Extrusion Coatings Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Extrusion Coatings market, exploring its growth prospects, market sizing, segmentation, regional insights, and key industry trends from 2023 to 2033.

| Metric | Value |

|---|---|

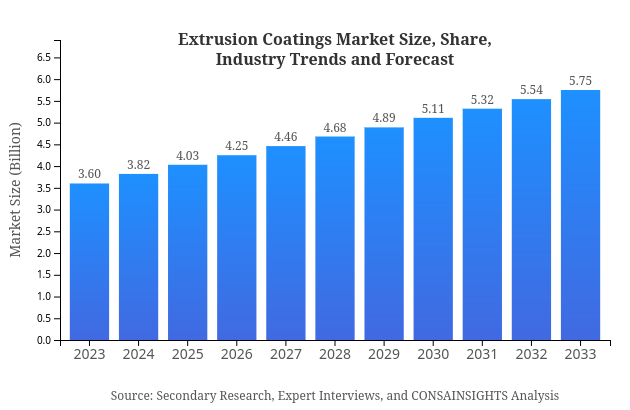

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.60 Billion |

| CAGR (2023-2033) | 4.7% |

| 2033 Market Size | $5.75 Billion |

| Top Companies | Dow Inc., DuPont, BASF SE, ExxonMobil |

| Last Modified Date | 02 March 2025 |

Extrusion Coatings Market Overview

What is the Market Size & CAGR of Extrusion Coatings market in 2023?

Extrusion Coatings Industry Analysis

Extrusion Coatings Market Segmentation and Scope

Request a custom research report for industry.

Extrusion Coatings Market Analysis Report by Region

Europe Extrusion Coatings Market Report:

In Europe, the Extrusion Coatings market is forecasted to grow from $1.13 billion in 2023 to $1.81 billion by 2033. The emphasis on reducing environmental impacts and increasing focus on recyclable materials plays a significant role in this growth.Asia Pacific Extrusion Coatings Market Report:

In the Asia Pacific region, the market for Extrusion Coatings is estimated to reach $1.16 billion by 2033, up from $0.73 billion in 2023. The growth can be attributed to increasing industrial activity, a burgeoning packaging sector, and a preference for polyolefin-based coatings.North America Extrusion Coatings Market Report:

North America is expected to experience growth from $1.20 billion in 2023 to $1.92 billion in 2033. The market is driven by advancements in coating technology, strong demand from the automotive industry, and an increase in environmentally sustainable product developments.South America Extrusion Coatings Market Report:

The South American market is projected to grow from $0.31 billion in 2023 to $0.49 billion in 2033. The key drivers include rising demand for food packaging and growth in the automotive and construction sectors, stimulating the adoption of extrusion coatings.Middle East & Africa Extrusion Coatings Market Report:

The Middle East and Africa are projected to witness growth from $0.23 billion in 2023 to $0.37 billion in 2033. This growth is accelerated by rising investments in industrial infrastructure, especially in packaging and construction sectors.Request a custom research report for industry.

Extrusion Coatings Market Analysis By Application

Global Extrusion Coatings Market, By Application Market Analysis (2024 - 2033)

The key applications of Extrusion Coatings include: Food and Beverage ($2.03 billion in 2023, rising to $3.25 billion in 2033), Consumer Goods ($0.87 billion to $1.38 billion), Industrial ($0.35 billion to $0.56 billion), Pharmaceutical ($0.35 billion to $0.55 billion), and Packaging where it dominates with a market size of $1.63 billion expected to grow to $2.60 billion by 2033. The food and beverage sector alone holds a significant market share due to increasing demand for safe and sustainable packaging.

Extrusion Coatings Market Analysis By Material

Global Extrusion Coatings Market, By Material Market Analysis (2024 - 2033)

The primary materials used in Extrusion Coatings include Polyethylene, Polypropylene, and Other Materials. Polyethylene dominates the market, with a size of $2.47 billion in 2023 projected to reach $3.94 billion by 2033. Polypropylene follows with a growth estimate from $0.99 billion to $1.59 billion over the same period. Other Materials make a smaller contribution, rising from $0.14 billion to $0.22 billion.

Extrusion Coatings Market Analysis By Technology

Global Extrusion Coatings Market, By Technology Market Analysis (2024 - 2033)

The major technologies employed in Extrusion Coatings include Blown Extrusion, Cast Extrusion, and Sheet Extrusion. Blown Extrusion represents the largest segment with a market size of $2.47 billion in 2023, expected to grow to $3.94 billion by 2033. Cast Extrusion and Sheet Extrusion also exhibit growth potential, increasing from $0.99 billion to $1.59 billion and from $0.14 billion to $0.22 billion respectively.

Extrusion Coatings Market Analysis By End User

Global Extrusion Coatings Market, By End-User Industry Market Analysis (2024 - 2033)

End-user industries such as automotive, electronics, construction, and health care are vital to the Extrusion Coatings market. The automotive sector is expected to grow from $0.79 billion in 2023 to $1.27 billion in 2033. In electronics, the market is projected to expand from $0.40 billion to $0.64 billion. The construction industry also plays a crucial role, moving from $0.41 billion to $0.66 billion, driven primarily by rising infrastructure projects.

Extrusion Coatings Market Trends and Future Forecast

Request a custom research report for industry.

Global Market Leaders and Top Companies in Extrusion Coatings Industry

Dow Inc.:

A leading global materials science company known for its innovative approaches towards sustainable extrusion coatings and other polymer products.DuPont:

Specializes in high-performance materials and is recognized for its advanced technologies in the extrusion coatings market, enhancing product durability and reducing environmental footprints.BASF SE:

A multinational chemical company that offers a broad portfolio of extrusion coatings, emphasizing eco-friendly solutions and product safety.ExxonMobil:

Global powerhouse in petrochemicals, recognized for developing advanced polyethylene and polypropylene materials for extrusion coating applications.We're grateful to work with incredible clients.

Related Industries

FAQs

What is the market size of extrusion Coatings?

The extrusion coatings market is valued at approximately $3.6 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.7%, forecasted to reach a larger size by 2033.

What are the key market players or companies in this extrusion Coatings industry?

Key players in the extrusion coatings industry include prominent companies involved in the manufacturing and distribution of polymer coatings and coatings technology. These companies play a critical role in advancing product innovation and expanding market reach.

What are the primary factors driving the growth in the extrusion coatings industry?

Growth in the extrusion coatings industry is primarily driven by increasing demand from end-use industries like packaging, consumer goods, and food and beverage, coupled with advancements in coating technologies. Regulatory changes also promote sustainable packaging solutions.

Which region is the fastest Growing in the extrusion coatings market?

Asia-Pacific is the fastest-growing region in the extrusion coatings market, with growth from $0.73 billion in 2023 to an estimated $1.16 billion by 2033, reflecting strong demand across various industries.

Does ConsaInsights provide customized market report data for the extrusion Coatings industry?

Yes, ConsaInsights provides customized market report data tailored to specific client needs in the extrusion coatings industry, ensuring comprehensive insights and actionable intelligence for strategic decision-making.

What deliverables can I expect from this extrusion Coatings market research project?

Expect detailed market analysis, including market size, growth forecasts, competitive landscape, segmentation data, and insights into regional dynamics tailored specifically for the extrusion coatings market sector.

What are the market trends of extrusion coatings?

Current trends in the extrusion coatings market include a shift towards eco-friendly coating materials, an increase in demand for high-performance coatings, and innovations in manufacturing processes to enhance product efficiency and sustainability.