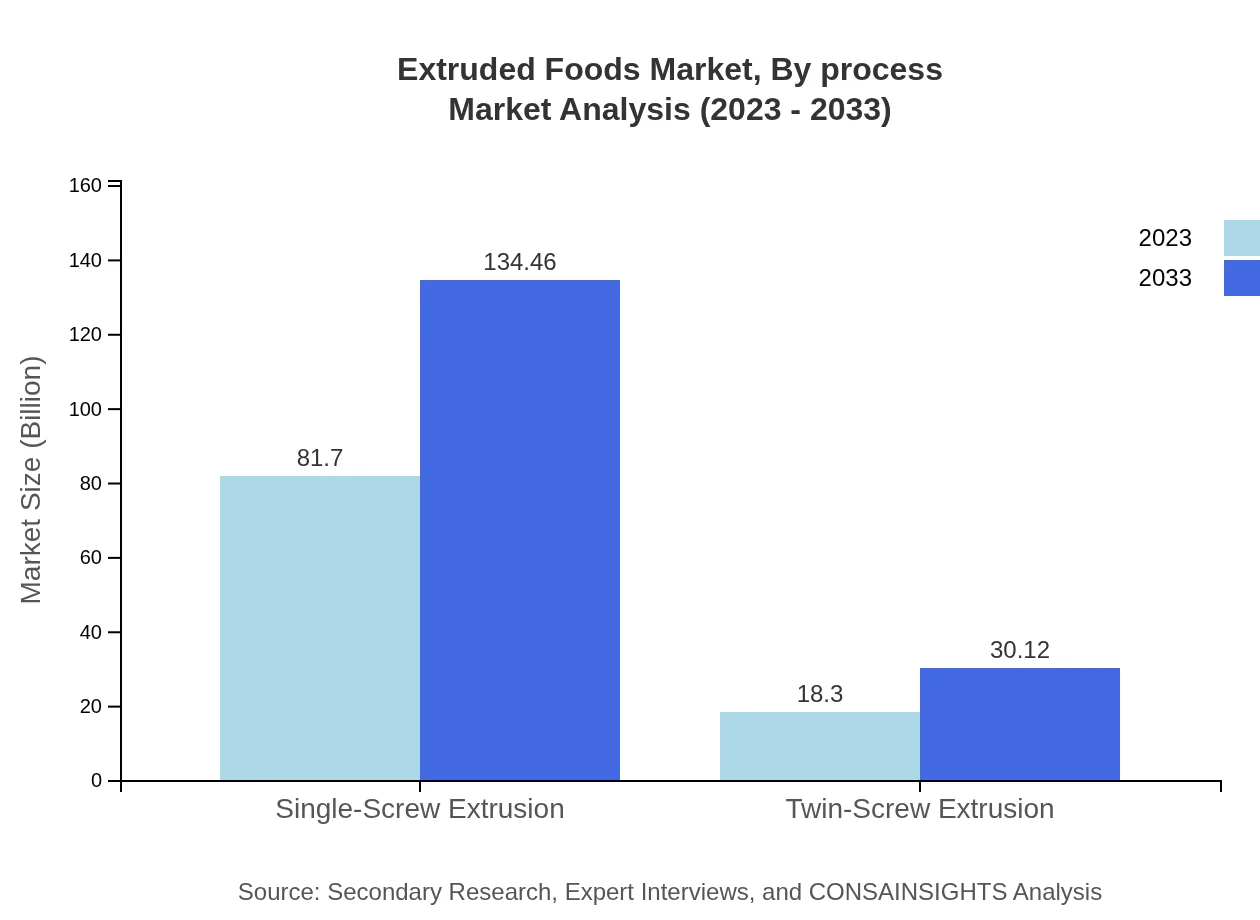

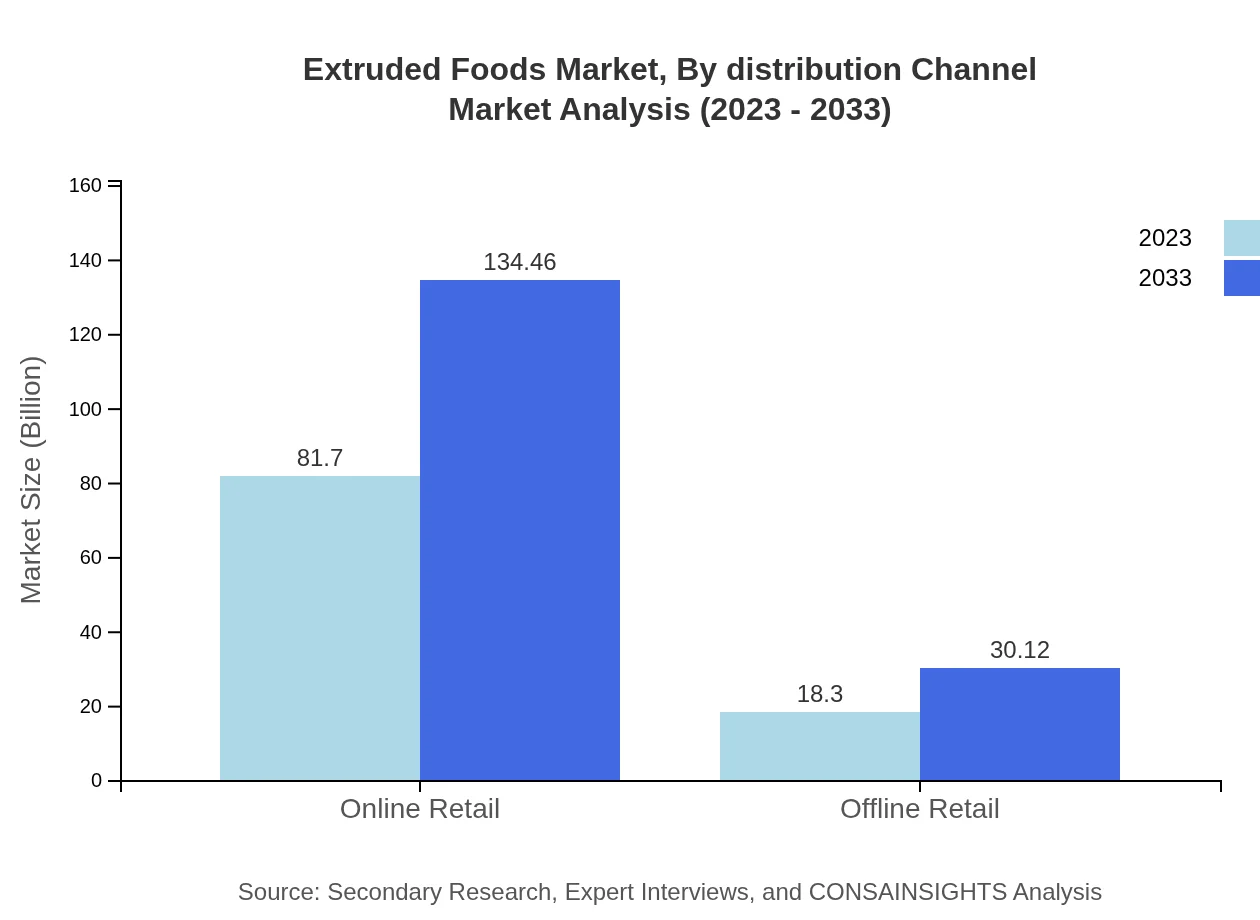

Extruded Foods Market Analysis By Product Type

The product types in the Extruded Foods market are diverse. The single-screw extrusion segment holds a substantial share, with a market size of $81.70 billion in 2023, projected to grow to $134.46 billion by 2033. In contrast, the twin-screw extrusion segment is expected to grow from $18.30 billion in 2023 to $30.12 billion by 2033. This highlights the flexibility and versatility in processing capabilities, catering to varied consumer preferences across product types.

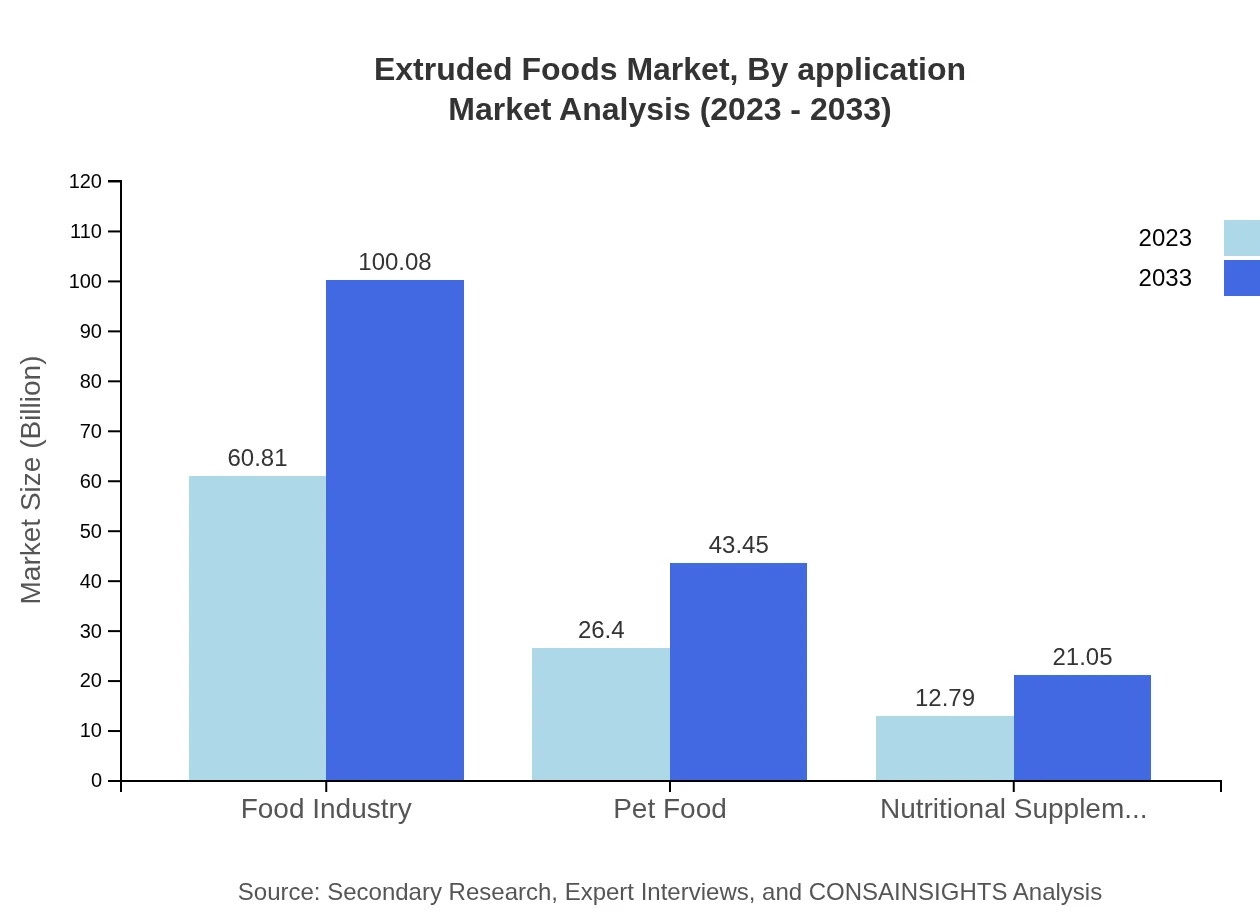

Extruded Foods Market Analysis By Application

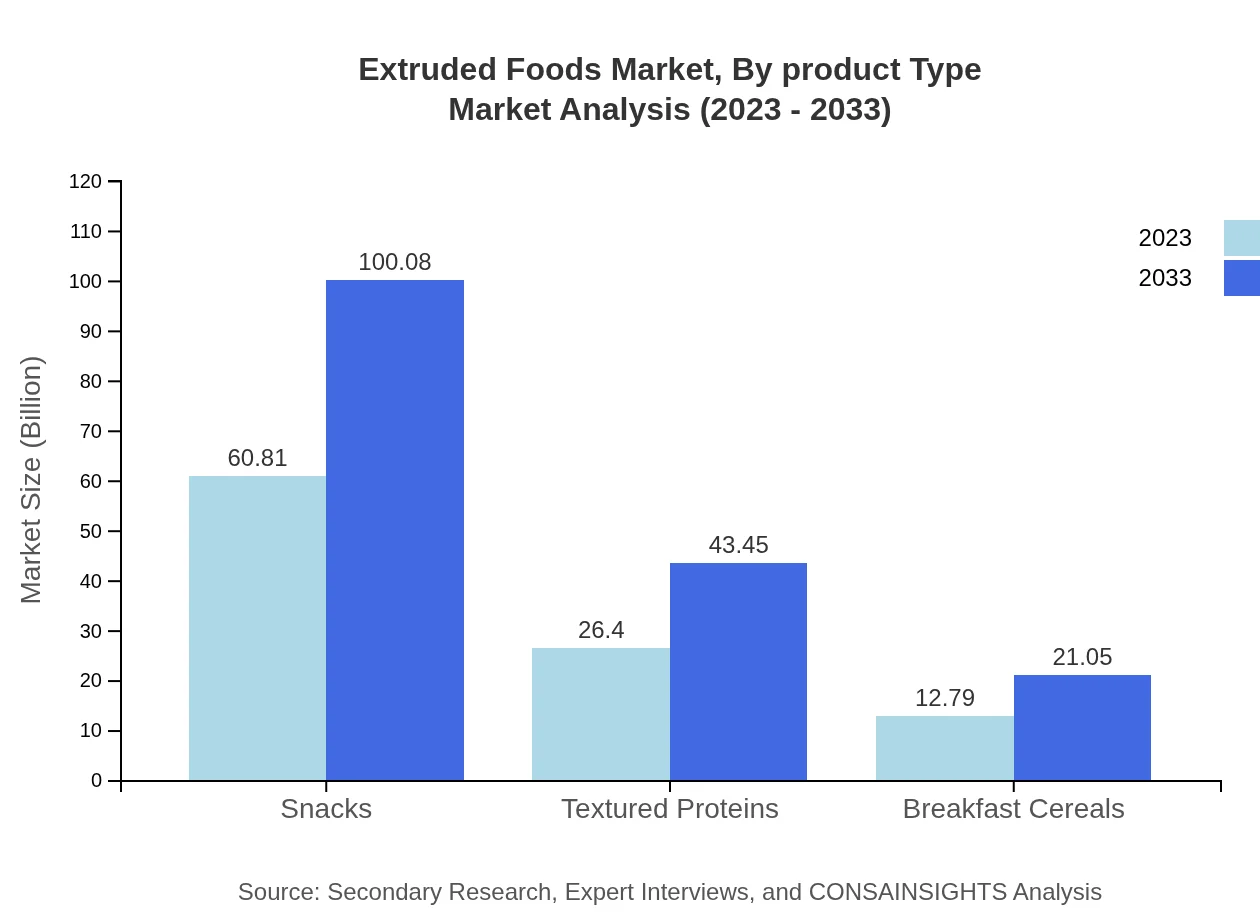

Applications of extruded foods include snacks, breakfast cereals, and pet food. Snacks lead the market, valued at $60.81 billion in 2023, expected to expand to $100.08 billion by 2033. The pet food sector, reflecting a growing trend towards specialized nutrition, is set to increase from $26.40 billion to $43.45 billion in the same period, indicating a rising trend toward health-conscious pet owners.

Extruded Foods Market Analysis By Process

The primary extrusion processes enriching the market are single-screw and twin-screw extrusion. Single-screw extrusion dominates the market with a projection of $81.70 billion in 2023, while twin-screw extrusion will grow to $30.12 billion by 2033. Both processes allow for customization in product features such as texture and nutritional enhancement.

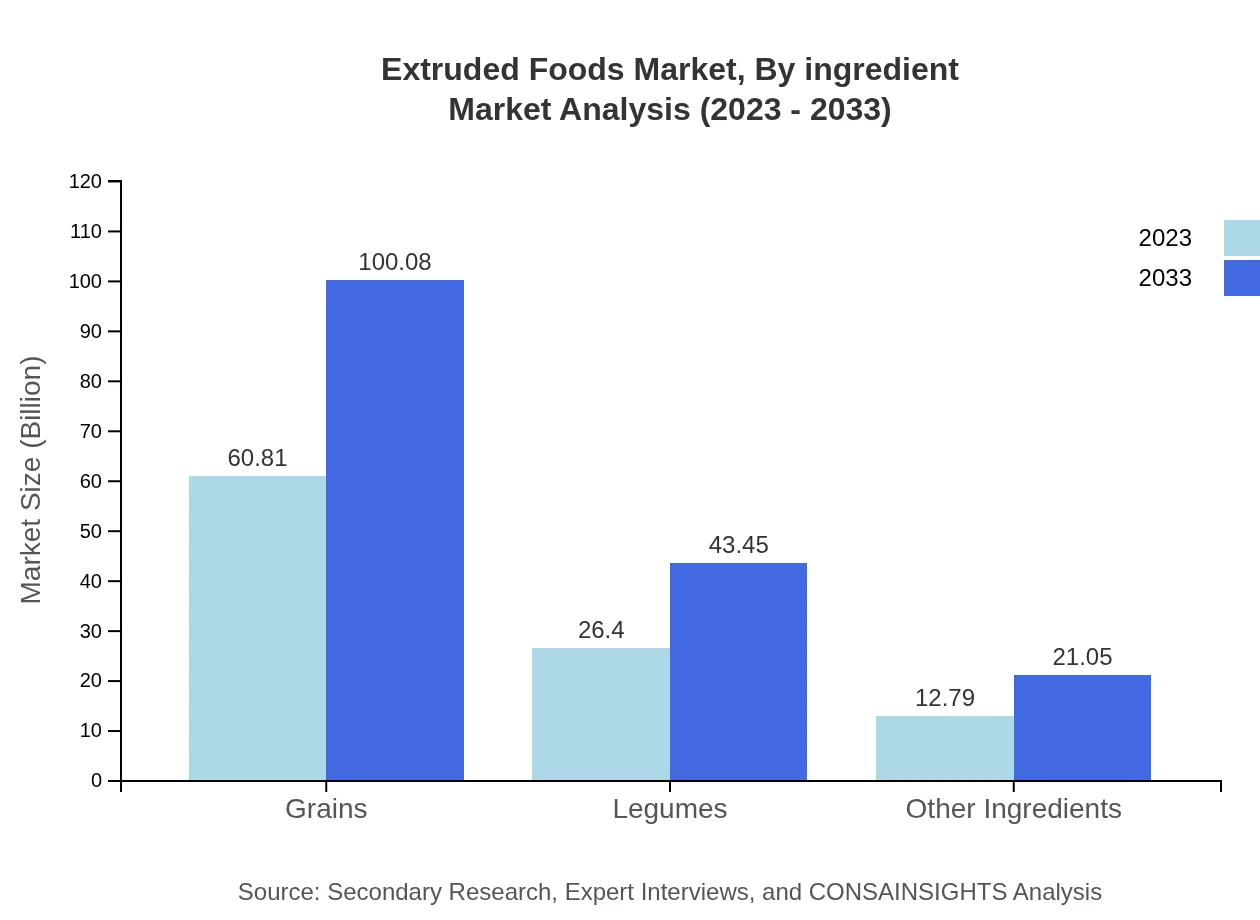

Extruded Foods Market Analysis By Ingredient

Grains form the largest segment within the extruded foods ingredient market, with a size of $60.81 billion in 2023, due to the high demand for healthy grains in snacks and breakfast products. Legumes are also gaining traction, expected to grow from $26.40 billion to $43.45 billion. The use of varied ingredients leads to the development of innovative products catering to diverse dietary needs.

Extruded Foods Market Analysis By Distribution Channel

The distribution landscape encompasses online and offline retail channels. The online retail sector has seen significant growth, estimated to reach $134.46 billion by 2033, due to the convenience offered to consumers. Conversely, offline retail maintains a substantial market at an expected growth to $30.12 billion, continuing to serve traditional retail environments.

Extruded Foods Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Extruded Foods Industry

General Mills:

A leading global food company known for its innovation in extruded cereals and snacks, catering to health-conscious consumers.PepsiCo:

One of the largest food and beverage companies globally, producing a range of extruded snacks under brands such as Doritos and Cheetos.Kraft Heinz:

A major player in the food industry targeting the extruded foods sector with a focus on health and convenience.Mars, Incorporated:

Known for its quality pet foods and extruded snack products, leveraging advanced food processing technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of Extruded Foods?

The global extruded foods market size is projected to reach $100 million by 2033, growing at a CAGR of 5%. In 2023, the market is valued at $100 million, expected to expand significantly in the coming decade.

What are the key market players or companies in the extruded foods industry?

Key players in the extruded foods industry include major food manufacturers and specialized extrusion companies. These companies are involved in producing various extruded products, including snacks, cereals, and pet foods, which dominate the market.

What are the primary factors driving the growth in the extruded foods industry?

The growth in the extruded foods industry is driven by increasing consumer demand for convenient food products, the rise in health-conscious eating habits, and innovations in extrusion technology that allow for diversified food applications.

Which region is the fastest Growing in the extruded foods market?

Among the regions, Europe is expected to be the fastest-growing market for extruded foods, with projected growth from $31.00 million in 2023 to $51.02 million by 2033, highlighting strong market potential.

Does ConsaInsights provide customized market report data for the extruded foods industry?

Yes, ConsaInsights offers tailored market reports on the extruded foods industry. These customized reports cater to specific research needs, providing detailed insights and data-driven conclusions to help make informed decisions.

What deliverables can I expect from this extruded foods market research project?

Deliverables from this market research project include comprehensive reports, market analysis, trend identification, competitor benchmarking, and insights on market segments, ensuring a thorough understanding of the extruded foods landscape.

What are the market trends of extruded foods?

Current market trends in the extruded foods sector include increasing innovation in flavors and ingredients, a shift towards healthy snacking options, and growing preference for online retail channels, reflecting consumer changes.