Extruders Market Report

Published Date: 22 January 2026 | Report Code: extruders

Extruders Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the extruders market, examining current trends, market size, and forecasts from 2023 to 2033. It includes insights on regional dynamics, technological advancements, market segmentation, and key players in the industry.

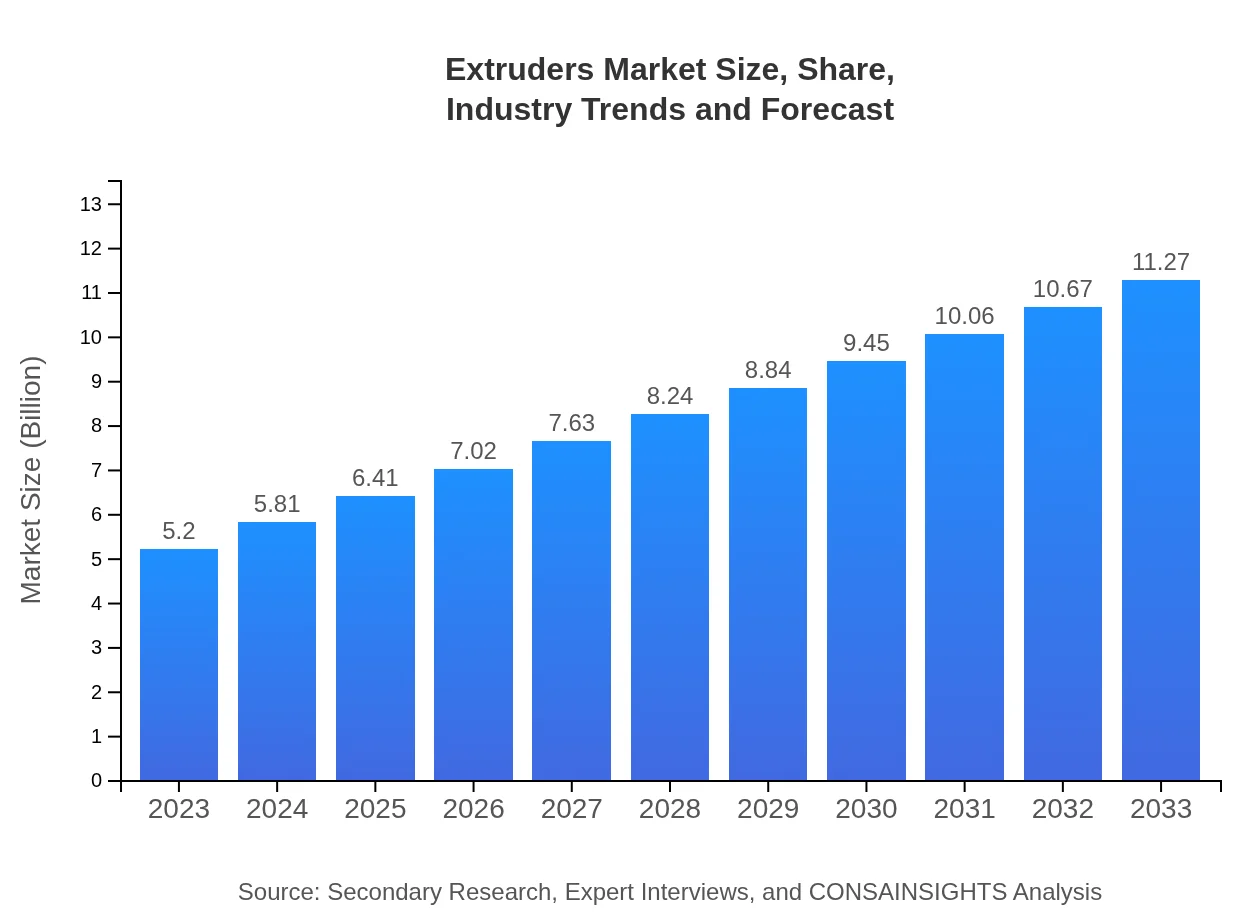

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $11.27 Billion |

| Top Companies | Haitian International Holdings Limited, Battenfeld-Cincinnati, KraussMaffei Group, Coperion GmbH, Mann+Hummel Group |

| Last Modified Date | 22 January 2026 |

Extruders Market Overview

Customize Extruders Market Report market research report

- ✔ Get in-depth analysis of Extruders market size, growth, and forecasts.

- ✔ Understand Extruders's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Extruders

What is the Market Size & CAGR of Extruders market in 2023?

Extruders Industry Analysis

Extruders Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Extruders Market Analysis Report by Region

Europe Extruders Market Report:

Europe's extruders market, valued at $1.47 billion in 2023, is projected to grow to $3.19 billion by 2033. The region's focus on innovation, coupled with stringent regulations on production processes, enhances demand for high-quality extruded products.Asia Pacific Extruders Market Report:

In 2023, the Asia Pacific extruders market is valued at $0.98 billion, anticipated to increase to $2.13 billion by 2033. This growth is fueled by rising industrialization and urbanization in countries like China and India. The demand for polymer products across various sectors is significantly boosting the market.North America Extruders Market Report:

North America is experiencing robust market growth, with an estimated market size of $1.97 billion in 2023, expected to reach $4.27 billion by 2033. The region's commitment to advanced manufacturing technologies and sustainable practices significantly supports market expansion.South America Extruders Market Report:

The South American extruders market is valued at $0.12 billion in 2023, with projections indicating $0.25 billion by 2033. This growth, while slower compared to other regions, is driven by a burgeoning food processing sector and increasing innovation in plastics technology.Middle East & Africa Extruders Market Report:

Currently valued at $0.66 billion in 2023, the Middle East and Africa market is forecasted to grow to $1.42 billion by 2033. This growth is driven by investments in infrastructure and increasing demand for high-performance materials across various industries.Tell us your focus area and get a customized research report.

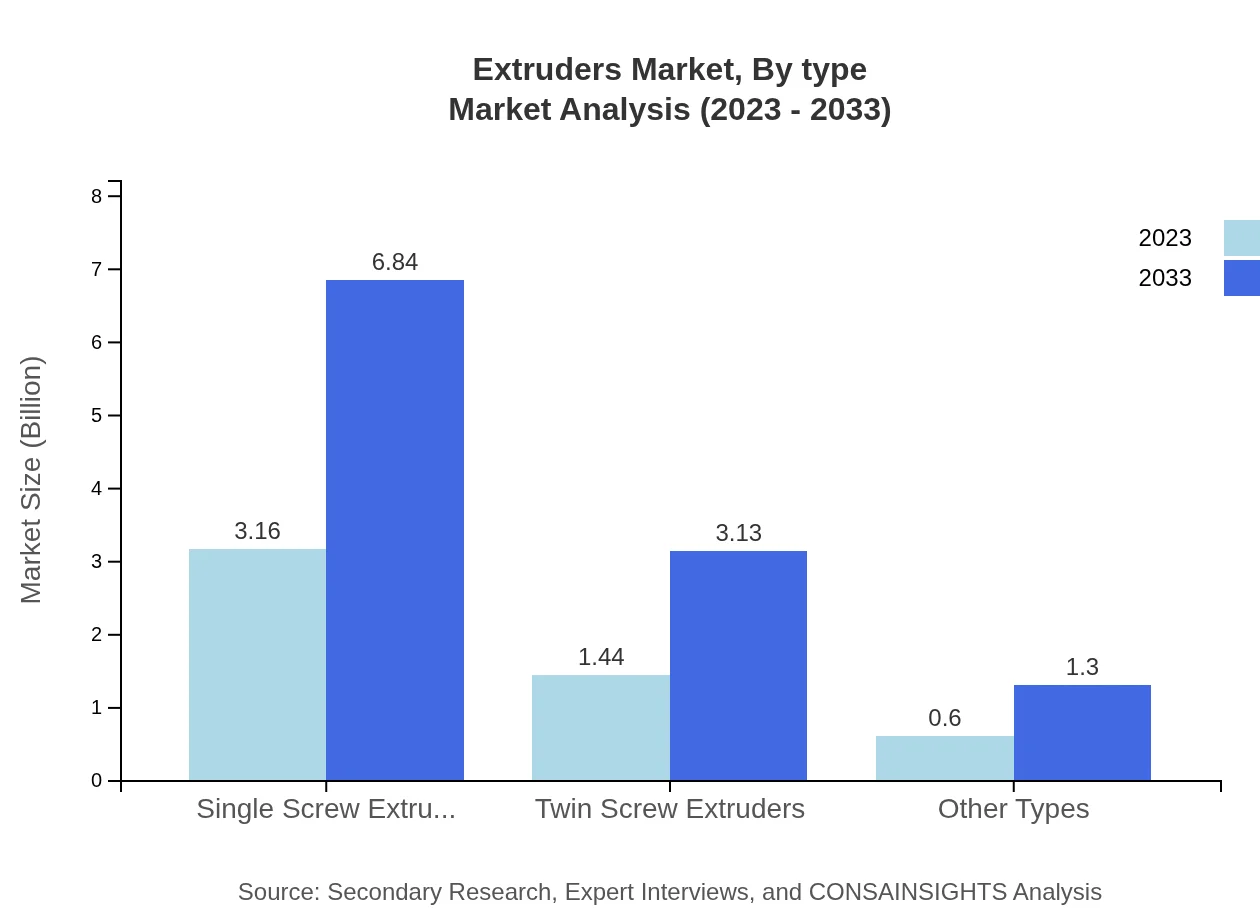

Extruders Market Analysis By Type

The extruders market is primarily divided into single screw and twin screw extruders. Single screw extruders dominate the market with a size of $3.16 billion in 2023, expected to grow to $6.84 billion by 2033, holding a market share of 60.71%. Twin screw extruders, valued at $1.44 billion in 2023, are anticipated to reach $3.13 billion by 2033, with a share of 27.74%. Other types, while smaller, also show growing significance with projected sizes of $0.60 billion in 2023 and $1.30 billion by 2033.

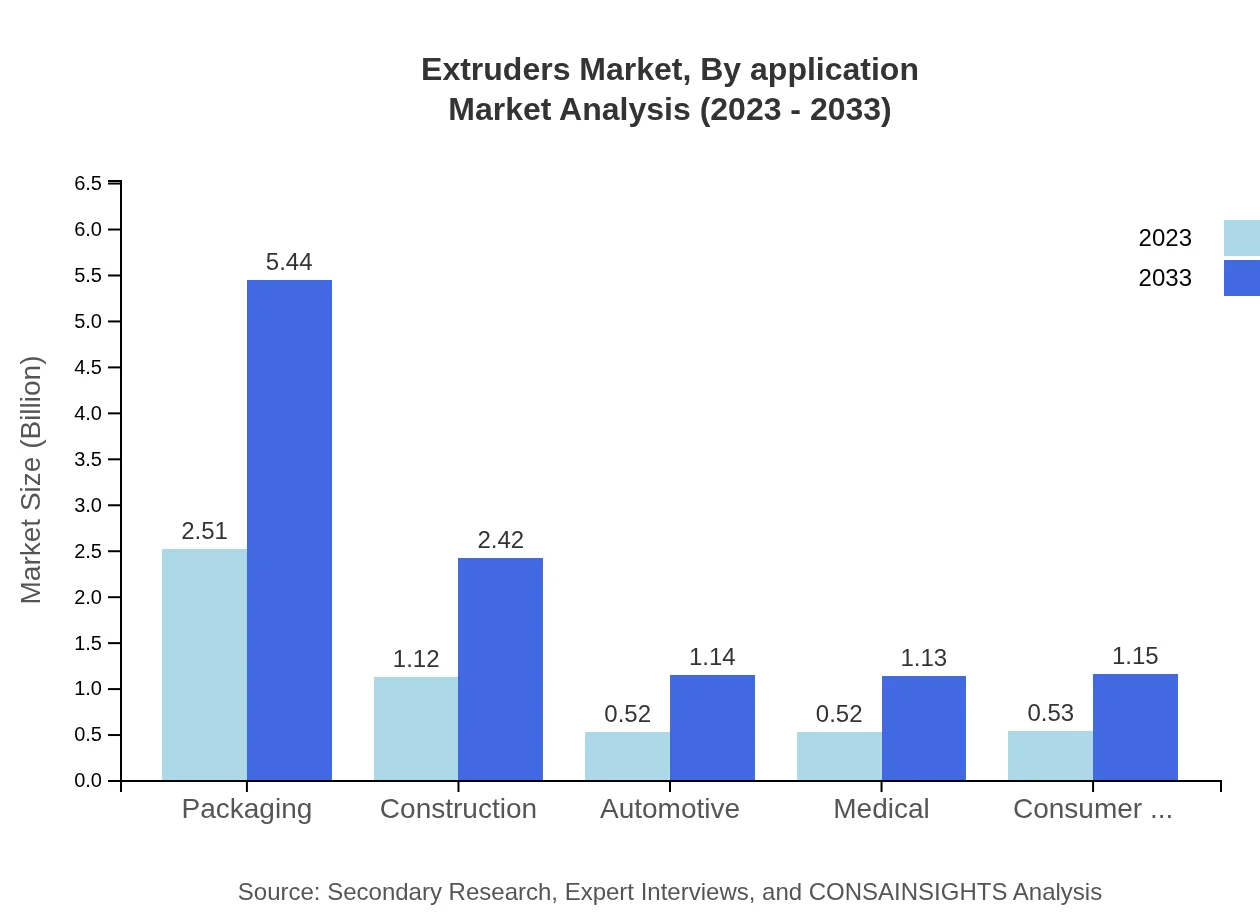

Extruders Market Analysis By Application

Applications include food and beverages ($2.81 billion in 2023 to $6.09 billion by 2033), consumer products ($1.09 billion in 2023 to $2.37 billion by 2033), packaging ($2.51 billion in 2023 to $5.44 billion by 2033), construction ($1.12 billion to $2.42 billion), and automotive applications ($0.52 billion to $1.14 billion). Each application highlights a growing need for efficiency and innovation in production techniques.

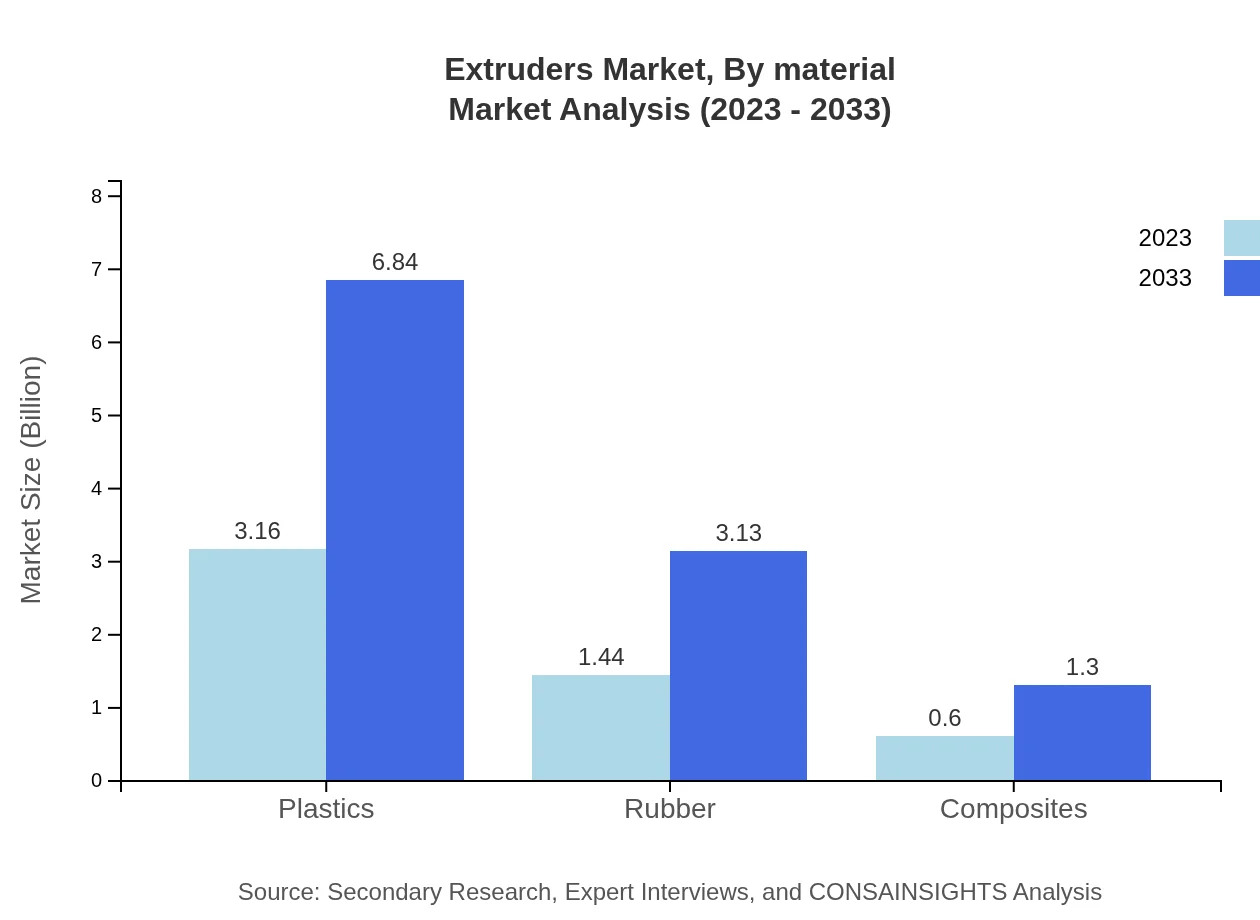

Extruders Market Analysis By Material

The extruders market is segmented by materials used, chiefly focusing on plastics, rubber, and composites. Plastics dominate, projected to grow from $3.16 billion in 2023 to $6.84 billion by 2033, capturing 60.71% of the market. Rubber and composites also play significant roles, with rubber expected to shift from $1.44 billion to $3.13 billion, and composites from $0.60 billion to $1.30 billion over the same period.

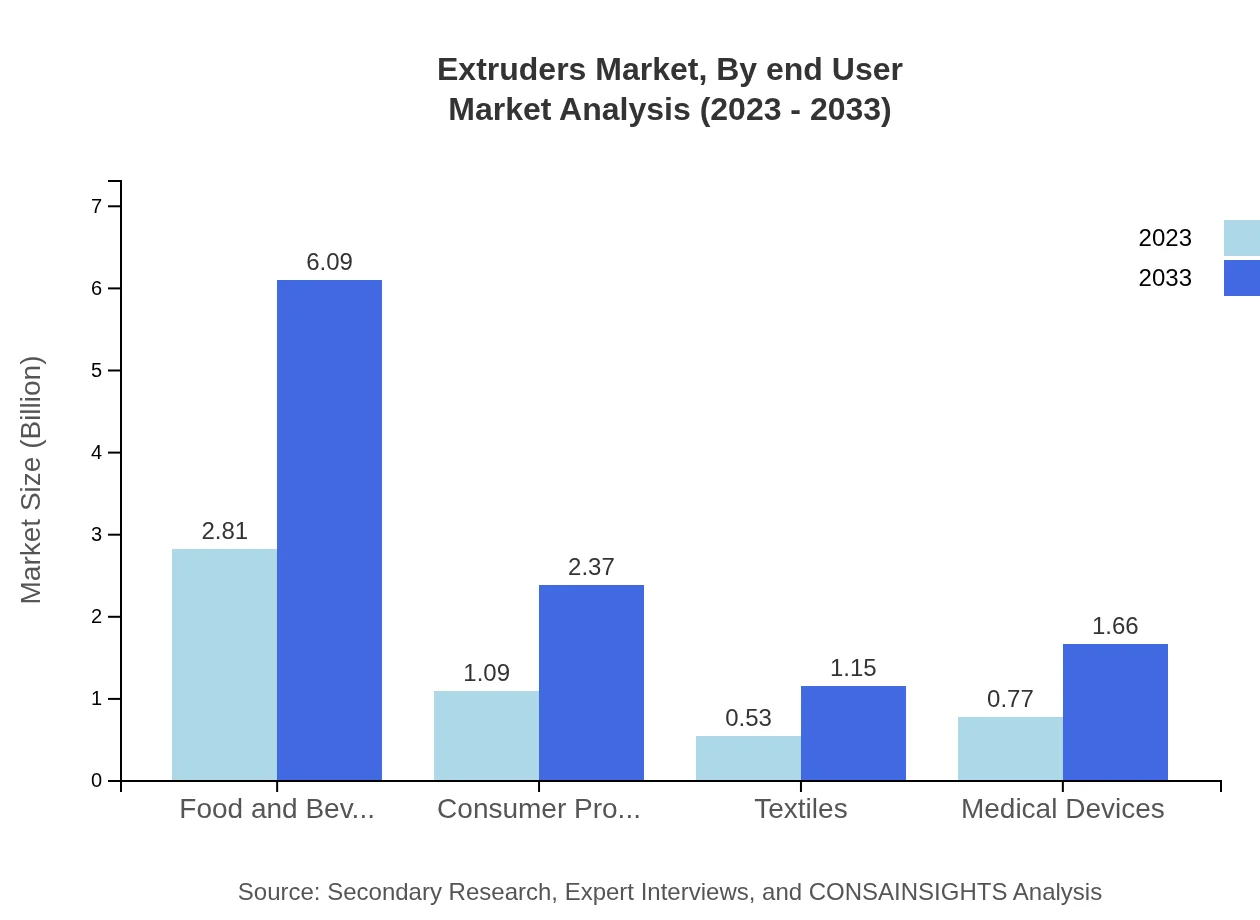

Extruders Market Analysis By End User

Key end-user segments of the extruders market include food and beverage, automotive, consumer products, and medical devices. The food and beverage sector leads with a market size anticipated to rise from $2.81 billion in 2023 to $6.09 billion by 2033. Other significant contributors include consumer products ($1.09 billion to $2.37 billion) and medical devices, expected to grow from $0.77 billion to $1.66 billion.

Extruders Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Extruders Industry

Haitian International Holdings Limited:

A leading global manufacturer of injection molding machines and extruders, known for its innovative approach to production and customization.Battenfeld-Cincinnati:

Specializes in processing technology and provides solutions in extruder construction for plastics, known for its advanced engineering capabilities.KraussMaffei Group:

A key player in the plastics market, known for its high-performance extruders and extensive customization options to meet diverse market needs.Coperion GmbH:

Focuses on engineering technology for extrusion and compounding, offering solutions known for efficiency and precision.Mann+Hummel Group:

Provides high-quality filtration and separation solutions, including technologies related to extruders, contributing to sustainable manufacturing.We're grateful to work with incredible clients.

FAQs

What is the market size of extruders?

The global extruders market is valued at approximately $5.2 billion in 2023 and is projected to grow at a CAGR of 7.8%, reaching significant growth by 2033.

What are the key market players or companies in the extruders industry?

Key players in the extruders industry include Coperion GmbH, KraussMaffei Berstorff, and Milacron Holdings Corp, which are leading the market with innovative technologies and comprehensive product offerings.

What are the primary factors driving the growth in the extruders industry?

The growth in the extruders industry is primarily driven by increasing demand from packaging, food and beverage sectors, technological advancements, and rising investments in manufacturing capacities.

Which region is the fastest Growing in the extruders market?

The Asia Pacific region is the fastest-growing in the extruders market, expected to grow from $0.98 billion in 2023 to $2.13 billion by 2033, due to expanding manufacturing sectors.

Does ConsaInsights provide customized market report data for the extruders industry?

Yes, ConsaInsights offers customized market report data tailored to clients' specific needs in the extruders industry, ensuring comprehensive insights and data analysis.

What deliverables can I expect from this extruders market research project?

Deliverables typically include an in-depth market analysis report, segmentation data, competitive landscape, market forecasts, and tailored insights relevant to clients' strategic decisions.

What are the market trends of extruders?

Current market trends for extruders include increasing focus on eco-friendly materials, advancements in automation technology, and a growing demand for high-efficiency models across various sectors.